- Home

- »

- Medical Devices

- »

-

Europe Breast Pumps Market Size & Share Report, 2030GVR Report cover

![Europe Breast Pumps Market Size, Share & Trends Report]()

Europe Breast Pumps Market Size, Share & Trends Analysis Report By Product (Open System, Closed System), By Technology (Manual, Electric), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-785-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The Europe breast pumps market size was estimated at USD 535.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. The regional product demand is anticipated to witness a surge due to rising employment among women. Various government initiatives aimed at improving consumer awareness and improving healthcare infrastructure, especially in emerging economies are other growth drivers. Moreover, increasing awareness about the benefits of breastfeeding, a rise in the number of working women, and increasing dual-income households, are among the essential factors driving the market growth. The higher inclination of Europeans toward using technologically advanced devices that make routine tasks simpler and faster is another important factor driving market growth.

Increasing women's employment is expected to be a high impact rendering growth driver for the market. Working women have a relatively higher disposable income and less time to breastfeed their babies, thus boosting the regional product demand. For instance, as per Eurostat, women’s employment rate aged 20 to 64 was around 66.2% in 2020.

Similarly, as per the European Commission statistics, among the EU Member States, Sweden had the highest employment rate for women (80%) in 2018. Following with percentages exceeding 75% are Lithuania, Germany, Estonia, Denmark, and the UK. They have share rates exceeding 73%, while the Netherlands, Latvia, and Finland reach 72%.

It becomes difficult for working women to provide proper nutrition to their babies, which has led to an increase in neonatal mortality. In such cases, breast pumps allow mothers to provide proper nutrition to their babies without hampering their professional lives. Hence, increasing women's employment in Europe is expected to propel the growth of the industry for breast pumps over the forecast period.

High awareness among target consumers, i.e. the awareness among lactating mothers, regarding the advantages of breastfeeding, is projected to create growth opportunities for the market over the forecast period. For instance, supportive initiatives undertaken by the governments, such as the breastfeeding initiative by UNICEF in the UK, are anticipated to positively influence the growth. As a result of these initiatives, the rate of breastfeeding increased to 43% in 2017 from 32% in 2010, which has led to a rise in regional demand.

Similarly, European governments are encouraging mothers to breastfeed babies up to the age of 6 months. Moreover, several agencies are arranging campaigns to raise awareness about breastfeeding. These factors are expected to drive the market. In addition, social media platforms, such as YouTube, Facebook, and Instagram, have enabled individuals to access information about breast pumps and related accessories. Several companies provide information on these platforms.

Favorable health insurance plans might also surge the demand for the product. Most health plans require consumers to purchase breast pumps of specific brands. Thus, manufacturers are entering into collaborations with insurance companies to enhance their market presence and increase market shares.

The market in developed economies such as Germany, France, and Poland is saturated owing to the increasing demand and the presence of key market players in these countries. Economic development in these regions and rising disposable income are anticipated to help in the future sustainability of the market. Manufacturers investing in these rapidly developing markets are expected to witness high growth, provided pricing and distribution activities are undertaken effectively.

Women in countries such as Germany and Poland are using technologically advanced devices in their everyday lives, which helps in reducing the time spent on routine activities. This is mainly on account of increasing awareness and disposable incomes as well as the easy availability of advanced devices in this market due to the extensive geographic presence of key market players.

The increasing number of milk banks in Germany is anticipated to further boost demand for wearable breast pumps and breastfeeding accessories. There are about 18 breastmilk banks in Germany, which can help provide premature infants with donor milk. The European Foundation for Care of Newborn Infants (EFCNI) initiated an international project to support clinical centers in Germany, Austria, and Switzerland in the setup & operation of human milk banks on a national level.

A negative effect on the market was observed due to the COVID-19 pandemic. However, following the release of COVID-19 vaccines, nations began to open their borders internationally, which restored normalcy to the supply chain during the post-pandemic period. In addition, after the pandemic, the birth rate rose as well. For instance, some researchers at the University of Michigan Health Organization expected that births would rebound, resulting in a normal birth volume. As a result, the market is projected to see a modest increase in the demand for breast pumps in the years to come.

A large number of companies are introducing new breast pumps to the market. For instance, Medela AG announced the release of Solo in January 2022. Solo is a single electric breast pump that is small and simple to use. Thus, the market is anticipated to have significant growth during the post-pandemic period due to an increase in product launches, introduction of COVID-19 vaccinations, and increase in birth rates.

Product Insights

Based on product, the market has been segmented into open-system and closed-system breast pumps. The closed system segment held the largest revenue share of 64.7% in 2022 and is anticipated to grow at the fastest CAGR of 9.0% during the forecast period. The product is considered to be safer as compared to the open system variant, which is expected to propel the segment in the coming years. This product provides better protection, ensuring maximum removal of impurities. Moreover, it is easy to clean. The introduction of portable instruments, such as Ameda HygieniKit is expected to drive market growth over the next six years.

Technology Insights

Based on technology, the market has been segmented into manual, battery-powered, and electric breast pumps. The electric pump segment held the largest revenue share of 50.3% in 2022 and is expected to grow at the fastest CAGR of 9.3% during the forecast period owing to the increasing inclination toward technologically advanced products. Moreover, working mothers generally prefer using electric pumps as they can easily extract more milk in less time.

Electric pumps can often be quite heavy and noisy, but manufacturers continue to use advanced technology, which helps them create lighter pumps that generate less noise. Electric pumps are also available for rent for mothers who cannot afford to buy a new pump and require them for a short duration.

Application Insights

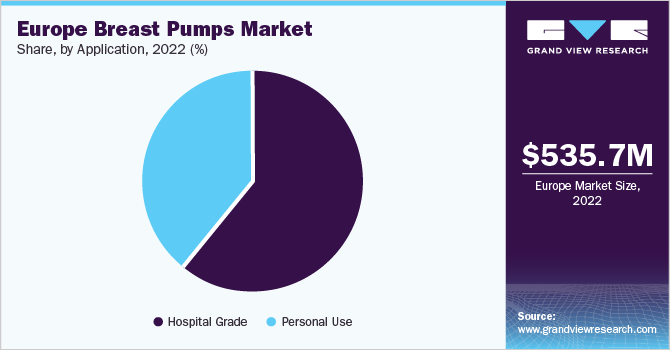

Based on application, the market has been segmented into personal use and hospital grade. The hospital-grade breast pumps segment held the largest revenue share of 60.9% in 2022 and is expected to grow at the fastest CAGR of 9.2% during the forecast period owing to the rising awareness regarding the benefit of breastfeeding and increasing adoption of the product due to the rise in women's employment.

Hospital-grade pumps are approved and designed by the Food and Drug Administration as safe for multiple users. These pumps can be used by more than one mother as they are designed with barriers that prevent cross-contamination. The introduction of portable instruments, such as Elite, Lact-e, & SMB by Ameda and Lactina & Symphony by Medela, is expected to further drive the segment over the next six years.

Country Insights

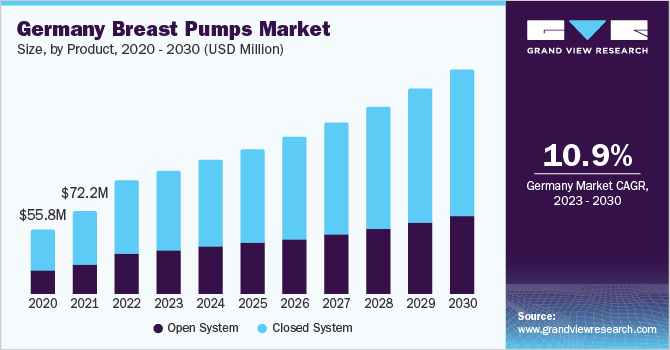

The UK dominated the market in 2022 and held the largest revenue share of 19.8%. Germany has a considerable market share and is anticipated to grow at the fastest CAGR of 10.8% during the forecast period owing to the high breastfeeding rate, increasing awareness, and various initiatives taken by the government. In Germany, 14 weeks of paid maternity leave is provided, which can be availed from six weeks before birth to eight weeks after childbirth. This period can be extended to 12 weeks in case of multiple births.

In addition, 12 months of parental leave is available with 65.0% of the mother’s salary being paid, and mothers are entitled to unpaid parental leave for up to 3 years. Moreover, once mothers resume work, they are entitled to two 30-minute breaks at the workplace per 8 hours to pump breast milk. Such initiatives are expected to boost breastfeeding in Germany, thus, driving the market.

France’s breast pumps market is still at a nascent stage. According to data published in ‘An International Comparison Study’ into the Implementation of the WHO Code and other breastfeeding initiatives by The Australian Government Department of Health, France has one of the lowest breastfeeding rates in Europe. Low rates indicate the need for more breastfeeding awareness and campaigns in the country.

France has strict regulations for advertising and marketing breastfeeding products. However, key players can advertise and sell their products to health professionals and encourage product usage in the country. According to French laws, pregnant women can take up to 16 weeks of paid leave, six weeks pre- and 10 weeks postpartum.

The parents have the right to job-protected leave or part-time arrangement of job for the first three years after a child’s birth. Such supportive laws are expected to create more opportunities for key players in the market. In addition, creating awareness about the benefits of breastfeeding by celebrating Breastfeeding Week is expected to positively impact market growth.

However, in France, 50.7% of people said they postponed their plans to have a child in 2020 owing to the pandemic. According to the national statistics agency INSEE, the percentage of babies born in France in 2020 decreased by 13%, the biggest decline in 45 years. Thus, the demand for wearable breast pumps and breastfeeding accessories is anticipated to be moderate in France over the forecast period.

Key Companies & Market Share Insights

The Europe market is moderately fragmented and competitive and consists of both local and international players. With the growing popularity of breast pumps, firms such as Philips are developing these devices, and it is projected that several well-known and larger companies will enter the market in the future.

Key players engage in strategic initiatives, such as mergers and acquisitions, partnerships, and product launches to sustain the competition. Increasing funding for R&D is expected to drive the market. For instance, in March 2021, Philips Avent launched the Philips Avent Double Electric Breast Pump, Advanced. With innovative Natural Motion Technology and a compact, portable design, the new breast pump was created to meet the demands of the modern mother who is balancing a busy lifestyle while breastfeeding. In October 2021, The Dairy Fairy's Perfect Pumping Bra was launched by Willow, ‘The Willow pump bra’ is designed specifically to give mothers exceptional comfort, support, and a perfect fit so they may enjoy the best pumping experience. Some prominent players in the Europe breast pumps market include:

-

Koninklijke Philips N.V.

-

Pigeon Corporation

-

Chiaro Technology Limited

-

Ardo Medical Ltd.

-

Ameda (Magento, Inc.)

-

Medela AG

-

Albert

-

Mayborn Group Limited

Europe Breast Pumps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 579.0 million

Revenue forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Koninklijke Philips N.V.; Pigeon Corporation; Chiaro Technology Limited; Ardo Medical Ltd.; Ameda (Magento, Inc.); Medela AG; Albert; Mayborn Group Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Breast Pumps Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe breast pumps market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Open system

-

Closed system

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Battery powered

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal use

-

Hospital grade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Frequently Asked Questions About This Report

b. The Europe breast pumps market size was estimated at USD 535.7 million in 2022 and is expected to reach USD 579.0 million in 2023.

b. The Europe breast pumps market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 1.0 billion by 2030.

b. Electric pumps dominated the technology segment with a share of above 50.3% in 2022. This is attributable to increasing disposable incomes, rising standard of living, and relative cost-effectiveness of these pumps over electric breast pumps.

b. Some key players operating in the Europe breast pumps market include Ameda AG, Energizer Holdings, Inc., Medela AG, Philips, Buettner-Frank GmbH, Inc., and Pigeon Corporation.

b. Key factors that are driving the Europe breast pumps market growth include increasing women's employment rates, various government initiatives aimed at improving consumer awareness, and improving healthcare infrastructure in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."