- Home

- »

- Medical Devices

- »

-

Europe Diabetic Foot Ulcer Treatment Market, Report, 2030GVR Report cover

![Europe Diabetic Foot Ulcer Treatment Market Size, Share & Trends Report]()

Europe Diabetic Foot Ulcer Treatment Market Size, Share & Trends Analysis Report By Treatment (Biologics, Wound Care Dressings), By Type (Neuro-Ischemic, Neuropathic), By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-959-6

- Number of Report Pages: 124

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

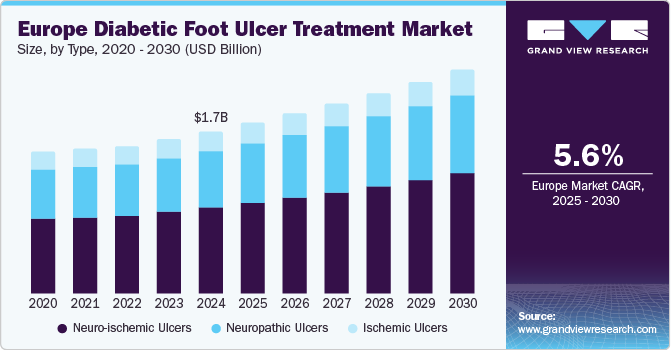

The Europe diabetic foot ulcer treatment market size was estimated at USD 1.68 billion in 2024 and is expected to grow at a CAGR of 5.62% from 2025 to 2030. Major factors contributing to the market growth include the increasing prevalence of foot ulcers among diabetes patients, increasing cases of ischemic ulcers, increasing number of diabetic patients vulnerable to diabetic injuries, a rise in the geriatric population, and technological advancements in diabetic foot management.

The increasing population of diabetic patients in Europe is significantly driving the market, as the rise in diabetes cases correlates with a higher incidence of foot ulcers. For instance, according to WHO, diabetes is one of the most common long-term health issues in the European Region, and Europe has the highest rate of type 1 diabetes globally. By 2045, it is estimated that 1 in 10 people in the Region is expected to suffer from diabetes. Factors contributing to this rise include lifestyle changes, such as poor dietary habits and the aging population. The growing prevalence of diabetes poses significant challenges, leading to various complications such as foot ulcers and other neurological complications.

Rising number of geriatric population is also driving the market as aging population in Europe is contributing significantly to the rise in diabetes cases, as older adults are more prone to develop type 2 diabetes. As people live longer, the number of geriatric population is increasing, leading to a higher risk of diabetes-related complications, including diabetic foot ulcers. This trend creates a growing demand for effective treatments and care strategies tailored to older patients, further impacting the healthcare system and the market. For instance, according to the WHO, the number of people aged 60 and older in the European region was 215 million in 2021. This number is expected to grow to 247 million by 2030 and over 300 million by 2050.

Increasing investment in developing novel and advanced treatments for diabetic foot ulcers is also expected to drive market growth. For instance, In February 2021, the University of Bath initiated a Euro 1.7 million project to evaluate an innovative treatment for diabetic patients with foot ulcers. Funded by the National Institute for Health Research, this study intends to assess the efficacy of a pioneering approach that combines electrical stimulation with standard care protocols to promote wound healing. The initiative addresses the prevalent and serious complications associated with diabetes, mainly foot ulcers, which can result in severe health consequences, including the risk of amputation.

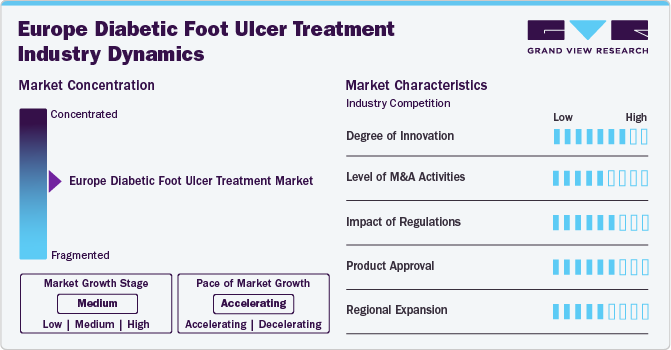

Market Concentration & Characteristics

The market exhibits a moderate level of industry concentration, characterized by several key players alongside several smaller companies and emerging firms. Major multinational corporations, including Smith & Nephew Plc., ConvaTec Group PLC, and Molnlycke Health Care AB, dominate the market, leveraging their extensive product portfolios and established distribution networks. These players focus on innovation, investing significantly in research and development to enhance existing treatments and introduce advanced therapies such as bioengineered skin substitutes and novel wound dressings.

The growing number of partnerships and collaborative efforts among companies is expected to significantly boost industry growth. This trend can be seen in various industries, where players realize the benefits of working together to improve their competitiveness. By partnering, companies can combine resources, share knowledge, and utilize each other's strengths, which helps in innovation and creating new products or services.

The market is characterized by a high degree of innovation, driven by the need for advanced solutions to address the complexities of wound care. Companies are focusing on developing novel therapies, such as bioengineered skin substitutes, growth factors, and smart dressings that incorporate technology for enhanced monitoring and treatment efficacy.

Mergers and acquisitions (M&A) activity within the market has been robust as established players seek to expand their product portfolios and market presence. This trend is expected to continue as firms aim to enhance their capabilities in wound management and respond to the growing demand for innovative treatment options. For instance, in March 2022, ConvaTec Group Plc announced the acquisition of Triad Life Sciences Inc. As part of this transition, the Triad team, along with its current portfolio and product pipeline, integrated into ConvaTec's Advanced Wound Care (AWC) business unit, which rebranded as ConvaTec Advanced Tissue Technologies. This acquisition underlines ConvaTec's commitment to enhancing its capabilities and offerings in advanced wound care.

Regulatory frameworks play a significant role in shaping the market. Compliance with regulations from bodies such as EMA in Europe is essential for product approval and market entry. Stringent regulations ensure the safety and efficacy of medical products, influencing development timelines and costs. Companies must navigate these regulatory landscapes carefully, as changes in regulations can impact market dynamics and competitive positioning.

Product approval is a critical factor in the market, as it directly affects the availability and adoption of new therapies. The approval process can be lengthy and resource-intensive, requiring robust clinical evidence to demonstrate safety and efficacy. Companies that successfully navigate this process gain a competitive edge, enabling them to bring innovative solutions to market more quickly and capitalize on emerging trends in wound care.

Regional expansion is a key focus for market companies, driven by the increasing prevalence of diabetes and related complications in Europe.

Type Insights

The neuro-ischemic ulcers segment held the largest market share of 53.10% in 2023 and is expected to continue its dominance over the forecast period. Neuro-ischemic ulcers, which result from a combination of neuropathy and compromised blood flow, require specialized treatment approaches that often involve advanced wound care products and therapeutic devices. Innovations such as bioengineered tissues, growth factor therapies, and improved dressing materials are gaining popularity for enhancing healing in these challenging cases. In addition, integrating technologies such as vascular interventions and personalized treatment plans drives the demand for effective solutions in managing neuro-ischemic ulcers.

The neuropathic ulcer segment is expected to grow rapidly over the forecast period. The segment's growth is driven by the increasing prevalence of diabetes in Europe. This segment focuses on innovative therapies and products specifically designed for patients experiencing nerve damage and loss of sensation, leading to ulcer development. Leading aids include advanced wound care dressings, offloading devices, and therapeutic interventions such as growth factors and bioengineered skin substitutes. This segment is expected to witness significant expansion, fueled by heightened awareness of diabetic complications and ongoing advancements in treatment options.

Treatment Insights

The biologics segment dominated the market, with a 36.37% share in 2024, owing to the high demand for biologicals in the treatment of diabetic foot. Biological therapies for diabetic foot ulcers leverage growth factors, skin substitutes, stem cell therapy, and collagen-based products to enhance healing by promoting angiogenesis, reducing inflammation, and stimulating cell proliferation. These treatments are particularly beneficial for chronic, non-healing wounds, potentially improving healing rates and reducing amputation risks. Challenges such as cost, accessibility, and variable patient responses remain. Thus, integrating biologicals with standard wound care and multidisciplinary approaches can significantly optimize patient outcomes.

The therapy devices segment is expected to register the fastest CAGR from 2025 to 2030. Therapy devices include NPWT, oxygen & hyperbaric oxygen equipment, electric stimulation devices, pressure relief devices, and other tools. These devices are particularly useful for chronic and hard-to-heal wounds, providing a non-invasive treatment option. The growing demand for non-invasive and patient-friendly treatment options is propelling the adoption of these devices in clinical settings. Challenges such as proper training, device accessibility, and patient compliance remain, necessitating ongoing advancements and education in this market. Thus, combining technological innovation and increasing awareness of effective wound care strategies positions the therapy device market for continued expansion in the coming years.

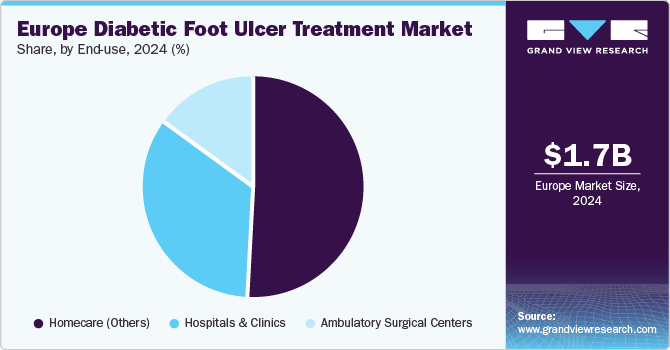

End-use Insights

The homecare segment accounted for a share of 52.72% in 2024 and is expected to grow fastest during the forecast period. The growth of the segment can be attributed to several key factors. Primarily, it enhances patient comfort and convenience, fostering improved adherence to treatment protocols and yielding better clinical outcomes. In addition, homecare services are often more cost-effective than traditional hospital settings, significantly reducing the financial burden on patients and the healthcare system. Integrating telehealth technologies facilitates continuous monitoring and virtual consultations, essential for effectively managing DFUs. Also, these programs frequently include comprehensive education on wound care and diabetes self-management, empowering patients to participate actively in their treatment.

With the increasing prevalence of diabetes among the aging population, the demand for homecare solutions is expected to continue rising, reflecting a broader shift towards more patient-centered healthcare strategies. This personalized approach enables healthcare providers to customize treatment plans based on individual patient needs, optimizing healing and reducing the risk of complications.

Country Insights

UK Diabetic Foot Ulcer Treatment Market Trends

The diabetic foot ulcer treatment market in the UK held a significant share in 2024. The UK has a well-defined healthcare system consisting of advanced medical technologies for treating diabetic foot ulcers. The increasing prevalence of foot ulcers among diabetic patients in the UK is expected to drive the market's growth over the forecast period. For instance, in June 2022, NHS Resolution published a report on diabetes and lower limb complications, stating that 7957 cases of diabetes-induced lower limb amputations were recorded in the UK between 2017 and 2020.

Germany Diabetic Foot Ulcer Treatment Market Trends

The diabetic foot ulcer treatment market in Germany is expected to grow owing to the increasing recurrence of foot ulcers in diabetic patients in Germany. For instance, a study published in Diabetes Research and Clinical Practice Journal in December 2020 aimed to estimate the incidence of diabetic foot ulcer (DFU) recurrence and corresponding risk factors in Germany stated that the cumulative recurrence rate of diabetic foot ulcers (DFUs) was approximately 70% over 15 years. In Germany, 69% (154) of patients experienced at least one recurrence of DFU. The crude cumulative incidence of DFUs in the first year was 28% in this population.

France Diabetic Foot Ulcer Treatment Market Trends

The diabetic foot ulcer treatment market in France is expected to grow owing to technological advancements and the growing incidence of diabetic foot in the country. For instance, a study published in the Cardiovascular Diabetology Journal in February 2023 stated that in France, approximately 3.5 million individuals, representing 5.3% of the population, received treatment for diabetes in 2020. This statistic underscores the significant public health challenge posed by diabetes within the country.

Key Europe Diabetic Foot Ulcer Treatment Company Insights

The presence of established and emerging players in the European market, coupled with their various initiatives to stay competitive, is expected to significantly drive overall market growth. These market leaders are consistently engaging in strategic efforts to enhance their offerings, broaden their market reach, and maintain a competitive edge.

Key Europe Diabetic Foot Ulcer Treatment Companies:

- ConvaTec Group PLC

- Acelity L.P. Inc.

- 3M Health Care

- Coloplast Corp.

- Smith & Nephew Plc.

- B. Braun SE

- Medline Industries, LP

- Organogenesis, Inc.

- Molnlycke Health Care AB

- Medtronic.

View a comprehensive list of companies in the Europe Diabetic Foot Ulcer Treatment Market

Recent Developments

-

In October 2024, Molnlycke Health Care AB, a globally recognized leader in the MedTech sector specializing in wound care and management, announced the successful completion of the acquisition of P.G.F. Industry Solutions GmbH. P.G.F. Industry Solutions GmbH is well-known for its Granudacyn product line, specializing in advanced wound cleansing and moistening solutions.

-

In January 2021, Smith & Nephew Plc., a global leader in medical technology, announced the completion of the acquisition of the Extremity Orthopaedics business from Integra LifeSciences Holdings Corporation for USD 240 million. This acquisition strategically aligns with the company’s objective to invest in higher-growth segments, significantly strengthening its extremities business by integrating a dedicated sales channel and a complementary portfolio of shoulder replacement and upper and lower extremities solutions.

-

In January 2020, ConvaTec Group PLC, a prominent global medical technology company, announced the launch of ConvaMax, a new superabsorber dressing distributed by Convatec. The ConvaMax superabsorber wound dressing is designed to effectively manage exuding wounds, including leg ulcers, pressure ulcers, diabetic foot ulcers, and dehisced surgical wounds.

Europe Diabetic Foot Ulcer Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.77 billion

Revenue forecast in 2030

USD 2.32 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, ulcer type, end-use, country

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

ConvaTec Group PLC; Acelity L.P. Inc.; 3M Health Care; Coloplast Corp.; Smith & Nephew Plc.; B. Braun SE; Medline Industries, LP; Organogenesis, Inc.; Molnlycke Health Care AB; Medtronic.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Diabetic Foot Ulcer Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the Europe diabetic foot ulcer treatment market report based on treatment, type, end-use, and country:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Care Dressings

-

Biologics

-

Therapy Devices

-

Antibiotic Medications

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neuropathic Ulcers

-

Ischemic Ulcers

-

Neuro-ischemic Ulcers

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

Homecare (Others)

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany6

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe diabetic foot ulcer treatment market size was estimated at USD 1.68 billion in 2024 and is expected to reach USD 1.77 billion in 2025.

b. The Europe diabetic foot ulcer treatment market is expected to grow at a compound annual growth rate of 5.62% from 2025 to 2030 to reach USD 2.32 billion by 2030.

b. UK dominated the Europe diabetic foot ulcer treatment market with a share of 23.03% in 2024. This is attributable to the increased diabetic population in this region.

b. Some key players operating in the Europe DFU treatment market include ConvaTec, Inc., Acelity L.P. Inc., 3M Healthcare, Coloplast Corp., Smith & Nephew Plc., B Braun Melsungen AG, Medline Industries, Inc., Organogenesis, Inc., Molnlycke Health Care AB, Medtronic

b. Key factors that are driving the Europe diabetic foot ulcer treatment market growth include the increasing incidence of diabetic population, supportive government initiatives, and increased complications for Covid-19 infected patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."