- Home

- »

- Next Generation Technologies

- »

-

Environmental Management Systems Market Report, 2033GVR Report cover

![Environmental Management Systems Market Size, Share & Trends Report]()

Environmental Management Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud-Based), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-711-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Environmental Management Systems Market Summary

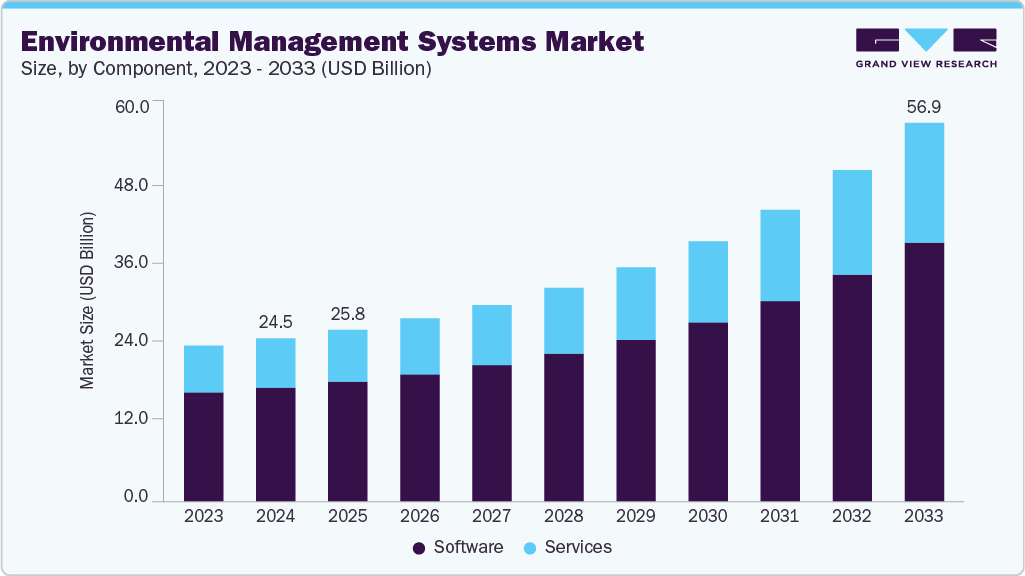

The global environmental management systems market size was estimated at USD 24.48 billion in 2024 and is projected to reach USD 56.97 billion by 2033, growing at a CAGR of 10.4% from 2025 to 2033. The global market is witnessing accelerated adoption driven by the integration of AI and machine learning for predictive compliance management, enabling automated identification of potential non-compliance risks before they occur.

Key Market Trends & Insights

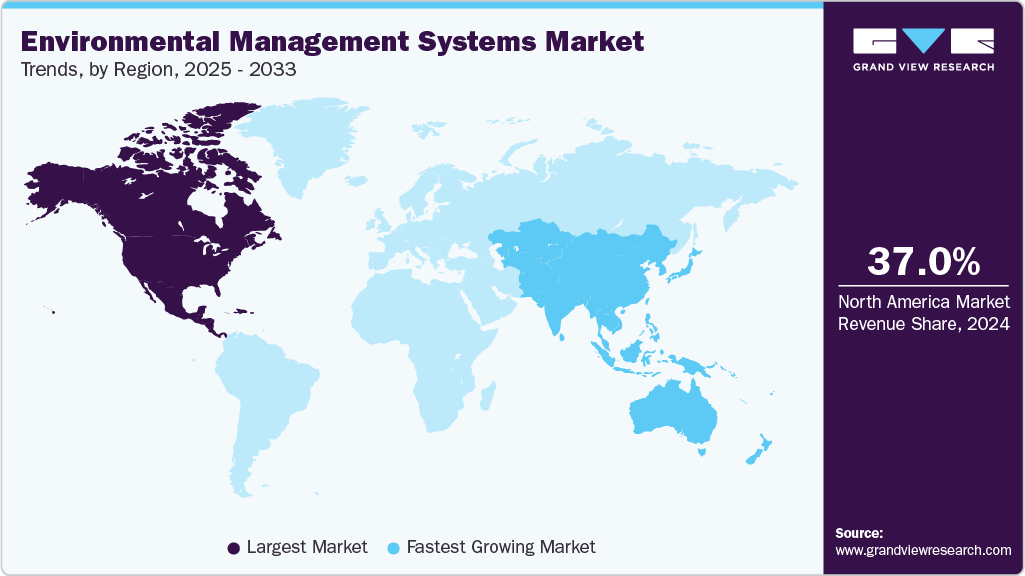

- North America held a 37.0% revenue share of the global Environmental Management Systems (EMS) market in 2024.

- In the U.S., the market is driven by strong regulatory enforcement, led by the Environmental Protection Agency’s mandates under the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act, which compel industries to implement robust monitoring, reporting, and compliance frameworks.

- By component, the software segment held the largest revenue share of 69.94% in 2024.

- By deployment, the cloud-based segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.48 Billion

- 2033 Projected Market Size: USD 56.97 Billion

- CAGR (2025-2033): 10.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

IoT-enabled real-time environmental monitoring is becoming standard, providing continuous data on emissions, waste, and energy usage from distributed assets. Moreover, the shift toward cloud-native EMS platforms is gaining momentum, as organizations seek scalability, faster deployment across multi-site operations, and seamless updates without disrupting workflows. Additionally, digital twin modeling for environmental performance forecasting is emerging, allowing industries to simulate operational changes and assess environmental impact in advance, thus optimizing resource consumption while meeting stricter reporting mandates.Additionally, the integration of EMS with carbon accounting, sustainability management, and ESG reporting platforms is creating a unified compliance ecosystem. This integration helps organizations consolidate their ISO 14001, EMAS, and local regulation reporting into centralized sustainability dashboards, reducing duplicated effort. Also, there is increasing demand for comprehensive lifecycle assessment tools that monitor environmental impact from product design to disposal, and for multi-framework compliance automation that ensures adherence to both global and regional standards. Furthermore, advanced data analytics and visualization features in EMS platforms are used to turn complex environmental data into actionable insights, helping companies find cost savings, boost operational efficiency, and improve brand value through transparent sustainability reporting.

Furthermore, from a regional viewpoint, the EMS market is influenced by platform localization to comply with country-specific regulations, sector-specific customization, and strategic vendor expansion into emerging markets. Asia-Pacific experiences the fastest growth due to rapid industrialization, infrastructure development, and increasingly strict environmental mandates, while Europe remains a stronghold driven by regulatory rigor under schemes like EMAS and the European Green Deal. The North American market benefits from corporate sustainability initiatives and tighter EPA compliance requirements. Moreover, the rise of M&A-driven geographic expansion and modular EMS architectures allows vendors to provide tailored solutions for both large enterprises and SMEs, ensuring flexibility in deployment and compliance across various industries and regions.

Component Insights

The software segment held the largest revenue share of 69.94% in the global Environmental Management Systems (EMS) market in 2024, driven by its ability to provide automated compliance tracking, real-time environmental performance insights, and integrated sustainability reporting across enterprise ecosystems. With increasingly complex regulations such as ISO 14001, EMAS, and region-specific mandates, organizations are adopting centralized EMS software to streamline audit workflows, unify facility-wide data, and ensure compliance across multiple jurisdictions. They are also leveraging AI-powered predictive analytics, IoT sensor integration, and cloud-native scalability to improve operational efficiency. The demand for modular dashboards, lifecycle assessment tools, and multi-framework compatibility further establishes software as the strategic core of modern EMS deployments. For example, in April 2025, Cority launched CorityOne, a mobile-first EMS platform enhanced with AI-driven features such as ergonomic risk detection via motion capture, real-time safety monitoring with computer vision, and seamless integration of EHS and sustainability data into a single dashboard. This reflects the broader market trend toward centralized, AI-enhanced software suites that support ESG performance goals and operational agility. In conclusion, this dominance highlights how software is evolving from a compliance tool to a strategic enabler of data-driven, sustainable decision-making in global enterprises.

The services segment is expected to grow at the highest CAGR of 11.0% during the forecast period. This growth is driven by the increasing need for comprehensive, end-to-end support in EMS deployment, optimization, and maintenance as organizations face strict environmental regulations. Additionally, companies are turning to specialized service providers for customized consulting, system integration, training, and ongoing compliance management to ensure EMS frameworks align effectively with global reporting standards such as GRI, CDP, and evolving ESG disclosure requirements. Moreover, this demand is further boosted by the complexity of managing multi-site and cross-border operations, where harmonizing environmental policies, performance metrics, and regulatory compliance requires regular audits. Furthermore, service providers are increasingly offering advanced analytics, real-time monitoring, and lifecycle assessment capabilities to help businesses shift from reactive compliance to proactive environmental stewardship. In summary, the significant growth of the services segment underscores its vital role in helping organizations turn EMS adoption into a lasting advantage by improving operations, reducing risks, and achieving clear sustainability outcomes.

Deployment Insights

The cloud-based segment accounted for the largest revenue share of 65.09% in the global Environmental Management Systems (EMS) market in 2024, driven by the increasing demand for centralized, real-time data management, cross-site integration, and rapid scalability to meet the growing complexity of sustainability reporting and environmental compliance. Organizations are adopting cloud-based EMS to leverage advanced analytics, automated ESG disclosures, and integration with enterprise-wide systems, enabling faster adaptation to evolving global regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate-related disclosure rules. For instance, in October 2024, IFS, in collaboration with PwC, launched a Sustainability Management Module within IFS Cloud to streamline ESG data collection, KPI tracking, and regulatory compliance through a unified, cloud-based platform. This dominance reflects the accelerating shift toward cloud-enabled EMS solutions that combine operational agility, regulatory readiness, and strategic sustainability management in a single, scalable ecosystem.

The on-premises segment is expected to grow at a CAGR of 9.6% over the forecast period, driven by heightened demand from industries with stringent data security, compliance, and operational control requirements, such as defense, energy, and government sectors. These organizations prioritize on-premises EMS deployments to maintain full ownership of sensitive environmental data, ensure uninterrupted operations in low-connectivity areas, and meet industry-specific regulations that restrict cloud data storage or transfer across borders. Additionally, sectors handling confidential industrial processes or hazardous material management favor on-premises solutions for their ability to integrate deeply with existing SCADA, ERP, and production control systems while minimizing cybersecurity risks from external networks. Moreover, the growth is further supported by increasing investments in advanced, AI-powered on-premises EMS platforms that deliver predictive environmental analytics, automated compliance reporting, and real-time monitoring without reliance on third-party hosting. In conclusion, the aforementioned factors are contributing remarkably in driving the growth for mission-critical, regulation-intensive industries seeking sustainable operations without compromising data sovereignty.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of 68.39% in the global Environmental Management Systems (EMS) market in 2024, driven by the scale and complexity of their operations, the extent of their global supply chains, and the stringent regulatory and reporting requirements they face across multiple jurisdictions. These organizations prioritize comprehensive EMS solutions that enable enterprise-wide compliance monitoring, centralized and real-time environmental data consolidation, advanced analytics for sustainability performance tracking, lifecycle impact assessments, and seamless integration with enterprise resource planning, Internet of Things, and carbon accounting platforms. In addition, the financial capacity of large enterprises allows for substantial investments in high-value EMS deployments, ensuring both operational efficiency and alignment with ambitious environmental, social, and governance (ESG) targets. For instance, in June 2025, ESO, a leading software and data services provider, announced the strong adoption of its AI-powered Auto Generated Narrative feature, launched in May 2025, which enabled EMS professionals to automate documentation processes and delivered an estimated 35,700 work hours in productivity savings during its first month of general availability. Consequently, the market dominance of large enterprises reflects their strategic commitment to leveraging EMS as a critical enabler of operational sustainability, regulatory compliance, and long-term competitive advantage through measurable environmental performance improvements.

The small and medium enterprises (SMEs) segment is expected to grow at the highest CAGR of 11.0% during the forecast period, driven by increasing enforcement of environmental regulations on businesses of all sizes, growing pressure from customers and investors to show sustainability commitments, and the rising availability of affordable, subscription-based EMS solutions tailored to smaller operations. Cloud-based and modular EMS platforms are helping SMEs deploy advanced features such as emissions tracking, compliance reporting, and waste management without needing extensive IT infrastructure or large upfront investments. Additionally, the integration of IoT sensors and AI-driven analytics gives SMEs real-time insights into environmental performance, enabling proactive decision-making and faster compliance. Better access to funding and government incentives for green initiatives further boost EMS adoption among SMEs. In conclusion, the rapid growth of the SME segment reflects a shift toward easier access to sustainability tools, empowering smaller organizations to reach measurable environmental goals and stay competitive in an increasingly ESG-focused market.

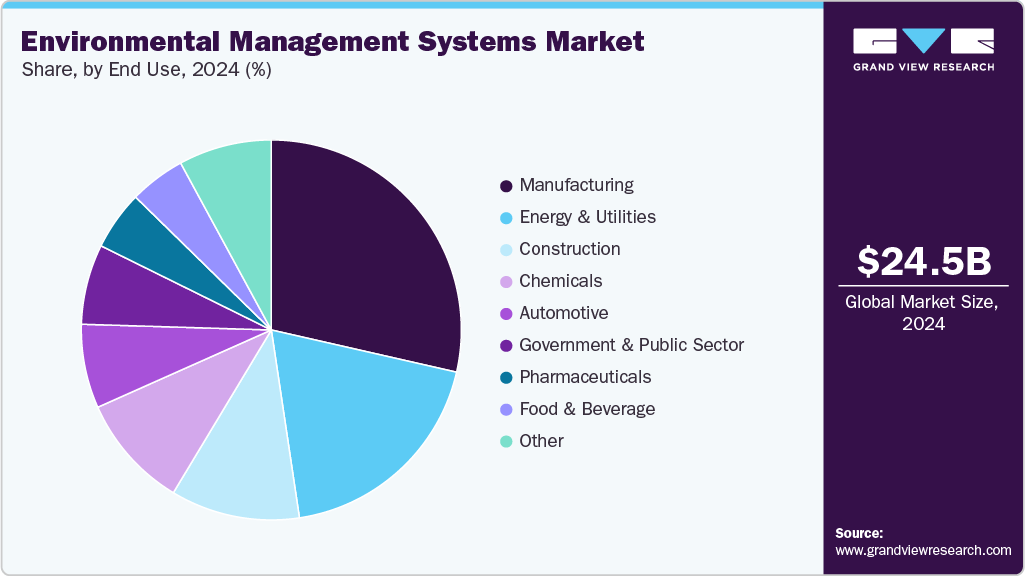

End Use Insights

The manufacturing segment accounted for the largest revenue share of 28.57% in the global Environmental Management Systems (EMS) market in 2024, driven by the sector’s substantial environmental footprint, strict regulatory requirements, and increasing adoption of advanced digital technologies to manage sustainability performance. Sustainability initiatives such as circular economy practices and supply chain transparency have further boosted EMS deployment across production operations to optimize energy use, minimize waste, and evaluate product lifecycle impacts. The integration of IoT-enabled sensors, AI-based anomaly detection, and predictive maintenance tools allows manufacturers to improve operational efficiency while achieving ambitious environmental goals. For example, in April 2024, Accruent launched enhanced regulatory compliance features within its Maintenance Connection CMMS, including one-click electronic signatures, audit trails, and document version control to meet demanding FDA and ISO 27001 standards. This advancement strengthens the sector’s move toward integrated EMS solutions that combine environmental compliance with operational resilience, aligning with manufacturing’s broader push for efficiency, transparency, and long-term sustainability. Overall, the dominance of the manufacturing segment highlights its evolution from a compliance obligation to a strategic tool for efficiency, brand differentiation, and long-lasting operational sustainability in global markets.

The construction segment is expected to grow at the highest CAGR of 11.7% during the forecast period, driven by rising regulatory pressure to reduce carbon emissions, optimize resource use, and comply with green building standards such as LEED, BREEAM, and WELL. Rapid infrastructure expansion is creating increased demand for EMS platforms that track energy consumption, monitor air quality, manage waste, and automate compliance with evolving environmental legislation. Additionally, the adoption of sustainable practices like eco-friendly material use, renewable energy integration, and water conservation has increased EMS deployment in construction as firms seek to meet ESG goals and gain a competitive edge in project bidding. Moreover, advanced technologies such as IoT-enabled environmental sensors, AI-driven project analytics, and digital twin modeling are enabling real-time monitoring and predictive environmental planning. Furthermore, global sustainability guidelines are being updated to integrate stricter environmental controls and climate action into construction workflows. For instance, in January 2025, the Institution of Environmental Sciences (IES) released its first major update since 2013 on integrating air quality management and climate action into construction practices addressing emissions that account for significant shares of particulate matter (PM10) and nitrogen oxides (NOx) in urban areas like London, signaling the rising industry expectation for EMS solutions to enable compliance and performance optimization. In conclusion, the rapid growth of the construction segment reflects its transition from a compliance-focused approach to proactive environmental management, positioning EMS as a key driver of sustainable, efficient, and future-ready building practices.

Regional Insights

The Environmental Management Systems (EMS) market in North America held a substantial share of 37.0% in 2024, driven by strict environmental regulations such as the United States Environmental Protection Agency’s Clean Air Act and Clean Water Act, along with Canada’s Net Zero Emissions Accountability Act, which require thorough monitoring, reporting, and compliance across various industries. The region is experiencing accelerated EMS adoption as corporate ESG commitments grow stronger under the influence of investor expectations and disclosure frameworks, including the U.S. Securities and Exchange Commission’s proposed climate risk reporting requirements. Additionally, the regional focus on decarbonization, the adoption of circular economy practices, and increased investment in renewable energy are fueling demand for EMS solutions that provide measurable sustainability results and operational improvements. Consequently, these combined factors reinforce North America’s position as a global leader in EMS deployment and innovation.

U.S. Environmental Management Systems (EMS) Market Trends

The Environmental Management Systems (EMS) market in the U.S. is characterized by strong regulatory enforcement, led by the Environmental Protection Agency’s mandates under the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act, which compel industries to implement robust monitoring, reporting, and compliance frameworks. Additionally, growing corporate focus on sustainability disclosures, driven by the U.S. Securities and Exchange Commission’s proposed climate risk reporting requirements, is further accelerating EMS adoption across sectors such as manufacturing, energy, and transportation. Moreover, the integration of advanced technologies including IoT-enabled sensors, AI-driven analytics, and cloud-based compliance platforms is enabling U.S. enterprises to achieve real-time environmental performance tracking, predictive risk modeling, and streamlined audit readiness. Furthermore, the federal government’s decarbonization targets, coupled with state-level initiatives like California’s Advanced Clean Fleets regulation and New York’s Climate Leadership and Community Protection Act, are fostering demand for EMS solutions that support emissions reduction, waste minimization, and resource optimization. Consequently, these factors position the United States as an essential market for EMS innovation, compliance leadership, and scalable sustainability transformation.

Europe Environmental Management Systems (EMS) Market Trends

The Environmental Management Systems (EMS) market in Europe is expected to grow significantly from 2025 to 2033, driven by strict environmental regulations such as the European Green Deal, the Industrial Emissions Directive, and the Waste Framework Directive, which require organizations to implement structured environmental management. Additionally, the region’s strong push toward reaching climate neutrality by 2050 is encouraging industries to adopt EMS solutions that allow for carbon footprint monitoring and compliance with emerging sustainability disclosure frameworks like the Corporate Sustainability Reporting Directive. Furthermore, increasing investor pressure for transparent ESG reporting, along with funding initiatives like Horizon Europe and the Innovation Fund, is speeding up EMS adoption for sustainable process improvements. As a result, these factors position Europe as a leader in integrating EMS into corporate sustainability strategies, promoting both regulatory compliance and long-term competitiveness in a low-carbon economy.

The Environmental Management Systems (EMS) market in Germany is expected to grow, driven by the country’s strict environmental regulations, including the Federal Climate Change Act, the Circular Economy Act, and the Supply Chain Due Diligence Act, which collectively require strong environmental monitoring and sustainability reporting across industries. Germany’s leadership in renewable energy adoption and its goal to reach greenhouse gas neutrality by 2045 encourage businesses to adopt EMS platforms that provide advanced carbon accounting, energy optimization, and waste management capabilities. Additionally, the increasing influence of the EU Green Deal and the Corporate Sustainability Reporting Directive (CSRD) is urging companies to improve transparency and accountability in environmental performance. These factors are positioning Germany as a technologically advanced and regulation-driven EMS market, where adoption is increasingly seen as vital for maintaining global competitiveness and supporting the country’s shift toward a circular and low-carbon economy.

Asia Pacific Environmental Management Systems (EMS) Market Trends

Asia Pacific is expected to register a CAGR of 11.3% from 2025 to 2033 in the Environmental Management Systems (EMS) market, driven by increasing regulatory enforcement and the growing prioritization of sustainability initiatives. Governments in countries such as China, Japan, and Australia are strengthening environmental compliance frameworks and introducing stricter emission control policies, prompting enterprises to adopt EMS solutions for real-time monitoring, reporting, and compliance management. The region’s accelerated adoption of renewable energy, green manufacturing practices, and circular economy models is further fueling the integration of EMS platforms that enable data-driven decision-making and resource optimization. In addition, the rapid digitalization of industries, coupled with significant investments in smart factory infrastructure, is encouraging the deployment of cloud-based and AI-enabled EMS tools for predictive analytics, automated reporting, and operational efficiency.

The Environmental Management Systems market in Japan is supported by the country’s strong regulatory framework, including the Act on Promotion of Global Warming Countermeasures and the Environmental Impact Assessment Act, which mandate rigorous environmental management and reporting across industries. Japan’s commitment to carbon neutrality by 2050 is driving companies to adopt EMS solutions that facilitate comprehensive emissions tracking, energy efficiency improvements, and waste reduction initiatives. Additionally, the growing emphasis on sustainable supply chains and alignment with international ESG standards is encouraging Japanese enterprises to leverage EMS as a strategic tool for risk management, regulatory compliance, and competitive differentiation. These factors collectively position Japan as a mature and innovation-driven EMS market focused on achieving long-term environmental sustainability and operational excellence.

The Environmental Management Systems (EMS) market in China is poised for significant growth driven by the country’s stringent environmental regulations such as the Environmental Protection Law, Air Pollution Prevention and Control Action Plan, and the 14th Five-Year Plan’s emphasis on green development and carbon peaking targets. The government’s strong focus on achieving carbon neutrality by 2060 is compelling industries to adopt comprehensive EMS solutions that support emissions monitoring, energy efficiency, and waste management at scale. Additionally, China’s growing participation in global ESG frameworks and supply chain sustainability requirements is encouraging enterprises to enhance transparency and operational sustainability through EMS adoption.

The Environmental Management Systems (EMS) market in India is expected to experience robust growth from 2025 to 2033, driven by strong environmental regulations such as the Air (Prevention and Control of Pollution) Act, Water (Prevention and Control of Pollution) Act, and the recent emphasis on the National Action Plan on Climate Change. Increasing government initiatives to promote sustainable development, alongside growing awareness among industries about environmental compliance and corporate social responsibility, are encouraging widespread EMS adoption across manufacturing, energy, construction, and waste management sectors. The rapid digital transformation in India, including the integration of IoT devices, cloud computing, and AI-based analytics, is enabling companies to implement scalable and cost-effective EMS solutions that facilitate real-time monitoring, predictive analytics, and automated reporting. Additionally, the rising pressure from global supply chains and investors to meet international ESG standards is motivating Indian enterprises to strengthen their environmental governance and transparency. These combined factors are positioning India as a fast-growing EMS market focused on achieving regulatory compliance, operational efficiency, and sustainable growth.

Key Environment Management Systems Company Insights

Key players operating in the Environmental Management Systems (EMS) industry are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP) and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, ABB launched a new smart energy management solution designed to optimize home energy use by intelligently monitoring and controlling energy consumption. The solution integrates advanced analytics and automation to enhance energy efficiency, reduce costs, and support sustainable energy practices for residential users.

-

In December 2024, Tetra Tech launched the TETRA Oasis TDS, an end-to-end water treatment and desalination technology aimed at enhancing the reuse of produced water in the Permian Basin.

Key Environment Management Systems Companies:

The following are the leading companies in the environment management systems (EMS) market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Accruent, Inc.

- Bentley Systems, Incorporated

- Dassault Systèmes SE

- Enviance, Inc.

- IBM Corporation

- Intelex Technologies, Inc.

- IFS AB

- IsoMetrix Pty Ltd

- SAP SE

- Sphera Solutions Inc.

- Tetra Tech, Inc.

- UL LLC

- VelocityEHS

- Wolters Kluwer N.V.

Environmental Management Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 25.82 billion

Revenue forecast in 2033

USD 56.97 billion

Growth rate

CAGR of 10.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB Ltd.; Accruent, Inc.; Bentley Systems, Incorporated; Dassault Systèmes SE; Enviance, Inc.; IBM Corporation; Intelex Technologies, Inc.; IFS AB; IsoMetrix Pty Ltd; SAP SE; Sphera Solutions Inc.; Tetra Tech, Inc.; UL LLC; VelocityEHS; Wolters Kluwer N.V.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Management Systems (EMS) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Environmental Management Systems (EMS) market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Construction

-

Energy and Utilities

-

Chemicals

-

Automotive

-

Pharmaceuticals

-

Food and Beverage

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental management systems market size was estimated at USD 24.48 billion in 2024 and is expected to reach USD 25.8 billion in 2025.

b. The global environmental management systems market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2033 to reach USD 57.0 billion by 2033.

b. The software segment accounted for the largest revenue share of 69.94% in the global Environmental Management Systems (EMS) market in 2024, driven by its ability to deliver automated compliance tracking, real-time environmental performance insights, and integrated sustainability reporting across enterprise ecosystems.

b. Some key players operating in the EMS market include ABB Ltd., Accruent, Inc., Bentley Systems, Incorporated, Dassault Systèmes SE, Enviance, Inc., IBM Corporation, Intelex Technologies, Inc., IFS AB, IsoMetrix Pty Ltd, SAP SE, Sphera Solutions Inc., Tetra Tech, Inc., UL LLC, VelocityEHS, and Wolters Kluwer N.V. and Others.

b. Factors such as accelerated adoption driven by the integration of AI and machine learning for predictive compliance management, enabling automated identification of potential non-compliance risks before they occur plays a key role in accelerating the Environmental Management Systems (EMS) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.