- Home

- »

- Healthcare IT

- »

-

Electronic Trial Master File Systems Market Size Report 2030GVR Report cover

![Electronic Trial Master File Systems Market Size, Share & Trends Report]()

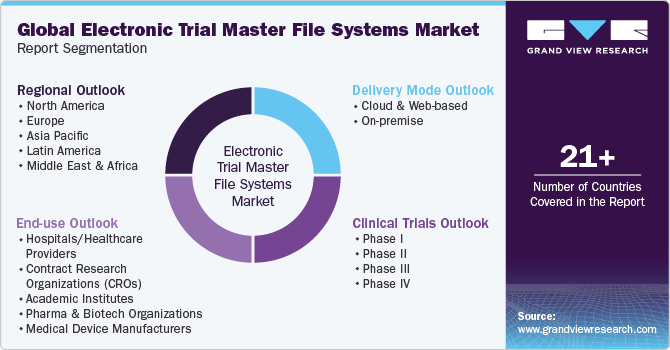

Electronic Trial Master File Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Delivery Mode (Cloud & Web-based, On-premise), By Clinical Trials (Phase I, Phase II), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

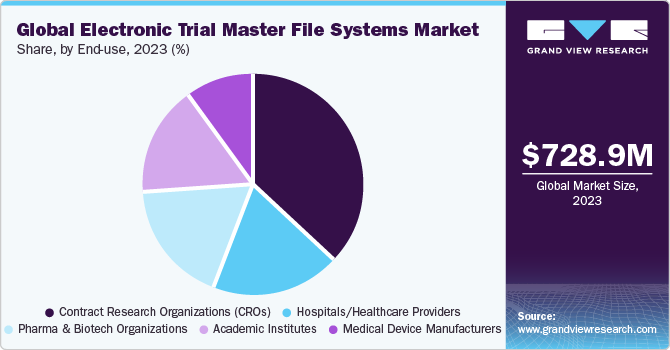

The global electronic trial master file systems market size was estimated at USD 728.9 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2024 to 2030. The market growth is attributed to the increasing number of clinical trials and the growing adoption of eTMF systems. According to ClinicalTrials.gov, as of January 2024, there were 477,237 registered clinical trials globally. Moreover, growing partnerships between contract research organizations (CROs) and biopharma companies also contribute to market growth.

Moreover, the presence of a stringent regulatory structure for clinical trials and an increased need for safety monitoring are playing a vital role in the growth of the market in developed economies such as the U.S. For instance, the U.S. Department of Health and Human Services and the National Institutes of Health are tightening clinical trial registration requirements and promoting clinical data sharing. Surging demand for software solutions for clinical trials by pharma and biopharma companies is one of the primary growth stimulants of the market. In addition, increasing government grants to substantiate trials and widening the end-user base for eTMF solutions are anticipated to boost the market over the forecast period.

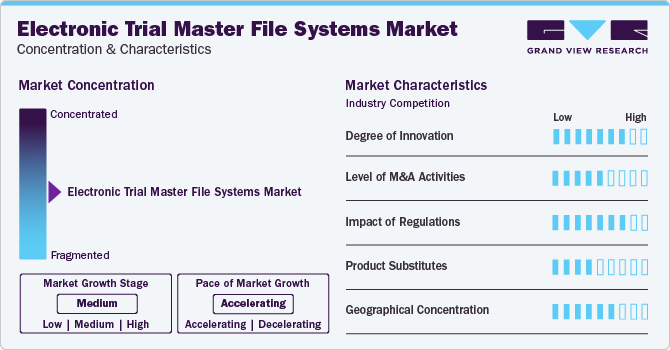

Market Concentration & Characteristics

The market is expected to experience an unprecedented growth rate, owing to the increasing externalization, and outsourcing of clinical trials by most of the leading pharmaceutical and biotechnological companies from 2024 to 2030. For instance, in March 2023, LEO Pharma, a prominent player in medical dermatology, partnered with ICON plc to enhance the efficiency of clinical trial execution with a patient-centric and cost-effective focus. The partnership is expected to utilize a customized and adaptable hybrid approach, incorporating fully outsourced and functional outsourcing models to optimize resources and streamline the clinical trial process.

Degree of Innovation: The market has seen advancements in data management and workflow, with innovations enabling users to directly execute, review, and approve workflows within the eTMF application.

The eTMF solutions market faces a major constraint due to limited awareness about research software, services, and clinical data management systems. This lack of awareness, especially in developing economies, hampers the adoption of these solutions.

The regulatory landscape plays a crucial role in shaping the adoption of eTMF solutions. While FDA and international GCP guidelines mandate the use of TMFs, they don't specify them to be electronic. Sponsors are obligated to maintain, provide access to, and ensure accuracy in TMFs, following regulations. Opting for an eTMF puts the responsibility on sponsors to guarantee the system's security and compliance with 21 CFR Part 11.

Delivery Mode Insights

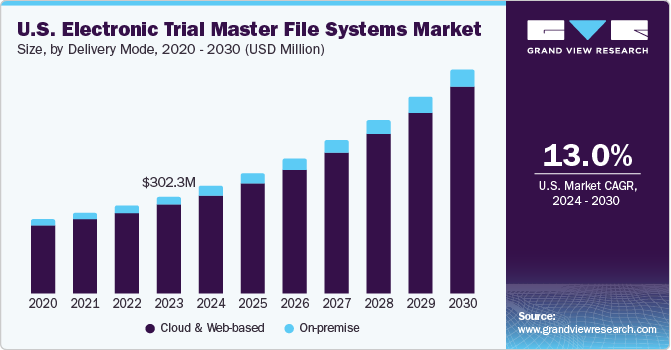

Cloud and web-based segment dominated the market with largest revenue share of 91.3% in 2023. This is due to benefits like easy accessibility, usability, and lower investments. Cloud and web-based products offer easy customization, allowing providers to tailor information presentations for diverse user groups. Moreover, these products demonstrate higher interoperability. This segment is expected to maintain its position throughout the forecast period.

On-premise delivery mode involves installing services and solutions on computers present within the organization. Though the software needs to be installed within the organization’s premises, it can be accessed from remote locations, providing the benefit of reduced costs due to power consumption and system maintenance. The on-premise eTMF solution is the most preferred solution due to its benefits, such as security and ease of access. Preference for these services is mainly due to complete access to information and full control within the premises.

Clinical Trials Insights

Phase III segment dominated the market with the largest revenue share of 53.3% in 2023. The drug development sector is experiencing significant growth due to a rising number of drugs successfully advancing to phase III. In this phase, drug efficacy is studied using a group exceeding 1,000 patients. With the growing patient number, study complexity rises, creating a demand for technologically advanced data management systems. Consequently, computer-based systems like eTMF solutions are being increasingly adopted.

The phase I segment is anticipated to witness the fastest growth at a CAGR of 15.6% from 2024 to 2030. The segment is anticipated to grow significantly due to a large number of phase I trials and the intricate management and analysis of data obtained across various studies. As of June 2021, the American clinical trial database reported approximately 20,182 registered clinical trials in the UK. Advances in biological modeling systems and personalized medicine technologies have accelerated the development of new drugs, further fueling market growth.

End-use Insights

Contract Research Organizations (CROs) segment dominated the market with the largest revenue share of 37.1% in 2023. Moreover, the segment is projected to rise at the fastest CAGR of 15.0% during the forecast period. Pharmaceutical companies are increasingly looking for ways to cut down on their overall expenditure. Thus, there has been a growing adoption of eTMF solutions in research, which is contributing to the segment growth.

Benefits involved in outsourcing clinical trials to CROs are responsible for the heightened growth of this segment. For instance, in January 2021, ICON plc, provided clinical trials services to BioNTech SE and Pfizer, showcasing the benefits of a strong partnership between the sponsor and CRO. This collaboration has redefined industry expectations in terms of trial management and speed.

Regional Insights

North America Electronic Trial Master File (eTMF) Systems Market

North America dominated the market with the largest revenue share of 49.5 % in 2023. The market growth is attributed to a combination of factors, including an increasing target population, a rise in lifestyle-associated diseases such as diabetes and cardiac disorders, and the launch of new products by key market players. Government grants have also contributed to the growth of the market in the region. Furthermore, the presence of well-established healthcare infrastructure is anticipated to further boost the growth of the regional market.

U.S. Electronic Trial Master File (eTMF) Systems Market

The U.S. eTMF systems market is poised for growth, benefiting from a robust healthcare infrastructure and government support in the form of grants and funding for healthcare research and development.

Europe Electronic Trial Master File (eTMF) Systems Market

Europe eTMF systems market is expected to experience significant growth, driven by increasing demand for cloud-based solutions in clinical trials and the necessity for improved data sharing and collaboration among stakeholders.

Germany Electronic Trial Master File (eTMF) Systems Market

Germany eTMF systems market is anticipated to grow, reflecting a focus on patient-centric approaches in healthcare and clinical research within the country.

Denmark Electronic Trial Master File (eTMF) Systems Market

Denmark eTMF systems market is projected to grow, influenced by a rising population and preventive initiatives by the healthcare system, leading to increased adoption of eTMF services.

Asia Pacific Electronic Trial Master File (eTMF) Systems Market

In the Asia-Pacific region, eTMF systems market is set to witness rapid growth with highest CAGR of 16.5% over the forecast period. The surge is fueled by high unmet medical needs, rising prevalence of chronic diseases, and the outsourcing of trials to countries like China, India, Korea, and Japan due to large patient populations and cost advantages.

China Electronic Trial Master File (eTMF) Systems Market

China's eTMF market systems is expected to grow, driven by increasing government funding for research and drug discovery, particularly under initiatives like Healthy China 2030, forecasting the expansion of the healthcare market to USD 2.4 trillion by 2030.

Japan Electronic Trial Master File (eTMF) Systems Market

Japan's eTMF market is poised for growth due to the rising adoption of eTMF solutions enhancing the efficiency of clinical trials through streamlined data collection, analysis, and reporting.

India Electronic Trial Master File (eTMF) Systems Market

India eTMF systems market is anticipated to grow at the fastest CAGR, supported by the National Digital Health Mission (NDHM), aiming to create a national digital health ecosystem, driving the adoption of eTMF solutions in the region.

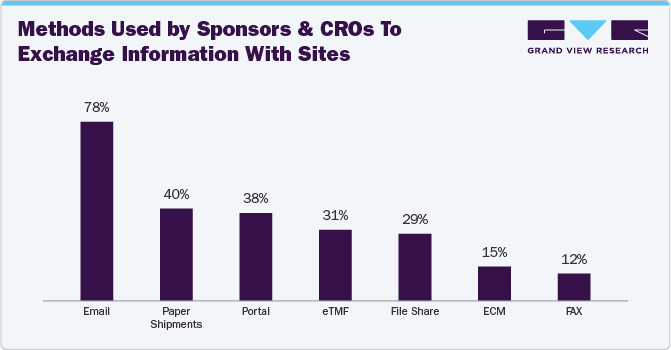

Survey Insights

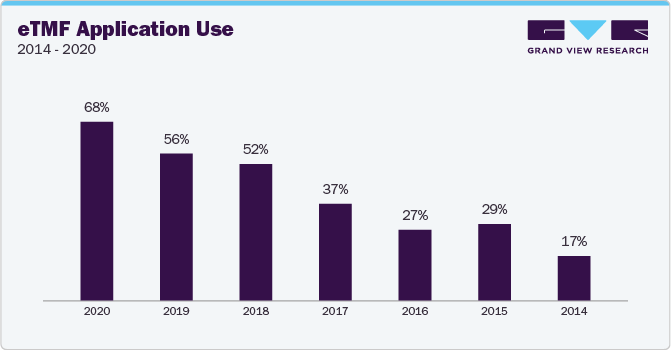

The 2020 Unified Clinical Operations Survey Report by Veeva Systems showcases the growing acceptance of eTMF solutions within CROs and sponsors for streamlining clinical trials. The report indicates a rise in eTMF adoption for trial management, increasing from 59% in 2017 to 78% in 2020. In addition, the below bar graph reveals that 31% of CROs and sponsors leverage eTMF solutions for information exchange with trial sites.

Furthermore, the bar chart below illustrates that eTMF application adoption quadrupled in 2020 compared to a 17% adoption rate in 2014, as highlighted in the survey.

Key Electronic Trial Master File Systems Company Insights

The competitive eTMF systems market is characterized by a few notable players, including Oracle, Clinevo Technologies, MasterControl Solutions, Inc., Veeva Systems, Aris Global LLC, PHARMALEX GMBH, TransPerfect, and Aurea, Inc., among others. These players are actively involved in strategic initiatives like mergers and acquisitions to strengthen their market positions.

In June 2022, Anju Software launched eTMF Master, a novel cloud-based eTMF software. This innovative solution aims to enhance collaboration among sponsors, Contract Research Organizations (CROs), and trial sites by providing an efficient and secure platform for managing clinical trial content in full compliance with regulatory standards.

“With clinical studies becoming more complex and stakeholders responsible for tracking and reporting rapidly multiplying trial-related content, the industry is asking for more efficient regulatory-compliant processes to create and manage essential trial content. As the latest addition to our eClinical suite, we designed eTMF Master so sponsors, CROs, and sites working on a clinical trial anywhere in the world can collaborate with each other and quickly collect and manage all their content in one system to help ensure that no information about that trial is ever missing.”

- Debashish Niyogi, Ph.D., Anju’s Director of Product Management-eTMF

Key Electronic Trial Master File Systems Companies:

The following are the leading companies in the electronic trial master file systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these eTMF systems companies are analyzed to map the supply network.

- Oracle

- Clinevo Technologies

- MasterControl Solutions, Inc.

- Veeva Systems

- Aris Global LLC

- PHARMALEX GMBH

- TransPerfect

- Aurea, Inc.

- ePharmaSolutions (WCG Clinical)

- SureClinical Inc.

- Ennov

- Montrium Inc.

- Cloudbyz

- TRIAL INTERACTIVE

- Anju Software

- Octalsoft

- Egnyte, Inc.

Recent Developments

-

In November 2023, Egnyte introduced a Quality Control feature for its eTMF application, enabling users to execute review and approve workflows directly within the eTMF application. This streamlines the process before formally archiving sensitive trial content into the Trial Master File (TMF), eliminating challenges associated with managing operations across multiple systems.

-

“Egnyte’s new eTMF Quality Control feature joins a suite of eTMF-focused features in the Egnyte platform and is a reflection of our commitment to creating industry-leading solutions that improve workflows and data management for biotechs.Integrating the review process into the eTMF solution not only improves the user experience, it also enables companies to better adhere to regulatory guidelines.”

-

In August 2021, Alimentiv, Inc. announced a partnership with Veeva Vault eTMF, allowing sponsors secure and real-time access to all clinical documentation throughout the clinical trial lifecycle. Alimentiv adopted Vault eTMF as part of its technology modernization strategy, aiming to enhance the efficiency of clinical trial workflows and offer real-time transparency into the Trial Master File (TMF) status. Vault eTMF fully supports the TMF Reference Model, facilitating easy and quick document retrieval for Alimentiv and its partners

Electronic Trial Master File Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 819.9 million

Revenue forecast in 2030

USD 1.9 billion

Growth rate

CAGR of 14.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, clinical trials, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; South Korea; Australia; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle; Clinevo Technologies; MasterControl Solutions, Inc.; Veeva Systems; Aris Global LLC; PHARMALEX GMBH; TransPerfect; Aurea, Inc.; ePharmaSolutions (WCG Clinical); SureClinical Inc.; Ennov; Montrium Inc.; Cloudbyz; TRIAL INTERACTIVE; Anju Software; Octalsoft; Egnyte, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Trial Master File Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic trial master file systems market report based on delivery mode, clinical trials, end-use, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud And Web-based

-

On-premise

-

-

Clinical Trials Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Healthcare providers

-

Contract Research Organizations (CROs)

-

Academic Institutes

-

Pharma & Biotech Organizations

-

Medical Device Manufacturers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Rest of Europe (EU) {RoE}

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific (RoAPAC)

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of Latin America (RoLA)

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa (RoMEA)

-

-

Frequently Asked Questions About This Report

b. The global electronic trial master file systems market size was estimated at USD 728.9 million in 2023 and is expected to reach USD 819.9 million in 2024.

b. The global electronic trial master file systems market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 1.9 billion in 2030.

b. North America dominated the electronic trial master file systems market with a share of 49.52% in 2023. The is attributed to an increasing target population, a rise in lifestyle-associated diseases such as diabetes and cardiac disorders, and the launch of new products by key market players.

b. Some key players operating in the eTMF systems market include Oracle; Clinevo Technologies; MasterControl Solutions, Inc.; Veeva Systems; Aris Global LLC; PHARMALEX GMBH; TransPerfect; Aurea, Inc.; ePharmaSolutions (WCG Clinical); SureClinical Inc.; Ennov; Montrium Inc.; Cloudbyz; TRIAL INTERACTIVE; Anju Software; Octalsoft.

b. Key factors that are driving the eTMF systems market growth include growing partnerships between contract research organizations (CROs) and biopharma companies and an increasing number of clinical trials,

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.