- Home

- »

- Advanced Interior Materials

- »

-

Europe Baling Wire Market Size, Industry Report, 2030GVR Report cover

![Europe Baling Wire Market Size, Share & Trends Report]()

Europe Baling Wire Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Recycling, Waste Management, Agriculture, Construction), Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-539-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Baling Wire Market Size & Trends

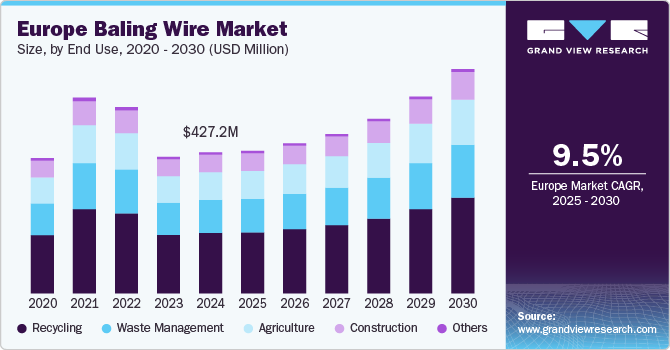

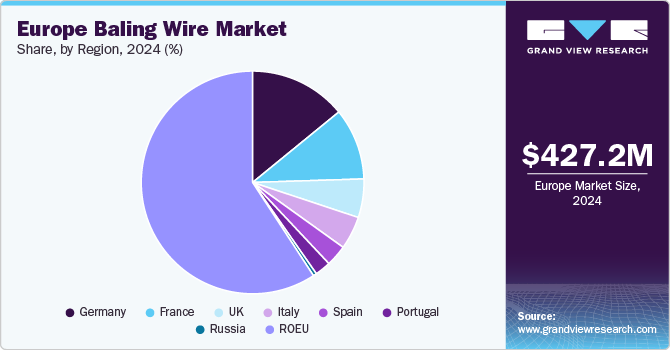

The Europe baling wire market size was estimated at USD 427.2 million in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. Baling wire is a strong, flexible wire used to secure and bundle materials such as hay, cardboard, and recyclables. Typically made from galvanized steel or annealed steel, it offers durability and resistance to rust or breakage.

It is widely used in agriculture, recycling, and waste management industries, where it helps compact and tie materials for easier handling and transport. Baling wire is often used with baling machines, which compress materials into tightly bound bundles.

Drivers, Opportunities & Restraints

The Europe baling wire market is anticipated to grow due to the increasing emphasis on waste management and recycling initiatives across the region. Stringent EU regulations on waste disposal and sustainability targets are driving demand for efficient baling solutions in industries such as paper, plastic, and metal recycling. In addition, the rising adoption of automated baling machines in the agriculture and packaging sectors is likely to boost the need for high-quality baling wire. The growth of the e-commerce and logistics industry is also contributing to increased packaging waste, further supporting market expansion.

Advancements in material technology are projected to create opportunities for manufacturers to develop high-strength, corrosion-resistant baling wire with enhanced durability. The shift toward sustainable and biodegradable binding solutions in response to environmental concerns is expected to encourage innovation in eco-friendly coatings and materials. In addition, the growing demand for circular economy practices in Europe presents opportunities for baling wire suppliers to cater to businesses focusing on waste reduction and resource efficiency. Expanding infrastructure for recycling plants and waste processing facilities is likely to further drive the adoption of baling wire solutions.

Fluctuating raw material prices, particularly for steel and other metals, is anticipated to challenge market stability by affecting production costs and pricing strategies. In addition, the increasing adoption of plastic and alternative binding solutions in some industries may limit the growth potential of traditional baling wire. Stringent environmental regulations on metal production and emissions are also expected to impact manufacturing processes, potentially increasing compliance costs for market players. Furthermore, supply chain disruptions and geopolitical uncertainties may create challenges in the availability and distribution of raw materials across Europe.

End Use Insights

The European construction industry significantly contributes to the demand for baling wire, primarily due to its applications in securing materials and reinforcing structures. This substantial activity level is anticipated to drive the consumption of steel wire products, including baling wire, which is essential for tasks such as binding materials and reinforcing concrete structures. The industry's reliance on small and medium-sized enterprises (SMEs), which constituted 71.2% of the sector's value-added, further underscores the widespread use of baling wire across various construction projects.

In the European agricultural sector, baling wire plays a crucial role in efficiently managing and storing crops like hay and straw. The EU's agricultural industry is characterized by a diverse range of farms, with the latest agricultural census in 2020 providing valuable insights into farm structures and labor. The increasing adoption of mechanized farming equipment, such as balers that utilize baling wire, is projected to enhance operational efficiency and meet the growing demand for agricultural products. This trend is likely to sustain the demand for baling wire in the agricultural sector, ensuring the secure handling and storage of essential feed materials.

Regional Insights

UK Baling Wire Market Trends

The UK construction sector is facing challenges, with activity contracting by 0.1% in January 2025, primarily due to declines in manufacturing and construction sectors. This downturn is anticipated to impact the demand for construction materials, including baling wire, as fewer projects commence. Conversely, agriculture remains a significant land use, with 57% of the UK's land mass dedicated to farming activities. This extensive agricultural landscape is likely to sustain the demand for baling wire, essential for securing and managing crops like hay and straw.

Germany Baling Wire Market Trends

Germany's construction industry leads Europe, however, the sector faces challenges, as residential building permits fell to 215,900 in 2024, the lowest since 2010, indicating a potential slowdown in upcoming projects. In agriculture, Germany contributed 12.6% to the EU's total standard output in 2020, underscoring its role in European farming. This substantial agricultural activity is likely to maintain steady demand for baling wire used in crop management.

France Baling Wire Market Trends

France’s construction sector is likely to witness steady growth, supported by increasing investments in infrastructure and urban renewal projects. The government's emphasis on sustainable building practices is anticipated to drive demand for high-quality construction materials, including baling wire for reinforcement and binding applications. In the agricultural sector, France's strong presence in livestock and crop farming is expected to sustain the need for baling wire, particularly for securing hay and straw. The growing focus on mechanized farming is also projected to further boost its usage in agricultural balers.

Italy Baling Wire Market Trends

Italy’s construction industry is projected to experience growth, particularly in office construction and infrastructure. Renovation projects supported by government incentives are likely to boost the demand for binding and reinforcement materials. In addition, country’s extensive vineyard and olive farming operations are anticipated to drive demand for baling wire in securing agricultural bundles.

Key Europe Baling Wire Company Insights

Some of the key players operating in the market include Accent Wire Tie, Advanced Wires Limited and Barnfather Wire

-

Advanced Wires Limited was established in 2018 and based in Huddersfield, UK, The company specializes in the production of baling wire products for the recycling industry. The company's owners bring a combined 46 years of industry experience, focusing on products like Quicklink wire.

-

Established in 2007, Barnfather Wire is a key wire production company based in Wednesbury, West Midlands, UK. The company specializes in manufacturing high-quality drawn wire products, catering to various industries.

Key Europe Baling Wire Companies:

- Accent Wire Tie

- Advanced Wires Limited

- AGST Draht-und Biegetechnik GmbH

- Barnfather Wire

- Heinrich Erdmann GmbH

- Gama Metal

- Hörle Wire AB

- IBERMETAIS

- MAZZOLENI TRAFILERIE BERGAMASCHE SPA

- Metalurgia S.A.

Recent Developments

-

In August 2023, Apollo, a prominent alternative investment firm, successfully acquired the Accent Family of Companies, encompassing Accent Wire-Tie, Accent Wire-Tie, and Accent Building Materials. Known for its expertise in distributing and manufacturing baling wire and wire-tier machines, Accent plays a key role in supplying the recycling and waste management sectors across the U.S., Canada, and the U.K.

Europe Baling Wire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 431.5 million

Revenue forecast in 2030

USD 679.5 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use and country

Regional scope

Europe

Country scope

UK; Germany; France; Russia; Spain; Italy; Portugal

Key companies profiled

Accent Wire Tie; Advanced Wires Limited; AGST Draht-und Biegetechnik GmbH; Barnfather Wire; Heinrich Erdmann GmbH; Gama Metal; Hörle Wire AB; MAZZOLENI TRAFILERIE BERGAMASCHE SPA; IBERMETAIS; Metalurgia S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Baling Wire Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe baling wire market report on the basis of end use and region.

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Recycling

-

Waste Management

-

Agriculture

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

Spain

-

Portugal

-

-

Frequently Asked Questions About This Report

b. The Europe baling wire market size was estimated at USD 427.2 million in 2024 and is expected to reach USD 431.5 million in 2025.

b. The Europe baling wire market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 679.5 million by 2030.

b. Based on end use, recycling accounted for a revenue share of more than 44% in 2024 of the overall market.

b. Some of the key vendors of the Europe baling wire market are Accent Wire Tie, Advanced Wires Limited, AGST Draht-und Biegetechnik GmbH, Barnfather Wire, Heinrich Erdmann GmbH, Gama Metal, Hörle Wire AB, MAZZOLENI TRAFILERIE BERGAMASCHE SPA, and IBERMETAIS, among others

b. Rising focus on recycling and along with need to manage growing waste are the key factors driving the Europe baling wire market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.