- Home

- »

- Next Generation Technologies

- »

-

Europe Edge Computing Market Size, Industry Report, 2030GVR Report cover

![Europe Edge Computing Market Size, Share & Trends Report]()

Europe Edge Computing Market Size, Share & Trends Analysis Report By Component, By Application (Remote Monitoring, Content Delivery), By Organization Size, By Industry Vertical, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-227-2

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Edge Computing Market Trends

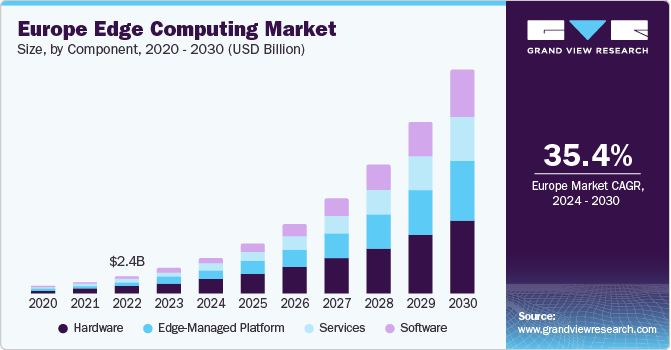

The Europe edge computing market size was valued at USD 3.42 billion in 2023 and is expected to grow at a CAGR of 35.4% from 2024 to 2030. In order to make informed decisions, the demand for edge computing for the collection, processing, and analysis of vast data is rising, which is expected to boost the market. Edge computing is in its initial phase of development currently. Its deployment and operating models are evolving and are expected to offer significant growth prospects for new entrants in the near future.

In 2023, Europe accounted for over 20% of the edge computing market. Edge computing improves the efficiency of organizations by providing data processing near to the device itself. It expedites data gathering and sharing process, thereby driving the efficiency of enterprises. The growing adoption of IoT and big data across various sectors, including education, healthcare, and manufacturing, is generating large volumes of data. With the increasing volumes of data, computing is also getting more and more complex. The increasing penetration of cloud services and IoT is expected to impact the industry’s growth positively.

Edge computing envisages leveraging local computing power using devices such as routers, smartphones, and PCs. It offers several benefits and helps in processing the data at faster rates with reduced latency, thereby optimizing costs and providing real-time information. Edge computing technology is scalable as it can potentially utilize computing capabilities to meet contextual computing requirements.

This capability has thus provided an impetus to the adoption of edge computing solutions among enterprises. Low latency of current IoT infrastructure, the need to perform analytics at the edge of the network, and a higher awareness regarding data security amongst businesses are some of the important factors driving the sector.

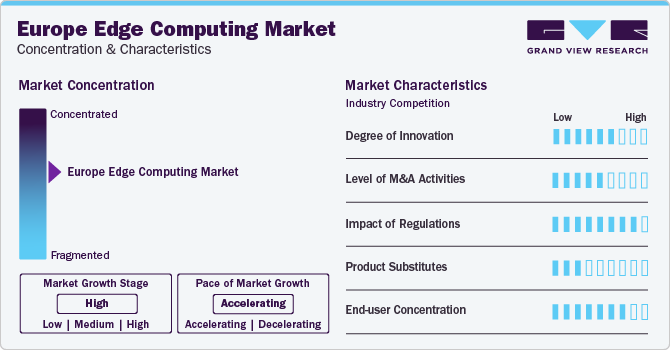

Market Concentration & Characteristics

The market is characterized by a moderate to high level of innovation. The profound growth in connected devices and cloud infrastructure has driven the adoption of edge computing technology across a broad range of verticals. Various companies within the ecosystem, including cloud service providers, communication technology providers, platform providers, and system integrators are exploring new opportunities.

The industry is also characterized by a significant level of mergers and acquisitions among the leading companies. Market incumbents remain keen on increasing their market share, exploiting untapped market potential, acquiring new technologies and expertise, and expanding their client base. They keep undertaking various initiatives such as collaborating with other market companies, indulging in mergers and acquisitions and launching new products and services.

The market is also subject to increasing regulatory scrutiny due to concerns related to data privacy and security, and compliance standards. The data collected through edge computing in smart home applications have the potential to allow consumers to access and control their personal data. The market companies are adopting edge computing solutions to meet the GDPR regulations in the Europe region.

There are limited technological substitutes for the market. Cloud computing can be used as an alternative to edge computing; however, they typically deliver a different level of performance or result depending on the specific needs of the end-user or application.

End-user concentration is also a significant factor in the industry, as there are a number of end-user industries that are creating demand for edge computing solutions. End-users comprise various industries and sectors adopting edge computing solutions, such as manufacturing, energy & utilities, IT & telecom, consumer appliances, healthcare & life sciences, and transportation & logistics.

Application Insights

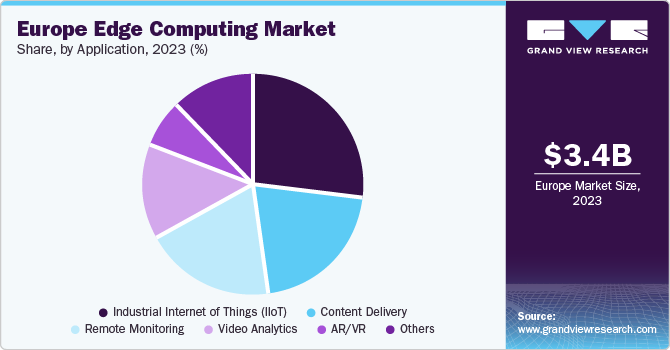

The IIoT segment dominated the market with the largest revenue share in 2023. Edge computing is playing a key role in helping organizations in the digitization of their facilities. The demand for edge infrastructure is projected to increase as service intricacy rises and the infrastructure edge becomes more accessible. Edge computing helps manufacturers to reach the goal of digitization of their facilities. The demand for edge infrastructure is projected to increase as service intricacy rises and edge infrastructure becomes more accessible.

The AR/VR segment is expected to grow with the highest CAGR over the forecast period due to the ultra-low latency and high data bandwidth edge computing offers for resource heavy AR/VR applications. Edge computing significantly impacts AR/VR and makes it more accessible, cost-effective, and secure. With edge computing, the processing required for AR applications can run on devices such as smartphones and tablets, rather than relying on cloud computing and remote servers. This significantly reduces cloud-based AR systems’ latency and data transmission costs.

Component Insights

The hardware segment accounted for the largest revenue share of over 42.0% in 2023. This can be credited to the increasing popularity of hardware in the managed services industry. With the growing application of IoT and IIoT devices, the volume of data created by these devices is also increasing. As a result, enterprises are increasingly adopting hardware components, such as edge computing gear to minimize the load on cloud and data centers.

The growth of the software segment can be attributed to the growing investment in cloud services and the surge in the adoption of artificial intelligence across industries. Key companies are emphasized on completing various business strategies to enhance their cloud services and broaden their business globally. For instance, in May 2022, IBM Corporation partnered with AWS to provide an IBM software catalog as software-as-a-service on AWS.

Industry Vertical Insights

The datacenters segment is expected to grow with the highest CAGR over the forecast period. This is due to the fact that edge computers enable data centers to have access to local data efficiently and at low latencies and analyze it rapidly. Western Europe in particular is expected to increase its expenditure on machine learning and AI technologies to fulfill the growing IT-skill shortage in the region. This, in turn, offers significant growth opportunities for edge computing technologies, especially across smart applications.

The industrial segment also witnessed a significant market share in 2023. The real-time monitoring function increases the operational efficiency and productivity of the manufacturing companies. Edge computing is the best solution for remote sites where cloud connectivity is not stable. Thus, the remote oil fields are widely adopting edge computing technology.

Country Insights

Europe has introduced the General Data Protection Regulation (GDPR) for online privacy and data protection. The GDPR compliance is focused on providing standard data protection laws for all member countries and helps EU citizens understand how their data is used and stored. Administrations in European countries are also adding favorable legislation for edge computing segments.

UK Edge Computing Market Trends

The UK accounted for the highest market share in 2023. European countries follow a wide-scale application of health-specific personal wellness, including wearable blood pressure, glucose level monitors, telehealth systems, and heart rate monitors, which exchange medical information between patients, medical professionals, and sites. The rise in the adoption of IIoT in other sectors, such as government and retail, is expected to act as a major contributor to regional growth.

Key Europe Edge Computing Company Insights

Some of the key companies operating in the market include Siemens, Amazon Web Services (AWS), Inc., Microsoft, etc.

-

Siemens is a pioneer in assisting enterprises in disrupting their business activities by delivering electrification, automation, and digitalization solutions.

-

AWS is the world's most comprehensive and widely used cloud platform, providing over 200 fully featured services from data centers around the world. Startups, largest enterprises, and leading government agencies, use AWS.

Atos SE, and Cisco Systems, Inc. are some other participants in the Europe edge computing market.

- Atos SE helps businesses achieve their digital transformation goals by offering innovative solutions and technologies in the areas of high-tech transactional services, cloud, unified communications, cybersecurity, and big data.

Key Europe Edge Computing Companies:

- Siemens AG

- Atos SE

- Amazon Web Services, Inc.

- Aricent, Inc.

- Cisco Systems, Inc.

- GE

- Hewlett Packard Enterprise Development

- Honeywell International Inc.

- IBM

- Intel

- Microsoft

- Rockwell Automation, Inc.

- SAP SE

Recent Developments

-

In April 2023, Nokia launched third-party applications for MX Industry Edge (MXIE). The applications aim to help companies analyze data by connecting and collecting the data from operational technology assets in a secure on-premises edge.

-

In August 2022, Semtech Corporation acquired Sierra Wireless. With this acquisition Semtech is expected to expand addressable market and is expected to create a strong and diverse portfolio of connectivity solutions for the growing IoT sector.

Europe Edge Computing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.42 billion

Revenue forecast in 2030

USD 30.00 billion

Growth Rate

CAGR of 35.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Application, Industry Vertical, Organization Size, and Region

Regional scope

Europe

Country scope

Germany, UK, France, Italy, Spain

Key companies profiled

Amazon Web Services (AWS), Inc.; Aricent, Inc.; Atos; Cisco Systems, Inc.; General Electric Company; Hewlett Packard Enterprise Development; Honeywell International Inc.; Huawei Technologies Co., Ltd.; IBM Corporation; Intel Corporation; Microsoft Corporation; Rockwell Automation, Inc; SAP SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Edge Computing Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe edge computing market report based on component, application, industry vertical, organizational size, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Hardware, by Type

-

Edge Nodes/Gateways (Servers)

-

Sensors/Routers

-

Others

-

-

Hardware, by End-Point Devices

-

Cameras

-

Drones

-

HMD

-

Robots

-

Others

-

-

-

Software

-

Services

-

Edge-Managed Platform

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Internet of Things (IIoT)

-

Remote Monitoring

-

Content Delivery

-

Video Analytics

-

AR/VR

-

Connected Cars

-

Smart Grids

-

Critical Infrastructure Monitoring

-

Traffic Management

-

Assets Tracking

-

Security & Surveillance

-

Smart Cities

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Energy & Utilities

-

Healthcare

-

Agriculture

-

Transportation & Logistics

-

Retail

-

Data Centers

-

Wearables

-

Government & Public Sector

-

Media & Entertainment

-

Manufacturing

-

Telecom & IT

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe edge computing market size was estimated at USD 3.42 billion in 2023 and is expected to reach USD 4.86 billion in 2024.

b. The Europe edge computing market is expected to grow at a compound annual growth rate of 35.4% from 2024 to 2030 to reach USD 30.00 billion by 2030.

b. The energy & utilities segment accounted for the dominating revenue share in 2023 and is expected to grow at a CAGR of 15.4% from 2024 to 2030, owing to the rapid adoption of edge computing solutions in the industry.

b. The key players in this Europe edge computing market include Siemens AG, Amazon Web Services (AWS), Inc., Microsoft Corporation, Atos SE, and Cisco Systems, Inc., among others.

b. Key factors that are driving the market growth include the adoption of the Internet of Things, increasing demand for data intelligence, rising trends towards industry 4.0 and smart manufacturing, along the proliferation of the 5G network across the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."