- Home

- »

- Healthcare IT

- »

-

Europe Healthcare Analytics Market, Industry Report, 2030GVR Report cover

![Europe Healthcare Analytics Market Size, Share & Trends Report]()

Europe Healthcare Analytics Market Size, Share & Trends Analysis Report By Type (Descriptive Analytics, Predictive Analytics), By Component, By Delivery Mode, By Application, By End-Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-211-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Healthcare Analytics Market Trends

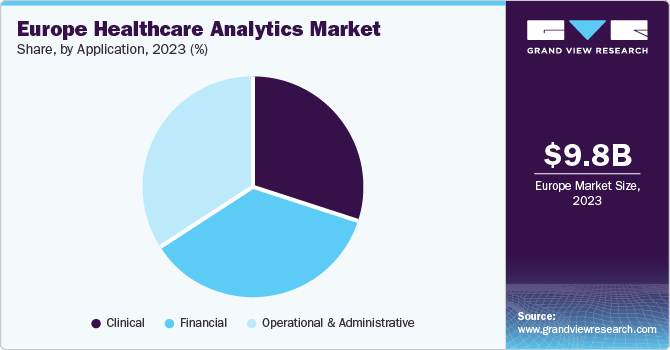

The Europe healthcare analytics market size was valued at USD 9.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.01% from 2024 to 2030. Key factors determining the growth are increasing geriatric population, disposable income, prevalence of chronic diseases, demand for treatments, and a stagnant or declining trained healthcare workforce. Rapidly growing adoption of Electronic Health Records (EHR) and other healthcare information and management systems is expected to further enhance the growth of the market.

According a PWC report named, Sherlock in Health discovered that the usage of analytics and AI in healthcare in the early detection of diseases can help save around USD 84.9 billion in healthcare costs in Europe over the coming decade. The country’s senior population has significantly increased, and hence it is highly susceptible to various diseases. Hence, change in lifestyle and demographics demands new standards for healthcare facilities and services. Some of the other factors anticipated to boost European healthcare costs are growing number of claims pertaining to non-communicable diseases, prioritizing wellness in workplace, and growing focus on wellness among adults and geriatric population. Growing healthcare costs are boosting the demand for healthcare analytics to streamline third-party processes and optimize the overall cost.

The healthcare sector in Europe is under pressure due to several major challenges that are affecting the industry's sustainability. In addition, structural inefficiencies in certain European countries are a problem for this industry. The shift to value-based healthcare will continue to increase demand for improved patient outcomes at more affordable prices. Incorporating analytics into novel medical innovations might address pressing problems in healthcare. According to data obtained from the Centre for the Promotion of Imports (CPI), rising healthcare costs are currently placing a significant financial burden on several European countries.

Numerous government programs are being implemented to support technical development and offer top-notch healthcare services, which will likely propel the market. For instance, the European Commission's Digital Single Market Strategy facilitates access to Internet services and goods in Europe for businesses and consumers. As a result, more people are utilizing digital networks and services. According to the European Federation of Pharmaceutical Industries and Associations, Spain exported pharmaceutical goods valued at USD 13.7 billion. Hence, the demand for analytics and advanced computing in the pharmaceuticals space is increasing, which, is contributing to market growth.

Market Concentration & Characteristics

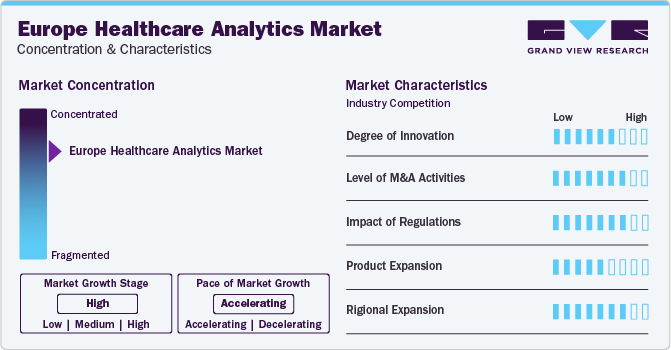

The Europe healthcare analytics market growth is high, and the pace of market growth is accelerating. The market is largely competitive, and key players contribute to this competitive landscape with strategic initiatives such as new technology development, R&D, and regional expansion to drive market growth.

With several technological innovations, healthcare has made massive advancements, globally. Several large companies are taking the initiative to develop innovative products like health wearables, mobile health apps, and more to gain swift access to medical databases, information, and laboratory uses. The midsize to smaller companies are growing their market presence by securing new contracts and tapping new markets with technological advancements and product innovations. In addition, the government's funding and support of digital health projects have accelerated healthcare analytics development & adoption in the country.

The market is characterized by high number of merger & acquisition (M&A) and collaborative activities that are being undertaken by the prominent players. Several companies are adopting these strategies to upgrade their portfolio. In June 2020, LDPath collaborated with Ibex Medical Analytics to launch clinical-grade AI applications for cancer detection in pathology supporting UK pathologists to enhance diagnostic accuracy and efficiency. These initiatives are expected to accelerate market growth in Europe.

Rapidly changing government regulations are affecting private companies by increasing the cost of compliance, especially the cost of document processing to inform compliance decisions. Growing demand among end-users to reduce regulatory compliance expenses is a key factor anticipated to boost the adoption of advanced analytics in administrative compliance of the healthcare industry. In May 2021, the WHO and a German federal agency established a hub for pandemic data for analyzing the spread of disease, innovation in the field of medicine, and surveillance of patients to mitigate further risks in the future. This is expected to improve the medical outcome over the forecast period mainly owing to the stringent regulations implemented by the government as well as the private players to avoid any product recall/ adverse reactions.

The market has witnessed several strategic launches that led to product expansion in the European region. There has been an increase in awareness among end users regarding the benefits of big data analytics such as focused financial services, operational & administrative services, clinical services, sales & marketing analysis in the life science industries, pharmaceutical innovation & drug safety trials, and various safety analysis for healthcare companies. The growing adoption of these technologies enables data exploration and analysis, ultimately leading to product expansion in the region.

Prominent companies like IBM, Wipro, McKesson Corporation, and Allscripts Healthcare, LLC have a significant presence in the European region, along with several other emerging companies. For instance, the McKesson Corporation operates through three business segments: U.S Pharmaceutical & Specialty Solutions, European Pharmaceutical Solutions, and Medical-Surgical Solutions. These companies are further expected to expand their geographical presence in the coming years in the region.

Type Insights

The descriptive analytics market held the largest revenue share of 48% in 2023. The segment is expected to witness lucrative growth as most developed economies have started implementing descriptive software in their business process. Descriptive analytics helps in describing the progression of a past event and involves the conversion of raw data into interpretable information. Moreover, the cost associated with purchasing descriptive data or reports is comparatively lower than that of predictive or prescriptive analytics, owing to which these reports can be purchased by stakeholders across the market.

The predictive analytics market is expected to witness the fastest CAGR over the forecast period. This method is largely used in government organizations, such as healthcare financing systems, to avoid fraud. Growing demand for predictive analytical software by various enterprises to attain market competitiveness is one of the key factors anticipated to drive the market. The CMS Fraud Prevention System (FPS) integrates predictive analytics and advanced algorithms in its anti-fraud strategy. Moreover, the CMS is developing next-generation predictive analytics, which is expected to boost the usage of predictive analytics.

Component Insights

The healthcare analytics software market held the largest revenue share of 42% in 2023 as it can perform critical functions such as data capture, storage, interpretation, and analysis. Periodic software upgrades are necessary to be in sync with latest analytics methods. For instance, NVIDIA CLARA is a combination of software and hardware that brings advanced data analytics to medical imaging systems for advanced diagnosis, detection, & treatment of diseases.IBM, Oracle, and SAS are the key software vendors in the industry.Increasing adoption of software solutions such as data mining, clinical decision support systems, and clinical trial management systems is further expected to propel market demand.

The healthcare analytics services market is expected to witness the fastest CAGR over the forecast period. The services market is anticipated to grow at a lucrative rate as there is a prevailing trend of outsourcing healthcare services. Companies may lack the resources and skillsets required for the deployment of analytics. Therefore, these services are outsourced. Outsourcing can be short-term project-based or long-term contracts. These services are offered in packages that include compliance on promotional spending, social media analytics, manufacturing process, preventive maintenance, predictive analytics for medical device failure, and benchmarking services.

Delivery Mode Insights

The on-premises segment held the largest revenue share of 48% in 2023 as these solutions can be installed on organizations’ premises and accessed from remote locations, thereby reducing maintenance & other costs. Healthcare organizations are installing analytical software and tools to store & manage data on their premises as it is easier to access & safeguard the data. However, the introduction of cloud computing and its rapid adoption by healthcare IT providers are expected to hinder the segment’s growth over the forecast period. In addition, high maintenance and physical area costs of server rooms are anticipated to impede this segment. These server rooms also require a large amount of energy to prevent the heating of hardware, which adds to the maintenance cost.

The cloud-based segment is expected to witness the fastest CAGR over the forecast period. This lucrative growth can be attributed to increased flexibility & efficiency, lesser capital investment, real-time data tracking, and easier storage. Cloud-based technologies store data remotely, allowing free space on users’ devices and facilitating data retrieval as per their needs. The technology comprises three services: Platform as a Service (PaaS), Infrastructure as a Service (IaaS), and Software as a Service (SaaS).

End-Use Insights

The healthcare providers segment held the largest revenue share of 44% in 2023 and is also expected to witness the fastest CAGR over the forecast period. Providers comprise healthcare professionals such as physicians & clinicians, hospitals, and clinics. This segment is expected to witness lucrative growth as analytics is being increasingly used, especially in hospitals.

Applications of analytics include disease surveillance, chronic care management, population health management, operational intelligence, performance management, and financial management. The increasing prevalence of chronic disorders and the rising cost of healthcare are factors leading to an increase in the adoption of analytics in hospitals. Analytics can help hospitals improve the efficiency of workflow, thus reducing healthcare expenditure.

Application Insights

The healthcare financial analytics market held the largest revenue share of 36% in 2023. Growing healthcare expenses and increasing need for optimal quality of care are prompting healthcare organizations to adopt analytical solutions for their financial systems. In addition, claims settlements & prevention of frauds are driving adoption and contributing to the growth of the financial systems segment. Financial applications are witnessing rapid & significant adoption in government and private healthcare settings. Initiatives such as FPS to avoid fraud and help save costs can increase demand for these services. Key financial applications include claims settlement, fraud analysis, risk adjustment, and assessment.

The clinical analytics market segment is expected to witness a lucrative CAGR over the forecast period which can be attributed to initiatives promoting healthcare analytics. Clinical analytics can be used in laboratories, diagnostic centers, research laboratories, and clinical trials. Healthcare organizations in the pharmaceutical, genomics, medical devices, and biotechnology spaces are adopting analytical solutions to enhance their R&D productivity and address the growing demand for licensing products & technologies.

Country Insights

In 2023, Europe was the second largest region in the global healthcare analytics market with a share of nearly 23%. The rising usage of healthcare analytics for personalized medicine has contributed significantly to the region’s market growth. In recent years, it has emerged as a tool for cost-saving opportunities by analyzing data. Furthermore, the increasing adoption of technological advancements like machine learning and AI is projected to give rise to the Europe healthcare analytics market during the forecast period.

Germany Healthcare Analytics Market Trends

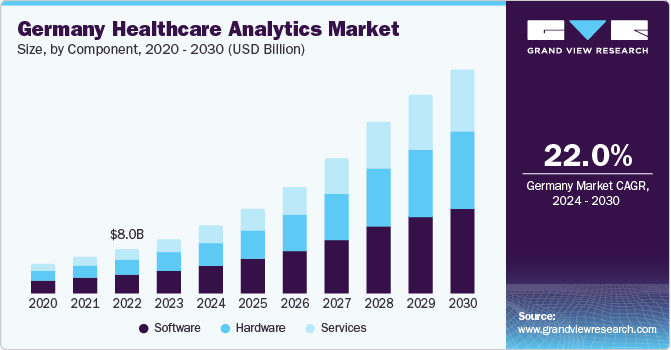

The Germany healthcare analytics market was valued at USD 1.8 billion in 2022 and is expected to witness a lucrative growth over the forecast period. The increasing elderly population, growing healthcare expenditure, shift from volume to value-based care, and increasing adoption of analytics by healthcare companies, health insurers, healthcare providers, healthcare payers, biopharmaceuticals, medical device companies, and pharmaceuticals are key factors expected to drive the market in Germany.

Germany’s healthcare market is rapidly adopting digitalization and creating significant new opportunities for established companies & emerging startups. The country’s geriatric population has significantly increased, and hence it is highly susceptible to various diseases. Hence, change in lifestyle and demographics demands new standards for healthcare facilities and services. The increasing prevalence of chronic diseases, coupled with high healthcare costs, is increasing the demand for analytics in healthcare market, which is further driving the market.

UK Healthcare Analytics Market Trends

The healthcare analytics market in the UK held the second largest revenue share in the European market. The presence of sophisticated infrastructure, increase in per capita income, high healthcare costs, rise in the demand for advanced technological solutions, and high prevalence of chronic disorders have led to an increase in the adoption of analytics services in the UK. Furthermore, shifts in economics, technology, and social demographics is transforming the pharmaceutical industry in the UK. Currently, people in the UK are experiencing age-related health issues, which is a major concern for the government. Thus, the National Health Service (NHS) is encouraging technological innovations that are expected to help patients monitor their health.

Spain Healthcare Analytics Market Trends

The Spain healthcare analytics market is expected to witness a CAGR of 23% from 2024 to 2030, which is majorly driven by factors such as the rising geriatric population, growing disease burden, and increasing public policies supporting the development of integrated health systems. In addition, rising investments in health IT infrastructure are boosting the market. The adoption of EHRs is high in hospitals, which is significantly boosting the market growth.

Thus, the availability of suitable health IT infrastructure in Spain is driving the healthcare information technology market. The Spanish government is undertaking measures to promote efficient IT management & real-time analytics-based patient record maintenance and increase patient engagement. For instance, in September 2021, the Spanish government announced plans to develop a health data lake that would serve as a large warehouse of raw health data.

France Healthcare Analytics Market Trends

The healthcare analytics market in France is anticipated to grow at a substantial rate over the forecast period. This growth can be attributed to various factors such as favorable reimbursement coverage, healthcare sector improvements, an increase in healthcare expenditure, product innovation & development, and a rise in the prevalence of chronic diseases. Increasing disease burden, growing medical expenses, and shortage of skilled healthcare personnel are among the factors leading to an increase in the demand for analytics in the healthcare space. Constant product innovations, rising adoption of advanced analytical solutions, and regulatory approvals are boosting the growth of the healthcare analytics market in France.

Russia Healthcare Analytics Market Trends

The healthcare analytics market in Russia held a significant share in the European market. The Russian healthcare system is well-maintained and established in bigger cities like Moscow. For instance, in April 2021, SAS helped Russia’s pharmacy chain 36.6 improve communication with its customers by automating it using the SAS solution. However, poor access to healthcare and lack of proper infrastructure in other cities may hamper market growth in Russia. Of late, Russia has made significant investments to digitalize its healthcare system. Most of the investments are made to integrate advanced digital health technologies and solutions in big life science companies, with a plan to introduce AI and machine learning in R&D pertaining to pharmaceuticals, medical devices, and biotechnology.

Key Europe Healthcare Analytics Company Insights

European healthcare analytics companies are undertaking rapid technological advancements to understand better data derived from patient information, and massive investments are two significant strategies being adopted by key market players like IBM, Wipro, and others. Several more strategies like acquisitions, mergers, product launches, and understanding the level of spread and containment of disease to deliver better care solutions to healthcare providers and institutions are also being adopted. Using big data analytics and AI has also given rise to new platforms to better understand and analyze data.

Key Europe Healthcare Analytics Companies:

- IBM Pvt Ltd.

- Wipro Ltd.

- Allscripts Healthcare, LLC

- Cerner Corporation

- McKesson Corporation

- Oracle

- SAS Institute, Inc.

- Lumiata

- Flatiron

- Health Catalyst

Recent Developments

-

In December 2023, BC Platforms announced the acquisition of Medexprim. This acquisition is part of BC Platforms' strategic vision to become a global leader in RWD, at the nexus of sensitive healthcare data and life science advancements that are driving next-generation drug development

-

In October 2023, Oracle Health announced the launch of a new Health Support Hub in Barcelona to better serve the needs of its European customers by modernizing their healthcare systems to improve patient outcomes and care. It will feature a team of more than 60 service representatives and professionals

-

In February 2022, symplr announced the acquisition of Midas Health Analytics Solutions from Conduent Incorporated to strengthen its best-in-class SaaS-based GRC portfolio for the customers to experience efficient and better-serving healthcare system

Europe Healthcare Analytics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 40.3 billion

Growth Rate

CAGR of 22.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, delivery mode, application, end-use, region

Regional scope

Europe

Country scope

France, Italy, Germany, UK, Spain, Russia

Key companies profiled

IBM Pvt Ltd.; Wipro Ltd.; Allscripts Healthcare, LLC; Cerner Corporation; McKesson Corporation; Oracle; SAS Institute, Inc.; Lumiata; Flatiron; Health Catalyst

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Healthcare Analytics Market Report Segmentation

This report forecasts revenue growth in the Europe market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe healthcare analytics market based on type, component, delivery mode, application, and end-use:

-

Type (Revenue in USD Million, 2018 - 2030)

-

Descriptive Analytics

-

Diagnostic Analytics

-

Predictive Analytics

-

Prescriptive Analytics

-

-

Component (Revenue in USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Delivery Mode (Revenue in USD Million, 2018 - 2030)

-

On-premises

-

Web-based

-

Cloud-based

-

-

Application (Revenue in USD Million, 2018 - 2030)

-

Clinical

-

Financial

-

Operational and Administrative

-

-

End-use (Revenue in USD Million, 2018 - 2030)

-

Healthcare Payers

-

Healthcare Providers

-

Others

-

-

Country (Revenue in USD Million, 2018 - 2030)

-

France

-

Italy

-

Germany

-

UK

-

Spain

-

Russia

-

Frequently Asked Questions About This Report

b. The Europe healthcare analytics market was valued at USD 9.8 billion in 2023 and is expected to reach USD 12.2 billion in 2024.

b. The Europe healthcare analytics market is expected to grow at a compounded annual growth rate of 22.0% from 2024 to 2030 to reach USD 40.3 billion in 2030.

b. The descriptive analytics market held the largest revenue share of 48.0% in 2023. The segment is expected to witness lucrative growth as most developed economies have started implementing descriptive software in their business process

b. Some of the prominent players in the Europe healthcare analytics market are IBM Pvt Ltd., Wipro Ltd., Allscripts Healthcare, LLC, Cerner Corporation, McKesson Corporation, Oracle, SAS Institute, Inc., Lumiata, Flatiron, Health Catalyst.

b. Key factors determining the growth are increasing geriatric population, disposable income, prevalence of chronic diseases, demand for treatments, and a stagnant or declining trained healthcare workforce.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."