- Home

- »

- Medical Devices

- »

-

Electrophysiology Mapping And Ablation Devices Market Report, 2033GVR Report cover

![Electrophysiology Mapping And Ablation Devices Market Size, Share & Trends Report]()

Electrophysiology Mapping And Ablation Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Procedure Type (EP Ablation Procedures, Stand-Alone EP Diagnostic Procedures), By Product Coverage (Mapping & Lab Systems, Diagnostic Catheters), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-687-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrophysiology Mapping And Ablation Devices Market Summary

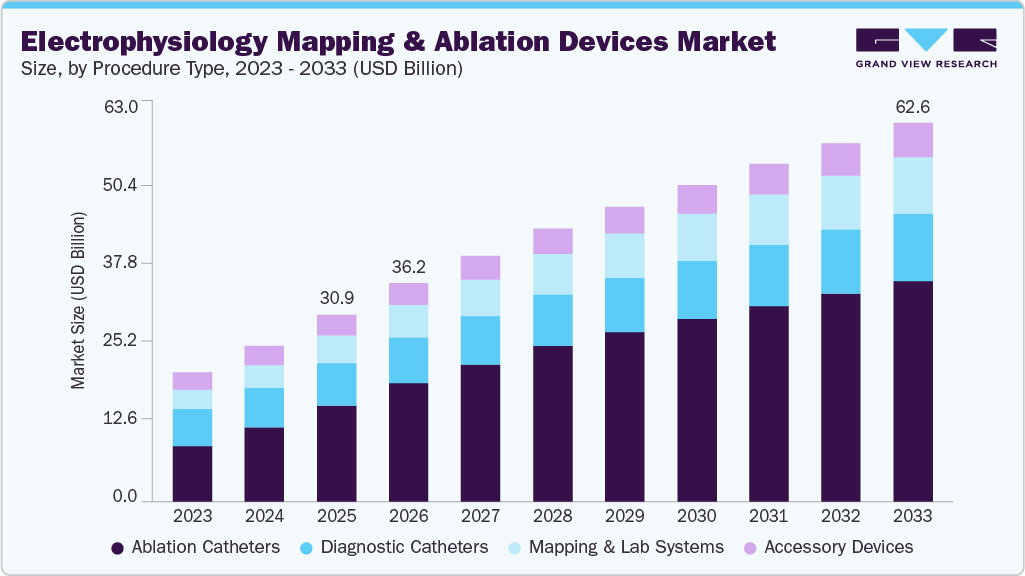

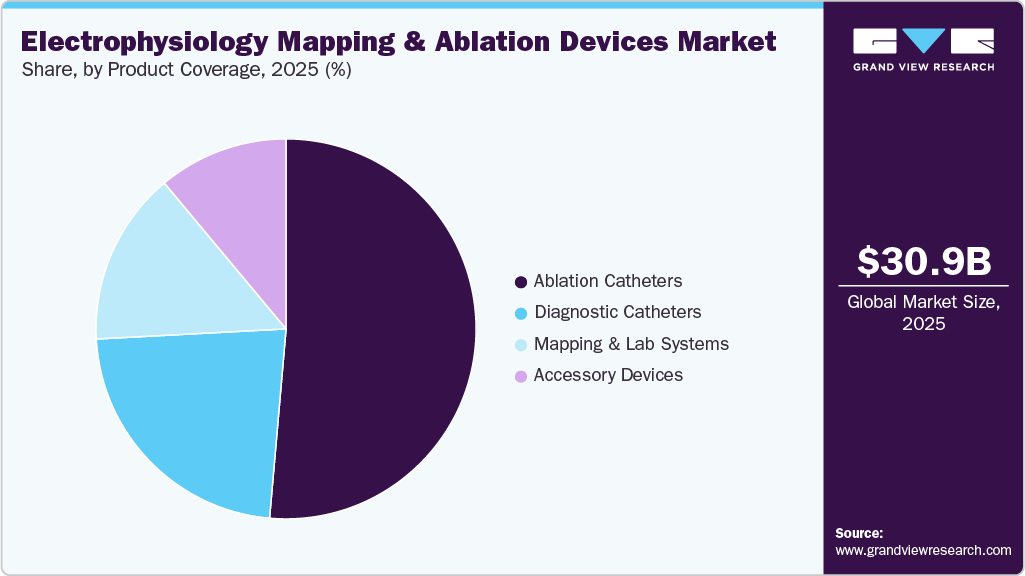

The global electrophysiology mapping and ablation devices market size was estimated at USD 30.89 billion in 2025 and is projected to reach USD 62.61 billion by 2033, growing at a CAGR of 8.2% from 2026 to 2033. Growing adoption of electrophysiology (EP) mapping and ablation devices for the diagnosis and treatment of complex arrhythmias, particularly atrial fibrillation, is a key driver of market growth.

Key Market Trends & Insights

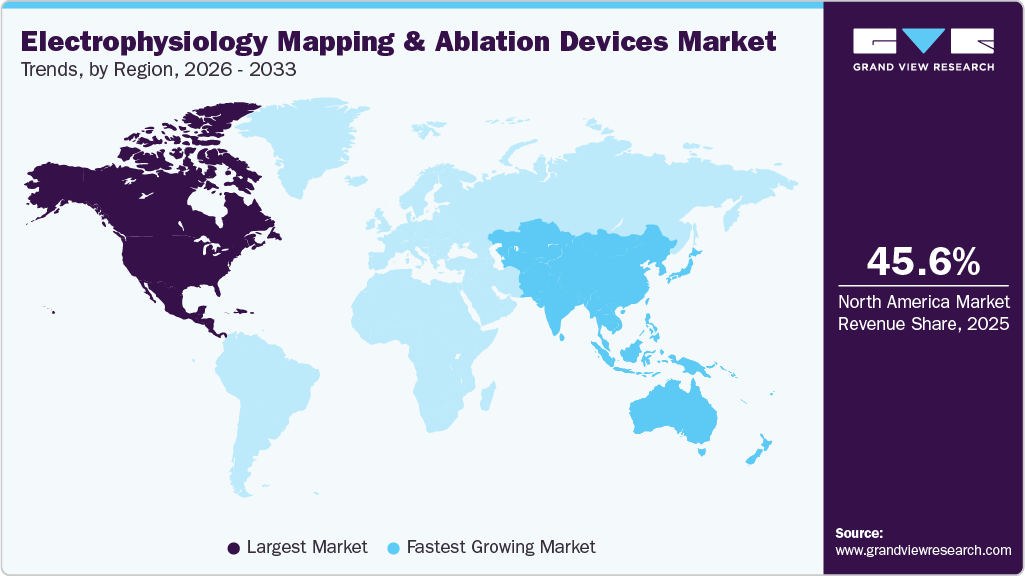

- North America electrophysiology (EP) mapping and ablation devices market held the largest share of 45.55% of the global market in 2025.

- The electrophysiology (EP) mapping and ablation devices industry in the U.S. is expected to grow significantly over the forecast period.

- By product coverage, the ablation catheters segment held the largest market share of 51.39% in 2025.

- By procedure type, the EP ablation procedures segment held the highest market share in 2025.

- Based on indication, the atrial fibrillation segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 30.89 Billion

- 2033 Projected Market Size: USD 62.61 Billion

- CAGR (2026-2033): 8.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rising demand for advanced rhythm management tools in both hospital and ambulatory settings, coupled with the increasing burden of cardiac conditions among younger populations due to sedentary lifestyles, smoking, and alcohol use, is accelerating device utilization.According to a February 2024 article by Johnson & Johnson Services, Inc., over 37.5 million people globally are affected by atrial fibrillation. Roughly 1 in 4 adults over 40 is projected to develop the condition during their lifetime.Advances in EP Mapping Drive Adoption Across Global Cardiac Care Centers

The increasing use of electrophysiology mapping and ablation devices for diagnosing and treating complex arrhythmias, especially atrial fibrillation, is a major factor driving the market. Growing recognition of catheter ablation as a primary therapy for symptomatic AF is driving increase use in established centers and emerging EP programs worldwide. The competitive landscape is evolving rapidly, with various global players advancing next-generation systems to gain early adoption, for instance, in March 2025, Abbott received CE Mark approval in Europe for its Volt Pulsed Field Ablation (PFA) System, enabling commercial use for atrial fibrillation treatment.

Minimally Invasive Cardiac Procedures Boost Demand for Advanced EP Tools

The shift toward minimally invasive cardiac procedures in both hospital and ambulatory care is driving demand for advanced EP mapping and ablation tools. These devices are becoming integral to rhythm management workflows, offering real-time imaging and high-resolution data. In May 2025, a joint EHRA-HRS-ESC consensus in EP Europace urged improved standardization in AI-based electrophysiology research. The EHRA AI analysis showed that less than 55% of studies reported essential methods, with transparency in trial registration and model training below 20%, highlighting the need for more rigorous reporting practices.

Rising Arrhythmias Among Younger Adults Reshape Electrophysiology Trends

The growing incidence of cardiac arrhythmias among young and middle-aged individuals, driven by sedentary lifestyles, poor dietary habits, smoking, and alcohol use, is reshaping the electrophysiology landscape. With arrhythmias increasingly affecting younger populations, there is a growing emphasis on earlier diagnosis and intervention. In March 2025, the European Heart Rhythm Association (EHRA) reported that one in three people worldwide faces the risk of developing serious cardiac arrhythmias, issuing a call for urgent public awareness on Pulse Day. Atrial fibrillation has nearly doubled in prevalence over the past decade, with cases projected to rise by more than 60% by 2050.

Technological Advancements

Technological advancements are reshaping the electrophysiology landscape, with growing emphasis on integrated platforms that enhance procedural efficiency and clinical outcomes. Innovations are increasingly focused on combining mapping precision with versatile ablation modalities to streamline workflows in complex arrhythmia cases. Technological advancements in EP devices are driving market expansion by enhancing the precision and efficacy of diagnostic and therapeutic procedures.

Technology

Description

Product Example

Impact

Radiofrequency (RF) Ablation

Uses heat to ablate arrhythmogenic tissue; most widely adopted technique

ThermoCool SmartTouch SF (Biosense Webster)

High precision and adaptability across various arrhythmias

Cryoablation

Employs cold temperatures to isolate arrhythmogenic foci, especially near sensitive anatomy

Arctic Front Advance (Medtronic)

Safer near pulmonary veins and AV nodes; lower risk of collateral damage

3D Electroanatomical Mapping

Creates real-time anatomical and electrical maps of the heart

CARTO 3 System (Biosense Webster)

Enhances procedural accuracy and reduces fluoroscopy use

Advancements, Comparative Outcomes, and Emerging Technologies in Pulsed Field Ablation (PFA) for Atrial Fibrillation Treatment

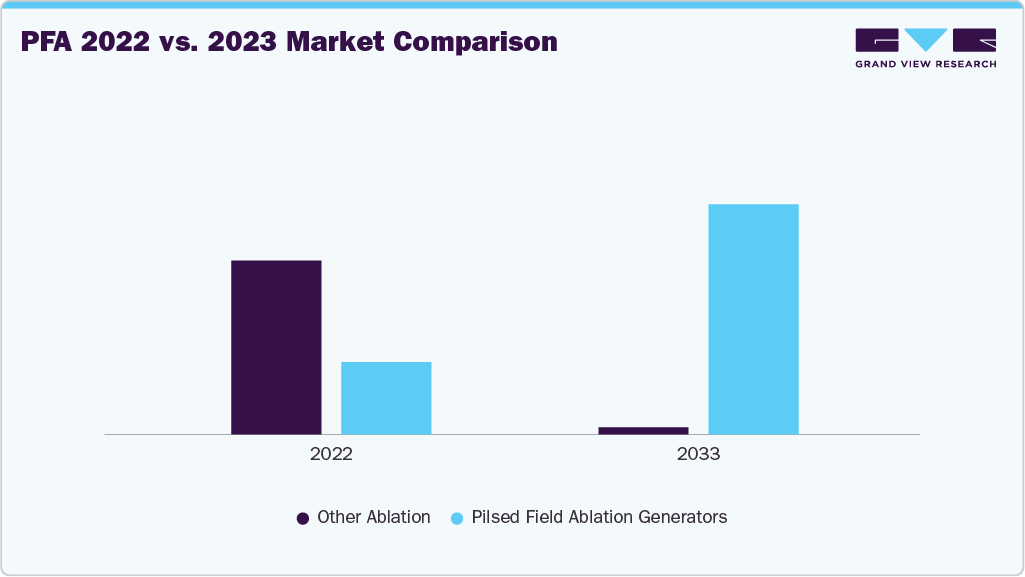

Pulsed Field Ablation (PFA) has emerged as one of the most promising technologies in atrial fibrillation (AFib) treatment, delivering targeted myocardial ablation with minimal risk to adjacent tissues including the esophagus, phrenic nerve, and pulmonary veins. This safety profile makes it a strong alternative to traditional thermal ablation techniques such as radiofrequency (RF) and cryoballoon ablation. Leading innovation is Boston Scientific’s FARAPULSE system, which has accelerated the adoption of PFA globally. Furthermore, clinical data increasingly highlight PFA’s ability to outperform thermal ablation in both efficacy and safety, establishing it as a preferred option.

Table 1 Overview of Techniques

Aspect

Cryoballoon (CB) Ablation

Pulsed Field Ablation (PFA)

Technology

Uses a balloon filled with cryogenic gas

Uses pulsed electric fields through a catheter

Balloon/Catheter Size

Complete Analysis will be a part of the final report

Primary/Mechanism

Table 2 Efficacy and Safety Comparison

Metric

Cryoballoon (CB) Ablation

Pulsed Field Ablation (PFA)

Acute Success Rate

98%

100%

Median Procedure Time

Complete Analysis will be a part of the final report

Fluoroscopy Time

Overall Complications

Regulatory Milestones and Clinical Adoption (2021 - 2025)

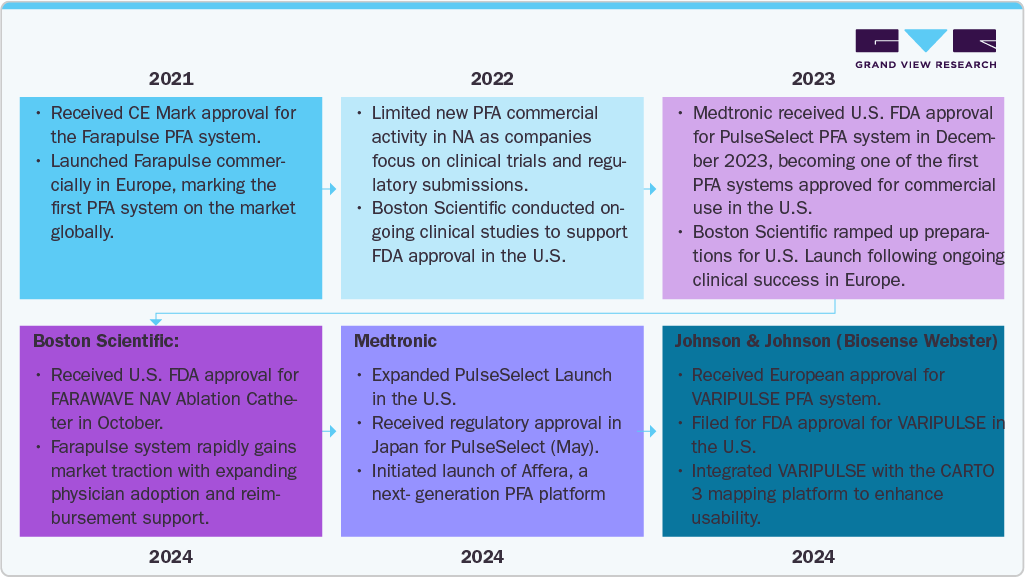

The progression of PFA from investigational therapy to routine clinical practice has been accelerated by significant regulatory milestones and initial adoption in electrophysiology centers.

-

Notable US approvals & regulatory events

-

Johnson & Johnson / Biosense Webster - VARIPULSE: FDA approval in Nov 2024 (integrated with CARTO mapping); subsequent limited distribution and updates to usage instructions after observed neurovascular events; J&J paused some rollout activities to investigate.

-

Key Market Events

Pulsed Field Ablation Devices Under Development

Company

Device

Approval Status

Abbott Laboratories

Volt

Under investigation

TactiFlex Duo (PFA/RF)

Under investigation

Adagio Medical Holdings Inc.

Complete Analysis will be a part of the final report

Arga Medtech SA

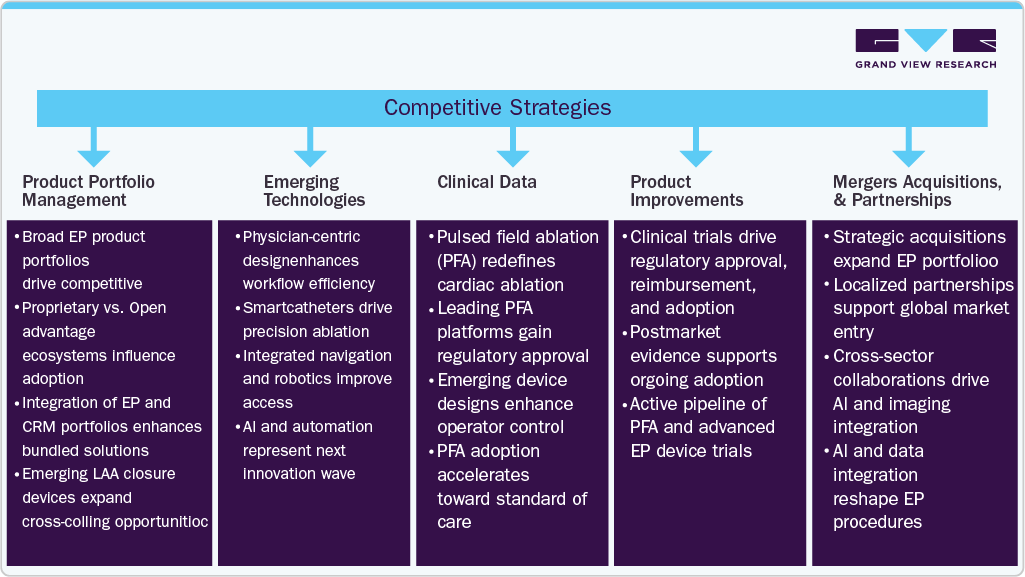

Market Concentration & Characteristics

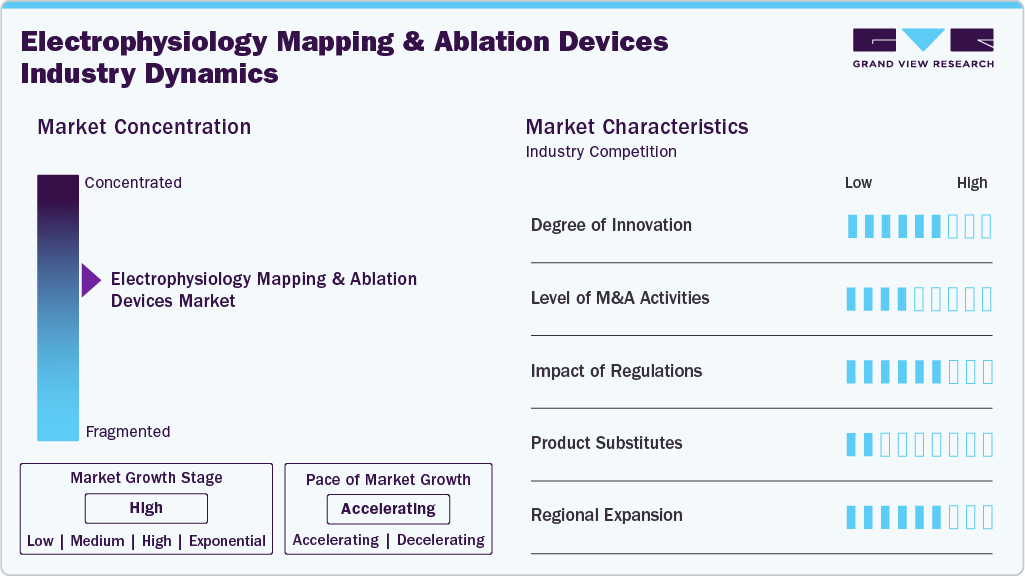

Innovation in the electrophysiology (EP) mapping and ablation devices industry is high. The market is driven by rapid advancements in 3D mapping, AI-enabled navigation, and pulsed field ablation technologies. These innovations are improving accuracy, procedural efficiency, and patient outcomes, while also pushing companies to continuously update their portfolios. In July 2025, Boston Scientific Corporation received FDA approval to expand the labeling of its FARAPULSE Pulsed Field Ablation System for treating persistent atrial fibrillation. The update allows use beyond pulmonary veins to include posterior wall ablation, reflecting continued innovation in non-thermal energy approaches for complex arrhythmias.

The level of mergers and acquisitions in the electrophysiology (EP) mapping and ablation devices industry is moderate. Most activity is strategic, aimed at acquiring complementary technologies or expanding into new geographies. While the volume of deals is not high, the impact of targeted acquisitions, particularly in software, imaging, or energy delivery, is significant. In January 2024, CardioFocus acquired Galvanize Therapeutics’ electrophysiology division, including the CE-marked Centauri PFA system and the QuickShot catheter.

Regulatory influence on the electrophysiology (EP) mapping and ablation devices industry is high. Strict approval standards apply due to the complexity and risks associated with cardiac procedures. Companies must demonstrate clinical safety, software reliability, and long-term device performance, all of which add to development time and cost. However, successful navigation of these regulations strengthens market credibility and creates barriers to entry.

The presence of product or service substitutes in the electrophysiology (EP) mapping and ablation devices industry is low. Alternatives such as antiarrhythmic interventions the preferred option. The lack of comparable precision or long-term outcomes from other methods reinforces the dominant role of mapping and ablation systems in arrhythmia treatment.

Regional expansion in the electrophysiology (EP) mapping and ablation devices industry is moderate to high. Companies are increasingly targeting growth in Asia-Pacific, Latin America, and Eastern Europe, where demand is rising due to improving cardiac care infrastructure and a growing burden of arrhythmias. While challenges remain around reimbursement and clinician training, long-term opportunities in these underpenetrated regions are significant.

Procedure Type Insights

The EP ablation procedures segment held the largest share of the electrophysiology (EP) mapping and ablation devices market in 2025, accounting for 88.47% of total revenue and is anticipated to grow at the fastest CAGR over the forecast period.This growth is driven by the rising prevalence of atrial fibrillation and ventricular tachycardia, increasing adoption of advanced ablation technologies such as pulsed field ablation, and strong clinical validation for newer systems such as Abbott’s Volt and Merit’s Ventrax. According to the Elsevier B.V. article published in December 2024, Atrial fibrillation (AFib) stands as the most prevalent persistent heart rhythm disorder, impacting an estimated 46.3 million people globally. Its significant role in increasing the risks of stroke, heart failure, cognitive impairment, and frequent hospital admissions underscores the urgent need for effective treatment options.

The stand-alone EP diagnostic procedures segment is projected to grow at a significant CAGR over the forecast period, driven by increasing use of advanced mapping systems, rising detection rates of complex arrhythmias, and growing adoption of non-therapeutic electrophysiology evaluations in outpatient and ambulatory settings. in February 2025, Boston Scientific’s FARAWAVE NAV Ablation Catheter and the FARAVIEW Software received CE Mark. Unique to Boston Scientific’s pulsed-field ablation ecosystem, this combination allows for diagnostic mapping and therapy delivery via a single catheter.Magnetic navigation and real-time visualization through integrated OPAL HDx mapping streamline the workflow and eliminate the need for multiple device exchanges.

Product Coverage Insights

The ablation catheters held the largest share of 51.39% the electrophysiology (EP) mapping and ablation devices market in 2025 and is projected to grow at the fastest CAGR over the forecast period. This dominance is attributed to the increasing adoption of catheter-based ablation techniques for treating complex arrhythmias, particularly atrial fibrillation. Technological advancements enabling improved precision and safety in ablation procedures have further accelerated the demand for these catheters across hospitals and specialty clinics. For instance, in May 2025, Abbott launched the TactiFlex Sensor Enabled Ablation Catheter, the first of its kind to combine a flexible tip with contact force technology for atrial fibrillation treatment. Designed for use with the EnSite X EP System, the catheter offers enhanced mapping precision and improved stability during ablation procedures. Clinical data from the TactiFlex AF IDE study showed strong performance, supporting its role in advancing EP treatment outcomes.

Diagnostic catheters segment is the second largest segment in the electrophysiology (EP) mapping and ablation devices market in 2025, driven by their critical role in mapping cardiac electrical activity with precision before ablation procedures. The growing complexity of arrhythmia cases has increased reliance on high-resolution, multi-electrode diagnostic catheters to enhance procedural planning and outcomesIn July 2023, Biosense Webster launched the OPTRELL mapping catheter with TRUEref technology in the U.S. to support advanced mapping of complex cardiac arrhythmias. The catheter, featuring 48 fixed-array electrodes, works with the CARTO 3 System to deliver detailed electrical insights, helping clinicians locate ablation targets with greater speed and precision.

Regional Insights

North America electrophysiology (EP) mapping and ablation devices marketdominatedwith the largest market share of 45.55% in 2025, driven byrobust healthcare spending, high procedural volumes, and strong support for cardiovascular research. In September 2024, the Canadian Institutes of Health Research (CIHR), along with the Government of Canada, Heart & Stroke, and Brain Canada, announced a USD 10 million investment to establish two national research networks. One focuses on improving heart health during and after pregnancy, and the other targets stroke in women, with each network receiving USD 5 million over five years. These initiatives reflect the region’s continued emphasis on advancing cardiac care and research, indirectly supporting growth in EP device adoption.

U.S. Electrophysiology (EP) Mapping And Ablation Devices Market Trends

The U.S. electrophysiology (EP) mapping and ablation devices market continues to drive regional growth, supported by a high prevalence of atrial fibrillation, strong adoption of advanced EP technologies, and ongoing investment in cardiac care infrastructure. According to the American Heart Association article published in March 2025, atrial fibrillation (AFib) remains the most common type of sustained arrhythmia in the U.S., affecting an estimated five million people in 2024, with projections indicating that more than 12 million individuals could be impacted by 2030. This growing patient population continues to fuel demand for EP mapping and ablation devices nationwide.

Europe Electrophysiology (EP) Mapping And Ablation Devices Market Trends

Electrophysiology (EP) mapping and ablation devices market in Europe held the second-largest market share in 2025, supported by a high incidence of cardiovascular conditions, well-established healthcare systems, and increasing use of electrophysiology technologies. As reported by the WHO in May 2024, cardiovascular diseases remain the primary cause of death and disability in the European Region, contributing to over 42.5% of all annual fatalities. This equates to around 10,000 deaths per day, highlighting the critical need for advanced diagnostic and therapeutic solutions such as EP mapping and ablation devices.

Germany electrophysiology (EP) mapping and ablation devices market is growing steadily due to its robust healthcare infrastructure, high procedural volume, and strong clinical expertise in cardiac care. According to the Georg Thieme Verlag KG article published in August 2024, Germany’s healthcare system handled approximately 168,841 cardiac-related procedures in 2023, with more than 100,000 classified as traditional heart surgeries. This high procedural load reflects sustained demand for advanced cardiac technologies, including EP mapping and ablation devices, as the country continues to modernize its approach to arrhythmia management.

Electrophysiology (EP) mapping and ablation devices market in the UK maintained a significant market share in 2025, driven by a high prevalence of cardiovascular diseases, well-established EP infrastructure, and consistent public health investment. According to the British Heart Foundation article published in January 2025, in the UK, heart and circulatory diseases impact over 7.6 million individuals, including more than four million men and approximately 3.6 million women, highlighting the significant burden cardiovascular conditions place on public health. This widespread disease prevalence continues to drive demand for advanced EP mapping and ablation technologies.

Asia Pacific Electrophysiology (EP) Mapping And Ablation Devices Market Trends

Electrophysiology (EP) mapping and ablation devices market in APAC is expected to grow at the fastest CAGR over the forecast period, led by rising demand for cutting-edge ablation solutions, increasing prevalence of cardiac arrhythmias, and ongoing expansion of electrophysiology capabilities in emerging countries. In July 2025, Johnson & Johnson MedTech launched the VARIPULSE Platform across Asia-Pacific, marking the regional debut of its fully integrated pulsed field ablation (PFA) system. This rollout underscores the region’s growing focus on innovation-driven cardiac care and accelerating uptake of next-generation EP technologies.

Japan electrophysiology (EP) mapping and ablation devices market is anticipated to grow at a significant rate in the region, supported by its aging population, strong healthcare infrastructure, and continued investment in advanced electrophysiology technologies. In April 2025, according to Japan's Interior Ministry, the citizen population fell by a record 898,000 to 120.3 million, the steepest decline since 1950.. As the population continues to age, the prevalence of atrial fibrillation and other arrhythmias is expected to rise, sustaining long-term demand for EP mapping and ablation devices.

Latin America Electrophysiology (EP) Mapping And Ablation Devices Market Trends

Electrophysiology (EP) mapping and ablation devices market in Latin America is growing steadily, driven by rising investments in cardiac care and expanding access to EP services. Demographic shifts and infrastructure improvements are further supporting market momentum. However, regional disparities in procedure volumes and technology access continue to pose challenges. In January 2025, the Latin American Heart Rhythm Society reported major gaps in arrhythmia care across the region. Uruguay led with 188 ablation procedures per million, while Venezuela recorded only 5, far below Europe’s 288. Access to 3D mapping systems and ICD implantation rates also remained significantly limited across most countries.

Electrophysiology (EP) mapping and ablation devices market in Brazil is expanding due to a large and regionally diverse atrial fibrillation (AF) burden that is driving demand for advanced diagnostic and treatment solutions. According to a ScienceDirect article published in July 2024 in Heart Rhythm O2, AF affects an estimated 4.6% of Brazilian men and 3.6% of women over the age of 55, translating to approximately 170,000 new cases each year. Crude AF prevalence varies widely by region, from 440 per 100,000 in Amapá to 1,175 per 100,000 in Rio Grande do Sul. After age standardization, rates converge between 730 and 828 per 100,000 population, underscoring the national scale of AF and the growing need for EP mapping and ablation devices.

Middle East & Africa Electrophysiology (EP) Mapping And Ablation Devices Market Trends

Electrophysiology (EP) mapping and ablation devices market in MEAis witnessing rising demand due to the younger and increasingly detectable atrial fibrillation (AF) population, coupled with improving regional treatment protocols. In February 2025, an article published in the Journal of Cardiovascular Electrophysiology reported that AF patients in the UAE had a mean age of 63.4 years, with 44% classified as obese and a mean CHA₂DS₂‐VASc score of 2.95. Among 198 patients, 55.8% received NOACs, with a one-year stroke incidence of 0% and a mortality rate of 6.7%. These findings highlight a relatively younger, lower-risk AF population in the UAE compared to global averages, signaling growing opportunities for early intervention with EP mapping and ablation technologies.

Saudi Arabiaelectrophysiology (EP) mapping and ablation devices market is expected to grow at a strong CAGR due to rising cardiovascular disease burden, increasing healthcare investment, and expanding access to advanced electrophysiology procedures. In December 2024, a position statement from the Saudi Heart Association highlighted that 18.7% of adults in Saudi Arabia were living with diabetes in 2021, with nearly 2 million undiagnosed cases.This high prevalence of diabetes significantly raises the risk of arrhythmias, driving demand for EP mapping and ablation devices across the country.

Key Electrophysiology Mapping And Ablation Devices Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Electrophysiology Mapping And Ablation Devices Companies:

The following are the leading companies in the electrophysiology (EP) mapping and ablation devices market. These companies collectively hold the largest Market share and dictate industry trends.

- Siemens Healthineers

- Koninklijke Philips N.V.

- Abbott

- Johnson & Johnson (Biosense Webster)

- GE HealthCare

- Boston Scientific Corporation

- Medtronic

- Biotronik SE & Co KG

- MicroPort Scientific Corporation

- CardioFocus, Inc.

Competitive Strategies

Emerging Technologies

This strategy involves exploring and integrating breakthrough innovations such as Pulsed Field Ablation (PFA), AI-enabled mapping systems, robotic navigation, and multimodal imaging platforms into the EP space. These next-generation technologies aim to disrupt traditional approaches by improving precision, reducing risk, and enhancing procedural outcomes.

Technology

Description

Product Example

Impact

Pulsed Field Ablation (PFA)

Non-thermal, tissue-selective ablation using electrical fields

FARAPULSE PFA System (Boston Scientific)

Reduced risk to surrounding structures and shorter procedure times

Artificial Intelligence (AI)

Applied to mapping systems and ablation strategy optimization

KODEX-EPD AI Tools (Philips)

Enhances arrhythmia localization and outcome prediction

Recent Developments

-

In July 2025, Banner Wyoming Medical Center opened a USD 7.3 million electrophysiology (EP) lab in Casper, significantly reducing the need for patients to travel out of state for routine heart rhythm treatments. Staffed part-time by Colorado-based electrophysiologists, the lab offers advanced procedures such as ablations, pacemaker implants, and lead extractions. The facility addresses growing local demand, particularly for atrial fibrillation care, and aims to expand operations as patient volume increases.

-

In July 2025, Boston Scientific secured FDA approval to broaden the indications for its Farapulse pulsed field ablation (PFA) system to include the treatment of drug-resistant, symptomatic persistent atrial fibrillation. Supported by results from the ADVANTAGE AF trial, the system demonstrated an 85.3% rate of symptom-free recurrence with no major adverse events.

-

In May 2025, CoreMap received FDA investigational device exemption (IDE) to expand its clinical trial for a next-generation EP mapping system to the U.S. The technology uses a high-density micro-electrode catheter and advanced algorithms to precisely identify AFib drivers and guide ablation. The system has already shown promising safety and efficacy in over 50 patients, targeting persistent and long-standing persistent atrial fibrillation.

Electrophysiology Mapping And Ablation Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 36.15 billion

Revenue forecast in 2033

USD 62.61 billion

Growth rate

CAGR of 8.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, product coverage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Siemens Healthineers.; Koninklijke Philips N.V.; Abbott; Johnson & Johnson (Biosense Webster); GE HealthCare; Boston Scientific Corporation; Medtronic; Biotronik SE & Co KG; MicroPort Scientific Corporation; CardioFocus, Inc.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrophysiology Mapping And Ablation Devices Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. for this study, Grand View Research has segmented the global electrophysiology mapping and ablation devices market report based on procedure type, product coverage, and region:

-

Procedure Type Outlook (In Thousands, 2021 - 2033)

-

EP Ablation Procedures

-

By Indication

-

Atrial Fibrillation

-

Paroxysmal AF

-

Persistent AF

-

Long standing persistent/permanent

-

-

Right Atrial Flutter

-

Left Atrial Flutter

-

Atrioventricular Nodal Reentry Tachycardia (AVNRT)

-

Right Atrial Tachycardia (AT)

-

Left Atrial Tachycardia (AT)

-

Right Wolff-Parkinson-White (WPW

-

Left Wolff-Parkinson-White (WPW)

-

Right Ventricular Tachycardia (VT)

-

Left Ventricular Tachycardia (VT)

-

-

-

Stand-Alone EP Diagnostic Procedures

-

By Product Type

-

Focal Ablation Catheter

-

Radiofrequency (RF)

-

Conventional

-

Irrigated-tip

-

Contact-Force-Sensing

-

Standard

-

-

-

Alternative Energy

-

Pulsed Field Ablation

-

-

Balloon Ablation Catheters

-

-

-

-

Product Coverage Outlook (Market Value (USD Million), Unit Sold, ASP Per unit (USD), 2021-2033)

-

Mapping & Lab Systems

-

X-Ray Systems

-

Mapping Systems

-

EP Recording Systems

-

ICE Systems

-

RF Ablation Generators

-

Pulsed Field Ablation Generators

-

Cryoablation Generators

-

-

Diagnostic Catheters

-

Conventional

-

Fixed

-

Steerable

-

-

Advanced

-

Ultrasound

-

-

Ablation Catheters

-

Focal Ablation Catheter

-

Radiofrequency (RF)

-

Conventional

-

Irrigated-tip

-

Contact-Force-Sensing

-

Standard

-

-

-

Alternative Energy

-

Pulsed Field Ablation

-

-

Balloon Ablation Catheters

-

-

Accessory Devices

-

Long Introducer Sheaths

-

Fixed

-

Steerable

-

-

Transseptal Needles

-

Conventional

-

RF

-

-

Navigational Accessories

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrophysiology mapping and ablation devices market size was estimated at USD 30.89 billion in 2025 and is expected to reach USD 36.15 billion in 2025.

b. The global electrophysiology mapping and ablation devices market is expected to grow at a compound annual growth rate of 8.16% from 2026 to 2033 to reach USD 62.61 billion by 2033.

b. North America dominated the electrophysiology (EP) mapping and ablation devices market with a share of 45.55% in 2025, driven by robust healthcare spending, high procedural volumes, and strong support for cardiovascular research.

b. Some key players operating in the EP mapping and ablation devices market include Siemens Healthineers, Koninklijke Philips N.V., Abbott, Johnson & Johnson (Biosense Webster), GE HealthCare, Boston Scientific Corporation, Medtronic, Biotronik SE & Co KG, MicroPort Scientific Corporation, and CardioFocus, Inc..

b. Key factors driving the growth of electrophysiology (EP) mapping and ablation devices include the growing adoption of these devices for diagnosing and treating complex arrhythmias, particularly atrial fibrillation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.