- Home

- »

- Medical Devices

- »

-

Europe Blood Screening Market Size & Share Report, 2030GVR Report cover

![Europe Blood Screening Market Size, Share & Trends Report]()

Europe Blood Screening Market Size, Share & Trends Analysis Report By Product (Reagent, Instrument), By Technology (Nucleic Acid Amplification Test, ELISA, Next Generation Sequencing), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-711-7

- Number of Report Pages: 64

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

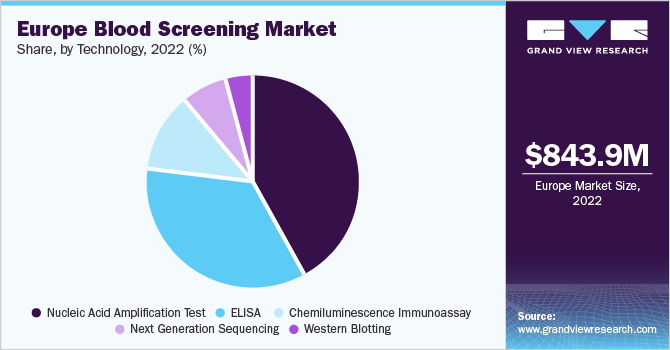

The Europe blood screening market size was valued at USD 843.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. An increase in the number of blood transfusion procedures, the rising prevalence of infectious diseases, and increasing awareness about the importance of blood screening in the region are some of the primary factors driving market growth. The need for blood transfusions increases with surgeries, accidents, and chronic diseases. Consequently, the need for blood screening to ensure the safety of blood transfusions also increases.

The prevalence of infectious diseases such as HIV, hepatitis B, and hepatitis C also drives the market's growth. Blood tests are used to detect these diseases in donated blood to prevent transmission of infections to patients. In addition, increasing awareness about the importance of blood testing is also expected to boost growth in the market. People are becoming better aware of the benefits of blood screening and request these tests from healthcare providers. However, the cost of blood screening is high, which can be a barrier for some people.

The market has continued to grow due to its maturity and its ability to accurately and efficiently screen a wide range of diseases, making blood screening outnumber patients and healthcare professionals. In recent years, European economies have seen several changes in their healthcare systems. These changes have led to a greater emphasis on the prevention and early detection of diseases and thus created favorable conditions for the development of the blood test market.

Guidelines for blood transfusion services provide a regulatory framework for manufacturers of blood transfusion reagents. European countries have introduced mandatory blood testing for HIV, HBV, HCV, parvovirus B19, and other viruses. The International Red Cross, the code of the International Blood Transfusion Society, and the German Transfusion Act regulate blood transfusion services in Germany. Whereas the French Blood Establishment (EFS) regulates the collection, preparation, testing, and distribution of labile blood products in France. In Italy, the National Blood Centre (NBC), a division of the health ministry, is responsible for coordinating technical and scientific control of the blood system.

The COVID-19 pandemic had disrupted the supply chain of blood testing products and services. This made it more difficult for blood banks to obtain needed supplies and increased costs. The pandemic also led to a drop in demand for blood testing services. Many scheduled surgeries were postponed or canceled during the pandemic period.

The rising prevalence of chronic diseases, increasing volume of blood transfusions, and growing awareness of the importance of blood safety are likely to continue to drive market growth. In addition, there has been an increase in the number of product launches by key market players, which has boosted the growth of the market. For instance, in June 2020, Danaher Corporation launched a COVID-19 blood testing and detection kit.

Product Insights

In 2022, the reagents segment dominated the market with 73.1% of the market share and is expected to further expand with the fastest CAGR of 11.5% during the forecast period. Reagents are necessary for enzyme-linked immunosorbent assay (ELISA), western blotting, and nucleic acid amplification test (NAAT). The rising adoption of these tests is driving the growth of the segment.

Based on the product, the European blood screening market is segmented into reagents and instruments. Instruments are expected to witness lesser demand than reagents in the coming years, as they are a one-time investment for blood testing due to their high costs and long shelf-life. In May 2022, Agilent launched IVDR-Compliant instruments, kits, and reagents in the European Union under the new EU IVDR regulation, facilitating labs to use these products without disruptions.

Technology Insights

The NAAT segment dominated the Europe blood screening market with a revenue share of 42.0% in 2022. It was initially introduced in six European countries, including France, Germany, Spain, Italy, U.K., and Switzerland, between 1999 and 2001. It is the first mandatory plasma screening test to detect Hepatitis C Virus. Hologic Amplified MTD Test (Gen Probe) and Xpert MTB/RIF assay are two NAA tests approved by the Food and Drug Administration (FDA) for testing respiratory specimens.

The market is classified based on technology into NAAT, ELISA, Chemiluminescence Immunoassay (CLIA), next-generation sequencing (NGS), and western blotting. The demand for ELISA, particularly from developing countries, is rising due to low screening costs, wide application areas, and the rising prevalence of chronic infectious diseases. It is used for detecting HIV, HCV, and HBV, and is recommended for routine use in the European region. In September 2022, J MITRA launched its 4th generation Elisa-based HCV test known as HCV Gen 4 Ag & Ab Microlisa.

The kit helps eliminate infected units of blood, detecting antibodies against HCV in human plasma or serum, and is also used for clinical diagnostic tests for Hepatitis C. In another instance, Charles River Laboratories International, Inc. launched HCP-ELISA, an enzyme-linked immunosorbent assay kit, in February 2023. It is the company’s first kit that helps detect and quantify residual Host Cell Proteins (HCP) in CHO-based biotherapeutics.

On the other hand, the next-generation sequencing technology is the fastest-growing segment, with a CAGR of 15.9% expected during the forecast period, due to its ability to provide effective results in a shorter period. In addition, next generation sequencing also makes it possible to test hundreds of samples at the same time. Continuous research and development activities in this segment are expected to drive its growth over the projected timeframe.

Regional Insights

Germany was the largest blood screening market in Europe with a revenue share of 24.4% in 2022, and is expected to retain its position throughout the forecast period. A high prevalence of chronic diseases such as cancer and heart diseases and a strong focus on preventive healthcare drive the German market. In addition, growing awareness regarding blood donation is also expected to drive the country’s growth in the future.

According to the International Trade Administration, in August 2022, Germany was declared the third-largest medical technology market in Europe. In a recent development, Mainz Biomed NV declared that three companies from Germany had incorporated the ColoAlert home screening test for colorectal cancer in their corporate healthcare programs in April 2023.

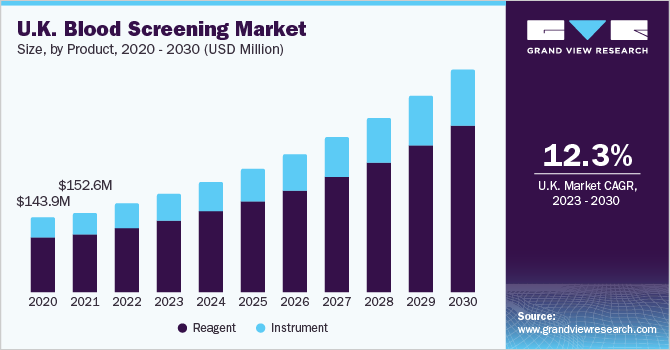

The Europe blood testing market is expected to continue growing steadily in the coming years, as an aging population and growing awareness of the importance of early disease detection drive demand for blood testing services. The U.K. was Europe's second-largest blood testing market with a 20% regional revenue share in 2022. An aging population and a growing awareness of the importance of early disease diagnosis are driving the U.K. market.

Key Companies & Market Share Insights

The European market has the presence of several large and small companies competing for market share. Key companies are adopting strategies such as product developments, mergers and acquisitions, and investments in R&D to gain an edge over competitors. For instance, in 2017, Grifols acquired Hologic’s unit, which is engaged in the manufacturing and R&D of assays and instruments based on NAT technology for donor screening. The sales of Procleix NAAT Solutions from this acquisition became the leading source of revenue for the diagnostic division. Following are some of the key players in the Europe blood screening market:

-

Danaher Corporation

-

Beckman Coulter, Inc.

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc.

-

Becton, Dickinson and Company

-

Grifols

-

Ortho Clinical Diagnostics

-

F. Hoffmann-La Roche Ltd.

-

Bio-Rad Laboratories, Inc.

-

Siemens AG

Europe Blood Screening Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 931.4 million

Revenue forecast in 2030

USD 1.95 billion

Growth Rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Danaher Corporation; Beckman Coulter, Inc.; Abbott Laboratories; Thermo Fisher Scientific Inc.; Becton, Dickinson and Company; Grifols; Ortho Clinical Diagnostics; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Siemens AG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Blood Screening Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe blood screening market report based on product, technology, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagent

-

Instrument

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleic Acid Amplification Test

-

ELISA

-

Chemiluminescence Immunoassay

-

Next Generation Sequencing

-

Western Blotting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe blood screening market size was estimated at USD 843.9 million in 2022 and is expected to reach USD 931.4 million in 2023.

b. The Europe blood screening market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 1.95 billion by 2030.

b. Germany dominated the Europe blood screening market with a share of 24.4% in 2022. This is attributable to a rise in awareness about blood donation in countries such as the U.K., Germany, France, Italy, and Spain.

b. Some key players operating in the Europe blood screening market include Roche Diagnostics; Bio-Rad Laboratories, Inc.; Siemens Healthcare GMBH; Grifols, S.A.; Becton, Dickinson and Company; Agilent Technologies; Thermo Fisher Scientific, Inc.; and Danaher Corp.

b. Key factors that are driving the market growth include rising number of blood transfusion procedures and rise in the number of complex surgeries performed, such as chemotherapy, heart surgery, and organ transplant, which require a large amount of blood samples.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."