- Home

- »

- Next Generation Technologies

- »

-

Europe Digital Experience Platform Market Report, 2030GVR Report cover

![Europe Digital Experience Platform Market Size, Share, & Trends Report]()

Europe Digital Experience Platform Market (2022 - 2030) Size, Share, & Trends Analysis Report By Component, By Deployment, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-930-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

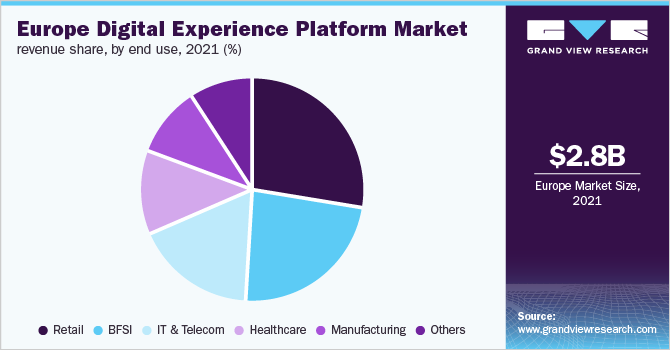

The Europe digital experience platform market size was valued at USD 2.88 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2022 to 2030. The current growth can be attributed to the increasing rate of digital transformation across industry verticals and the growing need to enrich customer experiences for enhanced customer engagement. The COVID-19 pandemic compelled several businesses to become digital to improve workflow efficiency and preserve business growth. These platforms have enhanced automation and digitalization in several businesses in various industry verticals. Hence, more vendors are adopting digital experience platforms (DXP)s, which allow them to reach customers via digital devices and facilitate upselling and cross-selling across their businesses.

The acceptance rate of the latest technologies, such as Artificial Intelligence (AI) and Machine Learning (ML) in DXP solutions is expected to boost market growth. Digital experience platforms permit businesses to focus on a larger customer base by designing and planning new products and implementing new business models and services. For instance, in March 2022, the Dutch Council for Refugees, a government body, announced a partnership with SparkOptimus, a digital strategy consultancy, to launch RefugeeHelp.com, a digital platform to provide a transparent overview of initiatives for both Ukrainian refugees and volunteers. At the same time, the platform is positioned to meet the future incursions of refugees worldwide. These benefits will supplement the growth.

Digital experience platforms can be easily integrated with the existing set of business processes such as Customer Relationship Management (CRM), contact centers, and social media platforms. With the help of these capabilities, organizations can obtain powerful insights helping them boost their return on investment. For instance, in September 2020, Deloitte Digital announced a collaboration with Lamborghini, an Italian automotive giant, to help transform its digital experience. Deloitte Digital created a new CRM platform using the Salesforce platform and integrated the CRM with a content management system, and enabled Lamborghini to create and deliver the right content to their customers. These features are driving the growth of the regional market.

The growing inclination for cloud-based digital experience platforms from companies helps the regional market to grow. Several enterprises prefer cloud services, as they reduce investments in physical infrastructure and rapid deployment capability. With the help of cloud-based digital experience platforms, companies can access the platform from multiple devices such as smartphones, laptops, and desktop computers and can deliver customized content based on customer preferences, buying behavior, and historical transactions. Trends like these are likely to fuel the regional market growth of the digital experience platform.

The evolving use of voice commerce is expected to aid the growth of the regional market as a medium to sell various products and services. The presence of a sound e-commerce industry complements digital commerce, creating a bilateral pathway for revenue generation and profit-sharing. Several e-commerce companies in the region, such as Otto Group, Marks & Spencer, and Apple, among others, have increased the bar of choice for the masses by hosting products and their brands. The option of trying and buying has also become a popular resort for e-commerce buyers. These trends are expected to drive the demand for DXP in the region.

Component Insights

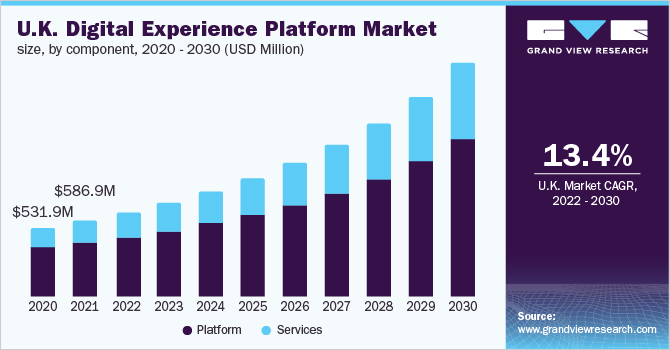

The platform segment accounted for the largest market share of 71.2% in 2021. The augmented efforts by the companies to provide integrated, personalized, and optimized user engagement and experience throughout multiple marketing channels are anticipated to boost the segment growth. It helps engage consumers through well-thought-out, customized digital experiences while providing companies with the opportunity to improve their efficiency. In addition to this, DXPs allow the acquisition of new customers and retention of existing customers. This will supplement the growth of the segment during the forecast period.

The services segment is expected to register a CAGR of 13.7% during the forecast period. The growth can be attributed to the rising demand for services such as training and consulting across various industries. Several industries use digital experience platform services to save costs, increase return-on-investment (ROI), and improve company operational performance. These are very useful for companies with no internal budgets or analytical skills to implement and manage the Customer Experience (CX) solution. Moreover, they also handle end-to-end deployment and after-sales services for the solutions. These factors are responsible for the growth of the service segment.

Deployment Insights

The on-premise segment accounted for the largest market share of 53.8% in 2021. Several organizations choose on-premise deployment due to its ability to customize as per user requirements during the implementation. For instance, LoginRadius Inc., a Customer Identity and Access Management (CIAM) platform help companies securely manage customer identities and data to deliver a unified customer experience with the help of in-house data centers. It provides organizations better control over sensitive data and supports easy compliance. Additionally, with on-premise deployment organizations can install a personalized network of digital transformation that suits the organization's necessities precisely and effectively.

The cloud segment is expected to grow at a CAGR of 15.9% over the forecast period due to cost-efficiency and hassle-free integration of cloud with various applications. Several enterprises prefer cloud services, as it helps reduce initial IT costs, such as the costs of hardware setup and power consumption, require less physical space, and achieve improved collaboration, along with faster performance, quick responsiveness, and greater agility. For instance, in November 2021, Accenture announced the collaboration with Organon, a healthcare company, to set up and manage the transformation of the company’s Enterprise Resource Planning (ERP) technology in a cloud-based digital core.

Application Insights

The Business-to-Consumer (B2C) segment accounted for the largest market share of 65.1% in 2021. The growth can be attributed to the increasing disposable income level, escalating usage of the internet and smartphones, and an increasing number of online shoppers. Moreover, technological advancement supported by increasing usage of AI is providing customers with a real-time shopping experience. For instance, Augmented Reality (AR) technology offers customers virtual changing rooms, wherein customers can try a product virtually. The adoption of these technologies will supplement the growth of the segment during the forecast period.

The Business-to-Business (B2B) segment is expected to grow at a CAGR of 11.7% over the forecast period. The closure of physical stores due to the over-expansion of malls and changes in spending habits, and an increase in the number of online orders, have positively impacted the region’s B2B business outlook. Moreover, the proliferation of cloud services and web applications has boosted the demand. For instance, in December 2020, Amazon Web Services expanded its partnership with Nationwide Mutual Insurance Company, a British mutual financial institution, by selecting it as its cloud provider for the company-wide digital transformation. It helps the organizations effectively redesign business content on various touchpoints such as tablets, cell phones, and workstations.

End-use Insights

The retail segment held a market share of 27.6% in 2021 and is expected to dominate the market by 2030. The growing number of customers’ expectations and improvements in real-time payment technologies are likely to foster the segment growth during the forecast period. Moreover, several retailers have adopted technological tools to improve operational efficiency and enhance customer interactions. For instance, H&M, a Swedish clothing company, uses AI to review its purchasing patterns of all items in each store. The data includes all the information from five billion footfalls from last year to its stores and traction on its websites. The adoption of these advanced technologies will drive the segment growth during the forecast period.

The BFSI segment is expected to grow at a CAGR of 13.8% over the forecast period. The segment growth can be attributed to strong demand from growing regional personal banking and insurance applications. With investment in cloud-based digital banking platform solutions, banks are anticipated to reduce their operational costs, and enhance customer experience, thus increasing productivity and revenues. The complexity and high investment of on-premise solutions is another reason that is boosting the demand for cloud-based digital banking platforms. The increased digitization across the BFSI sector is expected to create lucrative business opportunities in the market.

Country Insights

The U.K. accounted for the largest revenue share of 20.3% in 2021, attributed to the improved infrastructure & credit environment, ongoing government investments, economic recovery, and increasing trends among Information and Communication Technology (ICT) operators. DXP helps enterprises address the impact of new technologies on their processes, decision-making, product rollouts, promotions, and issues about customer engagement. Tech giants such as Capgemini, Accenture, and Roland Berger emphasize digitally transforming the customer experience by improving top-line growth, customer understanding, and customer touchpoints, which is also expected to positively impact regional market growth.

Germany is expected to grow at a CAGR of 12.7% over the forecast period. The increase in adoption of technologies (AI, machine learning, and automation) across several industries including banking, insurance, technology, and telecoms is expected to fuel the growth. Several digital services are helping German companies, such as Siemens, DXC Technology, and HCL Technologies achieve sustainability and decarbonization goals, which are becoming more critical as potential tax increases and regulatory issues loom on the horizon. These may include consulting and advisory services, monitoring and dashboards, and larger initiatives, such as clean energy supply systems or new office configurations to reduce carbon footprints. These factors will supplement the growth of the regional market.

Key Companies & Market Share Insights

The dominant players operating in the market include Microsoft Corporation; Oracle Corporation; SAP SE; Salesforce.com, Inc.; and IBM Corporation, among others. Market players are observed to invest resources in R&D activities to support growth and enhance their internal business operations. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares.

For instance, in January 2022, SAP SE announced a partnership with Icertis, a software company that provides contract management software to enterprise businesses, to help companies increase efficiency, minimize risk, and realize the full intent of their agreements. The partnership includes a financial investment from SAP in Icertis, which will lead to a joint product road map and deeper technological integration to deliver enterprise-wide value, including faster negotiations, greater compliance, and AI-powered business insights and automation. With this partnership, SAP and Icertis customers will be able to derive end-to-end value across the enterprise, so the intent of every contract is correctly memorialized. Some prominent players in the Europe digital experience platform market include:

-

Salesforce.com, Inc.

-

Oracle Corporation

-

Microsoft Corporation

-

IBM Corporation

-

SAP SE

-

Adobe

-

Acquia Inc.

-

Open Text Corporation

-

Appway AG

-

Sopra Steria

Europe Digital Experience Platform Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.17 billion

Revenue forecast in 2030

USD 8.09 billion

Growth Rate

CAGR of 12.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain

Key companies profiled

Salesforce.com, Inc.; Oracle Corporation; Microsoft Corporation; IBM Corporation; SAP SE; Adobe; Acquia Inc.; Open Text Corporation; Appway AG; Sopra Steria

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe digital experience platform market report based on component, deployment, application, end-use, and country:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Business-to-Consumer (B2C)

-

Business-to-Business (B2B)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others (Education, Transportation & Logistics, and Energy and Utilities, among others)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe digital experience platform market was valued at USD 2.88 billion in 2021 and is expected to reach USD 3.17 billion in 2022.

b. The Europe digital experience platform market is expected to grow at a compound annual growth rate is 12.4% from 2022 to 2030 to reach USD 8.09 billion by 2030.

b. The cloud segment is anticipated to register considerable growth of 15.9% over the forecast period. Several enterprises prefer cloud services, as it helps reduce initial IT costs, such as the costs of hardware setup and power consumption, require less physical space, and achieve improved collaboration, along with faster performance, quick responsiveness, and greater agility. These key factors are supplementing the growth of the segment.

b. Some key players operating in the Europe digital experience platform market include Salesforce.com, Inc.; Oracle Corporation; Microsoft Corporation; International Business Machines Corporation; SAP SE; Adobe; Acquia Inc.; Open Text Corporation; Appway AG; and Sopra Steria

b. The current growth of the regional Europe digital experience platform market can be attributed to the increasing rate of digital transformation across industry verticals and the growing need to enrich customer experiences for enhanced customer engagement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.