- Home

- »

- Next Generation Technologies

- »

-

Europe Commercial Drone Market, Industry Report, 2030GVR Report cover

![Europe Commercial Drone Market Size, Share & Trends Report]()

Europe Commercial Drone Market Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Propulsion Type, By Range, By Operating Mode, By Endurance, By Maximum Takeoff Weight, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-295-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The Europe commercial drone market was estimated at USD 5.90 billion in 2023 and is projected to grow at a CAGR of 12.6% from 2024 to 2030. Governments and regulatory bodies across Europe have been working to establish clear and standardized regulations for the operation of drones in commercial airspace. The introduction of regulatory frameworks, such as the European Union's UAS (Unmanned Aircraft Systems) Regulation, has provided clarity and guidance for businesses looking to leverage drones for commercial purposes. These regulations have helped mitigate safety concerns and legal uncertainties, thereby fostering a conducive environment for the growth of the commercial drone sector. In November 2022, the European Commission adopted the European Drone Strategy 2.0 to develop the drone market further.

The European Drone Strategy 2.0 aims to implement financial, technical, and operational flagship actions to foster the right commercial and regulatory environment. The new strategy entails making drone services a standard part of life in Europe. This strong emphasis by the European Commission is expected to propel market growth over the forecast period. Technological advancements in commercial drones are boosting market growth. Operating on a 5G network grants the drone low-latency connectivity and enables it to quickly receive and act on commands from the ground control center. This reduction of lag between commands sent & received and acted upon is extremely useful in GPS-denied areas and paves the way for a precise view of where the drone is. In addition, the use of composite materials, next-gen batteries, and extended flight time are some developments in drone technology. These enhancements are expected to bolster market growth.

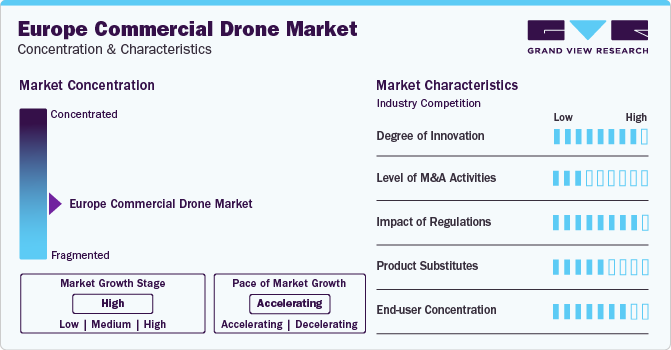

Market Concentration & Characteristics

The Europe commercial drone industry is relatively fragmented, with numerous manufacturers. It is characterized by players undertaking countless strategic initiatives to expand their presence through new product launches, acquisitions, and collaboration with other players. For instance, in January 2024, Airbus Helicopters announced the acquisition of Aerovel and Flexrotor. This acquisition expands Airbus's tactical unmanned solutions and responds to the growing demand for additional mission capabilities worldwide.

The degree of innovation in the industry is high as drone manufacturers are rolling out new and innovative products that are solving complex problems for end-users. For instance, in March 2024, Flyability, a company operating in the industry with its forte in making drones for applications involving confined spaces, announced a new ultrasonic thickness measurement payload (UTM) payload for its Elios 3. The company created this payload in collaboration with Cygnus Instruments Ltd., which offers a safer and more effective way to access thickness measurement locations (TMLs). The feature has been one of the most requested demands from the company's clients and is now available for purchase.

Product Insights

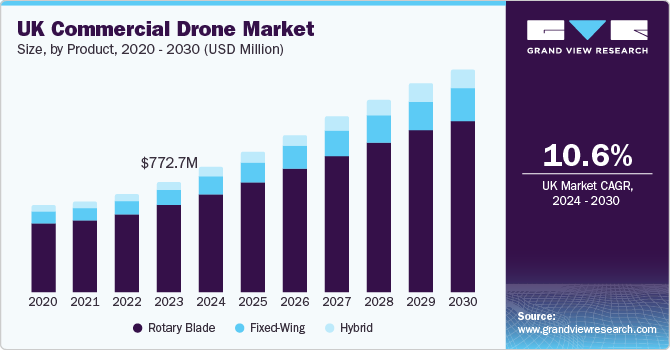

The rotary blade segment dominated the market with a share of 79.3% in 2023. Rotary blade drones are highly sought-after for inspection and surveillance activities due to their maneuverability and ability to maintain visuals on targets for long periods. Advancements in rotor blade technology, battery efficiency, and flight control systems have propelled the growth of the rotary blade segment. Improved battery life and energy management systems enable longer flight times and increased operational range, enhancing the capabilities and usability of rotary blade drones for extended missions, such as aerial mapping, surveillance, and search-&-rescue operations.

The hybrid segment is projected to grow at the fastest CAGR over the forecast period. Increasing demand for multi-role drones capable of performing various tasks within a single mission is driving the segment growth. Hybrid drones can switch flight modes and configurations to accommodate diverse payloads and mission requirements. This flexibility offers cost-effective solutions that can address multiple needs, such as aerial photography, crop monitoring, and infrastructure inspection, without the need for numerous specialized drones.

Application Insights

The commercial segment accounted for the highest market share in 2023. Increasing adoption of drones for aerial imaging and data collection purposes drives the adoption of commercial drones. Commercial drones equipped with high-resolution cameras, LiDAR sensors, and other advanced imaging technologies offer a cost-effective and efficient solution for capturing detailed aerial imagery and geospatial data.

This data is effectively utilized by various industries, such as agriculture, construction, and environmental monitoring, enabling precise analysis, decision-making, and planning. The government & law enforcement segment is expected to grow at a significant growth rate over the forecast period. The key factor driving the segment’s growth is the increasing demand for drones for border patrol, search & rescue operations, and police operations.

Maximum Takeoff Weight Insights

The <25kg segment held the dominant market share in 2023. The increasing adoption of drones for last-mile delivery and logistics applications drives the segment growth. With the rise of e-commerce and online shopping, there's a growing demand for efficient and timely delivery solutions. Drones in the <25kg segment are efficient in last-mile delivery, as they can navigate urban environments and deliver packages quickly and cost-effectively, especially in areas with traffic congestion or limited access. This demand for delivery drones drives product adoption and market growth.

The 25kg - 500 kg segment is expected to grow at the fastest CAGR over the forecast period. The growing demand for aerial solutions in critical infrastructure industries fuels the adoption of drones in Europe's 25kg - 500kg segment. Drones with larger payloads and extended flight ranges can inspect infrastructure and maintain and monitor applications. The 25kg - 500kg segment offers a cost-effective and efficient alternative to traditional manned aerial operations, reducing downtime, improving safety, and extending asset lifespan. This demand for aerial solutions in infrastructure industries drives adoption and market growth within the 25kg - 500kg segment.

End-use Insights

The security & law enforcement segment held the dominant market share in 2023. The increasing sophistication of threats and criminal activities, including terrorism, organized crime, and illicit trafficking, is driving the adoption of commercial drones. Law enforcement agencies and security forces are adopting commercial drones as they offer versatile and agile tools for gathering intelligence, monitoring suspicious activities, and enhancing situational awareness in urban and remote areas, thereby assisting in preemptive and responsive measures to maintain public safety and security. Delivery & logistics is projected to be the fastest-growing segment over the forecast period. The rising demand for faster and more flexible delivery services in e-commerce and online retail is driving the segment growth.

As consumers increasingly opt for online shopping, there is a growing need for rapid and reliable delivery options to fulfill orders quickly and meet customer expectations for same-day or next-day delivery. Drones offer a viable solution for faster delivery times by bypassing traffic congestion and navigating direct routes to deliver packages directly to customers' doorsteps. In October 2023, Amazon.com, Inc. announced the expansion of its Prime Air drone delivery system, extending its reach to international destinations, such as Italy and the UK. These drone deliveries seamlessly integrate into Amazon's existing delivery network, with drones launching from select Same-Day Delivery sites. Moreover, in Italy and the UK, Amazon will commence integration into specific fulfillment centers, promising customers swifter delivery of a wider array of products.

Propulsion Type Insights

The electric segment held the highest market share in 2023. Government investment plays a significant role in driving the growth and development of the electric segment within the market. Electric drones offer a cleaner and greener alternative to traditional combustion-powered drones, as they produce zero emissions during operation. It aligns with the broader objectives of European governments to transition towards renewable energy sources and reduce the environmental impact of transportation and logistics activities. In May 2023, the European Investment Bank (EIB) disclosed its commitment to invest EURO 40 million (USD 43.8 million) in quasi-equity into Wingcopter GmbH, a European firm specializing in unmanned delivery drone technology.

This investment from the EIB is supported by the European Commission’s InvestEU initiative, specifically under its sustainable infrastructure arm. The utilization of electric cargo drones for delivering essential goods offers an alternative to high-carbon transportation methods, thus aiding the shift towards a more environmentally friendly and sustainable economy. The hybrid segment accounted for a substantial market share in 2023 and is estimated to register the fastest CAGR over the forecast period. Hybrid propulsion offers end-users enhanced flight performance in terms of stability and distance while keeping the costs and weight down. These advantages associated with hybrid drones are propelling the segment’s growth.

Range Insight

The visual line of sight (VLOS) segment held the dominant market share in 2023. The increasing demand for real-time data and actionable insights drives the adoption of VLOS operations in the market. VLOS flights allow operators to capture high-quality aerial imagery and data in real-time, enabling timely decision-making and response in various industries, such as agriculture, construction, and emergency response. By maintaining direct visual contact with the drone, operators can ensure the accuracy and reliability of data collection, facilitating more informed decision-making and enhancing operational efficiency.

The beyond visual line of sight (BVLOS) is expected to grow at the fastest CAGR over the forecast period. These drones can be employed for long distances, long-distance delivery, agriculture surveying, and other applications. Advancements in artificial intelligence (AI) and detection and avoidance (DAA) technology are expected to foster the segment’s growth over the forecast period.

Operating Mode Insights

The remotely piloted segment dominated the market in 2023. The growing demand for remote inspection and monitoring solutions in critical infrastructure industries, such as energy, utilities, and transportation, fuels the adoption of remotely piloted drones in Europe. Remotely piloted drones offer a safer and more efficient alternative to traditional inspection methods, such as manual or manned aircraft, enabling companies to identify and address potential issues or hazards quickly and cost-effectively. From inspecting power lines and pipelines to assessing the condition of bridges and railways, remotely piloted drones play a vital role in ensuring critical infrastructure assets' safety, reliability, and integrity.

The fully autonomous segment is projected to grow at the fastest CAGR over the forecast period. Advancements in sensor technology and miniaturization contribute to the growth of the fully autonomous segment in the market. Fully autonomous drones are equipped with a wide range of sensors, including cameras, LiDAR, thermal imaging, and multispectral sensors, that enable them to perceive and interact with their environment with precision and accuracy. Fully autonomous drones have various applications across different industries, such as agriculture, construction, and environmental monitoring.

Endurance Insights

The <5 hours segment dominated the market with the highest revenue share in 2023. The rising demand for aerial solutions in various industries, such as agriculture, construction, and environmental monitoring, drives the adoption of drones in Europe's <5 hours segment. Shorter-endurance drones offer a cost-effective and efficient means of collecting aerial data and imagery for crop monitoring, land surveying, and habitat assessment. These drones cover smaller areas or specific points of interest within a limited timeframe, providing valuable insights that inform decision-making and drive operational efficiency across industries.

The 5-10 hours segment is estimated to grow at the fastest CAGR over the forecast period. There is a growing demand for drones with extended operational capabilities in remote or inaccessible areas. Industries, such as mining, forestry and environmental conservation, often require drones to operate in remote locations where access is challenging. Drones in the 5 - 10 hours segment can cover large areas and perform comprehensive surveys or inspections without frequent recharging or refueling, enabling them to operate in remote and rugged terrain.

Country Insights

France Commercial Drone Market Trends

The market in France held the largest share of 19.1% in 2023 and is estimated to expand at a fast-paced CAGR over the forecast period. Government support for unmanned aerial vehicles (UAVs)/drones supports the country's market growth. For instance, in 2023, the French police were authorized to use drones equipped with cameras for crowd monitoring and other applications. Moreover, the announcement of the nation's military budget last year entailed a significant proportion of funds to deal with operational emergencies in terms of drones and anti-drone warfare.

Finland Commercial Drone Market Trends

The market in Finland is projected to witness the fastest CAGR over the forecast period. Finland's expertise in sectors, such as forestry, agriculture, and maritime industries, drive the adoption of commercial drones for specialized applications. Finnish companies leverage drones for forest monitoring, crop surveillance, and maritime surveillance, enabling more efficient and sustainable management practices. This industry expertise and practical application of drones contribute to market growth in Finland and Europe.

Key Europe Commercial Drone Company Insights

Some key players operating within the market include DJI, Autel Robotics, and Parrot Drone SAS

-

DJI specializes in commercial UAVs (drones) and has a global presence. The company operated end-use industries, such as aerial surveying, oil & gas, electricity, and public safety, among others. The company’s camera drones, such as the DJI Air 3 and DJI Mavic 3 Pro, are highly sought-after in filmmaking and photography

-

Autel Robotics's product portfolio includes multiple rotor blades and fixed-wing drones. The company has 1053 authorized patents worldwide and has won multiple awards for its drones. It also offers software compatible with its drones for surveying and construction, spatial planning, inspection, border watch, premise management, and other applications, specializing in commercial unmanned aerial vehicles (drones)

-

Parrot Drone SAS specializes in developing high-performance drones equipped with advanced features, such as high-resolution cameras, precision sensors, and autonomous flight capabilities. These drones cater to various industries, including agriculture, construction, cinematography, public safety, and infrastructure inspection. Parrot's drones serve as indispensable tools for search and rescue missions, surveillance, and disaster response efforts, thanks to their agility, endurance, and thermal imaging capabilities in public safety and security applications

Key Europe Commercial Drone Companies:

- ESA Space Solutions

- ModalAI

- DJI

- Griff Aviation

- Autel Robotics

- EHang

- Intel Corporation

- Parrot Drone SAS

- Potensic

- Elistair

- Airmedia360

- Flyability

- Delair.

- Field

- AIRBUS

- Dronevolt

- General Atomics

Recent Developments

-

In December 2023, Parrot Drone SAS interconnected the Parrot ANAFI Ai with the UAVIA robotics platform. This integration will aid in refining inspection/surveillance procedures and emergency interventions and provide a better real-time assessment of the scenario

-

In November 2023, Elistair launched KHRONOS, a fully automated drone. It can be deployed from a mobile drone box in less than two minutes at the press of a button. The drone has the latest intelligent functions, including cued camera slewing, target tracking, and automated object categorization

-

In January 2023, Delair acquired Notilo Plus, a manufacturer of underwater drones, among other products, and formed a new business unit called DELAIR MARINE. The acquisition aligns with Delair's external growth strategy, aiming to strengthen its offering in industrial inspection and defense applications

-

In May 2022, Flyability launched Elios 3, a first-of-its-kind collision-tolerant drone integrated with LiDAR for 3D mapping. The drone was primarily made to serve companies' inspection needs. The drone creates 3D models in real-time during the flight, has a modular payload, and has excellent stabilization. Patrick Thévoz, Flyability's CEO, considers it a key enabler of Industry 4.0

Europe Commercial Drone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.81 billion

Revenue forecast in 2030

USD 13.56 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight, country

Country scope

UK; Germany; France; Italy; Spain; Ireland; Sweden; Denmark; Norway; Finland

Key companies profiled

ESA Space Solutions; ModalAI; DJI; Griff Aviation; Autel Robotics; EHang; Intel Corp.; Parrot Drone SAS; Potensic; Elistair; Airmedia360; Flyability; Delair; AIRBUS; Dronevolt; General Atomics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Commercial Drone Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe commercial drone market report based on product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight, and country:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fixed-Wing

-

Rotary Blade

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Others

-

-

Government & Law Enforcement

-

Firefighting & Disaster Management

-

Search & Rescue

-

Maritime Security

-

Border Patrol

-

Police Operations

-

Traffic Monitoring

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Delivery & Logistics

-

Energy

-

Media & Entertainment

-

Real Estate & Construction

-

Security & Law Enforcement

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operating Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Endurance Outlook (Revenue, USD Million, 2018 - 2030)

-

<5 Hours

-

5-10 Hours

-

10 Hours

-

-

Maximum Takeoff Weight Outlook (Revenue, USD Million, 2018 - 2030)

-

<25kg

-

25kg - 500 kg

-

>500 kg

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Ireland

-

Sweden

-

Denmark

-

Norway

-

Finland

-

Frequently Asked Questions About This Report

b. The Europe commercial drone market size was estimated at USD 5.90 billion in 2023 and is expected to reach USD 6.81 billion in 2024

b. The Europe commercial drone market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 13.56 billion by 2030

b. France dominated the Europe commercial drone market with a share of 19.1% in 2023. Government support for unmanned aerial vehicles/drones is supporting the country's market growth

b. Some key players operating in the Europe commercial drone market include ESA Space Solutions, ModalAI, DJI, Griff Aviation, Autel Robotics., EHang, Intel Corporation, Parrot Drone SAS, Potensic, Elistair, Airmedia360, Flyability, Delair, AIRBUS, Dronevolt, and General Atomics

b. Factors such as the increasing adoption of drones for aerial photography, surveillance, and agriculture and growing demand for drone-based delivery services is driving the market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."