- Home

- »

- Pharmaceuticals

- »

-

Epigenetics Drugs & Diagnostic Technologies Market Report 2030GVR Report cover

![Epigenetics Drugs & Diagnostic Technologies Market Size, Share & Trends Report]()

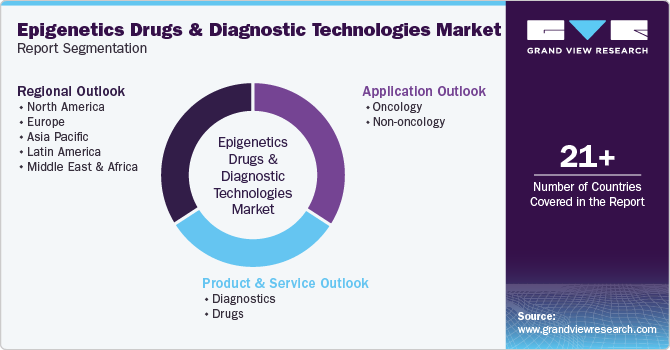

Epigenetics Drugs & Diagnostic Technologies Market Size, Share & Trends Analysis Report By Product & Service (Diagnostics, Drugs), By Application (Oncology, Non-oncology), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-760-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

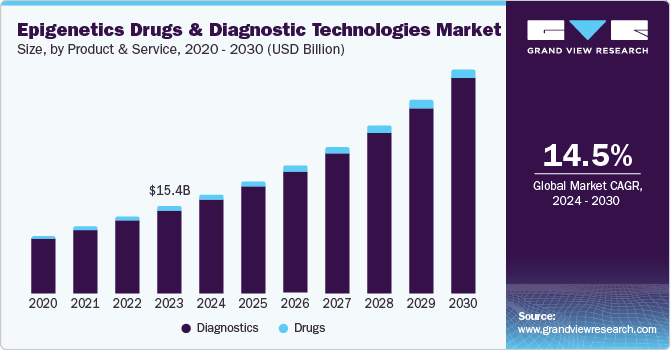

The global epigenetics drugs & diagnostic technologies market size was valued at USD 15.4 billion in 2023 and is projected to grow at a CAGR of 14.5% from 2024 to 2030. This growth is attributed to lifestyle-related disorders such as diabetes and obesity and is also used in screening early-stage cancer and other uncommon differences in skin cells, liver cells, or brain cells. In addition, the growth is further boosted by the rising prevalence of chronic disorders such as central nervous system (CNS) diseases and the introduction of enhanced products.

Studying epigenetics provides healthcare experts and researchers with valuable insights into the molecular processes that affect health and diseases, leading to the prevention of severe disorders, early detection, and more targeted treatments. In addition, the growing occurrences of chronic diseases such as related to central nervous system diseases, Alzheimer’s, Huntington’s disease, schizophrenia, autism, and bipolar disorder across the globe are leading to the positive demand with mounting utilization of epigenetics in drug research, and development has also augmented the growth of the epigenetic diagnostics industry. Furthermore, due to their characteristic of low toxicity, it can be given with other drugs for improved treatment.

This interaction between advanced epigenetic research and the demand for precision medicine facilitates the formation of novel epigenetic diagnostic methods and technologies, which fuels the market for epigenetic drugs and diagnostics. With the advancements in research, implementing epigenetic insights ensures evolving personalized healthcare services and improved patient outcomes. Furthermore, the increasing prevalence of cancer impelled significant improvements in diagnostic procedures, mainly in the field of epigenetics.

Product & Service Insights

Diagnostics products and services dominated the market and accounted for the largest revenue share of 94.9% in 2023 attributed to the increasing prevalence of chronic diseases and cancer, advancements in technology, and a rising geriatric population. Furthermore, diagnostic technology is further categorized into various segments, including reagents, kits, instruments, enzymes, and services. Reagents are expected to keep their dominance as they play an important role in the advancement of epigenetic diagnostics, encouraging innovation and extending diagnostic technology capabilities. In addition, the advancements in technology and the rising demand for personalized medicine further enhance the need for reagents, as they are essential for altering epigenetic states and studying gene expression. Moreover, strategic collaborations among companies boost innovation and product development in this field.

Drugs are expected to grow at a CAGR of 10.9% over the forecast period. This involves Histone Deacetylase (HDAC) and DNA Methyltransferase (DNMT) inhibitors, which are important in the epigenetics drug and diagnostic market, especially in cancer therapy. HDAC inhibitors minimize the elimination of acetyl groups from histone proteins, leading to a more precise chromatin structure and increased gene expression. This is significant in reactivating tumor suppressor genes in cancer cells.

Application Insights

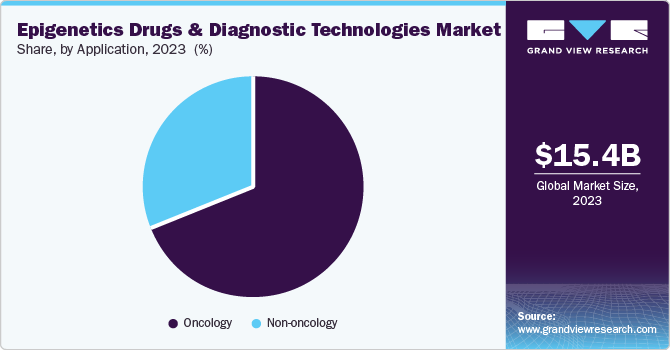

Oncology led the market and accounted for the largest revenue share of 69.1% in 2023 owing to the high prevalence of cancer among people across the world, and the surging number of cancer-related deaths results in the segment growth. However, cancer is a disease with much more clinical significance, with medical research being focused on it. Thus, the alignment of oncology and epigenetics endures to boost diagnostic advances, impacting the scenario of precision therapy for patients diagnosed with cancer. In addition, epigenetics has a prospective for cancer therapies that ensures recovery of the affected genes for normal functioning.

Non-oncology application is expected to grow at a CAGR of 15.5% over the projected years. This growth is driven by the stringent R&D programs initiated by private organizations and biopharmaceutical companies. In addition, epigenetic changes are at the base of many non-oncological disorders, including metabolic disorders, neurodegenerative disorders, and infectious diseases. Furthermore, its applications by epigenetics comprise neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, etc. The increasing usage of epigenetics in non-oncology indications further boosts the growth of the segment.

Regional Insights

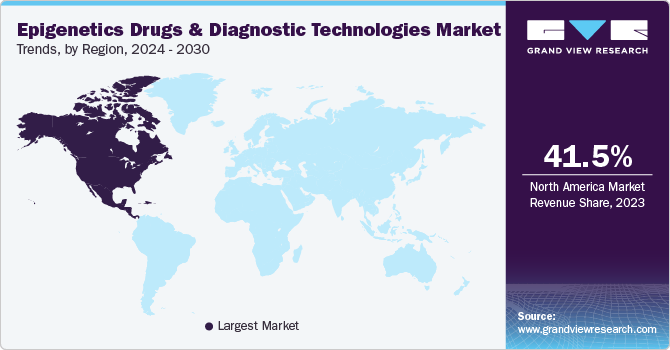

North America epigenetics drugs & diagnostic technologies market dominated the global market and accounted for the largest revenue share of 41.5% in 2023. North America is further expected to grow due to prospective growth, increasing awareness about personalized medicine, and increasing investment in the healthcare sector. The region dominates the market due to the presence of major pharmaceutical companies, academic institutions, and favorable reimbursement policies, which enhance the market growth and epigenetics drugs & diagnostic technologies market share.

U.S. Epigenetics Drugs & Diagnostic Technologies Market Trends

The U.S. epigenetic drugs and diagnostic technologies marketdominated the North American market and accounted for the largest revenue share of 87.3% in 2023. The growing number of epigenetic needs for cancer treatment and other disorders is propelling the implementation of epigenetic drugs and diagnostic technology in the country. In addition, the vast patient population in North America, combined with the rising frequency of chronic diseases that include cancer, diabetes, and cardiovascular disorders, creates a significant demand for accurate and timely diagnostic tools.

Asia Pacific Epigenetics Drugs & Diagnostic TechnologiesMarket Trends

The epigenetic drugs and diagnostic technologies market in Asia Pacific is anticipated to grow at a CAGR of 15.7% over the forecast period. The high prevalence of chronic diseases and technological development in the epigenetics field are likely to be the major drivers propelling

The China epigenetic drugs and diagnostic technologies market is driven by increased awareness of diseases and early diagnosis. Companies are simultaneously focusing on innovation. Partnerships between academic institutions, pharmaceutical companies, and diagnostic technology are nurturing the innovation that drives the market.

India’s presence of government funding initiatives for continuous research projects, enhanced healthcare facilities, and continuously rising geriatric population are some of the leading driving factors. The region has the highest incidence of liver and stomach cancers, with prostate cancer becoming one of the leading male cancers, which results in enhanced and improved epigenetic drugs and diagnostic technologies.

Europe Epigenetics Drugs & Diagnostic Technologies Market Trends

The Europe epigenetic drugs and diagnostic technologies marketis expected to grow significantly over the forecast years. The rising geriatric population, more active lifestyles, and technological innovations have led to the growth of the market, which is led by people who seek quality treatment.

The epigenetic drugs and diagnostic technologies market in Germany leads the European market owing to the prevalence of cancer, people becoming more conscious of early diagnosis, and rising healthcare infrastructure. Moreover, the high prevalence of cancer and other chronic diseases, coupled with a rising geriatric population, are key factors for market expansion. Organizations such as the International Human Epigenome Consortium (IHEC), the National Cancer Institute (NCI), and the National Institute of Health (NIH) are also continuously supported by funding for research and product development in the field of epigenetics.

The UK epigenetic drugs and diagnostic technologies market is expected to grow substantially over the forecast years. This growth is driven by the injuries among patients and their severity, often with multiple fractures and nerve and soft tissue damage. Epigenetic diagnostics technologies are crucial tools for early disease detection, including cancer. Challenges related to drug production remain, but innovations in screening techniques and a growing elderly population continue to drive market expansion. Hence, the epigenetics drugs and diagnostic technologies market is projected for substantial growth in the forecast years.

Key Epigenetics Drugs & Diagnostic Technologies Company Insights

Some of the key companies in the epigenetics drugs and diagnostic technologies market include Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Eisai Co., Ltd., Novartis AG, ELEMENT BIOSCIENCES, Cantata Bio, and Illumina, Inc.; these companies are in the market and are focusing on continuous development and innovation to gain a competitive edge in the industry.

-

Hoffmann-La Roche Ltd., commonly known as Roche, is a research-based healthcare company that develops pharmaceuticals and diagnostics solutions, such as drugs for the treatment of metabolic diseases, used against virus diseases, and cancer treatment. The company is committed to developing life-changing medicines and delivering medical breakthroughs worldwide.

-

Thermo Fisher Scientific, Inc.: Thermo Fisher Scientific Inc. is a life science and clinical research company that offers tools and technologies to help make the world healthier. Its product portfolio includes laboratory supplies, laboratory equipment, clinical and diagnostics products, chemicals, and more healthcare products.

Key Epigenetics Drugs & Diagnostic Technologies Companies:

The following are the leading companies in the epigenetics drugs & diagnostic technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Eisai Co., Ltd.

- Novartis AG

- ELEMENT BIOSCIENCES

- Cantata Bio

- Illumina, Inc.

- Promega Corporation.

- Abcam Limited.

- Merck KGaA

Recent Developments

-

In February 2024, Element Biosciences and DNAnexus have announced a collaboration to enhance multi-omics analysis by enabling direct data streaming from Element's AVITI System to DNAnexus accounts. This integration, set to launch in Q1 2024, combines AVITI's advanced sequencing capabilities with DNAnexus' secure analysis platform. Key features include streamlined data transfer and automated workflows for rapid insights, showcasing a commitment to improving genomic research efficiency and flexibility for users in the life sciences sector.

-

In May 2024, Novartis AG entered an agreement about the acquisition of Mariana Oncology, a biotech company aimed at developing and improving novel radio ligand therapies (RLTs) for the treatment of cancers while providing sufficient patient needs. Furthermore, this will bolster the pipeline of Novartis RLT and widen the company’s research infrastructure and clinical supply abilities, assisting the company’s strategic priorities of oncology and RLT platform innovation.

Epigenetics Drugs & Diagnostic Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.4 billion

Revenue forecast in 2030

USD 39.2 billion

Growth Rate

CAGR of 14.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Eisai Co., Ltd.; Novartis AG; ELEMENT BIOSCIENCES; Cantata Bio; Illumina, Inc.; Promega Corporation.; Abcam Limited.; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epigenetics Drugs & Diagnostic Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global epigenetics drugs and diagnostic technologies market report based on product & service, application, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Reagents

-

Kits

-

Chip Sequencing Kit

-

Whole Genomic Amplification Kit

-

Bisulfite Conversion Kit

-

RNA Sequencing Kit

-

Others

-

-

Instruments

-

Enzymes

-

Services

-

-

Drugs

-

Histone Deacetylase (HDAC) Inhibitors

-

DNA Methyltransferase (DNMT) Inhibitors

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Solid Tumors

-

Liquid Tumors

-

-

Non-oncology

-

Inflammatory Diseases

-

Metabolic Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."