- Home

- »

- Clinical Diagnostics

- »

-

Electrophoresis Market Size & Share, Industry Report, 2030GVR Report cover

![Electrophoresis Market Size, Share & Trends Report]()

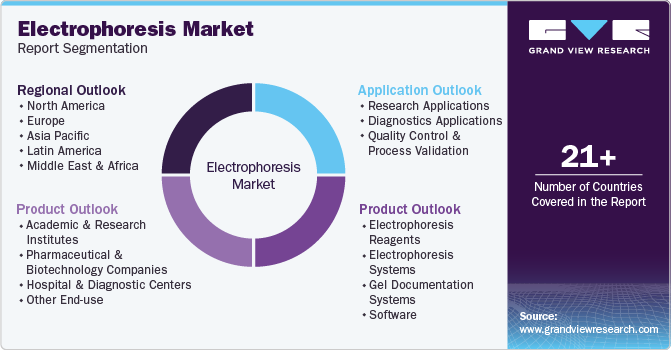

Electrophoresis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Electrophoresis Reagents, Systems), By Application (Research Applications, Diagnostics Applications), By End Use (Academic & Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrophoresis Market Summary

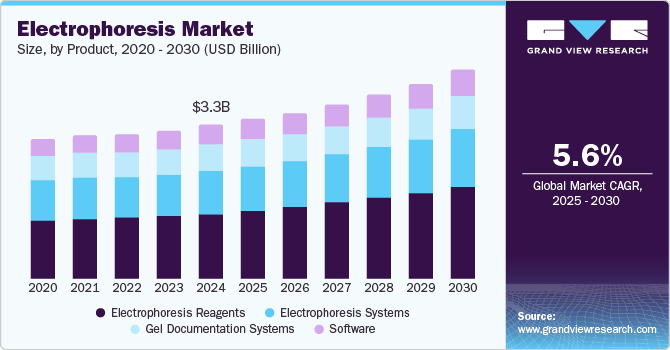

The Global Electrophoresis Market size was estimated at USD 3.29 billion in 2024 and is projected to reach USD 4.49 billion by 2030, growing at a CAGR of 5.62% from 2025 to 2030. The growth of the market is attributed to the increasing demand for advanced diagnostic tools, rising investments in biotechnology and healthcare research, and the growing need for efficient protein and nucleic acid analysis.

Key Market Trends & Insights

- North America electrophoresis market dominated the market with the largest revenue share of 35.41% in 2024.

- The Asia Pacific market is expected to witness the fastest CAGR of over the projected period.

- Based on product, the electrophoresis reagents segment dominated the market with a share of 41.85% in 2024.

- Based on application, the research applications segment dominated the market with a share of 52.65% in 2024.

- Based on end use, the pharmaceutical and biotechnology companies segment dominated the market with a share of 43.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.29 Billion

- 2030 Projected Market Size: USD 4.49 Billion

- CAGR (2025-2030): 5.62%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Electrophoresis plays a critical role in various applications such as drug development, disease diagnosis, and research, driving the demand for more sophisticated, high-throughput systems. As the biotechnology, pharmaceutical, and academic sectors continue to focus on precision medicine and genetic research, the need for reliable and efficient electrophoresis systems to separate and analyze proteins, DNA, and RNA is on the rise.

One of the major drivers of growth is the continuous advancements in technology. The development of automated systems, which enhance the efficiency and reproducibility of experiments, is increasing the adoption of these techniques across laboratories worldwide. Additionally, innovations such as high-resolution electrophoresis and the integration of multiplexing capabilities are improving the sensitivity and throughput of these systems. With these advancements, electrophoresis is becoming more accessible and versatile, capable of meeting the evolving demands of various industries, including clinical diagnostics, academic research, and biopharmaceuticals. For instance, the Agilent ProteoAnalyzer system, which is an advanced automated parallel capillary electrophoresis platform designed for protein analysis. This innovative solution streamlines and optimizes the analysis of complex protein mixtures, serving a wide range of industries including pharmaceuticals, biotechnology, food analysis, and academic research.

The rising emphasis on personalized medicine and targeted therapies is another significant factor driving the growth of the market. As healthcare shifts towards more tailored treatments, genetic testing, biomarker identification, and molecular diagnostics have become essential components of medical research and clinical practice. Electrophoresis plays an integral role in these areas, enabling the precise separation and analysis of biomolecules that can be used for disease detection, treatment selection, and monitoring therapeutic efficacy. The increasing demand for genetic testing and the expanding use of electrophoresis in oncology, neurology, and other therapeutic areas are expected to further fuel market growth.

Furthermore, another key factor driving the electrophoresis industry is the increasing demand from clinical laboratories and diagnostic centers. As more clinical laboratories adopt electrophoresis techniques for routine testing and disease diagnosis, particularly in the areas of genetic testing, blood analysis, and protein profiling, the market is experiencing a steady uptick in adoption. Additionally, the rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, which require precise molecular diagnostic techniques for early detection, further contributes to the demand for electrophoresis-based systems.

Moreover, Pharmaceutical and biotechnology companies are also contributing to the market expansion by investing heavily in research and development (R&D) to discover new drugs and therapies. Electrophoresis is widely used in the drug development process, from screening potential drug candidates to analyzing protein interactions and characterizing therapeutic antibodies. As pharmaceutical companies continue to focus on creating innovative biologic drugs, the demand for advanced systems capable of high-throughput analysis and detailed protein profiling is rising. This growth is particularly evident in areas such as monoclonal antibody development and gene therapy, where electrophoresis is crucial for analyzing complex molecules.

However, the high cost associated with advanced systems and their maintenance is a major restraining factor for growth of the market. These systems, particularly high-throughput or automated platforms, often require significant capital investment, specialized equipment, and skilled personnel for operation, making them less accessible to smaller laboratories or those in emerging markets with limited budgets. Additionally, the complexity of certain electrophoresis techniques can result in longer training periods and potential errors if not properly managed. While these systems offer superior accuracy and efficiency, their cost and operational demands can limit adoption, particularly in low-resource settings. Furthermore, the slow pace of technology adoption in some regions, coupled with regulatory barriers and the need for regulatory approvals, can hinder market growth in certain areas.

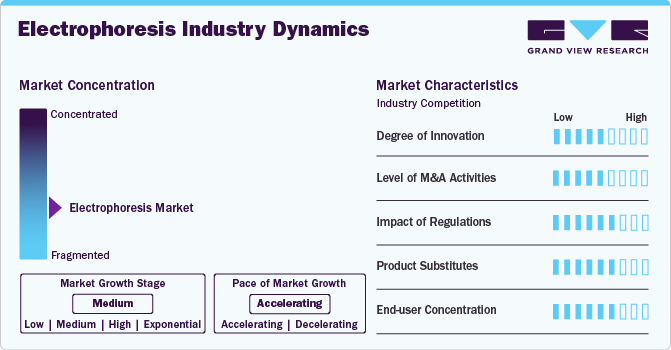

Market Concentration & Characteristics

The degree of innovation in the electrophoresis market is high, driven by advancements in technology aimed at improving the speed, accuracy, and efficiency of electrophoresis techniques. Innovations include the development of automated systems, high-resolution gel, and capillary electrophoresis, which provide enhanced performance and reduce the potential for human error. Newer technologies, such as microfluidic devices and lab-on-a-chip systems, are also being incorporated into electrophoresis instruments to enable more precise analyses with smaller sample volumes. Companies like Bio-Rad Laboratories and Thermo Fisher Scientific are continuously releasing new products that incorporate cutting-edge technologies, which further increase the market’s growth.

The level of mergers and acquisitions (M&A) activities in the market is medium. Larger players in the industry, such as Thermo Fisher Scientific, GE Healthcare, and Agilent Technologies, have been acquiring smaller companies or forming partnerships to enhance their product portfolios and expand market presence. These acquisitions often focus on gaining access to new technologies, intellectual property, or distribution networks to strengthen the position in the competitive landscape. For example, Thermo Fisher’s acquisition of Patheon has broadened its capabilities in life sciences, including electrophoresis-related products.

The impact of regulations on the electrophoresis industry is high, as the use of this technology in clinical diagnostics, pharmaceuticals, and research requires compliance with strict regulatory standards. In regions like North America and Europe, products must meet the guidelines set by regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations ensure that electrophoresis systems are safe, effective, and meet quality control standards.

The threat of product substitutes in the market is medium. While electrophoresis remains the gold standard for separating biomolecules based on their size, charge, and other properties, alternative techniques like chromatography, mass spectrometry, and microfluidic platforms are gaining traction. For instance, liquid chromatography-mass spectrometry (LC-MS) offers high sensitivity and resolution, potentially replacing electrophoresis for certain applications in protein analysis and genomics.

The end user concentration in the market is medium, with key segments including research laboratories, clinical diagnostics, pharmaceutical companies, and academic institutions. While research labs and academic institutions are major users of electrophoresis for molecular biology, protein analysis, and genetic research, clinical diagnostic labs also represent a significant market for products, especially for detecting genetic disorders and protein abnormalities. Pharmaceutical companies use electrophoresis for drug development and quality control testing.

Product Insights

Electrophoresis reagents segment dominated the market with a share of 41.85% in 2024 driven due to the essential role these reagents play in the success of electrophoresis techniques. Reagents such as buffers, gels, dyes, and markers are critical for ensuring proper separation, visualization, and analysis of biomolecules like proteins, nucleic acids, and lipids. Without high-quality reagents, even the most advanced electrophoresis systems cannot function effectively. The continuous need for replenishing and optimizing reagents for various applications, such as DNA sequencing or protein profiling, drives steady demand in the market. Companies like Bio-Rad Laboratories and Thermo Fisher Scientific provide specialized reagents, like precast gels and molecular markers, to meet the specific requirements of different research and clinical applications.

Electrophoresis systems segment holds significant share in the market attributed to their central role in conducting the separation and analysis of biomolecules. These systems, including gel electrophoresis apparatus, capillary electrophoresis instruments, and automated electrophoresis systems, are integral to various applications in research, clinical diagnostics, and pharmaceutical industries. As demand for precise and efficient analysis of DNA, RNA, and proteins grows, so does the need for advanced systems. Innovations such as automated systems, which improve throughput and reduce human error, are further driving market growth.

Application Insights

Research applications segment dominated the market with a share of 52.65% in 2024 and is anticipated to grow at fastest growth rate over the forecast period driven by widespread use of electrophoresis techniques in fundamental molecular biology and biochemistry research. Electrophoresis is crucial for separating and analyzing DNA, RNA, proteins, and other biomolecules, making it an indispensable tool in genetic research, drug discovery, and biomarker identification. Researchers rely on electrophoresis to study gene expression, protein interactions, and genetic mutations, driving consistent demand for both systems and reagents. For example, gel electrophoresis is commonly used in PCR-based applications, DNA sequencing, and protein analysis, which are foundational in genomics and proteomics research. Prominent academic institutions and research organizations worldwide, such as those conducting genomic research for personalized medicine, continue to rely heavily on electrophoresis.

Diagnostic application segment is anticipated to grow at significant growth rate over the forecast period owing to an increasing dependence on electrophoresis techniques for detecting and diagnosing a wide range of genetic, infectious, and protein-based disorders. Electrophoresis is frequently used in clinical diagnostics for protein analysis, such as identifying abnormal hemoglobin variants (e.g., sickle cell anemia), diagnosing genetic disorders like cystic fibrosis, and assessing the presence of certain biomarkers in diseases like multiple myeloma. Techniques such as serum protein electrophoresis (SPEP) and hemoglobin electrophoresis are routinely used in laboratories to identify and quantify specific proteins or abnormal molecular forms.

End Use Insights

The pharmaceutical and biotechnology companies segment dominated the market with a share of 43.71% in 2024 and is anticipated to grow at fastest growth rate over the forecast period. Pharmaceutical and biotech firms use electrophoresis to analyze proteins, peptides, and nucleic acids during drug discovery, ensuring that potential therapies are safe and effective. Additionally, electrophoresis techniques are essential for characterizing biologics, such as monoclonal antibodies, which are a major focus in biotechnology. For instance, capillary electrophoresis is used for the purity analysis of therapeutic proteins, and gel electrophoresis is key for evaluating DNA or RNA samples during vaccine development. Companies like Thermo Fisher Scientific and GE Healthcare offer specialized systems and reagents tailored for use in the pharmaceutical and biotechnology sectors.

The academic and research institutes segment holds a significant share in the electrophoresis industry due to the essential role electrophoresis plays in scientific discovery and experimentation. Academic and research labs use techniques extensively in molecular biology, genetics, proteomics, and biochemistry to separate and analyze nucleic acids, proteins, and other biomolecules. It is a foundational technique in research for understanding gene function, protein synthesis, and cellular processes. Leading research institutions like the University of Oxford, Harvard University, and the Max Planck Institute rely heavily on electrophoresis to advance scientific knowledge.

Regional Insights

North America electrophoresis market dominated the market with the largest revenue share of 35.41% in 2024. The dominance of the region is attributed to the presence of advanced healthcare infrastructure, a strong focus on research and development, and increasing demand for precise diagnostic and research tools. The rising prevalence of chronic diseases, genetic disorders, and the need for personalized medicine have increased the demand for advanced diagnostic solutions, where electrophoresis plays a crucial role. Additionally, regulatory support and the presence of major players in the market, such as Thermo Fisher Scientific and Bio-Rad Laboratories, contribute to the region’s market growth. The strong emphasis on innovation, coupled with a well-established healthcare system, ensures that North America remains a key market for systems and reagents.

U.S. Electrophoresis Market Trends

U.S. electrophoresis market is expected to grow over the forecast perioddue to the presence of robust healthcare system, advanced research infrastructure, and the increasing prevalence of chronic diseases and genetic disorders. The U.S. is home to leading pharmaceutical and biotechnology companies, research institutions, and diagnostic laboratories that heavily rely on electrophoresis for protein analysis, genetic research, and clinical diagnostics.

Europe Electrophoresis Market Trends

Europe electrophoresis market accounted for a significant share of the market. This can be attributed to the factors such as strong research capabilities, an expanding healthcare infrastructure, and increasing demand for precise diagnostic tools. Europe is home to leading academic institutions, pharmaceutical companies, and biotechnology firms that rely on electrophoresis for a variety of applications, including genetic research, proteomics, and drug development.

The UK electrophoresis market is growing primarily due to the presence of strong healthcare system, significant investments in research and biotechnology, and increasing demand for advanced diagnostic tools.

The France electrophoresis market is expected to grow over the forecast period due to the strong presence of well-established and emerging product manufacturers, and the growing investment in biotechnology and molecular research.

Germany electrophoresis market in is expected to grow due to the presence of strong healthcare infrastructure, leading-edge research capabilities, and increasing demand for precise diagnostic and research tools. The rise in genetic disorders, chronic diseases, and cancer has fueled the demand for accurate diagnostic methods, where electrophoresis plays a vital role in the detection and analysis of biomarkers.

Asia Pacific Electrophoresis Market Trends

The Asia Pacific market is expected to witness the fastest CAGR of over the projected period driven due to various factors, such as rapid advancements in healthcare infrastructure, increasing research activities, and a rising demand for efficient diagnostic solutions. Countries like China, India, Japan, and South Korea are investing heavily in their healthcare systems, with a focus on improving diagnostic capabilities and expanding access to advanced technologies. The growing prevalence of genetic disorders, infectious diseases, and cancer in the region has led to an increased demand for precise and reliable diagnostic tools, where electrophoresis plays a crucial role in separating and analyzing biomolecules.

Electrophoresis market in China is expected to grow over the forecast period due to factors, including significant investments in healthcare infrastructure, rapid advancements in biotechnology, and increasing demand for accurate diagnostic and research tools.

The electrophoresis market in Japan is expected to grow over the forecast period driven by rising demand for personalized medicine and targeted therapies in Japan has driven the need for precise and reliable diagnostic tools, where electrophoresis plays a crucial role in protein analysis and molecular profiling.

Latin America Electrophoresis Market Trends

Latin America electrophoresis market was identified as a lucrative region in this industryowing to increasing focus on improving healthcare infrastructure, including the adoption of modern diagnostic technologies, which is critical for detecting genetic disorders, infectious diseases, and cancers.

The electrophoresis market in Brazil is expected to grow over the forecast period due to increasing investments in healthcare infrastructure, expanding research and development activities, and a growing demand for advanced diagnostic and molecular analysis tools.

Middle East & Africa (MEA) Electrophoresis Market Trends

MEA electrophoresis market was identified as a lucrative region in this industry. The market is witnessing significant growth opportunities, due to several factors, including increasing healthcare investments, rising demand for advanced diagnostic technologies, and expanding research initiatives.

The electrophoresis market in Saudi Arabia is expected to grow over the forecast period attributed to significant investments in healthcare infrastructure, an increasing focus on medical research, and rising demand for advanced diagnostic technologies.

Key Electrophoresis Company Insights

Key players operating in the market include major companies like Thermo Fisher Scientific, Bio-Rad Laboratories, GE Healthcare, Agilent Technologies, and Merck KGaA. These companies dominate the market due to their extensive product portfolios, technological innovations, and global reach. Thermo Fisher Scientific, for instance, is a leading provider of systems and reagents, offering a range of solutions for both research and diagnostic applications. Bio-Rad Laboratories is another significant player, known for its advanced electrophoresis systems, including gel electrophoresis and automated capillary electrophoresis systems, used in genomics, proteomics, and clinical diagnostics. These companies continuously invest in research and development to innovate and provide advanced solutions that meet the evolving needs of healthcare, biotechnology, and research sectors.

Other prominent players such as Agilent Technologies and Merck KGaA are also contributing to the market's growth by offering systems, reagents, and consumables tailored to specific applications in molecular biology, drug discovery, and clinical diagnostics. Agilent Technologies focuses on providing high-performance capillary electrophoresis systems for analyzing proteins, nucleic acids, and other biomolecules, while Merck KGaA supplies reagents and kits for both research and clinical applications. With a strong emphasis on expanding their product offerings and maintaining high-quality standards, these key players are shaping the global market, driving technological advancements, and meeting the growing demand for electrophoresis solutions in both developed and emerging markets.

Key Electrophoresis Companies:

The following are the leading companies in the electrophoresis market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Merck KGaA

- GE Healthcare

- QIAGEN

- Lonza Group Ltd.

- PerkinElmer, Inc.

- Danaher

- Harvard Bioscience, Inc.

- Shimadzu Corporation

Recent Developments

-

In February 2024, Sysmex Corporation and Hitachi High-Tech Corporation announced a strategic partnership to jointly develop genetic testing systems utilizing capillary electrophoresis sequencers.

-

In January 2024, Agilent Technologies Inc. announce the launch of the Agilent ProteoAnalyzer system, an automated parallel capillary electrophoresis platform designed for protein analysis, at the 23rd Annual PepTalk Conference, taking place from January 16-19 in San Diego. This cutting-edge system enhances the efficiency and simplicity of analyzing complex protein mixtures, a critical process in analytical workflows within the pharmaceutical, biotechnology, food analysis, and academic sectors.

Electrophoresis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.42 billion

Revenue forecast in 2030

USD 4.49 billion

Growth Rate

CAGR of 5.62% from 2025 to 2030

Actual Data

2024

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, End Use, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Merck KGaA; GE Healthcare; QIAGEN; Lonza Group Ltd.; PerkinElmer, Inc.; Danaher; Harvard Bioscience, Inc.; Shimadzu Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrophoresis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrophoresis market report based on product, application, end Use, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Electrophoresis Reagents

-

Protein Electrophoresis Reagents

-

Nucleic Acid Electrophoresis Reagents

-

-

Electrophoresis Systems

-

Gel Electrophoresis Systems

-

Capillary Electrophoresis Systems

-

-

Gel Documentation Systems

-

Software

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Research Applications

-

Diagnostics Applications

-

Quality Control and Process Validation

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Academic and Research Institutes

-

Pharmaceutical and Biotechnology Companies

-

Hospital and Diagnostic Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrophoresis market size was estimated at USD 3.29 billion in 2024 and is expected to reach USD 3.42 billion in 2025.

b. The global electrophoresis market is expected to expand at a compound annual growth rate (CAGR) of 5.62% from 2025 to 2030 to reach USD 4.49 million by 2030

b. The electrophoresis reagents accounted for the largest revenue share of 41.85% in 2024. Reagents such as buffers, gels, dyes, and markers are critical for ensuring proper separation, visualization, and analysis of biomolecules like proteins, nucleic acids, and lipids. Without high-quality reagents, even the most advanced electrophoresis systems cannot function effectively. The continuous need for replenishing and optimizing reagents for various applications, such as DNA sequencing or protein profiling, drives steady demand in the market.

b. Some key players operating in the electrophoresis market include Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Merck KGaA, GE Healthcare, QIAGEN, Lonza Group Ltd., PerkinElmer, Inc., Danaher, Harvard Bioscience, Inc., Shimadzu Corporation.

b. Key factors that are driving the market growth include the increasing demand for advanced diagnostic tools, rising investments in biotechnology and healthcare research, and the growing need for efficient protein and nucleic acid analysis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.