- Home

- »

- Medical Devices

- »

-

Europe Compression Tape Market, Industry Report, 2033GVR Report cover

![Europe Compression Tape Market Size, Share & Trends Report]()

Europe Compression Tape Market (2026 - 2033) Size, Share & Trends Analysis Report By Indication & Pathology (Sports Injuries, Post-operative Edema, Lymphedema), By Compression Class (Class 1, Class 2), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-841-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Compression Tape Market Summary

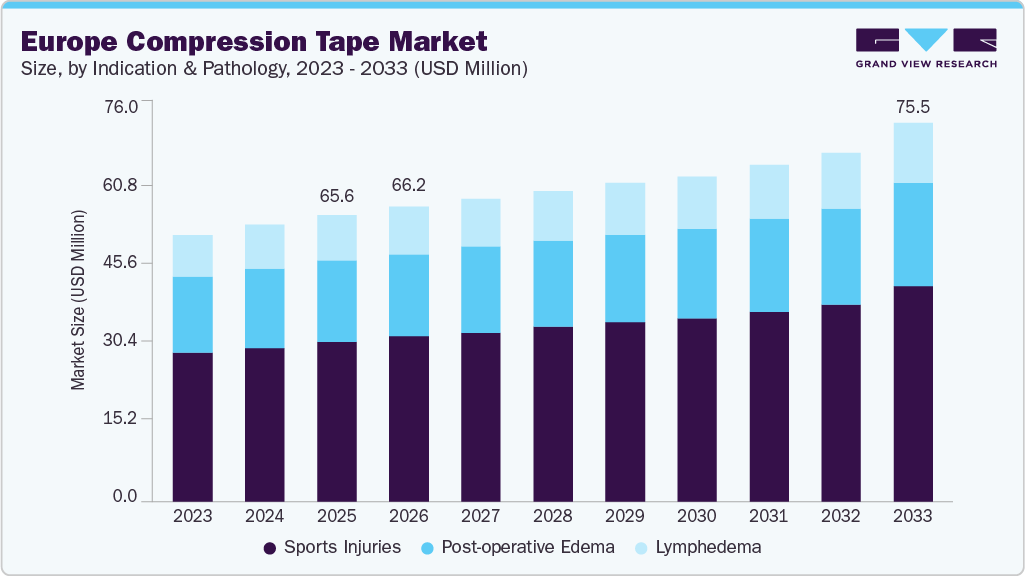

The Europe compression tape market size was estimated at USD 65.55 million in 2025 and is projected to reach USD 73.47 million by 2033, growing at a CAGR of 1.44% from 2026 to 2033. The market is driven by rising participation in recreational and professional sports, increasing incidence of musculoskeletal injuries, and growing preference for non-invasive, drug-free injury management solutions. Expanding outpatient rehabilitation and physiotherapy services, along with higher awareness of kinesiology taping among clinicians and athletes, further support adoption.

In addition, aging demographics and a growing volume of orthopedic procedures contribute to steady demand for compression tapes in post-injury and post-operative care settings across European healthcare systems.

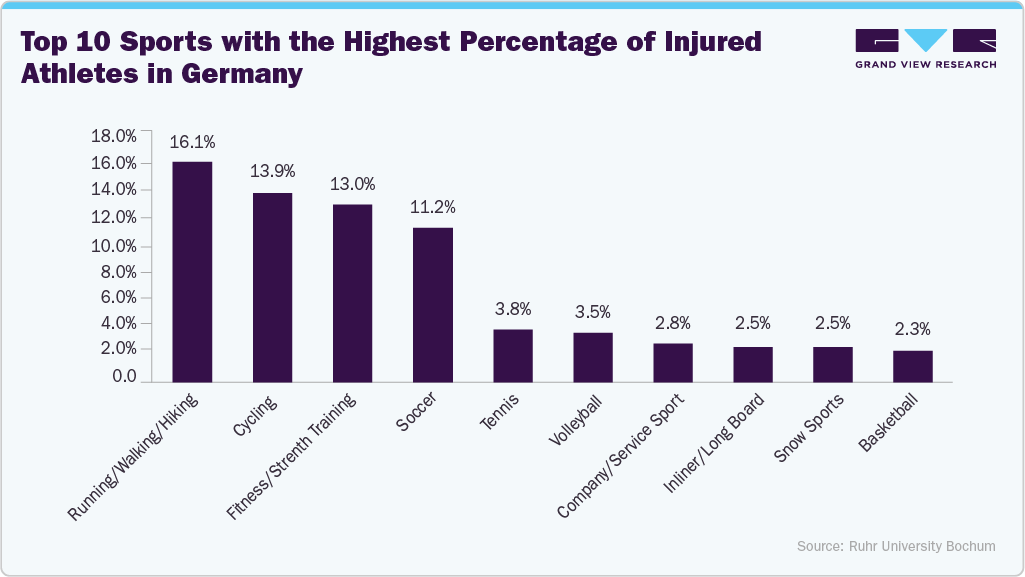

A study published in October 2024 by the Department of Sports Medicine and Sports Nutrition at Ruhr University Bochum provides an overview of sports injuries and associated activities. Conducted from September 12 to 16, 2022, the survey included 2,002 individuals aged 14 and above across Germany. Findings revealed that approximately 12.2% of athletes sustained sports injuries within the past 12 months that required medical attention or resulted in a temporary break from activity. The growing burden of sports injuries among the active population underscores the increasing demand for compression tape to facilitate faster recovery, reduce pain, and enhance performance rehabilitation among the expanding sports and fitness enthusiasts.

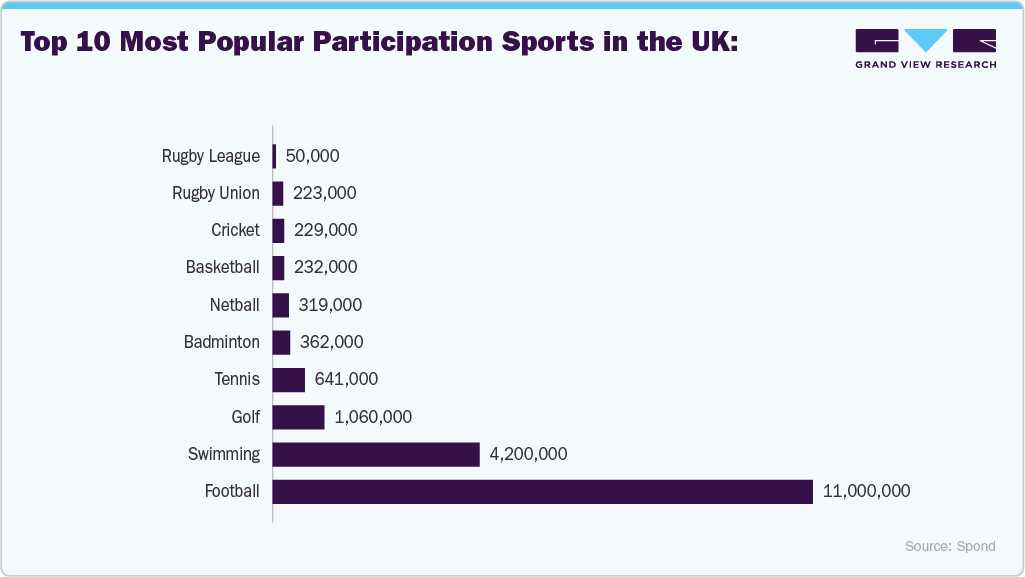

Moreover, a substantial portion of the UK population actively engages in sports at both grassroots and club levels. According to data published by Spond in February 2025, millions of individuals participate in a wide range of sports nationwide. This high level of sports participation is expected to significantly boost the demand for compression tape products, as athletes and recreational participants increasingly seek solutions to enhance recovery, reduce injury risk, and improve overall performance.

The increasing number of clinical trials evaluating compression tape products is creating significant growth opportunities for market participants. Academic institutions, research organizations, and medical device companies are increasingly investing in clinical research to assess the safety, efficacy, and performance of compression tape products, thereby bringing novel solutions to market. These trials support regulatory approvals and foster innovation in the Europe compression tape industry. Favorable results from these trials are expected to accelerate product development and market expansion.

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

Locations

Use of Compression Bandages in the Prevention of Post-mastectomy Lymphoceles

Lymphocele

DEVICE: Bandage|DEVICE: No bandage

University Hospital, Toulouse

84

11/1/2025

France

Immobilization With Compression Bandage vs Antebraquial Splint in Distal Radius Fractures

Distal Radius Fractures|Internal Fixation; Complications, Mechanical

DEVICE: Splint immobilization|DEVICE: Bandage immobilization

Hospital Costa del Sol

120

12/30/2026

Spain

Compression Therapy of the Lower Limbs in Patients With Decompensated Heart Failure

Heart Failure

DEVICE: UrgoK2 / UrgoK2 Lite|OTHER: Control

FundaciÃn para la InvestigaciÃn del Hospital ClÃnico de Valencia

106

7/1/2026

Spain

Efficacy and Safety of Light Compression System in the Local Treatment of Mixed Leg Ulcers (PROMETHEE Clinical Investigation)

Leg Ulcers

DEVICE: Treatment with light compression system during 16-week treatment period (6 medical visits are planned: D0, W2, W4, W8, W12, W16)|DEVICE: Light compression system of the mixed leg ulcer stage C6 / C6r of the CEAP classification

Laboratoires URGO

210

9/30/2027

France

Effectiveness of Cohesive Bandage on Axillary Web Syndrome After

Axillary Web Syndrome

OTHER: Manual drainage & arm therapeutic exercise|OTHER: Cohesive bandaging & arm therapeutic exercise

University of Alcala

90

2024-12

Spain

Prevention of Alopecia in Patients With Localized Breast Cancer

Chemotherapy-induced Alopecia

OTHER: standard cold cap|OTHER: scalp-cooling technique

Centre Francois Baclesse

196

9/3/2026

France

The growing focus on athletic performance and sports recovery is significantly driving the demand for compression tape products in Europe. Injuries such as sprains, strains, and muscle fatigue are among the most common conditions treated with compression garments and bandages among athletes. Sports institutions and clubs are adopting compression tape to enhance blood circulation, reduce swelling, and accelerate muscle recovery post-training or competition. The rising awareness of sports-related venous disorders and injury prevention among both professional and amateur athletes further supports market growth. The integration of compression tape in sports medicine and physiotherapy practices continues to strengthen its role in Europe healthcare and athletic recovery.

Number of Injuries of Athletes in France (2024)

Number of Injuries

Number of Athletes

Percentage (%)

1 Injury

1468

20.70%

2 Injuries

1693

23.90%

3 Injuries

1267

17.90%

4 Injuries

743

10.50%

5 Injuries

623

8.80%

6 Injuries

286

4.00%

7 Injuries

126

1.80%

8 Injuries

108

1.50%

9 Injuries

42

0.60%

≥10 Injuries

725

10.20%

Total Injured Athletes

7081

99.90%

Source: BMJ Open Sport & Exercise Medicine

Market Concentration & Characteristics

The Europe compression tape industry is growing as hospitals, outpatient centers, sports medicine facilities, and home-care settings increase the use of adhesive and wrap-style tapes for swelling control, musculoskeletal support, post-operative management, and injury prevention. Demand is supported by higher prevalence of venous and lymphatic disorders, rising surgical volumes, growth in organized sports participation, and broader adoption of self-care practices.

Innovation in the Europe compression tape industry is driven by advances in elastic, cohesive, and adhesive material science that enhance conformity, durability, and skin compatibility. European manufacturers are introducing wrap-tape hybrid formats, latex-free constructions, and extended-wear adhesive systems that enable consistent support with minimal application complexity. Product development increasingly targets sports recovery, post-surgical protocols, and adjunct edema management, with growing emphasis on easy-to-apply formats suitable for homecare and retail distribution across EU markets.

M&A activity in Europe remains moderate and selective, primarily focused on portfolio expansion, access to compression and wound-care technologies, and penetration into sports medicine and rehabilitation channels. Rather than large-scale acquisitions, companies favor strategic partnerships, distributor agreements, and brand licensing arrangements to strengthen regional reach, optimize supply chains, and integrate compression tapes into broader musculoskeletal and wound-care offerings.

Compression tapes in Europe are regulated under the EU Medical Device Regulation (MDR 2017/745) when positioned for medical use, while consumer-oriented sports tapes may fall under general product safety frameworks. Compliance with CE marking, biocompatibility standards, labeling, and post-market surveillance requirements significantly influences product design and time-to-market. Clinical guidelines for post-operative edema management and rehabilitation affect adoption patterns, while reimbursement structures for chronic conditions continue to favor medically oriented compression systems, indirectly shaping tape demand.

The Europe compression tape industry is moderately fragmented, comprising a mix of sports-medicine brands, wound-care specialists, and medical compression manufacturers. Key suppliers active in the region include 3M (Coban), Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN medical (Jobst), Hartmann Group, and Andover Healthcare. Competitive positioning is shaped by material technology, breadth of tape formats, distribution coverage, and the ability to serve both clinical and consumer segments across Europe.

Indication & Pathology Insights

The sports injuries segment accounted for the largest revenue share in Europe in 2025, driven by high participation in organized sports, recreational fitness, and professional athletics across countries such as Germany, UK, France, Spain, and Italy. Europe reports a consistently high burden of sprains, strains, ligament injuries, and overuse conditions, particularly in football, cycling, running, and indoor sports. Compression tapes are routinely used for immediate functional support, swelling control, and joint stabilization, making them a standard tool in sports clubs, physiotherapy clinics, emergency departments, and athletic training facilities. Growth is further supported by strong consumer self-care adoption, with athletes and active individuals increasingly using tapes for preventive support and home-based injury management.

The post-operative edema segment is expected to register moderate CAGR over the forecast period, supported by rising volumes of orthopedic, sports-related, and minimally invasive surgeries across European healthcare systems. Compression tapes are increasingly incorporated as adjuncts within post-surgical rehabilitation protocols to assist with localized swelling control, soft-tissue support, and early mobilization, particularly following knee, shoulder, and soft-tissue procedures. Adoption is reinforced by the expansion of day surgeries and outpatient care models, where lightweight, easy-to-apply compression solutions are favored over bulkier compression systems. Hospitals and physiotherapy providers across Europe continue integrating tape-based compression into standardized recovery pathways, supporting sustained demand in this segment.

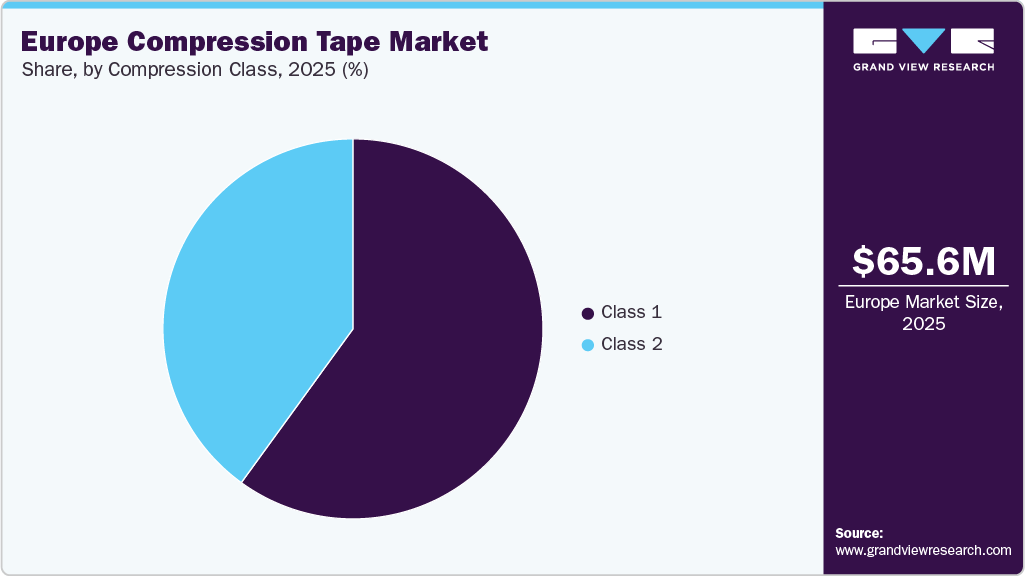

Compression Class Insights

The Class 1 compression tapes segment held the largest revenue share in 2025, driven by their widespread use across sports medicine, physiotherapy, and routine musculoskeletal injury management. Light-compression tapes are well suited for sprains, strains, overuse injuries, and preventive support, where maintaining mobility and comfort is critical. High adoption among athletes, recreational fitness participants, and physiotherapy patients supports strong consumption across retail, clinical, and home-care channels. Growth in self-care practices, along with broad availability through pharmacies, e-commerce platforms, and sports specialty outlets, further reinforced the segment’s leading position across major Europe markets.

The Class 2 compression tapes segment is expected to register the fastest CAGR during the forecast period, supported by rising demand for moderate-compression solutions in post-operative edema management and localized venous and swelling-related conditions. Increasing volumes of outpatient and day surgeries, particularly orthopedic and soft-tissue procedures, are expanding the use of structured compression during recovery. Adoption is further supported by clinician preference for adjustable, easy-to-apply formats compatible with home-based rehabilitation pathways. Expanding clinical acceptance and improving availability through medical supply and professional healthcare channels are expected to drive sustained growth of this segment in Europe.

Country Insights

UK Compression Tape Market Trends

The UK compression tape industry is anticipated to grow at a moderate pace, driven by high utilization in sports injury management, physiotherapy, and post-operative recovery. The healthcare system’s focus on outpatient care, early discharge, and community-based rehabilitation supports demand for light to moderate compression solutions that maintain mobility. Widespread use of compression tapes in athletic training, emergency care, and home-based self-management contributes to steady consumption across both clinical and consumer channels.

France Compression Tape Market Trends

France compression tape industry is expected to witness steady growth, supported by increasing use of ambulatory surgery and structured rehabilitation pathways. High participation in sports and fitness activities, combined with consistent demand for localized swelling control and functional support, drives adoption in physiotherapy and outpatient settings. Compression tapes are commonly used as adjunct solutions alongside garments and bandages, particularly where ease of application and patient comfort are prioritized during recovery.

Germany Compression Tape Market Trends

The Germany compression tape industry is experiencing stable growth, supported by a strong ambulatory care infrastructure, high volumes of orthopedic and sports-related procedures, and widespread access to physiotherapy services. Demand is reinforced by clinician preference for structured, easy-to-handle compression formats that integrate into rehabilitation and home-care pathways. Broad availability through medical supply distributors and sports-medicine networks further supports adoption across both professional and consumer segments.

Sports and Athletic Injuries Statistics in Germany (2022)

Parameter

Statistic

Description

Total Athletes Registered (2022 European Championships)

5,419

Across 9 sports

Total In-Competition Injuries

181

Reported during the event

Injury Incidence Rate

33.4 per 1,000 athletes

Overall injury rate

Sports with Higher Injury Rates

Triathlon, Cycling, Athletics

Higher-than-average injury incidence

Common Injury Locations / Types

Athletics: Lower limb, muscles, skin Triathlon: Lower limb, skin

Cycling: Head, trunk, upper limb, skin

Most frequent injury sites and tissues involved

Total Illnesses Reported

65

Reported among athletes

Illness Incidence Rate

12.0 per 1,000 athletes

Overall illness rate

Sports with Higher Illness Rates

Athletics, Rowing

More frequent illness occurrence

Most Affected Body Systems (Illness)

Cardiovascular (24.6%), Gastrointestinal (18.5%),

Upper respiratory (16.9%)

Major physiological systems affected

Source: BMJ Open Sports and Medicines

Spain Compression Tape Market Trends

Spain compression tape industry is expected to grow steadily, supported by rising use of outpatient and day-case surgical care, particularly in orthopedics, trauma, and sports-related procedures. In Spain, the growing number of surgical procedures is a key factor expected to drive the compression tape industry. As surgical volumes continue to rise due to an aging population, lifestyle-related disorders, and advancements in surgical techniques, the need for effective post-surgical recovery solutions has increased. Compression therapy is widely used to improve blood circulation, reduce swelling, and accelerate wound healing. According to the World Bank Group, Spain recorded approximately 6,953 surgical procedures per 100,000 population in 2023, highlighting a strong demand for surgical interventions across the country. This high surgical rate highlights the growing need for post-operative care solutions, including compression therapy products, to support recovery, prevent complications, and enhance patient outcomes.

Key Europe Compression Tape Company Insights

Key players in the Europe compression tape industry are focused on expanding product portfolios, strengthening regional manufacturing and supply capabilities, and enhancing distribution across clinical and consumer channels. Companies such as 3M, Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN medical (Jobst), Hartmann Group, and Andover Healthcare continue to advance elastic and cohesive tape technologies tailored for sports injury management, physiotherapy, and post-operative support.

Key C-Reactive Protein Testing Companies:

- Essity Aktiebolag

- Hartmann AG

- Medline Industries, LP.

- 3M

- Cardinal Health

- THYSOL Group BV

- SportTape (Sporttape Ltd)

- Rehband Deutschland GmbH

- K-Active

Recent Developments

-

In June 2025, Mölnlycke Health Care has secured USD 400 million in financing from The Swedish Export Credit Corporation (SEK) to support its global expansion and growth strategy. The agreement, signed in Stockholm and Gothenburg on June 24, 2025, will enable the company to strengthen its international presence further and invest in advancing its healthcare solutions worldwide.

-

In April 2025, Lohmann & Rauscher Group (L&R) has acquired Unisurge International Ltd.. This acquisition strengthens L&R’s market presence in the UK hospital and surgical products sector. Unisurge will continue to operate as an independent company within the L&R Group, with Amir Farboud remaining as CEO and all current jobs retained. L&R’s UK sales subsidiary, L&R Medical UK Ltd, will not participate in the OR business. The transaction aligns with L&R’s strategic growth and M&A expansion plans, enhancing its global footprint in surgical and hospital care.

-

In September 2025, Lohmann & Rauscher (L&R) has announced the completion of its acquisition of 49% of the shares in the ADA Group. The strategic partnership, effective retroactively from January 1, 2025, strengthens L&R’s manufacturing and supply capabilities. ADA, based in Seroa, Portugal, is a well-established producer of gauze, nonwoven products, bandages, incontinence items, and medical disposables.

Europe Compression Tape Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 66.21 million

Revenue forecast in 2033

USD 73.47 million

Growth rate

CAGR of 1.44% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication & pathology, compression class, country

Country scope

UK; Germany; Spain; France; Rest of Europe

Key companies profiled

Essity Aktiebolag; Hartmann AG; Medline Industries, LP; 3M; Cardinal Health; THYSOL Group BV; SportTape (Sporttape Ltd); Rehband Deutschland GmbH; K-Active

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Compression Tape Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe compression tape market report based on indication & pathology, compression class, and country.

-

Indication & Pathology Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports Injuries

-

Post-operative Edema

-

Lymphedema

-

-

Compression Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Class 1

-

Class 2

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe compression tape market size was estimated at USD 65.55 million in 2025 and is expected to reach USD 66.21 million in 2026.

b. The Europe compression tape market is projected to grow at a CAGR of 1.44% from 2026 to 2033 to reach USD 73.47 million by 2033.

b. Based on product, sports injuries segment accounted for the largest revenue share in Europe in 2025, driven by high participation in organized sports, recreational fitness, and professional athletics across countries such as Germany, U.K., France, Spain, and Italy. Europe reports a consistently high burden of sprains, strains, ligament injuries, and overuse conditions, particularly in football, cycling, running, and indoor sports.

b. Key players in the Europe compression tape market are focused on expanding product portfolios, strengthening regional manufacturing and supply capabilities, and enhancing distribution across clinical and consumer channels. Companies such as 3M, Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN medical (Jobst), Hartmann Group, and Andover Healthcare

b. The Europe compression tape market is driven by rising participation in recreational and professional sports, increasing incidence of musculoskeletal injuries, and growing preference for non-invasive, drug-free injury management solutions. Expanding outpatient rehabilitation and physiotherapy services, along with higher awareness of kinesiology taping among clinicians and athletes, further support adoption. Additionally, aging demographics and a growing volume of orthopedic procedures contribute to steady demand for compression tapes in post-injury and post-operative care settings across Europe healthcare systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.