- Home

- »

- Clinical Diagnostics

- »

-

Nucleic Acid Amplification Testing Market Size Report, 2033GVR Report cover

![Nucleic Acid Amplification Testing Market Size, Share & Trends Report]()

Nucleic Acid Amplification Testing Market (2025 - 2033) Size, Share & Trends Analysis By Type (Polymerase Chain Reaction Tests, Isothermal Nucleic Acid Amplification Technology Tests, Ligase Chain Reaction Tests), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-388-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nucleic Acid Amplification Testing Market Summary

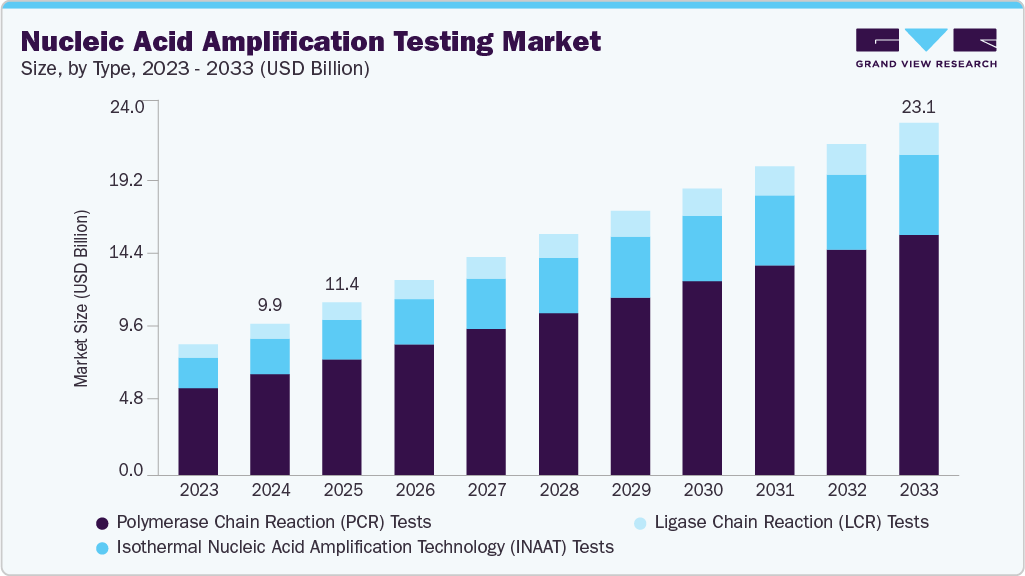

The global nucleic acid amplification testing market size was estimated at USD 9,956.82 million in 2024 and is projected to reach USD 23,146.69 million by 2033, growing at a CAGR of 9.30% from 2025 to 2033. This growth is primarily driven by several key factors, including the rising prevalence of infectious diseases, a shift toward point-of-care (POC), advancements in molecular diagnostic technologies, decentralized testing, and the growing demand for personalized medicine.

Key Market Trends & Insights

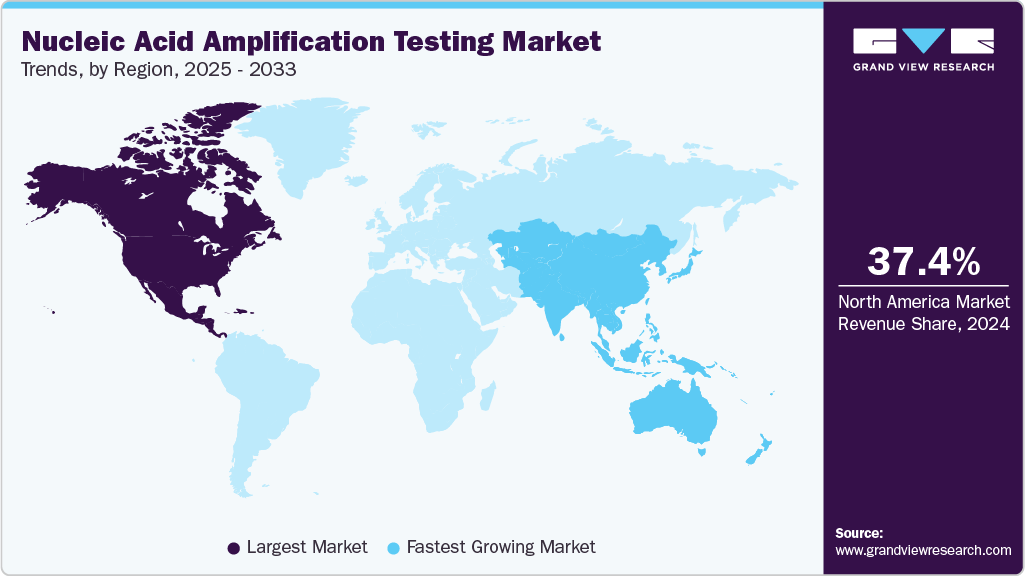

- North America dominated the nucleic acid amplification testing market with the largest revenue share of 37.37% in 2024.

- The nucleic acid amplification testing market in the U.S. accounted for the largest market revenue share in North America in 2024.

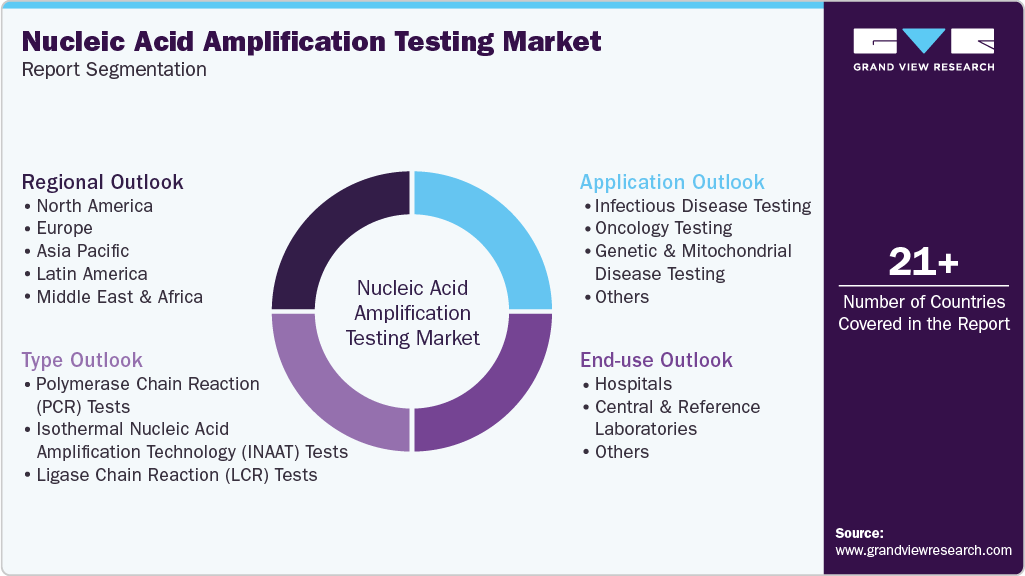

- Based on type, the polymerase chain reaction (PCR) tests segment led the market with the largest revenue share of 66.69% in 2024.

- Based on application, the infectious disease testing segment with the largest revenue share of 45.87% in 2024.

- Based on end use, the central and reference laboratories segment led the market with the largest revenue share of 42.01% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,956.82 Million

- 2033 Projected Market Size: USD 23,146.69 Million

- CAGR (2025-2033): 9.30%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising global burden of infectious diseases such as COVID-19, hepatitis, and HIV continues to underscore the importance of rapid and accurate diagnostic tools like NAAT, which offer high sensitivity and specificity. Moreover, continuous technological innovations, such as real-time PCR, isothermal amplification methods, and automated systems, enhance testing efficiency, speed, and accessibility across clinical and non-clinical settings.For instance, in June 2023, the U.S. Food and Drug Administration granted marketing authorization for the Cue COVID-19 Molecular Test, a molecular NAAT designed to detect SARS-CoV-2 genetic material from nasal swabs in symptomatic adults. Notably, this was the first at-home, over-the-counter molecular test for any respiratory illness to be approved using a traditional premarket review pathway. This milestone reflects the ongoing shift toward patient-centered diagnostics and the growing importance of home-based testing in public health surveillance.

Furthermore, the use of NAAT is expanding beyond infectious disease diagnostics to oncology, genetic screening, and pharmacogenomics, highlighting its importance in the era of precision medicine. Governments and healthcare organizations are also investing in early disease detection programs and laboratory infrastructure to help drive market growth. However, challenges such as high testing equipment costs, regulatory complexities, and limited access in low-resource settings continue to impede widespread adoption.

Finally, the global nucleic acid amplification industry is expected to expand steadily as technological innovation, healthcare decentralization, and the pursuit of personalized medicine work together to improve diagnostic capabilities around the world. With continued R&D investment and supportive regulatory frameworks, NAAT is expected to remain a cornerstone of modern molecular diagnostics for the next decade.

Furthermore, increasing awareness and implementing large-scale screening programs, particularly those initiated by governments and healthcare organizations, significantly improves disease detection and management. These initiatives promote regular health check-ups and genetic testing, which increases the use of nucleic acid amplification technologies. The rising prevalence of chronic and genetic disorders, such as cancer, cystic fibrosis, and hereditary blood diseases, has increased the need for precise molecular diagnostic solutions that allow for early detection and targeted treatment planning.

Moreover, the integration of advanced technologies and automation such as artificial intelligence (AI), machine learning, robotics, and microfluidics has significantly improved test sensitivity, throughput, and turnaround time. Automated NAAT systems reduce manual intervention, reduce human error, and improve workflow efficiency, making them more useful in both centralized laboratories and point-of-care (POC) settings. The advancement of portable and multiplexed platforms is increasing the accessibility of molecular testing to resource-constrained regions.

Furthermore, regulatory approvals and funding initiatives by public health authorities, international organizations, and private investors encourage innovation and product commercialization. Accelerated regulatory pathways, public-private partnerships, and government investments in pandemic preparedness have all helped to increase the global availability of cutting-edge NAAT products. These combined factors not only enhance diagnostic infrastructure but also lay the groundwork for long-term market growth.

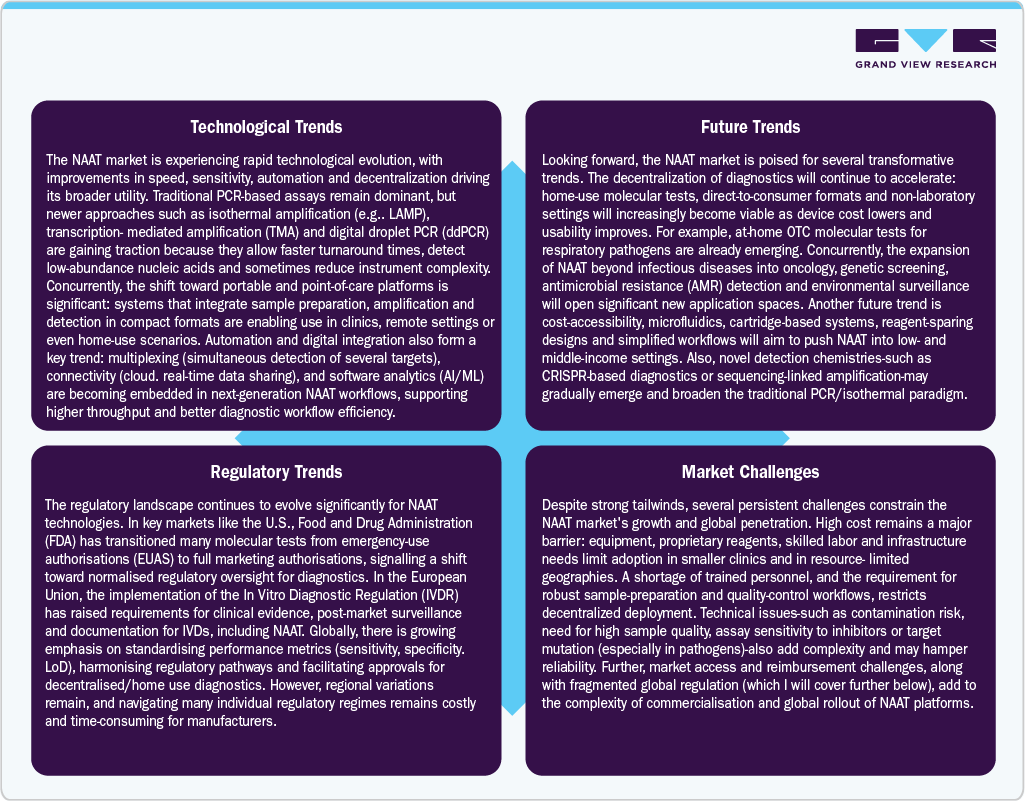

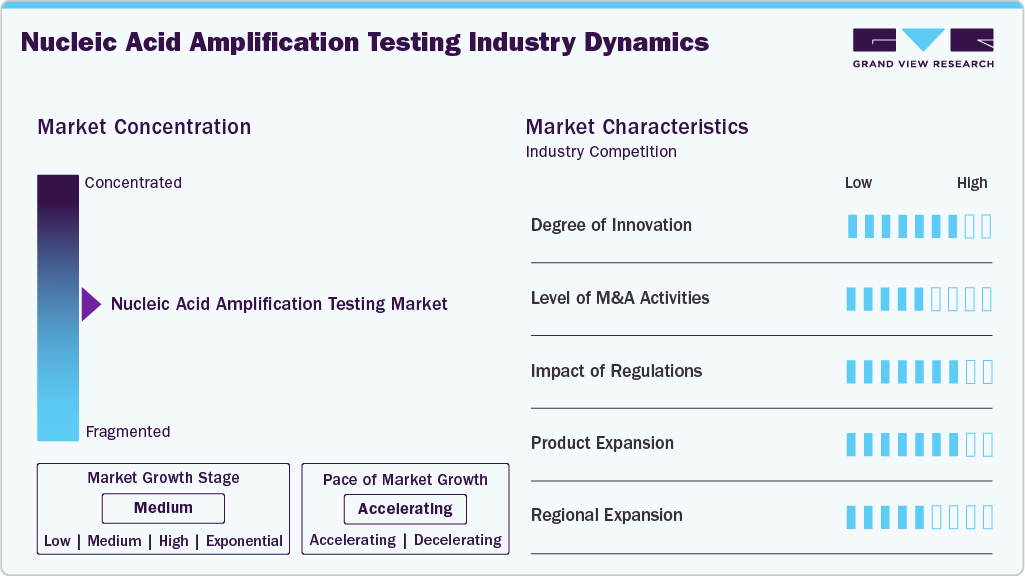

Market Concentration & Characteristics

The nucleic acid amplification industry is undergoing rapid innovation, driven by newer amplification methods such as isothermal techniques, including LAMP, RPA, and NEAR, and digital integration, including digital droplet PCR, which improve accuracy, speed, and accessibility. These advancements are not just incremental but transformative, signaling a shift away from traditional PCR and toward decentralized, rapid, portable, and multiplex systems. The increased R&D investment and pipeline of next-generation assays demonstrate innovation momentum.

M&A activity in this space is classified as medium. While there have been notable transactions, such as Roche Holding AG's acquisition of LumiraDx in 2024 to expand its diagnostics and NAAT capabilities. Compared to other diagnostics sub-markets, NAAT has fewer mega-acquisitions, with many players relying on collaborations and licensing instead of large buy-outs. So, while M&A is important, it is not yet at a "high" level overall.

The regulatory impact is rated highly. Given the direct impact of diagnostics on patient outcomes and public health surveillance, the NAAT space faces intense regulatory scrutiny. For example, the need for rigorous clinical validation, standardization, and approval by agencies such as the US Food and Drug Administration is frequently cited as a barrier to early market entry. Moreover, disparities in standards across geographies for instance, between regions with robust infrastructure and emerging markets; exacerbate regulatory complexity and influence launch timing, reimbursement, and adoption.

Product expansion in the nucleic acid amplification industry is rated as high. The product portfolio has expanded significantly beyond infectious disease detection to include oncology, genetic/mitochondrial disease testing, point-of-care (POC) formats, multiplex assays, and decentralized platforms. The shift from central lab to near patient and portable systems, along with new chemistry formats and user-friendly cartridges, represents a significant expansion of product varieties and use cases.

Regional expansion in nucleic acid amplification industry is considered medium to high. The market is well-established in mature regions (North America, Europe) with strong shares, but there is clear and rapid growth in emerging geographies (e.g., Asia-Pacific, India) that are significant growth engines. However, infrastructure, reimbursement, and regulatory differences in many markets mean that full penetration remains uneven-hence the assessment is not unequivocally "high". The momentum is strong, but there are still barriers in certain non-mature geographies.

Type Insights

The polymerase chain reaction (PCR) tests segment led the market with the largest revenue share of 66.69% in 2024, due to their high accuracy, widespread use, and sensitivity in clinical diagnostics, infectious disease testing, and research. Moreover, polymerase chain reaction (PCR) is still the gold standard for detecting a wide range of pathogens, such as viral and bacterial infections, due to its strong analytical performance and widespread use in both centralized laboratories and point-of-care settings.

Moreover, advanced real-time PCR systems, multiplexing capabilities, and automation have all contributed to this segment's dominance. Furthermore, strong regulatory approvals, proven reliability, and widespread infrastructure supporting PCR platforms have helped the company maintain its market leadership.

The isothermal nucleic acid amplification technology (INAAT) tests segment is expected to grow at the fastest CAGR during the forecast period, due to rising demand for rapid, portable, and cost-effective molecular diagnostic solutions. For instance, in November 2021, Meridian Bioscience, Inc. launched its Air-Dryable LAMP Mix and Air-Dryable RT-LAMP 1-Step Mix. These groundbreaking molecular master mixes are specifically designed for rapid isothermal amplification of nucleic acid sequences, allowing for the development of point-of-care ambient temperature-stable assays as well as faster diagnosis.

Furthermore, unlike qPCR, isothermal amplification technologies are used under a single temperature condition, making them ideal for point-of-care or portable devices; however, one limitation of LAMP assays, in particular, is the typical 45-minute time to produce a result. Unlike PCR, INAAT techniques like loop-mediated isothermal amplification and recombinase polymerase amplification (RPA) do not require thermal cycling, allowing for faster amplification at constant temperatures. In addition, this simplicity enables integration into small, battery-powered devices suitable for resource-constrained environments and point-of-care, making them ideal for infectious disease surveillance as well decentralized testing. Also, continuous innovation, shorter turnaround times, and increased adoption in emerging economies are expected to drive INAAT's rapid market growth in the coming years.

Application Insights

The infectious disease testing segment led the market with the largest revenue share of 45.87% in 2024, due to the widespread use of nucleic acid amplification tests (NAATs) for detecting and monitoring viral, bacterial, and parasitic infections. The segment's dominance is fueled by the growing global burden of infectious diseases such as HIV, influenza, tuberculosis, and COVID-19, as well as an increasing emphasis on early and accurate diagnosis for effective treatment and outbreak management. For instance, according to the World Health Organization, an estimated 10.8 million people fell ill with TB worldwide, including 6.0 million men, 3.6 million women, and 1.3 million children, globally in 2023. Moreover, ongoing government initiatives for infectious disease surveillance, the availability of rapid molecular diagnostic platforms, and advances in multiplex assays have strengthened this segment's position in the nucleic acid amplification industry.

The oncology testing segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increased use of nucleic acid amplification technologies for early cancer detection, companion diagnostics, and personalized medicine. NAAT-based assays enable the precise identification of genetic mutations, tumor markers, and circulating tumor DNA (ctDNA), allowing for customized treatment strategies as well as real-time monitoring of therapeutic response. The rising prevalence of cancer worldwide, combined with technological advancements in liquid biopsy and minimally invasive testing, is driving strong demand for molecular oncology diagnostics. Expanding research collaborations and clinical applications in genomics are expected to accelerate growth in this segment.

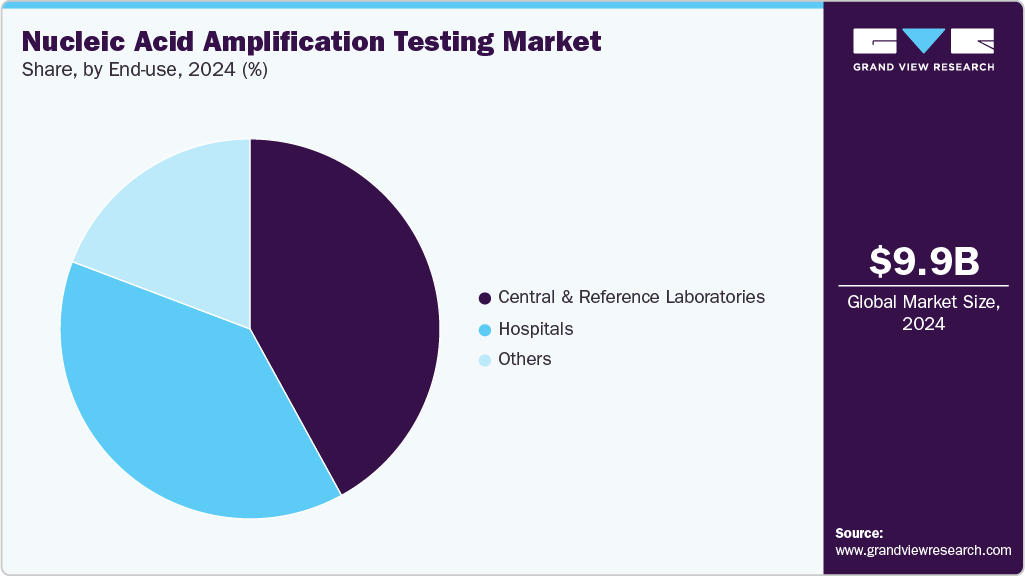

End Use Insights

The central and reference laboratories segment led the market with the largest revenue share of 42.01% in 2024. This dominance stems primarily from their advanced infrastructure, high-throughput capabilities, and ability to perform complex and multiplex assays with high accuracy and reliability. Also, these laboratories act as hubs for large-scale diagnostic testing, such as infectious disease screening, genetic analysis, and frequently support multiple healthcare providers and research institutions. Furthermore, their ability to handle a wide range of samples while adhering to strict quality control standards has cemented their leadership position in the nucleic acid amplification industry.

The hospitals segment is anticipated to grow at the fastest CAGR during the forecast period, due to several factors such as rising demand for rapid and on-site diagnostic testing to enable timely clinical decision-making, increased investments in molecular diagnostic infrastructure, and growing awareness among healthcare professionals of the benefits of NAATs for patient management. Also, hospitals increasingly support point-of-care NAAT platforms to improve turnaround times for infectious disease detection, oncology testing, and other applications. For instance, in April 2021, NIMS established a NAAT unit for safer blood transfusions in the sector in South India to have the NAAT facility for blood soon. The NAAT detects the virus directly, shortening this window period and reducing the risk of transmitting infections through blood transfusions. Further, expanding healthcare access in emerging regions and an increase in global hospital admissions contribute to this segment's robust growth.

Regional Insights

North America dominated the nucleic acid amplification testing market with the largest revenue share of 37.37% in 2024, due to high costs in the healthcare system, a sophisticated diagnostics infrastructure, and expanded government programming to monitor and combat diseases. The U.S. leads North America through a considerable investment in research and development, and an accelerated uptake of newer technologies, including PCR and isothermal amplification. The presence of large-scale companies in North America is sustained by strong regulation through the FDA, ensuring that NAAT products and their use are fully developed and implemented. Furthermore, the overall increase in the utilization of molecular diagnostics in oncology, precision, and personalized medicine is likely to support even greater interest in applications of NAAT.

U.S. Nucleic Acid Amplification Testing Market Trends

The nucleic acid amplification testing market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by the increasing incidence of infectious diseases, cancer, and genetic diseases. The market benefits from strong funding for research into molecular diagnostics and fast-tracked regulatory processes that expedite product approvals. In addition, COVID-19 has substantially increased the use of NAAT platforms such as PCR tests in the clinic and at point-of-care. Lastly, technological innovations in multiplexing and automation will improve test throughput and accuracy, bolstering the U.S. market's dominant position.

Europe Nucleic Acid Amplification Testing Market Trends

The nucleic acid amplification testing market in Europe occupies a large part of the global NAAT (nucleic acid amplification test) market, with major countries heavily invested in modernizing healthcare infrastructure and innovations in diagnostic testing. Europe’s robust regulations under the In Vitro Diagnostic Regulation (IVDR) assure product quality and safety but can make market access more cumbersome. Demand is anticipated to increase for rapid, dispersed testing solutions for infectious diseases and oncology. Collaborative research efforts, public health programs, and quality assurance are accelerating adoption across Western and Central Europe.

The UK nucleic acid amplification testing market is growing due to the growing investment in molecular diagnostics due to the Health Service's focus on increasing diagnostic capacity for infectious diseases and expanding cancer screening pathways. Moreover, NAAT's use in routine clinical practice is becoming more prevalent, particularly for sexually transmitted diseases and respiratory infections. Following Brexit, manufacturers have navigated regulatory changes to maintain alignment with UK and European regulatory agencies to ensure uninterrupted access and innovation.

The nucleic acid amplification testing market in Germany is growing rapidly due to its strong healthcare system and focus on precision medicine. Moreover, increasing launch of the NAAT products in Europe is fueling the growth of the market. For instance, in September 2024, QIAGEN N.V. (Germany) launched of the QIAcuityDx Digital PCR System, a pivotal addition to its digital PCR portfolio now expanding into clinical diagnostics. Moreover, the instrument and accessories are 510(k) exempt in the U.S. and IVDR-certified for diagnostic use in Europe including Germany. There is a substantial amount of R&D happening in Germany in the areas of oncology and rare genetic disease testing. The market benefits from existing reimbursement infrastructure, as well as a strong healthcare and laboratory network which facilitates market uptake of tests. In addition, Germany is a center for novel automated and high-throughput NAATs.

Asia Pacific Nucleic Acid Amplification Testing Market Trends

The nucleic acid amplification testing market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by growing government investments in molecular diagnostics, growing healthcare infrastructure, and growing healthcare awareness. NAAT technologies are rapidly being adopted by emerging economies such as China, India, and Southeast Asian countries to combat infectious diseases such as viral hepatitis, HIV, and tuberculosis. Decentralized and point-of-care platforms are growing in both rural and urban areas due to the demand for portable, low-cost testing solutions.

The Japan nucleic acid amplification testing market is characterized by cutting-edge technology, vigorous public health initiatives to control infections and diagnostic tests for cancer, and an emphasis on developing highly sensitive and rapid molecular tests. Japan will continue to focus on integrating NAAT with digital health technologies to monitor disease in real-time. Additionally, there is growing regulatory support and partnerships between academics and industry for innovation in test design and applications.

The nucleic acid amplification testing market in China is experiencing rapid growth driven by large population demand, government led public health campaign, and investment in molecular diagnostics manufacturing. There is a federal initiative place in which the government is stressing infectious disease prevention in light of the recent COVID 19 pandemic. This has led to a faster roll out of NAAT platforms in hospitals and community health care settings. For instance, in September 2024, Takara Bio USA, Inc. unveiled the SmartChip ND Real-Time PCR System, a high-throughput, automated research-use-only (RUO) qPCR solution for the monitoring of antimicrobial resistance (AMR), supporting the growing demand for environmental safety and sustainability. This system is highly flexible for the creation of large surveillance panels and support a variety of configurations. The system can be used to conduct 5,184 reactions per chip in less than 30 minutes of direct hands-on time. In addition, the rise of domestic production capacity and increasing uptake of isothermal amplification technologies all contribute to growth in the NAAT market.

Latin America Nucleic Acid Amplification Testing Market Trends

The nucleic acid amplification testing market in Latin America is gradually changing, aided by both underdeveloped healthcare systems and an increased familiarity with the importance of molecular diagnostics. Infectious diseases, such as Zika, dengue, and tuberculosis, are still important testing areas driving NAAT testing demand. However, regulatory heterogeneity and limitations in access in rural areas will limit the speed of market growth nationally. Modernizing laboratory infrastructures and government health programs will increase market penetration over the next several years.

Middle East And Africa Nucleic Acid Amplification Testing Market Trends

The nucleic acid amplification testing market in Middle East and Africa is driven largely as a function of increased infectious disease burden and development of healthcare infrastructure. The countries mentioned in this report including Saudi Arabia, UAE, South Africa, and Egypt specifically, are investing into their molecular diagnostic capabilities to help improve patient care and disease surveillance. However, while there are some shifts toward growth, efficacy of market performance is constrained by lighter regulatory frameworks and economic disparities in the region. New partnerships and technology transfer collaborations are helping to expand access to NAAT platforms

Key Nucleic Acid Amplification Testing Company Insights

The nucleic acid amplification testing industry features several key players driving innovation and adoption. Leading companies include F. Hoffmann-La Roche Ltd, Molbio Diagnostics Limited, Becton, Dickinson and Company, Danaher Corporation, Abbott Laboratories, Illumina, Inc., Siemens Healthineers, bioMérieux SA, Bio-Rad Laboratories, Inc., and Seegene Inc. These firms are heavily investing, rapidly evolving with continuous product innovation, geographic expansion, and strategic collaboration.

Key Nucleic Acid Amplification Testing Companies:

The following are the leading companies in the nucleic acid amplification testing market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Molbio Diagnostics Limited

- Becton, Dickinson and Company

- Danaher Corporation

- Abbott Laboratories

- Illumina, Inc.

- Siemens Healthineers

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Seegene Inc.

Recent Developments

-

In July 2025, Seegene Inc. (South Korea), launched its fully automated PCR testing system, CURECA, and its data analytics platform, STAgora. With the introduction of these new technologies, Seegene declares a transformative shift in the global diagnostics paradigm. Furthermore, CURECA is the world's first system to completely automate the PCR testing process, from sample storage and pre-treatment to nucleic acid extraction, amplification, and result analysis, with no human intervention. Designed for continuous operation 24 hours a day, seven days a week, the system reduces human error while dramatically improving the consistency and reliability of test results.

-

In June 2024, F. Hoffmann-La Roche Ltd received approval from the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA) for its cobas liat SARS-CoV-2, Influenza A/B & RSV nucleic acid test, an automated multiplex real-time polymerase chain reaction (RT-PCR) assay on the cobas liat system. The test uses a single nasopharyngeal or anterior nasal swab sample to confirm or rule out infection with SARS-CoV-2, influenza A virus, influenza B virus, and respiratory syncytial virus (RSV). Results are produced in just 20 minutes on a compact analyzer suitable for most healthcare settings.

-

In March 2023, BD received 510(k) clearance from the United States Food and Drug Administration (FDA) for the BD Vaginal Panel on the BD COR System. This comprehensive diagnostic test directly detects the three most common infectious causes of vaginitis using BD's high-throughput molecular diagnostic platform for large laboratories. The BD Vaginal Panel is the only FDA-cleared Nucleic Acid Amplification Test (NAAT) that provides separate results for C. glabrata and C. krusei, two Candida species known to be resistant to traditional antimicrobials, ensuring that appropriate treatments are prescribed.

Nucleic Acid Amplification Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,366.74 million

Revenue forecast in 2033

USD 23,146.69 million

Growth rate

CAGR of 9.30% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Molbio Diagnostics Limited; Becton, Dickinson and Company; Danaher Corporation; Abbott Laboratories; Illumina, Inc.; Siemens Healthineers; bioMérieux SA; Bio-Rad Laboratories, Inc.; Seegene Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nucleic Acid Amplification Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global nucleic acid amplification testing market based on type, application, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Polymerase Chain Reaction (PCR) Tests

-

Isothermal Nucleic Acid Amplification Technology (INAAT) Tests

-

Ligase Chain Reaction (LCR) Tests

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Disease Testing

-

COVID-19 Testing

-

Mosquito-Borne Disease Testing

-

Influenza Testing

-

Sexually Transmitted Infections Testing

-

Hepatitis Testing

-

Tuberculosis Testing

-

Others

-

-

Oncology Testing

-

Genetic & Mitochondrial Disease Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Central and Reference Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleic acid amplification testing market size was estimated at USD 9.95 billion in 2024 and is expected to reach USD 11.36 billion in 2025.

b. The global nucleic acid amplification testing market is expected to grow at a compound annual growth rate of 9.30% from 2025 to 2033 to reach USD 23.14 billion by 2033.

b. North America dominated the nucleic acid amplification testing market with a share of 37.37% in 2024. This is attributable to the increasing extent of healthcare awareness and growth in demand for nucleic acid amplification-based diagnostics to prevent infectious diseases in the region.

b. Some key players operating in the isothermal nucleic acid amplification technology market include F. Hoffmann-La Roche Ltd; Becton, Dickinson and Company; Danaher Corporation; Abbott Laboratories; Illumina, Inc.; Siemens Healthineers; bioMérieux SA; Novartis AG; Bio-Rad Laboratories, Inc., Seegene Inc.

b. Key factors driving the market growth include increase in demand for advanced rapid testing options and rising R&D investments for the development of novel biotechnological diagnostic techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.