- Home

- »

- Advanced Interior Materials

- »

-

Europe Air Compressor Market Size & Share Report, 2030GVR Report cover

![Europe Air Compressor Market Size, Share & Trends Report]()

Europe Air Compressor Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Product, By Lubrication, By End-use, By Operating Mode, By Power Range, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-175-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Air Compressor Market Size & Trends

The Europe air compressor market size was estimated at USD 6.46 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.0 % from 2024 to 2030. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly equipment. Furthermore, rising automation and robotics in many industries are driving market growth since air compressors play a crucial role in powering pneumatic systems used in these applications.

Air compressors are used in various pollution control and emission reduction processes to ensure compliance with these regulations.

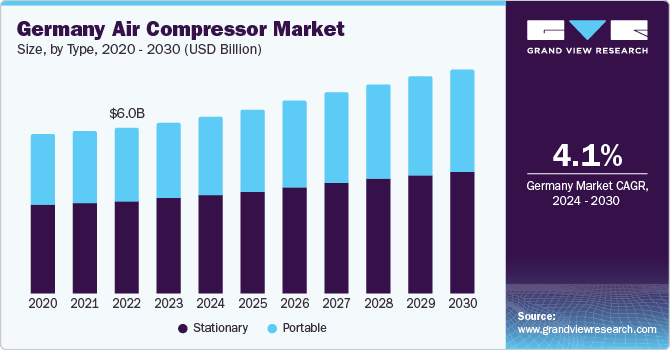

The Germany market is undergoing several trends and developments, driven by a range of factors such as the growing demand for energy-efficient and environmentally friendly compressed air systems. Businesses in Germany are increasingly focused on reducing their energy consumption and carbon footprint through the adoption of oil-free air compressors that offer a more efficient and sustainable alternative to traditional oil-lubricated compressors.

Germany is one of the most prominent automotive markets in Europe, with 42 engine production and assembly plants that contribute to one-third of the total automobile production in the region. The country is a prominent producer of passenger cars among all the member countries of the European Union and accounted for over 30% share of the European automotive market in 2022. This positive scenario of automotive industry along with the shifting trend toward the deployment of highly efficient air compressors is expected to propel market growth over the forecast period.

This shift in customer behavior is brought about by fast-paced technological advancements and increasing investments in research & development in the country. For instance, Alup Kompressoren, with more than 90 years of experience in the compressors segment, offers oil-free air compressors. The ALUP Compressor’s OF 75-220Hp and ALUP Compressor’s OF 20-75 lines of oil-free rotary compressors offer outstanding performance, sustainability & reliability while minimizing the overall ownership cost.

Industry 4.0 and the digitalization of manufacturing processes were prominent trends in Europe. Air compressors were being integrated with IoT technology, enabling remote monitoring and control. Predictive maintenance and data analytics helped improve compressor performance, reduce downtime, and enhance overall operational efficiency.

Market Concentration & Characteristics

Market growth stage is medium, and the pace of the market growth is accelerating. Europe's market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as mergers & acquisitions and collaborations, to strengthen their position in the European market.

Europe market is also characterized by a high level of merger & acquisition activity by the leading players. Players adopt this strategy to increase the reach of their products in the market and enhance the availability of their products & services in diverse geographical areas.

Europe market is also subject to increasing regulatory scrutiny. The European market has been placing a strong emphasis on energy efficiency and sustainability. Stricter environmental regulations and climate change concerns drove industries to adopt energy-efficient air compressor solutions. Manufacturers were increasingly offering compressors with advanced features such as variable speed drives, which optimize energy consumption by adjusting compressor output to match demand.

The Europe market is currently undergoing heightened regulatory scrutiny, reflecting a growing emphasis on environmental considerations and energy efficiency within the region. This scrutiny has significant implications for manufacturers and users of air compressors, necessitating compliance with evolving regulations and the adoption of eco-friendly technologies. As a result, companies in the Europe air compressor industry face the challenge of adapting their products and operations to align with these stringent regulatory measures while also addressing the rising demand for energy-efficient solutions. This regulatory landscape is reshaping the market dynamics, emphasizing the need for innovation and sustainable practices in the air compressor sector within Europe.

The Europe air compressor industry exhibits a diverse end-user concentration, with prominent sectors driving demand. The manufacturing industry emerges as a primary consumer, leveraging air compressors for pneumatic tools and automated processes. Construction also contributes significantly, relying on compressors to power various tools and machinery. The healthcare sector forms a specialized market, utilizing compressed air for medical equipment.

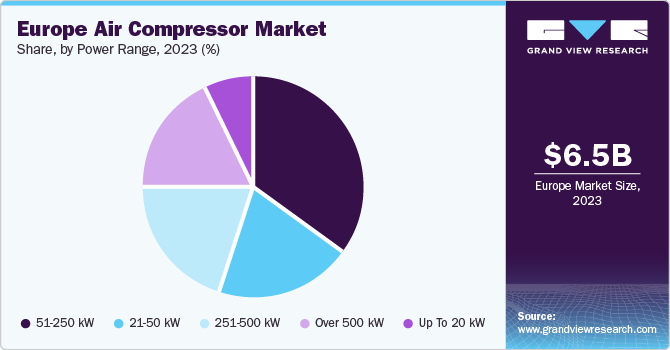

Power Range Insights

The 51-250 kW power range segment dominated the market in 2023 as it provides sufficient power to meet the demands of these applications while still maintaining a level of energy efficiency. Moreover, advancements in technology have led to the development of more compact and energy-efficient compressors within this power range, further enhancing their appeal. The adaptability, efficiency, and technological innovations associated with air compressors in the 51-250 kW range position them as the preferred choice for many end-users in Europe, contributing to their market dominance.

Advancements in technology have improved the efficiency and performance of air compressors in this range, making them more appealing for industries seeking both power and energy savings. As Europe continues to focus on infrastructure development and manufacturing expansion, the demand for air compressors in the 251-500 kW range is expected to experience robust growth, meeting the requirements of increasingly complex and energy-intensive industrial processes.

Type Insights

The stationary type segment led the Europe market in 2023 with a revenue share of 55.9%. Stationary air compressors typically have a capacity ranging from 60 to 240 gallons. These compressors are ideal for use in manufacturing plants, industrial plants, and auto repair shops. The larger tanks of these compressors have a greater capacity for air delivery, allowing more air storage. They are intended for difficult, more complex, and larger jobs, such as gas turbines or chemical plants. These air compressors are available in a variety of configurations, including climate control, base mounting, and electric. Stationary air compressors provide the high volume of air necessary for powering production and automotive air tools. These features are anticipated to propel their demand in the coming years.

Portable air compressors are available in various sizes and shapes. Smaller models are easy to transport, whereas larger models are equipped with wheels for mobility. They are ideal for small-scale applications such as job sites and homes. The efficiency of a portable air compressor depends on its design, size, and usage. Smaller, well-maintained air compressors with modern technology tend to be more energy efficient. In addition, proper maintenance and correct usage play a crucial role in ensuring energy efficiency. The key factors driving the industry-wide adoption of these compressors are low maintenance cost, efficient operation, retrofitting, and aftermarket service of existing air compressors.

Product Insights

The rotary/screw product segment held the largest market revenue share in 2023. The features of rotary/screw air compressors, such as low noise output, high energy efficiency, good performance, easy maintenance, and uninterrupted operation, are anticipated to attract more customers over the forecast period resulting in an increasing demand for rotary/screw air compressors. Furthermore, rotary/screw air compressors have a compact design, suitable for installations with limited space.

The centrifugal air compressor product segment is expected to register the fastest CAGR during the forecast period. A centrifugal air compressor is a type of dynamic compressor that uses high-speed rotating impellers to compress air or gas. Furthermore, centrifugal air compressors reduce operating costs by eliminating the need for down streaming filters and replacement of compressor oil separators, making them a viable option in both consumer and industrial applications. In applications requiring clean and oil-free compressed air, centrifugal air compressors are a suitable choice, ensuring product quality and process integrity.

Lubrication Insights

The oil filled lubrication segment held the largest market revenue share in 2023. An oil-filled air compressor, also known as an oil-lubricated air compressor, uses oil as a lubricant and coolant for its internal components, including the compressor pump. Oil-filled air compressors are commonly used in various industrial and commercial applications where clean, dry, and oil-free compressed air is not a strict requirement. These compressors are suitable for tasks like operating pneumatic tools, inflating tires, powering machinery in manufacturing, and providing compressed air for general-purpose applications.

The oil-free lubrication segment is expected to register the fastest CAGR during the forecast period. Oil-free air compressors play a vital role in ensuring product quality, process integrity, and environmental compliance in these and many other critical applications. Product demand is predicted to rise in the coming years as the prominence of energy recovery & energy efficiency will increase and CO2 emissions will further reduce.

End-use Insights

The manufacturing applications segment held the largest market revenue share in 2023. Manufacturing processes often require compressed air for various applications, such as operating pneumatic tools, controlling valves, powering machinery, and more. As the manufacturing sector expands, the demand for compressed air also grows. Further, modern manufacturing facilities increasingly use automation and robotics to improve efficiency and productivity.

The semiconductor & electronics application segment is expected to register the fastest CAGR during the forecast period. The demand for air compressors in the semiconductor & electronics industry is rapidly growing due to the need for high-quality compressed air for a range of processes, including chip manufacturing, wafer fabrication, and assembly. The semiconductor & electronics industries require high purity compressed air because contamination can cause product defects. Furthermore, semiconductor manufacturing takes place in highly controlled cleanroom environments where air quality is crucial. Air compressors are used to supply clean, dry, and oil-free compressed air for various functions such as powering pneumatic equipment, controlling processes, and maintaining cleanliness of the environment.

Operating Mode Insights

The electric operating mode segment led the market in 2023. Electric air compressors are versatile tools used in various industries and applications. One of the primary driving factors for electric air compressors is their energy efficiency. Compared to their gasoline or diesel counterparts, electric compressors tend to be more energy-efficient, resulting in cost savings over time. Energy-efficient compressors reduce electricity consumption and lower operating costs, making them attractive for businesses looking to reduce energy expenses and carbon footprints.

The Internal combustion engine (ICE) operating mode segment is projected to witness the fastest CAGR over the forecast period. Internal combustion engine (ICE) air compressors are commonly used in various industries and applications, and several factors drive their adoption and use. ICE air compressors are often mounted on portable trailers or vehicles, allowing them to be easily transported to job sites. Their mobility makes them ideal for applications where a stationary compressor may not be practical. In industries such as construction, mining, and agriculture, work often is conducted in remote locations where access to electrical power sources may be limited.

Country Insights

Germany dominated the market with a 35.0% revenue share in 2023. The market is undergoing several trends and developments, driven by a range of factors such as the growing demand for energy-efficient and environmentally friendly compressed air systems. Businesses in Germany are increasingly focused on reducing their energy consumption and carbon footprint through the adoption of oil-free air compressors that offer a more efficient and sustainable alternative to traditional oil-lubricated compressors.

France is anticipated to witness significant growth in the Europe market. Manufacturing & technology, transport, power generation, and agriculture are among the top industries in France. These industries are active users of air compressors. The growth of these industries is expected to positively impact product demand over the forecast period. Manufacturing is among the largest industries in the country, accounting for a major contribution to the country’s GDP. In addition, the country has a large aerospace sector, which is dominated by Airbus. The growth of the industries in the country owing to economic development is expected to positively influence the air compressor market in France.

Key Companies & Market Share Insights

Some of the key players operating in the market include BAUER COMP Holding GmbH, Atlas Copco, KAESER KOMPRESSOREN, and ELGi.

-

Bauer Comp Holding GmbH is the parent company of the global Bauer Group and its affiliates. It is a major player in the global high pressure screw compressor market. The company offers a wide range of products such as water-cooled compressors, air-cooled compressors, water-cooled boosters, air-cooled boosters, air gas treatment, storage systems, air & gas distribution, gas injection technology, fuel gas systems, screw compressors, and lease compressors. Furthermore, the company caters to a wide range of sectors such as aerospace, chemical, automotive, energy, food, oil & gas, and mining.

-

KAESER KOMPRESSOREN produces compressed air and vacuum products such as condensate management systems, filters, desiccant dryers refrigerated, high-speed turbo blowers, rotary screw blowers, rotary lobe blowers, oil-free reciprocating compressors, rotary screw compressors, and other related items.

-

MAT Holding, Inc., Sullair LLC, FS-ELLIOT CO., LLC are some of the emerging market participants in the Europe market.

-

Sullair, LLC is a major American manufacturer of industrial and commercial rotary screw air compressors, both stationary and portable. The company manufactures air compressor systems in Michigan City and provides services, as well as distributes them worldwide.

-

FS-ELLIOT CO., LLC manufactures centrifugal gas and air compressors. Its product portfolio includes desiccant dryers, regulus control systems, custom engineered compressors, oil-free gas compressors, and centrifugal oil-free air compressors. It was the first company to develop a multi-stage, integrally geared, and oil-free centrifugal air compressor in 1962.

Key Europe Air Compressor Companies:

- Atlas Copco

- BAUER COMP Holding GmbH

- Hitachi Industrial Equipment Systems Co. Ltd.

- Ingersoll Rand

- KAESER KOMPRESSOREN

- MAT Holding, Inc.

- Hanwha Power Systems CO., LTD.

- Sullair LLC

- Doosan Portable Power

- Sullivan-Palatek, Inc.

- ELGi

- FS-ELLIOT CO., LLC

- ZEN AIR TECH PRIVATE LIMITED

- Frank Technologies Private Limited

- Oasis Manufacturing

Recent Developments

-

In August 2023, FS Elliot Co., LLC introduced the P400HPR Centrifugal Air Compressor. The P400HPR ensures energy efficiency and dependability while meeting any high-pressure application with improved features and exceptional performance.

-

In May 2023, ELGi opened a manufacturing facility in Tamil Nadu, India. The 50,000-square-foot factory started producing pressure-reducing stations, cutting-edge high-pressure compressors, and portable breathing air compressors for the commercial shipping, navy, and industrial markets in India with an investment of over USD 4.8 million.

-

In April 2023, Atlas Copco completed the acquisition of Shandong Bozhong Vacuum Technology Co., Ltd., an innovator and manufacturer of vacuum systems and pumps. The acquired company became a division of the industrial vacuum division in the vacuum technique business segment of Atlas Copco.

Europe Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.69 billion

Revenue forecast in 2030

USD 8.46 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, lubrication, end-use, operating mode, power range, country

Regional scope

Europe

Country scope

Germany; UK; France; Spain; Italy

Key companies profiled

Atlas Copco; BAUER COMP Holding GmbH; Hitachi Industrial Equipment Systems Co. Ltd.; Ingersoll Rand; KAESER KOMPRESSOREN; MAT Holding Inc.; Hanwha Power Systems CO., LTD.; Sullair LLC; Doosan Portable Power; Sullivan-Palatek, Inc.; ELGi, FS-ELLIOT CO., LLC; ZEN AIR TECH PRIVATE LIMITED; Frank Technologies Private Limited; Oasis Manufacturing

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Air Compressor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe air compressor market report based on type, product, lubrication, end-use, operating mode, power range and country.

-

Type Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Stationary

-

Portable

-

-

Product Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

End-use Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

-

Operating Mode Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Engine

-

Internal Combustion Engine

-

-

Power Range Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Country Outlook (Volume Units; Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe air compressor market size was estimated at USD 6.46 billion in 2023 and is expected to be USD 6.69 billion in 2024.

b. The Europe air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 8.46 billion by 2030.

b. Germany country dominated the market in 2023 by accounting for a share of 35.0% of the market. The market is undergoing several trends and developments, driven by a range of factors such as the growing demand for energy-efficient and environmentally friendly compressed air systems. Businesses in Germany are increasingly focused on reducing their energy consumption and carbon footprint through the adoption of oil-free air compressors that offer a more efficient and sustainable alternative to traditional oil-lubricated compressors.

b. Some of the key players operating in the Europe air compressor market include Atlas Copco, BAUER COMP Holding GmbH, Hitachi Industrial Equipment Systems Co. Ltd., Ingersoll Rand, KAESER KOMPRESSOREN, MAT Holding, Inc., Hanwha Power Systems CO., LTD., Sullair LLC, Doosan Portable Power, Sullivan-Palatek, Inc., ELGi, FS-ELLIOT CO., LLC, ZEN AIR TECH PRIVATE LIMITED, Frank Technologies Private Limited, Oasis Manufacturing.

b. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly equipment. Air compressors are used in various pollution control and emission reduction processes to ensure compliance with these regulations. These factors are expected to augment the market demand in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.