- Home

- »

- Plastics, Polymers & Resins

- »

-

Electromagnetic Shielding Polymers for EV Components Market 2033GVR Report cover

![Electromagnetic Shielding Polymers for EV Components Market Size, Share & Trends Report]()

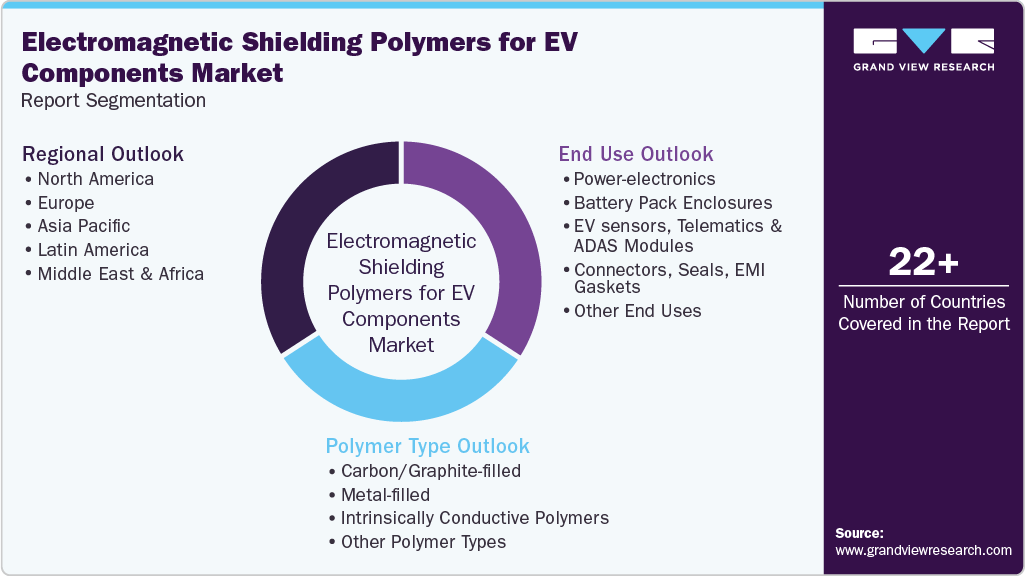

Electromagnetic Shielding Polymers for EV Components Market (2025 - 2033) Size, Share & Trends Analysis Report By Polymer Type (Carbon/Graphite-filled, Metal-filled, Intrinsically Conductive Polymers), By End Use (Power-electronics, Battery Pack Enclosures, EV Sensors), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-814-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electromagnetic Shielding Polymers for EV Components Market Summary

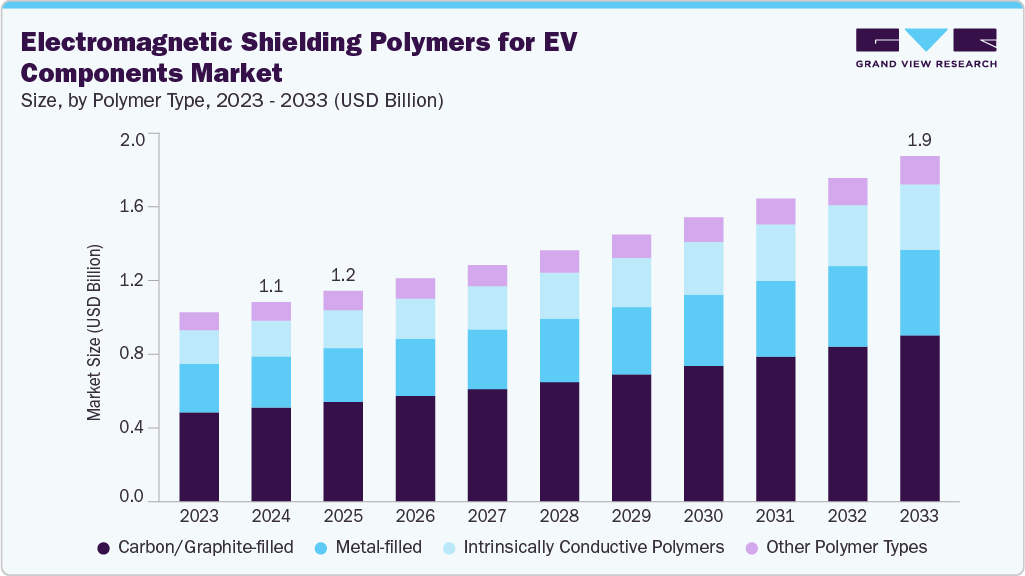

The global electromagnetic shielding polymers for EV components market size was estimated at USD 1.11 billion in 2024 and is projected to reach USD 1.93 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. A growing need to reduce vehicle weight is pushing OEMs to replace metal shielding with lighter polymer systems.

Key Market Trends & Insights

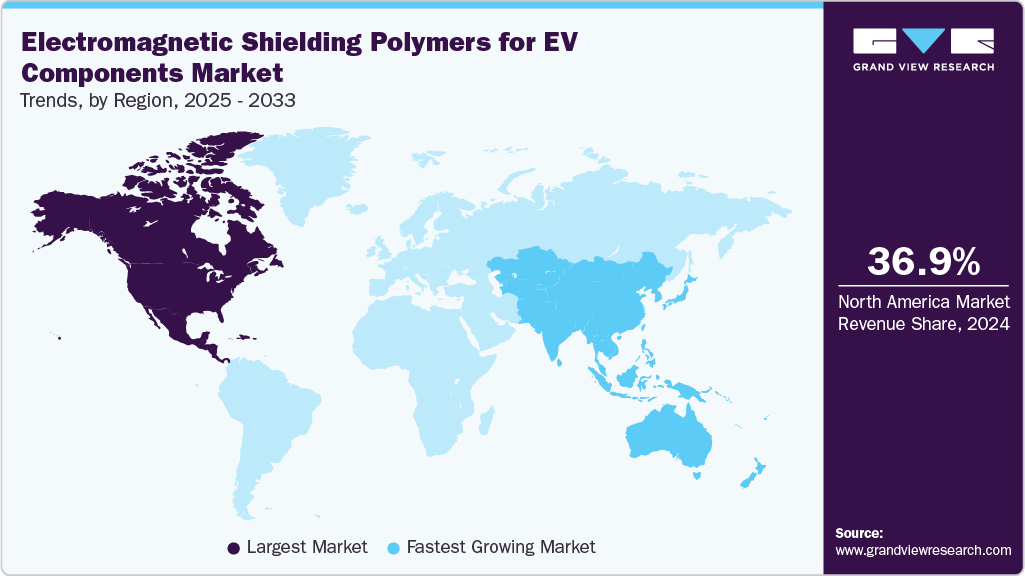

- North America dominated the electromagnetic shielding polymers for EV components market with the largest revenue share of 36.90%in 2024.

- The electromagnetic shielding polymers for EV components market in Canada is expected to grow at a substantial CAGR of 7.5% from 2025 to 2033.

- By polymer type, the intrinsically conductive polymers segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

- By application, the connectors, seals, EMI gaskets segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.11 Billion

- 2033 Projected Market Size: USD 1.93 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This shift supports better driving range and lowers production costs, which strengthens demand for advanced shielding polymers. Material development is shifting from simple conductive fillers to engineered polymer composites that combine EMI attenuation, structural stiffness, and thermal management.

Manufacturers are embedding graphene, carbon nanotubes and metal-coated microspheres into thermoplastics to meet EV packaging demands. This convergence is driven by the need to replace heavy metal shields with lighter, integrated polymer solutions.

Drivers, Opportunities & Restraints

The rise of electric powertrains and advanced driver assistance systems increases onboard electronic content and creates tighter EMC requirements. OEMs require shielding that saves weight while protecting sensitive power electronics, battery management systems and high-frequency telemetry. This regulatory and functional pressure is accelerating adoption of polymer-based shielding across EV architectures.

There is a clear commercial upside for suppliers who can deliver polymer systems that replace separate metal enclosures, cut mass, and simplify assembly. Integrating EMI shielding into battery housings, power electronics brackets and connector housings reduces parts count and can improve vehicle range. Targeted partnerships with Tier 1s and co-development for qualification programs create high-margin, long-cycle revenue streams.

Advanced conductive fillers and nano-engineered additives raise raw material and processing costs. Achieving consistent shielding performance while meeting automotive durability and RoHS/REACH compliance adds validation time and expense. End-of-life recyclability of polymer composites remains a challenge for large scale adoption in cost-sensitive vehicle programs.

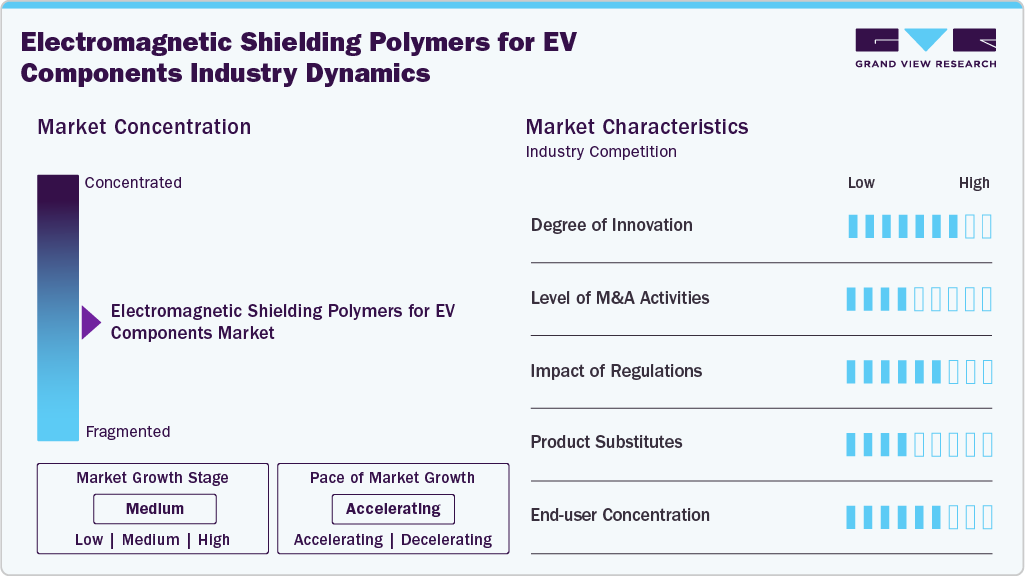

Market Concentration & Characteristics

The market growth stage of the electromagnetic shielding polymers for EV components market is medium, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies such as Avient Corporation, RTP Company, Henkel AG & Co., BASF SE, Covestro AG, Dow Inc., 3M Company, Rogers Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in shielding polymers is concentrated on multifunctional nanocomposites that combine high EMI attenuation with thermal management and structural performance. Developers are using MXenes, graphene, metal-coated particles and liquid-metal or printable silver systems to reach metal-like shielding while keeping parts light and formable. New approaches enable conformal coatings, stretchable printable composites and foam architectures that simplify integration into battery packs and power modules. These advances shorten system-level tradeoffs between protection, cooling and package mass.

Traditional metal shields remain the primary substitute for polymer solutions because aluminum, copper and steel deliver predictable shielding and mechanical robustness. Conductive coatings, metal foils, stitched conductive fabrics and board-level cans also replace polymer shields at different assembly levels when cost or frequency performance matters. Each substitute trades weight and corrosion resistance against cost and manufacturability, which keeps the market split between polymers for lightweight design and metals for legacy or high-power applications.

Polymer Type Insights

Carbon/graphite-filled dominated the electromagnetic shielding polymers for EV components market across the polymer type segmentation in terms of revenue, accounting for a market share of 47.21% in 2024. Graphite- and carbon-filled polymers gain traction because they deliver a balance of shielding performance and cost efficiency for mass-market EV parts. These fillers improve bulk conductivity and heat spread while keeping part weight lower than stamped metal. Suppliers can tune filler loading to meet targeted shielding levels without redesigning existing injection-molded housings. This makes graphite-filled systems attractive for large structural components where scale matters.

The intrinsic conductive polymers segment is anticipated to grow at a substantial CAGR of 7.1% through the forecast period. Intrinsic conductive polymers are finding new demand because they enable thin, conformal coatings and molded parts with predictable electrical behavior. Polymers such as polyaniline and PEDOT derivatives reduce the need for secondary metallization steps and simplify supply chains. This appeals to EV OEMs that need repeatable, high-frequency performance for sensors and lightweight modules. Market growth forecasts for conductive polymers underpin supplier investment in automotive grades.

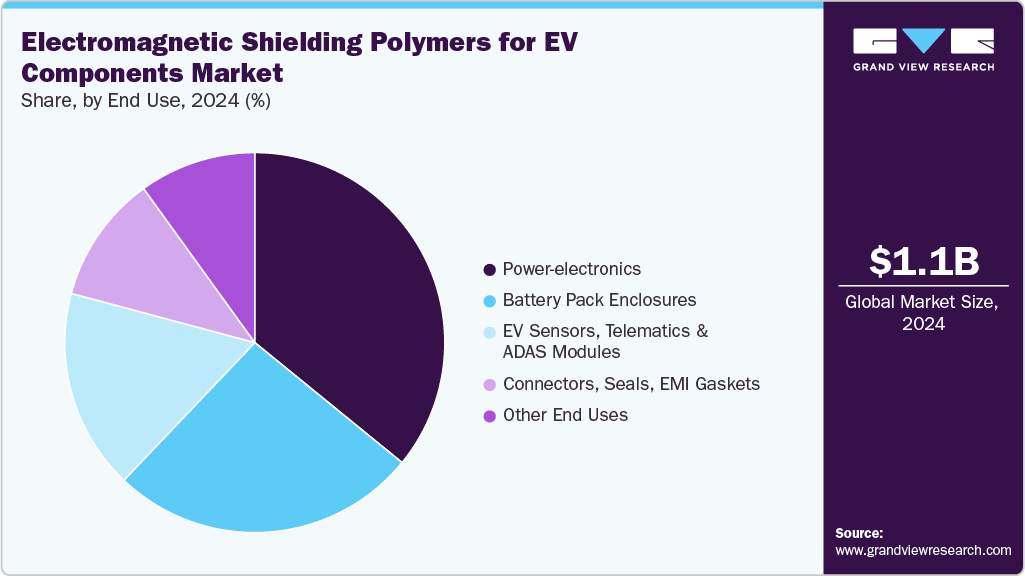

End Use Insights

Power-electronics dominated the electromagnetic shielding polymers for EV components market across the application segmentation in terms of revenue, accounting for a market share of 35.88% in 2024. Power-electronics assemblies drive requirement for polymer shielding that combines EMI attenuation with thermal management. Inverters and DC-DC converters generate broad-spectrum emissions and concentrated heat. OEMs therefore prefer composite materials that protect sensitive electronics while enabling more compact cooling designs. The intensifying electronic content in EV architectures is increasing order sizes and accelerating validation cycles for qualified polymer solutions.

The connectors, seals, EMI gaskets segment is expected to expand at a substantial CAGR of 7.2% through the forecast period. Demand for conductive elastomers and gasket materials is rising as EV designs require reliable interfaces with minimal assembly complexity. Connectors and seals are failure-critical points where even small EMI leaks can disrupt BMS and communication lines. Materials that offer repeatable contact resistance and long-term environmental tolerance shorten qualification timelines for Tier 1 suppliers. Growth in gasket-specific product lines reflects OEM focus on robust, serviceable shielding at interface points.

Regional Insights

North America held the largest share of 36.90%in terms of revenue of the electromagnetic shielding polymers for EV components market in 2024 and is expected to grow at the fastest CAGR of 6.6% over the forecast period. Large-scale investments in battery plants and EV assembly across North America are driving demand for locally sourced, qualified polymer shielding. OEM and Tier 1 qualification cycles shrink when materials are nearby, raising order visibility for suppliers. Recent gigafactory projects and manufacturing incentives are creating scale opportunities for polymer formulators and compounders.

U.S. Electromagnetic Shielding Polymers for EV Components Market Trends

Federal incentives historically encouraged reshoring of battery and EV component manufacturing, expanding supplier pipelines for advanced polymers. That policy-led demand makes the U.S. a priority market for suppliers who can meet automotive qualifications. Recent legislative adjustments have introduced near-term uncertainty, so suppliers must balance investment speed with flexible qualification paths.

Europe Electromagnetic Shielding Polymers for EV Components Market Trends

Stringent EMC rules and dense regulatory oversight force OEMs to adopt predictable shielding solutions early in vehicle design. European manufacturers also prioritize recyclability and substance compliance, which raises the bar for polymer composites. Suppliers able to combine certified EMC performance with compliance and documented end-of-life plans gain a strategic advantage.

Asia Pacific Electromagnetic Shielding Polymers for EV Components Market Trends

China’s dominant EV production and export role is creating massive local demand for integrated shielding materials and fast qualification cycles. Suppliers in the Asia Pacific region benefit from large batch volumes and rapid design iterations. India’s incentive programs and localization mandates are also opening new pockets of demand for qualified polymer solutions tailored to domestic OEMs.

Electromagnetic Shielding Polymers for EV Components Market Company Insights

The Electromagnetic Shielding Polymers for EV Components Market is highly competitive, with several key players dominating the landscape. Major companies include Avient Corporation, RTP Company, Henkel AG & Co., BASF SE, Covestro AG, Dow Inc., 3M Company, and Rogers Corporation. The electromagnetic shielding polymers for EV components market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Electromagnetic Shielding Polymers for EV Components Companies:

The following are the leading companies in the electromagnetic shielding polymers for EV components market. These companies collectively hold the largest market share and dictate industry trends.

- Avient Corporation

- RTP Company

- Henkel AG & Co.

- BASF SE

- Covestro AG

- Dow Inc.

- 3M Company

- Rogers Corporation

Recent Developments

-

In June 2025, Henkel launched a graphene-enhanced polymer composite for EMI shielding in high-frequency applications. The product targets lightweight, multifunctional shielding with integrated thermal management for electronics and telecom equipment.

-

In April 2024, BASF expanded its e-mobility plastics portfolio to include grades specifically formulated for EMI shielding in e-motor and power-electronics applications. The announcement highlighted materials that combine shielding performance with long service life and thermal management for automotive electrification.

Electromagnetic Shielding Polymers for EV Components Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.18 billion

Revenue forecast in 2033

USD 1.93 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report segmentation

Polymer type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Avient Corporation; RTP Company; Henkel AG & Co.; BASF SE; Covestro AG; Dow Inc.; 3M Company; Rogers Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electromagnetic Shielding Polymers for EV Components Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the electromagnetic shielding polymers for EV components market report on the basis of polymer type, end use, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carbon/Graphite-filled

-

Metal-filled

-

Intrinsically Conductive Polymers

-

Other Polymer Types

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Power-electronics

-

Battery Pack Enclosures

-

EV sensors, Telematics & ADAS Modules

-

Connectors, Seals, EMI Gaskets

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.