- Home

- »

- Renewable Chemicals

- »

-

Ethyl Lactate Market Size, Share & Trends Report, 2030GVR Report cover

![Ethyl Lactate Market Size, Share & Trends Report]()

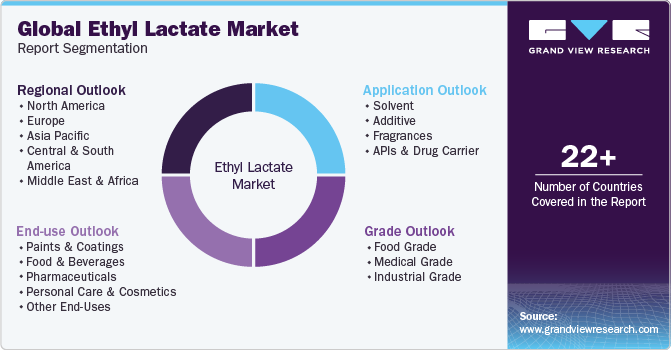

Ethyl Lactate Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (Food Grade, Medical Grade, Industrial Grade), By Application (Solvent, Additive, Fragrances), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-318-8

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethyl Lactate Market Summary

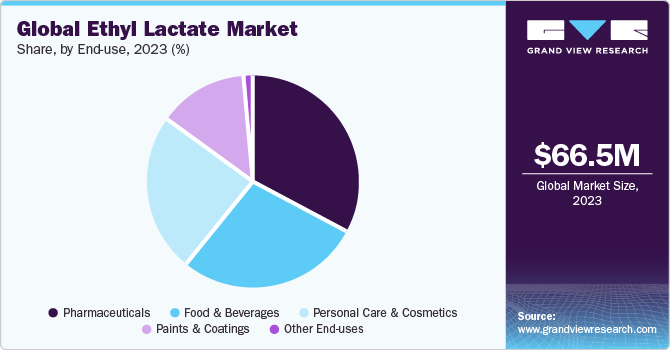

The global ethyl lactate market size was estimated at USD 66,484 thousand in 2023 and is projected to reach USD 85,992 thousand by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The demand for the product is set to witness substantial growth owing to its increasing consumption in the cosmetic & personal care industry due to its low cost and flexible nature.

Key Market Trends & Insights

- North America dominated the ethyl lactate market and accounted for a 35.8% share in 2023.

- Based on grade, the industrial segment dominated the market with the largest revenue share of 39.9% in 2023.

- Based on application, the solvent segment dominated the market with the largest revenue share in 2023.

- Based on end-use, the pharmaceutical segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 66,484 Thousand

- 2030 Projected Market Size: USD 85,992 Thousand

- CAGR (2024-2030): 3.7%

- North America: Largest market in 2023

Ethyl lactate is a less toxic and carcinogenic substance, which makes it a desirable product in the cosmetics & personal care industry. It is 100% biodegradable and can be recycled easily, which makes the product a popular choice across many industries.

A primary objective of the climate goal agreed by the United Nations Climate Change Conference in Glasgow (COP28) was ensuring a safe and environmentally sustainable environment through aligning industries using technology to produce clean, green products. Solvents have originally been major pollutants to the environment. Hence, ethyl lactate is the most feasible substitute for solvents in applications such as industrial coatings that help industries achieve sustainability goals. Coatings provide an enhanced visual appearance and protection against corrosion. The growth in the industrial coatings industry has been attributed to infrastructural development, the growing automotive industry, and sustained construction activity worldwide.

Ethyl lactate is an ideal substitute for acetone and ethyl acetate, both harsher on the skin. Hence, it is used as an additive in cosmetics and perfumes, and its growing global demand is expected to boost perfume consumption. The increased consumer preference for environmentally safe, biodegradable beauty products has been resulting in the usage of sustainable compounds such as ethyl lactate to be increasingly used in the personal care & cosmetics industry. Hence, a number of brands have announced geographic expansion to cater to the growing number of users across the world. For instance, in December 2023, Coty, a fragrance and beauty care brand announced its expansion plans for the Indian market to cater to the country’s booming beauty industry.

Lactic acid is a key raw material used to produce ethyl lactate. In the past few years, climate change has resulted in irregular rainfall, adversely impacting cultivation and crop yield worldwide. This has resulted in increased prices of lactic acid, which is expected to increase in the coming years owing to increased energy and logistics costs. This is expected to place a key restraint on the growth of the ethyl lactate market. Moreover, the increase in input cost has resulted in a decline in profitability in the industry.

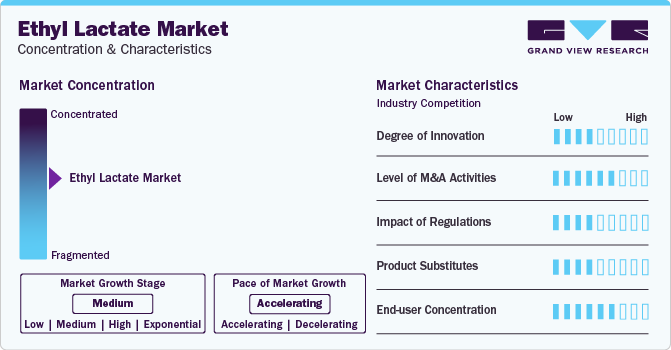

Market Concentration & Characteristics

Market growth stage is exponential, and pace of the market growth is accelerating. Ethyl lactate is an essential ingredient in cleaners, solvents, additives, and fragrances, among others. It is supplied to end-use industries, namely paints & coatings, food & beverages, pharmaceuticals, personal care & cosmetics. Key end-users include Procter and Gamble, S.C. Johnson, Reckitt Benckiser, Henkel AG, Unilever, Avon, THE ESTÉE LAUDER COMPANIES, DNE Nutraceuticals Inc., Trillium Health Care Products Inc., Cafe Bravo Coffee Roasting Co Inc, Citrus Systems Inc., L’Oréal, PepsiCo, and Nestlé.

The paints & coatings industry was characterized by a series of expansions that reflected the growth in its end-use industries. For instance, in February 2024, AkzoNobel Powder Coatings completed an expansion at its Como, Italy plant for an investment of EUR 21.0 million (~USD 22.7 million). The plant will cater to the demand from segments such as consumer appliances, architecture, automotive, agriculture & construction machinery, furniture, and general industry.

In addition, in September 2023, PPG completed the expansion of its powder coatings plant in Sumare, Brazil for an investment of Brazilian Reals 13.0 million (~USD 2.7 million) and increased its production capacity by 40%. This would help the plant to cater to appliance manufacturers, agricultural machinery, transportation, and other consumer goods products. Furthermore, in April 2023, the company announced the completion of its USD 15 million-investment-capacity powder coatings plant in Brazil, Indiana, U.S.

Grade Insights

Based on grade, the industrial segment dominated the market with the largest revenue share of 39.9% in 2023. This is attributed to its versatile & environment-friendly solvent with diverse uses across various industries. Its excellent solvency properties make it suitable for paint and coating formulations, adhesive production, and as a cleaning agent in the electronics and automotive manufacturing industries.

Medical-grade ethyl lactate serves as a versatile compound with several beneficial properties. It is primarily used as a solvent for pharmaceuticals, excipients, and active ingredients, due to its ability to dissolve a wide range of compounds. Its low toxicity and biodegradability make it suitable for various pharmaceutical formulations, including topical creams, ointments, and oral solutions.

One of the key advantages of ethyl lactate in food-grade applications is that it exhibits good stability under typical food processing conditions, including moderate temperatures and pH ranges, ensuring consistent performance and quality in food products. Such advantages of ethyl lactate in food-grade applications are expected to drive the segment in the coming years.

Application Insights

Based on application, the solvent segment dominated the market with the largest revenue share in 2023. This is attributable to the rising demand for ethyl lactate as a green solvent for isolating biologically active ingredients from natural sources. An example includes the extraction of phytosterol from damp corn fibers, resulting in oil products enriched with free fatty acids and phytosterol. Compared to conventional solvents, ethyl lactate stands out as one of the most synthesized organic solvents. Derived from agricultural sources, it can be extracted from plants or synthesized from carbohydrates, such as corn waste or sugar, making it a sustainable and eco-friendly option for various industrial applications.

Ethyl lactate serves as a fragrance agent in various products, due to its pleasant fruity odor. As a fragrance ingredient, ethyl lactate adds a subtle fruity scent to perfumes, colognes, lotions, creams, and other cosmetic and personal care products. Its fruity aroma is often described as sweet and refreshing, making it appealing in a wide range of fragrance formulations. The low volatility and stability of ethyl lactate contribute to its longevity in fragranced products, ensuring the scent remains consistent.

Additionally, ethyl lactate enhances the olfactory experience of consumers by imparting a pleasant and subtle fruity fragrance to various consumer goods. It can soften the harsh edges of other fragrance components, add a touch of fruitiness, and improve fragrance diffusion. This versatility allows perfumers to achieve a more balanced and nuanced final scent.

End-use Insights

Based on end-use, the pharmaceutical segment dominated the market with the largest revenue share in 2023. This is attributed to its use as a carrier solvent for drug delivery systems, such as injectables, transdermal patches, and topical creams. Its ability to solubilize hydrophobic drugs and enhance their bioavailability makes it valuable in improving drug delivery efficiency and patient compliance. Additionally, the low toxicity and biodegradability of ethyl lactate contribute to its acceptance in pharmaceutical formulations, ensuring safety and minimizing environmental impact.

Users in the paints & coatings industry prefer ethyl lactate, as it enhances the performance of coatings by acting as a coalescing agent, promoting film formation, and improving adhesion, durability, and weather resistance. Its compatibility with various resins and additives allows users to tailor coating formulations to meet specific performance requirements while maintaining consistency and quality.

Moreover, ethyl lactate has applications as a preservative in the food industry, helping to extend the shelf life of perishable products by inhibiting the growth of microorganisms and spoilage bacteria. Its antimicrobial properties make it particularly useful in preserving sauces, dressings, marinades, and other liquid food products, thereby reducing food waste and enhancing product safety.

Regional Insights

North America dominated the ethyl lactate market and accounted for a 35.8% share in 2023. This high share is attributable to the growing demand from manufacturers in the region to create products that taste good and deliver functional benefits such as energy enhancement, immune support, or stress relief, the demand for innovative flavor combinations and natural ingredients. Thus, the increasing demand for functional beverages is expected to positively impact the demand for ethyl lactate in the coming years.

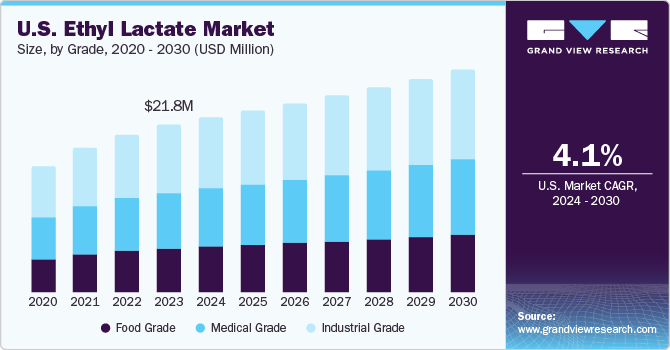

U.S. Ethyl Lactate Market Trends

The U.S. ethyl lactate market is experiencing significant growth from several industries, particularly the food & beverage industry. Ethyl lactate exhibits antimicrobial properties, making it suitable for use as a natural preservative in food products. It can help inhibit the growth of spoilage microorganisms, thereby extending the shelf life of perishable items such as sauces, dressings, marinades, and ready-to-eat meals. In addition, it can be used as a mold inhibitor in bakery products.

Europe Ethyl Lactate Market Trends

Europe has the largest market for personal care products, a factor strongly influencing the ethyl lactate market. The surge in demand for personal care items, notably in Germany, Italy, France, Spain, and the UK, stems from consumers' growing focus on grooming to positively boost self-esteem. With increasing urbanization, there's a corresponding rise in the usage of skincare products, haircare solutions, and cosmetics among city dwellers. Ethyl lactate's adaptability across a spectrum of formulations, from cleansers to exfoliants, underscores its significance within the personal care industry.

Germany ethyl lactate market is growing as the country is the largest producer of biopharmaceuticals in Europe. This is attributed to several crucial factors, including the robust industrial infrastructure, the enduring strength of the local chemical industry, and a highly skilled workforce. The positive trajectory of the German pharmaceutical industry is expected to drive the growth of the ethyl lactate market in the country. Ethyl lactate is a valuable component in pharmaceutical formulations, acting as a solvent for active pharmaceutical ingredients (APIs) and excipients. As the German pharmaceutical sector continues to flourish, the demand for ethyl lactate is anticipated to rise owing to its essential role in producing high-quality pharmaceutical products.

Asia Pacific Ethyl Lactate Market Trends

The easy availability of low-cost labor in various countries of the region makes it an attractive destination for manufacturing companies looking to reduce their overall production costs by undertaking the economies-of-scale approach. Asia Pacific has become a central hub in the global supply chain due to its strategic location and efficient logistics network. Due to these factors, the region has grown significantly in numerous industries including pharmaceutical, healthcare, automotive, mining, and oil & gas. According to the India Brand Equity Foundation (IBEF) report, the size of Indian pharmaceutical market is expected to be USD 130 billion by 2030.

China ethyl lactate market is growing as the country is the world’s largest consumer and importer of food, displaying a significant appetite for imported food and beverage items. According to the China Food Import Report, 2023 China's food imports have demonstrated an impressive CAGR of 12.3% from 2013 to 2023. In 2023 alone, the country's total food imports surged beyond USD 139 billion, solidifying its robust presence as a significant player in the global market. This upward trajectory in China's food and beverage imports underscores the immense scale of the market and the dynamic interplay of consumer preferences and economic factors propelling this growth.

The ethyl lactate market in India is growing as India is the foremost supplier of generic medicines globally, commanding a substantial 20% share of the global supply by volume, according to Invest India. Bolstering this status are over 3,000 pharmaceutical companies nationwide, supported by a network of 10,500 manufacturing facilities and a highly skilled workforce. India's prominence extends to the production of active pharmaceutical ingredients (APIs), with approximately 500 API manufacturers contributing 8% to the global API industry. With a portfolio encompassing 60,000 generic brands spanning 60 therapeutic categories, India accounts for 20% of the global generics supply thereby playing a pivotal role in the pharmaceutical sector.

Central & South America Ethyl Lactate Market Trends

The region is also witnessing an emerging trend of functional drinks. The popularity of functional drinks containing protein and promising increased energy is rising, particularly among fitness enthusiasts. Additionally, immunity-boosting claims have gained prominence in the market. The proliferation of fitness centers in the region further fuels this trend, indicating a growing demand for functional beverages that support overall health and wellness. Thus, the positive influence of users for the functional beverages is anticipated to boost market growth over the forecast period. Ethyl lactate, derived from natural sources such as lactic acid and ethanol, aligns well with this trend. Its natural origin and eco-friendly properties make it an attractive choice for beverage manufacturers aiming to meet consumer preferences for clean-label products.

Brazil ethyl lactate market is growing as Brazil’s pharmaceutical industry expands to meet its population's growing healthcare needs, creating a higher demand for solvents like ethyl lactate. Ethyl lactate is used as a solvent in drug formulations, particularly for oral medications and topical preparations. The rise in drug manufacturing activities will consequently lead to an increased requirement for ethyl lactate.

Middle East & Africa Ethyl Lactate Market Trends

The Middle East is experiencing notable expansion, driven by the increasing purchasing power of its local consumers. With digitalization playing a key role, the region, particularly the Gulf countries, presents abundant growth opportunities, mainly due to untapped per capita potential. The surge in disposable incomes and overall wealth, particularly among the burgeoning younger urban middle class, also creates opportunities for value-added beauty products focusing on health and well-being. Considering these factors, the demand for personal care products is anticipated to grow substantially, consequently positively impacting the market for ethyl lactate in the upcoming years.

The food & beverage market in Saudi Arabia is experiencing notable expansion, propelled by the thriving food and dairy industry and the rising consumption of various food & beverage products, notably milk and dairy items. Furthermore, increasing awareness regarding the health benefits associated with milk and related products, coupled with the growing fitness trend, is expected to further fuel market growth throughout the forecast period.

Key Ethyl Lactate Company Insights

Some of the key players operating in the market include Corbion N.V., ADM, Stepan, and Galactic among others.

-

Corbion N.V. produces and distributes biochemical, biomedical, bioplastic, and food ingredient solutions. Its product line includes lactic acid and its derivatives, emulsifiers, functional enzyme mixes, minerals, vitamins, and algal components. The company provides food solutions to numerous industries, including bakery, poultry, oils, meat, dairy, seafood, drinks, fruits, vegetables, refrigerated foods, and emulsifiers. The company offers biochemical solutions to agrochemicals, animal health and nutrition, pharmaceuticals, chemicals, home care, and personal care applications.

-

Archer Daniels Midland Co (ADM) produces, processes, transports, stores, and markets agricultural products, commodities, and ingredients. The company manufactures food & beverage ingredients and other products from corn, wheat oilseeds, and other agricultural commodities.

Aurochemicals, Henan Kangyuan, Musashino Chemical Laboratory, Ltd. are some of the emerging market participants in the Ethyl Lactate market.

-

Aurochemicals specializes in the research, production, and quality assurance of flavor and aroma ingredients. The company offers its products to various industries, such as food & beverages, pharmaceuticals, and cosmetics. The company serves its customers on five continents, including client corporations such as Givaudan and Firmenich.

-

Henan Kangyuan is engaged in the manufacturing and sales of food additives, edible essences, and fine chemical products. Its main products for production and sales include food additives (ethyl caproate, ethyl lactate, ethyl octanoate, propyl acetate, phenylethanol, 2,3 butanedione, ethyl propionate, ethyl isobutyrate, ethyl butyrate, isoamyl acetate, glacial acetic acid (low-pressure carbonylation method), acetal, glycerol, allyl hexanoate, allyl heptanate), ethyl acetate, ethyl heptanate, lactic acid, caproic acid, butyric acid, and propionic acid.

Key Ethyl Lactate Companies:

The following are the leading companies in the ethyl lactate market. These companies collectively hold the largest market share and dictate industry trends.

- Corbion N.V.

- ADM

- Stepan

- Musashino Chemical Laboratory

- Vertec Biosolvents

- Galactic

- Henan Kangyuan

- Godavari Biorefineries Ltd

- Aurochemicals

Recent Developments

-

In September 2022, Stepan announced the acquisition of the surfactant business and associated assets of PerformanX Specialty Chemicals, LLC. Headquartered in Westerville, Ohio. PerformanX includes ethoxylates, disinfectants, lubricant additives, and a variety of specialty products for markets that range from the paints and coatings, cleaning & detergents to oil and gas, personal care, and pulp and paper industries.

-

In July 2021, Corbion NV announced the acquisition of a Mexico-based provider of functional blends, Granolife. The company plans to expand its market reach in the Mexican bakery and fortification industries. By expanding Granolife's presence, expertise, blending capabilities and application laboratories, Corbion NV pans to make a significant difference in the Mexican market.

Ethyl Lactate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 69,313 thousand

Revenue forecast in 2030

USD 85,992 thousand

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons; revenue in USD thousand and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Corbion N.V.; ADM; Stepan; Musashino Chemical Laboratory; Vertec Biosolvents; Galactic; Henan Kangyuan; Godavari Biorefineries Ltd; Aurochemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethyl Lactate Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ethyl lactate market report based on grade, application, end-use, and region:

-

Grade Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Food Grade

-

Medical Grade

-

Industrial Grade

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Solvent

-

Additive

-

Fragrances

-

APIs & Drug Carrier

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Paints & Coatings

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Other End-Uses

-

-

Region Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global ethyl lactate market size was estimated at USD 66,484 thousand in 2023 and is expected to reach USD 69,313 thousand in 2024.

b. The global ethyl lactate market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030, reaching USD 85,992 thousand by 2030.

b. North America dominated the ethyl lactate market with a share of 35.8% in 2023. This is attributable to rising consumers' growing interest in the health benefits offered by functional beverages, leading to significant changes across the food & beverage industry

b. Some key players operating in the ethyl lactate market include Corbion, Galactic, Vertec Biosolvents, Godavari Biorefineries Ltd, Henan Kangyuan, Musashino Chemical (China) Co., Ltd, etc.

b. Key factors driving market growth include increasing consumption in the cosmetic and personal care industry due to its low cost and flexible nature.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.