- Home

- »

- Medical Devices

- »

-

Endoscopes Market Size, Share And Growth Report, 2030GVR Report cover

![Endoscopes Market Size, Share & Trends Report]()

Endoscopes Market Size, Share & Trends Analysis Report By Product (Disposable, Flexible, Rigid), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-550-2

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Endoscopes Market Size & Trends

The global endoscopes market size was valued at USD 20.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2030. The rise in prevalence of chronic disorders and growing awareness about early detection of diseases through minimally invasive surgical procedures are some of the major factors anticipated to drive endoscopy market growth over the forecast years. Furthermore,increasing FDA approvals for endoscopic devices and favorable reimbursement policies are also expected to boost the growth of the market. For instance, in 2021, the United States Food and Drug Administration granted 510(k) clearance to EndoFresh’s disposable digestive endoscopy system, a device developed to reduce the chance of contamination in gastrointestinal procedures.

Furthermore, endoscopic procedures have been largely adopted to diagnose and treat functional gastrointestinal disorders. This disorders can affect any part of the gastrointestinal tract, including the stomach, esophagus, and intestines. The growing prevalence of functional gastrointestinal disorders, such as Irritable Bowel Syndrome (IBS), functional constipation, or functional dyspepsia, is also expected to accelerate product adoption and boost market growth over the forecast years. For instance, in 2021, a multinational study published in the Gastroenterology journal on 33 countries reported that, globally, over 40% of persons have functional gastrointestinal disorders.

Increasing prevalence of global cancer and cancer-related mortality is expected to drive the market demand for endoscopic procedures with enhanced visualization. As per WHO, cancer is the leading causes of death globally and claims one in every six lives. According to GLOBOCAN 2020 update on cancer incidences and mortalities, an approximate 19.3 million new cancer cases were diagnosed, and 10.0 million cancer mortalities were recorded in 2020 worldwide. Some of the common cancers along with their incidence rate in 2020 were: breast cancer (11.7%), lung cancer (11.4%), colorectal cancer (10.0%), prostate cancer (7.3%), and stomach cancer (5.6%). In addition, it is estimated that by 2040 more than 28.4 million new cancer cases would be diagnosed across the globe with a sharp rise of 47% from 2020. According to American Cancer Society, in 2021, around 1.9 million new cancer cases are expected to be diagnosed and around 608,570 people are estimated to die due to cancer in U.S. Thus, increasing prevalence of cancer is expected to drive the market growth.

Minimally invasive endoscopic bariatric procedures, conducted through patients' mouths, are expected to drive market growth, supported by a rising demand for such procedures. Additionally, the increasing global burden of cancer, with 19.3 million new cases and 10 million deaths in 2020, is fueling the need for early diagnosis and treatment, particularly driving the demand for endoscopic biopsy and contributing to anticipated market growth in the forecast years.

A decrease in the number of endoscopic procedures during the COVID-19 pandemic hampered the market growth in 2020. Due to the risk of cross-contamination and the chance of SARS-CoV-2 transmission, several endoscopic facilities have canceled or postponed the elective, and semi-urgent procedures, which is restraining the market growth. Furthermore, supply chain disruption and changing regulations to curtail the infection are also some of the major factors that hindered the market growth in 2020. For instance, a study on the endoscopy unit of the Cancer Institute of the State of São Paulo, published in the Clinics (Sao Paulo) journal in 2021, revealing a 55% reduction in endoscopic procedures during the pandemic, with colonoscopy experiencing the most significant decline at -79%.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The endoscopes market is characterized by a moderate degree of growth owing to growing research activities, rising investments and approvals from governments and regulatory bodies to improve healthcare infrastructure and advance research in the endoscopy field.For instance, in May 2021, Pentax Medical and Jiangsu Vedkang Medical Science and Technology entered a multiyear joint venture to codevelop disposable therapeutic products in the flexible endoscopy space. Under this joint venture, Pentax Medical would offer its sales & distribution network, and Jiangsu Vedkang would utilize its production and R&D capabilities.

The global endoscopes market is characterized by high innovation, with new technologies and methods being developed and introduced regularly. For instance, the application of artificial intelligence (AI) in many gastroenterology fields is becoming more widespread, especially in endoscopic image processing. These significant technological advancements are anticipated to bolster the endoscopic market growth rate.

Several market players, such as Olympus Corp.; Ethicon US, LLC; Fujifilm Holdings Corp.; Boston Scientific Corp.; Karl Storz GmbH & Co., KG; Stryker, and Medtronic are involved in mergers and acquisitions. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in December 2022, Olympus Corporation signed an agreement to acquire Odin Vision, a London-based cloud-AI endoscopy company, to enhance patient care by transforming procedural and clinical workflows.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel endoscopic technologies. For instance, the European Union (EU) has recently imposed laws and guidelines that can affect Endoscopists and patients. The new regulations raise the requirement for clinical trials and observational studies for both new and existing endoscopic device uses to assure therapeutic benefit and minimize patient damage.

A wide range of product substitutes are available, as endoscopic devices is a rapidly evolving field in healthcare. For instance, the conventional endoscope can be replaced by an innovative capsule endoscopy technology. Three technological developments have been necessary for the development of the capsule endoscope are powerful, compact camera systems that are only a few millimeters in size, wireless technology that allows camera images to be transmitted in real-time, and sensor or actuator systems that allow intuitive control of the capsule inside the body.

Several market players are adopting geographical expansion strategies to strengthen their positions in the market and expand their manufacturing capacities. Due to rising awareness and increased use of robotic-assisted endoscopy solutions in healthcare sector, the demand for robotic technology has increased across the globe. Thus, many companies are adopting this strategy to expand their product portfolio.

Product Insights

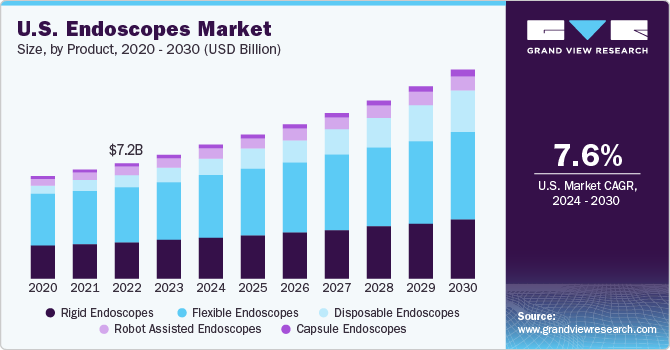

The product segment comprises of rigid endoscopes, flexible endoscopes, disposable endoscopes, robot-asssited endoscopes, and capsule endoscopes. The flexible endoscopes dominated the market and accounted for the largest revenue share of over 46.7% in 2023. This is attributed to increasing demand for minimally invasive surgical procedures such as laparoscopy and cystoscopy. However, the COVID-19 pandemic has impacted the demand for rigid endoscopes, as elective surgeries were postponed during this time to prioritize COVID-19-infected patients. In the postpandemic period, there has been a shift as many elective surgeries have resumed, primarily due to the rising burden of chronic diseases globally. For instance, according to Cancer Tomorrow, cancer incidence was 13.3 million in 2020 and is projected to increase to 30.3 million in 2040. This anticipated increase in surgeries postpandemic is expected to drive market growth for rigid endoscopes.

Disposable endoscopes segment is expected to witness fastest CAGR growth during the forecast period. The increasing demand for single-use endoscopes to mitigate the risk of device-related infections drives the disposable endoscopes segment. Factors such as patient preference for minimally invasive procedures, supportive regulatory frameworks, and favorable reimbursement policies in developed countries also contribute to market growth. Furthermore, the segment is benefiting from investments, funds, and grants from governments and organizations to improve healthcare infrastructure and advance research in the endoscopy field.

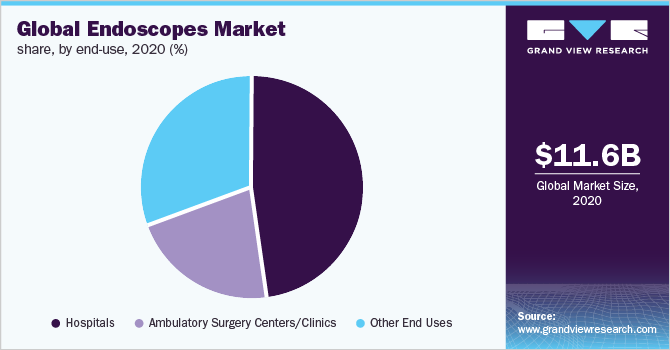

End-use Insights

The end-use segment comprises of hospitals and outpatient facilities. In 2023, the outpatient facilities dominated the market in terms of revenue share and segment is also anticipated to register the fastest growth over the forecast period. Rising adoption of endoscopes across outpatient facilities, such as diagnostic clinics and ambulatory surgery centers (ASCs), for the early diagnosis and detection of chronic diseases is supporting the growth of the segment.

Outpatient facilities play a vital role in the endoscopes market by providing convenient & efficient diagnostic and therapeutic procedures. The increasing popularity of endoscopes in outpatient settings can be attributed to their numerous advantages. One significant advantage of endoscopes in outpatient facilities is their cost-effectiveness. These single-use devices eliminate the need for reprocessing, saving valuable time and resources for cleaning, sterilizing, & maintaining reusable endoscopes. This streamlined approach improves workflow efficiency, reduces turnaround time, and enhances patient throughput.

Regional Insights

North America led the market in 2023 and accounted for the highest share of 40.5% of the global revenue. The regional market is estimated to retain the dominant position throughout the forecast period owing to the increasing adoption of elective endoscopic procedures, improved healthcare expenditure, and the high geriatric population. In addition, the high burden of cancer and functional gastrointestinal disorders in the U.S.is anticipated to further drive the market over the forecast period. For instance, according to the American Cancer Society, about 1.9 million new cancer cases are estimated to be diagnosed in 2021 in the U.S.

Similarly, developing countries and emerging economies around the world are rapidly growing markets owing to the growing disease prevalence and development of high-quality healthcare infrastructure. For instance, the growing medical tourism industry in India is positively impacting the endoscopy market in India.

On the other hand, the Middle East and Africa is projected to be the fastest-growing regional market over the forecast period. This growth is owing to presence of a growing patient population pool suffering from functional gastrointestinal disorders and other chronic lifestyle disorders. Advancedments in healthcare infrastructure, growing healthcare expenditure, and increasing awareness towards available diagnostic & therapeutic solutions is driving the regional market growth. Some of the other factors contributing to the growth of the regional market include the growing geriatric population and rapid economic development and increasing government healthcare investments are projected to attract foreign investments in this region. Moreover, the presence of key players in MEA is also fueling the adoption of endoscopes, which, in turn, supports the regional market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Olympus Corporation (Olympus), Boston Scientific, and Stryker.Whereas, some of the emerging market players in the industry are CONMED Corporation, Richard Wolf GmbH, and Medtronic.

-

Olympus Corporation is one of the market leader and is a medical technology company offering medical systems, such as endoscopes and endoscopy products. The company is leading innovator in designing & adopting technologically advanced solutions. The company houses world-class R&D resources & facilities and therefore, are one of pioneering companies in the endoscopes industry,

-

Boston Scientific is a renowned player in the medical devices industry and the company devises numerous strategies in the form of collaborations and partnerships to expand their business geographies.

-

FUJIFILM Holdings Corporation is another dominant player in the endoscopes industry and focuses on innovating novel therapies and technologies. FUJIFILM utilizes their R&D capabilities to advance their product offerings.

-

PENTAX Medical is a division of HOYA Group delivering endo-imaging solutions. The company has manufacturing and R&D innovation centers in the U. S., Japan, and Europe. The company utilizes their innovation capabilities and devises their merger & partnership strategies to grow across various business geographies.

Key Endoscopes Companies:

- Olympus Corporation (Olympus)

- PENTAX Medical

- Ethicon (Johnson & Johnson, Inc.)

- FUJIFILM Holdings Corporation

- Stryker

- Boston Scientific Corporation

- CONMED Corporation

- Karl Storz GmbH & Co., KG

- Richard Wolf GmbH

- Medtronic

Recent Developments

-

In November 2023, Olympus Corporation (Olympus), launched EVIS X1, its next-generation endoscopy system in China. This endoscopy system has been demonstrated at the 6th annual China International Import Expo that was held in Shanghai from November 5th -10th.

-

In March 2023, AIG Hospitals in Hyderabad launched a Center of Excellence (CoE) in collaboration with Boston Scientific. This collaboration aims to enhance healthcare services by providing advanced treatment options and expertise in various medical fields.

-

In January 2023, FUJIFILM India has launched FushKnife, a diathermic slitter and ClutchCutter, a rotatable forceps. The products were introduced at the 63rd Annual Conference of Indian Society of Gastroenterology-ISGCON in Jaipur.

Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.3 billion

Revenue forecast in 2030

USD 37.1 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, enduse, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Norway; Sweden; Denmark; China; Japan; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation (Olympus); PENTAX Medical; Ethicon (Johnson & Johnson, Inc.); FUJIFILM Holdings Corporation; Stryker; Boston Scientific Corporation; CONMED Corporation; Karl Storz GmbH & Co., KG; Richard Wolf GmbH; Medtronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global endoscopes market report on the basis of product, enduse, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

-

Robot Assisted Endoscopes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopes market size was estimated at USD 20.3 billion in 2023 and is expected to reach USD 22.3 billion in 2024.

b. The global endoscopes market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 37.1 billion by 2030.

b. Flexible endoscopes dominated the endoscopes market with a share of 46.7% in 2023. This is attributable to their ergonomics features, increased safety, efficiency, and advancements in medical-optics technology thus driving the demand and consumption of flexible endoscopes.

b. Some key players operating in the endoscopes market include Fujifilm Holdings Corporation; Olympus Corporation LLC; Stryker Corporation; Ethicon Endo-Surgery; Richard Wolf GmbH; Karl Storz; and Boston Scientific Corporation.

b. Key factors that are driving the endoscopes market growth include an increasing geriatric population; a growing preference for minimally invasive surgeries; and a rise in incidences of cancer, gastrointestinal diseases, and other chronic diseases.

Table of Contents

Chapter 1. Endoscopes Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. End Use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Endoscopes Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. End Use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Endoscopes Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing prevalence of global cancer and cancer-related mortality

3.2.1.2. Technological advancements

3.2.1.3. Growing demand for minimally invasive procedures

3.2.2. Market restraint analysis

3.2.2.1. Stringent regulations & approvals

3.3. Endoscopes Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.4. Case Study Analysis

Chapter 4. Endoscopes Market: Product Estimates & Trend Analysis

4.1. Product Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Endoscopes Market by Product Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Endoscopes

4.4.1.1. Rigid Endoscopes

4.4.1.2. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.1. Laparoscopes

4.4.1.2.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.2. Arthroscopes

4.4.1.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.3. Ureteroscopes

4.4.1.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.4. Cystoscopes

4.4.1.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.5. Gynecology Endoscopes

4.4.1.2.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.6. Neuroendoscopes

4.4.1.2.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.7. Bronchoscopes

4.4.1.2.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.8. Hysteroscopes

4.4.1.2.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.9. Laryngoscopes

4.4.1.2.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.10. Sinuscopes

4.4.1.2.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.11. Otoscopes

4.4.1.2.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.12. Sigmoidoscopes

4.4.1.2.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.13. Pharyngoscopes

4.4.1.2.13.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.14. Duodenoscopes

4.4.1.2.14.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.15. Nasopharyngoscopes

4.4.1.2.15.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2.16. Rhinoscopes

4.4.1.2.16.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.3. Flexible Endoscopes

4.4.1.4. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.1. Laparoscopes

4.4.1.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.2. Arthroscopes

4.4.1.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.3. Ureteroscopes

4.4.1.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.4. Cystoscopes

4.4.1.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.5. Gynecology Endoscopes

4.4.1.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.6. Neuroendoscopes

4.4.1.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.7. Bronchoscopes

4.4.1.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.8. Hysteroscopes

4.4.1.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.9. Laryngoscopes

4.4.1.4.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.10. Sinuscopes

4.4.1.4.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.11. Otoscopes

4.4.1.4.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.12. Sigmoidoscopes

4.4.1.4.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.13. Pharyngoscopes

4.4.1.4.13.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.14. Duodenoscopes

4.4.1.4.14.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.15. Nasopharyngoscopes

4.4.1.4.15.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.16. Rhinoscopes

4.4.1.4.16.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4.17. Colonoscopes

4.4.1.4.17.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.5. Disposable Endoscopes

4.4.1.6. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.1. Laparoscopes

4.4.1.6.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.2. Arthroscopes

4.4.1.6.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.3. Ureteroscopes

4.4.1.6.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.4. Cystoscopes

4.4.1.6.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.5. Gynecology Endoscopes

4.4.1.6.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.6. Neuroendoscopes

4.4.1.6.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.7. Bronchoscopes

4.4.1.6.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.8. Hysteroscopes

4.4.1.6.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.9. Laryngoscopes

4.4.1.6.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.10. Sinuscopes

4.4.1.6.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.11. Otoscopes

4.4.1.6.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.12. Sigmoidoscopes

4.4.1.6.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.13. Pharyngoscopes

4.4.1.6.13.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.14. Duodenoscopes

4.4.1.6.14.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.15. Nasopharyngoscopes

4.4.1.6.15.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.16. Rhinoscopes

4.4.1.6.16.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.6.17. Colonoscopes

4.4.1.6.17.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.7. Capsule Endoscopes

4.4.1.8. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.9. Robot Assisted Endoscopes

4.4.1.10. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Endoscopes Market: End Use Estimates & Trend Analysis

5.1. End Use Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Endoscopes Market by End Use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Hospitals

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Outpatient Facilities

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Endoscopes Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

6.8.3. Argentina

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Endsocope Market Share, by Company

7.4. Vendor Landscape

7.4.1. Olympus Corporation (Olympus)

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. PENTAX Medical

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Ethicon (Johnson & Johnson Service Inc.)

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. FUJIFILM Holdings Corporation

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. Stryker

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. Boston Scientific Corporation

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. CONMED Corporation

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Karl Storz GmbH & Co., KG

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. Richard Wolf GmbH

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

7.4.10. Medtronic

7.4.10.1. Company overview

7.4.10.2. Financial performance

7.4.10.3. Product benchmarking

7.4.10.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America endoscopes market, by region, 2018 - 2030 (USD Million)

Table 3 North America endoscopes market, by product, 2018 - 2030 (USD Million)

Table 4 North America endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 5 U.S. endoscopes market, by product, 2018 - 2030 (USD Million)

Table 6 U.S. endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 7 Canada endoscopes market, by product, 2018 - 2030 (USD Million)

Table 8 Canada endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 9 Europe endoscopes market, by region, 2018 - 2030 (USD Million)

Table 10 Europe endoscopes market, by product, 2018 - 2030 (USD Million)

Table 11 Europe endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 12 Germany endoscopes market, by product, 2018 - 2030 (USD Million)

Table 13 Germany endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 14 UK endoscopes market, by product, 2018 - 2030 (USD Million)

Table 15 UK endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 16 France endoscopes market, by product, 2018 - 2030 (USD Million)

Table 17 France endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 18 Italy endoscopes market, by product, 2018 - 2030 (USD Million)

Table 19 Italy endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 20 Spain endoscopes market, by product, 2018 - 2030 (USD Million)

Table 21 Spain endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 22 Denmark endoscopes market, by product, 2018 - 2030 (USD Million)

Table 23 Denmark endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 24 Sweden endoscopes market, by product, 2018 - 2030 (USD Million)

Table 25 Sweden endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 26 Norway endoscopes market, by product, 2018 - 2030 (USD Million)

Table 27 Norway endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 28 Asia Pacific endoscopes market, by region, 2018 - 2030 (USD Million)

Table 29 Asia Pacific endoscopes market, by product, 2018 - 2030 (USD Million)

Table 30 Asia Pacific endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 31 China endoscopes market, by product, 2018 - 2030 (USD Million)

Table 32 China endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 33 Japan endoscopes market, by product, 2018 - 2030 (USD Million)

Table 34 Japan endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 35 India endoscopes market, by product, 2018 - 2030 (USD Million)

Table 36 India endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 37 South Korea endoscopes market, by product, 2018 - 2030 (USD Million)

Table 38 South Korea endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 39 Australia endoscopes market, by product, 2018 - 2030 (USD Million)

Table 40 Australia endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 41 Thailand endoscopes market, by product, 2018 - 2030 (USD Million)

Table 42 Thailand endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 43 Latin America endoscopes market, by product, 2018 - 2030 (USD Million)

Table 44 Latin America endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 45 Brazil endoscopes market, by product, 2018 - 2030 (USD Million)

Table 46 Brazil endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 47 Mexico endoscopes market, by product, 2018 - 2030 (USD Million)

Table 48 Mexico endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 49 Argentina endoscopes market, by product, 2018 - 2030 (USD Million)

Table 50 Argentina endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 51 MEA endoscopes market, by region, 2018 - 2030 (USD Million)

Table 52 MEA endoscopes market, by product, 2018 - 2030 (USD Million)

Table 53 MEA endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 54 South Africa endoscopes market, by product, 2018 - 2030 (USD Million)

Table 55 South Africa endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 56 Saudi Arabia endoscopes market, by product, 2018 - 2030 (USD Million)

Table 57 Saudi Arabia endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 58 UAE endoscopes market, by product, 2018 - 2030 (USD Million)

Table 59 UAE endoscopes market, by end use, 2018 - 2030 (USD Million)

Table 60 Kuwait endoscopes market, by product, 2018 - 2030 (USD Million)

Table 61 Kuwait endoscopes market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Endoscopes market: market outlook

Fig. 9 Endoscopes competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Endoscopes market driver impact

Fig. 15 Endoscopes market restraint impact

Fig. 16 Endoscopes market strategic initiatives analysis

Fig. 17 Endoscopes market: Product movement analysis

Fig. 18 Endoscopes market: Product outlook and key takeaways

Fig. 19 Endoscopes market estimates and forecast, 2018 - 2030

Fig. 20 Rigid endoscopes market estimates and forecast, 2018 - 2030

Fig. 21 Laparoscopes market estimates and forecast, 2018 - 2030

Fig. 22 Arthroscopes market estimates and forecast, 2018 - 2030

Fig. 23 Ureteroscopes market estimates and forecast, 2018 - 2030

Fig. 24 Cystoscopes market estimates and forecast, 2018 - 2030

Fig. 25 Gynecology endoscopes market estimates and forecast, 2018 - 2030

Fig. 26 Neuroendoscopes market estimates and forecast, 2018 - 2030

Fig. 27 Bronchoscopes market estimates and forecast, 2018 - 2030

Fig. 28 Hysteroscopes market estimates and forecast, 2018 - 2030

Fig. 29 Laryngoscopes market estimates and forecast, 2018 - 2030

Fig. 30 Sinuscopes market estimates and forecast, 2018 - 2030

Fig. 31 Otoscopes market estimates and forecast, 2018 - 2030

Fig. 32 Sigmoidoscopes market estimates and forecast, 2018 - 2030

Fig. 33 Pharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 34 Duodenoscopes market estimates and forecast, 2018 - 2030

Fig. 35 Nasopharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 36 Rhinoscopes market estimates and forecast, 2018 - 2030

Fig. 37 Flexible endoscopes market estimates and forecast, 2018 - 2030

Fig. 38 Laparoscopes market estimates and forecast, 2018 - 2030

Fig. 39 Arthroscopes market estimates and forecast, 2018 - 2030

Fig. 40 Ureteroscopes market estimates and forecast, 2018 - 2030

Fig. 41 Cystoscopes market estimates and forecast, 2018 - 2030

Fig. 42 Gynecology endoscopes market estimates and forecast, 2018 - 2030

Fig. 43 Neuroendoscopes market estimates and forecast, 2018 - 2030

Fig. 44 Bronchoscopes market estimates and forecast, 2018 - 2030

Fig. 45 Hysteroscopes market estimates and forecast, 2018 - 2030

Fig. 46 Laryngoscopes market estimates and forecast, 2018 - 2030

Fig. 47 Sinuscopes market estimates and forecast, 2018 - 2030

Fig. 48 Otoscopes market estimates and forecast, 2018 - 2030

Fig. 49 Sigmoidoscopes market estimates and forecast, 2018 - 2030

Fig. 50 Pharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 51 Duodenoscopes market estimates and forecast, 2018 - 2030

Fig. 52 Nasopharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 53 Rhinoscopes market estimates and forecast, 2018 - 2030

Fig. 54 Colonoscopes market estimates and forecast, 2018 - 2030

Fig. 55 Disposable endoscopes market estimates and forecast, 2018 - 2030

Fig. 56 Laparoscopes market estimates and forecast, 2018 - 2030

Fig. 57 Arthroscopes market estimates and forecast, 2018 - 2030

Fig. 58 Ureteroscopes market estimates and forecast, 2018 - 2030

Fig. 59 Cystoscopes market estimates and forecast, 2018 - 2030

Fig. 60 Gynecology endoscopes market estimates and forecast, 2018 - 2030

Fig. 61 Neuroendoscopes market estimates and forecast, 2018 - 2030

Fig. 62 Bronchoscopes market estimates and forecast, 2018 - 2030

Fig. 63 Hysteroscopes market estimates and forecast, 2018 - 2030

Fig. 64 Laryngoscopes market estimates and forecast, 2018 - 2030

Fig. 65 Sinuscopes market estimates and forecast, 2018 - 2030

Fig. 66 Otoscopes market estimates and forecast, 2018 - 2030

Fig. 67 Sigmoidoscopes market estimates and forecast, 2018 - 2030

Fig. 68 Pharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 69 Duodenoscopes market estimates and forecast, 2018 - 2030

Fig. 70 Nasopharyngoscopes market estimates and forecast, 2018 - 2030

Fig. 71 Rhinoscopes market estimates and forecast, 2018 - 2030

Fig. 72 Colonoscopes market estimates and forecast, 2018 - 2030

Fig. 73 Capsule endoscopes market estimates and forecast, 2018 - 2030

Fig. 74 Robot assisted endoscopes market estimates and forecast, 2018 - 2030

Fig. 75 Endoscopes Market: End Use movement Analysis

Fig. 76 Endoscopes market: End Use outlook and key takeaways

Fig. 77 Hospitals market estimates and forecasts, 2018 - 2030

Fig. 78 Outpatient facilities market estimates and forecasts,2018 - 2030

Fig. 79 Laparoscopic ablation market estimates and forecasts,2018 - 2030

Fig. 80 Global Endoscopes market: Regional movement analysis

Fig. 81 Global Endoscopes market: Regional outlook and key takeaways

Fig. 82 North America, by country

Fig. 83 North America market estimates and forecasts, 2018 - 2030

Fig. 84 U.S. market estimates and forecasts, 2018 - 2030

Fig. 85 Canada market estimates and forecasts, 2018 - 2030

Fig. 86 Europe market estimates and forecasts, 2018 - 2030

Fig. 87 UK market estimates and forecasts, 2018 - 2030

Fig. 88 Germany market estimates and forecasts, 2018 - 2030

Fig. 89 France market estimates and forecasts, 2018 - 2030

Fig. 90 Italy market estimates and forecasts, 2018 - 2030

Fig. 91 Spain market estimates and forecasts, 2018 - 2030

Fig. 92 Denmark market estimates and forecasts, 2018 - 2030

Fig. 93 Sweden market estimates and forecasts, 2018 - 2030

Fig. 94 Norway market estimates and forecasts, 2018 - 2030

Fig. 95 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 96 China market estimates and forecasts, 2018 - 2030

Fig. 97 Japan market estimates and forecasts, 2018 - 2030

Fig. 98 India market estimates and forecasts, 2018 - 2030

Fig. 99 Thailand market estimates and forecasts, 2018 - 2030

Fig. 100 South Korea market estimates and forecasts, 2018 - 2030

Fig. 101 Australia market estimates and forecasts, 2018 - 2030

Fig. 102 Latin America market estimates and forecasts, 2018 - 2030

Fig. 103 Brazil market estimates and forecasts, 2018 - 2030

Fig. 104 Mexico market estimates and forecasts, 2018 - 2030

Fig. 105 Argentina market estimates and forecasts, 2018 - 2030

Fig. 106 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 107 South Africa market estimates and forecasts, 2018 - 2030

Fig. 108 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 109 UAE market estimates and forecasts, 2018 - 2030

Fig. 110 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 111 Endoscopy Market Share By Company (2023)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Endoscopes Product Outlook (Revenue, USD Million, 2018 - 2030)

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Endoscope End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Outpatient Facilities

- Endoscope Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- North America Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- U.S.

- U.S. Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- U.S. Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Endoscopes

- U.S. Endoscope Market, By Product

- Canada

- Canada Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Canada Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Canada Endoscope Market, By Product

- North America Endoscope Market, By Product

- Europe

- Europe Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Europe Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- U.K.

- U.K. Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- U.K. Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- U.K. Endoscope Market, By Product

- Germany

- Germany Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Germany Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Germany Endoscope Market, By Product

- Italy

- Italy Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Italy Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Italy Endoscope Market, By Product

- France

- France Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- France Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- France Endoscope Market, By Product

- Spain

- Spain Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Spain Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Spain Endoscope Market, By Product

- Norway

- Norway Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Norway Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Norway Endoscope Market, By Product

- Sweden

- Sweden Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- SwedenEndoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Sweden Endoscope Market, By Product

- Denmark

- Denmark Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Denmark Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Denmark Endoscope Market, By Product

- Europe Endoscope Market, By Product

- Asia Pacific

- Asia Pacific Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Asia PacificEndoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Australia

- Australia Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- AustraliaEndoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Australia Endoscope Market, By Product

- China

- China Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- China Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- China Endoscope Market, By Product

- Japan

- Japan Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- Japan Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- Japan Endoscope Market, By Product

- India

- India Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- India Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- India Endoscope Market, By Product

- South Korea

- South Korea Endoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Endoscopes

- South Korea Endoscope Market, By End-Use

- Hospitals

- Outpatient Facilities

- South Korea Endoscope Market, By Product

- Thailand

- ThailandEndoscope Market, By Product

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes