- Home

- »

- Advanced Interior Materials

- »

-

Energy Efficient Fixtures Market Size, Industry Report, 2030GVR Report cover

![Energy Efficient Fixtures Market Size, Share & Trends Report]()

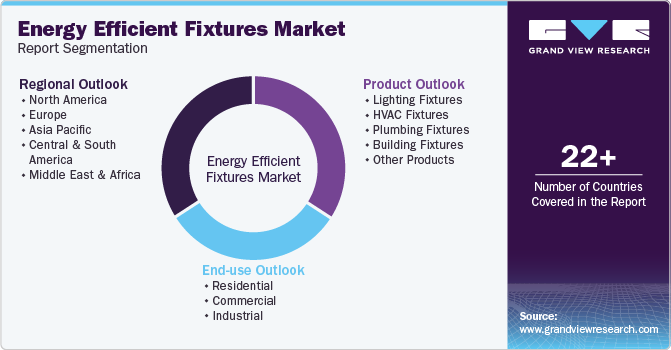

Energy Efficient Fixtures Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lighting Fixtures, HVAC Fixtures), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-529-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Efficient Fixtures Market Summary

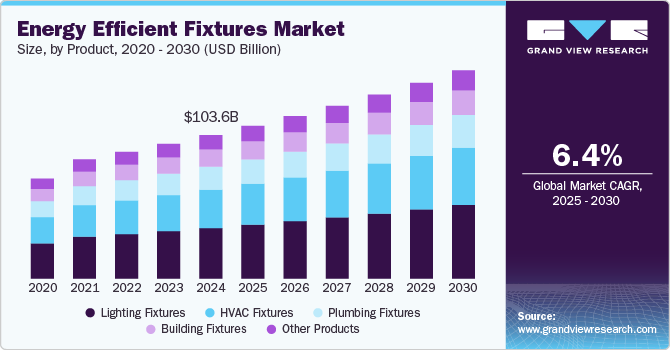

The global energy efficient fixtures market size was estimated at USD 103.64 billion in 2024 and is projected to reach USD 150.38 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. Technological advancements in lighting and fixture design are significantly contributing to the expansion of the market.

Key Market Trends & Insights

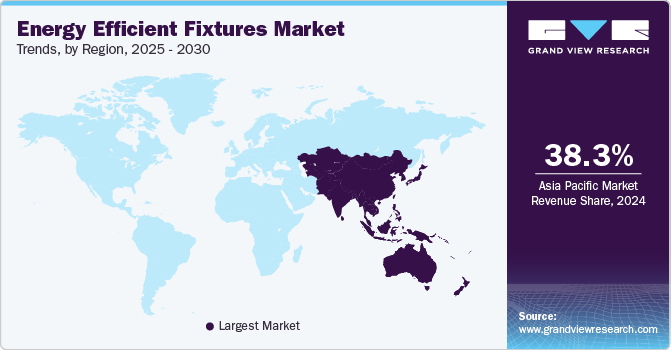

- Asia Pacific dominated the market and accounted for the largest revenue share of 38.3% in 2024.

- Based on product, the lighting fixtures segment led the market and accounted for the largest revenue share of 35.2% in 2024.

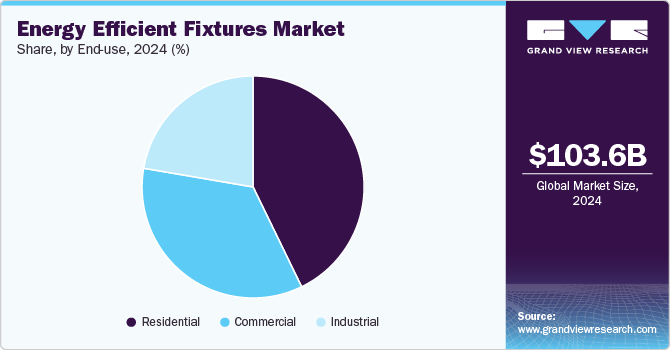

- Based on end use, the residential segment dominated the market and accounted for the largest revenue share of 42.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 103.64 Billion

- 2030 Projected Market Size: USD 150.38 Billion

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

The widespread adoption of LED technology, smart lighting systems, and motion-sensor-enabled fixtures has improved energy savings while enhancing convenience and functionality. Integration of Internet of Things (IoT)-based solutions allows for automated and adaptive lighting, reducing energy wastage in commercial buildings, warehouses, and public infrastructure. In addition, innovations in material science, such as the development of reflective coatings and high-performance diffusers, have enhanced the efficiency and durability of energy-efficient fixtures.

The growing emphasis on energy conservation and sustainability is a primary driver of the global energy-efficient fixtures market. Governments and regulatory bodies worldwide are implementing stringent energy efficiency standards and policies to reduce overall energy consumption and carbon emissions. Initiatives such as the European Union’s Energy Performance of Buildings Directive (EPBD) and the U.S. Department of Energy’s lighting efficiency regulations have encouraged the adoption of energy-efficient fixtures across residential, commercial, and industrial sectors. In addition, increasing consumer awareness regarding the environmental and economic benefits of energy-efficient lighting and fixtures has further fueled market growth.

Rising investments in green building projects and smart city initiatives have further accelerated the demand for energy-efficient fixtures. Governments and private entities are prioritizing sustainable infrastructure development, incorporating energy-efficient lighting systems into urban planning, highways, and commercial spaces. Certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) have incentivized the adoption of energy-efficient fixtures in new and existing constructions. Moreover, increasing construction activities in emerging economies, coupled with urbanization trends, are expected to drive market growth.

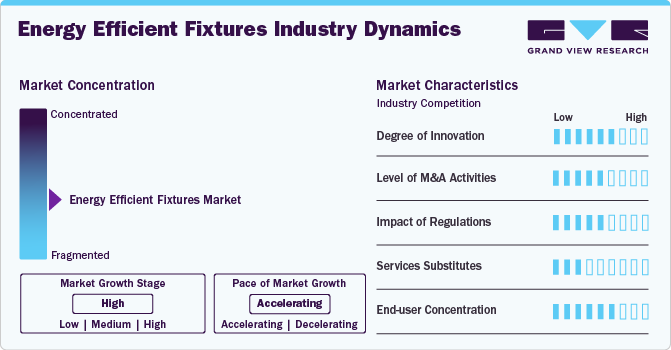

Market Concentration & Characteristics

The global energy-efficient fixtures market is moderately concentrated, with a mix of established multinational corporations and emerging players competing to gain market share. Leading companies focus on research and development to introduce technologically advanced products that enhance energy savings and comply with evolving regulatory standards. The market is characterized by a high degree of innovation, particularly in smart lighting solutions, LED technology, and IoT-enabled fixtures. Companies are investing in sensor-based and adaptive lighting systems that optimize energy consumption based on occupancy and natural light availability. In addition, advancements in materials and designs have contributed to improved durability and efficiency, making energy-efficient fixtures a preferred choice across residential, commercial, and industrial sectors.

Regulatory frameworks play a significant role in shaping the market dynamics, as governments worldwide implement stringent energy efficiency standards and sustainability policies. Regulations such as the European Union’s Ecodesign Directive, the U.S. Department of Energy (DOE) efficiency standards, and various green building certifications have driven the adoption of energy-efficient fixtures. While direct substitutes for energy-efficient fixtures remain limited, traditional incandescent and halogen lighting solutions continue to be phased out due to their higher energy consumption and regulatory restrictions. The market exhibits a strong end use concentration in commercial and industrial sectors, where businesses seek to reduce operational costs through energy savings. In addition, the residential sector is witnessing growing adoption, driven by increased consumer awareness and government incentives promoting energy-efficient solutions.

Product Insights

The lighting fixtures segment led the market and accounted for the largest revenue share of 35.2% in 2024. Technological advancements in lighting fixture design and functionality are contributing to the expansion of the market. Innovations such as IoT-enabled smart lighting, motion sensors, and adaptive lighting systems have improved energy efficiency and user convenience. The integration of lighting fixtures with automation and building management systems enables real-time energy monitoring and optimization, making them a preferred choice in commercial and industrial applications. Furthermore, the increasing focus on sustainable construction and green building certifications, such as LEED (Leadership in Energy and Environmental Design), has led to a rising demand for energy-efficient lighting fixtures in residential, commercial, and infrastructure projects.

The HVAC fixtures segment is expected to grow at fastest CAGR of 6.8% over the forecast period. The increasing emphasis on energy conservation and sustainability is a primary driver of the HVAC fixtures segment in the global energy-efficient fixtures market. Rising energy costs and growing concerns about carbon emissions have led governments and regulatory bodies to implement stringent energy efficiency standards for heating, ventilation, and air conditioning (HVAC) systems.

End-use Insights

The residential segment dominated the market and accounted for the largest revenue share of 42.8% in 2024. The increasing consumer awareness of energy conservation and sustainability is a key driver of the residential segment in the global energy-efficient fixtures market. Rising electricity costs and the growing emphasis on reducing carbon footprints have led homeowners to adopt energy-efficient lighting and fixtures to lower energy consumption. Governments and regulatory bodies worldwide are actively promoting energy-efficient solutions through incentives, rebates, and tax benefits, encouraging the adoption of LED lighting, smart fixtures, and sensor-based technologies in residential spaces.

Commercial segment is expected to grow at fastest CAGR of 6.8% over the forecast period. Businesses are increasingly adopting energy-efficient lighting and fixture solutions to comply with environmental regulations and corporate sustainability initiatives. Governments worldwide are implementing stringent energy efficiency standards, such as the U.S. Energy Policy Act and the European Union’s Ecodesign Directive, which mandate the use of energy-saving lighting systems in commercial buildings.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 38.3% in 2024, driven by the rapid urbanization and industrialization in major economies such as China, India, and Japan. The increasing construction of commercial and residential buildings has heightened the demand for energy-saving lighting and fixture solutions. Governments across the region are implementing stringent energy efficiency regulations and green building initiatives to reduce energy consumption and carbon emissions.

The China energy-efficient fixtures market is primarily driven by the government’s strong commitment to energy conservation and carbon neutrality goals. The Chinese government has implemented stringent policies and regulations to promote energy efficiency across various sectors, including the phasing out of inefficient lighting and the adoption of LED and smart lighting solutions. Programs such as the China Energy Conservation Program and the National Development and Reform Commission’s (NDRC) energy efficiency standards have accelerated the shift towards energy-efficient fixtures in residential, commercial, and industrial applications.

North America Energy Efficient Fixtures Market Trends

The growing emphasis on energy conservation and sustainability is a key driver of the North America energy-efficient fixtures market. Governments across the region, particularly in the United States and Canada, have implemented stringent energy efficiency regulations and policies to reduce carbon emissions and promote sustainable building practices. Programs such as the U.S. Department of Energy’s (DOE) Energy Star certification and Canada’s Energy Efficiency Regulations encourage the adoption of energy-efficient lighting and fixtures in residential, commercial, and industrial sectors. In addition, initiatives such as tax credits, rebates, and financial incentives for energy-saving upgrades have significantly boosted market demand, prompting businesses and consumers to transition toward energy-efficient solutions.

U.S. Energy Efficient Fixtures Market Trends

Technological advancements and the increasing adoption of smart lighting solutions are driving the expansion of the U.S. energy-efficient fixtures market. Innovations in LED technology, IoT-enabled lighting systems, and automated controls have enhanced the efficiency and functionality of modern fixtures. Businesses and homeowners are increasingly incorporating occupancy sensors, daylight harvesting systems, and adaptive lighting solutions to optimize energy use. Furthermore, the rapid expansion of smart cities and infrastructure modernization projects across the U.S. has heightened the demand for energy-efficient fixtures in public buildings, transportation hubs, and street lighting.

Europe Energy Efficient Fixtures Market Trends

The increasing consumer and business focus on sustainability is a significant driver in the European market. With rising awareness of climate change and environmental impact, there has been a growing demand for products that reduce energy consumption and minimize carbon footprints. Both private and public sectors in Europe are prioritizing green building practices and the use of energy-efficient solutions to meet sustainability standards and reduce operational costs. In addition, government incentives, such as rebates, tax breaks, and funding for energy-efficient upgrades, further support the adoption of energy-efficient fixtures across residential, commercial, and industrial sectors.

Germany’s strong industrial sector, which includes automotive, manufacturing, and retail, plays a crucial role in driving the adoption of energy-efficient fixtures. Many industries are setting ambitious sustainability targets to meet both local and international environmental regulations, as well as to enhance their corporate social responsibility profiles. As part of these efforts, industrial facilities and commercial establishments are upgrading their lighting systems to more energy-efficient solutions.

Latin America Energy Efficient Fixtures Market Trends

The growing demand for energy-efficient solutions in Latin America is primarily driven by the need for cost reduction and sustainability in both residential and commercial sectors. As energy prices rise across the region, there is a strong incentive for businesses and consumers to adopt energy-saving technologies, particularly energy-efficient fixtures. These solutions, such as LED lighting and smart lighting systems, offer significant reductions in energy consumption and maintenance costs, making them an attractive option for both commercial and residential users.

Middle East & Africa Energy Efficient Fixtures Market Trends

The rise of the hospitality, retail, and commercial sectors across the MEA region is a key factor stimulating demand for energy-efficient fixtures. As tourism and business activities increase, especially in tourism hubs like Dubai and Cape Town, there is a growing need for commercial establishments to adopt energy-efficient lighting to reduce operating costs and meet sustainability expectations. Hotels, shopping malls, and office buildings are increasingly adopting energy-efficient lighting systems to improve their environmental credentials and appeal to eco-conscious consumers.

Key Energy Efficient Fixtures Company Insights

Some of the key players operating in market include Eaton Corporation, Advanced Lighting Technologies South Korea Inc.

-

Eaton specializes in a wide range of energy-saving lighting solutions, including LED fixtures, lighting controls, and energy-efficient ballasts. Their product offerings cater to both commercial and residential applications, focusing on reducing energy consumption while improving lighting performance.

-

Advanced Lighting Technologies South Korea Inc. is a prominent player in the South Korean market, offering advanced lighting solutions designed to improve energy efficiency and reduce environmental impact. The company’s product portfolio includes LED retrofit kits, energy-efficient lighting systems for industrial, commercial, and retail applications, and smart lighting controls. Their lighting solutions are designed to meet the unique needs of the South Korean market, focusing on reliability, performance, and sustainability.

Philips Lumec, General Electric are some of the emerging market participants in energy efficient fixtures market.

-

Philips Lumec, a division of Philips, is known for its advanced outdoor lighting solutions and energy-efficient fixtures designed for urban and architectural environments. Their product offerings include a broad range of LED outdoor lighting solutions, streetlights, bollards, and decorative lighting designed to enhance safety, visibility, and aesthetic appeal while reducing energy consumption. Philips Lumec also provides smart lighting systems that enable remote management and optimization of lighting infrastructure, contributing to energy conservation and operational cost savings.

-

General Electric (GE) is a multinational conglomerate renowned for its expertise in providing energy-efficient solutions across various industries, including lighting. In the energy-efficient fixtures market, GE offers a comprehensive range of LED lighting products, including commercial, industrial, and residential lighting fixtures designed to reduce energy consumption and enhance lighting quality. GE’s smart lighting solutions integrate advanced technologies, such as IoT connectivity and automated controls, allowing for optimized energy usage and improved operational efficiency.

Key Energy Efficient Fixtures Companies:

The following are the leading companies in the energy efficient fixtures market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton Corporation

- Advanced Lighting Technologies South Korea Inc.

- Philips Lumec

- General Electric

- Nichia Corporation

- Schneider Electric

- ABB

- Bridgelux, Inc.

- Toshiba Corporation

- Digital Lumens, Inc.

Recent Developments

-

In January 2025, Signify, inaugurated the Philips Smart Light Hub in Kolkata, marking a significant milestone in the energy-efficient fixtures market. The new facility will serve as a hub for advanced smart lighting solutions, providing cutting-edge products designed to optimize energy consumption while enhancing lighting performance. The Philips Smart Light Hub will focus on offering state-of-the-art LED technology, smart lighting controls, and IoT-integrated systems to both commercial and residential customers. By expanding its presence in Kolkata, Signify aims to contribute to the region’s energy efficiency goals and support the growing demand for sustainable lighting solutions.

Energy Efficient Fixtures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 110.28 billion

Revenue forecast in 2030

USD 150.38 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Eaton Corporation; advanced lighting technologies South Korea inc.; philips lumec; General Electric; nichia corporation; Schneider Electric; ABB; Bridgelux, Inc.; toshiba corporation; Digital Lumens, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Efficient Fixtures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy efficient fixtures market report based on product, end Use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lighting Fixtures

-

HVAC Fixtures

-

Plumbing Fixtures

-

Building Fixtures

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global energy efficient fixtures market size was estimated at USD 103.64 billion in 2024 and is expected to reach USD 110.28 billion in 2025.

b. The energy efficient fixtures market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 150.38 billion by 2030.

b. The lighting fixtures segment led the market and accounted for the largest revenue share of 35.2% in 2024. Technological advancements in lighting fixture design and functionality are contributing to the expansion of the market

b. Some of the key players operating in the energy efficient fixtures market include Eaton Corporation, advanced lighting technologies South Korea inc., philips lumec, General Electric, nichia corporation, Schneider Electric, ABB, Bridgelux, Inc., toshiba corporation, Digital Lumens, Inc.

b. The key factors that are driving the energy efficient fixtures market include growing government regulations and incentives promoting sustainability and energy conservation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.