- Home

- »

- Renewable Energy

- »

-

Energy Retrofit Systems Market Size, Industry Report, 2030GVR Report cover

![Energy Retrofit Systems Market Size, Share & Trends Report]()

Energy Retrofit Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Envelope, LED Retrofit Lighting, HVAC Retrofit, Appliances), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-739-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Retrofit Systems Market Summary

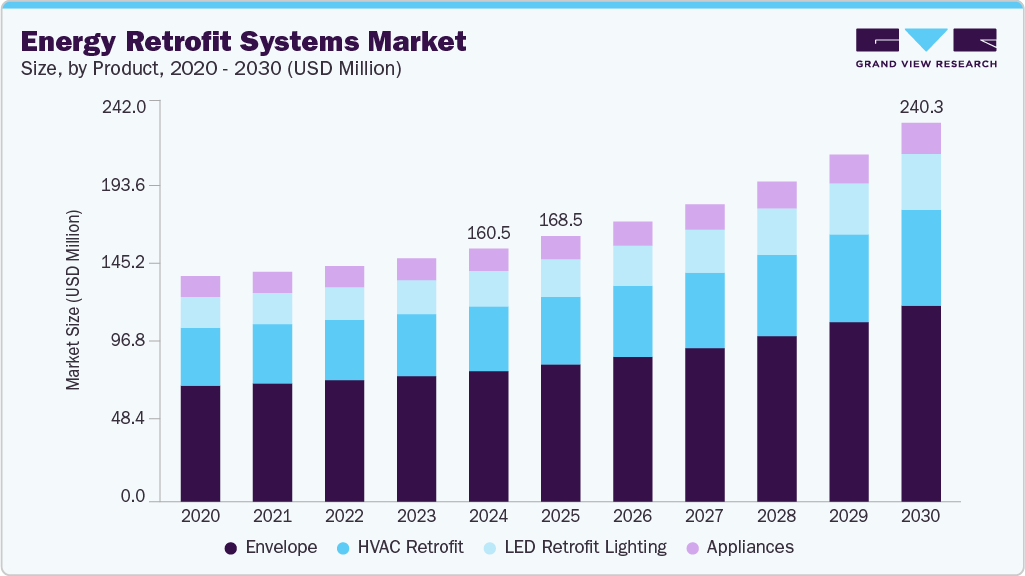

The global energy retrofit systems market size was estimated at approximately USD 160.5 million in 2024 and is projected to reach USD 240.3 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. Growing investments in renewable integration and advancements in vanadium redox and hybrid flow chemistries are supporting the market's expansion.

Key Market Trends & Insights

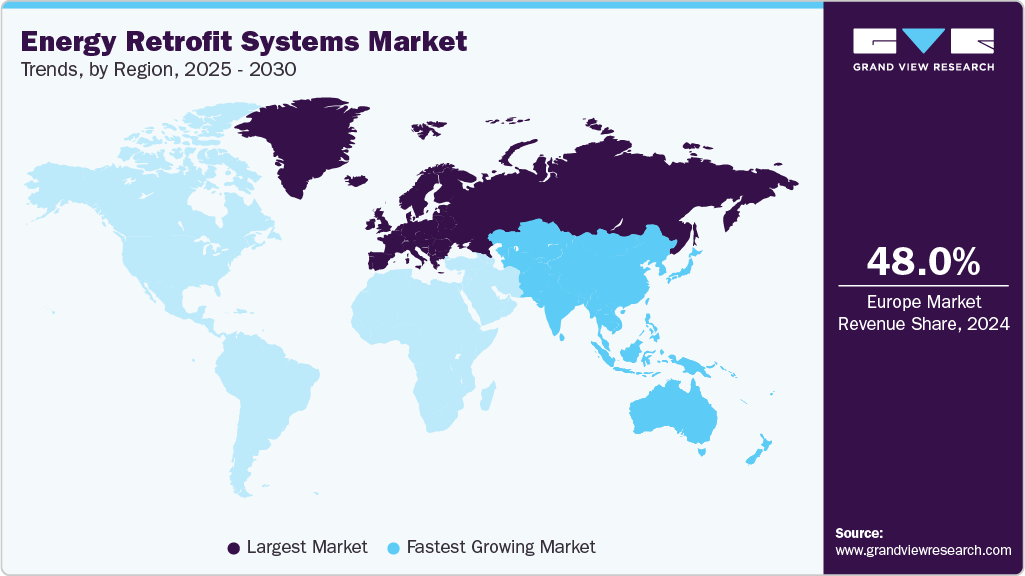

- The Europe energy retrofit systems market held the largest share of approximately 48% in 2024.

- The Energy Retrofit Systems market in the U.S. is expected to grow significantly over the forecast period.

- By product, the envelope segment held the largest market share of around 52% in 2024.

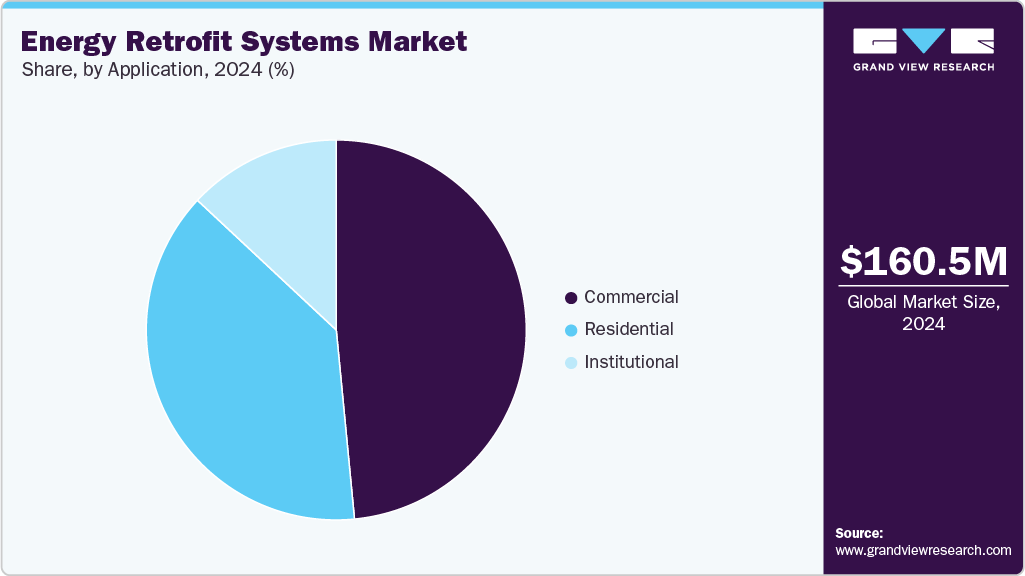

- Based on application, the commercial segment captured the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 160.5 Million

- 2030 Projected Market Size: USD 240.3 Million

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing need for large-scale, long-duration storage solutions to stabilize renewable power generation and improve grid reliability drives the adoption of flow batteries worldwide. Unlike conventional lithium-ion systems, flow batteries offer extended lifespans, flexible scalability, and enhanced safety, making them well-suited for utility, industrial, and commercial end-uses. Strategic partnerships among energy developers, storage technology firms, and government agencies are also helping accelerate commercialization and deployment across regions.

North America's market growth is primarily driven by federal and state-level initiatives that encourage renewable energy deployment and grid modernization. Flow battery adoption is gaining momentum in utility-scale projects to support peak load management, renewable integration, and energy resilience. The United States is leading regional deployment, leveraging abundant solar and wind resources while exploring new business models around storage-as-a-service. With rising electricity demand and corporate sustainability commitments, the region is expected to see steady investment in flow battery installations over the forecast period.

Europe represents a significant growth hub for flow battery, with Germany, the United Kingdom, and the Netherlands spearheading adoption. Supportive policy frameworks, ambitious renewable energy targets, and strong EU-level funding for energy storage projects create a favorable environment for large-scale flow battery installations. Technology’s long-duration storage capability is increasingly deployed to support grid balancing and reduce dependence on fossil-fuel-based peaking plants. Technological advancements and partnerships between European utilities and technology developers have fostered innovation, reinforcing the region's role as a leading contributor to the market growth.

Drivers, Opportunities & Restraints

The global energy retrofit systems market is primarily driven by the growing need to improve the energy efficiency of existing buildings and industrial facilities amid rising energy costs and tightening environmental regulations. Aging infrastructure across developed economies, coupled with the rapid urbanization and industrialization in emerging regions, creates a strong demand for retrofit solutions that enhance energy performance without requiring full-scale reconstruction. Supportive government policies such as tax incentives, green building certifications, and mandatory energy performance standards accelerate retrofitting initiatives across commercial, residential, and public sectors. Furthermore, increasing awareness of carbon footprint reduction and the growing adoption of smart building technologies reinforce industry growth, as organizations seek to optimize operational efficiency and reduce long-term energy expenditures.

Opportunities are expanding due to technological innovations in HVAC systems, lighting, building automation, and insulation materials that deliver superior performance and faster payback periods. Integrating IoT, AI, and advanced analytics into energy management platforms enables predictive maintenance and data-driven optimization, creating new business models for service providers and retrofitting initiatives in historical and heritage buildings, district energy systems, and industrial process upgrades present significant untapped potential and additionally, growing investments in net-zero energy buildings and the rising adoption of performance contracting models-where energy savings finance retrofit costs-are fostering new market opportunities. The push toward decarbonization and corporate sustainability targets across industries will stimulate demand for energy retrofit solutions worldwide.

However, the market faces several restraints. High initial investment requirements and long payback periods remain key barriers to adoption, particularly in small and medium-sized enterprises and residential applications. Limited access to financing mechanisms, a lack of skilled workforce for complex retrofitting projects, and challenges in integrating new technologies into outdated infrastructure impede growth. Fragmented regulatory frameworks and varying building codes across regions create inconsistencies in implementation. Moreover, the reluctance of building owners to disrupt ongoing operations during retrofit activities and the slow return on investment compared to new construction projects continue to restrain near-term market expansion.

Product Insights

The Envelope segment held the largest revenue share of around 52% in 2024, reflecting its critical importance in improving building energy performance and reducing operational costs. Retrofitting the building envelope-through upgrades to insulation, windows, doors, roofing systems, and façades-significantly enhances thermal comfort and minimizes energy loss. These solutions are key in lowering HVAC energy consumption and ensuring compliance with evolving energy-efficiency regulations. The growing emphasis on sustainable architecture, carbon-neutral goals, and high-performance building standards has fueled the adoption of envelope retrofit solutions across residential, commercial, and institutional facilities.

Moreover, ongoing advancements in materials and construction technologies are expanding the efficiency and lifespan of envelope systems. Innovations such as smart glazing, phase-change materials, reflective roof coatings, and modular façade systems allow faster installation and better integration with existing structures. Supportive government initiatives, including tax rebates and green building certification programs, encourage large-scale investments in envelope retrofits.

Application Insights

The commercial segment held the largest market share, approximately 48% in 2024, driven by extensive retrofit initiatives across offices, retail spaces, healthcare facilities, educational institutions, and hospitality buildings. Rising energy costs, sustainability mandates, and growing emphasis on corporate social responsibility have prompted commercial property owners to adopt energy-efficient retrofit solutions that enhance building performance and reduce operational expenses.

Real estate developers and facility managers increasingly integrate IoT-enabled monitoring systems, predictive maintenance tools, and renewable energy integration into retrofit strategies to meet net-zero and ESG objectives. As a result, the commercial segment continues to dominate the global energy retrofit systems market and is expected to remain a key contributor to long-term market growth.

Regional Insights

The North America energy retrofit systems market is a prominent regional segment, driven by the need to modernize aging commercial, residential, and industrial infrastructure while improving energy efficiency and reducing operational costs. Stringent building energy codes, government incentives, and sustainability mandates in the U.S. and Canada are fueling large-scale adoption of retrofit solutions, including advanced HVAC systems, lighting upgrades, insulation improvements, and building automation technologies. Growing corporate focus on ESG goals, decarbonization initiatives, and demand for smart, resilient, high-performance buildings further support market growth.

U.S. Energy Retrofit Systems Market Trends

The energy retrofit systems industry in the U.S. represents the largest single-country market within North America, contributing a substantial share in 2024, with federal and state-level initiatives supporting renewable integration and long-duration energy storage fuel adoption. Flow batteries are being deployed in utility-scale renewable projects, community microgrids, and industrial facilities to provide load shifting, energy arbitrage, and grid stabilization. R&D investments and demonstration projects, often backed by public-private partnerships, are accelerating commercialization. With the increasing focus on decarbonization, corporate sustainability commitments, and resilience against climate-driven grid disruptions, the U.S. is expected to remain a key driver of the global market growth through 2030.

Europe Energy Retrofit Systems Market Trends

The energy retrofit systems industry in Europe accounted for approximately 48% of the global revenue in 2024, making it the leading regional market. This dominance is primarily attributed to the region’s stringent energy-efficiency regulations, ambitious decarbonization goals, and strong commitment to achieving net-zero emissions by 2050. High energy prices, extensive funding programs, and tax incentives for green building upgrades have further encouraged the adoption of advanced retrofit technologies in both public and private sectors. Countries such as Germany, the UK, France, and the Netherlands are leading the charge with national energy renovation strategies focused on reducing building-related emissions and improving overall energy resilience.

Asia Pacific Energy Retrofit Systems Market Trends

The Asia Pacific energy retrofit systems industry is witnessing rapid growth, driven by increasing urbanization, industrialization, and rising energy demand. Governments in countries such as China, Japan, India, and Australia are implementing stringent energy-efficiency regulations, incentives, and green building initiatives to modernize aging infrastructure and reduce carbon emissions. The region’s focus on sustainable development and growing investments in smart buildings, HVAC upgrades, lighting retrofits, and building automation systems is accelerating market adoption.

Latin America Energy Retrofit Systems Market Trends

The energy retrofit systems industry in Latin America is gradually expanding, driven by rising energy costs, aging building infrastructure, and growing awareness of energy efficiency and sustainability. Governments across Brazil and Chile are introducing policies, incentives, and financing programs to promote energy-efficient retrofits in commercial, industrial, and residential sectors. Increasing urbanization, the expansion of commercial real estate, and the adoption of smart building technologies further support market growth.

Middle East & Africa Energy Retrofit Systems Market Trends

The Middle East & Africa (MEA) energy retrofit systems industry is witnessing steady growth, driven by the region’s focus on energy efficiency, rising electricity costs, and the need to modernize aging infrastructure. Governments in countries such as the UAE, Saudi Arabia, South Africa, and Egypt are implementing energy-efficiency regulations, sustainability initiatives, and incentive programs to encourage building retrofits across commercial, residential, and industrial sectors. The increasing adoption of smart building technologies, advanced HVAC systems, lighting upgrades, and building automation solutions further supports market expansion.

Key Energy Retrofit Systems Company Insights

Some of the key players operating in the global market include Johnson Controls, Schneider Electric, Siemens AG, Honeywell International Inc., and Orion Energy Systems, Inc., among others. These companies are actively engaged in developing and implementing advanced retrofit solutions focused on improving building energy efficiency, reducing carbon emissions, and optimizing operational performance.

Key Energy Retrofit Systems Companies:

The following are the leading companies in the energy retrofit systems market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls

- Schneider Electric

- Siemens AG

- Honeywell International Inc.

- Ameresco, Inc.

- Eaton Corporation plc

- Daikin Industries Ltd.

- AECOM

- Trane Technologies plc

- Orion Energy Systems, Inc.

Recent Developments

- In April 2025, Johnson Controls announced the launch of its next-generation OpenBlue Retrofit Platform, designed to accelerate large-scale building modernization across the Asia Pacific and North American markets. The platform integrates AI-driven energy analytics, HVAC optimization, and advanced building automation to reduce operational energy consumption by up to 30%.

Energy Retrofit Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 168.5 million

Revenue forecast in 2030

USD 240.3 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

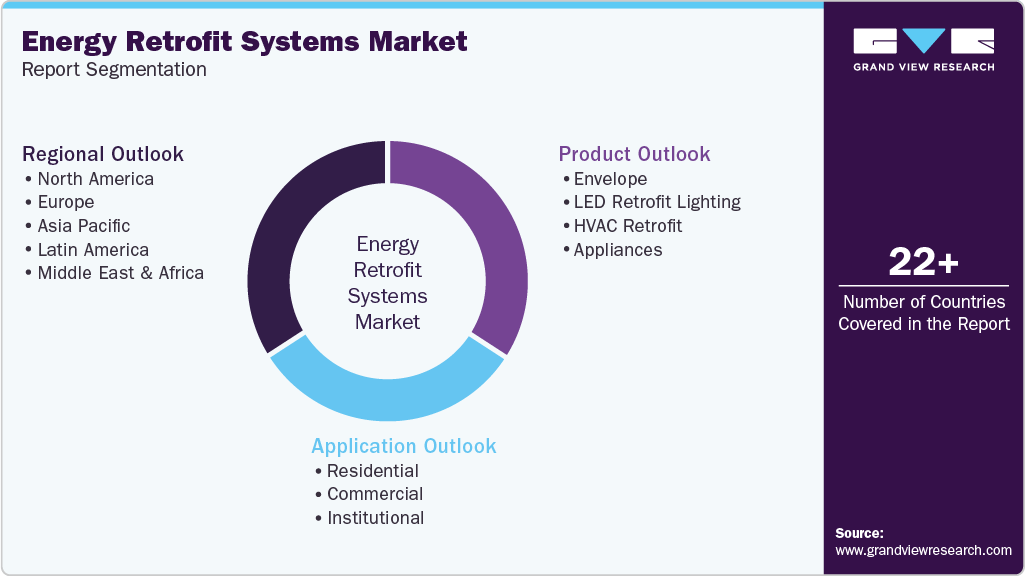

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Johnson Controls; Schneider Electric; Siemens AG; Honeywell International Inc.; Ameresco, Inc.; Eaton Corporation plc; Daikin Industries, Ltd.; AECOM; Trane Technologies plc; Orion Energy Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Retrofit Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy retrofit systems market report on the basis of product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Envelope

-

LED Retrofit Lighting

-

HVAC Retrofit

-

Appliances

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global energy retrofit systems market size was estimated at USD 160.5 million in 2024 and is expected to reach USD 240.3 million in 2025.

b. The global energy retrofit systems market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 240.3 million by 2030.

b. Europe dominated the energy retrofit systems market with the highest share of about 47.0% in 2024. Favorable government regulations towards the installation of energy retrofit along with increasing prices of conventional energy are expected to propel the market growth.

b. Key factors driving the energy retrofit systems market growth include rising energy consumption is expected to increase product demand over the forecast period.

b. Some key players operating in the energy retrofit systems market include Daikin Industries, Orion Energy Systems, Inc., Eaton, Schneider Electric, Ameresco, and Johnson Control, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.