- Home

- »

- Animal Health

- »

-

Equine Artificial Insemination Market Size, Share Report, 2033GVR Report cover

![Equine Artificial Insemination Market Size, Share & Trends Report]()

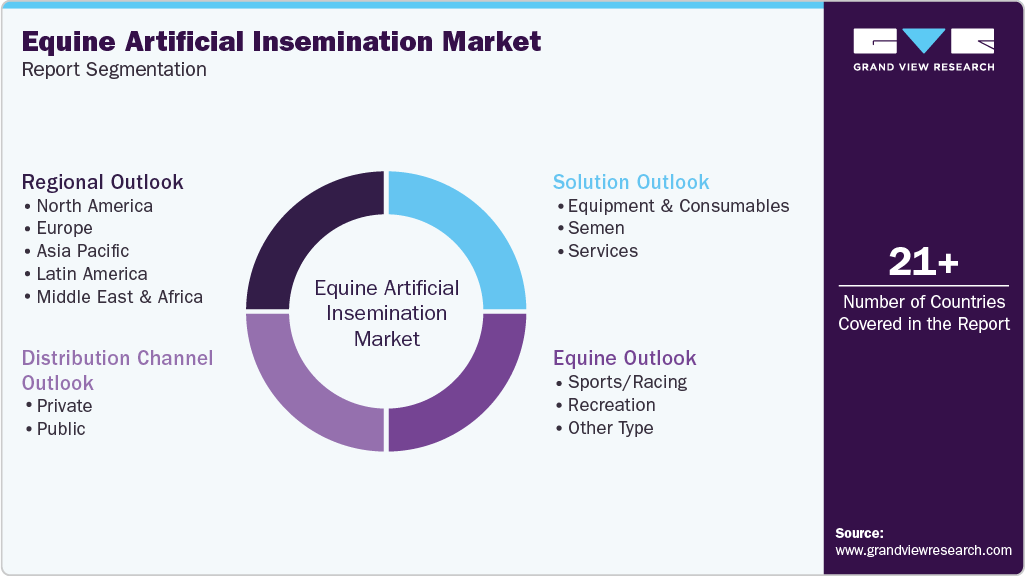

Equine Artificial Insemination Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Equipment & Consumables, Semen), By Equine (Sports/Racing, Recreation), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-067-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Equine Artificial Insemination Market Summary

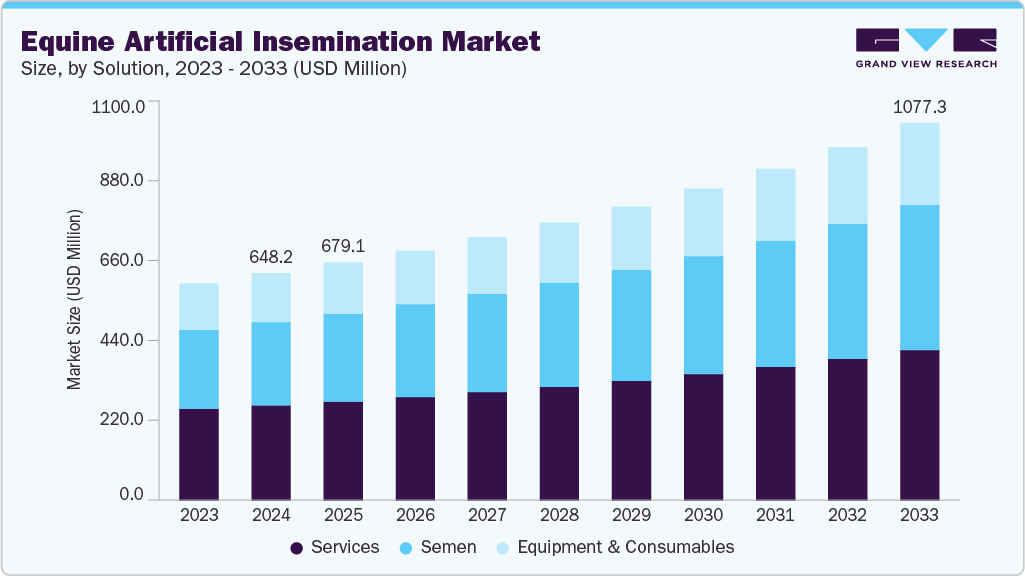

The global equine artificial insemination market size was estimated at USD 648.17 million in 2024 and is projected to reach USD 1,077.33 million by 2033, growing at a CAGR of 5.94% from 2025 to 2033. The market is advancing, driven by rising demand for high-value breeding and genetic improvement, advancements in reproductive technologies and veterinary expertise, anddisease control and biosecurity benefits.

Key Market Trends & Insights

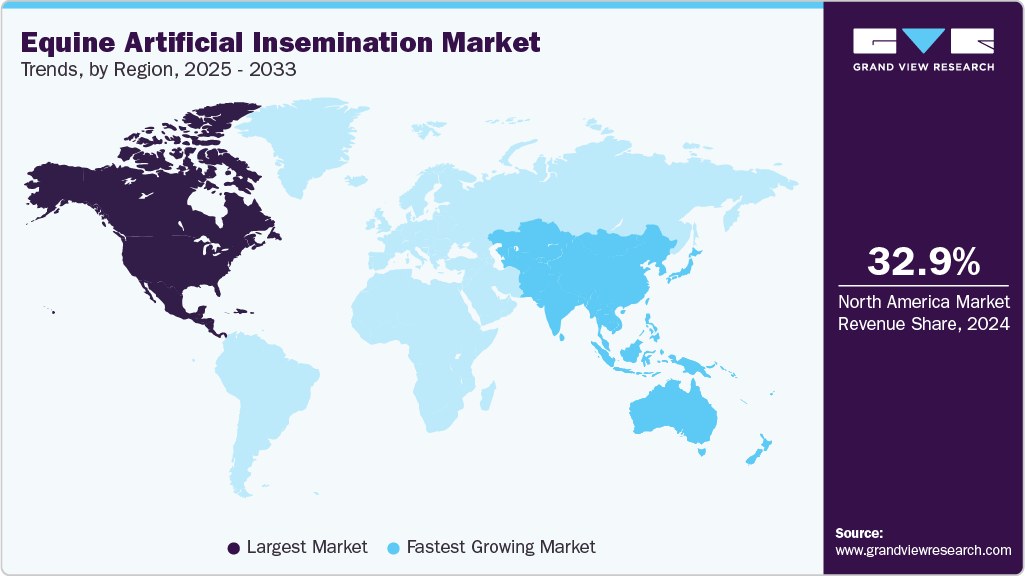

- North America equine artificial insemination market held the largest global revenue share of 32.88% in 2024.

- The equine artificial insemination industry in India is expected to grow at the fastest CAGR from 2025 to 2033.

- By solution, the services segment held the highest revenue share of 41.89% in 2024.

- By equine, the sports/racing segment held the highest market share of 59.69% in 2024.

- By distribution channel, the private segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 648.17 Million

- 2033 Projected Market Size: USD 1,077.33 Million

- CAGR (2025-2033): 5.94%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing demand for high-performance horses in sports, racing, and leisure activities is a major market growth driver. Artificial insemination enables breeders to access superior stallion genetics without geographical limitations, improving offspring quality and market value. In 2022, 1,248 stallions bred 28,548 mares in North America, producing 18,143 live foals for 2023, according to the Jockey Club’s Live Foal Report released in October 2023.Artificial insemination also reduces the risks associated with live cover, such as injuries or disease transmission. Along with technological advancements in semen freezing, storage, and shipping, breeders can utilize genetic material globally, expanding breeding options. This ability to selectively improve desirable traits in foals is fueling artificial insemination adoption among professional breeders and equestrian organizations worldwide.

Technological improvements in semen collection, cryopreservation, and reproductive hormone management have significantly enhanced the success rates of equine artificial insemination. The availability of skilled veterinary professionals and specialized reproduction centers has made artificial insemination more accessible and efficient for breeders. Techniques such as deep-horn insemination and ultrasound-guided procedures improve conception rates, even in mares with challenging reproductive histories. Furthermore, artificial insemination supports better scheduling and planning of breeding programs, allowing multiple mares to be serviced from a single stallion. These innovations are reducing costs, increasing efficiency, and boosting the commercial appeal of artificial insemination in the equine breeding industry. The chart below illustrates a detailed description of various technologies used for artificial insemination:

Technology

Description

Benefits

Limitations

Microfluidic Sperm Isolation Devices (e.g., VetMotl, Samson)

Mimic natural sperm selection in the mare’s tract, isolating motile, morphologically normal sperm with minimal DNA damage.

Higher sperm quality, reduced DNA fragmentation, better fertilization potential.

Lower yield, higher cost than conventional methods.

Electrophoretic Sperm Separation (Felix Device)

Uses electrical currents to separate sperm based on membrane charge and motility in minutes.

Reduced oxidative damage, works on fresh/frozen-thawed semen, improved results for sub-fertile stallions.

Lower sperm yield compared to standard methods.

Low-Dose Deep-Horn Artificial Insemination

Insemination with as few as 3 million motile sperm via hysteroscopy or deep-horn catheterization.

Efficient use of limited sperm, cost-effective, ideal for cryopreserved semen.

Requires skilled handling, invasive procedure.

Advanced Semen Extenders & Preservation (e.g., INRA 96, Botu products)

Antioxidants, antibiotics, and membrane stabilizers to enhance sperm survival in chilled/frozen storage.

Extended semen viability, supports long-distance breeding, preserves motility and membrane integrity.

Dependent on correct handling/storage conditions.

Source: Journal of Reproduction, Fertility and Development.

Equine artificial insemination offers substantial biosecurity advantages, making it a preferred choice for breeders concerned about disease prevention. By eliminating the need for physical contact between stallions and mares, artificial insemination minimizes the risk of transmitting sexually transmitted infections and other contagious equine diseases. Processed semen can also be screened and treated before use, ensuring better herd health. This is especially critical for high-value breeding programs, where disease outbreaks could cause significant financial and genetic losses. As awareness of animal health and welfare grows, artificial insemination as a safe and controlled breeding method continues to strengthen its market demand.

Market Concentration & Characteristics

The equine artificial insemination market exhibits a moderate concentration in the market, and the pace of the growth is accelerating. The market is dominated by global players such as Zoetis, IMV Technologies, NEOGEN Corporation, Stallion AI Services, and MINITÜB GMBH. These companies leverage strong R&D, broad portfolios, and global distribution networks to maintain competitiveness.

The equine artificial insemination industry demonstrates moderate to high innovation, with advancements in semen freezing technology, genetic testing, and AI-specific extenders. Developments in portable semen analyzers, improved cryopreservation methods, and precision ovulation timing are enhancing conception rates. For instance, in September 2024, Memphasys initiated a three-year study with global partners to position its Felix device as a breakthrough in equine sperm selection, aimed at rapid industry adoption and significant commercial opportunities.

M&A activity in the equine AI market is moderate, driven by companies seeking to expand product portfolios and geographic reach. Strategic partnerships with genetic testing firms and veterinary networks are also increasing to enhance service integration and competitive advantage. For instance, in May 2024, Bangalore’sEquipreneur established Yelhanka’s first private equine semen lab with ICAR-NRCE support, offering advanced fresh, cooled, and frozen stallion semen services, marking a milestone in equine reproductive technology.

Regulations significantly influence the equine artificial insemination market, covering animal welfare, biosecurity, and genetic diversity preservation. International breeding standards and country-specific veterinary licensing requirements affect semen import/export and service delivery. Compliance with breed registry rules and quarantine protocols ensures ethical practices, while regulatory variations between regions can either restrict or facilitate cross-border AI services and semen distribution.

Substitutes for equine AI include natural breeding, embryo transfer (ET), and advanced reproductive technologies such as intracytoplasmic sperm injection (ICSI). While AI offers controlled breeding and genetic optimization, natural mating remains preferred in certain breeds due to tradition or registry rules. ET and ICSI are gaining ground in high-value horses but are costlier and require specialized expertise.

Regional expansion in the equine AI market is growing, with providers extending services to emerging equestrian hubs in the Middle East, Asia-Pacific, and Latin America. Increasing horse ownership, competitive sports, and government-backed equine programs fuel demand. Companies leverage distributor networks, partnerships with veterinary clinics, and training programs to establish local presence and adapt solutions to regional breeding practices.

Solution Insights

The services segment accounted for the largest share of 41.89% in 2024, driven by rising demand for specialized reproductive solutions and advanced breeding techniques. Veterinary service providers offer comprehensive solutions, including semen collection, evaluation, storage, transportation, and insemination procedures, ensuring high conception rates and genetic improvement. Growth is further supported by increased adoption of artificial insemination to enhance performance traits, reduce disease transmission, and optimize breeding schedules in sport and racing horses. Technological advancements in semen freezing, sex-sorted semen, and mobile veterinary units have expanded service accessibility, strengthening their dominance and making them the preferred choice for breeders globally.

The semen segment is projected to witness the fastest growth in the global equine artificial insemination industry, fueled by rising demand for high-quality genetics and superior performance traits in horses. Increasing use of chilled, frozen, and sex-sorted semen enables breeders to access top stallions globally without geographical limitations, enhancing breeding efficiency and genetic diversity. Advances in cryopreservation techniques and semen analysis technology have improved viability and conception rates, further driving adoption. The segment’s growth is also supported by expanding international equine trade, higher investment in elite breeding programs, and the preference for artificial insemination to minimize disease risks and optimize breeding outcomes.

Equine Insights

The sports/racing equines segment led the equine artificial insemination market with the largest share of 59.69% in 2024 and is among the fastest-growing segments, driven by the high economic value and demand for superior performance horses. Breeders in this segment prioritize genetic excellence, speed, stamina, and agility, making advanced breeding techniques essential. Artificial insemination enables access to top-tier stallions worldwide, overcoming geographical barriers and improving genetic diversity. Thoroughbreds, Standardbreds, and other competitive breeds benefit from AI’s ability to enhance reproductive efficiency while reducing disease transmission risks. The segment’s dominance is further fueled by the global popularity of horse racing, substantial prize money, and investments in elite breeding programs to produce championship-winning bloodlines.

The other type segment, encompassing work and utility horses, is emerging as a promising area in the equine artificial insemination industry. Demand is rising as these horses are essential for agriculture, forestry, police work, and tourism in many regions. Artificial insemination enables breeders to improve strength, endurance, and temperament while preserving specific working traits. It also facilitates breeding across distances, reducing disease risks and costs associated with live cover. Governments and NGOs supporting rural livelihoods are promoting AI adoption to enhance workhorse productivity and genetic diversity. As modernization meets tradition, this segment is gaining recognition for its economic and cultural importance.

Distribution Channel Insights

The private segment led the equine artificial insemination industry with a revenue share of 65.90% in 2024 and is expected to remain the fastest-growing segment over the forecast period, driven by individual breeders, stud farms, and equestrian business owners aiming to improve breeding outcomes and horse quality. Private stakeholders often invest heavily in premium semen, advanced reproductive technologies, and specialized veterinary services to enhance genetic traits, performance, and health. This segment benefits from greater flexibility in breeding decisions, faster adoption of innovations, and personalized care for each mare. High-value sports, racing, and show horses in the private sector further fuel demand, as owners prioritize producing top-performing offspring with strong market value and competitive advantages. In July 2020, Pearl Pod LLC introduced iUPOD, a magnetic intrauterine device for mares, simplifying insertion, detection, and removal while aiding behavior control and synchronizing ovulation for same-day artificial insemination.

The public segment is emerging as a notable growth area in the equine artificial insemination market, driven by increased government-led breeding programs, research initiatives, and equine population management efforts. Public institutions, including state-run breeding centers, veterinary universities, and research organizations, are investing in advanced reproductive technologies to enhance horse genetics, support sports and racing industries, and preserve native breeds. Subsidies and funding for rural development further encourage the adoption of artificial insemination in public facilities. Additionally, public sector involvement ensures standardized procedures, high-quality genetic material, and wider accessibility, positioning this segment as a catalyst for innovation, education, and sustainable equine breeding practices globally.

Regional Insights

The North America equine artificial insemination market held the largest revenue share of 32.88% in 2024, driven by advanced reproductive technologies, rising demand for superior bloodlines, and improved breeding efficiency. Some of the players include Zoetis, IMV Technologies, and Neogen. Technological advancements like precision sperm selection, cryopreservation, and portable AI equipment are enhancing success rates, while collaborations with veterinary research institutions are expanding commercial adoption across breeding programs.

U.S. Equine Artificial Insemination Market Trends

The U.S. equine artificial insemination industry’s growth is fueled by demand for elite genetics, efficiency in breeding, and regulatory support for assisted reproduction. Players like Zoetis, Neogen, and Stallion AI Services drive innovation. Advancements in sperm selection, cryogenic preservation, and portable AI kits are improving breeding outcomes, while partnerships with equine research centers accelerate technology adoption nationwide.

Europe Equine Artificial Insemination Market Trends

The Europe equine artificial insemination industry showcases lucrative growth, driven by advanced breeding technologies, growing demand for elite sport horses, and rising adoption of ICSI and embryo transfer. For instance, in December 2023, Estonian scientists achieved a milestone by producing the country’s first horse embryo via ICSI, transferring it to a surrogate mare, positioning Estonia among Europe’s elite providers of advanced equine reproductive technologies. Technological advancements in sperm selection, genetic testing, and cryopreservation are enhancing success rates and expanding the cross-border equine genetics trade.

The UK equine artificial insemination market is driven by rising demand for advanced breeding, genetic improvement, and fertility management. Advancements include purpose-built reproduction units, embryo transfer techniques, and improved semen preservation technologies, enhancing breeding efficiency and supporting the country’s strong Thoroughbred and sport horse breeding sector. For instance, in May 2025, Clyde Veterinary Group opened a purpose-built equine reproduction facility in Maddiston, Scotland, offering breeders advanced services such as artificial insemination, natural cover, embryo flush, and infertility investigations.

Asia Pacific Equine Artificial Insemination Market Trends

The Asia-Pacific equine artificial insemination industry is among the fastest-growing regions, driven by growing sport horse breeding, rising equestrian events, and demand for superior genetics. Key players include Kikkuli Breeding, Equibreed, and leading Japanese breeding farms. Advancements in semen freezing, embryo transfer, and ICSI techniques are enhancing breeding success rates, supporting expansion in emerging markets like China, India, and Southeast Asia.

India’s equine artificial insemination market’s growth is driven by the growing demand for superior horse breeds in racing, polo, and ceremonial use, alongside government breeding programs. Key players include Remount Veterinary Corps, ICAR-NRCE, and private breeders like Equipreneur. Advancements in frozen semen technology, embryo transfer, and AI training programs are enhancing genetic diversity and breeding efficiency across the country.

Latin America Equine Artificial Insemination Market Trends

Latin America’s equine artificial insemination industry’s growth is fueled by the rising popularity of horse sports, racing, and breeding for export, especially in Brazil and Argentina. Some of the players include Haras Santa Maria de Araras, Haras La Fortaleza, and regional veterinary universities. Advancements in cryopreservation, embryo transfer, and portable AI kits are improving breeding efficiency and international genetic exchange.

Brazil’s equine artificial insemination market’s growth is driven by its strong Thoroughbred and sport horse breeding industry, demand for superior genetics, and government support for livestock improvement. Some of the companies include Haras Santa Maria de Araras, the Brazilian Association of Horse Breeders, and local veterinary labs. Advancements in semen freezing, embryo transfer, and AI protocols are boosting breeding success and genetic diversity.

Middle East & Africa Equine Artificial Insemination Market Trends

The Middle East equine artificial insemination industry is driven by the region’s strong equestrian heritage, government support for breeding programs, and rising demand for high-value bloodlines. Advancements such as embryo transfer, IVF “test tube foal” techniques, and mobile reproductive services are enhancing breeding efficiency and accessibility. For example, in December 2024, Salam Equine Hospital offered advanced equine reproduction, including AI, natural insemination, embryo transfer, and IVF, supported by mobile clinics delivering expert on-site care across Saudi Arabia.

The South Africa equine artificial insemination market’s growth is driven by a thriving Thoroughbred racing sector, demand for genetic improvement, and supportive breeding regulations. Some of the players include Onderstepoort Veterinary Academic Hospital, Baker McVeigh Equine Hospital, and Kyalami Equine Clinic. Advancements such as chilled and frozen semen technology, embryo transfer, and improved fertility diagnostics are boosting breeding success and expanding international genetic exchange.

Key Equine Artificial Insemination Company Insights

Major players such as Zoetis, IMV Technologies, Stallion AI Services, NEOGEN Corporation, and MINITÜB GMBH command significant market share, leveraging broad product/ service portfolios, global networks, and strong regulatory adherence. They reinforce their positions through innovations in recombinant and vector-based vaccines, expansion into emerging markets, and strategic M&A. Nonetheless, regulatory hurdles, high R&D expenses, and tighter antibiotic use restrictions are influencing competition, while emerging and regional firms gain ground with cost-effective, locally adapted solutions.

Key Equine Artificial Insemination Companies:

The following are the leading companies in the equine artificial insemination market. These companies collectively hold the largest market share and dictate industry trends.

- IMV Technologies

- Stallion AI Services

- NEOGEN Corporation

- Zerlotti Genetics Ltd

- ERC s.r.o.

- CVS (UK) Limited.

- HOFFMAN A.I. BREEDERS INC.

- Nasco

- Continental Genetics, LLC

- MINITÜB GMBH

- Sussex Equine Hospital

Recent Developments

-

In December 2024, Salam Equine Hospital opened in Buraidah, Saudi Arabia, combining advanced technology, innovative design, and specialized expertise to deliver cutting-edge equine care, research, and reproduction services, reflecting the Kingdom’s veterinary innovation ambitions.

-

In September 2024, IMV Technologies acquired UD-Vet B.V., a leading Benelux veterinary equipment and imaging supplier, enhancing regional market presence and service offerings under the continued leadership of Remon van Rijn.

-

In December 2023, Estonian scientists achieved their first equine ICSI embryo pregnancy, joining Europe’s elite providers, in collaboration with Luunja and Perila Stables, marking a major milestone in assisted reproduction for sport horses.

Equine Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 679.08 million

Revenue forecast in 2033

USD 1,077.33 million

Growth rate

CAGR of 5.94% from 2025 to 2033

Historical data

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, equine, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

IMV Technologies; Stallion AI Services; Zoetis; NEOGEN Corporation; Zerlotti Genetics Ltd; ERC s.r.o.; CVS (UK) Limited.; HOFFMAN A.I. BREEDERS INC.; Nasco; Continental Genetics, LLC; MINITÜB GMBH; Sussex Equine Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Equine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global equine artificial insemination market report based on solution, equine, distribution channel, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment & Consumables

-

Semen

-

Normal Semen

-

Sexed Semen

-

-

Services

-

-

Equine Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports/Racing

-

Recreation

-

Other Type

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global equine artificial insemination market size was estimated at USD 648.17 million in 2024 and is expected to reach USD 679.08 million in 2025.

b. The global equine artificial insemination market is expected to grow at a compound annual growth rate of 5.94% from 2025 to 2033 to reach USD 1,077.3 million by 2033.

b. North America dominated the equine artificial insemination market with a share of 32.88% in 2024. This is attributable to greater number of horse farms and the increasing frequency of horse racess.

b. Some key players operating in the equine artificial insemination market include IMV Technologie, Stallion AI Services, Zoetis, Neogen Corporation, Zerlotti Genetics Ltd, ERC s.r.o., CVS (UK) Limited., HOFFMAN A.I. BREEDERS INC., Nasco, Continental Genetics, LLC, MINITÜB GMBH, Sussex Equine Hospital.

b. Key factors that are driving the equine artificial insemination market growth include the adoption of normal semen in developing economies, the rise in demand for horse artificial insemination techniques, and the demand to increase animal productivity and efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.