- Home

- »

- Advanced Interior Materials

- »

-

Europe Chemical Anchors Market Size & Share Report, 2030GVR Report cover

![Europe Chemical Anchors Market Size, Share & Trends Report]()

Europe Chemical Anchors Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Injectable Adhesive, Capsule Adhesive), By Resin (Epoxy Acrylate, Hybrid Systems), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-154-2

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Chemical Anchors Market Trends

The Europe chemical anchors market size was estimated at USD 321.9 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2024 to 2030. The market is expected to grow with the growing European construction industry. The rapid expansion of the construction sector is aided by the increased construction spending by governments across several regional economies, including France, Spain, the U.K., and Poland, on account of the rapid population growth and industrial development. There have been several developments in epoxy resin technology over the years. Technological improvements have increased functioning, fair shelf life, and a high level of corrosion resistance that is similar to two-component epoxy polyamide coatings. Epoxy is an important component in the chemical anchoring formulation that boosts its end-use functionality.

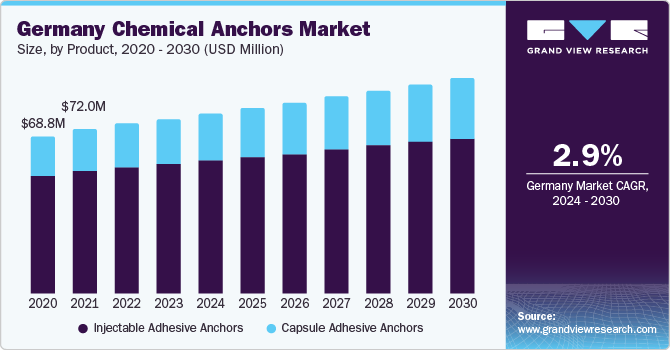

Germany is expecting a positive trend in the construction sector in the near future, as it is witnessing investments in various construction projects. In 2023, some of the largest construction projects initiated in Germany are Rock Tech’s lithium plant in Brandenburg, the Stuttgart 21 Project in Stuttgart, the Digital Park Fechenheim Project, and the Frankfurt Airport Terminal 3 Construction Project. The projects are worth between USD 230.0 to USD 500.0 million. Such investments are anticipated to increase the need for chemical anchors in the country over the forecast period.

The chemical anchors industry in Europe was disrupted due to the COVID-19 pandemic that emerged in late December 2019. Construction activities involve the construction of buildings, civil engineering, and specialized construction tasks. The construction output of the European Union witnessed a decline of 25.9% in March and April 2020; however, it climbed by 20.4% in May 2020, recovering some of the losses incurred during the crisis. The construction output has been steadily increasing since that period onwards; in January 2022, it was 1.9% higher than that recorded in February 2020.

The European construction sector continues to expand at a substantial rate. Several European economies, including the UK, Italy, Germany, Spain, France, and Poland, are major consumers of chemical anchors. The rise in construction activities, rapid infrastructure development, and increasing renovation projects are resulting in a proliferation of construction activities in the region, in turn, contributing to the demand for construction anchors.

The growing popularity of lightweight construction materials, rising demand for improved insulation, and emphasis on environmentally friendly solutions have all benefited the market. Construction anchors are commonly utilized in several industries, including industrial, commercial, residential, and infrastructures, for purposes such as fixing structural elements to hollow or solid materials such as bricks, concrete, stone, and porous concrete.

The major disadvantage of chemical anchors lies in their installation since they are more sensitive to poor hole cleaning compared to mechanical anchors. Furthermore, the high costs of chemical anchors compared to mechanical anchors are likely to hamper the adoption rate of chemical anchors in economies around Europe.

Product Insights

Based on product, the market is segmented into injectable adhesive anchors and capsule chemical anchors. Injectable adhesive anchors led the market with a revenue share of 74.6% in 2023. They are larger in terms of anchorage sizes and lengths when compared to capsule systems' set sizes. In addition, in some situations, such as flooded or large holes, injectable chemical anchors are the safest alternative.

The capsule chemical anchors are anticipated to grow at a CAGR of 4.2% over the forecast period. Capsule adhesive anchors function well on concrete but not well on masonry materials because the resin can be lost in cavities, perforations, and empty gaps between the leaves of brickworks. One reason capsule anchors are not as well known and have been supplanted by injectable adhesive anchors is that there are not as many options available compared to the abundance of injection anchors in the market.

Resin Insights

Polyester chemical anchors are utilized for construction parts of handrails, building facades, steel dowels, sound barriers, pipelines, stairwells, brackets, and post-installation rebar connections, as well as dynamically loaded constructions. These can also be incorporated for medium-load rebar anchoring used on dry concrete and threaded rods.

Epoxy acrylate was the largest used resin in 2023 for the production of chemical anchors, with a revenue of over USD 115.5 million. These chemical anchors have excellent chemical resistance in extremely aggressive situations or under humid circumstances and they can even be used in underwater anchors. These are also used for fixings in solid or hollow structural supports such as walls, columns, facades, and floors.

An unsaturated polyester chemical anchor is a reactive resin that is extensively utilized for manufacturing a two-component injection mortar, wherein both styrene-free unsaturated polyester resins and styrene-dissolved unsaturated polyester resins are applied as reactive solvents. Two-component injection mortars of resin are easy and fast to use, thereby the resin segment is expected to grow at the fastest rate over the forecast period.

Hybrid Systems incorporate a two-part chemical anchor that cures quickly and allows one to load an attaching point earlier than an epoxy anchor. These systems can be utilized anywhere a threaded rod or rebar needs to be inserted into concrete. Highly reactive polymers can be injected into the borehole before a steel stud or bolt is inserted to attach structural steel connections like steel beams or columns to concrete.

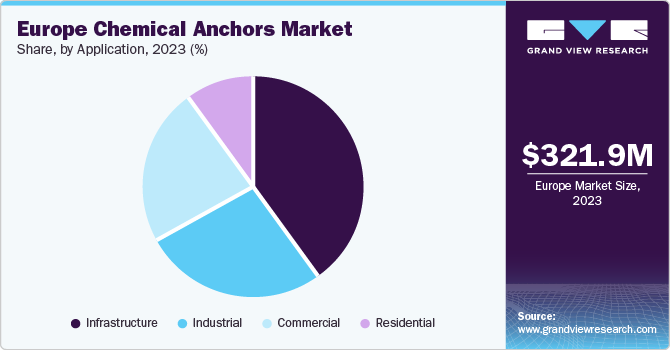

Application Insights

In terms of application, the infrastructure segment held the largest revenue share in 2023 and is further expected to advance at a steady CAGR of 3.5% during the forecast period. Infrastructure is vital for people and businesses across Europe, from trains and roads that transport people and goods to communications networks and power plants that support industrial and domestic operations, as well as for basic human needs such as clean water and sanitation.

Commercial construction comprises the development or building of offices, shops, malls, and hotels, among other commercial facilities. The commercial construction sector of Europe is poised to witness a downturn on account of higher interest rates and the rising cost of borrowing in the real estate sector. Additionally, the growing work-from-home trend and hybrid working patterns following the outbreak of the COVID-19 pandemic are expected to restrict the expansion of the office segment in the region.

According to the UN statistic International Migrant Stock 2020, Europe has the most international migrants, with roughly 86.7 million international migrants residing in Europe in 2020. The number of residential buildings is expanding to meet a growing number of migrants in urban areas, leading to an increased need for chemical anchors.

The rising need for larger houses and flats, and a large population relocating from the city to the countryside, are two key trends that positively influence residential construction in European economies. These factors are expected to boost demand for chemical anchors in the region over the forecast period.

Country Insights

Germany dominated the market with a revenue of USD 76.3 million in 2023. Germany is expecting a positive trend in the construction sector in the near future, as it is witnessing investments in various construction projects. In 2023, large construction projects were initiated in Germany worth between USD 230.0 and USD 500.0 million. Such investments are anticipated to increase the need for chemical anchors in the country over the forecast period.

Poland is anticipated to grow at a CAGR of 4.9% over the forecast period. The construction sector is a crucial component of Poland’s GDP, contributing about 10% of GDP in 2022. In addition, government and private players in various industries such as construction and tourism forecast economic growth to pick up in 2024 and 2025 owing to rising investments. This is expected to propel demand for chemical anchor products in Poland over the forecast period.

Increasing urbanization and infrastructure developments along with rising construction spending in France are projected to propel market growth. Rising private and public investments by governments in the construction industry are expected to spur market growth in France over the forecast period. Increasing demand for luxury buildings in France is expected to boost the demand for chemical anchors.

The sluggish growth of the manufacturing sector of Italy, as a result of rising utility spending on a domestic level, is expected to limit the application of numerous chemical anchor products for commercial applications over the forecast period. However, the increasing number of casinos on a domestic level is expected to play a crucial role in promoting the usage of chemical anchor products.

Key Companies & Market Share Insights

The market consists of key players such as Sika AG; Hilti Corporation; Simpson Strong-Tie Company, Inc.; Henkel AG & Co. KGaA; fischer Group of Companies; and Illinois Tool Works Inc. Market participants are taking on a variety of initiatives, including new product launches, acquisitions and mergers, and research & development.

In July 2023, Simpson Strong-Tie Company, Inc. announced the launch of AT-3G, an all-weather hybrid-acrylic anchoring adhesive for high-strength bonding, and curing for uncracked and cracked concrete. The new product introduction aims to attract additional clients and expand their chemical anchor customer base.

Key Europe Chemical Anchors Companies:

- Sika AG

- Hilti Corporation

- Simpson Strong-Tie Company, Inc.

- Henkel AG & Co. KGaA

- fischer Group of Companies

- Illinois Tool Works Inc.

- Mungo AG

- HALFEN

- Chemfix

- Fasten.it S.r.l.

- Klimas Sp. z o.o.

- Etanco Polska

Europe Chemical Anchors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 342.6 million

Revenue forecast in 2030

USD 411.4 million

Growth rate

CAGR of 3.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin, application, country

Regional scope

Europe

Country scope

Germany; U.K.; France; Italy; Spain; Poland

Key companies profiled

Sika AG; Hilti Corporation; Simpson Strong-Tie Company, Inc.; Henkel AG & Co. KGaA; fischer Group of Companies; Illinois Tool Works Inc.; Mungo AG; HALFEN; Chemfix; Fasten.it S.r.l.; Klimas Sp. z o.o.; Etanco Polska

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Chemical Anchors Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe chemical anchors market report based on product, resin, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable Adhesive Anchors

-

Capsule Adhesive Anchors

-

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester Chemical Anchor

-

Unsaturated Polyester Chemical Anchor

-

Epoxy Acrylate Chemical Anchor

-

Pure Epoxy Chemical Anchor

-

Hybrid Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Infrastructure

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Poland

-

-

Frequently Asked Questions About This Report

b. The Europe chemical anchors market size was estimated at USD 331.9 million in 2023 and is expected to reach USD 342.6 million in 2024.

b. The Europe chemical anchors market is expected to grow at a compound annual growth rate of 3.1% from 2023 to 2030 to reach USD 411.4 million by 2030.

b. The injectable adhesive anchors of the market accounted for the largest revenue share of 74.6% in 2023 owing to rising use to fix steel dowels, staircases, handrails, building facades, sound barriers, pipes, brackets, and post-installation rebar connections.

b. Some of the key players operating in the Europe chemical anchors market include Sika AG, Hilti Corporation, Simpson Strong-Tie Company, Inc., Henkel AG & Co. KGaA, fischer Group of Companies, and Illinois Tool Works Inc.

b. The key factors that are driving the Europe chemical anchors market includes the increased construction spending by governments across several countries including Spain, France, the UK, and Poland owing to rapid population growth and industrial development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.