- Home

- »

- Medical Devices

- »

-

Electrodes For Medical Devices Market, Industry Report 2030GVR Report cover

![Electrodes For Medical Devices Market Size, Share & Trends Report]()

Electrodes For Medical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Diagnostics (Electrocardiogram, Electroencephalogram, Electromyogram), Therapeutics, By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-1-68038-913-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrodes For Medical Devices Market Summary

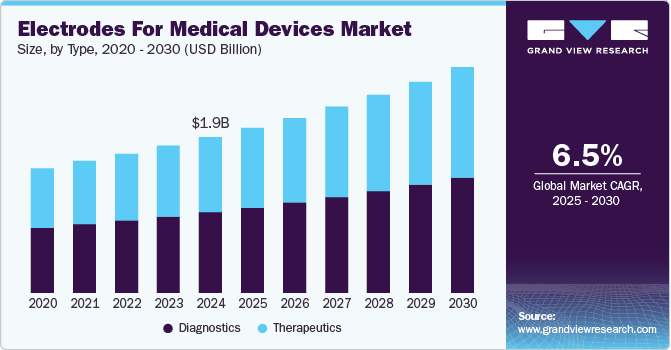

The global electrodes for medical devices market size was estimated at USD 1.9 billion in 2024 and is projected to reach USD 2.7 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The increasing prevalence of chronic conditions, advancements in electrode technology, and the growing global aging population are key drivers behind the rising demand for medical devices.

Key Market Trends & Insights

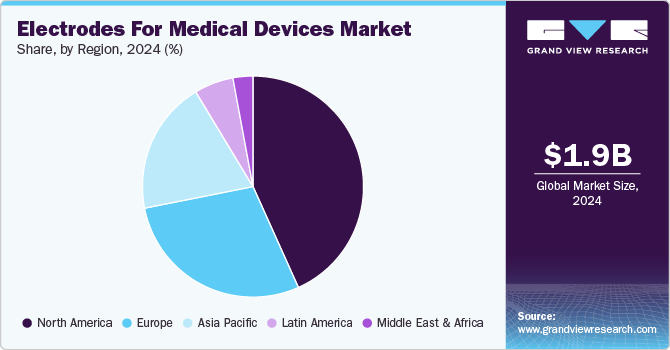

- North America's electrodes for medical devices dominated the market with a 43.3% share in 2024.

- Based on type, the diagnostics segment holds the highest market share of 51.8% in 2024.

- Based on type, the therapeutics segment is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.9 Billion

- 2030 Projected Market Size: USD 2.7 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

Innovations such as wireless and flexible electrodes are enhancing patient care. At the same time, the need for devices that address age-related health issues continues to expand the market for essential medical technologies. In August 2024, Biosense Webster, Inc. announced the CE mark approval for the OPTRELL Mapping Catheter equipped with TRUEref Technology. This catheter incorporates a fixed array of small electrodes, allowing for high-definition mapping of intricate cardiac arrhythmias, including persistent atrial fibrillation, thereby improving treatment accuracy.

The rising global burden of chronic conditions like diabetes, cardiovascular diseases, and neurological disorders has significantly increased the demand for medical devices that aid in monitoring and treatment. Electrodes play a crucial role in neuromodulation, electrotherapy, and cardiac monitoring, contributing to their growing adoption in medical devices. In May 2024, the WHO reported that cardiovascular diseases (CVDs) are the leading cause of disability and premature death in Europe, responsible for over 42.5% of annual deaths, equating to around 10,000 daily fatalities. Men are 2.5 times more likely to die from CVDs than women, and the risk of dying young from these diseases is nearly five times higher in Eastern Europe and Central Asia compared to Western Europe.

Ongoing advancements in electrode technology, such as developing more flexible, biocompatible, and high-performance electrodes, are driving the market's growth. Innovations like wireless electrodes, smart electrodes, and nano-based materials have enhanced the functionality and precision of medical devices, offered better patient outcomes, and encouraged further adoption. In July 2024, the World Health Organization launched the MeDevIS (Medical Devices Information System), a global online platform providing access to medical device information. The system supports informed decision-making regarding over 10,000 medical devices used worldwide, including simple technologies like pulse oximeters and complex equipment such as electrocardiograms and cardiac stents, addressing various health issues.

The global aging population contributes to a higher demand for medical devices that manage age-related conditions, including pain management, mobility assistance, and cognitive monitoring. Electrodes are integral to these devices, as they are used in therapies like TENS (transcutaneous electrical nerve stimulation) and deep brain stimulation, making them essential for improving the quality of life for older adults. In September 2024, according to the Population Reference Bureau, the global population aged 65 and older has reached 800 million, surpassing the total population of Latin America and the Caribbean. In some regions, particularly East Asia and Europe, this age group comprises 20% or more of the population. This demographic shift is expected to lead to an increase in noncommunicable diseases and a greater need for caregiving services.

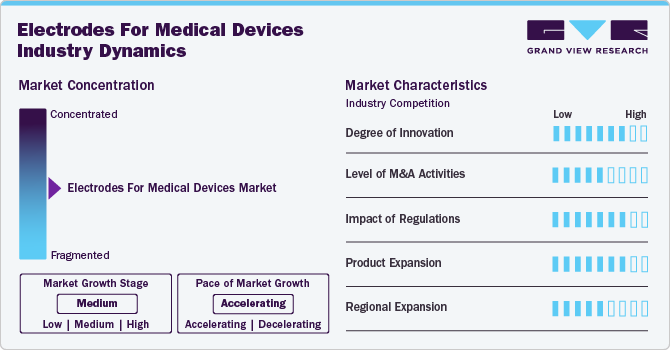

Market Concentration & Characteristics

The degree of innovation in the electrodes for medical devices industry is high, driven by continuous advancements in materials, technology, and design. Innovations include the development of flexible, bio-compatible, and high-performance electrodes that enhance the efficacy of medical treatments such as neuromodulation and cardiac monitoring. In July 2023, Nissha Medical Technologies received FDA premarket approval for its HeartSync defibrillation electrodes. These electrodes offer advantages such as enhanced patient comfort with smaller pads, greater lead-wire length options for flexibility, improved energy distribution with a novel conductor plate design, and superior adhesiveness from an advanced hydrogel material.

The level of mergers and acquisitions (M&A) in the electrodes for the medical devices industry is medium. While large companies are actively acquiring smaller, innovative firms to bolster their technological capabilities and expand product offerings, the market is not as fragmented as other medical device sectors. Nonetheless, M&As are expected to rise as the demand for advanced and specialized electrode technologies grows, prompting companies to consolidate resources and gain a stronger foothold in emerging markets

The impact of regulation on the electrodes for the medical devices industry is high, as these devices must comply with stringent safety and quality standards set by regulatory bodies like the FDA and EMA. Compliance with regulations is critical to ensuring patient safety and device efficacy. The regulatory approval process can be lengthy and expensive, influencing market entry and the speed of innovation. Strict guidelines, especially regarding biocompatibility and electrical safety, can also increase the cost and complexity of developing new electrode-based medical devices

The electrodes for medical devices industry is expanding rapidly. Companies are focusing on enhancing the functionality and range of their products to cater to various therapeutic areas, such as pain management, cardiac care, and neurological treatments. However, while product diversification is ongoing, it is often constrained by technological limits, regulatory hurdles, and high development costs. As a result, new product lines are introduced gradually, emphasizing improving the performance and integration of existing technologies.

The level of regional expansion in the electrodes for the medical devices industry is medium. Companies seek to penetrate emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, where healthcare infrastructure and demand for advanced medical devices are rapidly growing. Increasing awareness of healthcare issues, rising disposable incomes, and aging populations in these regions drive the demand for medical devices. Companies are establishing distribution networks and forming local partnerships to capitalize on these growth opportunities.

Type Insights

The diagnostics segment holds the highest market share of 51.8% in 2024. The diagnostics segment dominated the electrodes for medical devices industry due to the critical role electrodes play in non-invasive monitoring and diagnostic procedures. Electrodes are integral to devices used in electrocardiograms (ECGs), electroencephalograms (EEGs), and electromyography (EMG), which are essential for diagnosing a wide range of conditions like heart diseases, neurological disorders, and muscle-related issues. In October 2024, Natus Medical Incorporated launched the Grass MR Conditional / CT Cup Electrodes, which feature lead lengths 28% longer than previous models, enhancing application ease. These electrodes have received FDA clearance for safe use in 1.5T and 3T MR environments, minimizing strain during EEG testing and ensuring low artifact during imaging.

The therapeutics segment is anticipated to grow at the fastest CAGR over the forecast period. The therapeutics segment dominated due to their pivotal role in delivering therapeutic electrical stimulation for various treatments. Electrodes are used in therapeutic devices for pain management, neuromodulation, muscle stimulation, and cardiac pacing. Technologies like Transcutaneous Electrical Nerve Stimulation (TENS), deep brain stimulation (DBS), and neurostimulation rely heavily on electrodes to target specific areas of the body to treat conditions such as chronic pain, depression, and neurological disorders. In April 2024, the Texas Medicaid & Healthcare Partnership (TMHP) announced that starting June 1, 2024, transcutaneous electrical nerve stimulation (TENS) will be a benefit under the Children with Special Health Care Needs (CSHCN) Services Program, requiring prior authorization for clients aged 18 and older. TENS is used to treat overactive bladder (OAB).

Regional Insights

North America's electrodes for medical devices dominated the market with a 43.3% share in 2024, driven by the region’s advanced healthcare infrastructure, high adoption of cutting-edge technologies, and strong healthcare funding. The U.S. is at the forefront of medical device innovation, with a high demand for diagnostic and therapeutic electrodes across various medical applications, including cardiac care, neurology, and pain management. The presence of leading medical device manufacturers and regulatory support from the FDA contributes to the robust market growth in North America. In August 2024, Nissha Medical Technologies (NMT) announced the successful registration of its ZBrand Electrodes in Mexico, marking an important step in its global healthcare expansion. These electrodes provide a cost-effective solution for general patient monitoring and come in hygienic single-use packs and resealable bulk pouches.

U.S. Electrodes For Medical Devices Market Trends

The U.S. electrodes for medical devices industry is characterized by its large healthcare sector, technological advancements, and high demand for medical treatments. With an aging population and a high incidence of chronic diseases, such as cardiovascular disorders, diabetes, and neurological conditions, the demand for electrodes used in diagnostics and therapeutics is substantial. The U.S. also benefits from strong R&D investments, a favorable regulatory environment, and the early adoption of innovative medical technologies, further driving the market's growth. In May 2023, NeuroOne Medical Technologies Corp introduced its Evo sEEG electrode line in the U.S. to improve neurosurgery for patients with neurological conditions. Zimmer Biomet exclusively distributes these products globally and will incorporate them with its ROSA One Brain robotic system for complex, minimally invasive surgeries.

Europe Electrodes For Medical Devices Market Trends

The electrodes for medical devices industry in Europe is experiencing significant growth driven by strong healthcare systems, high levels of medical research, and growing demand for advanced medical technologies. The region has a well-established presence of major medical device companies, particularly in countries like Germany, Switzerland, and the UK. As Europe focuses on improving patient care and outcomes, the use of electrodes in diagnostic and therapeutic devices continues to expand, with increasing emphasis on neuromodulation, pain management, and chronic disease monitoring. In June 2024, the EU-funded ThrombUS+ project aims to enhance early detection of venous thrombosis, a condition that can lead to severe complications like pulmonary embolisms. Collaborating with 18 European partners, the project is developing a portable diagnostic device that utilizes an ultrasound cuff to monitor lower limb blood vessels. The initiative is supported by USD 10.2 million from the Horizon Europe Innovation Action program.

The UK electrodes for medical devices market is a key part of Europe, benefiting from its advanced healthcare system, well-established healthcare regulations, and increasing prevalence of chronic conditions. The demand for electrodes in diagnostic devices such as ECGs and EEGs is high, along with their use in therapeutic devices for pain management and neurological treatments. The NHS Supply Chain framework for electrodes, ultrasound gels, defibrillation consumables, and related products will run from February 1, 2024, to January 31, 2026, with a possible 24-month extension. It includes nine lots, covering items like ultrasound gels, ECG electrodes, defibrillation pads, and related consumables. There are opportunities for savings through the National Pricing Matrix (NPM), and the framework emphasizes sustainability, with suppliers committed to reducing environmental impact.

The electrodes for medical devices market in France is characterized by its strong healthcare system and increasing adoption of innovative medical technologies. The country is witnessing a growing demand for electrodes in diagnostic and therapeutic applications, especially cardiovascular and neurological treatments. In October 2024, the French National Authority for Health (HAS) released five recommendations on reimbursing medical devices and aids following CNEDiMTS meetings. These recommendations address registration conditions and extensions for devices in the List of Reimbursable Products and Services (LPPR), specifically focusing on endocrine and spine devices.

Asia Pacific Electrodes For Medical Devices Market Trends

The Asia Pacific electrodes for medical devices industry is experiencing significant growth driven by a large aging population, improved healthcare infrastructure, and increased healthcare spending. Countries like China, Japan, and India are key contributors to this growth, with rising demand for medical devices across diagnostics and therapeutics. In May 2024, China's NMPA approved four innovative directional deep brain stimulation (DBS) products. These first domestically produced devices include an electrode lead kit and dual-channel pulse generators, enabling targeted stimulation of specific brain regions. This technology reduces side effects and the need for additional surgeries compared to traditional electrodes.

The Japan electrodes for medical devices market is experiencing significant growth driven by its aging population, high healthcare standards, and focus on cutting-edge medical technology. The country is a leader in developing high-quality medical devices, with significant demand for electrodes in diagnostic tools like ECGs, EEGs, and therapeutic devices for neuromodulation and pain management. In September 2024, Japan's elderly demographic reached an unprecedented level, totaling 36.25 million individuals aged 65 and above. Japan's Ministry of Internal Affairs and Communications reported that the elderly comprise approximately 29.3 percent of the population, marking the highest proportion found in any country or region with more than 100,000 residents.

The electrodes for medical devices market in India is witnessing robust growth due to a large population, increasing healthcare awareness, and growing incidences of chronic diseases such as diabetes, cardiovascular diseases, and neurological disorders. As the healthcare infrastructure improves and access to medical technologies expands, there is a rising demand for both diagnostic and therapeutic electrodes. Additionally, India’s large base of healthcare professionals and patients seeking affordable medical solutions contributes to the market's growth potential. In June 2024, an article in Cardiovascular Therapeutics discussed that approximately 77 million individuals in India are affected by diabetes, making the country the second-largest diabetic population worldwide, just after China.

Latin America Electrodes For Medical Devices Market Trends

The electrodes for medical devices market in Latin America is experiencing a notable shift driven by improving healthcare systems and increasing access to advanced medical technologies. Countries like Brazil, and Argentina are seeing a rise in the use of diagnostic and therapeutic electrodes, particularly in pain management, neurological care, and cardiac monitoring. The region’s growing focus on healthcare infrastructure development and expanding middle class, along with government initiatives, contribute to the increasing demand for these medical devices.

The Brazil electrodes for medical devices market is characterized by its extensive healthcare network and rising demand. With a high prevalence of chronic conditions such as heart disease, diabetes, and neurological disorders, there is a strong need for electrodes used in diagnostic tools like ECGs and EEGs, as well as therapeutic devices for pain relief and neuromodulation. In July 2024, the Brazilian Journal of Pain published an article on Transcutaneous Electrical Nerve Stimulation (TENS) as a non-pharmacological pain relief method. TENS reduced pain intensity and inflammation, improving function and quality of life without significant side effects. It is accessible for both healthcare providers and patients.

Middle East & Africa Electrodes For Medical Devices Market Trends

The electrodes for medical devices industry in the Middle East and Africa is growing rapidly due to improving healthcare infrastructure, increasing awareness about health conditions, and rising disposable incomes. Countries like the UAE, Saudi Arabia, and South Africa invest heavily in healthcare development, leading to growing demand for diagnostic and therapeutic medical devices. The market for electrodes is expanding as more people seek advanced treatments for chronic diseases and as medical professionals embrace new technologies to enhance patient care. An August 2024 article in BMC Public Health highlighted that improved material needs security correlates with a higher cardiovascular risk for older adults in rural South Africa. This information could guide treating and managing cardiovascular diseases in South Africa and similar low- and middle-income countries.

The electrodes for medical devices market in Saudi Arabia is witnessing robust growth fueled by the country’s substantial healthcare investments, growing healthcare needs, and an aging population. With a focus on addressing prevalent health issues such as cardiovascular diseases, diabetes, and neurological disorders, Saudi Arabia's growing healthcare sector provides a robust environment for the electrode market. In an article published in August 2024 in BMC Cardiovascular Disorders, it was highlighted that 1.6% of the Saudi population aged 15 and above suffers from cardiovascular diseases (CVDs), amounting to 236,815 individuals. The data indicates a higher prevalence among men, with 1.9%, in contrast to 1.4% for women.

Key Electrodes For Medical Devices Company Insights

Key companies in the electrodes for medical devices market are actively pursuing various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of electrodes for medical devices, which aims to achieve better clinical outcomes and enhance patient comfort. To meet the global market's diverse needs, these players focus on product diversification, offering various products suitable for different procedures.

Key Electrodes For Medical Devices Companies:

The following are the leading companies in the electrodes for medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Boston Scientific Corporation

- GE HealthCare

- CONMED Corporation

- Medtronic

- Natus Medical Incorporated

- Thermo Fisher Scientific Inc.

- Asahi Kasei Corporation

- Koninklijke Philips N.V.

- X-trodes

Recent Developments

-

In November 2024, Nihon Kohden revealed that it had acquired a 71.4% interest in NeuroAdvanced Corp., which is the parent company of Ad-Tech Medical Instrument Corporation. This strategic acquisition reinforces Nihon Kohden's leadership in the medical device sector by integrating its knowledge in EEG technology with Ad-Tech’s specialized electrodes used for treating epilepsy, thereby enhancing its capability to tackle challenging neurological disorders, including those resistant to medication.

-

In April 2024, Soterix Medical Inc. introduced a groundbreaking device called MxN-GO EEG, designed for research in real-world settings. This innovative system integrates non-invasive brain stimulation with EEG technology, featuring a wireless, lightweight design for easy use. It offers 33 channels for stimulation and 32 for recording brain activity, ensuring precise data collection and effective interaction with the brain. This advancement aims to enhance research capabilities in mobile environments.

-

In February 2024, Threshold NeuroDiagnostics, a stealth startup, introduced the Medusa Electrode, an FDA-registered device that connects neuromodulation electrodes to neurodiagnostic equipment using artificial intelligence. This innovation facilitates access to over 70,000 invasive electrodes annually in the U.S., improving neurodiagnostic capabilities and expanding research applications by converting connections into universal formats.

Electrodes For Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.0 billion

Revenue forecast in 2030

USD 2.7 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3M; Boston Scientific Corporation; GE HealthCare; CONMED Corporation; Medtronic; Natus Medical Incorporated; Thermo Fisher Scientific Inc.; Asahi Kasei Corporation; Koninklijke Philips N.V.; X-trodes

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrodes For Medical Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrodes for medical devices market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Electrocardiogram (ECG)

-

Electroencephalogram (EEG)

-

Electromyogram (EMG)

-

Electroretinogram (ERG)

-

Fetal Scalp

-

Others

-

-

Therapeutics

-

Pacemaker

-

Transcutaneous Electrical Nerve Stimulator (TENS)

-

Defibrillator

-

Electrosurgical

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrodes for medical devices market size was estimated at USD 1.9 billion in 2024 and is expected to reach USD 2.0 billion in 2025.

b. The global electrodes for medical devices market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 2.7 billion by 2030.

b. Key factors that are driving the market growth include rise in the prevalence of Parkinson’s Disease (PD), heart diseases, Alzheimer’s disease, Trigeminal neuralgia (TN or TGN), sinusitis, and Raynaud's disease, and introduction of technological advancement in medical electrodes.

b. North America dominated the electrodes for medical devices market with a share of 43.3% in 2024. This is attributable to the rising increasing prevalence of CVDs, changing lifestyles of individuals, and the presence of a huge target population in the U.S. and Canada.

b. Some key players operating in the electrodes for medical devices market include 3M, Boston Scientific Corporation, GE Healthcare, CONMED, Medtronic, Thermo Fisher Scientific Inc., Asahi Kasei Corporation, and Philips Healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.