- Home

- »

- Next Generation Technologies

- »

-

Europe Anime Merchandising Market Size Report, 2030GVR Report cover

![Europe Anime Merchandising Market Size, Share & Trends Report]()

Europe Anime Merchandising Market Size, Share & Trends Analysis Report By Type (Figurine, Clothing, Books, Board Games & Toys, Posters), By Distribution Channel (E-commerce, Brick & Mortar), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-167-7

- Number of Report Pages: 144

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Europe Anime Merchandising Market Trends

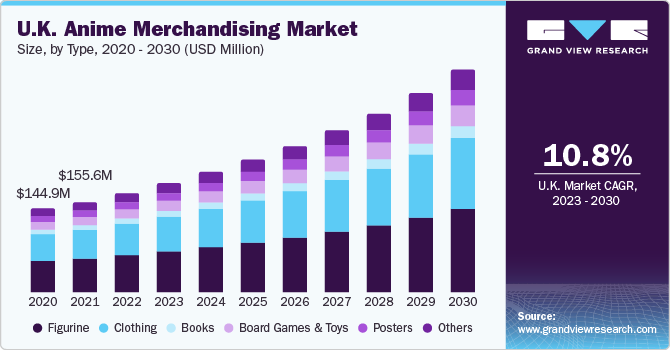

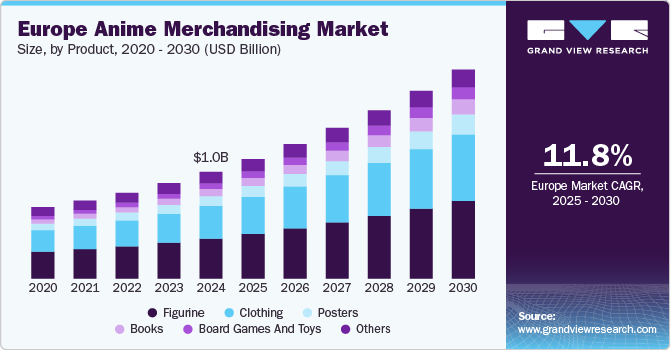

The Europe anime merchandising market size was estimated at USD 947.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. In Europe, extensive ownership of smartphones has contributed to the accessibility of anime. The popularity of anime in the region boosts demand for anime-based accessories, figurines, clothing, and other items. The fandom for anime has grown globally, especially during the COVID-19 pandemic. This trend was followed in subsequent years, contributing to the growth of the anime merchandising industry. In June 2023, Toei Animation Co., Ltd, which created the Dragon Ball series, announced a new collection of Dragon Ball & Dragon Ball Z T-Shirts by the UT GRAPHIC COLLECTION across all stores in the EMEA region.

Moreover, the global audiences’ share of demand for anime content has been increasing rapidly compared to other sub-genres of entertainment. The availability of advanced animation techniques, enthralling storylines of anime series, and the use of immersive styles, colors, effects, and expressions by animators is fueling the Europeans’ interest in anime content. A rising number of people in Europe and worldwide are forming online communities and attending anime events to connect with other fans and collect their favorite anime merchandise, contributing to overall industry growth in the region.

Naruto, Attack on Titan, Fullmetal Alchemist, and Death Note are the most popular anime series in Europe. The high popularity of such programs supports the growth of the European anime merchandising market. France anime merchandising market has witnessed significant growth in the past few years due to the increasing number of anime fans. French TV channels aired many anime series from the late 70s to early 90s. Thus, the current adult generation in the country grew up watching different anime series, boosting the anime merchandising industry.

Anime is regarded as a Japanese product; however, in the past few decades, the business tie-ins or collaborations among Japanese and foreign companies involved in the fields of publishing, printing, licensing, game manufacturing, and other industry-related activities have contributed to the growth of the Europe anime merchandising market. Anime is now becoming a mainstream form of entertainment in Europe with the wide availability of different genres that appeal to a wide range of viewers.

Some genres are specific to the anime community, such as kodomomuke, shoujo, shonen, seinen, and josei. For instance, shonen is focused on action and is aimed more at a male audience, whereas shoujo is romantic and aimed at a female audience. This wide array of genres allows fans to find what they are looking for in an animated show.

Type Insights

Based on the type, the figurine segment dominated the global market with a revenue share of around USD 357 million in 2022. These figurines are often highly detailed, making them more desirable among collectors, which is expected to drive the segment’s growth. Their widespread accessibility across several e-commerce platforms is further augmenting the segmental growth. The figurine type of merchandise has experienced tremendous growth in the anime market. Figurines have become a staple of the anime merchandising industry and a must-have for any serious collector. As evident from their increasing demand, there is an increase in production and availability.

The books segment observed a steady growth rate of around 12.0% during the forecast period from 2023 to 2030. The demand for anime books, such as manga comics and light novels, is increasing due to the popularity of anime series and movies. Manga comics, the Japanese graphic novels, have become increasingly popular worldwide, with many anime series adapted from them. The anime industry has been utilizing manga comics as source material to create successful anime series, such as Naruto, Attack on Titan, and One Piece, leading to a surge in demand for manga comics in Japan and internationally. In addition to manga comics, light novels are too gaining popularity among anime fans. Light novels are one of Japanese literature that targets young adult readers and are often adapted into anime series.

Distribution Channel Insights

E-commerce distribution channels accounted for the highest CAGR of around 11.6% during the forecast period from 2023 to 2030. The popularity of anime continues to surge across Europe. The key factor contributing to this growth is the increasing acceptance and appreciation of Japanese pop culture. Anime has transcended geographical boundaries with its unique storytelling and vibrant aesthetics, captivating a diverse European audience.

This cross-cultural appeal has created a substantial consumer base eager to engage with and own products inspired by their favorite anime series or characters. The anime merchandising products featuring several popular anime characters, quotes, shows, movies, etc., are available on numerous online platforms and dedicated websites.

Regional Insights

France accounted for the largest market revenue share of USD 206.4 million in 2022. Factors contributing to market growth are the increasing number of anime and manga conventions and events in France. For instance, a popular anime and manga convention in France is the Japan Expo, which takes place annually in Paris and attracts tens of thousands of visitors. The event features various activities, including cosplay competitions, concerts, and merchandise sales. In addition to conventions and events, there are also a growing number of specialty stores and online retailers catering to the anime and manga fan base in France.

Germany accounted for the highest CAGR of around 11.3% during the forecast period from 2023 to 2030. The rise of online platforms and e-commerce has further fueled the expansion of the anime merchandising market in Germany. Consumers can easily access different anime-related products through various online retailers, enabling them to explore and purchase items from the comfort of their homes. This accessibility has broadened the reach of anime merchandise and facilitated the emergence of a niche market catering to specific fandoms.

Key Companies & Market Share Insights

-

The major players in the Europe anime merchandising market were ranked according to the key strategies to maintain a competitive edge in the market and their product offerings. The key strategies include strategic collaborations, partnerships & agreements, new product development, capability expansion, mergers & acquisitions, and research & development initiatives.

-

In August 2023, Toei Animation Co., Ltd., a studio that created the Dragon Ball series, announced the French footwear and clothing retail chain Gémo will highlight the Dragon Ball super in its collection.

Key Europe Anime Merchandising Companies:

- Kotobukiya Co., Ltd.

- Bandai Namco

- Good Smile Company, Inc.

- The Walt Disney Company

- Toei Animation Co. Ltd.

- TokyoPOP

- Dekai Ltd.

- Yokaiju Ltd

- Threadheads

- Crunchyroll (Sony Music Entertainment)

- Etsy, Inc.

- Anime Limited

- Anime Bluray

- OtakuHype

- Otaku World Ltd

- Akibashi

- Curibo

- Anime Republic

- Max Factory, Inc.

Europe Anime Merchandising Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.04 billion

Revenue forecast in 2030

USD 2.07 billion

Growth rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading country animes, competitive landscape, growth factors, trends

Segments covered

Type, distribution channel, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Rest of Europe

Key companies profiled

Kotobukiya Co., Ltd.; Bandai Namco; Good Smile Company, Inc.; The Walt Disney Company; Toei Animation Co. Ltd.; TokyoPOP; Dekai Ltd.; Yokaiju Ltd.; Threadheads; Crunchyroll (Sony Music Entertainment); Etsy, Inc.; Anime Limited; Anime Bluray; Otakuhype; Otaku World Ltd.; Akibashi; Curibo; Anime Republic; Max Factory, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Europe Anime Merchandising Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe anime merchandising market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Figurine

-

Clothing

-

Books

-

Board Games & Toys

-

Posters

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-Commerce

-

Brick & Mortar

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. The Europe anime merchandising market size was estimated at USD 947.8 million in 2022 and is expected to reach USD 1.04 billion in 2023.

b. The Europe anime merchandising market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 2.07 billion by 2030.

b. Based on country, France dominated the Europe anime merchandising market in 2022 with a revenue share of over 20.0%. France is one of the leading countries in the European anime industry, with the high popularity of different anime series. The market’s growth in France is driven by the availability of anime content on streaming platforms and increasing interest in Japanese culture among the young population of the country

b. The key players in this Europe anime merchandising market include KOTOBUKIYA CO., LTD., BANDAI NAMCO, GOOD SMILE COMPANY, INC., THE WALT DISNEY COMPANY, TOEI ANIMATION CO. LTD., TOKYOPOP, DEKAI LTD., YOKAIJU LTD, THREADHEADS, CRUNCHYROLL (SONY MUSIC ENTERTAINMENT), ETSY, INC., ANIME LIMITED, ANIME BLURAY, OTAKUHYPE, OTAKU WORLD LTD, AKIBASHI, CURIBO, ANIME REPUBLIC, and MAX FACTORY, INC., among others.

b. Key factors that are driving the market growth include the globalization of anime content, easy accessibility to anime content and merchandise, and the growing number of anime conventions in Europe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."