- Home

- »

- Green Building Materials

- »

-

Environmental Remediation Market Size, Share Report, 2030GVR Report cover

![Environmental Remediation Market Size, Share & Trends Report]()

Environmental Remediation Market (2024 - 2030) Size, Share & Trends Analysis Report By Site Type (Public, Private), By Medium (Soil, Water, Air), By End-use (Agriculture, Waste Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-427-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Environmental Remediation Market Summary

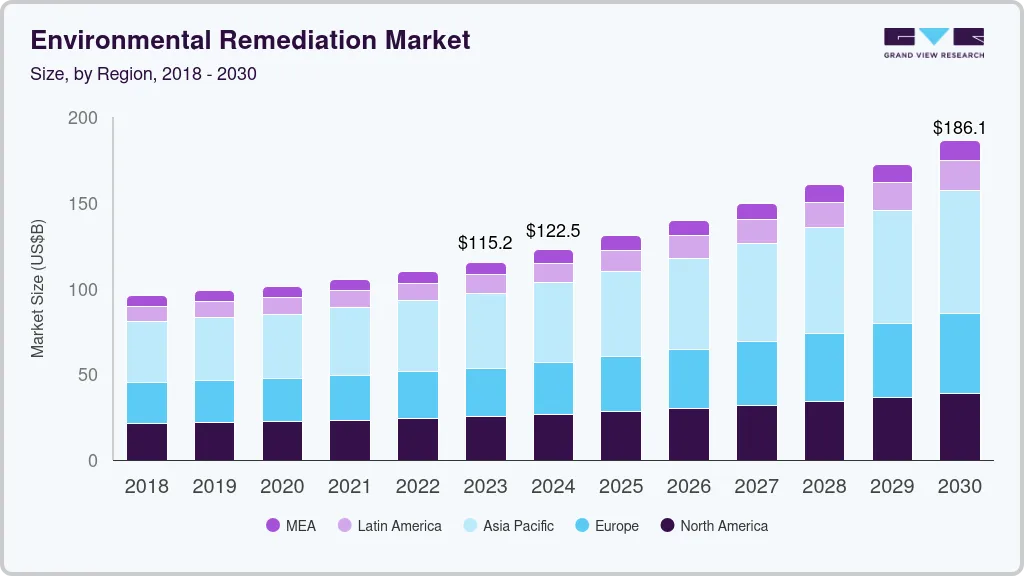

The global environmental remediation market size was estimated at USD 115.2 billion in 2023 and is projected to reach USD 186.1 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. The market is experiencing significant growth due to a confluence of factors that underscore the increasing urgency for effective environmental management and pollution control.

Key Market Trends & Insights

- Asia Pacific was the largest revenue generating market in 2023.

- Based on site type, the public segment dominated the market in 2023, accounting for a market share of 68.5%.

- Based on end use, the oil and gas segment held 29.0% of the market share in 2023.

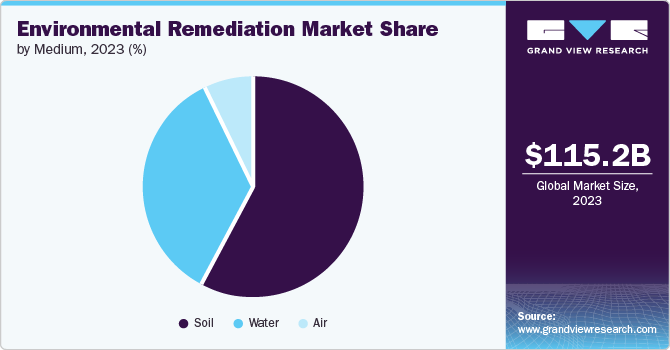

- Based on medium, the soil segment held 57.9% of the market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 115.2 Billion

- 2030 Projected Market Size: USD 186.1 Billion

- CAGR (2024-2030): 7.2%

- Asia Pacific: Largest market in 2023

Technological advancements play a crucial role in the market's growth trajectory. Innovations in remediation technologies, such as bioremediation, nanoremediation, and advanced oxidation processes, are enhancing the efficiency and effectiveness of environmental cleanup. These technologies offer more sustainable and cost-effective solutions and address a wider range of contaminants, including emerging pollutants like pharmaceuticals and microplastics.

Drivers, Opportunities & Restraints

Regulatory frameworks and policies are also pivotal in fueling the market expansion. Governments around the world are implementing stricter environmental regulations and standards, which mandate the cleanup of hazardous waste sites and the prevention of future contamination.

One prominent opportunity is the increasing investment in research and development of advanced remediation technologies. Innovations such as smart sensors, remote monitoring systems, and biodegradable materials are opening new avenues for more effective and efficient cleanup solutions.

Advanced technologies and extensive cleanup operations often require substantial financial investment, which can be a barrier for smaller companies or projects with limited budgets. In addition, the complexity of certain contamination scenarios can lead to unpredictable costs and extended project timelines, further inhibiting market growth.

Site Type Insights

“The private segment is expected to grow at a significant CAGR of 7.4% from 2024 to 2030 in terms of revenue”

The private sector’s growth in environmental remediation is primarily driven by corporate social responsibility (CSR) and sustainability goals. Companies are increasingly recognizing the value of investing in environmental remediation to enhance their brand reputation, reduce liability, and meet regulatory requirements.

The public segment dominated the market in 2023, accounting for a market share of 68.5%. The public sector’s involvement in environmental remediation is significantly driven by increasing regulatory pressures and the need for compliance with stringent environmental standards. Government agencies are tasked with addressing large-scale contamination issues, including hazardous waste sites and polluted public lands, thereby fostering market growth.

End-use Insights

"The growth of waste management segment is expected to grow at a significant CAGR of 7.7% from 2024 to 2030 in terms of revenue”

One of the most significant drivers is the growing volume and complexity of waste generated by industrialization and urbanization. As cities, particularly in emerging economies, expand and industries proliferate, the amount of waste produced has surged, leading to heightened concerns about its environmental impact. The need to address the legacy of pollution from improper waste disposal practices has created a substantial market for remediation services aimed at restoring contaminated land and water resources.

The oil and gas segment held 29.0% of the market share in 2023. In the oil and gas sector, remediation efforts are driven by the need to address contamination resulting from exploration, extraction, and transportation activities. Oil spills, leaks, and other environmental accidents require immediate and effective remediation to minimize environmental damage and comply with regulations.

Medium Insights

"The demand for the water segment is expected to grow at a rapid CAGR of 7.4% from 2024 to 2030 in terms of revenue”

Water remediation is experiencing growth due to regulatory requirements related to water quality and safety. Governments and international organizations are setting stringent standards for drinking water and wastewater discharge. The health problems caused by hazardous chemicals, heavy metals, and pathogens in water sources are driving investments in advanced water treatment technologies.

The soil segment held 57.9% of the market share in 2023, and it is driven by increasing industrial activity and urban development, which often lead to soil contamination through the release of pollutants such as heavy metals, hydrocarbons, and toxic chemicals. As industries expand and urban areas develop, the demand for cleaning and restoring contaminated soil to make it suitable for reuse or development grows.

Regional Insights

“China to witness fastest market growth at 7.8% CAGR”

The North America environmental remediation market is driven by the presence of a well-established environmental remediation industry, coupled with technological innovation, contributing to market growth. North American companies are at the forefront of developing and implementing advanced remediation technologies, such as bioremediation and nanoremediation, to address complex contamination issues. This technological leadership supports continued growth and expansion in the region.

Asia Pacific Environmental Remediation Market Trends

The environmental remediation market in Asia Pacific is experiencing robust growth due to several key factors. Rapid industrialization and urbanization are primary drivers, with countries such as China, India, and Southeast Asian nations experiencing significant increases in industrial activities and population growth. This expansion has led to increased emissions of pollutants and contamination of soil, water, and air, necessitating advanced remediation solutions to address environmental challenges. Moreover, public awareness and advocacy for environmental sustainability are also rising. Growing concerns about air and water quality, coupled with increased environmental activism, are pushing governments and corporations to prioritize remediation efforts and invest in cleaner technologies.

The environmental remediation market in China is estimated to grow at 7.8% over the forecast period.China's commitment to achieving carbon neutrality by 2060 and its participation in international agreements like the Paris Agreement signal a long-term strategy to address environmental challenges. This commitment is likely to drive investments in green technologies and remediation practices as the country seeks to balance economic growth with environmental sustainability.

Europe Environmental Remediation Market Trends

The environmental remediation marketin Europeis driven by the European Union’s stringent environmental regulations and policies. Frameworks such as the EU soil strategy for 2030 and the Water Framework Directive set high standards for environmental protection and remediation. These regulations mandate the cleanup of contaminated sites and the implementation of sustainable practices, creating a strong demand for remediation services.

Key Environmental Remediation Company Insights

Some of the key players operating in the market include ENTACT and WSP among others.

-

ENTACT is a company that specializes in environmental remediation services such as bioremediation, decontamination, Ex-situ treatment, marine sediment sampling support, radiological licensing and waste disposal, and several others. The company has remediated more than 150 superfund sites and over 150 battery, smelter, and mine sites. It also offers geotechnical services and caters to industries such as oil and gas, chemicals, real estate, and others.

-

WSP is a leading global professional services consulting firm providing engineering and design solutions across a wide range of sectors. The company offers a comprehensive range of services, including remediation for contaminated land, urban planning and design, airport master planning, process consulting, mine engineering, and transport planning. The firm serves clients across various sectors, such as acute care and general hospitals, the chemical industry, consumer products, aerospace, education, food and beverage, marine, aviation, transport, and infrastructure.

Key Environmental Remediation Companies:

The following are the leading companies in the environmental remediation market. These companies collectively hold the largest market share and dictate industry trends.

- ENTACT

- DEME.

- WSP

- CLEAN HARBORS, INC.

- Sequoia Environmental

- Bristol Industries, LLC.

- In-Situ Oxidative Technologies, Inc.

- HDR, Inc.

- AECOM.

- Tetra Tech Inc.

- BRISEA

- Jacobs

Recent Developments

-

In September 2023, ENTACT expanded its sediment management capabilities by acquiring White Lake Dock & Dredge. This strategic acquisition enhances ENTACT's ability to offer comprehensive sediment remediation and management services, combining their existing expertise with White Lake’s specialized dredging equipment and services. The integration is expected to strengthen ENTACT’s market position and broaden its service offerings in sediment control and environmental remediation.

-

DEME Environmental and C-Biotech are collaborating to address PFAS contamination using industrial hemp. This innovative partnership aims to utilize hemp’s natural properties for the effective removal of persistent PFAS chemicals from contaminated sites. The collaboration represents a significant step forward in sustainable and eco-friendly solutions for managing hazardous pollutants.

Environmental Remediation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 122.5 billion

Revenue forecast in 2030

USD 186.1 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Site type, medium, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil;

Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

ENTACT, DEME., WSP, CLEAN HARBORS, INC., Sequoia Environmental, Bristol Industries, LLC., In-Situ Oxidative Technologies, Inc., HDR, Inc., AECOM., Tetra Tech Inc., BRISEA, and Jacobs.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Remediation Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global environmental remediation market report based on site type, medium, end-use, and region:

-

Site Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

-

Medium Outlook (Revenue, USD Billion, 2018 - 2030)

-

Soil

-

Water

-

Air

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mining and Forestry

-

Oil and Gas

-

Agriculture

-

Automotive

-

Waste Management

-

Manufacturing

-

Construction

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global environmental remediation market size was estimated at USD 115.2 billion in 2023 and is expected to reach USD 122.5 billion in 2024.

b. The Environmental Remediation market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 186.1 billion by 2030.

b. The waste management segment dominated the market in 2023 accounting for 24.8% of the market share in 2023. The emergence of new technologies in waste management is facilitating more effective remediation processes and fostering segment growth.

b. Some of the key players operating in the environmental remediation market ENTACT, DEME., WSP, CLEAN HARBORS, INC., Sequoia Environmental, Bristol Industries, LLC., In-Situ Oxidative Technologies, Inc., HDR, Inc., AECOM., Tetra Tech Inc., BRISEA, and Jacobs.

b. The environmental remediation market is driven by stricter regulations, increased public awareness, and the need for land redevelopment. Governments enforce tougher standards to combat contamination, prompting companies to invest in compliance solutions and rising public concern over health risks associated further drives the prominence of environmental remediation services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.