Epichlorohydrin Market Summary

The global epichlorohydrin market size was estimated at USD 2.23 billion in 2017 and is projected to reach USD 4.40 billion by 2030, growing at a CAGR of 5.4% during the forecast period 2018 to 2030. Epoxy resins find application in a large number of end-use industries.

Key Market Trends & Insights

- North America was the second-largest regional market in 2017 with a volume-based market share of over 19%.

- Asia Pacific was the largest regional market in 2017 with a global share of over 50% in terms of volume.

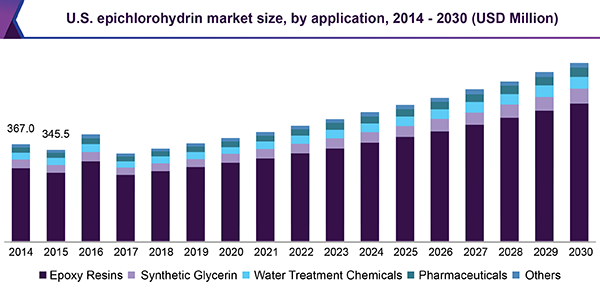

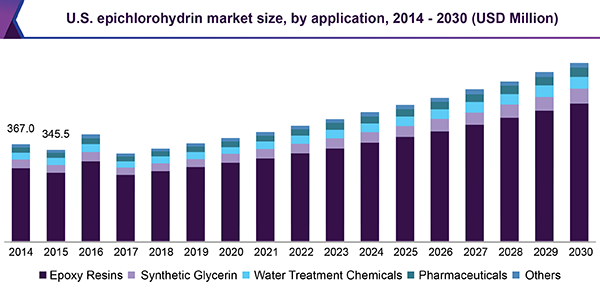

- Based on application, the major application segments for epichlorohydrin are epoxy resins, pharmaceuticals, water treatment chemicals, and synthetic glycerin.

Market Size & Forecast

- 2017 Market Size: USD 2.23 Billion

- 2030 Projected Market Size: USD 4.40 Billion

- CAGR (2018-2030): 5.4%

- North America: Largest market in 2017

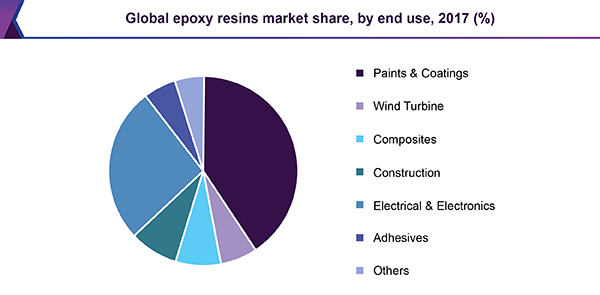

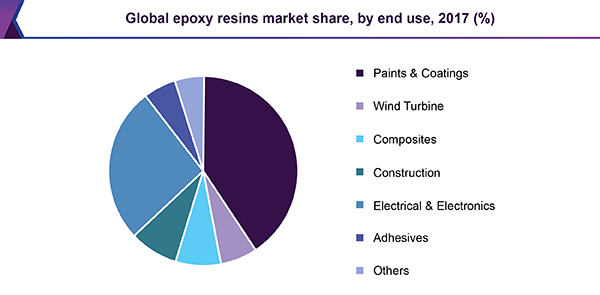

Thus, rising demand for epoxy resins from various end-use industries such as building and construction, automotive, and renewable energy equipment is expected to be a major driving factor for the market. Paints and coatings is one of the largest end-use segment that uses epoxy resins in their formulations.

Economic growth in the emerging countries of Asia Pacific will lead to a rise in consumption of epoxy resin in paints and coatings, automotive, and building and construction sectors. Rise in private and public non-residential spending, as a result of increased employment opportunities, are improving the growth prospects for epoxy resins, thus benefitting the epichlorohydrin (ECH) market.

Largely, epichlorohydrin manufacturing uses propylene as a raw material. Rising penetration of bio-based products has forced manufacturers to use glycerin-based starting material. Numerous companies such as Dow Chemical Company, Samsung Fine Chemical, and Belgium’s Solvay SA have started the usage of renewable feedstock glycerin to manufacture ECH. Traditionally, epichlorohydrin was being manufactured in a multi-step procedure where propylene was used as the starting material.

High fluctuation in the prices of propylene coupled with increased production of raw glycerin, obtained as a by-product of biodiesel manufacturing, has increased the interest in processes where the glycerol is used as a raw material. Recently, the manufacturing of ECH has followed the “green” trend in the chemical industry by using sustainable engineering and environmentally friendly raw materials. Rising demand from the developing countries in Eastern Europe and Asia is augmenting the market growth.

These regions remain the major product importers. Moreover, advent of new technologies that are being applied in the polycarbonate and epoxy resin industries would also drive the epichlorohydrin market. Tight supply of ECH in the Asia Pacific is expected to continue as plants in China cut output to comply with environmental regulations in the country. An environmental clean-up program that was first propelled in 2016, but congregated much more speed from January 2017, has led to factory closures.

Application Insights

The major application segments for epichlorohydrin are epoxy resins, pharmaceuticals, water treatment chemicals, and synthetic glycerin. Epoxy resins produced from epichlorohydrin are used across multiple industries including adhesives, coatings, and plastics. These resins are also used to produce inks and dyes used in various end-use sectors. Whereas, synthetic glycerin is robustly used in the cosmetics industry and in commercial insecticides surfactants, solvents, pharmaceuticals, textiles, and paper sectors.

In the construction industry, epoxy resins are used to manufacture floorings in high traffic areas such as shopping malls, industrial buildings, and hospitals due to their anti-slip textures. They are also used to bind concrete to itself or to steel in monument restoration applications.

Epichlorohydrin has other multiple applications across diverse end-use industries, which include its use in ECH-based rubber, inks and dyes, paper, agricultural products (such as fungicides, insecticides, and bactericides), textiles, and ion-exchange resins among others. The current ECH production trend has typically shifted from its manufacturing through petroleum-based feedstock to bio-based feedstock, thereby switching from propylene to glycerin.

The agricultural residues are used extensively to prepare anion exchangers after they are reacted with ECH and dimethylamine. This holds specific importance, as agricultural residues anion exchangers can eliminate NO3 and increases yield at lower costs.

Regional Insights

North America was the second-largest regional market in 2017 with a volume-based market share of over 19%. Rising optimism in industries with high demand for chemical products is boosting demand for specialty chemicals. The U.S., the major consumer of epichlorohydrin in this region, has adopted a cautious approach for economic growth. The introduction of stricter laws against epichlorohydrin in Canada will lower the demand for epichlorohydrin. Capacity expansions and capital infusion are the major factors that are expected to play a major role in driving the demand for epichlorohydrin.

Asia Pacific was the largest regional market in 2017 with a global share of over 50% in terms of volume. The global dominance was mainly due to the presence of emerging countries such as China, Taiwan, and Malaysia, which are among the major consumers of epichlorohydrin. India and Taiwan markets are expected to grow rapidly over the coming years owing to rising demand from end-use industries such as building and construction and electronic manufacturing. The rise in petroleum refining activities coupled with increasing demand for epoxy resins is also expected to propel market growth in these regions.

Key Companies & Market Share Insights

The industry participants are majorly focusing on the development of capacity expansions and expanding the product portfolio. Most of the companies carry a wide range of product line catering to numerous end-use industries in different geographies maintaining the demand-supply balance. Dow Chemical Company leads the market. Some of the key companies in the market include Lotte Fine Chemical and Shandong Haili Chemical Industry Co. Ltd. Top 10 epichlorohydrin manufacturers cater to around 74% of the total market demand.

Epichlorohydrin Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2019

|

USD 2.47 billion

|

|

Revenue forecast in 2030

|

USD 4.40 billion

|

|

Growth Rate

|

CAGR of 5.4% from 2018 to 2030

|

|

Base year for estimation

|

2017

|

|

Historical data

|

2014 - 2016

|

|

Forecast period

|

2018 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2018 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S., Canada, Mexico, Germany, France, U.K., Spain, Belgium, Netherlands, Luxembourg, Ireland, Denmark, Finland, Iceland, Norway, Switzerland, Austria, Poland, Czech Republic, Slovakia, Baltic Nations, China, India, Malaysia, Thailand, Australia, Vietnam, South Korea, Brazil, Chile, Colombia, North Africa, Sub-Saharan Africa

|

|

Key companies profiled

|

Dow Chemical Company, Lotte Fine Chemical, and Shandong Haili Chemical Industry Co. Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2030. For the purpose of this study, Grand View Research has segmented the global epichlorohydrin market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2030)

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2030)

-

North America

-

Europe

-

Germany

-

The U.K.

-

France

-

Spain

-

Belgium

-

Netherlands

-

Luxembourg

-

Ireland

-

Denmark

-

Finland

-

Iceland

-

Norway

-

Sweden

-

Switzerland

-

Austria

-

Poland

-

Czech Republic

-

Slovakia

-

Baltic Nations

-

Asia Pacific

-

China

-

India

-

Malaysia

-

Taiwan

-

Australia

-

Vietnam

-

South Korea

-

Central & South America

-

Middle East

-

Africa

-

North Africa

-

Sub Saharan Africa