- Home

- »

- Clinical Diagnostics

- »

-

Epigenetics Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Epigenetics Diagnostics Market Size, Share & Trends Report]()

Epigenetics Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Kits, Instruments, Enzymes, Services), By Technology(Histone Methylation), By Application (Oncology, Non-oncology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-831-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Epigenetics Diagnostics Market Trends

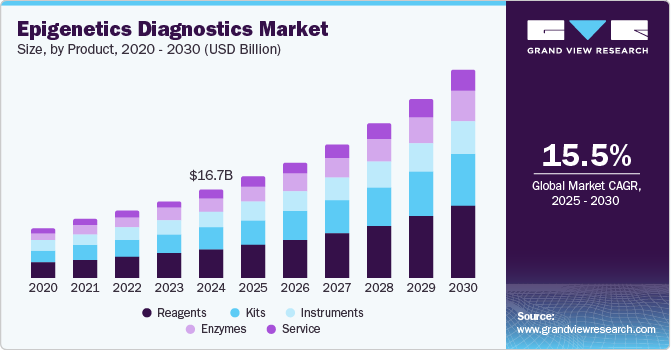

The global epigenetics diagnostics market size was valued at USD 16.69 billion in 2024 and is projected to grow at a CAGR of 15.5% from 2025 to 2030. The high growth is mainly attributed to the increase in investment, funds, and approvals for epigenetics research & development, growing applications of epigenetics in drug discovery & development, and increased affordability of genome sequencing. Epigenetics has exhibited its potential for application in non-oncology conditions, thus creating tremendous opportunities for market growth. Epigenetic pathways may be directly or indirectly involved in a variety of cancers, Cardiovascular Disorders (CVDs), reproductive problems, autoimmune diseases, and ailments that affect cognitive function.

External stimuli, including the causative agents, such as heavy metals, pesticides, smoke, hormones, radiation, viruses, environmental factors, and essential nutrients can influence the function of these epigenetic pathways. Increasing awareness regarding epigenetic testing and the increasing demand for such kits and assays is one of the crucial factors in the growth of this market. Increased healthcare R&D spending globally is also anticipated to fuel market expansion over the forecast period. According to the WHO report published in April 2023, the weighted average health GERD as% of GDP increased the most in high-income nations (0.25%) compared to the previous analysis (0.21%). The increase in cases of GERD in several high-income countries can be largely attributed to significant investments in research and development. Notably, the Republic of Korea has seen the most substantial rise, having invested over 112 trillion won (approximately $84.6 billion) in this area.

For instance, in November 2024, Oxford Nanopore partnered with UK Biobank to create the world’s first extensive epigenetic dataset, large scale. This dataset will include 50,000 samples and aid in the early detection and diagnosis of diseases.

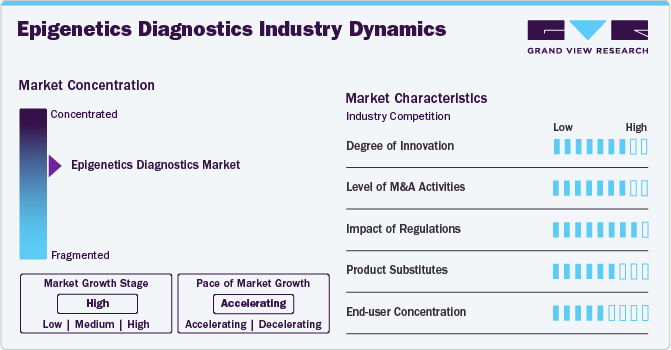

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. The epigenetics diagnostics industry is characterized by growing technological advancements, driven by high research and development investments. In August 2024, Illumina, Inc. received FDA approval for the in vitro diagnostic test TruSight, which profiles a patient's solid tumor to help identify actionable, targeted biomarkers that facilitate targeted therapy.

The epigenetics diagnostics industry is marked by the emergence of innovative therapies developed by leading companies. This growth can be attributed to several factors, including the rising incidence of cancer, technological advancements, genome sequencing advancements, and positive government support for new initiatives.

The epigenetics diagnostics industry is subject to dynamic regulatory outlook. These regulations help reduce potential issues such as misdiagnosis, ambiguous data, and breach of a patient’s database. As a result, governments and regulatory bodies around the world are framing regulations to govern the development and use of epigenetic diagnostics. Rising development of epigenetic diagnostic methodologies and growing awareness among people are also contributing to the need for evolving regulations and guidelines.

There are a limited number of direct substitutes for epigenetic diagnostics. However, there are a number of alternate techniques that can be used to achieve outcomes similar to those of epigenetic diagnostics. Despite the availability of current techniques, companies are making huge investments in the R&D of epigenetic diagnostic methodologies.

Product Insights

Reagents accounted for the largest share of 32.8% in 2024. The large share of this segment is mainly attributed to the high usage of reagents in epigenetic research studies. The two main categories of reagents used in epigenetics are histone and DNA modifiers. Epigenetics is the study of persistent, maybe reversible changes in gene expression that take place without altering the DNA sequence permanently, but that still transfer from one generation to the next generation. Without any changes to the DNA, epigenetically controlled genes can be triggered or suppressed.

The services segment is expected to record the fastest CAGR of over 17.9 % during the forecast period. Demand in the service segment is driven by trends such as the increasing prevalence of chronic diseases, advancements in sequencing technologies, and higher research and development investments.

The kits segment is anticipated to grow rapidly during the forecast period. Epigenetic kit demand is fueled by trends such as a rise in chronic disease cases, a growing aging population, and an increase in the application of epigenetic treatments. In addition, the growing awareness among people and an increasing number of companies involved in the development of advanced kits will push segment growth further.

Technology Insights

DNA methylation held the largest market share of 44.5 % in 2024. DNA is treated biochemically and enzymatically by methylation-sensitive enzymes as part of the DNA methylation process, which is used to prepare DNA for methylation analysis. The DNA methylation method holds great promise for unraveling the functional processes behind complicated disorders as well as developing individualized medicines. The rising demand for DNA methylation techniques is responsible for market growth. Technology advancements are making it possible to evaluate locus-specific DNA methylation on a genome-wide scale more often. In October 2024, EpiMedTech announced the launch of a tool called epiGeneComplete, which will use next-generation sequencing to provide insights about various health factors.

The histone acetylation segment is expected to register the fastest CAGR of 18.3 % during the forecast period due to its improved efficacy as a result of the development of innovative methods. Many studies indicate that histone acetylation could provide therapeutic benefits for conditions like solid tumors, inflammation, leukemia, and viral infections. Histone Acetyltransferase 1 (HAT1), General Control Norepressible 5 (GNC5), CREB-binding protein (CBP), P300/CBP-binding protein (PCAF), MYST family, P300, TAFII250, and Rtt109 are the HAT subfamilies that have received the most attention to date. It has commonly been claimed that HAT1 contributes to carcinogenesis. With such wide therapeutic potential applications, the market is likely to flourish during the forecast period.

Application Insights

The oncology segment dominated the market in 2024, capturing a market share of 69.1 %. Cancer is currently the primary focus of epigenetics research. With the rising number of cancer cases, the market for epigenetic diagnostics related to cancer is expected to expand. According to the American Cancer Society, the estimated number of new cancer cases in the U.S. in 2024 was 2.01 million, with around 6,11,720 deaths caused by cancer.

The non-oncology application segment is projected to grow at the fastest CAGR of 16.5 % over the forecast period. There has been a growing interest in epigenetics studies in non-oncology diseases. Epigenetics applications in non-oncology diseases include neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, etc., and developmental disorders, such as ASDs, CVDs, metabolic disorders, and many others. The increasing usage of epigenetics in non-oncology indications will further boost the growth of this segment.

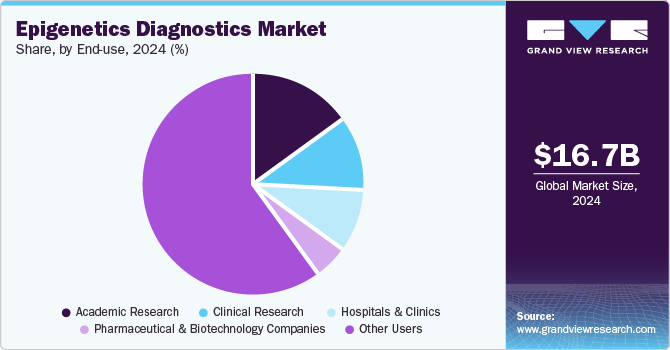

End-use Insights

The academic research segment accounted for the largest market share, at 37.4% in 2024. This segment is driven by increased investments in research and development and growing demand for personalized medicine. For instance, in April 2025, the Swedish government announced it would allocate around USD 8.0 million to enhance precision in genomic medicine within cancer care. Such initiatives highlight the global emphasis on advancing healthcare through genomics and underscore the critical role of academic institutions in pioneering innovative research.

The clinical research segment is expected to grow at the fastest CAGR of 16.6% over the forecast period. Advanced technologies and an increased awareness of epigenetic modifications in disease development drive the market. In January 2025, at Leuven (CME), researchers developed a new diagnostic method that detects both genetic and epigenetic anomalies and gives quick diagnoses in a single analysis.

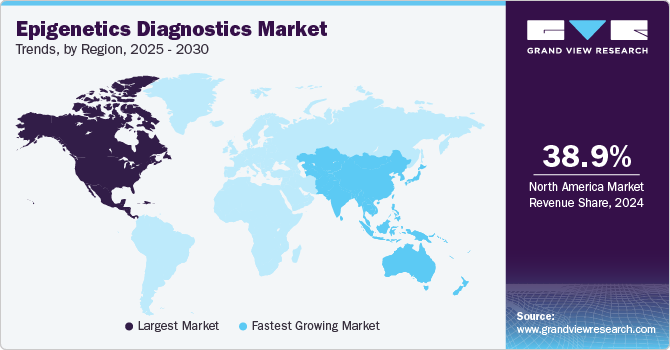

Regional Insights

The North American epigenetics diagnostics market held the largest share of 38.9% in 2024. High awareness among people, advanced medical infrastructure, and high R&D expenditure support the region's market growth. Moreover, the high prevalence of chronic diseases and the increasing investment by market participants in developing epigenetics will further boost regional growth.

U.S. Epigenetic Diagnostic Market Trends

The U.S. dominated the North American epigenetic diagnostics market in 2024 due to government support and funding and an increase in investment in R&D for epigenetic research. In January 2024, the U.S. government allocated USD 1.5 million towards research-focused epigenetic reprogramming. This funding reflects a national commitment to advancing precision medicine and age-related disease management through epigenetic innovation.

Europe Epigenetic Diagnostics Market Trends

The European epigenetics diagnostics market was identified as a lucrative region in 2024. The increasing prevalence of chronic diseases and advanced technology drives its growth. According to the WHO report, in 2022, Europe reported a total of 4,471,422 cancer cases and 1,986,093 related deaths, highlighting the growing prevalence and significant health burden of cancer across the region. The UK epigenetics diagnostics market held a substantial market share in 2024, owing to factors like advancements in gene editing and increased focus on chronic diseases.

Asia Pacific Epigenetic Diagnostics Market Trends

The Asia Pacific epigenetic diagnostic market is anticipated to grow at a CAGR of 16.9 % from 2025 to 2030. This is owing to increasing investment in research & development activities by the government and growing incidences of cancer. For instance, in 2022, the WHO South-East Asia Region recorded 1.4 million cancer-related fatalities and approximately 2.2 million new cases, accounting for over one out of every ten deaths in the region. Lung cancer caused 10.6% of cancer-related fatalities, followed by breast cancer (9.4%), cervical cancer (8%), non-oncology (6.6%), and oral cavity cancer at 6.4%. The growing adoption of epigenetics in developing economies will boost regional market growth during the forecast period. The Indian epigenetics diagnostics market is expected to grow at the fastest CAGR for the forecasted period. This is attributed to drivers like increasing research and development investments and advancements in sequencing technologies.

Key Epigenetic Diagnostics Company Insights

Technological advancements are expected to boost market growth over the forecast period. The market is consolidated due to the presence of major market players, such as Roche Diagnostics; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; and Novartis AG. These players focus on growth strategies, such as new type launches, collaborations, partnerships, expansions, and mergers & acquisitions. In March 2025, L’Oréal partnered with Tru Diagnostic to advance research on beauty and longevity. The collaboration will explore how epigenetic markers relate to skin and hair health, driving innovation in long-term beauty solutions.

Key Epigenetics Diagnostics Companies:

The following are the leading companies in the epigenetics diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Hoffmann- La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Eisai Co. Ltd.

- Novartis AG

- Element Biosciences, Inc.

- Cantata Bio (Dovetail Genomics LLC.)

- Illumina, Inc.

- ValiRx Plc.

- Abcam Ltd.

Recent Developments

- In March 2025, the Ontario Brain Institute partnered with EpiSign to enhance the diagnosis of genetic disorders by leveraging AI and machine learning, ultimately improving patient outcomes.

Epigenetic Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.08 billion

Revenue forecast in 2030

USD 39.15 billion

Growth rate

CAGR of 15.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product , technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK, France, Italy, Spain, Denmark, Sweden, Norway; China, Japan, India, Australia, , South Korea; Brazil, Argentina; South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Roche Diagnostics, Thermo Fisher Scientific, Inc., Eisai Co. Ltd., Novartis AG, Element Biosciences, Inc., Cantata Bio (Dovetail Genomics LLC.) , Illumina, Inc., ValiRx Plc., Abcam plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epigenetics Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global epigenetic diagnostics market report based on product, technology, application and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Kits

-

Chip Sequencing Kit

-

Whole Genomic Amplification kit

-

Bisulfite Conversion kit

-

RNA Sequencing kit

-

-

Instruments

-

Enzymes

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Solid Tumors

-

Others

-

-

Non - Oncology

-

Inflammatory Diseases

-

Metabolic Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Methylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Histone Methylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Histone Acetylation

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Large Non - Coding RNA

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

MicroRNA Modification

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

Chromatin Structures

-

Reagents

-

Kits

-

Instruments

-

Enzymes

-

Services

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global epigenetics diagnostics market size was estimated at USD 12.82 billion in 2022 and is expected to reach USD 14.63 billion in 2023.

b. The global epigenetics diagnostics market is expected to grow at a compound annual growth rate of 15.10% from 2023 to 2030 to reach USD 39.15 billion by 2030.

b. Reagents dominated the epigenetics market with a share of 31.5% in 2022. This is attributable to the growing R&D activities with increasing demand for rapid and sensitive diagnostic techniques.

b. Some key players operating in the epigenetics diagnostic market include F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; and Novartis AG.

b. Key factors that are driving the epigenetics diagnostic market include the increasing prevalence of cancer and other chronic diseases along with the rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.