- Home

- »

- Medical Devices

- »

-

Electrolysis Hair Removal Market Size, Industry Report 2033GVR Report cover

![Electrolysis Hair Removal Market Size, Share & Trends Report]()

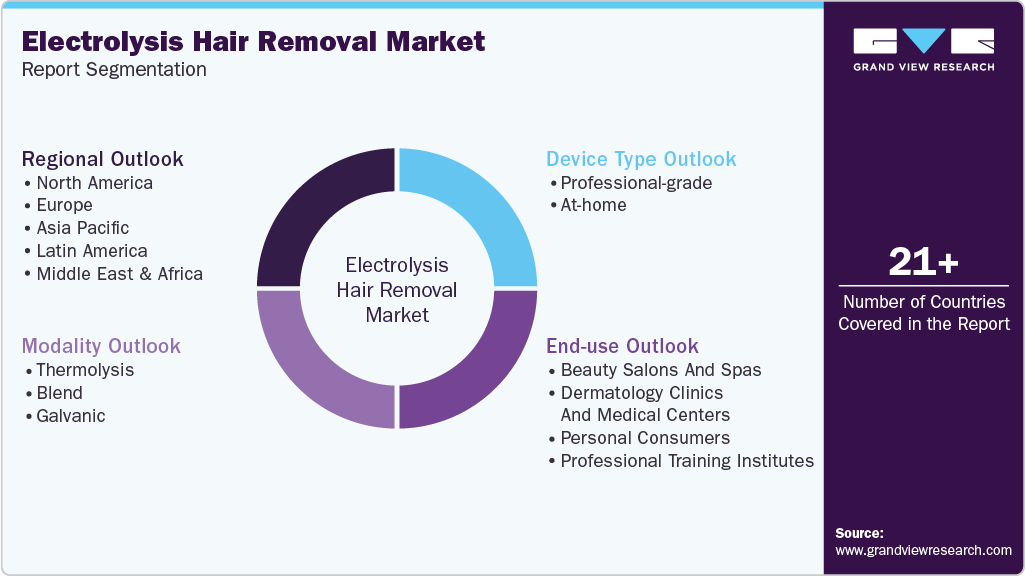

Electrolysis Hair Removal Market (2025 - 2033) Size, Share & Trends Analysis Report By Device Type (Professional-grade, At-home), By Modality (Galvanic, Thermolysis, Blend), By End-use (Beauty Salons & Spas, Personal Consumers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-626-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrolysis Hair Removal Market Summary

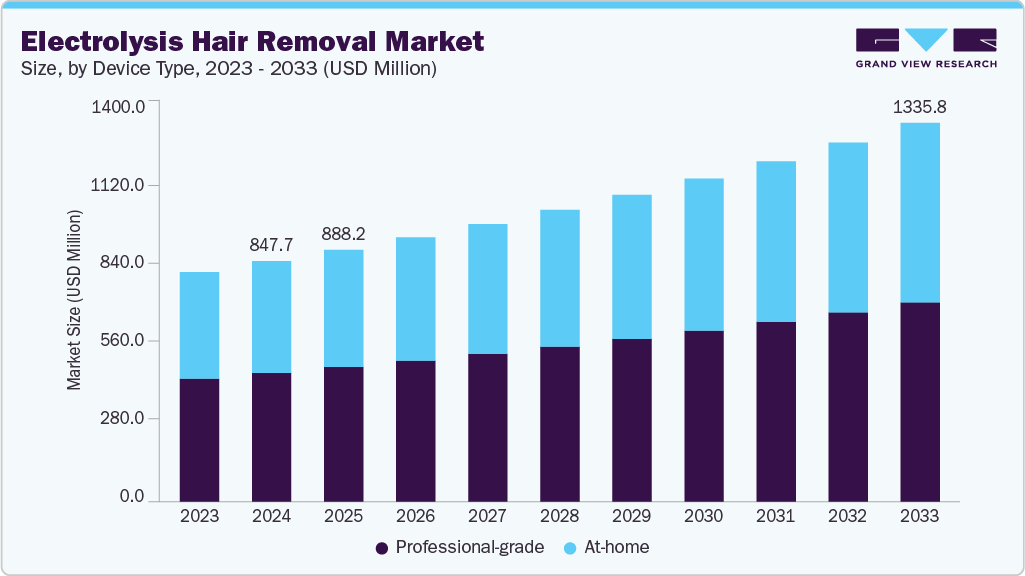

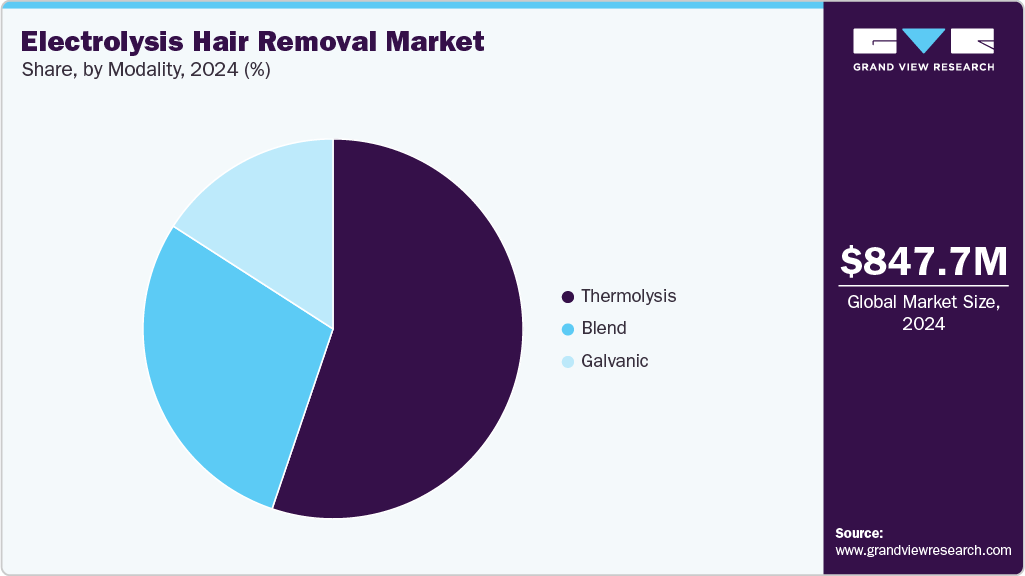

The global electrolysis hair removal market size was estimated at USD 847.7 million in 2024 and is projected to reach USD 1,335.8 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. Electrolysis hair removal is a specialized method that uses electrical currents to destroy hair follicles permanently. They deliver energy through a fine probe inserted into each follicle, using galvanic, thermolysis, or blend modalities to stop future hair growth.

Key Market Trends & Insights

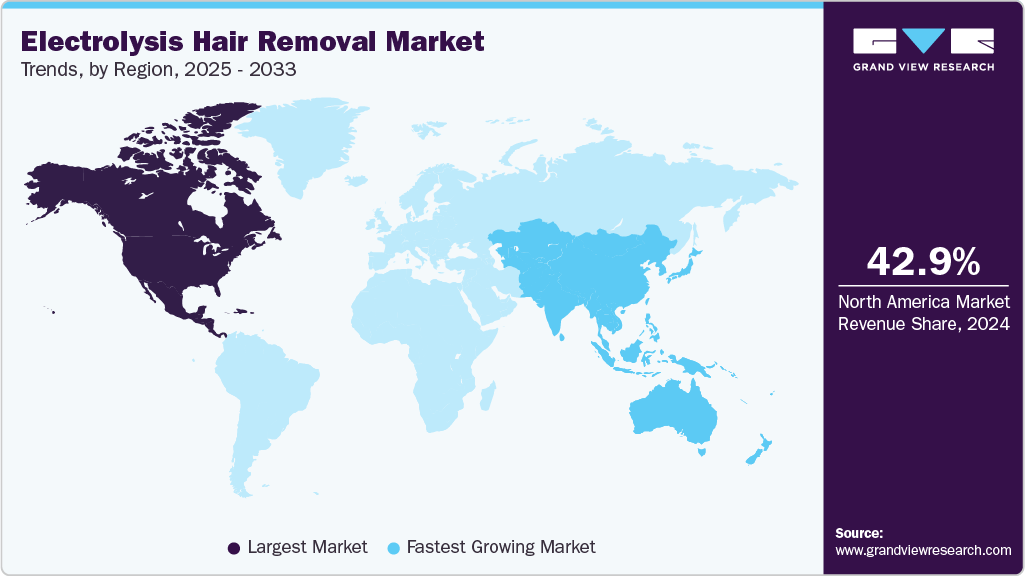

- North America electrolysis hair removal market held the largest share of 42.9% of the global market in 2024.

- The electrolysis hair removal industry in the U.S. is expected to grow significantly over the forecast period.

- By device type, the professional-grade segment held the highest market share of 53.6% in 2024.

- Based on modality, the thermolysis segment held the highest market share in 2024.

- By end use, the beauty salons and spas segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 847.7 Million

- 2033 Projected Market Size: USD 1,335.8 Million

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing number of hair removal procedures is one of the factors boosting market growth. According to an International Society of Aesthetic Plastic Surgery (ISAPS) article published in 2023, around 1,608,447 hair removal procedures were carried out during the year. This figure indicates strong consumer demand for solutions that offer longer-lasting results than temporary methods such as shaving or waxing. Electrolysis provides a permanent hair removal option that is effective for all skin tones and hair types. With growing awareness of these benefits, more individuals are turning to electrolysis to avoid the need for frequent maintenance. The increase in hair removal procedures highlights a broader trend toward more durable and results-driven aesthetic treatments.Increasing awareness and acceptance of aesthetic treatments drive the growth of the market. According to an American med spa ( AmSpa ) article published in November 2024, the number of medical spas in the U.S. rose from 8,899 in 2022 to 10,488 in 2023. This nearly 18% year-over-year increase demonstrates sustained consumer demand for cosmetic treatments and a strong confidence in the industry's long-term potential. The rise in medical spas also indicates an expanding infrastructure that offers diverse services, including permanent hair removal solutions such as electrolysis. These clinics continue to provide advanced, minimally invasive procedures, consumers have greater access to trusted hair removal professionals, improving awareness and adoption of electrolysis. The broader growth of the medical aesthetics space creates an ecosystem that nurtures demand for high-efficacy treatments, further solidifying electrolysis as a preferred method for long-term hair removal, especially among individuals with varying hair types and skin tones.

Rising grooming expenditures drives the growth of the market. According to the U.S. Bureau of Economic Analysis article published in June 2025, the U.S. has witnessed a steady rise in consumer spending on personal care products, indicating a more substantial commitment to grooming and self-maintenance. Quarterly spending on hair, dental, shaving, and miscellaneous non-electrical personal care items in the U.S. rose from USD 113.3 billion in Q1 2023 to USD 122.5 billion in Q4 2024, with Q1 2025 already reaching USD 123.8 billion. This sustained upward trend suggests a growing consumer inclination toward investing in appearance-enhancing solutions.

This increase in grooming-related expenditures highlights a broader shift toward value-driven and long-term care preferences, boosting the electrolysis hair removal industry. While individuals become more willing to allocate higher budgets to aesthetic care, permanent hair removal techniques such as electrolysis, which reduce the need for ongoing spending on temporary solutions such as razors, waxing, or creams, are more appealing. This consumer behavior shift strengthens electrolysis services in the evolving beauty economy.

Top 5 Countries by Number of Hair Removal Procedures in 2023

Rank

Country

Number of Procedures (2023)

1

U.S.

240,373

2

Argentina

133,166

3

India

97,601

4

France

60,000

5

Italy

26,296

Source: International Society of Aesthetic Plastic Surgery & Grand View Research

Technological advancements in electrolysis hair removal drive the growth of the market. For instance, in June 2024, Genesys Electronics Design congratulated its client, Permanence, for the successful U.S. launch of the GEMM-16 multi-needle electrolysis hair removal system in April. This launch followed the achievement of IEC 60601-1 certification, a critical safety and performance standard for medical electrical devices. The GEMM-16 was developed in partnership with Skiant Holdings, showcasing a collaborative effort in creating advanced electrolysis technology. Electrolysis remains a clinically validated solution for permanent hair removal, supporting individuals affected by conditions such as hormonal imbalances, medication side effects, gender dysphoria, and genetic predispositions. The GEMM-16’s introduction reinforces the effectiveness of electrolysis in addressing long-term hair removal needs while meeting rigorous medical-grade safety benchmarks.

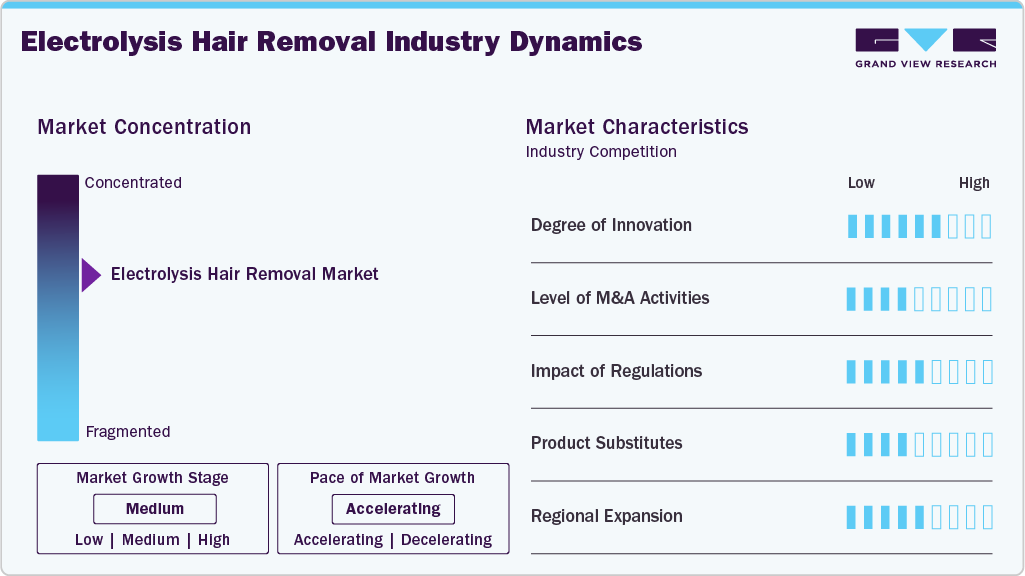

Market Concentration & Characteristics

The electrolysis hair removal industry is witnessing significant innovation, highlighted by the development of multi-needle technologies, enhanced energy delivery systems, and more intelligent control interfaces. These advancements improve treatment speed, precision, and patient comfort, making procedures more efficient and less time-consuming. As a result, users experience more effective and targeted hair removal with fewer sessions, encouraging greater adoption among professionals and clients seeking long-lasting results.

Several key players in the electrolysis hair removal industry, including Dectro International, Silhouet‑Tone, Instantronics International, and Sterex, are actively pursuing strategic initiatives such as product innovation, technology integration, and global expansion. These companies are focused on enhancing treatment precision, improving device ergonomics, and incorporating intelligent energy delivery systems to optimize results. Their continuous efforts aim to meet the rising demand for effective, safe, and permanent hair removal solutions while maintaining competitiveness in a rapidly evolving aesthetics industry.

Regulatory bodies such as the FDA and European health authorities play an essential role in overseeing the electrolysis hair removal industry. They ensure that devices meet strict safety and quality standards. Although this can lead to longer approval times, updated guidelines and growing support for advanced technologies are helping companies bring safer and more effective electrolysis devices to industry.

There are no direct substitutes for electrolysis hair removal to achieve permanent hair removal across all skin and hair types. Unlike other methods, such as laser hair removal, which may not be effective on light or fine hair, electrolysis targets individual follicles precisely. While alternatives may offer faster results, electrolysis remains the only FDA-approved method for permanent hair removal, making it a preferred option for those seeking long-term and reliable outcomes.

Key electrolysis hair removal industry manufacturers are widening their reach by entering underpenetrated markets, collaborating with regional distributors, and customizing their devices to meet local cosmetic and medical preferences. These strategies help improve access to permanent hair removal solutions and address the growing demand for inclusive and effective treatments in various regions.

Device Type Insights

The professional-grade segment held the largest share of over 53.6% in 2024. Professional-grade electrolysis devices are high-powered systems used exclusively by trained electrologists in clinical or salon environments. Rising hair removal procedures and technologically advanced products that the key players offer drive the market's growth. For instance, Apilus xCell Pro by Dectro International is renowned for its computerized systems that provide gentle, effective, and rapid permanent hair removal. Moreover, other key manufacturers are Silhouette-Tone, known for its Sequentium VMC machine with customizable settings for different hair and skin types, and Alvi Prague, which produces the T-18 electrolysis and electrocoagulation device, combining modern design and safety features for professional use.

The at-home segment is growing at the fastest CAGR during the forecast period. At-home electrolysis kits are compact, user-friendly devices designed for non-professional use. They mimic the basic principle of clinic-grade electrolysis using an electrical current delivered via a probe or stylus to weaken hair follicles and impede regrowth. Increasing hair removal procedures and technologically advanced products offered by key players drive the market's growth. For instance, Verseo offers a needle-free pen-style device, Verseo ePen, which uses micro-electrical pulses on the skin's surface. Its compact design allows discreet targeting of fine facial hair and comes with conductive gel and replacement heads. Users report favorable results when used regularly.

End-use Insights

The beauty salons and spas segment held the largest share at 30.4% in 2024. Beauty salons and spas often choose professional electrolysis systems that deliver comfort, customization, and speed to attract and retain clientele. For instance, Inanna Medical Spa in Berlin employs the Apilus xCell Pro, a high-frequency (27.12 MHz) system featuring ultra-short pico-impulses and thermal relaxation phases. This combination allows practitioners to treat stubborn follicles with precision and comfort,making it suitable for delicate facial areas and larger body zones. Moreover, Beauty Essence in the UK uses the Apilus Platinum Pure, a computer-assisted device praised for its comfort and effectiveness across all hair and skin types. The machine adjusts to client tolerance levels thanks to a built-in sensitivity test, significantly improving the salon experience.

The personal consumers segment is expected to grow significantly during the forecast period. The segment involves individuals using at-home electrolysis systems for permanent hair reduction. These compact devices deliver low-level electrical currents-typically galvanic, radio-frequency, or a mix via a fine probe or conductive pad directly to hair follicles. They offer an affordable and private alternative to clinical treatments for small areas such as the upper lip, chin, or underarms. While less powerful, they can be effective with precision, consistency, and patience. Technologically advanced products offered by the manufacturer drive the growth of the market. For instance, Avance Beauty offers Aavexx 300 Microlysis System, a needle-free, patch-based galvanic system that includes reusable electrode patches and conductive gel, offering a more comfortable and hygienic experience. Marketed as a value option for home users, it delivers professional-level performance at a consumer price, with detailed instructions and versatile settings.

Modality Insights

The thermolysis segment held the largest share of over 55.2% in 2024. Thermolysis (short-wave diathermy or high-frequency electrolysis) is a method of permanent hair removal in which a high-frequency alternating current, typically around 13.56 MHz, is passed through a fine probe inserted into the hair follicle. This generates localized heat that coagulates and destroys the follicular tissue within a fraction of a second, making thermolysis a fast and efficient technique compared to the slower galvanic method . Increasing hair removal procedures and technologically advanced products offered by key players drive the market's growth. For instance, Apilus xCell Pro / xCell Pur (Dectro International), these high-end systems operate at an ultrafast 27.12 MHz, featuring multiple thermolysis modes such as PicoFlash, MeloFlash, and MultiPlex. These technologies offer quick, localized coagulation and layered heat application, enabling rapid, comfortable treatments even on resistant hairs.

Blend segment is growing at the fastest CAGR during the forecast period. Blend Electrolysis is a permanent hair removal technique that combines galvanic (chemical) and thermolysis (heat) methods. Applying direct current to produce lye and using high-frequency current to heat the follicle accelerates chemical action. It enhances penetration, destroying hair follicles more effectively and quickly than either method alone . Key players offering technologically advanced products drive the growth of the market. For instance, one well-known professional system utilizing the blend modality is the Sterex SX‑B Blend Epilator. This UK-manufactured, clinic-grade unit allows electrologists to seamlessly switch between thermolysis, galvanic, or blend modes. It features digital control, adjustable intensities, and a footswitch or hand-activated operation, empowering practitioners to customize treatments for different follicle types and client comfort. The Sterex Academy also offers comprehensive training on SX B blend techniques, ensuring safe and effective usage in clinical settings.

Regional Insights

North America dominated the electrolysis hair removal market with a share of 42.9% in 2024. Increased hair removal cases, government initiatives, and technological advancements drive the market's growth. According to an ISAPS article published in 2023, in North America, 299,070 hair removal procedures were performed in the U.S. (240,373 procedures) and Mexico (58,697 procedures), highlighting the region’s strong demand for hair reduction solutions. This growing number of procedures reflects a broader shift in consumer preference toward long-lasting and permanent hair removal methods. Within this trend, electrolysis continues to gain attention as a reliable solution, particularly for individuals with light, gray, or fine hair types less responsive to laser treatments. The steady volume of procedures also allows electrolysis providers to expand services, especially as more consumers seek permanent alternatives backed by safety and FDA approval. A rising interest in personalized grooming, professional treatments, and regulated, clinic-based services across the North American market further supports this demand.

U.S. Electrolysis Hair Removal Market Trends

The U.S. accounted for the largest share of North America's electrolysis hair removal market 2024. Key players offering advanced products drive the growth of the market. For instance, Instantronics International contributes to market expansion with its Elite Spectrum electrolysis system, which is known for its versatility and professional-grade performance. The company also supplies a range of high-precision needle probes, such as the Ballet F2-F6 Stainless Steel and Gold Needle Probes (.002–.006), as well as the Ballet K2-K6 Stainless Steel Probes, which cater to varying skin sensitivities and hair types, enhancing treatment effectiveness. Similarly, Verseo, Inc. plays a role in expanding the availability of electrolysis with its Verseo ePen Permanent Hair Removal device, which is designed for at-home use. These innovations meet licensed practitioners' needs and appeal to consumers seeking convenience and affordability.

Europe Electrolysis Hair Removal Market Trends

Europe's electrolysis hair removal market held the second-largest revenue market share in 2024. The increasing number of hair removal procedures and key players offering advanced products drive the market's growth. For instance, Sterex, a well-established brand in the UK, contributes significantly to this growth with its professional-grade SX‑B Blend Epilator, which integrates galvanic and thermolysis modalities for effective and customizable treatments. The company also provides a wide selection of electrolysis needles, including two-piece, one-piece, and stainless-steel needles, catering to varying skin types and treatment needs. Similarly, Alvi Prague, a prominent manufacturer based in Central Europe, enhances the market with state-of-the-art devices such as the T‑18 Electrolysis Hair Removal Machine and the Epil Ultimate N‑01, known for their precision and efficiency in permanent hair removal. Alvi Prague also offers high-quality needle options like the Ballet Gold Needle (K‑series), further supporting safe and effective procedures. The availability of such advanced equipment and accessories across Europe encourages more clinics and professionals to adopt electrolysis, thus fueling overall market expansion.

Germany's electrolysis hair removal market has grown over the forecast period. Rising hair removal procedures and technological advancement drives the growth of the market. According to an ISAPS article published in 2023, Germany recorded 4,415 hair removal procedures, reflecting a steady interest in long-term grooming solutions among its population. While laser treatments remain popular, this figure also underscores a growing opportunity for electrolysis hair removal, particularly among individuals seeking permanent results across all hair and skin types. Electrolysis, known for its precision and effectiveness regardless of hair color, is gaining traction in Germany as more consumers seek personalized and medically approved alternatives. The country's strong focus on quality healthcare services and a rising demand for aesthetic treatments position electrolysis as a reliable option within the broader hair removal landscape.

The Italy electrolysis hair removal market is growing over the forecast period. Rising hair removal procedures and key players offering technologically advanced products drive the market's growth. According to an ISAPS article published in 2023, Italy recorded 26,296 hair removal procedures, reflecting a steady consumer interest in aesthetic treatments focused on long-term results. While temporary methods and laser treatments are commonly used, there is a growing awareness and demand for electrolysis, a technique recognized for its precision and ability to permanently remove hair regardless of skin or hair type. This shift is particularly relevant in Italy’s beauty-conscious market, where individuals increasingly seek reliable and lasting solutions. While more dermatology clinics and aesthetic centers adopt advanced electrolysis technologies and trained specialists become more accessible, the country is seeing gradual growth in electrolysis as a trusted method for hair removal.

The France electrolysis hair removal market is anticipated to grow significantly during the forecast period. Rising hair removal procedures and key players offering technologically advanced products drive the market's growth. According to an ISAPS article published in 2023, France reported approximately 60,000 hair removal procedures, highlighting the country’s strong and sustained interest in aesthetic treatments. While various methods are available, the demand for permanent and precise solutions is driving greater attention toward electrolysis. The only approved method for permanent hair removal effective on all hair and skin types, electrolysis is becoming an increasingly appealing choice for individuals in France seeking long-term results. This growing preference aligns with the country’s well-established beauty and skincare culture, where consumers value effectiveness and safety. With more clinics integrating advanced electrolysis systems and trained professionals offering tailored treatments, France is witnessing a gradual but promising rise in electrolysis adoption within its broader hair removal market.

Asia Pacific Electrolysis Hair Removal Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period. Growing number of beauty salons, spas, dermatology clinics, and medical centers offering professional services tailored to permanent hair removal. For instance, in Japan, clinics such as Shinjuku Skin Clinic and Tokyo Skin Clinic integrate electrolysis into their dermatology services, especially for facial areas where precision is crucial. These facilities often provide a blend of galvanic and thermolysis treatments, catering to clients who may not respond well to laser treatments due to hair color or skin sensitivity.

China accounted for the largest electrolysis hair removal market share in the Asia Pacific region in 2024. In China, while consumer-facing electrolysis services remain in the early stages of development, there is a growing availability of professional-grade electrolysis equipment sourced from global manufacturers. These devices are primarily purchased by dermatology clinics, specialty cosmetic centers, and select medical institutions seeking to provide advanced, permanent hair removal solutions. Several international manufacturers known for their electrolysis technologies, such as Dectro International, which has confirmed export presence, are increasingly accessible in the Chinese market through authorized distributors or B2B platforms such as Alibaba and Made-in-China. Other brands such as Silhouet‑Tone may also reach Chinese buyers through indirect or third-party distribution channels.

The Japanese electrolysis hair removal market has grown over the forecast period. Rising hair removal procedures and key players offering technologically advanced products drive the market's growth. According to an ISAPS article published in 2022, Japan recorded 595,232 hair removal procedures, highlighting consumer interest in advanced grooming and aesthetic treatments. While laser technologies remain prevalent, the market shows signs of diversification as consumers explore more targeted and permanent solutions. Electrolysis, known for its effectiveness on all hair types, including light or fine hairs often resistant to laser, is gaining recognition among clients seeking thorough, long-lasting results. In a market driven by precision, safety, and skin sensitivity considerations, electrolysis offers a niche yet valuable alternative, particularly within Japan’s highly specialized dermatology clinics and aesthetic practices prioritizing tailored treatment options.

The Indian electrolysis hair removal market is experiencing significant growth over the forecast period. Rising hair removal procedures and key players offering technologically advanced products drive the market's growth. According to an ISAPS article published in 2023, India reported 97,601 hair removal procedures, reflecting a growing preference for professional aesthetic treatments across urban and semi-urban regions. While temporary methods like waxing and laser continue to dominate, a segment of consumers is beginning to seek more permanent and meticulous hair removal options. Electrolysis is slowly gaining recognition for its ability to target individual hair follicles regardless of hair or skin type a key advantage in a country with diverse skin tones. This shift encourages specialized clinics and dermatology centers to explore electrolysis services, especially for clients with persistent or hormonally driven hair growth. The market is gradually opening up to this technique, driven by increasing awareness, rising disposable income, and demand for personalized beauty solutions.

Latin America Electrolysis Hair Removal Market Trends

The Latin American electrolysis hair removal market is growing due to several factors. Increasing hair removal procedures drive the growth of the market. According to an ISAPS article published in 2023, with 149,578 hair removal procedures performed in Brazil and Argentina during 2023, there's clear evidence of Latin America's growing investment in aesthetic self-care. This rising interest is shaping the demand for popular treatments like laser and creating space for more permanent and precise solutions, such as electrolysis.

Brazil's electrolysis hair removal market is expanding due to several distinct growth drivers. Rising hair removal procedures drive the growth of the market. According to an ISAPS article published in 2023, Brazil recorded 16,412 hair removal procedures, reflecting growing interest in advanced treatment options. While laser remains common, electrolysis is gaining traction among individuals seeking permanent results, especially for fine or stubborn hair. Companies like Dectro International and Silhouet‑Tone are helping drive this shift by supplying professional electrolysis equipment to clinics and aesthetic centers across Brazil.

MEA Electrolysis Hair Removal Market Trends

The MEA electrolysis hair removal market is expected to grow over the forecast period. The Increasing hair removal procedures, rising grooming expenditures, and technologically advanced products offered by the manufacturers drive market growth. For instance, key players such as Dectro International, and Silhouet‑Tone supply products to the MEA region

Saudi Arabia's electrolysis hair removal market is growing at a CAGR of 4.9% over the forecast period. Rising demand for permanent and precise hair removal solutions. While consumers seek more advanced grooming treatments, clinics and aesthetic centers gradually incorporate electrolysis into their service offerings. Key players such as Dectro International, Silhouet‑Tone, and Instantronics International support this growth by supplying professional electrolysis systems to the region through distributors and beauty technology partners.

Key Electrolysis Hair Removal Company Insights

Some of the key players operating in the industry include Dectro International, Silhouet‑Tone, and Instantronics International. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Verseo, Inc. and Ballet Technologies Global are some of the emerging players in electrolysis hair removal market.

Key Electrolysis Hair Removal Companies:

The following are the leading companies in the electrolysis hair removal market. These companies collectively hold the largest market share and dictate industry trends.

- Dectro International

- Silhouet‑Tone

- Instantronics International

- Sterex

- Alvi Prague

- Ballet Technologies Global

- Verseo, Inc.

Recent Developments

-

In March 2025, Silhouet‑Tone launched the EVOLUTION XHD, the first electrolysis device to feature three adjustable frequencies (6.78 MHz, 13.56 MHz, and 27.12 MHz). This flexibility allows practitioners to tailor treatments based on hair type and client comfor

-

In October 2024, Silhouet‑Tone finalized the acquisition of Clareblend, Inc., a U.S.-based manufacturer of electrology and microcurrent devices for medspas and skincare clinics.

-

In September 2023, Dectro International announced a significant expansion of its Quebec City facility, adding more than 10,000 square feet for production and warehousing. This move responds to rising demand for their professional-grade electrolysis systems and aims to double production efficiency by early 2024 through new hires and advanced manufacturing technologies.

Electrolysis Hair Removal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 888.2 million

Revenue forecast in 2033

USD 1,335.8 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Dectro International; Silhouet‑Tone; Instantronics International; Sterex; Alvi Prague; Ballet Technologies Global; Verseo, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrolysis Hair Removal Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electrolysis hair removal market report based on device type, modality, end-use, and region:

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Professional-grade

-

At-home

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermolysis

-

Blend

-

Galvanic

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Beauty Salons and Spas

-

Dermatology Clinics and Medical Centers

-

Personal Consumers

-

Professional Training Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrolysis hair removal market size was estimated at USD 847.7 million in 2024 and is expected to reach USD 888.2 million in 2025.

b. The global electrolysis hair removal market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 1,335.8 million by 2030.

b. North America dominated the electrolysis hair removal market with a share of 42.9% in 2024. Increased hair removal cases, government initiatives, and technological advancements drive the market's growth.

b. Some of the major participants in the electrolysis hair removal market include Dectro International; Silhouet‑Tone; Instantronics International; Sterex; Alvi Prague; Ballet Technologies Global; Verseo, Inc.

b. The increasing number of hair removal procedures is one of the factors boosting market growth. The increase in hair removal procedures highlights a broader trend toward more durable and results-driven aesthetic treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.