- Home

- »

- Medical Devices

- »

-

Europe Compression Therapy Market Size Report, 2033GVR Report cover

![Europe Compression Therapy Market Size, Share & Trends Report]()

Europe Compression Therapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Static Compression Therapy, Dynamic Compression Therapy), By Distribution Channel, By End Use (Hospitals, Specialty Clinics), By Country And Segment Forecasts

- Report ID: GVR-4-68040-843-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Compression Therapy Market Summary

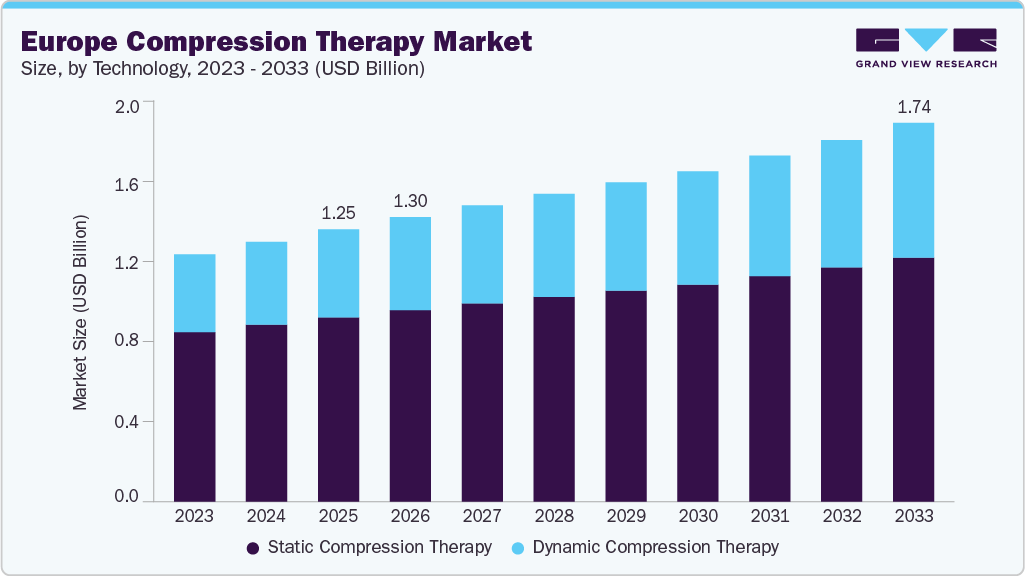

The Europe compression therapy market size was estimated at USD 1.25 billion in 2025 and is projected to reach USD 1.74 billion by 2033, growing at a CAGR of 4.19% from 2026 to 2033. This growth is attributed to the increasing prevalence of venous disorders, including chronic venous insufficiency, varicose veins, deep vein thrombosis (DVT), and lymphedema, particularly among aging populations and individuals with sedentary lifestyles.

Key Market Trends & Insights

- By technology, the static compression therapy segment led the market with the largest revenue share in 2025.

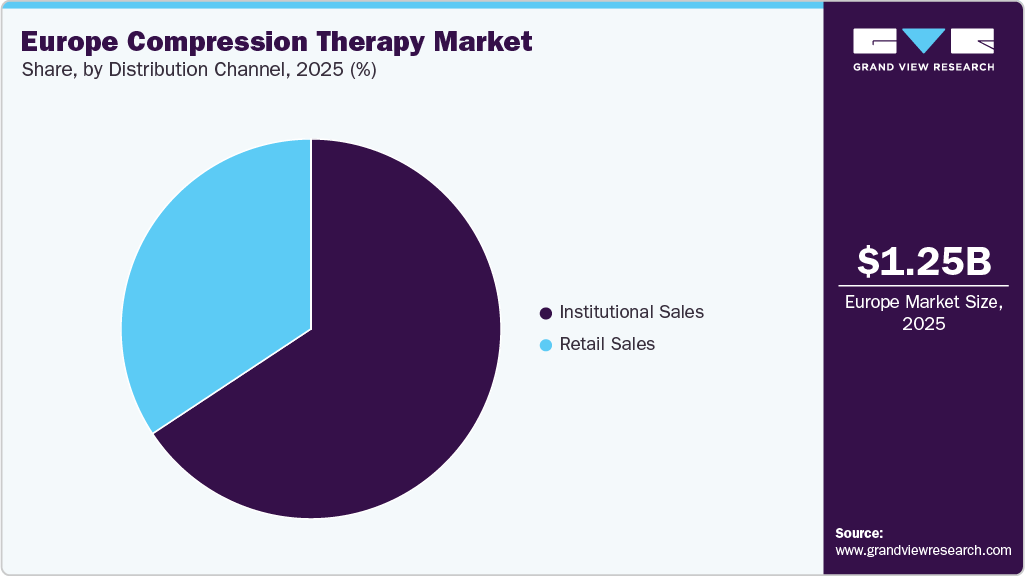

- By distribution channel, the institutional sales segment led the market with the largest revenue share in 2025.

- By end use, the hospitals segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.25 Billion

- 2033 Projected Market Size: USD 1.74 Billion

- CAGR (2026-2033): 4.19%

The rising awareness of the clinical benefits of compression therapy in improving blood circulation, reducing edema, and preventing post-surgical complications has increased its adoption across healthcare and home care settings. Besides, expanding reimbursement coverage, technological advancements in advanced compression materials and smart wearable systems, and increased focus on preventive healthcare and patient self-management are further propelling market growth.

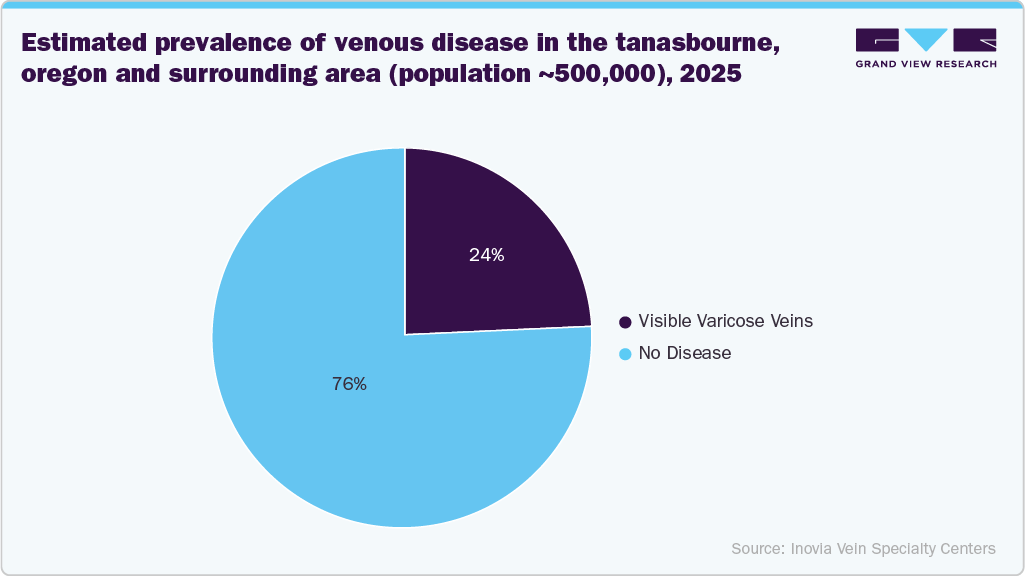

The increasing prevalence of chronic venous disorders, including chronic venous insufficiency (CVI), varicose veins, deep vein thrombosis (DVT), and venous leg ulcers, is a key driver of the Europe compression therapy industry. Factors such as sedentary lifestyles, obesity, aging populations, and prolonged periods of standing or sitting at work are significantly contributing to the growing burden of these conditions. According to data published by the Society for Vascular Surgery in July 2025, chronic venous insufficiency affects up to 40% of Americans. Similarly, data from WebMD LLC published in July 2025 indicate that in the U.S., more than 11 million men and 22 million women aged 40-80 years suffer from varicose veins, while over 2 million individuals are affected by advanced CVI. Each year, more than 20,000 people are diagnosed with ulcers resulting from CVI.

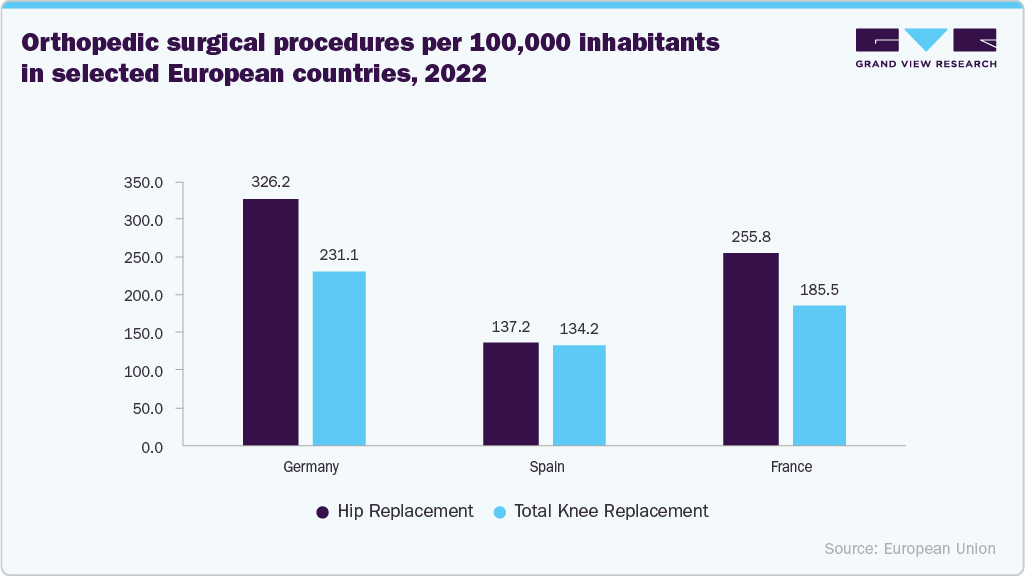

The rising volume of surgical procedures, including orthopedic and minimally invasive interventions, is a key driver of the Europe compression therapy industry. Even when surgeries are conducted on an outpatient or same-day basis, compression garments such as stockings or socks are commonly recommended as part of postoperative care. Patients who experience prolonged immobility following procedures involving the hip, knee, legs, or abdomen face an elevated risk of developing deep vein thrombosis (DVT). This risk increases further in longer surgeries that require general anesthesia for extended durations. As a result, the use of compression therapy until patients regain full mobility is widely regarded as an essential element of postoperative recovery and DVT prevention, supporting sustained market growth.

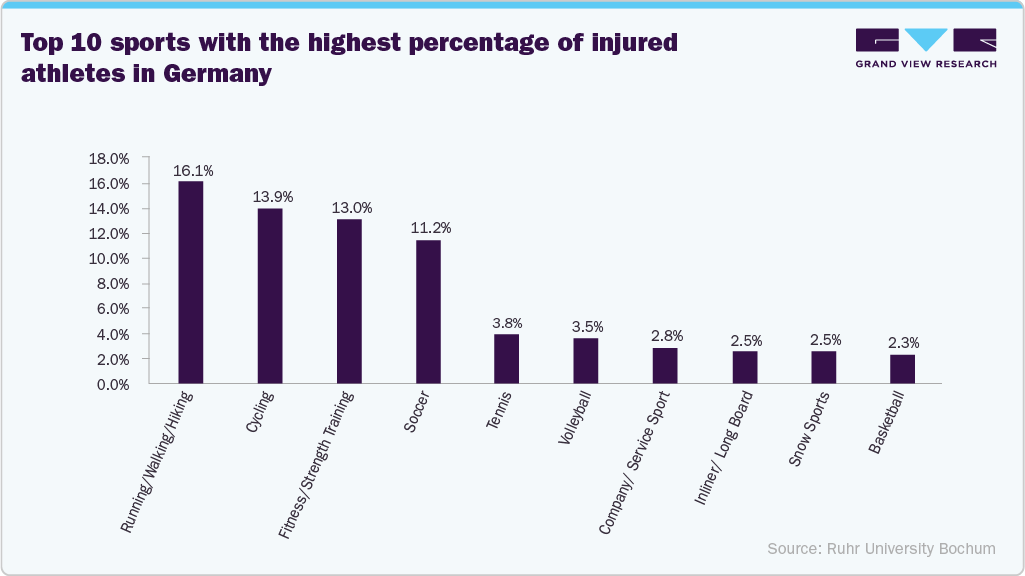

The increasing incidence of sports-related injuries is a significant driver of demand for compression therapy products, as athletes and fitness enthusiasts increasingly adopt compression garments to support recovery, prevent injuries, and optimize performance. Muscle strains, sprains, fatigue, and post-exercise inflammation are common among active individuals, driving the use of compression socks, sleeves, and tights to improve blood circulation, enhance oxygen delivery, and reduce muscle soreness and swelling. Compression therapy also supports lymphatic drainage and metabolic waste removal, enabling faster healing and rehabilitation while helping prevent complications such as deep vein thrombosis, particularly among athletes exposed to frequent travel or prolonged sitting. This trend is evident across Europe, including Germany, where a study published in October 2024 by the Department of Sports Medicine and Sports Nutrition at Ruhr University Bochum reported that approximately 12.2% of athletes experienced sports injuries within 12 months requiring medical attention or temporary activity cessation. The growing burden of sports injuries, combined with rising awareness of recovery-focused interventions, is reinforcing the adoption of compression therapy as a key component of modern sports medicine and active lifestyle management.

Market Concentration & Characteristics

The Europe compression therapy industry exhibits a high degree of innovation, driven by continuous advancements in materials science, wearable technology, and product design tailored to both clinical and lifestyle applications. Manufacturers are increasingly developing high-performance compression textiles that offer enhanced breathability, moisture management, and graduated compression profiles to improve comfort, efficacy, and user adherence. Innovations extend to smart and connected compression devices that integrate sensors for real-time monitoring of pressure, circulation, and activity levels, supporting personalized therapy and better clinical outcomes. In addition, the introduction of custom-fit and anatomically optimized garments, enabled by 3D scanning and digital fitting technologies, has improved product specificity and therapeutic precision.

The level of mergers and acquisitions activities has been moderately active and strategically focused, as larger medical device and healthcare companies seek to strengthen their portfolios with innovative compression solutions and expand their footprint across the region. Recent years have seen strategic acquisitions of specialized compression garment manufacturers and digital health technology providers to enhance product offerings across clinical and lifestyle segments. These transactions are driven by the desire to integrate advanced materials, smart wearable technology, and data-driven therapeutic solutions into existing platforms, as well as to capitalize on the growing prevalence of chronic venous diseases, lymphedema, and sports-related injury management.

Regulation plays a significant and shaping role in the compression therapy market in Europe, influencing product development, market entry, and commercialization timelines. Compression therapy products, particularly medical-grade stockings, bandages, and pneumatic compression devices, are regulated under the EU Medical Device Regulation (MDR 2017/745), which imposes stricter requirements for clinical evidence, product safety, performance validation, and post-market surveillance. The transition from the former Medical Device Directive (MDD) to MDR has increased compliance costs and extended approval timelines, especially for small and mid-sized manufacturers.

Product substitutes pose a moderate threat to the industry, as alternative treatment options are available for managing venous disorders, edema, sports injuries, and post-surgical recovery. Common substitutes include pharmacological therapies, such as anticoagulants, anti-inflammatory drugs, and pain management medications, which may be preferred in cases of acute or severe conditions. Physical therapy, manual lymphatic drainage, massage therapy, and exercise-based rehabilitation programs also serve as alternatives, particularly for long-term management of chronic venous insufficiency and lymphedema.

Technology Insights

The static compression therapy segment held the largest share of the Europe market in 2025. This dominance is driven by its widespread clinical acceptance, cost-effectiveness, and broad range of applications across chronic and preventive care. Static compression products, such as compression stockings, bandages, and wraps, are commonly prescribed as first-line therapy for conditions including chronic venous insufficiency, varicose veins, lymphedema, and deep vein thrombosis (DVT) prevention. Their ease of use, suitability for long-term wear, and availability across multiple compression classes make them highly accessible for both hospital and home-care settings. Additionally, strong physician preference, high patient compliance, and well-established reimbursement frameworks across several European countries further supported adoption.

Dynamic compression therapy is expected to grow at the fastest CAGR over the forecast period, due to its superior clinical effectiveness in managing complex and chronic conditions such as lymphedema, venous ulcers, and post-surgical edema, where static compression is often insufficient. Technologies such as intermittent pneumatic compression systems provide programmable, sequential pressure that mimics natural muscle movement, improving venous return and lymphatic drainage. Rapid advancements in portable, lightweight, and home-use devices have expanded adoption beyond hospitals into home care and rehabilitation settings, enhancing patient compliance.

End Use Insights

The hospitals segment dominated the Europe compression therapy industry in 2025 due to its central role in managing acute and chronic vascular conditions, postoperative care, and high patient volumes requiring clinically supervised treatment. Compression therapy is routinely used in hospital settings for the prevention of deep vein thrombosis (DVT), management of chronic venous insufficiency, lymphedema, and edema following orthopedic, cardiovascular, and general surgeries. Hospitals are also the primary adopters of advanced dynamic compression systems, such as intermittent pneumatic compression devices, which are commonly used during inpatient recovery and in intensive care units. The presence of trained healthcare professionals, access to reimbursement-backed therapies, and the growing number of surgical procedures across Europe further reinforced hospitals as the leading end user segment in the market in 2025.

Home healthcare is expected to grow at the fastest CAGR over the forecast period, driven by the increasing patient preference for at-home treatment, aging populations, and the shift toward decentralized care models. As more individuals seek comfortable, convenient, and cost-effective management of chronic conditions such as venous insufficiency, lymphedema, and post-surgical recovery, demand for home-use compression products, including easy-to-wear elastic garments and portable dynamic compression devices, has risen sharply. Advances in user-friendly technologies, such as lightweight pneumatic systems and adjustable compression wear, have made it easier for patients to self-administer therapy without frequent hospital visits.

Distribution Channel Insights

The institutional sales segment held the largest share in 2025. This dominance is attributed to their high volume of purchases made by hospitals, clinics, rehabilitation centers, and long-term care facilities. These institutions serve as primary treatment centers for conditions such as chronic venous insufficiency, lymphedema, deep vein thrombosis prevention, and post-surgical recovery, where compression therapy is a standard component of clinical protocols. Bulk procurement, long-term supply contracts, and centralized purchasing systems within public and private healthcare institutions further supported the dominance of this segment.

Retail sales are expected to grow at the fastest CAGR over the forecast period on the back of the rising consumer awareness, expanding self-care trends, and increased accessibility of compression products outside clinical settings. As patients and fitness enthusiasts seek convenient, over-the-counter solutions for managing venous health, mild edema, sports recovery, and travel-related circulation issues, demand for compression socks, sleeves, and support garments through retail channels has surged. The proliferation of e-commerce platforms, pharmacy chains, and specialty medical stores has made it easier for consumers to purchase a wide range of compression products without prescriptions or clinical referrals.

Country Insights

UK Compression Therapy Market Trends

The UK compression therapy industry is experiencing steady growth, driven by an aging population and the rising prevalence of chronic venous and lymphatic disorders, such as chronic venous insufficiency, lymphedema, and deep vein thrombosis, which increases demand for both medical compression garments and therapeutic devices. With the UK population aged 65 and over expanding significantly, an increasing number of individuals require compression solutions to manage circulation issues and swelling, contributing to rising adoption rates across both clinical and home care settings. In addition, advancements in product design and technology, including the use of smarter, more comfortable materials and integrated pressure-monitoring sensors, are enhancing therapeutic effectiveness and patient compliance, thereby further supporting market expansion.

Germany Compression Therapy Market Trends

The compression therapy industry in Germany is experiencing steady growth, supported by the rising prevalence of chronic venous and lymphatic conditions, such as varicose veins, chronic venous insufficiency, and lymphedema, largely driven by an aging population and lifestyle-related health issues, which increases demand for both static and dynamic compression solutions across clinical and home care settings. Germany’s well-established healthcare infrastructure and strong presence of key manufacturers in the compression segment also help sustain its market leadership in Europe.

Key Europe Compression Therapy Company Insights

The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the regional market.

Key Europe Compression Therapy Companies:

- Essity Aktiebolag

- Cardinal Health

- Hartmann AG

- ArjoHuntleigh

- Solventum

- Tactile Medical

- Julius Zorn GmbH

- Medi GmbH & Co.

- SIGVARIS

- URGO MEDICAL

- Medline Industries, LP.

- Smith+Nephew

- Mölnlycke Health Care AB

- L&R Group

- Ofa Bamberg GmbH

- Zimmer Biomet

Recent Developments

-

In June 2025, Mölnlycke Health Care secured USD 400 million in financing from The Swedish Export Credit Corporation (SEK) to support its global expansion and growth strategy. The agreement, signed in Stockholm and Gothenburg on June 24, 2025, will enable the company to strengthen its international presence further and invest in advancing its healthcare solutions worldwide.

-

In September 2025, Lohmann & Rauscher (L&R) announced the completion of its acquisition of 49% of the shares in the ADA Group. The strategic partnership, effective retroactively from January 1, 2025, strengthens L&R’s manufacturing and supply capabilities. ADA, based in Seroa, Portugal, is a well-established producer of gauze, nonwoven products, bandages, incontinence items, and medical disposables.

-

In April 2025, Cardinal Health announced the completion of its acquisition of Advanced Diabetes Supply Group (ADSG), a leading national direct-to-patient provider of diabetes medical supplies, serving approximately 500,000 patients annually.

Europe Compression Therapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.30 billion

Revenue forecast in 2033

USD 1.74 billion

Growth rate

CAGR of 4.19% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Segments covered

Technology, distribution channel, end use, country

Regional scope

Europe

Country scope

UK; France; Germany; Spain

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Essity Aktiebolag; Cardinal Health; Hartmann AG; ArjoHuntleigh; Solventum; Tactile Medical; Julius Zorn GmbH; Medi GmbH & Co.; SIGVARIS; URGO MEDICAL; Medline Industries, LP.; Smith+Nephew; Mölnlycke Health Care AB; L&R Group; Ofa Bamberg GmbH; Zimmer Biomet

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Compression Therapy Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe compression therapy market report on the basis of technology, distribution channel, end use, and country.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Static Compression Therapy

-

Compression Bandages

-

Compression Stockings & Hosiery

-

Compression Tape

-

Adjustable Compression Wraps (Leg/Calf)

-

-

Dynamic Compression Therapy

-

Compression Pumps

-

Compression Sleeves

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Institutional Sales

-

Retail Sales

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UK

-

France

-

Germany

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe compression therapy market size was estimated at USD 1.25 billion in 2025 and is expected to reach USD 1.30 billion in 2026.

b. The Europe compression therapy market is expected to grow at a compound annual growth rate of 4.19% from 2026 to 2033 to reach USD 1.74 billion by 2033

b. Static compression therapy dominated the Europe compression therapy market with a share of 67.72% in 2025. This dominance is driven by its widespread clinical acceptance, cost-effectiveness, and broad range of applications across chronic and preventive care.

b. Some key players operating in the Europe compression therapy market include Essity Aktiebolag; Cardinal Health; Hartmann AG; ArjoHuntleigh; Solventum; Tactile Medical; Julius Zorn GmbH; Medi GmbH & Co.; SIGVARIS; URGO MEDICAL; Medline Industries, LP.; Smith+Nephew; Mölnlycke Health Care AB; L&R Group; Ofa Bamberg GmbH; Zimmer Biomet

b. Key factors that are driving the market growth include the growing prevalence of venous disorders, such as chronic venous insufficiency, varicose veins, deep vein thrombosis (DVT), and lymphedema, particularly among aging populations and individuals with sedentary lifestyles. The rising awareness of the clinical benefits of compression therapy in improving blood circulation, reducing edema, and preventing post-surgical complications has increased its adoption across healthcare and home care settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.