- Home

- »

- IT Services & Applications

- »

-

Enterprise Data Management Market Size Report, 2030GVR Report cover

![Enterprise Data Management Market Size, Share, & Trends Report]()

Enterprise Data Management Market (2025 - 2030) Size, Share, & Trends Analysis Report By Software, By Services, By Deployment, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-832-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Data Management Market Summary

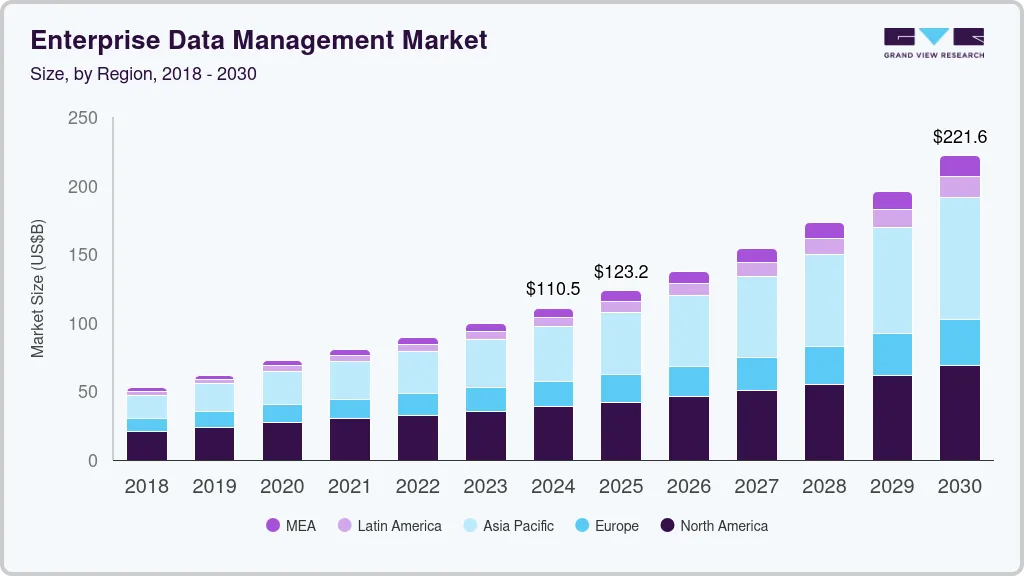

The global enterprise data management market size was estimated at USD 110.53 billion in 2024 and is anticipated to reach USD 221.58 billion by 2030, growing at a CAGR of 12.4% from 2025 to 2030. Several key factors drive the Enterprise Data Management (EDM) market. The exponential growth of data generated by businesses necessitates efficient data management solutions to harness this information for decision-making and competitive advantage.

Key Market Trends & Insights

- The North America enterprise data management market held the major share of over 34% of the enterprise data management market in 2024.

- The enterprise data management market in the U.S. is expected to grow significantly from 2025 to 2030.

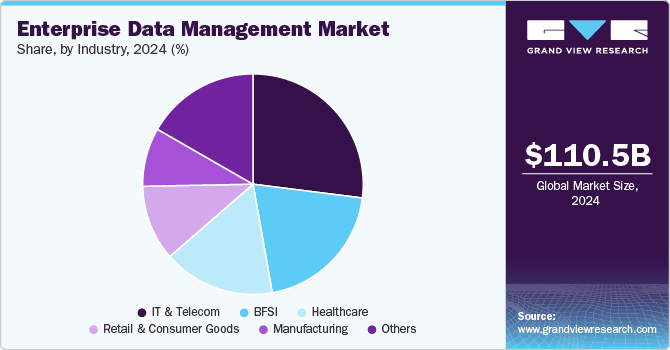

- By industry vertical, the IT & telecom segment accounted for the largest market share of about 27% in 2024.

- By software, the master data management segment accounted for the largest market share of over 16% in 2024.

- By service, the professional services segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 110.53 Billion

- 2030 Projected Market Size: USD 221.58 Billion

- CAGR (2025-2030): 12.4%

- North America: Largest market in 2024

Increasing regulatory requirements for data privacy and security compels organizations to adopt robust EDM practices to ensure compliance. The rise of cloud computing and advancements in data analytics technologies also propel the market, enabling more scalable and sophisticated data management capabilities. The increasing need for robust risk management strategies is driving the adoption of EDM software. As organizations collect and store vast amounts of data, the potential for security breaches, regulatory non-compliance, and compromised data integrity becomes a significant concern. The rising volumes of data, fueled by digital transformation initiatives and the subsequent adoption of emerging technologies, such as Internet of Things (IoT), creates a complex and dynamic data landscape and necessitates effective data management practices to mitigate the financial and reputational risks associated with data breaches, inaccurate insights, and regulatory non-compliance.

Data breaches can have severe financial implications stemming from undesired downtimes, data recovery costs, and potential lawsuits. Compromised data can also tarnish an organization's reputation, eroding customer trust and loyalty. To address these risks, enterprises are implementing robust data management strategies, such as data encryption, access controls, and Data Loss Prevention (DLP) measures. By adopting comprehensive data management practices, organizations can safeguard their data assets, ensure regulatory compliance, and gain a competitive edge. As the volume and complexity of data continue to grow, the need for effective risk management will only become more pressing.

Enterprises are facing an increasing risk of data breaches and privacy concerns due to the exponential growth in data volumes. According to IBM's 2022 Cost of a Data Breach Report, the average cost of a data breach reached a record high of USD 4.35 million globally. Effective data governance and risk management strategies are critical to mitigate these risks and protect an organization's brand reputation. A survey in November 2021, by Gartner found that 88% of the board of directors considered cybersecurity a business risk rather than solely an IT issue.

Regulatory compliance has become a critical driver in the EDM market, compelling organizations to rigorously manage and govern their data. Enterprises are confronted with a complex web of regulatory requirements varying for different industries, including finance, healthcare, and technology. These regulations mandate stringent data handling, storage, and security practices, making compliance essential for maintaining organizational reputation, avoiding hefty fines, and ensuring customer trust. Consequently, businesses are investing in sophisticated EDM solutions that provide robust data governance frameworks, audit trails, and compliance reporting features.

Software Insights

The master data management segment accounted for the largest market share of over 16% in 2024. Master data management is undergoing several key trends that are shaping its development. One significant trend is the increased adoption of cloud-based solutions, which provide scalability, flexibility, cost-effectiveness, and the convenience of accessing data from any location with an internet connection. Integrating artificial intelligence and machine learning technologies is another prominent trend in the segment as these technologies enhance data quality, automate data governance processes, and facilitate real-time data analysis.

The data security segment is expected to grow at a significant rate during the forecast period. The data security segment is growing on account of the growing cybersecurity threats and the increasing frequency of cyberattacks targeting sensitive organizational data. Businesses are investing in advanced data security solutions to protect against data breaches, ransomware, and other malicious activities that can result in significant financial and reputational damage. Moreover, key trends shaping the EDM data security segment include the adoption of advanced encryption techniques and multifactor authentication to safeguard data integrity and access.

Services Insights

The professional services segment accounted for the largest market share in 2024. Professional services help optimize staffing, improve collaboration, and automate time and expense management. Conventionally, small enterprises have been using spreadsheets for resource and time management, among other tasks. However, as the business grows and complexities increase, it often becomes challenging for enterprises to maintain business efficiency, improve throughput, enhance effectiveness, and optimally align resources while profitably delivering projects on time, thereby driving the need to automate these tasks.

The managed services segment is expected to grow at a significant rate during the forecast period. EDM managed services include data management, vendor management, and client management services. They help organizations simplify their data and improve business operations. Managed services can also integrate and effectively manage conventional and cloud-based IT infrastructures. As such, the growing reliance of organizations on IT assets to improve their productivity is expected to particularly bode well for the segment growth over the forecast period. The growing preference for outsourcing management services is also expected to contribute to the segment's growth.

Deployment Insights

The cloud segment accounted for the largest market share in 2024. Cloud deployment offers improved data accessibility, enabling seamless collaboration and data sharing across geographically dispersed teams. Integrating advanced analytics and AI capabilities within cloud platforms further drives this trend, allowing enterprises to derive actionable insights from their data more efficiently. Furthermore, robust security measures and compliance certifications provided by leading cloud providers help address data protection and regulatory compliance concerns, reinforcing confidence in cloud-based data management solutions.

The on-premise segment is expected to grow at a significant rate during the forecast period. Due to its proximity to the organization’s data sources and architecture, on-premise infrastructure can achieve low latency, provided it is well-maintained, appropriately sized, and regularly updated. Scaling an on-premise environment necessitates adding more physical or virtual infrastructure, often at significant expense, and typically lacks the flexibility to precisely align capacity with actual demand. However, the organization retains complete control over its security practices and tools, with all associated benefits and drawbacks.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024. The adoption of enterprise data management solutions by large enterprises can be attributed to the growing need to harness data as a strategic asset for competitive advantage. With the rapid growth of data volumes, diverse data sources, and the increasing complexity of data ecosystems, large enterprises are compelled to implement robust EDM practices to ensure data accuracy, consistency, and accessibility. Effective EDM improves decision-making, operational efficiency, and compliance with stringent regulatory requirements. In addition, integrating advanced analytics, artificial intelligence, and machine learning within EDM frameworks enables enterprises to derive actionable insights and foster innovation.

The small & medium enterprise segment is expected to grow at a significant rate during the forecast period. Enterprise data management solutions help SMEs improve costs, remove repetitive tasks, prioritize work, and improve team collaboration. The segment growth can be attributed to the increasing number of SMEs in emerging economies, such as China and India. Comprehensive data management practices help small and medium enterprises create new business models, reduce business risks, and streamline employee workflows. The growing preference for cloud-based solutions and the strong emphasis on developing cybersecurity strategies, preventing insider threats, and streamlining business operations is anticipated to drive the growth of the SME segment over the forecast period.

Industry Vertical Insights

The IT & telecom segment accounted for the largest market share of about 27% in 2024. The adoption of enterprise data management solutions in the IT & telecom industry is driven by the need to efficiently manage vast amounts of data generated from various sources. EDM enables IT & telecom companies to integrate disparate data sources, ensuring data consistency and reliability. This is crucial for optimizing network performance, improving customer service, and developing innovative products and services. Moreover, the growing need to enhance organizational effectiveness and documentation processes for reviewing IT services and operations is expected to drive the demand for enterprise data management solutions from incumbents of the IT & telecom industry.

The BFSI segment is expected to grow at a significant rate during the forecast period. Enterprise data management facilitates a secure and cleansed data sharing model, providing financial institutions with an organic, incremental approach to managing data across all master data domains. It ensures accurate metadata, data searches, and the capability to export data in multiple formats while maintaining a true master data core adhering to business-defined standards. Moreover, EDM simplifies the onboarding of new data and systems, making processes such as mergers and acquisitions less disruptive.

Regional Insights

The North America enterprise data management market held the major share of over 34% of the enterprise data management market in 2024. As organizations increasingly rely on data to drive business decisions, ensuring data quality and implementing strong governance practices have become top priorities. Companies are investing in sophisticated data cleansing and validation tools to maintain the integrity of their data assets. Data governance frameworks are being established to define roles, responsibilities, and processes for managing data throughout its lifecycle. This includes implementing policies for data access, usage, and retention.

U.S. Enterprise Data Management Trends

The enterprise data management market in the U.S. is expected to grow significantly from 2025 to 2030. Edge computing is becoming increasingly important in Enterprise Data Management (EDM) as companies in the U.S. are looking to process data closer to its source, especially with the growth of the Internet of Things (IoT) devices. This approach reduces latency and bandwidth usage by performing data processing and analysis at the edge of the network, which is crucial for applications that require real-time insights and actions.

Europe Enterprise Data Management Trends

The enterprise data management market in Europe is growing significantly at a CAGR of over 11% from 2025 to 2030. With increasing cybersecurity threats and growing concerns over data privacy, organizations are prioritizing data security. Advanced security solutions integrated into data management systems help protect sensitive information and ensure compliance with data protection laws. For instance, in January 2024, Infotel, a leading European provider of data governance and application management solutions, formed a strategic partnership with BMC, a global software company specializing in solutions for the Autonomous Digital Enterprise. This partnership aims to leverage the extensive expertise of both companies to deliver advanced mainframe software and security solutions to customers in the European market.

UK Enterprise Data Management Trends

The UK enterprise data management market is expected to grow rapidly in the coming years characterized by the adoption of advanced analytics and artificial intelligence (AI). Companies are investing in data governance frameworks to ensure compliance with stringent regulations like GDPR. Cloud-based solutions are gaining traction, facilitating remote data access and real-time analytics. The emphasis on data-driven decision-making is prompting organizations to integrate EDM with business intelligence tools, enhancing operational efficiency and strategic insights.

The enterprise data management market in Germany is held a substantial market share in 2024. Germany's EDM market is seeing a robust focus on data sovereignty and security, driven by regulatory requirements and the need for compliance with the EU's data protection laws. Businesses are investing in on-premises solutions alongside cloud options to ensure data control and integrity. The rise of Industry 4.0 is pushing manufacturers to adopt EDM solutions that can handle vast amounts of data generated by IoT devices, fostering a shift towards more automated and efficient data management practices.Asia Pacific Enterprise Data Management Trends

The enterprise data management market in the Asia Pacific is growing significantly at a CAGR of over 14% from 2025 to 2030. Cloud data management solutions are enabling enterprises in Asia Pacific to optimize their data management costs and improve operational efficiency. By leveraging the scalability and flexibility of the cloud, organizations can right-size their data infrastructure and only pay for the resources they need. Moreover, the automation and streamlining of data management tasks through these platforms help reduce the burden on IT teams and improve overall productivity.

China Enterprise Data Management Trends

The China enterprise data management market held a substantial market share in 2024, owing to the increasing digital transformation initiatives and government support for technology adoption. The emphasis is on big data analytics and cloud computing, with companies increasingly leveraging these technologies to gain competitive advantages. However, data privacy concerns and stringent regulations are driving enterprises to enhance their data governance strategies. Additionally, the integration of AI and machine learning in EDM solutions is becoming more prevalent, enabling businesses to derive actionable insights from large datasets.

Japan Enterprise Data Management Trends

The Japan enterprise data management market held a substantial market share in 2024. A strong emphasis on innovation and technology integration characterizes Japan's EDM market. Companies are increasingly adopting AI and machine learning to enhance data analytics capabilities, enabling real-time decision-making. There is a notable trend toward integrating EDM with cybersecurity measures to protect sensitive data, particularly in industries such as finance and healthcare. Additionally, the market is witnessing a shift towards hybrid cloud solutions, allowing organizations to balance control and flexibility in their data management strategies.

India Enterprise Data Management Trends

In India, the EDM market is growing rapidly, driven by the rise of digital initiatives across sectors. The increasing adoption of cloud-based solutions is a significant trend as organizations seek cost-effective and scalable options for managing data. Additionally, there is a heightened focus on data quality and governance, as companies aim to leverage data for strategic insights while complying with evolving regulations. The integration of advanced analytics and machine learning in EDM solutions is also becoming more common, enhancing the ability to derive value from data in real-time.

Key Enterprise Data Management Company Insights

Key players operating in the market include Amazon.com, Inc. (Amazon Web Services, Inc.), Broadcom, Cloudera, Inc., Informatica Inc., International Business Machines Corporation, LTIMindtree Limited, Open Text, Oracle, SAP SE, and Teradata. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, International Business Machines Corporation and Telefónica Tech, a digital transformation company, announced a new collaboration agreement to advance the deployment of analytics, AI, and data governance solutions, addressing the constantly evolving needs of enterprises. Initially focused on Spain, the agreement would establish a collaborative framework between the two companies, aimed at assisting customers in managing the complexities of new technologies in a diverse and dynamic environment and maximizing the value of these technologies in their business processes.

-

In March 2024, Cloudera, Inc. unveiled enhancements to its open data lakehouse on the private cloud, aimed at transforming on-premises data capabilities for scalable analytics and AI with enhanced trust. The latest updates would make Cloudera, Inc. the sole provider of an open data lakehouse featuring Apache Iceberg for both private and public cloud environments. The enhancements would enable customers to harness the full AI potential of their enterprise data.

Key Enterprise Data Management Companies:

The following are the leading companies in the enterprise data management market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc. (Amazon Web Services, Inc.)

- Broadcom

- Cloudera, Inc.

- Informatica Inc.

- International Business Machines Corporation

- LTIMindtree Limited

- Open Text

- Oracle

- SAP SE

- Teradata

Enterprise Data Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 123.24 billion

Revenue forecast in 2030

USD 221.58 billion

Growth rate

CAGR of 12.4% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software, services, deployment, enterprise size, industry vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc. (Amazon Web Services, Inc.); Broadcom; Cloudera, Inc.; Informatica Inc.; International Business Machines Corporation; LTIMindtree Limited; Open Text; Oracle; SAP SE; Teradata

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Data Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the enterprise data management market report based on software, services, deployment, enterprise size, industry vertical, and region:

-

Software Outlook (Revenue, USD Billion; 2018 - 2030)

-

Data Security

-

Master Data Management

-

Data Integration

-

Data Migration

-

Data Warehousing

-

Data Governance

-

Data Quality

-

Metadata Management

-

Reference Data Management (RDM)

-

others

-

-

Services Outlook (Revenue, USD Billion; 2018 - 2030)

-

Managed Services

-

Professional Services

-

-

Deployment Outlook (Revenue, USD Billion; 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Industry Vertical Outlook (Revenue, USD Billion; 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise data management market size was estimated at USD 110.53 billion in 2024 and is expected to reach USD 123.24 billion in 2025

b. Some key players operating in the enterprise data management market include Amazon.com, Inc. (Amazon Web Services, Inc.), Broadcom, Cloudera, Inc., Informatica Inc., International Business Machines Corporation, LTIMindtree Limited, Open Text, Oracle, SAP SE, and Teradata

b. The global enterprise data management market is expected to grow at a compound annual growth rate of 12.4% from 2025 to 2030 to reach USD 221.58 billion by 2030

b. North America region dominated the enterprise data management market with a share of over 34% in 2024. As organizations increasingly rely on data to drive business decisions, ensuring data quality and implementing strong governance practices have become top priorities. Companies are investing in sophisticated data cleansing and validation tools to maintain the integrity of their data assets. Data governance frameworks are being established to define roles, responsibilities, and processes for managing data throughout its lifecycle. This includes implementing policies for data access, usage, and retention.

b. The exponential growth of data generated by businesses necessitates efficient data management solutions to harness this information for decision-making and competitive advantage. Increasing regulatory requirements for data privacy and security compel organizations to adopt robust EDM practices to ensure compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.