- Home

- »

- Next Generation Technologies

- »

-

Energy ESO Market Size, Share, And Growth Report, 2030GVR Report cover

![Energy ESO Market Size, Share & Trends Report]()

Energy ESO Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Structuring & Layout, Digitization, R&D & Designing, Implementation & Maintenance), By Location, By Energy Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-069-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy ESO Market Size & Trends

The global energy ESO market size was valued at USD 322.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 19.3% from 2023 to 2030.Growing digitization in the energy sector will positively impact market growth over the forecast period. Over time, several Engineering Service Providers (ESPs) have introduced new technologies for smart grid management, plant digitization, embedded product engineering, and virtual prototyping. These technologies are expected to drive digital transformation in the energy sector, thereby increasing the potential of energy ESPs on a global scale. Furthermore, OEMs may drastically reduce labor costs, along with other investment costs, by outsourcing services to engineering service providers.

Engineering service providers have the competency to execute appropriate strategies and complete projects promptly as they have access to a ready team of skilled and trained engineers, and this is also expected to gain the attention of end-use industries during the forecast period.Furthermore, outsourcing firms leverage advanced engineering tools and technologies to serve their clients, which is expected to fuel market growth further. Partnering with service providers to accelerate Research and Development (R&D) activities has become common in the energy sector.

However, Intellectual Property (IP) and security threats are critical factors restraining market growth. OEMs and service providers regularly exchange confidential data on project specifications, technologies, and equipment performances to enhance collaboration on development, design, and support. Thus, IP management and data security issues have become increasingly crucial for businesses utilizing outsourcing services.

Furthermore, energy engineering service providers need to compete on pricing and their domain expertise to prove beneficial for energy-producing companies. ESPs emphasize providing services to address the difficulties experienced in the energy sector. For instance, power fluctuation is one of the major issues connecting wind farms to the power network. Hence, ESI Group, a French provider of virtual prototyping solutions, offers virtual testing technology for windmill operations. Similarly, Altair Engineering, Inc., a U.S.-based product engineering, industrial design, and analytics solutions provider, offers IoT-based digital transformation services for the energy outsourcing industry.

Over the past few years, the COVID-19 pandemic caused an unprecedented global slowdown. It affected the energy sector, delaying the construction of new infrastructure and facilities due to equipment delivery problems. For instance, China, the first country affected by the pandemic, is one of the primary producers of several types of clean energy equipment, including wind turbines and solar panels. The pandemic negatively affected the delivery and installation of energy-related equipment for renewable energy companies, resulting in reduced demand for engineering service providers.

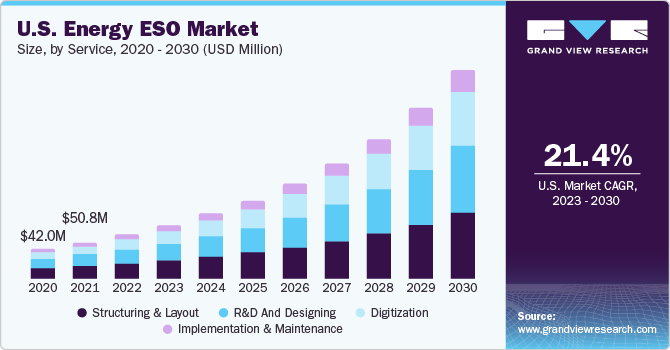

Service Insights

The structuring & layout segment held the largest market share of 33.5% in 2022. This growth is attributed to rising concerns about the operating efficiency of energy plants. Structuring and layout include construction and equipment procurement. Engineering service providers offer structuring and layout services for large infrastructure projects, including oil and gas, hydroelectric, mining, solar, and wind plants, and this is expected to drive segment growth over the forecast period.

The digitization segment is expected to expand at the fastest CAGR of 21.0% over the forecast period. As organizations and industries strive to improve energy efficiency and reduce operational costs, they turn to digital solutions to optimize energy consumption. Digitization enables real-time monitoring, data analytics, and advanced control mechanisms that help identify energy waste, inefficiencies, and opportunities for optimization.

The R&D and designing segment is expected to register a significant CAGR of 20.3% over the forecast period. The segment growth can be attributed to the increasing need for real-time analytics services to handle energy industry’s requirements, such as analyzing vast amounts of data generated in energy production and real-time feedback from smart grids. The implementation and maintenance segment accounted for a healthy revenue share in 2022.

Implementation and maintenance services include post-construction services such as equipment diagnostics and maintenance, operational support, and upgrade services. Engineering service providers offer implementation and maintenance services to OEMs for any issues revolving around operations or changes in project requirements. The availability of implementation and maintenance services is becoming a critical differentiator between engineering service providers. Hence, ESPs are emphasizing the provision of continuous support services to OEMs.

Energy Source Insights

The non-renewable segment dominated the market with the highest revenue share of 52.2% in 2022. Most non-renewable energy sources are fossil fuels, including natural gas, coal, and petroleum. Over the forecast period, natural gas production is expected to be the fastest compared to other fossil fuels. This development can be attributed to the abundant availability of natural gas resources, including shale gas, tight gas, and coalbed methane.

The renewable energy source segment is expected to have the fastest CAGR of 21.0% over the forecast period. It can be attributed to the growing awareness and concerns of environmental protection. Growth in the global economy and rapid industrialization will substantially increase the demand for energy over the coming years. Besides the challenges of fulfilling the rising energy demand and reducing greenhouse gas emissions, cleaner energy sources are crucial to protecting the environment. Hence, there has been a rise in the demand for renewable energy sources.

Chemical processing, which includes nuclear power generation, is expected to be the second-fastest-growing energy source globally. Nuclear power plants use nuclear fission of the radioactive element, uranium, to generate electricity. According to the U.K.-based World Nuclear Association, nuclear power is the second-largest source of low-carbon electricity worldwide after hydropower, and it reduces carbon dioxide emissions by 2.5 billion tons per year. Nuclear power is crucial in reducing greenhouse gases, which is expected to drive the demand for nuclear energy sources over the forecast period.

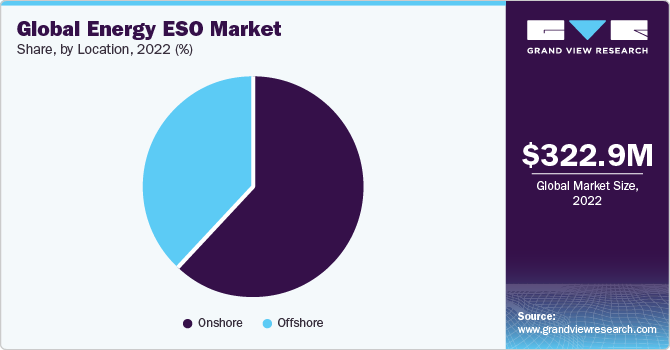

Location Insights

The onshore segment dominated the market with the dominant revenue share of 61.6% in 2022. OEMs prefer onshore outsourcing services owing to concerns regarding information security and privacy. Onshore services include the offerings provided to an OEM by an ESO vendor operating in its home country. Demographic factors such as language, communication, and working in the same time zone are expected to significantly contribute to the dominance of the onshore segment over the forecast period.

On the other hand, the offshore segment is expected to expand at a significant CAGR of 17.4% over the forecast period. Offshore engineering services refer to the offerings of ESPs based in international locations. One of the main driving forces of offshore outsourcing is its cost-effectiveness. Besides, companies beyond the traditional legacy of noncore outsourcing are willing to shift toward offshoring core processes, which is another factor expected to drive segment growth over the forecast period.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 37.0% in 2022. Favorable government regulations in countries such as India, China, and Japan, a skilled talent pool, and cost-effective labor make the countries in this region favorable for outsourcing activities. Moreover, increasing investments in clean energy sources are also expected to drive the growth of the energy ESO market in the region.

North America is expected to expand at the fastest CAGR of 21.0% during the forecast period. Increasing investment in renewable energy sources is the primary factor driving the region's growth. For instance, according to the U.S. Energy Information Administration (EIA), electricity production from renewable sources in 2020 increased to 20.0% from 17.0% in 2019. Moreover, the early adoption of advanced technologies in the energy sector is also expected to drive regional market growth over the forecast period.

The Middle East and Africa (MEA) region is expected to grow significantly over the forecast period. The increasing deployment of solar energy is one of the major factors driving the growth of this region. Moreover, increasing investments in the energy sector are also propelling regional market growth. For instance, according to the Middle East Solar Industry Association (MESIA), energy investment in the Middle East and North Africa (MENA) region could reach USD 1 trillion by 2023.

Key Companies & Market Share Insights

In recent years, ESPs have evolved from providing energy ESO services from their headquarters to opening key operations and excellence centers in developing countries. Most leading ESPs provide services for embedded product engineering, mechanical designs, plant layout designs, and digital manufacturing solutions. These firms are principally engineering, procurement, and construction management companies with a global presence.

As the industry has evolved from a domestic to a global domain, it has propelled companies to form global delivery systems. The market is witnessing robust growth, with numerous domestic and international companies operating across the regions. Moreover, key market participants are entering into mergers and acquisitions to expand their business presence and sustain the competitive business environment.

For instance, in April 2022, the government of Britain announced its plans to establish a publicly-owned system operator in the region, which will assume certain responsibilities of the National Grid. This move aims to support the country in achieving its net zero emissions climate target. By 2050, Britain aims to reach net zero emissions, which necessitates a significant rise in renewable electricity generation, widespread adoption of electric vehicles, and a shift in how homes are heated, as the majority currently rely on natural gas.

Key Energy ESO Companies:

- Semcon

- STATS

- Total OutSource, Inc.

- Cubic Corporation

- Segula Technologies

- QUEST GLOBAL

- Rilco Engineering Services

- Mott MacDonald

- LUXOFT, A DXC TECHNOLOGY COMPANY

- ESI Group

- Cyient

- Capgemini Engineering (Altran)

- Alten Group

- Assystem

- Altair Engineering Inc.

Recent Developments

-

In June 2023, Grain LNG, Europe's largest LNG terminal, announced the initiation of a market auction process for 375 GWh/d (approximately 9 mtpa) of existing capacity. This offering is specifically tailored for entities interested in acquiring a significant share in a major terminal in Northwest Europe. Compared to new-build projects, this opportunity provides advantages such as reduced costs and shorter contract durations

-

In February 2023, SolarEdge Technologies, Inc., a manufacturer of smart power technology, unveiled its inaugural “battery virtual power plant” designed to support the National Grid ESO Demand Flexibility Service (DFS) in the UK. This service is accessible to numerous SolarEdge home battery owners nationwide who possess suitable smart meters. This program reflects SolarEdge's commitment to enable homeowners to participate actively in the energy transition and contribute to the national grid's resilience

-

In September 2022, the Electricity System Operator (ESO) introduced a new strategy for connection management. The primary objective is to streamline the process by eliminating stalled projects occupying space on the Transmission Entry Capacity (TEC) register. The ESO is adopting a new approach to connection management, aiming to expedite the connection of new projects to the electricity transmission network. By removing stalled projects from the register, they can optimize it, ensuring it reflects projects with higher implementation probabilities. It is expected to create space for new projects and enhance the efficiency of the connection process

-

In August 2022, National Grid Electricity System Operator and Energy Exemplar entered a multi-year agreement to utilize the latter’s PLEXOS unified energy market simulation platform. Through this collaboration, National Grid ESO will leverage PLEXOS to identify the most cost-effective grid expansion priorities that facilitate the UK's transition to a carbon-neutral energy system. PLEXOS will significantly enhance National Grid ESO's ability to model future energy scenarios and determine necessary national electricity transmission network upgrades. It is expected to enable the seamless integration of new technologies, such as large-scale renewables, green hydrogen, and other emerging energy solutions

-

In April 2022, GE Digital announced that its long-term partner National Grid Electricity System Operator (ESO) has successfully implemented GE Digital's innovative Effective Inertia Metering & Forecasting solution across the electricity network in Great Britain. By leveraging GE Digital's advanced technology, National Grid ESO can effectively manage the complexities of the electricity network and ensure a reliable power supply to consumers

Energy ESO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 382.8 million

Revenue forecast in 2030

USD 1,313.5 million

Growth rate

CAGR of 19.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, location, energy source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Semcon; STATS; Total OutSource, Inc.; Cubic Corporation; Segula Technologies; QUEST GLOBAL; Rilco Engineering Services; Mott MacDonald; LUXOFT, A DXC TECHNOLOGY COMPANY; ESI Group; Cyient; Capgemini Engineering (Altran); Alten Group; Assystem; Altair Engineering Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy ESO Market Report Segmentation

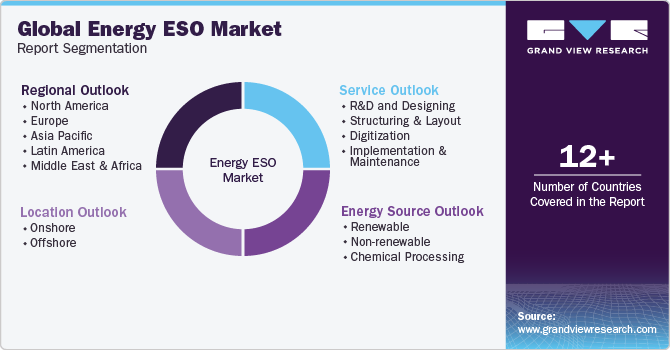

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global energy ESO marketreport on the basis of service, location, energy source, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

R&D and Designing

-

Structuring & Layout

-

Digitization

-

Implementation & Maintenance

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

Onshore

-

Offshore

-

-

Energy Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Renewable

-

Non-renewable

-

Chemical Processing

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global energy ESO market size was estimated at USD 322.9 billion in 2022 and is expected to reach USD 382.8 billion in 2023.

b. The global energy ESO market is expected to grow at a compound annual growth rate of 19.3% from 2023 to 2030 to reach USD 1,313.5 billion by 2030.

b. Asia Pacific dominated the global energy ESO market with a share of 36.97% in 2022. This is attributable to the growing investment in renewable energy infrastructure in this region.

b. Some key players operating in the global energy ESO market include QuEST Global Services Pte. Ltd.; Altran Energy; Alten Engineering; Kimley-Horn and Associates, Inc.; Rilco Engineering Services; Cyient; and Semcon.

b. Key factors that are driving the global energy ESO market growth include increasing investment in renewable energy resources and growing digitization in the energy sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.