- Home

- »

- Healthcare IT

- »

-

Europe Clinical Trials Market Size, Industry Report, 2033GVR Report cover

![Europe Clinical Trials Market Size, Share & Trends Report]()

Europe Clinical Trials Market (2025 - 2033) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, Indication By Study Design, By Service, By Sponsor, By Country and Segment Forecasts

- Report ID: GVR-4-68039-916-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Clinical Trials Market Summary

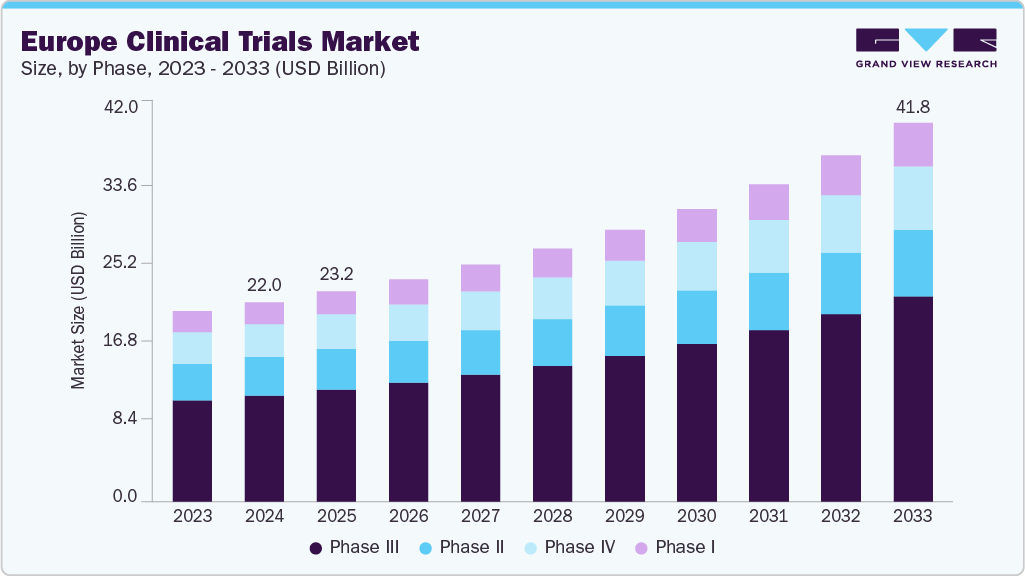

The Europe clinical trials market size was estimated at USD 22.01 billion in 2024 and is projected to reach USD 41.76 billion by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The market is witnessing robust growth, fueled by a strong regulatory framework, rising R&D investments, accelerating biopharma innovation, increased adoption of advanced technologies, and the rising shift toward decentralized trial models.

Key Market Trends & Insights

- Germany held the largest revenue share in Europe clinical trials market in 2024.

- By phase, the phase III segment held the largest market share of 53.25% in 2024.

- By study design, the interventional trials segment held the largest market share in 2024.

- By indication, the oncology segment held the largest revenue share in 2024.

- By service, laboratory services dominated with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.01 Billion

- 2033 Projected Market Size: USD 41.76 Billion

- CAGR (2025-2033): 7.6%

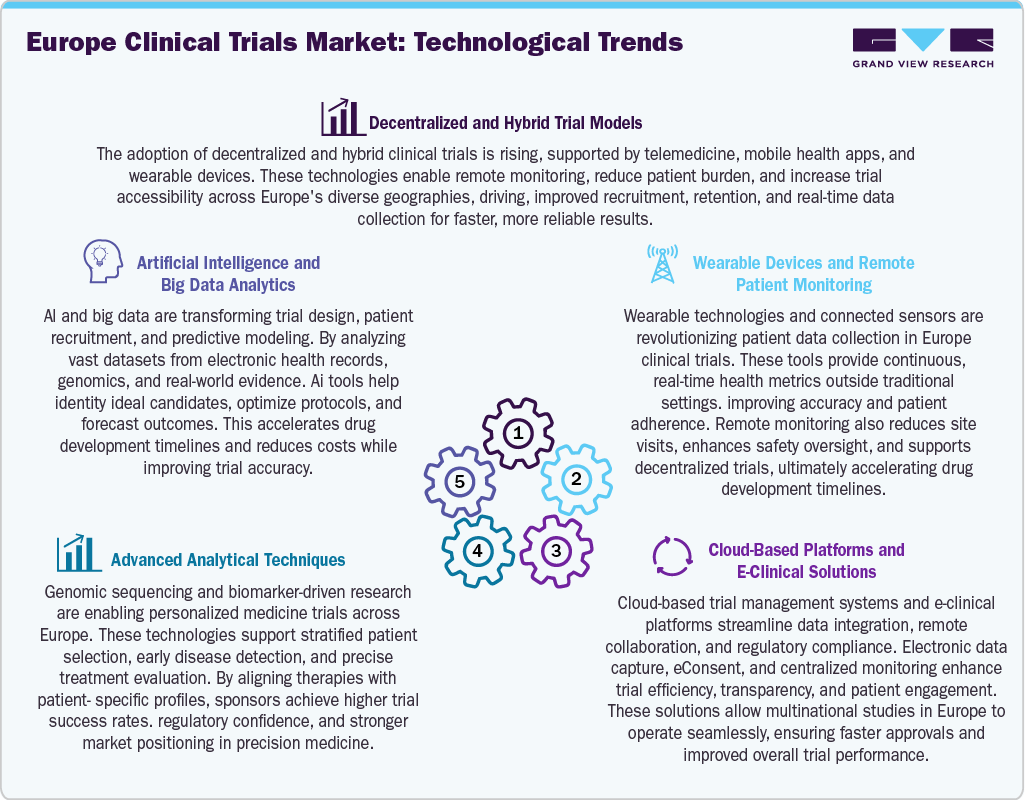

Some other factors contributing to market growth are increased demand for novel therapies, an ageing population facing an increasing burden of chronic diseases, and larger R&D budgets from major pharmaceutical companies and biotech companies. These factors have led to increased clinical trials for high-value therapeutic areas such as oncology and advanced therapies, creating a rising need for late-phase programs across the region.Moreover, the growing technological advancement has led to a rapid transformation in trial design and execution. In addition, technological advancements such as decentralized clinical trial (DCT) methodologies, remote monitoring, wearable technology, digital biomarkers, and artificial intelligence/machine learning for patient selection and signal detection have further transformed the pilot projects into standard practices. Besides, decentralized models support increased patient convenience and accessibility, which improves recruitment & retention rates and makes real-time data collection possible. Thus, trial management has become more efficient for sponsors and CROs, reducing timelines, enhancing patient retention, and allowing for continuous measurement of objective endpoints. Such factors are expected to drive the market.

Furthermore, the European Medicines Agency and the EU Clinical Trials Regulation implementation provide a framework that streamlines clinical trial approvals across member states. This ensures a standardized process, greater transparency, and stronger patient safety measures. Besides, the region has become an attractive destination for global pharmaceutical and biotechnology companies to conduct trials due to reduced administrative delays and increased cross-border collaborations. Sponsors can efficiently launch multi-country studies, speeding up drug development and market entry. Thus, the regulatory framework is expected to boost the region’s competitiveness in the market, further fueling the market growth.

Also, biotech companies, government programs, and established pharmaceutical companies invest in R&D across Europe, especially in precision medicine, oncology, rare diseases, and innovative treatments such as gene and cell therapy. For instance, according to the EUROSTAT data, the European Union spent USD 412 billion on R&D in 2023, or USD 919 per person. This represents a 6.7% increase in per capita spending over the previous year. Furthermore, the market has innovation clusters in France, Switzerland, the UK, and Germany, which support specialized trial designs such as decentralized models and adaptive trials. In addition, due to growing investment in the market, the region has witnessed a rising number of experimental medications that need to be assessed in clinical trials. Thus, contract research organizations (CROs) and academic centers are experiencing increased collaboration opportunities, further driving market expansion and strengthening Europe’s role as a hub for advanced clinical research.

Market Opportunities

The European clinical trials market is experiencing robust growth, driven by increasing demand for advanced therapies such as cell and gene therapies, oncology medications, and treatments for rare diseases. The region has a strong regulatory framework, diverse patient populations, and robust investment in research and development, making it a preferred location for complex, high-value studies. In addition, digital health, decentralized trials, and AI-based solutions enhance clinical trials for targeted therapies and adaptive study designs, further speeding up drug development.

Decentralized and hybrid trial models provide significant opportunities, improving recruitment, retention, and cost efficiency while broadening patient access globally. Strategic investments through EU-backed financial schemes, public-private partnerships, government incentives, and tax benefits in countries such as Germany, the UK, and France are attracting considerable trial activities in the region. Furthermore, the region is a global center for early and late-stage research with a highly qualified workforce and sophisticated healthcare infrastructure supporting the market.

The technology landscape of Europe’s clinical trials market is reshaping the clinical trials designed, executed, and monitored. Besides, the clinical trials market in Europe is witnessing dynamic changes due to technological advancements. In the market, wearable technology and telemedicine are widely used for decentralized and hybrid models that improve patient accessibility and real-time data collection. Besides, the precision medicine approach is driven by genetic and biomarker technology, whereas artificial intelligence and big data analytics optimize trial design, recruitment, and predicted outcomes. Cloud-based e-clinical platforms increase efficiency & transparency by streamlining data integration, compliance, and cooperation across international research. Furthermore, remote monitoring and wearable technology enhance continuous health surveillance, reduce the need for site visits, and boost patient adherence. Thus, these developments are propelling drug development, creating more patient-centric research models, and changing the clinical trial environment in Europe.

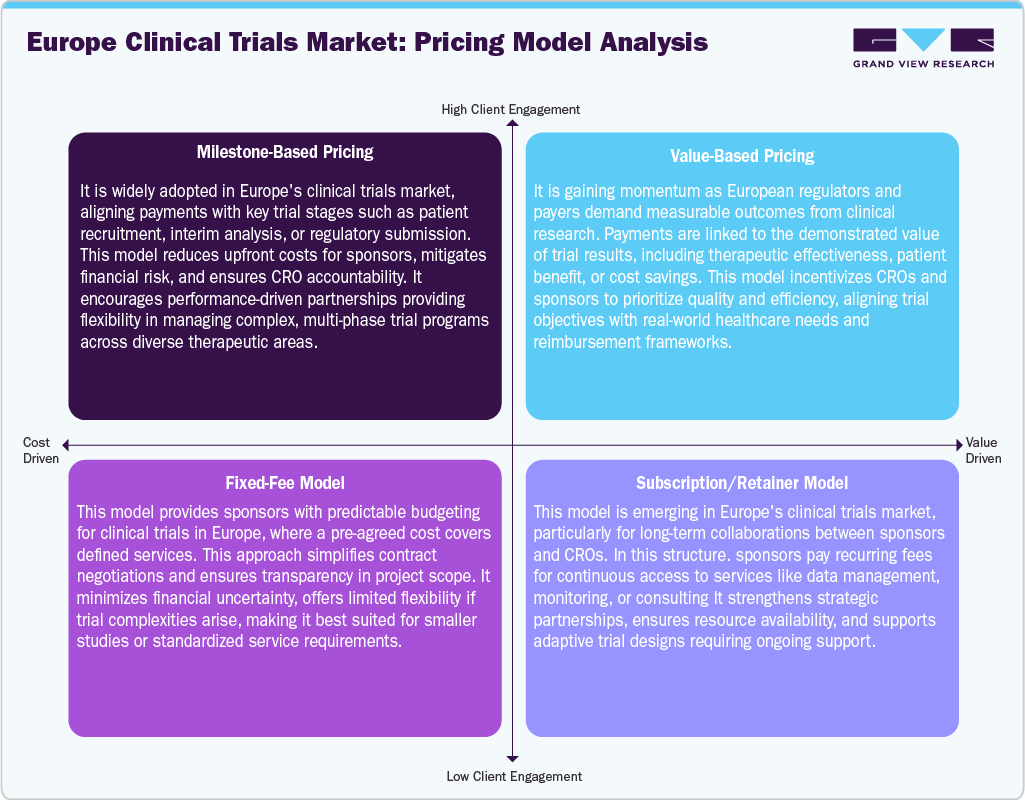

Europe clinical trials market employs diverse pricing models to balance cost efficiency and value delivery. Milestone-based pricing ties payments to key trial stages, reducing risks and ensuring accountability. Value-based pricing is rising, linking compensation to demonstrated therapeutic and economic outcomes, aligning with healthcare priorities. Fixed-fee models provide cost predictability and transparency, ideal for smaller or standardized studies, though less flexible in complex trials. Meanwhile, subscription or retainer models drive the long-term partnerships, offering ongoing access to critical services and adaptive trial support.

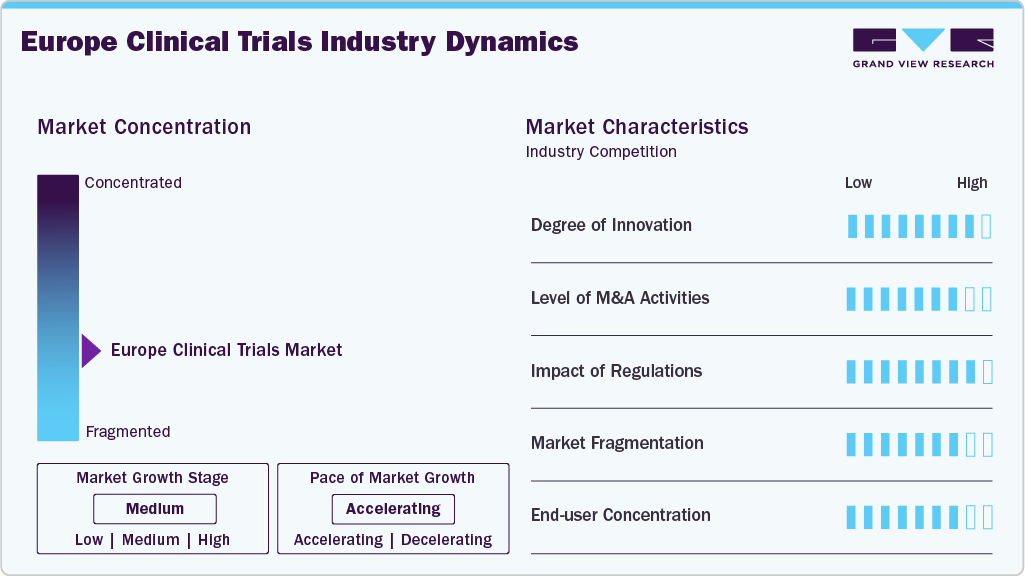

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by strong regulatory harmonization under the EU Clinical Trials Regulation, high R&D investment, and extensive academic-industry collaboration. Diverse patient populations, advanced infrastructure, and adoption of decentralized and digital trial models enhance efficiency, though recruitment challenges and cost pressures remain significant in the market.

Innovation in Europe’s clinical trials market is strong, driven by digital health technologies, AI-enabled data analytics, and decentralized trial models. Integration of wearables, real-world evidence, and remote monitoring enhances efficiency and patient diversity. These innovations reduce operational costs, improve patient compliance, recruitment and retention.

Europe clinical trials market is robustly influenced by the EU Clinical Trials Regulation (CTR), GDPR, and national-level guidelines. These frameworks emphasize patient safety, transparency, and data privacy, ensuring rigorous trial conduct. Compliance requirements increase operational complexity and costs and build public trust and foster harmonization across member states, enhancing cross-border collaboration opportunities.

The clinical trials market in Europe witnesses’ moderate level of mergers and acquisitions, due to CRO consolidation and alliances between technology suppliers and pharmaceutical firms. Larger CROs invest in niche companies focusing on decentralized trials, uncommon diseases, or digital solutions to increase capabilities. For instance, in August 2025, Sanofi completed the acquisition of Vigil Neuroscience, to boost its neurodegenerative pipeline. This agreement reaffirms Sanofi's dedication to promoting neurological innovation. Thus, these factors are expected to drive market growth.

The market is highly fragmented, with numerous CROs, biotech firms, and academic institutions operating at regional and national levels. This fragmentation fosters competition, innovation, and collaboration but creates challenges for standardization and streamlined trial execution across regions.

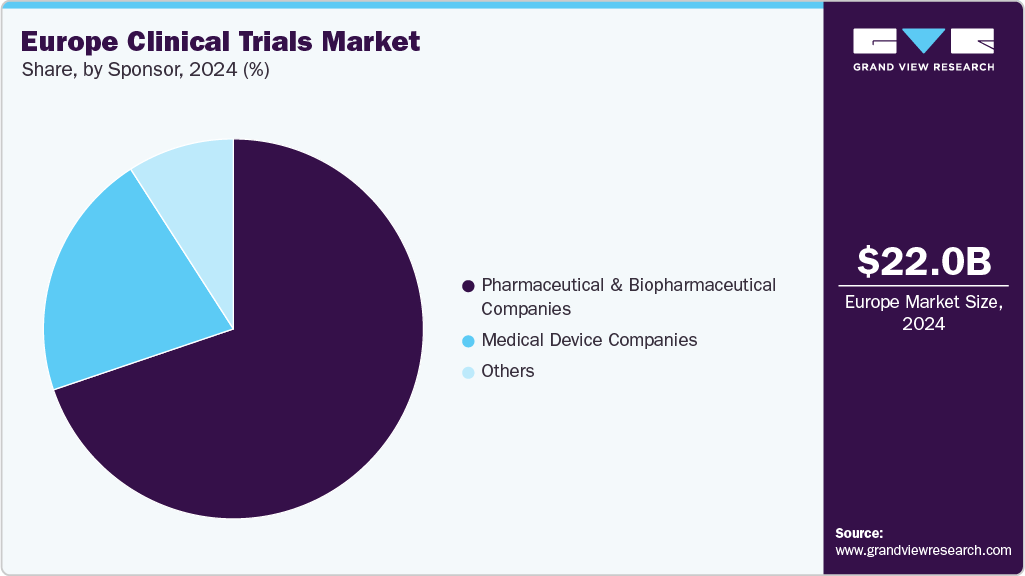

End use concentration in Europe’s clinical trials market is high, with pharmaceutical and biotechnology companies serving as primary sponsors. Academic institutions, research organizations, and government bodies also play critical roles.

Phase Insights

Phase III segment led the market and accounted for 53.2% of the total revenue share in 2024. Phase III is the most critical and cost-intensive stage of drug development, designed to ensure efficacy and safety in large patient populations across multiple countries. Besides, the EU Clinical Trials govern these trials regulation & registered in the Clinical Trials Information System, which ensures transparency and compliance. These systems provide the key data required for European Medicines Agency approval, often used for adaptive designs and biomarker-driven recruitment. Moreover, due to phase complexity, most of the sponsors rely on CRO partnerships, advanced e-clinical platforms, and multinational collaboration for regulatory approval and market entry. Such factors are expected to drive the market.

Phase I trials segment is the fastest-growing segment in the market over the forecast period, driven by increasing early-stage drug development and the rise of innovative therapies such as biologics, gene, and cell therapies. Besides, the phase I trials support to assess safety, tolerability, and pharmacokinetics, which are often required for specialized clinical sites & skilled investigators. Moreover, growing investment in R&D, coupled with advancements in adaptive trial designs and biomarker-driven patient selection are expected to drive the phase I trials over the estimated time period. Such factors are expected to drive the market’s growth.

Study Design Insights

The interventional trials studies segment dominated the market in 2024, owing to their crucial role in assessing the safety and effectiveness of novel medications, biologics, and medical devices. These studies are usually carried out across several nations and sizable patient populations which entail active interventions, such as giving people experimental medications. Besides, the market revenue is impacted by intricacy, stringent monitoring, regulatory compliance, and high operational expenses of interventional trials.

Observational trials segment is the fastest growing during the forecast period, fueled by increasing need for post-marketing surveillance and real-world evidence. These studies provide information on the efficacy, safety, and long-term results of treatments by monitoring patients without intervention. Besides, growing emphasis on rare diseases, chronic illnesses, and personalized medicine is expected to drive observational trials. In addition, technological innovations including wearable technology, electronic health records, and remote monitoring are expected to support the market.

Indication Insights

The oncology segment represented the largest revenue segment in 2024, fueled by rising cancer incidence, advances in targeted therapies, and growing investment in immuno-oncology & precision medicine. In addition, the oncology clinical trials programs are increasingly focusing on biomarker-driven patient stratification, combination therapies, and innovative treatment modalities such as CAR-T and gene therapies. Moreover, in oncology clinical trials, the large-scale, multi-center, late-stage cancer studies usually involve increased patient recruitment, specialist monitoring, and intricate regulatory compliance, which further contributes to segment growth. For instance, in September 2025, a European pharmaceutical company teamed up with a biopharma company. This collaboration accelerated the development of novel, patient-specific cancer treatments throughout Europe and launched clinical studies aimed at solid tumors. Moreover, advances in targeted therapies, immunotherapies, and precision medicine further boost investment and trial activity in this therapeutic area.

The diabetes segment is expected to grow at the second-highest CAGR during the forecast period. The segment is driven by the rising prevalence of type 1 and type 2 diabetes across all age groups. Besides, increasing awareness of diabetes-related complications and rising need for improved management strategies are fueling demand for innovative therapies, including insulin analogs, GLP-1 receptor agonists, and emerging gene and cell-based treatments. In addition, growing technological advancements such as continuous glucose monitoring, digital health platforms, and wearable devices support patient recruitment, adherence, and real-time data collection.

Service Insights

Laboratory services segment constituted the largest revenue segment in 2024, attributed to its vital significance in biomarker analysis, diagnostic testing, and centralized laboratory assessments in clinical research. All trial phases are supported by these services, which offer precise, standardized, and superior data that are necessary for therapeutic assessments and regulatory submissions. Complex trials in oncology, uncommon disorders, and customized medicine create high demand since they call for sophisticated laboratory capabilities. As sponsors depend on contract labs for bioanalytical testing, genetic profiling, and sample processing, laboratory services are a major source of income.

The patient recruitment segment is expected to grow at the fastest CAGR during the forecast period. The segment is driven by the increasing complexity of trials and the need for diverse, representative populations. The need for specialized recruitment tactics has increased due to dispersed trial designs, strict eligibility requirements, and the growing occurrence of uncommon diseases. To increase enrollment and retention, sponsors and CROs make use of digital platforms, social media marketing, and patient advocacy networks. Patient recruitment is a crucial and quickly growing part of Europe's clinical trial ecosystem because improved recruitment services shorten trial durations, lower dropout rates, and guarantee regulatory compliance.

Sponsor Insights

The pharmaceutical & biopharmaceutical companies segment accounted for the largest market revenue share in 2024, as they are the primary sponsors driving trial demand across therapeutic areas. These companies fund early to late-stage studies, ranging from Phase I safety assessments to Phase III pivotal trials, and invest heavily in innovative therapies such as biologics, gene and cell therapies, and precision medicines. Their substantial budgets cover complex trial operations, patient recruitment, laboratory services, and regulatory compliance.

Medical device companies is the second fastest growing segment in the market, driven by increased demand for innovative surgical instruments, implanted technology, and diagnostics. Trial activity is fueled by regulatory requirements that require comprehensive clinical review, such as CE labeling and MDR compliance. Research is further accelerated by developments in wearable health technology, digital monitoring devices, and minimally invasive procedures. Businesses are increasingly using multicenter and adaptive trial designs to validate safety and efficacy effectively.

Country Insights

UK Clinical Trials Market Trends

UK’s clinical trials market is the fastest growing in the region over the forecast period, driven by strong government support, public-private collaborations, and robust R&D infrastructure. For instance, in August 2025, Rein Therapeutics launched Phase 2 LTI-03 trial for idiopathic pulmonary fibrosis exemplified its focus on innovative, first-in-class therapies addressing unmet medical needs. In addition, significant investment such as in August 2024 including the USD 538 million VPAG programme, for establishing 18 new clinical trial hubs, accelerating patient access and research efficiency. Advanced capabilities in adaptive trial designs, digital health technologies, and regenerative medicine further enhance competitiveness.

Germany Clinical Trials Market Trends

Germany held the largest revenue share in the market in 2024. The market is driven by strong pharmaceutical and biotech presence and robust healthcare infrastructure. Some of the players are AskBio, Bayer AG, and major academic institutions are conducting innovative trials, including the REGENERATE-PD Phase 2 Parkinson’s study. Advancements in neurosurgical gene therapy, multicenter collaboration across Europe, and adaptive trial designs enhance efficiency and patient access.

France Clinical Trials Market Trends

France’s clinical trials market is highly competitive, owing to strong government support, advanced research infrastructure, and a focus on neurodegenerative and rare diseases. Key players include AP-HP, Toulouse University Hospital, NS-PARK both domestic and foreign biopharmaceutical businesses are important participants. The discovery of neuroprotective therapies is accelerated by innovative programs such as NS-PARK's Master Trial, the nation's first adaptive platform for Parkinson's disease, which began testing numerous medication candidates simultaneously in March 2025.

Key Europe Clinical Trials Company Insights

Europe clinical trials market is led by major CROs and pharmaceutical firms, with pharma and biopharma companies sponsoring around 60% of trials. Key players include IQVIA, Parexel, ICON plc, Thermo Fisher Scientific, LabCorp Drug Development, Syneos Health, and Medpace Holdings. These companies utilize advanced analytics, regulatory expertise, and extensive networks that drive the market growth through innovative trial designs, interventional and observational studies, and strategic collaborations. Regulatory initiatives such as ACT EU further enhance efficiency and market attractiveness. For instance, in January 2025, The PIPELINE project launched a Europe-wide collaboration to enhance maternal and infant health by addressing infectious diseases. Its adaptive RSV immunization trial, coordinated in France, aims to generate crucial safety and efficacy data, informing clinical practices and public health policies. This initiative strengthens cross-border research partnerships.

Key Europe Clinical Trial Companies:

- IQVIA HOLDINGS, INC.

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD) LLC.

- Syneos Health Inc.

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer, Inc.

- Dr. Notghi Contract Research GmbH

- Charite Research Organisation GmbH

- Janssen Global Services, LLC

- Mondosano GmbH

- KFGN

- Clariness

- Invisio clinical studies consulting

Recent Developments

-

In September 2025, Biogen mentioned the acquisition of Alcyone Therapeutics to advance ThecaFlex DRx, an implantable device for intrathecal delivery of antisense oligonucleotides, initially tested with SPINRAZA. This acquisition strengthened Biogen’s drug-device portfolio and expanded patient access to innovative neurological therapies, enhancing treatment delivery and patient experience.

-

In June 2025, UK’s 10 Year Health Plan enabled millions to access innovative clinical trials via the NHS App, accelerating research and patient enrollment. The SAFIRE consortium initiated the first Phase 3 trial evaluating antimalarials in first-trimester pregnancies, aiming to improve maternal and fetal outcomes. This initiative marked a transformative step in UK clinical research.

-

In June 2025, Novartis completed its acquisition of Regulus Therapeutics, making it a wholly owned subsidiary. The deal advanced Novartis’ renal disease pipeline, including farabursen, a next-generation oligonucleotide targeting ADPKD, following successful Phase 1b trials demonstrating efficacy and safety. This acquisition strengthened Novartis’ capabilities in high unmet-need kidney therapies.

Europe Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.20 billion

Revenue forecast in 2033

USD 41.76 billion

Growth rate

CAGR of 7.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, Europe clinical trials outlook, volume analysis

Segments covered

Phase, study design, indication, indication by study design, service, sponsor, country

Regional scope

Europe

Country Scope

UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway

Key companies profiled

IQVIA HOLDINGS, INC.; PAREXEL International Corporation; Pharmaceutical Product Development (PPD) LLC.; Syneos Health Inc; Eli Lilly and Company; Novo Nordisk A/S; Pfizer Inc.; Dr. Notghi Contract Research GmbH; Charite Research Organisation GmbH; Janssen Global Services, LLC; Mondosano GmbH; KFGN; Clariness; Invisio clinical studies consulting

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Clinical Trials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe clinical trials market report based on phase, study design, indication, indication by study design, service, sponsor, and country.

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Autoimmune/Inflammation

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain Management

-

Chronic Pain

-

Acute Pain

-

-

Oncology

-

Blood Cancer

-

Solid Tumors

-

Others

-

-

CNS Conditions

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle Regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular Diseases

-

Others

-

-

Indication by Study Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Autoimmune/Inflammation

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Pain Management

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Oncology

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

CNS Conditions

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Diabetes

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Obesity

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Cardiovascular Diseases

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Others

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Analytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe clinical trials market size was estimated at USD 22.01 billion in 2024 and is expected to reach USD 23.20 billion in 2025.

b. The Europe clinical trials market is expected to grow at a compound annual growth rate of 7.63% from 2025 to 2033 to reach USD 41.76 billion by 2033.

b. The Phase III accounted for the largest revenue share of 53.25% in 2024 and is also anticipated to witness the fastest growth over the forecast period. The segment growth is due to growing strategic initiatives undertaken by market players, government investments, and demand for outsourcing clinical trials, which drives the segment growth

b. Some key players operating in the Europe clinical trials market include IQVIA HOLDINGS, INC., PAREXEL International Corporation, Pharmaceutical Product Development (PPD) LLC., Syneos Health Inc, Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Inc., Dr. Notghi Contract Research GmbH, Charite Research Organisation GmbH, Janssen Global Services, LLC, Mondosano GmbH, KFGN, and Clariness, Invisio clinical studies consulting among others.

b. Key factors driving the clinical trials market growth include the growing number of CROs, strong regulatory framework, rising R&D investments, accelerating biopharma innovation, increased adoption of advanced technologies, rising need for personalized medicine and adoption of new technology in clinical research, and shift trends toward decentralized trial models.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.