- Home

- »

- Next Generation Technologies

- »

-

Enterprise Telecom Services Market Size Report, 2030GVR Report cover

![Enterprise Telecom Services Market Size, Share & Trends Report]()

Enterprise Telecom Services Market Size, Share & Trends Analysis Report By Service, By Transmission, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-058-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

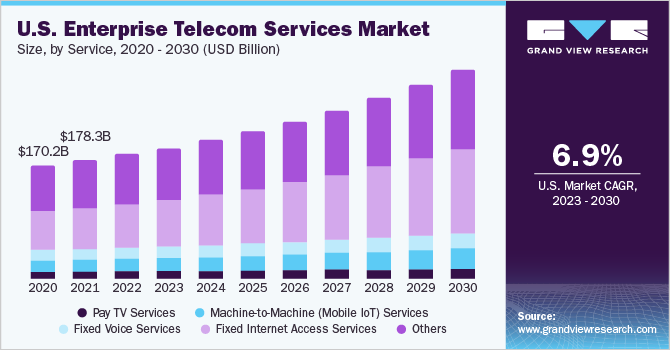

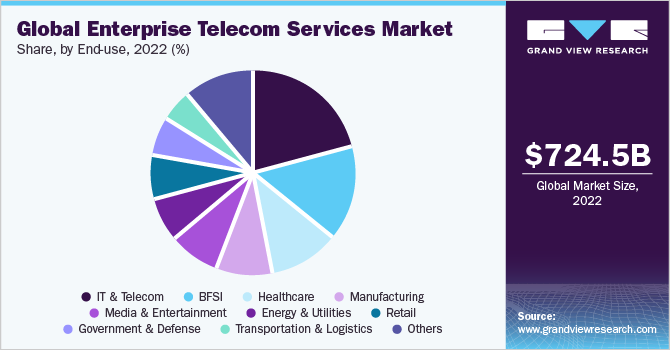

The global enterprise telecom services market size was valued at USD 724.52 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. Rising investment in 5G infrastructure rollout owing to a continuous shift in enterprises' preference for next-generation communication technologies is one of the primary reasons driving the market's growth. In addition, a surge in demand for high-speed data connectivity, an increase in mobile users, and an increase in demand for value-added managed services are the major factors contributing to the market's expansion, thereby driving the growth of the market.

Several enterprise telecom service providers are concentrating on building technologies by developing partnerships that will let business operations run smoothly. Such partnerships allow service providers to leverage the strengths and capabilities of other companies and provide a comprehensive solution for businesses. For instance, in May 2022, T-Mobile USA, Inc., and Cradlepoint, a part of Ericsson, announced their partnership to develop a custom-designed enterprise-grade 5G router for the company’s Business Internet customers. This partnership would help create a compelling fixed wireless solution for enterprises that rely on flexible, fast, and secure internet with managed services for business operations.

Digitalization has proven to be a key enabler for the growth of enterprise telecom services across the globe. Digitization enables service providers to offer their customers more reliable and faster connectivity solutions. This includes deploying advanced networks such as 5G, which provides faster data speeds, lower latency, and better connectivity for mission-critical applications. Digitization is also driving the adoption of IoT and machine-to-machine (M2M) connectivity solutions. These solutions enable companies to connect and control their devices remotely, which improves operational efficiency and reduces costs, thereby contributing to the growth of the market.

Rising adoption of cloud-based telecom services, such as Unified Communications As a Service (UCaaS) and Contact Center As a Service (CCaaS) is also a key factor contributing to the segment growth. These services offer flexible, and cost-effective solutions that enable companies to enhance their communication and collaboration capabilities. At the same time, cloud-based enterprise telecom services are highly scalable, allowing companies to add or remove users and features as needed. This enables companies to quickly adapt to changing business needs without the need for significant investments in infrastructure.

High investments are being made by businesses in developing communication infrastructure owing to a number of factors, such as the growing demand for high-speed internet and wireless services, the need to upgrade and modernize existing networks, and initiatives undertaken by the government to improve connectivity in rural areas. Companies and government organizations are investing in fiber optic cables, 5G networks, and other forms of communication infrastructure to keep pace with the increasing demand for data-intensive services. This increased spending is expected to bring benefits such as improved access to information, increased economic activity, and better connectivity for businesses. Additionally, the steady increase in the number of applications of Internet-of-Things (IoT) in industries such as energy, manufacturing, transportation, and public safety has propelled businesses and enterprises to deploy robust communications infrastructure.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the global market. During the early stages of the pandemic, demand for telecommunications services fell among businesses. Yet, the quick adoption of the remote working model as a result of lockdowns, as well as the rising requirement to respond to such needs in the future, compelled enterprises to spend in upgrading their infrastructure to provide a smooth working environment and effective company operation. As a result, demand for telecommunication services increased during the second and third quarters of 2020, as companies adopted cloud-based business models for operational efficiency. Organizations have also begun to spend significantly in the adoption of next-generation technologies such as AI, IoT, and IIoT to enable smarter automated processes.

Service Insights

The fixed internet services segment dominated the market in 2022 and accounted for more than 43.0% share of the global revenue. The segment is anticipated to expand at the fastest CAGR throughout the forecast period. Enterprises are seeking faster and more dependable internet connections as they rely increasingly on the internet for business, education, and pleasure. As a result, businesses are turning to fixed internet access services, which give higher internet speeds and are more stable. Furthermore, the growing popularity of online services, constant technological advancements, and increased government measures to encourage fixed broadband services all contribute to the growth of the fixed internet access services market.

The mobile data segment is projected to witness remarkable growth over the forecast period. As organizations become more digital, they must provide clear, open channels of communication to enhance worker and consumer contact. Mobile data services improve the customer experience by connecting workers and consumers directly. Adopting current phone and data services may not only ensure that customers' incoming calls are moved to the appropriate department, but also that calls are not interrupted. Improved connection and simple data transmission enabled by mobile voice and mobile data services are likely to promote the growth of the others category throughout the forecast period.

Transmission Insights

The wireless segment dominated the market in 2022 and accounted for more than 76.0% share of the global revenue.Wireless Local Area Network (WLAN) systems have been quickly adopted throughout the years, allowing cellular devices to connect to the internet in private homes, public spaces, business buildings, airport cafeterias, and other locations. Moreover, the adoption of artificial intelligence, cloud computing, and the internet of things is predicted to contribute greatly to the worldwide expansion of wireless communication channels. Moreover, wireless densification to improve work processes and automate routine test activities is likely to drive market expansion throughout the projection period.

The wireline segment is anticipated to grow substantially over the forecast period. Wireline telecom services link services to the business premises via cables or data lines. The wireline segment's rise may be due to the several benefits provided by wireline connectivity, such as dependability, flexibility, infrastructure, and coverage. When wireless infrastructure is unavailable or inconvenient, wireline transmission is a viable option for businesses. Large or very open regions, such as factories or industrial facilities, require a big volume of data, which wireless connectivity does not handle. In such cases, regular wireline connectivity offers dependable coverage.

Enterprise Size Insights

The small and medium enterprises segment dominated the market in 2022 and accounted for more than 89.0% share of the global revenue. The rising number of small and medium businesses is generating a potential market for enterprise telecom service providers. Small firms are looking for enough IT help to keep up with changing business demands, and an increasingly remote workforce requires an acceptable connection. Small & medium businesses are using telecom services to boost cross-team communication, increase employee productivity, and reach more clients, among other things. Such factors bode well for the growth of the segment over the coming years.

The large enterprises segment is projected to expand at the moderate CAGR over the forecast period. Large enterprises are in constant need to update their offerings and improve their work environment to sustain the growing competition in almost every field. To gain a competitive edge, large enterprises are undergoing digital transformation wherein AI, ML, cloud computing, and automation are playing a crucial role. This is creating significant opportunities for the adoption of telecom services. Additionally, large enterprises across industries such as healthcare, automotive, and manufacturing are seeking improved speed and efficiency through connectivity. At this juncture, telecom service providers are targeting large enterprises to yield more profits. Many telecom providers have also started offering telecom-as-a-service with an aim to partner with enterprises for their telecom needs. Such trends are expected to drive segment growth over the forecast period

End-use Insights

The IT & Telecom segment dominated the market in 2022 and accounted for more than 21.0% share of the global revenue. The broad deployment of 5G networks is a significant growing trend in the IT & Telecom services industry. 5G technology promises faster speeds, lower latency, and more network capacity, allowing new IoT, AR/VR, and autonomous car use cases. The implementation of next-generation high-speed networks is increasing demand for telecom services in IT and telecom applications. Companies are establishing 5G small cell networks, as well as private LTE and 5G networks, in order to acquire faster data bandwidth and prevent network latency. Increased bandwidth connectivity would enable businesses to meet the needs of their clients with minimal downtime, thereby improving the overall customer experience.

The BFSI segment is expected to grow significantly over the forecast period. In recent years, the BFSI industry has undergone a paradigm shift. Online banking, open banking, chatbots, and virtual assistants powered by cutting-edge technologies such as blockchain and big data are just a few of the latest technological trends that will shape the BFSI industry in the coming years. By delivering reliable telecommunications and internet access, enterprise telecom services are likely to play a key role in driving these changes. Yet, maintaining proper data security and privacy protection is one of the primary issues that the BFSI business has faced. Banks and financial institutions must take special precautions to secure their clients' private data and personal information against cyberattacks. As a result, business telecom service providers are developing novel solutions to assist incumbents.

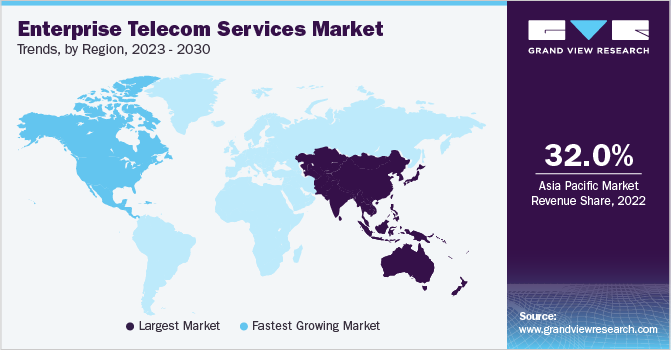

Regional Insights

The Asia Pacific region dominated the market in 2022 and accounted for more than 32.0% share of the global revenue. 5G networks are being rolled out across the Asia Pacific region, and this is expected to drive demand for enterprise telecom services. 5G networks will provide faster data speeds and lower latency, which will enable businesses to develop new applications and services. The Asia Pacific region is also seeing significant growth in the IoT market as more and more devices become connected to the internet, there is a growing demand for enterprise telecom services that can support these devices.

The North America region is expected to grow significantly over the forecast period. Increasing. Rising adoption of cloud-based communications solutions, which allows businesses to access telecom services through the cloud, improving scalability, and reducing costs is a significant factor contributing to the regional growth. The growing popularity of 5G networks is also transforming the industry, providing faster data speeds and low latency for enterprises. With the rise of IoT, there is a growing need for enterprise telecom services that can support connected devices, thereby contributing to the growth of the market.

Key Companies & Market Share Insights

Large corporations frequently engage in partnerships and collaborations, as well as acquisitions and mergers, in order to maintain market share. In addition, big firms focus on expanding their businesses to increase the growth of the market. For instance, in December 2022, Lumen Technologies announced its aim to expand the U.S. intercity networks by investing in another six million fiber miles, which are expected to be installed by 2026. Through this expansion, Lumen Technologies' intercity investment in the U.S. is expected to reach approximately 12 million fiber miles, establishing different links to more than 50 key cities across the country.

Numerous businesses in the enterprise telecom services market are forming alliances and partnerships with other industry participants. This allows them to use one other's expertise and resources, allowing them to give clients with more comprehensive and integrated solutions. Companies are also expanding their geographic footprint in order to access new markets and boost their consumer base. Collaboration with local players, investment in network infrastructure, and targeted marketing campaigns might all fall under this category. Some of the prominent players in the enterprise telecom services market include:

-

AT&T Inc.

-

Verizon Communications Inc.

-

Comcast

-

Charter Communications Inc.

-

Lumen Technologies

-

Cox Communications

-

Altice USA

-

Frontier Communications Corporation Parent Inc.

-

Windstream Intellectual Property Services, LLC.

Enterprise Telecom Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 760.19 billion

Revenue forecast in 2030

USD 1,197.67 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, transmission, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Telecom Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global enterprise telecom services market report based on service, transmission, enterprise size, end-use, and region.

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed Voice Services

-

Fixed Internet Access Services

-

Pay TV Services

-

Machine-to-Machine (Mobile IoT) Services

-

Others

-

-

Transmission Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wireline

-

Wireless

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

Manufacturing

-

Healthcare

-

Retail

-

Media & Entertainment

-

Government & Defense

-

Education

-

BFSI

-

Energy and utilities

-

Transportation & Logistics

-

Travel & Hospitality

-

O&G and Mining

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise telecom services market size was estimated at USD 724.52 billion in 2022 and is expected to reach USD 760.19 billion in 2023

b. The global enterprise telecom services market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 1,197.67 billion by 2030

b. Asia Pacific dominated the enterprise telecom services market with a share of 32.3% in 2022. 5G networks are being rolled out across the Asia Pacific region, and this is expected to drive demand for enterprise telecom services. 5G networks will provide faster data speeds and lower latency, which will enable businesses to develop new applications and services. The Asia Pacific region is also seeing significant growth in the IoT market as more and more devices become connected to the internet, there is a growing demand for enterprise telecom services that can support these devices

b. Some key players operating in the enterprise telecom services market include Nokia Corporation, TELEFONAKTIEBOLAGET LM ERICSSON, ZTE Corporation, AT&T INC., Huawei Technologies Co., Ltd., Verizon Communications Inc., Thales Group, Vodafone Group Plc., China Mobile Limited, and Microsoft Corporation

b. Key factors that are driving the enterprise telecom services market growth include growing demand for connected devices and use of 5G IoT in industry 4.0 and growing investments in 5G IoT pertaining to its applications and use cases

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."