- Home

- »

- Green Building Materials

- »

-

Energy Efficient Buildings Market Size & Share Report, 2030GVR Report cover

![Energy Efficient Buildings Market Size, Share & Trends Report]()

Energy Efficient Buildings Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Fiberglass, Mineral Wool, Cellulose), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-331-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Efficient Buildings Market Summary

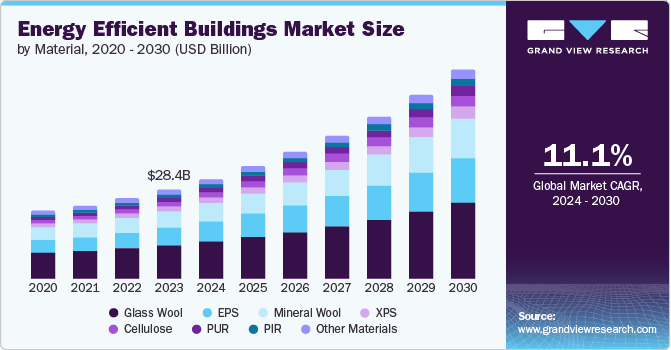

The global energy efficient buildings market size was estimated at USD 28.40 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030. The market growth is attributed to the rising implementation of strict building codes and energy efficiency standards to reduce carbon footprints and promote sustainable development.

Key Market Trends & Insights

- North America dominated the global energy efficient buildings market with the largest revenue share in 2023.

- The energy efficient buildings market in the U.S. led the North America market and held the largest revenue share in 2023.

- By material, the glass wool segment led the market, holding the largest revenue share of 37.3% in 2023.

- By end use, the residential segment is expected to grow at the fastest CAGR of 11.2% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 28.40 Billion

- 2030 Projected Market Size: USD 66.81 Billion

- CAGR (2024-2030): 11.1%

- North America: Largest market in 2023

Governments around the world also offer incentives such as tax benefits, subsidies, and grants.

Increasing energy prices motivate building owners and developers to invest in energy-efficient technologies to reduce operational costs and enhance long-term savings. Programs such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) incentivize the adoption of energy-efficient practices by providing recognition and certification for sustainable buildings therefore leading to the growth of the market.

Increasing energy prices motivate building owners and developers to invest in energy-efficient technologies to reduce operational costs and enhance long-term savings. For instance, rigid foam boards, cellulose and spray foam reduces heat transfer between building envelopes. This leads to low cooling and heating loads on the buildings.

Energy-efficient buildings use fiberglass, mineral wool, cellulose, polyisocyanurate (PIR), extruded polystyrene, expanded polystyrene, and polyurethane (PUR). These products are available worldwide owing to the presence of a large number of suppliers. Furthermore, region-specific raw materials are imported, which increases global reach. This trend is expected to continue over the next few years, which may lead to moderate bargaining power of suppliers.

The rapidly expanding construction industry is further driving demand and aiding the market's growth. The increasing focus on advanced architectural design across the construction sector is projected to create potential demand for innovative buildings over the forecast period. The economic development across rapidly developing countries, including China and India, is projected to accelerate the market's growth over the forecast period.

However, the fluctuating prices of raw materials such as cellulose, glass wool, and mineral wool adversely affect market growth. Industry participants have to pay high tariffs on gas and electricity, and these expenditures contribute more than 30% of overall production costs. Thus, the high costs of gas and electricity are one of the major challenges for this industry

Material Insights

Based on material, the glass wool segment led the industry with the largest revenue share of 37.3% in 2023 and is forecasted to grow at a significant CAGR from 2024 to 2030. Glass wool is manufactured by heating silica sand at 1200ºC to 1250ºC and then converted into fibers. It can be produced in the form of pipes, boards, and blankets of different sizes, with different technical properties specific to its applications. This product offers high thermal insulating properties, which further contribute to reducing energy consumption for heating and cooling purposes in residential as well as commercial buildings.

The product also offers acoustic insulation and fire safety. It helps to reduce energy consumption and temperature fluctuations. Glass wool provides extremely high-temperature tolerances, as it is flame-resistant. In addition, it is cost-effective, versatile, and easily customizable, which accounts for a notable demand as an energy-efficient material.

The Expanded Polystyrene (EPS) material segment is forecasted to grow at the fastest CAGR of 12.0% from 2024 to 2030. Foamed plastics, also known as cellular polymers or expanded plastics, are used as insulation to offer sound absorption, lightweight, quakeproof, and other superior properties.

The EPS segment is expected to witness significant demand from building insulation applications, owing to the energy efficiency regulations imposed by various governments across the globe. In addition, various advantages provided by the product, such as cost-effectiveness and resistance to dust and moisture, are expected to boost its demand.

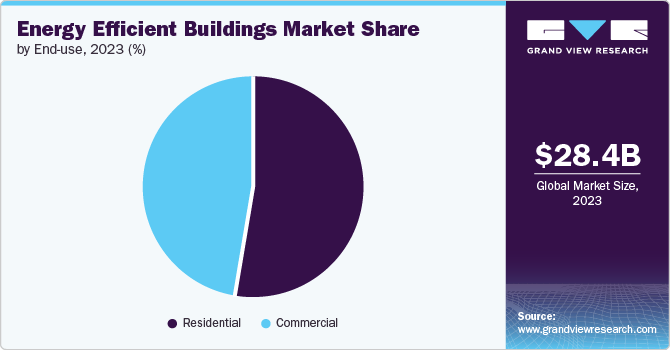

End Use Insights

Based on end use, the residential end use segment dominated the market in 2023 with a revenue share of 53.2%. This segment is further expected to grow at the fastest CAGR of 11.2% from 2024 to 2030. The residential building segment includes residential buildings, apartments, complexes, and small & larger houses. The growth in the number of single-family houses and the rising disposable income of consumers in developing economies are among the various factors that are projected to drive residential construction activities.

The growth of the residential segment is attributed to rapid urbanization in developing countries, as more and more people are shifting to urban areas in search of better opportunities and prospects. This is expected to rapidly drive the demand for energy-efficient materials in residential building applications over the coming years.

Regional Insights

The North America energy efficient buildings market is experiencing significant growth owing to the growing emphasis on construction of energy efficient buildings with the use of sustainable products. In addition, the migration rate to urban areas has grown over the years due to the rising population and an increasing number of opportunities in urban areas compared to rural areas. This has led to increased construction activities in both commercial and residential sectors in the region.

U.S. Energy Efficient Buildings Market Trends

The energy efficient buildings market in the U.S. is anticipated to grow at a significant rate over the forecast period. The U.S. government is investing in sustainable construction. For instance, in November 2023, the U.S. government announced an investment of USD 2.00 billion for 150 building projects of the federal government across 39 states, which will use sustainable materials leading to low carbon emissions. This, in turn, is expected to increase the demand for energy efficient buildings in the U.S.

Europe Energy Efficient Buildings Market Trends

The energy efficient buildings market in Europe accounted for the largest market share, with 37.2% in 2023. Europe has planned to achieve net zero carbon emissions by the year 2050. The building sector accounts for 30% of overall carbon emissions in the region, and to achieve this goal, the region plans to construct energy efficient buildings over the forecast period.

Asia Pacific Energy Efficient Buildings Market Trends

The Asia Pacific energy efficient buildings market is projected to grow at the fastest CAGR of 12.3% from 2024 to 2030. Several governments in the Asia Pacific, such as Japan, India, China, and Australia, are implementing policies and regulations to use sustainable building materials. For instance, Japan has implemented the goal of becoming a Zero Net Energy House (ZEH) country by 2030. Therefore, the Japanese government has taken steps to encourage green construction and energy efficient buildings as part of its efforts to promote sustainable development and reduce carbon emissions from the construction sector.

Key Energy Efficient Buildings Company Insights

Some of the key players operating in the market include Saint-Gobain S.A., Owens Corning, GAF Materials Corporation, Dow, and BASF SE:

-

BASF SE is one of the largest chemical producers across the globe. The company operates in six segments: materials, chemicals, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The company has a robust global presence, with operations in North America, Europe, Asia Pacific, South America, the Middle East, and Africa.

-

Owens Corning is a global company that specializes in developing and producing insulation, roofing, and fiberglass composite materials. The company operates through three main business segments: insulation, roofing, and composites. Its insulation products include fiberglass insulation for residential, commercial, and industrial applications. With operations in over 30 countries worldwide, Owens Corning has a strong presence in North America, Europe, and Asia-Pacific.

Johns Manville, Covestro AG, Fletcher Building, and American Rockwool Manufacturing LLC are some of the emerging market participants in the market.

-

American Rockwool Manufacturing LLC manufactures mineral wool boards and cement for residential and industrial insulation applications. It offers its customers a broad product portfolio, including boards, metal mesh blankets, and pipes.

-

Fletcher Building operates through six business divisions, namely building products, distribution, concrete, residential & development, and construction.

Key Energy Efficient Buildings Companies:

The following are the leading companies in the energy efficient buildings market. These companies collectively hold the largest market share and dictate industry trends.

- Saint-Gobain S.A.

- Owens Corning

- Johns Manville

- GAF Materials Corporation

- BASF SE

- Kingspan Group

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- Rockwool International A/S

- Fletcher Building

- American Rockwool Manufacturing LLC

Recent Developments

-

In December 2023, Saint-Gobain S.A. announced an agreement with SOPREMA for the sale of 75% of its stake in its polyisocyanurate (PIR) material activity in the UK under the Celotex brand. SOPREMA manufactures and sells PIR insulation across Europe.

-

In July 2023, Kingspan Insulated Panels North America announced that its QuadCore Technology is now standard on all its panels used in cold storage applications. This is the next generation of self-blended hybrid insulation core. The class-leading R-value of R-9.0 per inch for cold storage applications means QuadCore is one of the most thermally efficient insulation cores available on the market. Kingspan’s QuadCore Technology delivers R-values 11% better than high-quality PIR and up to 60% better than PUR.

Energy Efficient Buildings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.88 billion

Revenue forecast in 2030

USD 66.81 billion

Growth Rate

CAGR of 11.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan. India, South Korea, Brazil, Saudi Arabia

Key companies profiled

Saint-Gobain S.A., Owens Corning, GAF Materials Corporation, Johns Manville, BASF SE, Kingspan Group, Covestro AG, Dow Inc., Huntsman Corporation, Rockwool International A/S, Fletcher Building, American Rockwool Manufacturing LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Efficient Buildings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy efficient buildings market report based on material, end use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

Cellulose

-

PIR

-

PUR

-

Other Materials

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global energy efficient buildings market size was estimated at USD 28.40 billion in 2023 and is expected to reach USD 31.88 billion in 2024.

b. The energy efficient buildings market is expected to grow at a compound annual growth rate of 11.1% from 2024 to 2030 to reach USD 66.81 billion by 2030.

b. Among materials, glass wool accounted for the largest market in 2023 with a revenue share of 37.3% owing to its thermal insulation properties, which minimize heat transfer and maintain indoor temperatures of any building.

b. Some of the key players operating in the energy efficient buildings market include Saint-Gobain S.A., Owens Corning, GAF Materials Corporation, Johns Manville, BASF SE, Kingspan Group, Covestro AG, Dow Inc., and Huntsman Corporation.

b. The key factor that is driving the energy efficient buildings includes the rising demand for developing new energy-efficient homes in regions such as North America and Europe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.