- Home

- »

- Medical Devices

- »

-

Endoscope Reprocessing And Endoscopic Probe Disinfection Market Report, 2033GVR Report cover

![Endoscope Reprocessing And Endoscopic Probe Disinfection Market Size, Share & Trends Report]()

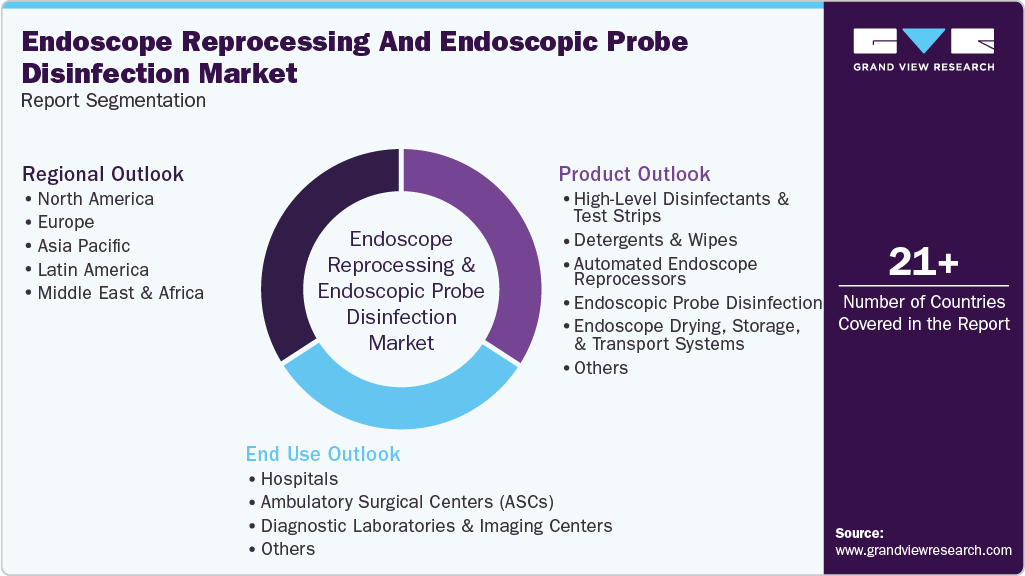

Endoscope Reprocessing And Endoscopic Probe Disinfection Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (High-Level Disinfectants and Test Strips, Detergents and Wipes), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-712-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscope Reprocessing And Endoscopic Probe Disinfection Market Summary

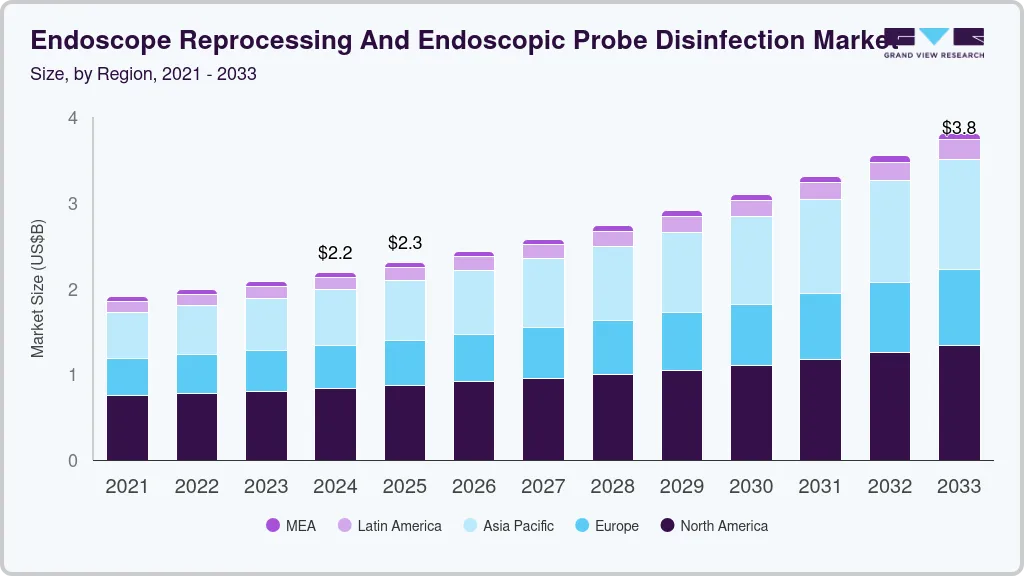

The global endoscope reprocessing and endoscopic probe disinfection market size was estimated at USD 2.19 billion in 2024 and is projected to reach USD 3.81 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2033. The increasing incidence of nosocomial infections associated with contaminated endoscopes has brought global attention to the critical need for effective endoscope reprocessing and probe disinfection solutions.

Key Market Trends & Insights

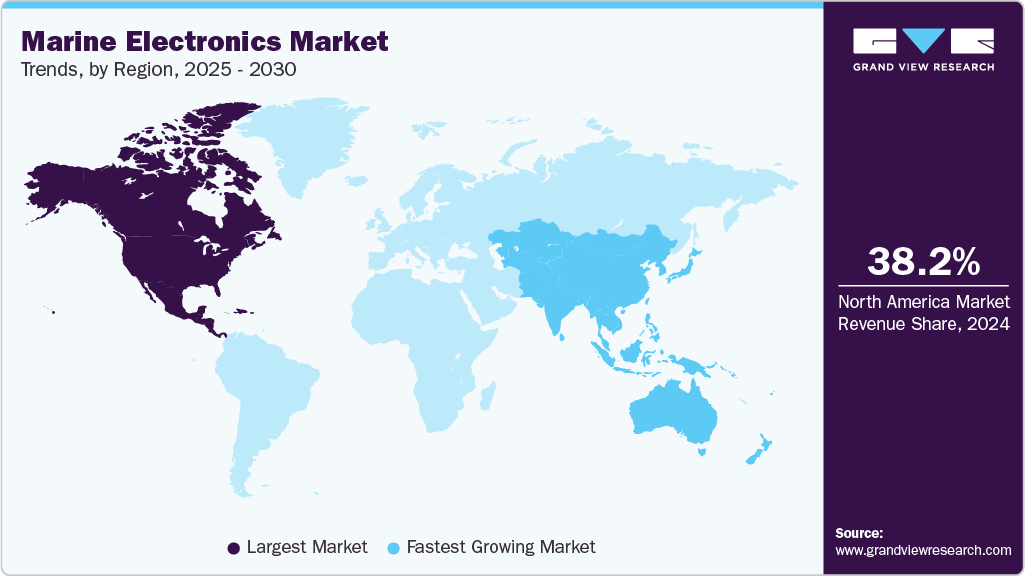

- North America endoscope reprocessing and endoscopic probe disinfection market with the largest revenue share of 38.2% in 2024.

- The Canada endoscope reprocessing and endoscopic probe disinfection market is anticipated to register at the fastest CAGR during the forecast period.

- In terms of product, the high-level disinfectants and test strips segment accounted for the largest market revenue share in 2024.

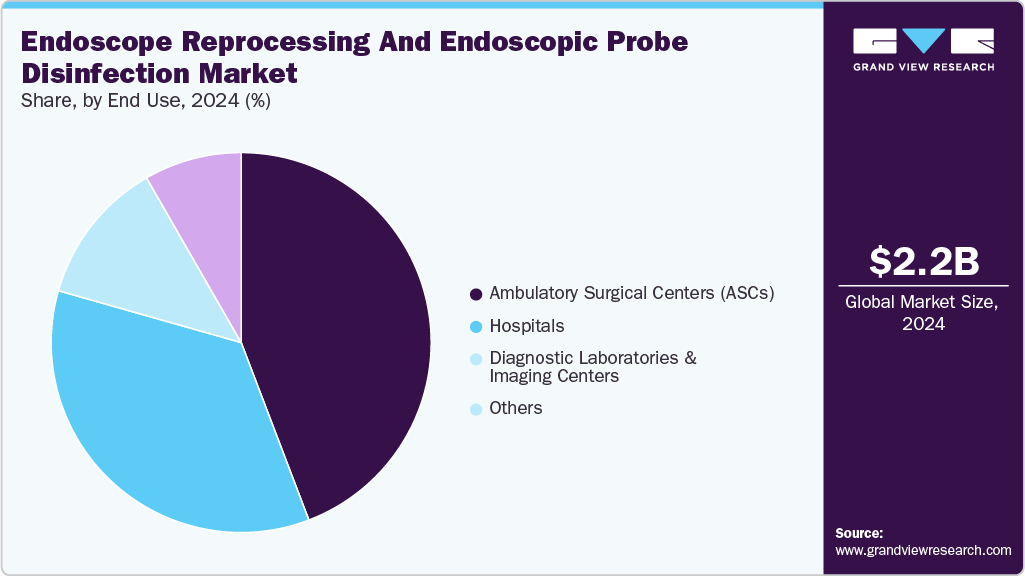

- In terms of the end use, the ambulatory surgical centers (ASCs) segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.19 Billion

- 2033 Projected Market Size: USD 3.81 Billion

- CAGR (2025-2033): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Despite strict cleaning protocols, reusable endoscopes remain a significant vector for microbial transmission in clinical settings. According to a study by the NCBI in March 2024, contamination rates in reprocessed endoscopes ranged from 14.3% to 47.5%, highlighting the persistent challenge of eliminating pathogens through standard cleaning methods.The increasing global burden of cancer and related mortality is significantly influencing the demand for advanced diagnostic and treatment modalities, including endoscopic procedures. According to the Cancer Progress Report 2023 by the American Cancer Society, approximately 1,958,310 new cancer cases were diagnosed in the U.S. in 2023, with 609,820 deaths reported. By 2040, this number will rise to 2.3 million new cases annually, highlighting the need for early and accurate diagnostic tools.

Endoscopic procedures such as Endoscopic Ultrasonography (EUS) and Endoscopic Retrograde Cholangiopancreatography (ERCP) are critical in the detection, staging, and management of various cancers, especially in the gastrointestinal tract, pancreas, lungs, and bile ducts. These minimally invasive techniques offer precise visualization, facilitate biopsy collection, and allow therapeutic interventions such as tumor resection, all while minimizing patient discomfort, reducing recovery time, and lowering the risk of complications.

With the rising number of cancer-related endoscopic procedures worldwide, there is a growing need for the safe and efficient reuse of costly endoscopy equipment. This has led to an increased demand for endoscope reprocessing systems that provide high-level disinfection, comply with infection control standards, and prioritize patient safety. Effective reprocessing of endoscopes is crucial for preventing cross-contamination and healthcare-associated infections, especially in the care of patients with cancer.

U.S. Hospital Database 2024

Hospital Category

Number of Hospitals

Total Number of All U.S. Hospitals

6,120

Number of U.S. Community Hospitals

5,129

Number of Nongovernment Not-for-Profit Community Hospitals

2,987

Number of Investor-Owned (For-Profit) Community Hospitals

1,219

Number of State and Local Government Community Hospitals

923

Number of Federal Government Hospitals

207

Number of Nonfederal Psychiatric Hospitals

659

Other Hospitals

125

Source: American Hospital Association & GVR

The increasing number of healthcare centers, including hospitals, oncology specialty clinics, and diagnostic centers, significantly drives the demand for endoscope reprocessing and probe disinfection solutions. While the number of endoscopic procedures grows globally, reliable, efficient, and compliant reprocessing workflows are required to prevent cross-contamination and healthcare-associated infections (HAIs).

With the rise in hospital infrastructure across various regions such as the U.S., UK, Italy, Spain, China, India, Brazil, South Africa, and the UAE, the procedures using both flexible and rigid endoscopes are increasing. According to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, Canada had 1,300 hospitals in 2021, and the European Union hosts around 15,000 hospitals. As of August 2023, the UK had 1,148 hospitals. This expanding hospital network necessitates a significant increase in disinfection and reprocessing devices.

The endoscope reprocessing industry has witnessed significant growth driven by increasing regulatory approvals, technological advancements in reprocessing equipment, and the launch of innovative cleaning and disinfection solutions. For instance, In May 2025, Olympus, a MedTech firm, launched the ScopeLocker Air endoscope drying cabinet, providing a new solution for healthcare facilities' drying needs. Properly drying endoscope channels is essential for reprocessing. The ScopeLocker Air endoscope drying cabinet, produced by Capsa Healthcare and distributed by Olympus, enhances the drying process while adhering to established guidelines for the drying and storing endoscopes.

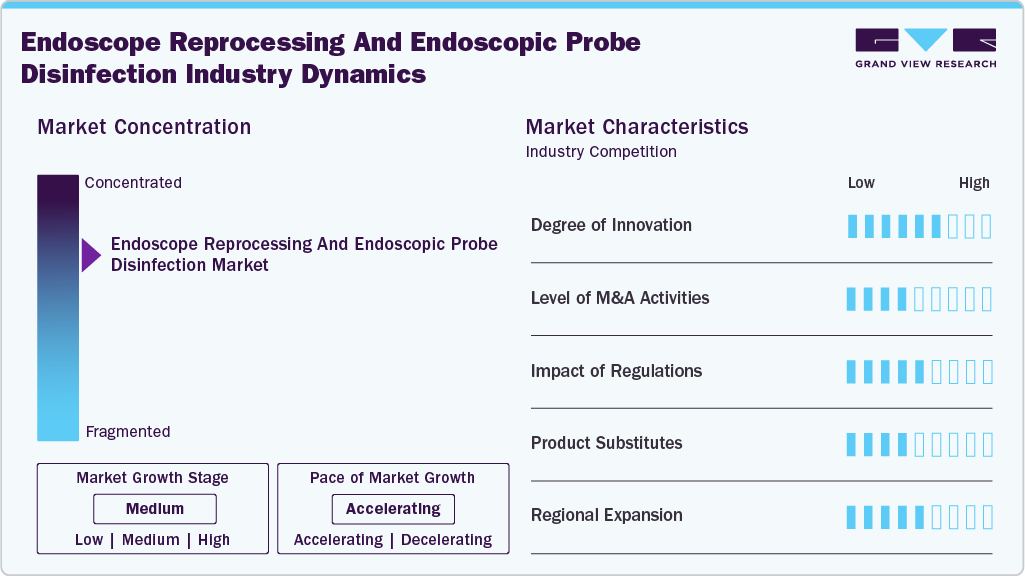

Market Concentration & Characteristics

The endoscope reprocessing and endoscopic probe disinfection industry has experienced notable innovation in recent years, driven by technological advancements, stringent regulatory standards, and heightened awareness of infection prevention. The industry is increasingly moving toward automated reprocessing systems equipped with advanced capabilities to enhance operational efficiency and minimize human error. These next-generation systems integrate cutting-edge technologies such as robotics, artificial intelligence (AI), and sophisticated sensor networks to optimize the reprocessing cycle, ensure consistent compliance, and significantly reduce the risk of cross-contamination.

The endoscope reprocessing and endoscopic probe disinfection industry has witnessed a significant level of merger and acquisition (M&A) activity among prominent industry players. This trend is largely driven by the need to strengthen market presence, broaden product portfolios, and enhance technological capabilities. Strategic acquisitions are enabling companies to address the rising global demand for advanced reprocessing solutions, tap into new geographic markets, and accelerate innovation through the integration of complementary technologies and expertise. In September 2024, Ecolab Healthcare ANZ acquired TCS Medical, distributor of EndoSelect endoscopy consumables, expanding its product range and local assembly capabilities to support regional sterilization needs (EN ISO 13485 certified).

Regulatory frameworks play a key role in determining the endoscope reprocessing and endoscopic probe disinfection industry by safeguarding patient health and ensuring the consistent performance of medical devices. Given that endoscopes are vital for diagnosing and treating a wide range of conditions, their complex structure and exposure to bodily fluids create substantial challenges for thorough cleaning and disinfection. As a result, healthcare facilities must comply with rigorous standards and protocols set by health authorities, which mandate validated reprocessing procedures, regular staff training, and strict quality assurance measures to minimize the risk of cross-contamination and infection.

Product substitutes in the endoscope reprocessing and endoscopic probe disinfection industry refer to alternative solutions that can replace conventional reprocessing practices. A prominent example is the adoption of single-use, disposable endoscopes, which are designed for one-time application and entirely remove the need for cleaning and disinfection between procedures. These devices help reduce the risk of cross-contamination, streamline workflow, and eliminate the costs and complexities associated with reprocessing infrastructure, making them an increasingly attractive option for certain clinical settings.

Several companies in the endoscope reprocessing and endoscopic probe disinfection industry are expanding into new geographic regions to strengthen their competitive position and diversify their product offerings. Increased product launches are creating additional opportunities for market entry in untapped areas. For instance, in January 2024,Gaining FDA approval for ULT in mid-2023 and Canadian Health Canada clearance in early 2024 positioned Tristel to initiate full product launches across the United States and Canada in partnership with Parker Labs. Clinical rollouts are already underway via early hospital adopters.

Product Insights

The high-level disinfectants and test strips segment led the market with the largest revenue share of 23.2% in 2024. High-level disinfectants and test strips chemistries refer to specialized chemical solutions and tools used in medical device reprocessing. Technologically advanced products offered by key players drive the market's growth. For instance, STERIS offers the RAPICIDE High-Level Disinfectant & Sterilant (Glutaraldehyde) & Test Strips, a fast-acting glutaraldehyde-based disinfectant validated explicitly for use in STERIS automated reprocessors. It requires no mixing, is non-staining, and accomplishes high-level disinfection in 5 minutes at 35 °C, with sterility assurance against difficult pathogens. The paired test strips help monitor concentration levels throughout the reuse cycle. In addition, STERIS offers RAPICIDE OPA/28 High-Level Disinfectant & Test Strips, a reusable ortho-phthalaldehyde (OPA) disinfectant for flexible endoscopes, cleared for both manual and automated reprocessing. It achieves high-level disinfection with a 5-minute contact time at 25 °C (or 10 minutes at room temperature). It offers 28-day reuse when minimum concentration is verified with matching test strips (3-second dip, 90-second read). Includes easy-to-read test strips for enhanced traceability.

The automated endoscope reprocessors (AERs) segment is anticipated to witness at the fastest CAGR over the forecast period. Endoscopic ultrasound (EUS) probes are semi‑critical medical devices that combine endoscopic access with high-frequency ultrasound imaging to evaluate internal structures adjacent to the gastrointestinal tract—such as lymph nodes, pancreas, and liver. Recent developments signal a transition toward automated and UV‑based disinfection systems for enhanced consistency and safety. ANSI/AAMI ST91:2021 and emerging TIR99 guidance discourage manual soak-based HLD due to variability and staff exposure risks, favoring validated automated reprocessing platforms. Moreover, in September 2024, Germitec’s Chronos UV‑C high-level disinfection chamber became the first FDA-cleared, enabling rapid (~90-second), chemical-free HLD with documented efficacy against bacteria, viruses (including HPV), mycobacteria, and spores. The automated monitoring, traceability features, and elimination of toxic chemicals significantly advance safe, efficient EUS probe reprocessing.

End Use Insights

The ambulatory surgical centers (ASCs) facilities segment led the market with the largest revenue share of 56.5% in 2024. The ambulatory surgical centers (ASCs) segment of the endoscope reprocessing and probe disinfection industry has grown significantly due to the increasing demand for outpatient procedures and the emphasis on minimally invasive surgeries. ASCs typically handle a high volume of endoscopic procedures, such as colonoscopy, gastroscopy, and bronchoscopy, where the risk of infection is a primary concern. This drives the need for efficient and reliable endoscope reprocessing systems, including automated endoscope reprocessors (AERs), high-level disinfectants, and drying/storage units to ensure proper cleaning, disinfection, and safe transport of endoscopes.

Top 5 U.S. States by Number of Ambulatory Surgical Centers (ASCs) in 2024

Sr

State

Number of ASCs

1

California

894

2

Florida

509

3

Texas

488

4

Georgia

419

5

Maryland

348

Source: Ambulatory Surgery Center Association & GVR

The hospitals segment is anticipated to register at the fastest CAGR over the forecast period. Technological advancements, coupled with the high sensitivity of disposable endoscopes, are providing momentum to the segment expansion. The number of hospitals is increasing in most countries, including the U.S., Canada, Spain, the UK, India, Italy, Japan, China, Brazil, Thailand, the UAE, South Africa, and Argentina. According to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, in 2021, there were 1,300 hospitals in Canada. The European Union has around 15,000 hospitals. Moreover, the UK has 1148 hospitals as of August 2023.

Regional Insights

North America dominated the endoscope reprocessing and endoscopic probe disinfection market with the largest revenue share of 38.2% in 2024, due to the increasing prevalence of gastrointestinal, respiratory, and urological disorders. The rising adoption of minimally invasive endoscopic procedures across healthcare settings has elevated the demand for reliable and efficient reprocessing solutions. Regulatory support is driving the adoption of novel technologies in endoscope reprocessing. In a significant move to enhance reprocessing standards, for instance, in March 2025, North American regulators approved the CORIS System, the first fully automated cleaner for the internal channels of flexible endoscopes. Improving mechanical cleaning before high-level disinfection addresses a significant challenge in removing biofilm and enhances reprocessing effectiveness.

U.S. Endoscope Reprocessing and Endoscopic Probe Disinfection Market Trends

The endoscope reprocessing and endoscopic probe disinfection market in the U.S. accounted for the largest market revenue share of 82.5% in North America in 2024. The growing burden of gastrointestinal diseases, particularly stomach cancer, is a significant factor contributing to the rising demand for endoscopic procedures in the U.S. Stomach cancer, which is typically diagnosed through upper gastrointestinal endoscopy (gastroscopy), continues to affect thousands of individuals annually. According to the American Cancer Society, Inc. article published in January 2025, approximately 30,300 new cases of stomach cancer are expected in the U.S. in 2025, with around 10,780 deaths attributed to the disease. Although it accounts for only about 1.5% of all newly diagnosed cancers in the country, the diagnostic and therapeutic procedures required for its management involve frequent use of reusable endoscopes.

The Canada endoscope reprocessing and endoscopic probe disinfection market is anticipated to register at a significant CAGR during the forecast period. In Canada, the growing need for endoscopic procedures is closely linked to the ongoing burden of stomach cancer. According to the Canadian Cancer Society article published in May 2024, it is estimated that around 4,000 Canadians will be diagnosed with this disease in 2024, with a significant proportion requiring diagnostic and follow-up gastroscopies. These procedures rely on flexible endoscopes, which must be carefully cleaned and disinfected after each use to ensure patient safety and prevent cross-contamination.

Europe Endoscope Reprocessing and Endoscopic Probe Disinfection Market Trends

The endoscope reprocessing and endoscopic probe disinfection market in Europe is anticipated to register at a significant CAGR during the forecast period. Increasing product launches and sanctions in the region are accelerating the market growth. In June 2023, PENTAX Medical Europe, a division of the HOYA Group, launched AquaTYPHOON, an automated pre-cleaning system for endoscopes that operates without the need for brushes.

The Germany endoscope reprocessing and endoscopic probe disinfection market is anticipated to grow at a considerable CAGR during the forecast period. Increasing rectal cancer incidence in Germany drives the growth of the market. According to an onkopedia article published in February 2025, in Germany, nearly 20,000 new cases of rectal cancer are reported annually, with approximately 12,000 men and 7,000 women affected each year. These figures account for about 4.3% of all malignant tumors in men and 3.0% in women, underscoring the significant burden of this disease across the country. The diagnosis and monitoring of rectal cancer typically require frequent endoscopic procedures such as colonoscopies, which in turn generate a high demand for effective reprocessing and disinfection of endoscopic equipment.

The endoscope reprocessing and endoscopic probe disinfection market in the UK is anticipated to grow at a considerable CAGR during the forecast period. Increasing rectal cancer incidence in the UK drives the growth of the market. According to the University of Aberdeen article published in May 2025, each year, approximately 12,000 individuals are diagnosed with rectal cancer in the UK, highlighting a substantial patient population requiring ongoing diagnostic and therapeutic care. The management of rectal cancer frequently involves procedures such as colonoscopies and sigmoidoscopies, which rely heavily on the use of flexible endoscopes. This consistent clinical demand significantly contributes to the volume of endoscopic procedures performed across healthcare facilities.

The Spain endoscope reprocessing and endoscopic probe disinfection market is anticipated to register at a significant CAGR during the forecast period. Increasing colorectal cancer cases in Spain drive the market growth. According to the Spanish Network of Cancer Registries article published in March 2025, an estimated 44,500 new cases are projected in 2025. The disease shows a higher prevalence among men, with a ratio of three male cases for every two in women. Despite a stable incidence trend, colorectal cancer continues to be the second leading cause of cancer-related deaths in the country, accounting for over 15,000 fatalities in 2022—approximately 13.7% of all cancer deaths. This significant burden highlights the vital role of early detection and intervention through endoscopic procedures. Consequently, the demand for reliable endoscope reprocessing and endoscopic probe disinfection solutions is rising in Spain to ensure safe, hygienic, and efficient diagnostic workflows.

Asia Pacific Endoscope Reprocessing and Endoscopic Probe Disinfection Market Trends

The endoscope reprocessing and endoscopic probe disinfection market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, owing to changes in lifestyle & demographics and a growing geriatric population suffering from chronic diseases, such as cancer, ophthalmic diseases, & GI disorders, which are factors driving the market. Moreover, partnerships among companies drive the market. For instance, in March 2023, Scivita Medical Technology Co., Ltd. and Boston Scientific Corporation, a prominent global medical technology company, signed an extended strategic cooperation agreement. As per the agreement, Scivita Medical enhances its partnership with Boston Scientific Corporation for strategic co-development and global distribution activities. Activities involve collaborating on the co-development of upcoming endoscopic devices and exploring global distribution opportunities for Scivita Medical’s single-use endoscopes & imaging devices.

The Japan endoscope reprocessing and endoscopic probe disinfection market is anticipated to register at a significant CAGR during the forecast period. The growing prevalence of chronic diseases and increasing demand for early diagnosis and treatment of diseases are expected to boost the market. According to NIH data in 2022, a Japanese prospective population‐based cohort study revealed that endoscopic screening lowered the occurrence of advanced gastric cancer by 22% and decreased gastric cancer mortality by 61% compared to no screening.

The endoscope reprocessing and endoscopic probe disinfection market in China is anticipated to register at a significant CAGR during the forecast period. Rising collaborations between industry players to create advanced endoscopes contribute to market growth. In July 2023, the HOYA Group and PENTAX Medical opened a new facility in Shanghai, China, dedicated to manufacturing, R&D, and servicing endoscopes through PENTAX Medical Shanghai Co., Ltd. The site focuses on producing endoscopic solutions specifically designed for the Chinese market.

The India endoscope reprocessing and endoscopic probe disinfection market is anticipated to register at a significant CAGR during the forecast period. The emerging scope of medical tourism in India has transformed the country’s healthcare system. Furthermore, increasing strategic initiatives that key market players adopt are fostering market growth. In July 2024, FUJIFILM India expanded its service network by inaugurating its second-largest service center in Mumbai. This new center focuses on expediting the repair of its bronchoscopes, high-end processors, and gastroscopes, leading to faster turnaround times & better service throughout India.

Latin America Endoscope Reprocessing and Endoscopic Probe Disinfection Market Trends

The endoscope reprocessing and endoscopic probe disinfection market in Latin America is growing, driven by the increasing shift toward minimally invasive procedures and the rising awareness regarding the importance of endoscopy in both diagnostic and therapeutic applications. This growing preference contributes to a greater demand for safe and effective reprocessing systems across the region.

The Brazil endoscope reprocessing and endoscopic probe disinfection market has grown rapidly. Brazil, the largest economy in Latin America, represents a high-growth potential market for medical devices, including endoscope reprocessing and endoscopic probe disinfection and disinfection systems. Moreover, as per the National Cancer Institute, in Brazil, colorectal cancer (CRC) stands as the second most prevalent cancer affecting both men and women, with approximately 45,630 new cases projected annually for the 2023-2025 period. This growing disease burden underscores the critical need for timely and accurate diagnostic procedures such as colonoscopy, which remains a key method for CRC screening and detection.

Middle East & Africa Endoscope Reprocessing and Endoscopic Probe Disinfection Market Trends

The endoscope reprocessing and endoscopic probe disinfection market in the Middle East & Africa is growing. The Middle East and Africa (MEA) is an economically diverse yet rapidly developing region, with certain countries, such as those in the Gulf Cooperation Council (GCC), boasting high per capita disposable incomes and technologically advanced healthcare systems. Government initiatives to expand reimbursement coverage are expected to boost market growth further over the forecast period.

The UAE endoscope reprocessing and endoscopic probe disinfection market is growing at a significant CAGR over the forecast period. Strategic initiatives by the key players drive the growth of the market. For instance, in July 2024, Dubai Healthcare City (DHCC) Phase 2 marked a significant leap in specialized gastroenterology infrastructure with the groundbreaking of the Asan UAE Gastroenterology Hospital, a first-of-its-kind integrated hospital developed in partnership with Asan Medical Center (AMC) and Scope Investment. This 65-bed facility, spanning multiple floors and including state-of-the-art endoscopy, oncology, bariatric, liver transplant, and digestive health services, is slated for completion in 2026. Its establishment elevates the regional standard of care and directly drives demand for advanced endoscope reprocessing and endoscopic probe disinfection solutions necessary to support high-throughput, complex GI procedures.

Key Endoscope Reprocessing and Endoscopic Probe Disinfection Company Insights

Key participants in the endoscope reprocessing and endoscopic probe disinfection industry are focusing on devising innovative business growth strategies for product portfolio expansions, partnerships and collaborations, mergers and acquisitions, and business footprint expansions.

Key Endoscope Reprocessing and Endoscopic Probe Disinfection Companies:

The following are the leading companies in the endoscope reprocessing and endoscopic probe disinfection market. These companies collectively hold the largest market share and dictate industry trends.

- STERIS

- Fortive Corporation (Advanced Sterilization Products)

- Olympus Corporation

- Ecolab

- Getinge AB

- Steelco S.p.A

- ARC Group of Companies Inc.

- Metrex Research, LLC.

- Shinva Medical Instrument Co., Ltd.

- Nanosonics

- Tristel Plc

- CIVCO Medical Solutions

- Germitec

- CS Medical LLC

- UV Smart

Recent Developments

-

In June 2025, Nanosonics achieved FDA de novo clearance for its Coris system, a novel high-level disinfection platform for endoscopes. Commercial rollout will begin in Q1 FY26 (mid‑2026) within select hospitals and expand thereafter. Coris is designed to drive additional consumables revenue and address the global demand for automated endoscope HLD systems.

-

In February 2025, Germitec secured USD 30 million in funding led by major European investor Eurazeo, with further support from existing shareholders and EIB. The capital is being used to expand U.S. operations, support regulatory approvals, and continue R&D for UV‑C infection prevention systems.

-

In June 2024, Metall Zug and Miele formally finalized their joint venture, uniting Steelco and Belimed under a single entity focused on Infection Control and Life Science solutions. This collaboration represents a significant development within the industry, creating a new brand identity known as SteelcoBelimed.

Endoscope Reprocessing and Endoscopic Probe Disinfection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.31 billion

Revenue forecast in 2033

USD 3.81 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

STERIS; Fortive Corporation (Advanced Sterilization Products); Olympus Corporation; Ecolab; Getinge AB; Steelco S.p.A; ARC Group of Companies Inc.; Metrex Research, LLC.; Shinva Medical Instrument Co., Ltd.; Nanosonics; Tristel Plc; CIVCO Medical Solutions; Germitec; CS Medical LLC; UV Smart.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscope Reprocessing and Endoscopic Probe Disinfection Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global endoscope reprocessing and endoscopic probe disinfection market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

High-Level Disinfectants and Test Strips

-

Detergents and Wipes

-

Automated Endoscope Reprocessors

-

By Type

-

Single Basin

-

Double Basin

-

-

By Portability

-

Standalone

-

Portable

-

-

-

Endoscopic Probe Disinfection

-

Endoscopic Probes [Ultrasound (EUS)]

-

Convex Probes

-

Linear Probes

-

Transesophageal (TEE) Probes

-

-

Endoscopic Probes [Ultrasound (EUS)]

-

Instruments

-

Consumables

-

-

-

Endoscope Drying, Storage, and Transport Systems

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Diagnostic Laboratories and Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscope reprocessing and endoscopic probe disinfection market size was estimated at USD 2.19 billion in 2024 and is expected to reach USD 2.31 billion in 2025.

b. The global endoscope reprocessing and endoscopic probe disinfection market is expected to grow at a compound annual growth rate of 6.47% from 2025 to 2033 to reach USD 3.81 billion by 2033.

b. North America dominated the endoscope reprocessing and endoscopic probe disinfection market with a share of 38.21% in 2024. The increasing prevalence of gastrointestinal diseases, cancer, and other medical conditions requiring endoscopic procedures contributes to the growth of the endoscope reprocessing and probe disinfection market in North America.

b. Some key players operating in the endoscope reprocessing and endoscopic probe disinfection market include Cantel Medical, Fortive Corporation (Advanced Sterilization Products), Olympus Corporation, Ecolab, Getinge AB, STERIS, Steelco S.p.A, ARC Group of Companies Inc., Metrex Research, LLC., Shinva Medical Instrument Co. Ltd. , and Belimed.

b. The increasing incidence of nosocomial infections associated with contaminated endoscopes has brought global attention to the critical need for effective endoscope reprocessing and probe disinfection solutions. Despite strict cleaning protocols, reusable endoscopes remain a significant vector for microbial transmission in clinical settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.