- Home

- »

- Biotechnology

- »

-

MicroRNA Market Size And Share, Industry Report, 2033GVR Report cover

![MicroRNA Market Size, Share & Trends Report]()

MicroRNA Market (2025 - 2033) Size, Share & Trends Analysis Report By Products & Services, By Application (Cancer, Infectious Diseases, Neurological Disease), By End-use (Biotechnology & Pharmaceutical Companies, Academic & Government Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-368-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

MicroRNA Market Summary

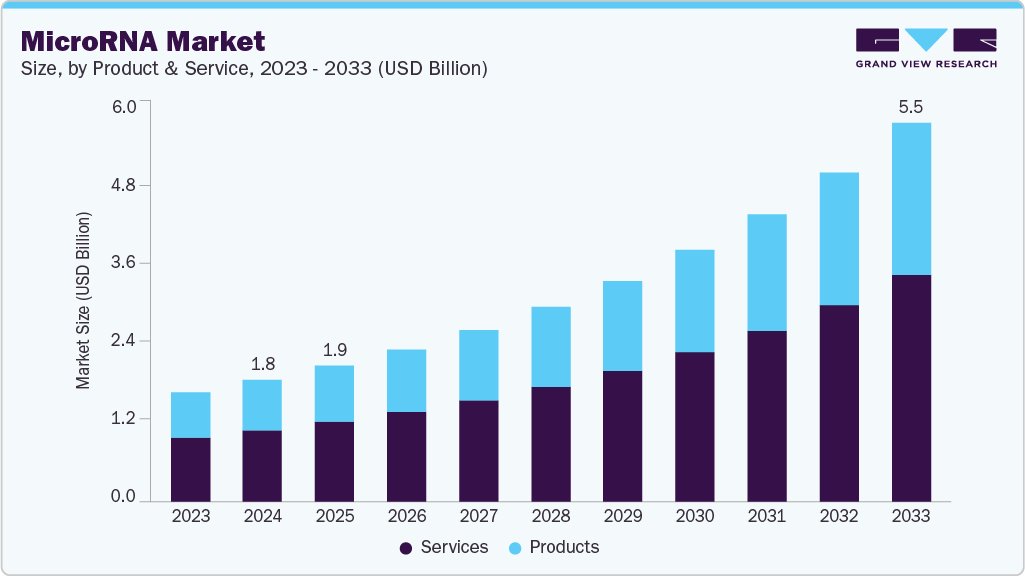

The global microRNA market size was estimated at USD 1.76 billion in 2024 and is projected to reach USD 5.48 billion by 2033, growing at a CAGR of 13.64% from 2025 to 2033. The increasing prevalence of diseases such as cancer, cardiovascular diseases, and neurological disorders across the globe, as well as growing advancements in genomic technologies, are the prime factors that drive market growth.

Key Market Trends & Insights

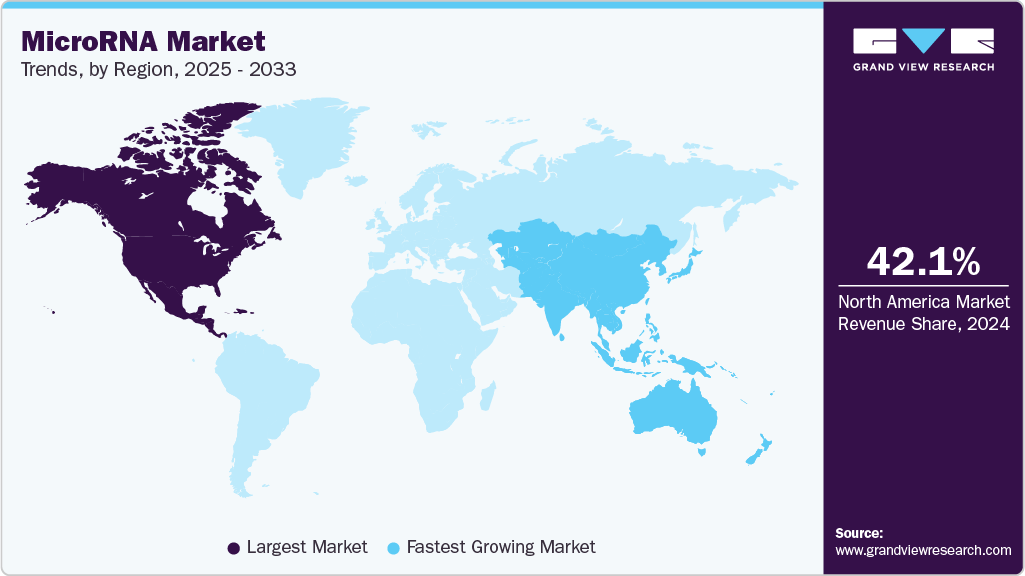

- The North America microRNA market held the largest share of 42.06% of the global market in 2024.

- The microRNA industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the services segment held the highest market share in 2024.

- By application, the cancer segment held the highest market share of 36.65% in 2024.

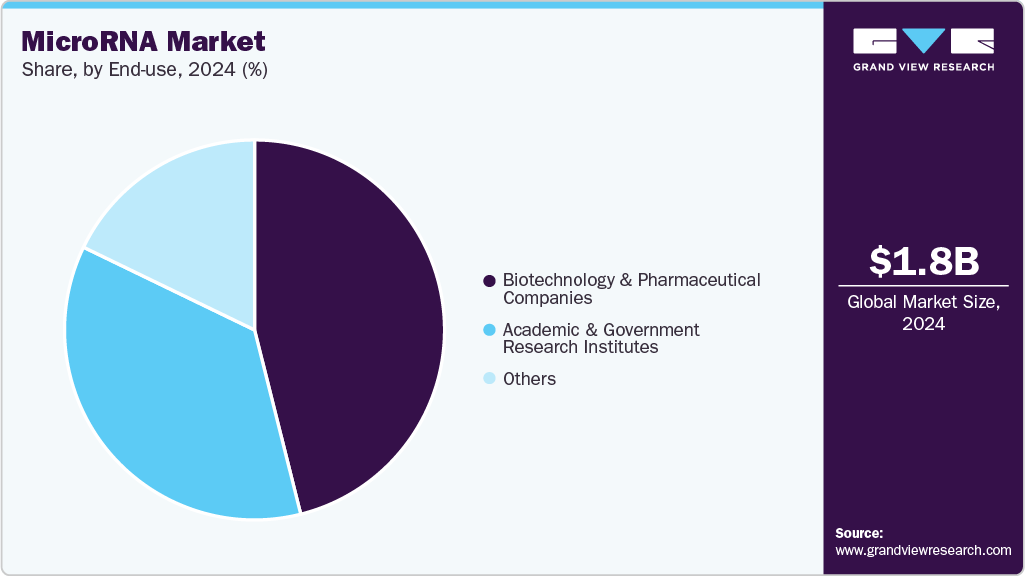

- By end-use, the biotechnology and pharmaceutical companies segment dominated the market in 2024 of 46.09%.

Market Size & Forecast

- 2024 Market Size: USD 1.76 Billion

- 2033 Projected Market Size: USD 5.48 Billion

- CAGR (2025-2033): 13.64%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding Use of miRNA in Drug Development & TherapeuticsThe growing adoption of miRNAs as powerful tools in drug development and precision therapeutics is a key driver of the microRNA (miRNA) market. Pharma and biotech companies are increasingly investing in miRNA mimics and inhibitors to modulate entire gene-regulatory networks, offering therapeutic potential in oncology, metabolic and fibrotic diseases, neurological disorders, and rare genetic conditions where traditional approaches often fall short. This ability of miRNAs to influence complex molecular pathways rather than single targets positions them as a transformative therapeutic class, significantly accelerating market demand.

Clinical Trials involving MicroRNA in 2024 & 2025

NCT Number

Conditions

Sponsor

Completion Year

NCT07181330

Cytomegalovirus Infections

Ting YANG

2025

NCT05680935

Atherosclerosis of Artery

I.M. Sechenov First Moscow State Medical University

2024

NCT05279079

Acute Pancreatitis Drug-Induced

University of Liverpool

2025

NCT06490055

Gastric Cancer

City of Hope Medical Center

2025

NCT05318898

Insulin Resistance

Instituto Nacional de Ciencias Medicas y Nutricion Salvador Zubiran

2024

NCT03931109

Primary Hyperparathyroidism

University of Pennsylvania

2024

NCT06342427

Gastric Cancer

City of Hope Medical Center

2024

NCT06414720

Endometriosis

University of Udine

2025

NCT06342401

Colorectal Cancer

City of Hope Medical Center

2025

NCT07139171

Schizophrenia

Tianjin Anding Hospital

2025

NCT06611046

Liver Transplant

Mar Dalmau

2024

NCT06786273

Fertility

Inti Labs

2024

NCT04089943

Peripheral Arterial Disease

University of West Florida

2025

NCT06271980

Colorectal Cancer

City of Hope Medical Center

2024

NCT04967807

Myocardial Injury

University Health Network, Toronto

2025

NCT06314971

Colorectal Cancer

City of Hope Medical Center

2025

NCT06866301

Anorexia Nervosa

University of Oviedo

2025

NCT06381583

Esophagus Cancer

City of Hope Medical Center

2024

NCT03999788

Multiple Sclerosis

Neuromed IRCCS

2025

NCT06037603

TBI (Traumatic Brain Injury)

University of Nevada, Las Vegas

2025

NCT04746586

Adolescent Idiopathic Scoliosis

Istituto Ortopedico Rizzoli

2025

NCT06529614

Breast Cancer

Tongji Hospital

2025

NCT05753254

Reactive Hyperemia

National Research Centre for the Working Environment, Denmark

2024

NCT04851210

Osteoarthritis

Istituto Ortopedico Rizzoli

2024

NCT02459106

Type 2 Diabetes Mellitus

AdventHealth Translational Research Institute

2024

NCT05921812

Non-Hodgkin Lymphoma

Sohag University

2025

NCT06439940

Breast Cancer Female

Oncoliq US Inc

2025

NCT06261723

Periodontal Diseases

Milagros Rocha Barajas

2025

NCT06527534

Rheumatoid Arthritis

Universita di Verona

2025

NCT06863870

Melanoma Neoplasms

IRCCS Azienda Ospedaliero-Universitaria di Bologna

2025

NCT06277986

Cachexia

Xijing Hospital

2024

NCT04321031

Nonalcoholic Fatty Liver Disease

Pfizer

2024

NCT04259125

Neonatal Seizure

University of California, San Francisco

2025

NCT04906330

Breast Cancer

Hospital Militar Central Cirujano Mayor Dr. Cosme Argerich

2025

NCT04703647

Complex Regional Pain Syndrome Type I

Clinique Romande de Readaptation

2025

NCT07037953

Chronic Kidney Disease

Ain Shams University

2025

NCT01849952

Astrocytoma

Dartmouth-Hitchcock Medical Center

2025

NCT03304678

Lymphangioleiomyomatosis

National Heart, Lung, and Blood Institute (NHLBI)

2025

NCT06388967

Pancreatic Cancer

City of Hope Medical Center

2025

NCT06899828

Heart Transplanted Patients

Fondazione IRCCS Policlinico San Matteo di Pavia

2024

NCT05826444

Cardiac Allograft Vasculopathy

German Heart Institute

2025

NCT03866109

Glioblastoma Multiforme

Genenta Science

2025

NCT06261294

Lung Cancer

Pharus Taiwan, Inc.

2025

NCT03667092

Midgut Neuroendocrine Tumors

University Hospital, Toulouse

2024

NCT06560541

Diabetes Mellitus, Type 2

Taylor's University

2024

NCT05147961

PreDiabetes

University of Pisa

2025

NCT06298799

Type 2 Diabetes|Obesity

GENGE

2025

NCT06736275

Advanced Cancer

Jiangsu Nutai Biologics Co., Ltd

2025

Source: Clinical Trial.gov.in, Secondary Research, Grand View Research

The advancement of miRNA-based therapeutics into preclinical and clinical pipelines is boosting commercialization prospects and fueling strong market momentum. With regulatory agencies becoming increasingly receptive to RNA-based modalities, the miRNA therapeutics segment is rapidly emerging as a high-growth area, driving demand for miRNA reagents, assays, sequencing tools, and delivery technologies across the broader market.

Increasing Cancer Prevalence and Need for Early-Stage Diagnostics

The rising global burden of cancer is a key driver of demand in the microRNA (miRNA) market, as healthcare systems increasingly seek early and accurate diagnostic solutions. miRNAs offer exceptional stability in body fluids such as blood, urine, saliva, and cerebrospinal fluid, making them well-suited for non-invasive testing. Their ability to capture disease-specific gene expression patterns enables earlier detection than many imaging or protein-based biomarkers. As cancer rates escalate due to aging populations and lifestyle and environmental factors, clinicians are turning to miRNA-based molecular signatures to improve diagnostic precision, support timely intervention, and reduce the costs associated with late-stage disease management.

miRNA technologies are becoming central to the growth of liquid biopsy platforms, offering high sensitivity for detecting tumor-derived signals and enabling applications such as treatment response tracking, recurrence prediction, and minimal residual disease monitoring. With precision oncology expanding and clinical validation studies consistently demonstrating the accuracy of miRNA biomarkers, cancer research remains the largest and fastest-growing application segment in the microRNA market, further accelerating overall market growth.

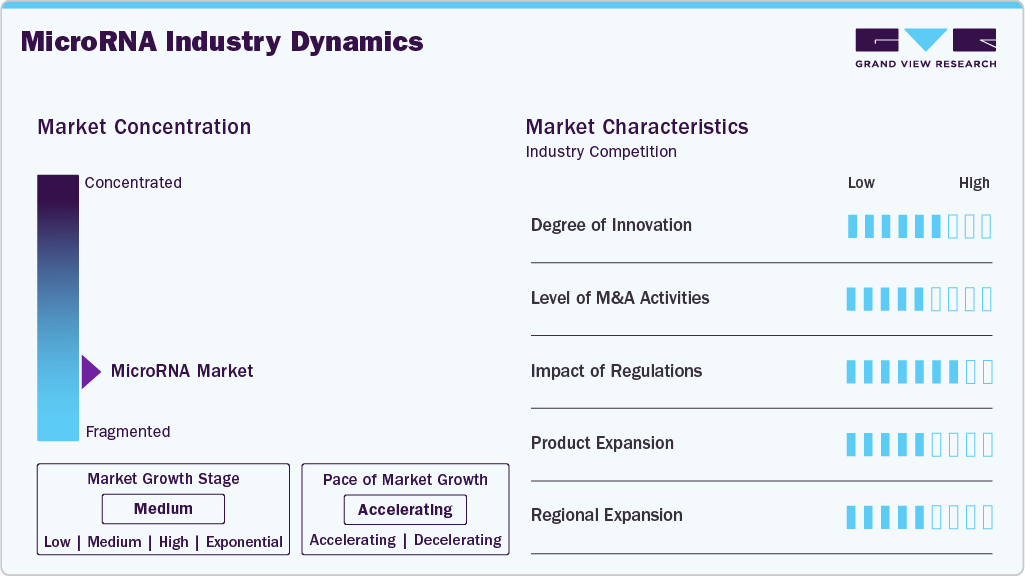

Market Concentration & Characteristics

The microRNA industry is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. This innovation extends across product formulations, delivery methods, and sustainability practices.

Several market players, such as Merck KGaA, Thermo Fisher Scientific, Inc., and QIAGEN, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in October 2023, Thermo Fisher Scientific planned to invest USD 3.1 billion to acquire Olink Holding AB to expand its life sciences portfolio, which aids in drug discovery.

Regulations strongly shape the microRNA industry by governing how miRNA-based diagnostics and therapeutics are validated, approved, and commercialized. Strict FDA and EMA requirements for analytical accuracy, clinical validation, and data security can raise development costs and slow product launches. At the same time, increasing regulatory openness toward RNA-based technologies and liquid biopsy tools is gradually streamlining approval pathways. As a result, regulatory oversight both limit and enables market growth, ensuring safety and standardization while supporting evidence-driven innovation in the miRNA space.

Product expansion is driving the microRNA industry as companies introduce more advanced sequencing kits, qPCR assays, extraction reagents, and bioinformatics tools to meet growing research and clinical needs. The launch of new diagnostic panels, delivery systems, and therapeutic candidates is further widening application areas across cancer, neurology, and other diseases. This continual diversification enables users to access more efficient, sensitive, and scalable miRNA solutions, accelerating market adoption and overall growth.

Regional expansion is driving microRNA industry growth as companies increase their presence in high-potential areas like Asia-Pacific, Latin America, and the Middle East. Growing research investment, rising healthcare spending, and expanding biotech ecosystems are boosting demand for miRNA tools and diagnostics. By building local partnerships and distribution networks, companies enhance market reach, reduce supply barriers, and accelerate global adoption of microRNA technologies.

Product & Service Insights

The service segment held the largest revenue share in 2024, driven by strong demand for isolation and purification, miRNA cDNA synthesis, profiling, localization and quantification, functional analysis, and other advanced service offerings that support comprehensive microRNA research and analysis.

The product segment is anticipated to witness significant market growth over the forecast period. Factors such as growing application as a potential biomarker in disease diagnosis and the presence of a substantial number of companies offering consumables such as kits and reagents for miRNA expression studies are chiefly attributed to the growth of the segment.

Application Insights

The cancer segment accounted for the largest revenue share in 2024 of 36.65%. The highest revenue share is due to high investments in cancer research, adopting miRNA signatures. Moreover, progress in clinical trials for therapies based on miRNA and clinical diagnostic tests for the differentiation of cancer subtypes and the stage is anticipated to fuel revenue growth. miRNA diagnostics is not only a surplus approach for the diagnosis of differentiated cancer but is also considered a potential breakthrough in cancers of unknown origin.

The infectious disease segment is estimated to register the fastest CAGR over the forecast period. miRNAs are rapidly being recognized as robust biomarkers of human diseases, as they play a significant role in regulating gene expression at the post-transcriptional level. Thus, the factors above are attributable to the segment growth. Moreover, the sudden increase in the growth rate of the infectious diseases segment was observed during the pandemic period, which further boosted the segment growth.

End-use Insights

The biotechnology and pharmaceutical companies segment dominated the market in 2024 of 46.09%, due to active partnerships with research institutions to speed up miRNA innovation and large-scale project development, the biotechnology and pharmaceutical companies. For instance, in August 2022, Singapore-based MiRXES launched a multi-cancer screening research initiative, new laboratories, and an Industry 4.0 manufacturing facility.

The academic and government research institutes segment is expected to witness strong growth, driven by the extensive use of miRNA techniques across a rising number of research studies. For instance, in October 2022, BHU researchers identified a microRNA capable of selectively destroying cervical cancer cells, highlighting the growing role of academic discoveries in advancing potential miRNA-based therapies.

Regional Insights

North America dominated the microRNA industry in 2024 with the largest share of 42.06%. Factors such as the local presence of a substantial number of key players such as Thermo Fisher Scientific; NanoString Technologies, Inc.; Merck KGaA.; and others, coupled with an upsurge in research and development spending by key players to develop innovative and advanced products are attributed for the miRNA industry growth in the region. For instance, in February 2025, Canada’s Afynia Laboratories secured USD 5M in seed funding to commercialize EndomiR, a microRNA-based blood test designed to accelerate non-invasive endometriosis diagnosis across North America.

U.S.MicroRNA Market Trends

The U.S. held a significant share of the North American market in 2024, supported by the presence of major players like Thermo Fisher Scientific, Merck KGaA, and QIAGEN, along with their strong distribution networks and R&D capabilities. The nation has easy access to miRNA services and products, and the market is growing thanks to continued research. For instance, in August 2021, researchers at the Texas Heart Institute used miRNA profiling to produce new disease insights, underscoring the growing significance of miRNAs in comprehending gene regulation and disease mechanisms.

Europe MicroRNA Market Trends

The microRNA (miRNA) industry in Europe is growing steadily, driven by strong research activity in countries like Germany, the UK, and France. Advancements in diagnostics and personalized medicine are increasing demand for miRNA-based biomarkers, while therapeutic applications are expanding through clinical research in rare and chronic diseases.

The UK microRNA market is growing, driven by AI-based diagnostics and research in cancer, neurodegenerative diseases, and precision medicine.

The Germany microRNA market is growing through non-invasive, blood-based diagnostics, especially in cancer immunotherapy. Strong academic research and next-generation sequencing support biomarker discovery. Emerging bioinformatics tools are enhancing miRNA data analysis for clinical applications.

Asia Pacific MicroRNA Market Trends

The Asia Pacific region is expected to grow at the fastest CAGR of 13.64% during the forecast period. Factors such as the presence of a significant target population, faster adoption of an array of technologies, several startups coupled with developing healthcare infrastructure, and the existence of high-unmet clinical needs are anticipated to provide growth opportunities to key manufacturers in the region. For instance, In October 2025, India launched its first microRNA-based blood test for breast cancer screening, enhancing early detection capabilities and driving demand for microRNA technologies in the diagnostic market.

The China microRNA market is growing rapidly, driven by blood-based diagnostics for early cancer detection and miRNA-based therapeutics. Strong research in cancer and cardiovascular diseases supports translational innovation. Nanoparticle and exosome delivery systems are expanding clinical applications.

The Japan microRNA industry is growing, driven by therapeutic development and biomarker discovery for cancer and autoimmune diseases, supported by strong research infrastructure and government funding.

MEA MicroRNA Market Trends

The MEA microRNA market is emerging, led by research in cancer diagnostics and infectious diseases. Investment in genomics research and growing adoption of non-invasive biomarker tests are driving gradual market growth.

The Kuwait microRNA market is still in its early stages, with limited clinical applications. Growth is driven by increasing research in cancer and metabolic disorders, supported by government health initiatives and collaborations with regional research centers.

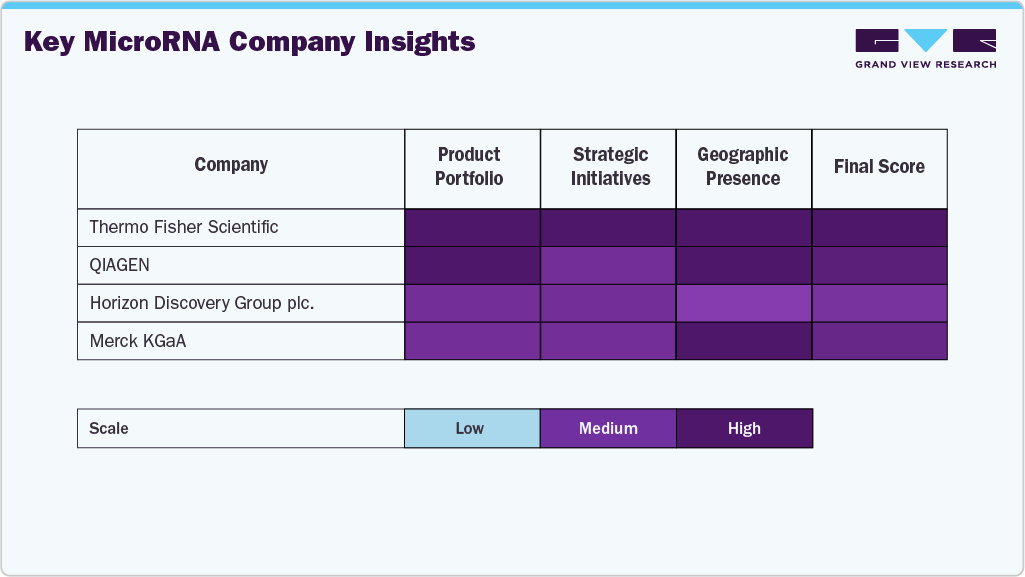

Key MicroRNA Company Insights

Key players dominate the microRNA (miRNA) industry through extensive product portfolios, strategic partnerships, and consistent R&D expenditures. Both established industry leaders and up-and-coming innovators drive the market. With their sophisticated miRNA profiling platforms, reliable reagent kits, and integrated analytical solutions for academic, clinical, and pharmaceutical applications, companies like Thermo Fisher Scientific, Inc., QIAGEN, Horizon Discovery Group plc., and NanoString Technologies, Inc. command a sizeable portion of the market.

Specialized miRNA assay kits, next-generation sequencing integration, and customized solutions for oncology, cardiovascular, and neurodegenerative disease research are some of the ways that mid-sized companies like Merck KGaA, Takara Bio, Inc., LGC Limited, and BioGenex are growing their market share. Through regional expansion programs, academic partnerships, and strategic alliances, these companies fortify their market positions.

By creating novel miRNA vectors, mimics, and inhibitors, companies like GeneCopoeia, Inc. and New England Biolabs are fostering the growth of the market and assisting with functional genomics, translational research, and gene regulation studies. Their emphasis on consistent assays and high-quality reagents improves reliability for both clinical and research applications.

Key MicroRNA Companies:

The following are the leading companies in the microRNA market. These companies collectively hold the largest Market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Horizon Discovery Group plc.

- NanoString Technologies, Inc.

- Merck KGaA

- Takara Bio, Inc.

- LGC Limited

- BioGenex

- GeneCopoeia, Inc.

- New England Biolabs

Recent Developments

-

In October 2025, Prerna launched Cantel, a microRNA-based blood test for breast cancer screening in India, offering a minimally invasive early detection solution and boosting demand in the regional microRNA diagnostics market.

-

In April 2025, NeuroSense Therapeutics reported Phase 2b PARADIGM trial results in the U.S., showing PrimeC’s modulation of ALS-related microRNAs, underscoring its disease-modifying potential and boosting regional microRNA therapeutic demand.

MicroRNA Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2033

USD 5.48 billion

Growth rate

CAGR of 13.64% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN; Horizon Discovery Group plc; NanoString Technologies, Inc.; Merck KGaA; Takara Bio, Inc; LGC Limited; BioGenex; GeneCopoeia, Inc; New England Biolabs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

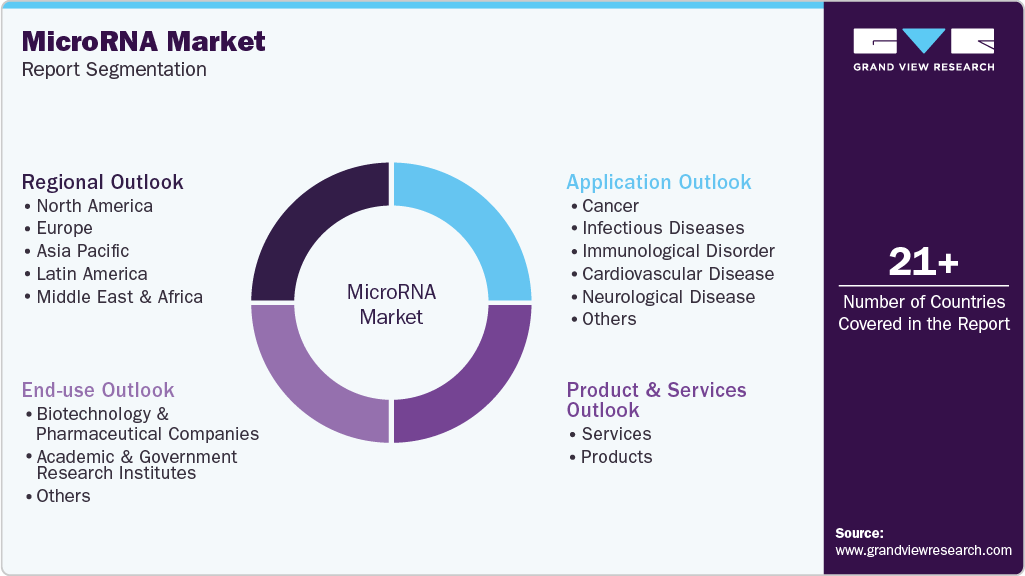

Global MicroRNA Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global microRNA market on the basis of product & service, application, end-use, and region:

-

Product & Services Outlook (Revenue in USD Million, 2021- 2033)

-

Services

-

Type

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis

-

Others

-

-

Specimen

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

-

Products

-

Instruments

-

Technology

-

Real Time PCR

-

Microarray

-

NGS

-

Others

-

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis & Others

-

Others

-

-

-

Consumables

-

Specimens

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis

-

Others

-

-

-

-

-

Application Outlook (Revenue, USD Million, 2021- 2033)

-

Cancer

-

Infectious Diseases

-

Immunological Disorder

-

Cardiovascular Disease

-

Neurological Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2021 - 2033)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microRNA market size was estimated at USD 1.76 billion in 2024 and is expected to reach USD 1.97 billion in 2025.

b. The global microRNA market is expected to grow at a compound annual growth rate of 13.64% from 2025 to 2033 to reach USD 5.48 billion by 2033.

b. microRNA-related profiling, localization, & quantification services dominated the microRNA market with a share of 33.03% in 2024. This is attributable to an increase in functional studies to investigate the role of different miRNAs in various diseases and the increasing adoption of advanced technologies such as NGS for accurate detection and quantification of miRNAs.

b. Some key players operating in the microRNA market include Thermo Fisher Scientific, Inc., QIAGEN, Horizon Discovery Group plc, NanoString Technologies, Inc., Merck KGaA, Takara Bio, Inc, LGC Limited, BioGenex, GeneCopoeia, Inc, and New England Biolabs.

b. The growth of the microRNA market is propelled by substantial investments in research and development initiatives for the development of novel diagnostic tests and therapeutics, coupled with the successful integration of microRNAs in clinical trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.