- Home

- »

- Communications Infrastructure

- »

-

Europe Data Center Colocation Market Size Report, 2030GVR Report cover

![Europe Data Center Colocation Market Size, Share & Trends Report]()

Europe Data Center Colocation Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Retail, Wholesale), By End-use (IT & Telecom, Healthcare), By Enterprise Size (Large Enterprises, SMEs), And Segment Forecasts

- Report ID: GVR-4-68039-344-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global Europe data center colocation market size was valued at USD 15.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.2% from 2023-2030. Major factors driving the growth of the Europe data center colocation industry include increasing demand for interconnection bandwidth and rising data traffic. With the emergence of edge computing applications, the need for high-capacity networks is growing considerably, and coping with the issues of network latency and the need for real-time insights led to the evolution of multi-locational hybrid data architectures, which has expanded the demand for transmission of data among private exchange points or data centers. Besides, businesses are shifting to the cloud, requiring higher bandwidth and enabling rapid, seamless data transfer and processing speeds.

The France, London, Amsterdam, Paris (FLAP) markets have dominated Europe's data center colocation for many years. These markets are still critical to the data center ecosystem from the market entry point of view. However, the FLAP markets have become mature and face limitations related to physical spaces and the need for more energy to power the data centers. Such constraints have propelled colocation providers to search for new locations such as Oslo, Berlin, Zurich, Reykjavik, Milan, Warsaw, Prague, and Vienna Madrid. These countries are regarded as potential hotspots for data center development across Europe.

Factors such as stringent environmental regulations in Europe and regional diversity are expected to challenge the market growth in the region. Colocation service providers may face contracting and multi-national product pricing complications with 23 languages spoken and 28 different currencies operating across Europe. Furthermore, such diversity increases data sovereignty issues across borders as GDPR has added liability and complexity to data management. However, companies can overcome these challenges by localizing their colocation services across European countries.

The high costs associated with owning and maintaining a data center, particularly for companies that generate inconsistent data volumes, are expected to be a key factor favoring market growth. Besides capital expenditure savings, data center colocation offers several other benefits to customers. Research studies suggest that owning or constructing a data center facility can cost over USD 300 per square foot, in addition to the cost incurred for laying the required fiber cabling. In such situations, in-house handling of an entire data center facility is a high-cost component for SMEs, whereas large-scale organizations can easily absorb this cost. Data center colocation is one solution that supports SMEs with a viable and affordable alternative to renting data center space, which is expected to drive market growth over the forecast period.

The market is driven by the significant demand for colocation services by hyperscale data center consumers such as public cloud service providers and large internet businesses. Besides setting up large data center campuses in remote areas, major cloud services providers such as Microsoft Azure, Google Cloud Platform, and Facebook has leased bunches of capacity from colocation data center companies in densely populated areas. The rise in colocation services results from increased network connectivity and the number of localized data centers in compliance with the General Data Protection Regulation (GDPR) to ensure data does not cross country borders. Europe is also witnessing increased demand from the Chinese telcos and hyper scalers looking to expand their global networks.

Type Insights

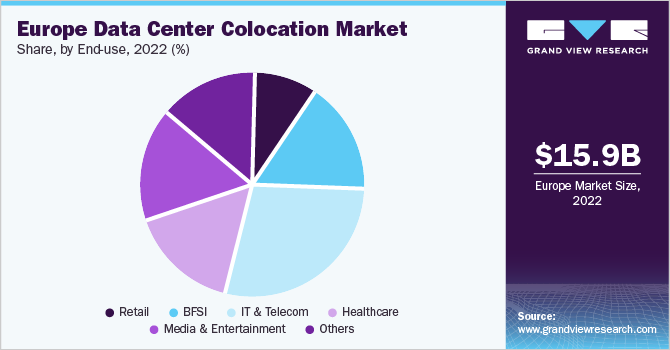

Regarding revenue, the retail colocation segment dominated the Europe market with a share of over 72% in 2022 and is estimated to retain the leading position throughout the forecast period. Small enterprises have limited data storage requirements, so they do not require dedicated data centers. As such, wholesale colocation services are expensive for small businesses as they only offer space and power, whereas the enterprises themselves must manage the IT infrastructure and staffing. Retail colocation provides racks, private data center suites, cabinets, and staffing suitable for small enterprises for a limited time.

Wholesale colocation data centers are still preferred among large businesses as they offer large space, which can accommodate large data volume configurations. The implementation of GDPR has led to increased investments in the wholesale colocation space by major cloud service providers. These investments result from customers becoming critical of their data storage while closely monitoring the data storage methods. As such, wholesale colocation allows cloud service providers to localize their large data centers while complying with GDPR and gaining customer trust.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of over 60% in 2022. This is attributed to major cloud service providers and hyper scalers adopting colocation services. Large enterprises manage a large volume of data and require infrastructure with high capacities and ample floor space to accommodate the equipment. Datacenter colocation helps these enterprises to fulfill their power and space requirements with complete control over data center infrastructure. These factors have resulted in large enterprises shifting toward colocation services rather than building and operating their own data centers.

The rising number of startup businesses has fueled the demand for colocation data centers across Europe. SMEs cannot afford to build and operate data centers, so they depend on colocation data centers. Meanwhile, small enterprises do not require the set-up of extensive data center facilities. Therefore, several SMEs find it suitable to deploy colocation centers and save on fixed, operational, and maintenance costs, subsequently driving market growth.

End-use Insights

The healthcare segment is expected to record the highest growth rate of over 18% over the forecast period in the market. The growth of colocation data centers in the healthcare industry can be attributed to the benefits such as shifting infrastructure from on-premise to off-premise, redundancy of colocation networks offering high uptime records, lower OPEX, and better resource allocation, diverse connectivity options, enhanced security compliance enabling reduced risk among others. Moreover, major companies in the regional market offer healthcare solutions, such as CoreSite Realty Corporation, Digital Realty Trust, Inc., and Iron Mountain Incorporated, among others, have also been crucial in developing the healthcare segment. The benefits of opting for colocation data centers by the healthcare industry, along with the availability of colocation data centers of top companies in the market, have contributed to the growth of the healthcare segment in the region’s data center colocation market over the forecast period.

The IT and telecom segment dominates the market presently with the largest market share and is expected to continue its dominance over the forecast period. The large market share is due to the continuous development of software and application in the industry and the launch of several start-ups across the region. Meanwhile, the telecom sector has witnessed a surge in mobile internet users, which has created a massive demand for data storage in the past years. The advancement in technologies such as IoT and 5G is expected to drive growth in the IT and telecom industry, driving market growth in the forthcoming years.

Country Insights

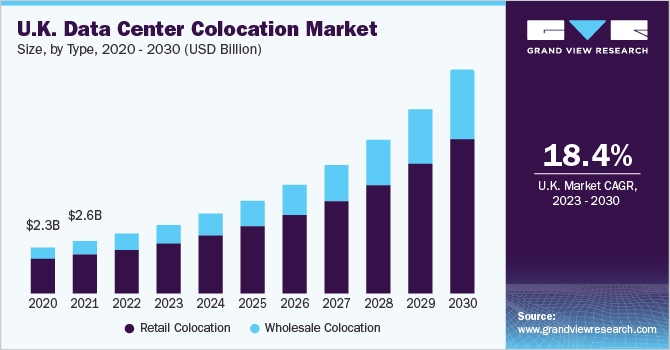

The UK is expected to register the highest CAGR of more than 18% over the forecast period. This growth is attributed to the huge volume of internet traffic and the presence of several cloud service providers in the country. In addition to the UK, FLAP markets are the primary markets in the region, attracting significant investments from international markets owing to enhanced interconnection hubs, high bandwidth connectivity, and cloud-friendly infrastructure.

Nordic countries are expected to attract substantial investments, with the data center capacity will grow from 102 MW in 2019 to 337 MW by 2024. As data center operators and their clients move toward greener initiatives, Oslo has emerged as an attractive option due to the low-cost hydropower available in the city. The Norwegian government offers energy and tax incentives to attract investments from hyper scalers in this country. Furthermore, Warsaw in Poland has emerged as a hotspot for investment in the CEE region, with many companies installing data centers in Poland. For instance, in July 2021, DATA4 announced its plan to set up a data center in Poland, for which the company plans to invest USD 118.7 million (EUR 100). The data center will have a power capacity of 50MW.

Key Companies & Market Share Insights

The key players operating in the Europe data center colocation market include CenturyLink, CyrusOne, Digital Realty Trust, Inc. Cyxtera Technologies, Inc. among others. To widen their product offering, companies employ a variety of inorganic growth tactics, such as mergers, partnerships, and acquisitions.Prominent players dominating the Europe data center colocation market include:

-

CenturyLink

-

China Telecom Corporation Limited.

-

CoreSite Realty Corporation

-

Colt Group Holdings Limited.

-

CyrusOne

-

Cyxtera Technologies, Inc.

-

Digital Realty Trust, Inc.

-

Equinix, Inc.

-

Global Switch

-

Interxion

-

Iron Mountain Incorporated

-

NTT Communications Corporation

-

RACKSPACE TECHNOLOGY

-

Switch

-

Telehouse

Europe Data Center Colocation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.9 billion

Revenue forecast in 2030

USD 48.6 billion

Growth Rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, end-use, country

Country scope

UK, Germany, France, Austria, Switzerland, Benelux, Nordics, CEE

Key companies profiled

CenturyLink; China Telecom Corporation Limited.; Colt Group Holdings Limited.; CoreSite Realty Corporation; CyrusOne; Cyxtera Technologies, Inc.; Digital Realty Trust, Inc.; Equinix, Inc.; Global Switch; Interxion; Iron Mountain Incorporated; NTT Communications Corporation; RACKSPACE TECHNOLOGY; Switch; Telehouse

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Data Center Colocation Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the this study, Grand View Research has segmented the Europe data center colocation market based on type, enterprise size, end-use and country.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Colocation

-

Wholesale Colocation

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Retail

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Austria

-

Switzerland

-

Benelux

-

Nordics

-

CEE

-

Frequently Asked Questions About This Report

b. The Europe data center colocation market size was estimated at USD 15.9 billion in 2022 and is expected to reach USD 17.9 billion in 2023.

b. The Europe data center colocation market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 48.6 billion by 2030.

b. The large enterprise segment dominated the global Europe data center colocation market and accounted for the largest revenue share of over 60% in 2022.

b. In terms of colocation type, the retail colocation segment accounted for over 70% of the market in 2022. The growth is attributed to the rise in small & medium scale industries in the emerging countries across Europe.

b. Some key players operating in the Europe data center colocation market include Equinix, Inc; Cyxtera Technologies, Inc; InterXion; CyrusOne, Inc; NTT Limited; Global Switch; Verne Global.

b. Key factors that are driving the Europe data center colocation market growth include the increasing requirement for faster data processing and high bandwidth; the emergence of immersive technologies and adoption of smart devices; and the growing viewership of OTT streaming platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.