- Home

- »

- Medical Devices

- »

-

Electronic Drug Delivery Systems Market Size Report, 2030GVR Report cover

![Electronic Drug Delivery Systems Market Size, Share & Trends Report]()

Electronic Drug Delivery Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Auto Injectors), By Application (Cardiovascular Disease), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-533-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Drug Delivery Systems Market Summary

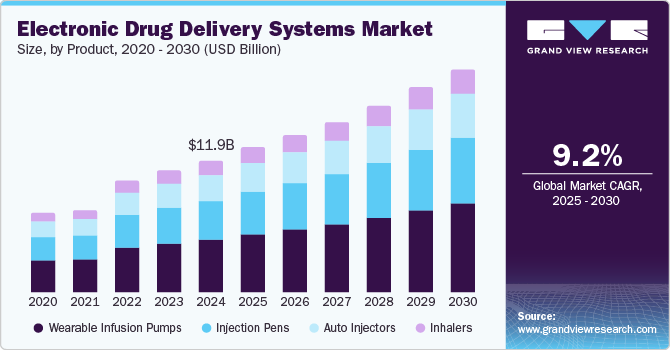

The global electronic drug delivery systems market size was valued at USD 11.95 billion in 2024 and is projected to reach USD 20.19 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The major factors driving the market include the increasing prevalence of chronic diseases, such as cardiovascular disease (CVDs), asthma, and diabetes, and technological advancements in developing smart drug delivery systems.

Key Market Trends & Insights

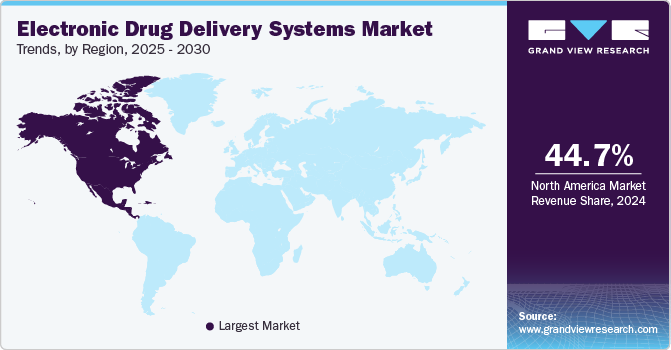

- North America electronic drug delivery systems market held the largest share of 44.7% in 2024.

- The Asia Pacific electronic drug delivery systems market is anticipated to grow at a CAGR of 9.8% over the forecast period.

- Based on product, the wearable infusion pumps segment accounted for the largest share of 41.4% in 2024.

- Based on application, the diabetes segment held the largest market share of 36.4% in 2024 and is expected to grow at the fastest CAGR over the forecast period.

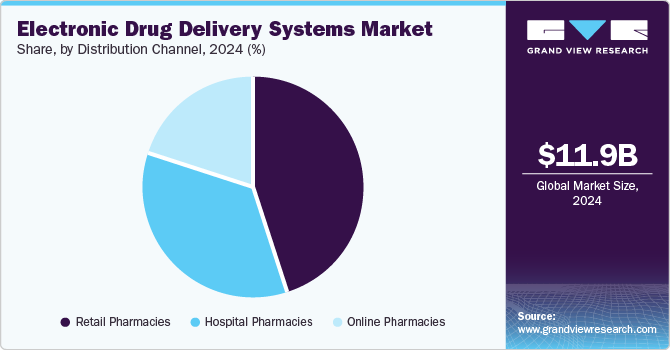

- Based on distribution channel, the retail pharmacies segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.95 Billion

- 2030 Projected Market Size: USD 20.19 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

Electronic drug delivery systems are portable devices that provide patients with convenient solutions, including enhanced adherence to treatment, quick administration times, precise dosing, and simplified drug delivery. The introduction of advanced minimally invasive drug delivery systems allows patients with chronic illnesses to administer their regular doses, reducing the need for hospital visits and associated costs.

The rising prevalence of chronic diseases such as cardiovascular diseases, asthma, and diabetes drives the electronic drug delivery systems market. These conditions require efficient and precise medication management, which electronic systems facilitate. According to the World Health Organization (WHO), diabetes is a chronic metabolic disease affecting around 830 million people worldwide, with a significant burden in low- and middle-income countries. Type 2 diabetes, the most common form, is rising dramatically due to lifestyle changes, while type 1 diabetes involves little to no insulin production by the pancreas. Despite global efforts to halt its rise by 2025, over half of those affected lack access to critical treatments, including insulin, highlighting a significant healthcare gap.

The adoption of advanced minimally invasive drug delivery systems has enabled patients with chronic illnesses to self-administer regular doses with ease and accuracy. This innovation enhances patient convenience and adherence to treatment regimens, reducing dependency on healthcare facilities. Such advancements are key drivers for the growth of the electronic drug delivery systems market, addressing the demand for patient-centric solutions. For instance, in February 2024, Koninklijke Philips N.V. launched the LumiGuide system, a 3D, light-powered navigation solution designed for minimally invasive surgeries, offering radiation-free precision. It employs advanced imaging and proprietary algorithms to provide surgeons with real-time guidance, improving accuracy and reducing patient trauma. LumiGuide represents a significant leap in medical imaging, focusing on safety and efficiency, and aligns with Philips' patient-centric approach to innovation.

Product Insights

Wearable infusion pumps accounted for the largest share of 41.4% in 2024. The growing demand for minimally invasive, user-friendly devices for managing chronic conditions such as diabetes is a key driving factor for wearable infusion pumps in the electronic drug delivery systems market. For instance, in September 2024, Embecta Corp received FDA clearance for its insulin patch pump for managing Type 1 and Type 2 diabetes. The compact, wearable device provides a minimally invasive solution for continuous insulin delivery, enhancing convenience and improving patient quality of life. This development underscores the company's commitment to advancing diabetes care through innovative drug delivery technologies.

The injection pens segment is expected to grow at the fastest CAGR of 9.9% over the forecast period. This growth can be attributed to the growing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis, requiring regular medication administration. Enhanced patient compliance and convenience due to injection pens' ease of use and precision further boost their adoption. In addition, advancements in technology, such as electronic tracking, dose adjustments, and increased awareness about self-administered therapies, are key contributors to market growth.

Application Insights

The diabetes segment held the largest market share of 36.4% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing demand for automated and precise insulin delivery systems to improve blood glucose management and reduce manual intervention. For instance, in August 2024, the FDA cleared the first device enabling automated insulin dosing for individuals with Type 2 diabetes. This system integrates continuous glucose monitoring and insulin pump technology to provide precise, automated insulin delivery tailored to patients' needs. This advancement aims to improve blood glucose management, reduce manual intervention, and enhance the quality of life for those managing Type 2 diabetes.

The respiratory diseases segment is expected to grow significantly over the forecast period. This growth can be attributed to the rising prevalence of respiratory conditions such as asthma and COPD due to urbanization and pollution. Technological advancements, such as smart inhalers and IoT-enabled devices, enhance drug delivery efficiency and patient compliance. These systems offer real-time tracking and remote monitoring capabilities, promoting better disease management. Increasing awareness and demand for personalized, user-friendly solutions further boost market growth.

Distribution Channel Insights

The retail pharmacies segment dominated the market with the largest revenue share in 2024. The growing demand for convenient home delivery of prescription medications, driven by advancements in digital pharmacy services and fulfillment networks, is a key driving factor for the segment. For instance, in March 2024, Eli Lilly and Company partnered with Amazon Pharmacy (Amazon.com, Inc.) to deliver its weight-loss drug, Zepbound, and other medications for diabetes and migraines via LillyDirect, a direct-to-consumer digital pharmacy service. This collaboration was expected to enable convenient home delivery of prescribed medicines, leveraging Amazon's fulfillment network. The growing demand for weight-loss drugs, driven by their potential for significant weight reduction, is fueling the expansion of this service.

The online pharmacies segment is projected to grow at the fastest CAGR of 10.6% over the forecast period. Online pharmacies are rising due to the increasing consumer demand for the convenience of home delivery, which allows easy access to medications. With lower operational costs than traditional pharmacies, online platforms can offer more affordable pricing. This cost efficiency, combined with convenience, is attracting more consumers to opt for online pharmacy services.

Regional Insights

North America electronic drug delivery systems market held the largest share of 44.7% in 2024, which can be attributed to the increasing demand for precise, reliable, and ISO-compliant testing solutions for autoinjectors, ensuring optimal performance and safety in drug delivery devices. For instance, in July 2024, Instron (Illinois Tool Works Inc.) introduced its next-generation Autoinjector Testing System, designed for comprehensive functionality testing of pen and autoinjectors according to ISO 11608 standards. In collaboration with pharmaceutical companies and CDMOs, the system evaluates key performance factors, including needle depth, injection time, activation force, dose accuracy, cap removal, and needle guard lockout. This innovative solution ensures precise and reliable performance for autoinjector devices.

U.S. Electronic Drug Delivery Systems Market Trends

The U.S. electronic drug delivery systems market dominated in 2024 due to the increasing adoption of smart connected devices to improve medication adherence and enhance patient outcomes. For instance, in February 2022, AptarGroup, Inc. launched the HeroTracker Sense, a smart connected device that integrates with pressurized metered dose inhalers (pMDIs) to enhance respiratory treatment management. It features sensors to monitor inhaler usage, providing patients and healthcare providers with real-time adherence data via digital platforms.

Europe Electronic Drug Delivery Systems Market Trends

The Europe electronic drug delivery systems market was identified as a lucrative region in 2024. The growing adoption of automated and connected drug delivery systems to enhance chronic disease management is driving the Europe electronic drug delivery systems market. For instance, in February 2024, Insulet Corporation's Omnipod 5 insulin pump, integrated with Abbott's FreeStyle Libre 2 continuous glucose monitor (CGM), received regulatory approval in the European Union. This system automates insulin delivery based on real-time glucose readings, enhancing diabetes management for patients aged two and older. The approval underscored advancements in connected healthcare technology, aiming to improve convenience and glycemic control for individuals with diabetes.

Asia Pacific Electronic Drug Delivery Systems Market Trends

The Asia Pacific electronic drug delivery systems market is anticipated to grow at a CAGR of 9.8% over the forecast period. The rising prevalence of diabetes and related complications in the Asia Pacific region is driving the demand for advanced electronic drug delivery systems for better disease management and early intervention. According to the WHO, in India, around 77 million adults are affected by type 2 diabetes, with nearly 25 million at risk of developing it due to prediabetes. Over 50% of individuals with diabetes are unaware of their condition, which can lead to severe complications such as heart attacks, strokes, nerve damage, foot ulcers, blindness, and kidney failure. Early detection and treatment are crucial to managing the health risks associated with diabetes.

The China electronic drug delivery systems market held a substantial market share in 2024 and is expected to grow at the fastest CAGR over the forecast period owing to the rising prevalence of chronic diseases such as diabetes and respiratory disorders, increasing adoption of smart healthcare devices, technological advancements, and growing demand for improved drug adherence and patient management solutions. In addition, government initiatives supporting healthcare modernization and expanding digital health solutions further fuel market growth.

Key Electronic Drug Delivery Systems Company Insights

Some of the key companies in the electronic drug delivery systems market include Bayer AG, Gerresheimer AG, Medtronic, Elcam Medical, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Bayer AG focuses on discovering, developing, and producing products for human health and agriculture. Its offerings include medicines for various diseases, crop protection solutions, seeds, and non-prescription products. The company markets its healthcare and agricultural products through wholesalers, pharmacies, hospitals, and retailers.

-

Medtronic is a global medical technology company that designs, develops, and manufactures various medical devices for treating heart valve disorders, heart failure, vascular diseases, neurological disorders, and musculoskeletal issues. The company also provides biologic solutions for orthopedics and dental markets.

Key Electronic Drug Delivery Systems Companies:

The following are the leading companies in the electronic drug delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Gerresheimer AG

- Medtronic

- Elcam Medical

- Novo Nordisk A/S

- Insulet Corporation

- Unilife Corporation (Amgen Inc.)

- BD

Recent Developments

-

In November 2024, Medtronic’s InPen, a smart insulin pen, received FDA approval for the management of type 1 and 2 diabetes. The device integrates with a mobile app, allowing users to track insulin doses, provide real-time dosage recommendations, and monitor blood glucose levels.

-

In May 2023, Medtronic announced its definitive agreement to acquire EOFlow, a South Korean company specializing in wearable insulin patch pumps. This acquisition aimed to enhance Medtronic's diabetes management portfolio by integrating EOFlow's innovative technology with its existing products.

-

In March 2021, Jabil Inc. entered into a collaboration agreement with E3D, granting exclusive rights to develop a high-volume reusable auto-injector and connected variants.

Electronic Drug Delivery Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.02 billion

Revenue forecast in 2030

USD 20.19 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bayer AG; Gerresheimer AG; Medtronic; Elcam Medical; Novo Nordisk A/S; Insulet Corporation; Unilife Corporation (Amgen Inc.); BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Electronic Drug Delivery Systems Market Report Segmentation

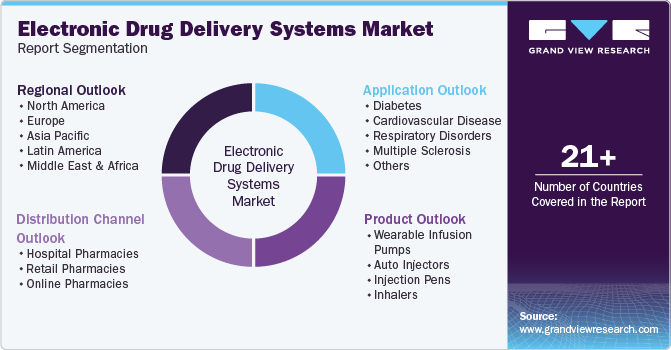

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic drug delivery systems market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wearable Infusion Pumps

-

Auto Injectors

-

Injection Pens

-

Inhalers

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diabetes

-

Cardiovascular Disease

-

Respiratory Disorders

-

Multiple Sclerosis

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.