- Home

- »

- Homecare & Decor

- »

-

Lighting Fixture Market Size, Share, Industry Report, 2033GVR Report cover

![Lighting Fixture Market Size, Share & Trends Report]()

Lighting Fixture Market (2026 - 2033) Size, Share & Trends Analysis Report By Product, By Source (Incandescent, Fluorescent, LED & OLED), By Distribution Channel (Offline & Online), By Application (Commercial & Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-173-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lighting Fixture Market Summary

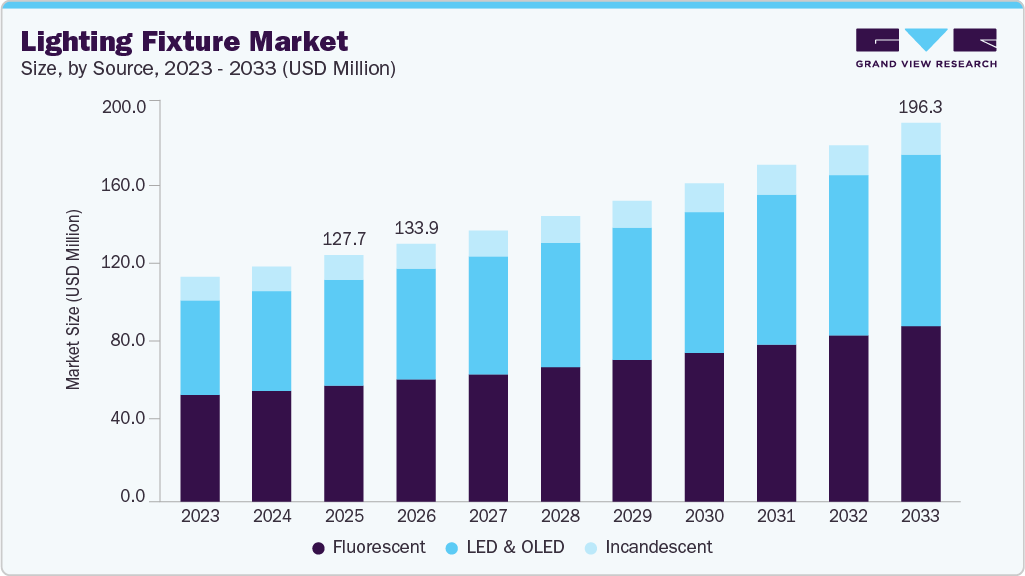

The global lighting fixtures market size was estimated at USD 127.66 billion in 2025 and is expected to reach USD 196.28 billion by 2033, growing at a CAGR of 4.5% from 2026 to 2033. Rising urbanization and real-estate handovers naturally expand the installed base of lighting hardware, as new housing societies, offices, retail developments, and hospitality projects include a much larger number of fixture points per square foot than in the past.

Key Market Trends & Insights

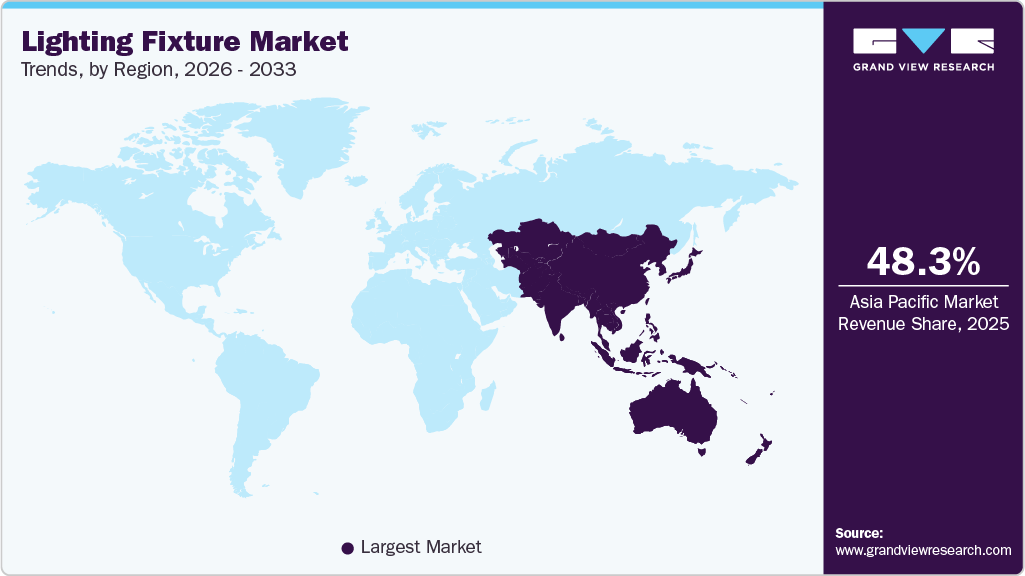

- By region, Asia Pacific led the market with a share of 48.3% in 2025.

- By product, ceiling lighting fixture led the market and accounted for a share of 32.1% in 2025.

- By source, fluorescent lighting fixtures led the market and accounted for a share of 47.2% in 2025.

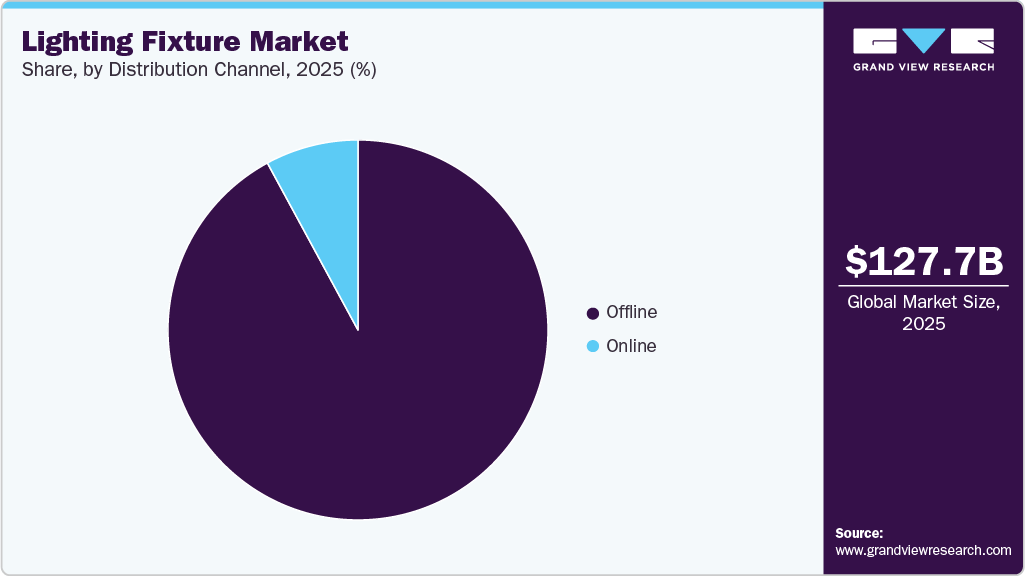

- By distribution channel, offline segment dominated the market with a share of 92.1% in 2025.

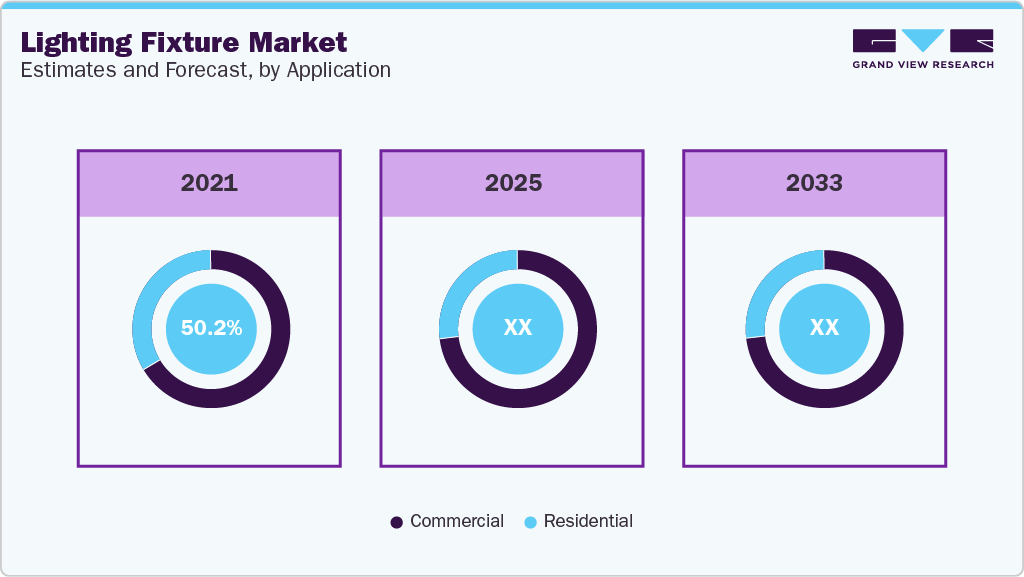

- By application, commercial segment led the market and accounted for a share of 84.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 127.66 Billion

- 2033 Projected Market Size: USD 196.28 Billion

- CAGR (2026-2033): 4.5%

- Asia Pacific: Largest market in 2025

Modern construction projects now integrate layered lighting zones, spotlights, wall fixtures, cove lighting, and modular tracks as part of standard electrical layouts, which directly raises fixture units consumed per building, not just lamps or bulbs.

Lighting has also become a lifestyle-infrastructure category. Younger home buyers and designers increasingly adopt fixtures that support warm/cool scene zoning, decorative pendants, magnetic tracks, and profile lights for architectural aesthetics. The rise of connected and sensor-embedded LED fixtures further increases unit demand, as these products combine illumination with embedded electronics, controllers, and smart-ambient features. Retailers in brick-and-mortar large-format chains benefit from this shift because lighting fixtures command higher average selling prices per SKU, carry multi-year replacement cycles, and offer favorable category margins when visibility support is co-funded by brands through end-caps, trend walls, and curated lighting bays.

Beyond construction, renovation cycles have accelerated, with consumers and businesses upgrading entire luminaires rather than replacing only the light source. This behavior is driven by the mainstream migration toward LED-integrated fixtures, which deliver materially lower energy consumption, minimal heat loss, improved durability, and significantly lower maintenance costs. Commercial buyers benchmark fixtures on life-cycle value, uptime, and payback, making energy-efficient luminaires financially rational replacements for halogen-, CFL-, or tube-based legacy hardware. Government tenders and green-building compliance frameworks reinforce this transition by prioritizing integrated LED solutions in infrastructure projects, institutional buildings, and commercial real estate.

The growing popularity of online shopping and e-commerce has made lighting fixtures more accessible. Consumers now have easy access to a variety of models, detailed reviews, and competitive pricing through online platforms, driving the market forward. E-commerce also allows for better price comparison, promotions, and the convenience of home delivery, further boosting the adoption of lighting fixtures.

Product Insights

The ceiling segment dominated the market, accounting for a 32.1% share in 2025. Growth of apartments and gated communities increases installations per household, while LEDs, smart lighting, and decorative panels gain traction because they reduce power consumption and elevate aesthetics. Retailers benefit through higher basket value, faster product replacement cycles, and increased attach-rates with switches, drivers, and decor accessories. Premiumisation within malls and large home-improvement chains also reinforces visibility for decorative lighting, making ceiling fixtures a persistent trend rather than a short-lived upgrade.

The pendant & chandeliers segment is expected to grow with a considerable CAGR of 5.2% from 2026 to 2033. As urban households move into modern apartments and gated communities, lighting is treated as a statement decor category rather than a utility purchase, pushing consumers toward premium designs. Social media and content platforms such as Instagram, YouTube, and Pinterest have amplified visual inspiration, making pendants and chandeliers a trend-led demand category. Retailers also benefit because these fixtures command higher margins (typically 35-55% / USD 8,300-41,600 per SKU annually in large retail, ₹50k-₹2.5 lakh visibility-linked displays), improve average basket values in decor aisles, and drive store-led trials through curated lighting zones in chains such as Reliance Retail, Shoppers Stop, and Health & Glow. In addition, rising demand for warm ambient lighting, smart home integration, and modular interior design preferences further reinforce the shift toward these high-visibility, design-forward lighting formats.

Source Insights

The fluorescent lighting fixtures segment dominated the market, accounting for a 47.2% share in 2025. Fluorescent fixtures deliver high luminous output at low electricity consumption and low upfront cost, typically 30-50% cheaper than LED alternatives for industrial batten and panel formats, making them attractive for factories, warehouses, parking lots, and government buildings. Many developing commercial zones and public facilities still specify fluorescent systems because they operate on bulk tender pricing, long replacement cycles, and existing ballast-based infrastructure that would incur additional rewiring or driver retrofit costs if fully converted to LEDs.

The LED & OLED segment is expected to grow with a considerable CAGR of 5.2% from 2026 to 2033. The market for LED and OLED lighting fixtures in India is rising primarily because consumers and retailers benefit from lower energy consumption, longer lifespan, and reduced total cost of ownership compared to traditional lighting. LED fixtures consume up to 70-80% less power than halogens and last 25,000-50,000 hours, making them ideal for homes and stores focused on durability and savings. Retailers adopt LED because it cuts electricity bills per store by 20-30% annually, while allowing brighter, uniform lighting for product visibility, which increases conversion and dwell time. OLED lighting, though smaller in scale, is gaining interest in premium interiors due to its ultra-thin form, glare-free light, and design appeal in high-end residential and boutique retail setups, where aesthetics drive purchase decisions.

Distribution Channel Insights

Sales of lighting fixtures through offline channels dominated the global market, accounting for a share of 92.1% in 2025. The market for offline retail sales of lighting fixtures is rising because physical stores remain the dominant validation and purchase channel for products that involve style, scale, material, and finish decisions. Homeowners increasingly prefer buying lighting fixtures in person since luminaires are high-consideration purchases that require visual inspection under real light conditions to judge brightness, housing, color temperature, and build quality, which is still not accurately replicable through standard online images. Retailers benefit because in-store displays drive higher per-basket value, and faster closing customers often enter the store unsure of the exact product but convert after seeing a live-lit assortment.

Sales of lighting fixtures through online channels are estimated to grow at a CAGR of 6.7% from 2026 to 2033. Online channels allow shoppers to compare designs, lumens, energy efficiency, smart-lighting features, and prices instantly, something traditional stores cannot match. The rise of home renovation trends, influencer-driven décor ideas, and smart-home adoption has pushed buyers to search online for modern fixtures. In addition, fast delivery, easy returns, virtual room-preview tools, and frequent discounts have made platforms such as Amazon, Flipkart, Pepperfry, and IKEA far more attractive for purchasing lighting products.

Application Insights

The commercial segment dominated the global market, accounting for an 84.1% share in 2025. The market for commercial lighting fixtures is rising due to strong structural demand from energy efficiency mandates, workplace redesign, and infrastructure expansion in retail, offices, hospitality, and industrial facilities. Businesses are replacing traditional lights with LED fixtures to reduce electricity costs. Commercial lighting can cut power consumption by 50-70%, and modern LEDs last 50,000-100,000 hours, improving the total cost of ownership. Growth is also pushed by the rapid build-out of organised retail chains, malls, warehouses, corporate offices, airports, hospitals, and hotels, all requiring uniform, high-compliance lighting.

The residential segment is projected to grow at a CAGR of 5.3% from 2026 to 2033. The residential lighting fixtures market in India is expanding due to strong housing construction momentum, increased interior-led upgrading, and broader consumer preference for layered home illumination beyond basic bulb lighting. Rising apartment handovers, growth of premium home segments, and increased renovation activity are driving higher per-home fixture consumption (ceiling, wall, pendant, decorative LEDs). Consumers now view lighting as a design asset, boosting demand for ambient/decorative fixtures in living rooms and bedrooms.

Regional Insights

North America Lighting Fixture Market Trends

The North America lighting fixture market accounted for a share of over 23% in 2025. Home renovation trends have popularized fixture replacement for improved ambiance and energy efficiency, while new housing, offices, and retail builds continue to expand demand. Consumers and businesses increasingly shift to LED and smart-compatible fixtures to lower long-term electricity costs, meet sustainability goals, and support connected lighting experiences. Multi-brand big-box stores and online marketplaces validate the momentum, showing high SKU availability and frequent new product drops. For retailers, fixtures improve basket value and store dwell time through inspirational displays and demonstrable energy-saving value, reinforcing continued adoption and sell-through velocity.

U.S. Lighting Fixture Market Trends:

The U.S. lighting fixture market is expected to grow at a CAGR of 5.2% from 2026 to 2033. The market for lighting fixtures in the U.S. is increasing due to the convergence of energy-efficiency mandates, renovation cycles, and smart building adoption. Federal incentives and utility rebate programs encourage LED upgrades as they lower electricity consumption and operating costs. Older commercial buildings and homes are entering accelerated remodel phases, driving replacement demand. Growth is also supported by connected lighting, IoT-enabled sensors, and automated controls being integrated into retail stores, offices, and residential homes for comfort and power savings.

Europe Lighting Fixture Market Trends

The lighting fixture market in Europe is expected to grow at a CAGR of 4.1% from 2026 to 2033. The market growth is increasing due to energy-efficiency regulations (EU Green Deal, lighting efficiency directives), which push consumers and businesses to replace traditional lights with LED-based fixtures that cut electricity costs. Demand is further lifted by home renovation and premium interior upgrades, where modern lighting is used to enhance aesthetics and ambiance, a trend amplified by Ikea-style affordable design, designer lighting boutiques, and smart-lighting zones in retail stores. The shift toward connected smart lighting also accelerates adoption, supported by higher urbanization, sustainability preferences, and rising disposable income, making lighting both a functional and lifestyle upgrade category across residential and commercial segments.

Asia Pacific Lighting Fixture Market Trends

The Asia Pacific lighting fixture market accounted for a share of 48.3% in 2025. Countries such as China, India, Indonesia, and Vietnam are investing heavily in smart cities, highways, airports, and commercial real estate, which directly expands demand for modern lighting fixtures. Government-led energy-efficiency mandates and sustainability programs are pushing mass replacement of conventional lighting with LED-based fixtures, with incentives from bodies such as India’s BEE and public procurement aligned with regional climate goals set by UNESCAP.

In addition, fast growth in residential construction, retail expansion by chains like IKEA, and rising consumer preference for aesthetic, long-life, low-power lighting under standards from IEC further support adoption, while stronger local manufacturing by brands such as Panasonic and demand for connected lighting ecosystems compatible with private-label smart electrical ecosystems (e.g., regional home-automation retailers) amplify overall market scale.

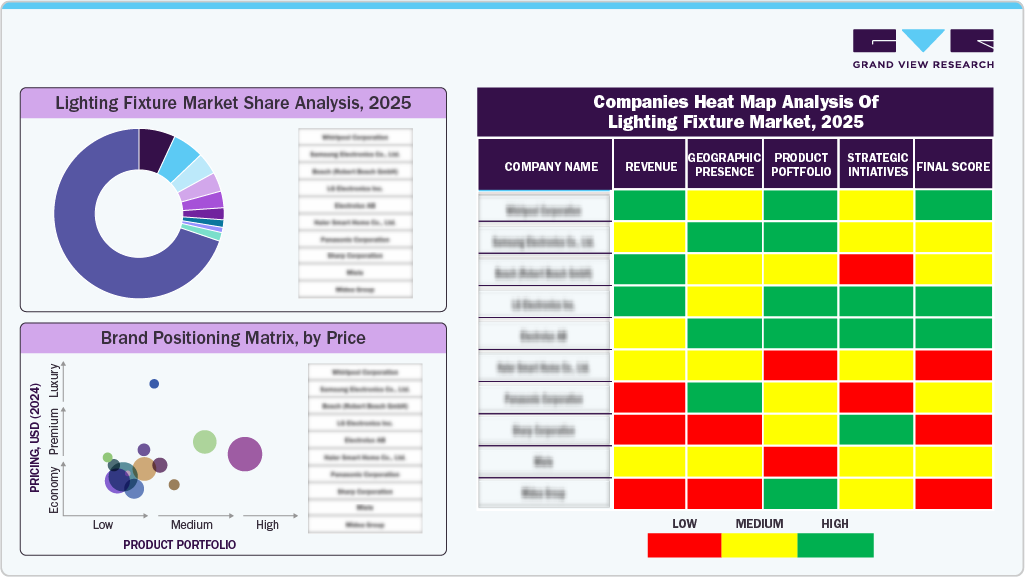

Key Lighting Fixture Company Insights

The major companies operating in the market have implemented business expansion and product launches as their key growth strategies to expand their market share and remain competitive in the market. Some of the key companies include AB Electrolux, Asko Appliances AB, Danby Products Inc., Haier Group Corporation, Havells India Limited, LG Electronics Inc., Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Smeg S.p.A., and Whirlpool Corporation.

Key Lighting Fixture Companies:

The following are the leading companies in the Lighting Fixture Market. These companies collectively hold the largest Market share and dictate industry trends.

- Koninklijke Philips N.V.

- Cree Inc.

- General Electric

- Hubbell Lighting, Inc.

- Acuity Brands, Inc.

- Havells India Limited

- Panasonic Corporation

- OSRAM Licht AG

- Nichia Corporation

- Everlight Electronics Co., Ltd.

Lighting Fixture Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 133.93 billion

Revenue forecast in 2033

USD 196.28 billion

Growth rate

CAGR of 4.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa.

Key companies profiled

Koninklijke Philips N.V.; Cree Inc.; General Electric; Hubbell Lighting, Inc.; Acuity Brands, Inc.; Havells India Limited; Panasonic Corporation; OSRAM Licht AG; Nichia Corporation; Everlight Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Lighting Fixture Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the lighting fixture market based on product, source, distribution channel, application, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ceiling

-

Pendant & Chandeliers

-

Wall Mounted

-

Portable

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Incandescent

-

Fluorescent

-

LED & OLED

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The fluorescent lighting fixtures segment dominated the market, accounting for a 47.2% share in 2025. Fluorescent fixtures deliver high luminous output at low electricity consumption and low upfront cost, typically 30–50% cheaper than LED alternatives for industrial batten and panel formats, making them attractive for factories, warehouses, parking lots, and government buildings.

b. Some key players operating in the lighting fixtures market include Koninklijke Philips N.V.; Cree Inc.; General Electric; Hubbell Lighting, Inc.; Acuity Brands, Inc.; Eaton Corporation; Panasonic Corporation; OSRAM Licht AG; Nichia Corporation; and Everlight Electronics Co., Ltd. and others.

b. Key factors that are driving the market growth include increasing demand for energy-efficient products in the residential and commercial sectors along with government support for low energy consumption plans.

b. The global lighting fixture market size was estimated at USD 127.66 billion in 2025 and is expected to reach USD 133.80 billion in 2026.

b. The global lighting fixture market is expected to grow at a compound annual growth rate of 4.5% from 2026 to 2033 to reach USD 196.28 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.