- Home

- »

- Catalysts & Enzymes

- »

-

Europe Homogeneous Precious Metal Catalyst Market Report 2030GVR Report cover

![Europe Homogeneous Precious Metal Catalyst Market Size, Share & Trends Report]()

Europe Homogeneous Precious Metal Catalyst Market Size, Share & Trends Analysis Report By Product (Palladium, Ruthenium), By End-use (Refineries, Pharmaceutical, Biomedical), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-296-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

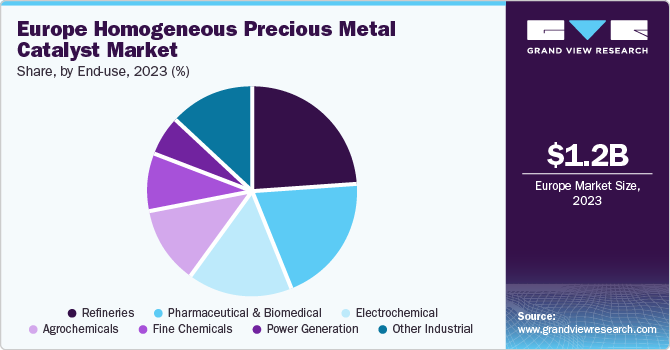

The Europe homogeneous precious metal catalyst market size was estimated at USD 1.16 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.0% from 2024 to 2030. This is attributed to the growth in global chemical manufacturing and sales in European countries, which are expected to fuel the homogeneous precious metal catalysts market growth soon.

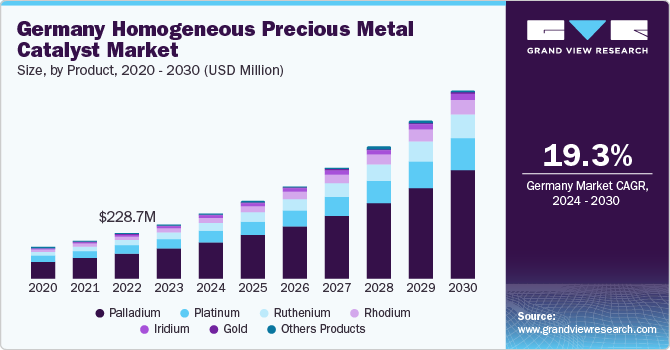

Germany emerged as the largest European market for homogeneous precious metal catalysts. The market growth in this country can be attributed to a strong presence of key end-use industries such as pharmaceuticals, chemicals, and power generation, among others. The growing investments for the establishment of new refineries as well as the expansion of existing refineries, despite the lack of natural resources in the country, is expected to fuel the product demand.

Germany is one of the prominent markets for homogenous metal catalysts in the European region, primarily driven by the increasing application scope in industries such as fine chemicals and manufacturing of pharmaceutical and biomedical. End-use segments such as refineries hold relatively low shares in the country’s market owing to its limited domestic natural gas and oil production capacity and its heavy dependence on imports. Natural gas is imported into the country exclusively via cross-border pipelines. This offers significant potential for growth in the petroleum refinery industry in the coming years, to reduce the country’s dependence on other European countries.

According to the CEFIC, Germany is one of the largest producers of chemicals across the globe, after China and the U.S., and the largest producer in Europe. The market growth in the country can be attributed to the presence of several key manufacturers, such as BASF SE; Bayer AG; Evonik Industries; and Henkel AG; among others, that hold significant shares in the global fine chemicals industry.

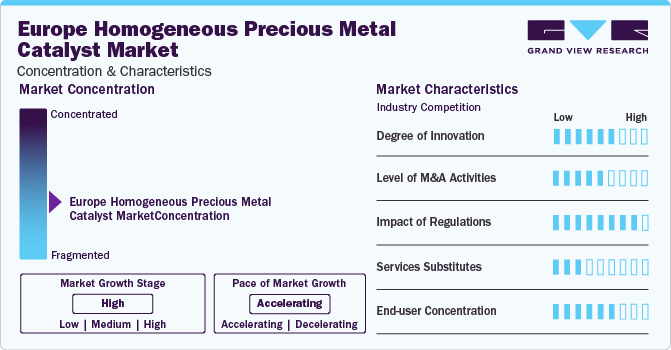

Market Concentration & Characteristics

The Europe homogeneous precious metal catalyst market is highly fragmented, with key players such as Cargill; Incorporated Alfa Aesar; Heraeus Holding; BASF SE; Evonik Industries AG; Johnson Matthey; Clariant AG; Haldor Topsoe; Umicore; American Elements; Chimet S.p.A.; Shaanxi Kai Da Chemical Engineering Co., Ltd.; and Sabin Metal Corp, dominating the industry. This fragmentation is driven by the growth in global chemical manufacturing and sales in European countries and is expected to fuel the homogeneous precious metal catalysts market growth shortly.

Homogeneous precious metal catalysis is a budding area in the chemical industry. The homogeneous catalysis process with precious metals is utilized to carry out reactions selectively and carefully in the chemical industry. A few specific chemical reactions, including metathesis and hydroformylation, can be carried out only with the help of homogeneous precious metal catalysis. The metal in homogeneous catalysts is efficiently utilized as compared to heterogeneous ones. In addition, homogeneous catalysis with precious metals provides an exceptional alternative when extremely specific reactions are desired; this, in turn, is estimated to fuel the product demand in the chemical industry, specifically for fine chemical applications.

The European chemical industry has been growing at a rapid pace over the last decade, owing to the extensive R&D activities taken up by various companies, and has emerged as the second largest producer of chemicals worldwide. Moreover, rapid industrialization, coupled with the rebound of the global chemical industry, is expected to boost homogeneous precious metal catalysts demand in the region over the forecast period.

Product Insights

The palladium segment dominated and accounted for a share of 56.3% in 2023. Platinum compounds, such as Karstedt’s catalyst, cisplatin ([PtCl2(NH3)2]), and hexachloroplatinic acid (H2[PtCl6]), serve as catalysts in various applications. Throughout Europe, platinum-based catalysts find application in hydrosilylation reactions. Karstedt’s catalyst, specifically, is utilized in paper coating for packaging and bottling applications and is particularly favored in hydrosilylation reactions. It is present in trace amounts and measured in parts per million (ppm). This characteristic poses challenges for the economic recovery of platinum from used catalysts. Moreover, Karstedt’s catalyst is employed in complexes with vinyl siloxane ligands.

Homogenous palladium catalysts are extensively used in applications requiring hydroesterification reactions. A key example of its application includes Lucite International, which uses the catalyst for MMA production from ethylene, carbon monoxide, and methanol. Similar technology is used by Dow Chemical to produce octene with the help of the palladium triphenylphosphine complex as a catalyst.

Rhodium-based homogenous metal catalysts are used in reactions that require to be carried out at lower temperatures and pressures such as hydroformylation. (acetylacetonato)carbonyl (triphenylphosphine)rhodium(I), (acetylacetonate)dicarbonylrhodium(I), and rhodium acetate are some of the key precursors for the product. Wilkinson’s catalyst, [RhCl (PPh3)3] is one of the most commonly used homogenous palladium catalysts.

End-use Insights

The refineries segment dominated the market with a staggering 24% market share in 2023. This high percentage is attributable to the presence of several mainstream refineries in Europe projecting significant potential for market growth over the forecast period. Homogenous precious metal catalysts are considered important in refineries as they help in optimized and economic oil production. Approximately 78 mainstream refineries operate across the Europe region in 2021. The growth in oil production in recent years is anticipated to highlight the demand for homogenous precious metal catalysts soon.

The agrochemicals segment, where homogenous precious metal catalysts are used for economical and efficient chemical reaction applications, projects moderate market opportunities. Europe is the third largest market in terms of crop protection, behind the Asia Pacific and Central & South America regions. According to the European Chemical Industry Council - CEFIC, the European crop protection market was valued at approximately USD 56,300 million, comprising 41% herbicides, 28.7% insecticides, 27.3% fungicides, and 3% others. Therefore, the presence of a moderately growing agrochemicals industry in the Europe region is likely to boost the demand for the product shortly.

Homogenous precious metal catalysts are used in pharmaceutical & biomedical end-use for making the reactions more yielding, environment-friendly, and economical, thus making the overall production process more profitable. The market has witnessed advancement in terms of R&D for catalyst recovery in pharmaceutical & biomedical processes as it is more challenging when compared to heterogeneous catalysts (for instance, nanofiltration recovery), and this is likely to expand the adoption of such catalysts in the market.

According to the European Federation of Pharmaceutical Industries and Association (EFPIA), the pharmaceutical industry is a key asset to the European economy. Advanced science and technology, supported by widened health awareness, has boosted the industry’s performance over the past years.

Regional Insights

Germany dominated the market share with 23.60% in 2023. This high share is attributable to the fact that the chemical industry in Germany, which encompasses the pharmaceutical sector, is a significant contributor in Europe. The European Chemical Industry Council reported that Germany’s chemical industry, including pharmaceuticals, was the third largest in Europe, accounting for Euro 227.1 billion in 2021.

Furthermore, Germany’s R&D investment in the chemical and pharmaceutical sector reached Euro 13.2 billion, emphasizing the country’s commitment to advancing research and development activities in these industries. These statistics support the substantial presence of the pharmaceutical industry, including the use of PGM catalysts. With their unique properties, PGM catalysts are well-positioned to support the growth, innovation, and high-quality standards required in the dynamic pharmaceutical sector of Germany and other leading European countries.

The presence of a robust product-manufacturing base in the UK, France, and Germany is expected to be favorable for the growth of the market. The European Commission has established the Horizon 2021 Strategy with the prime intention of promoting the consumption and production of natural ingredients in the chemical, personal care, automotive, and energy sectors.

Key Europe Homogeneous Precious Metal Catalyst Company Insights

Some key players operating in the market include BASF SE;Clariant Inc.; and Johnson Matthey:

-

BASF SE provides specific catalysts including mobile emission catalysts, process catalysts, battery materials, stationery emissions, precious metal services, adsorbents, indoor air quality, refining catalysts, and aircraft cabin/fuel inserting in several end-use applications. The catalyst’s business division is headquartered in Iselin, New Jersey, U.S., and operates with 30 manufacturing sites spread globally, engaging over 5,000 employees.

-

Johnson Matthey Plc is a global manufacturer, specializing in catalysts and related services for end-use industries such as automotive, chemical, pharmaceutical & medical, oil & gas, agrochemicals & fertilizers, food & beverage, energy generation & storage, and glass.

-

Heraeus Holding; Haldor Topsoe A/S; and Umicore are some of the emerging market participants in the homogeneous precious metal catalystmarket:

-

Umicore is a global manufacturer with a specialization in materials technology. Its business areas include catalysis and energy & surface technology along with recycling. The catalysis business area is further bifurcated into automotive catalysts and precious metals chemistry sub-business segments.

-

Haldor Topsoe A/S manufactures over 150 catalysts and designs & fabricates custom catalysts for specific applications. The company’s catalysts are designed to cater to a wide range of processes, some of which include hydrocracking, hydrotreating, lube oil processing, pressure drop control, gas processing, gasoline synthesis, and petrochemical processing.

Key Europe Homogeneous Precious Metal Catalyst Companies:

The following are the leading companies in the Europe homogeneous precious metal catalyst market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe homogeneous precious metal catalyst companies are analyzed to map the supply network.

- Alfa Aesar

- Heraeus Holding

- BASF SE

- Evonik Industries AG

- Johnson Matthey Plc

- Clariant International Ltd.

- Haldor Topsoe

- Umicore

- American Elements

- Chimet S.p.A.

- Shaanxi Kai Da Chemical Engineering Co., Ltd.

- Sabin Metal Corporation

Recent Developments

-

In September 2023, Evonik Industries disclosed its plans to relocate and enhance its facility for precious metal powder catalyst production situated in the Shanghai Chemical Industrial Park (SCIP). The objective of this initiative is to bolster the company’s presence and capabilities within the catalyst market.

-

In July 2023, BASF successfully concluded the carve-out process for its mobile catalysts emissions and precious metal services business, officially establishing the independent legal entity named BASF Environmental Catalyst and Metal Solutions (ECMS). The decision to carve out this entity was initially disclosed in December 2021, with an anticipated completion timeline of 18 months.

-

In October 2023, Evonik declared a formal agreement to engage in the development, scaling up, and production of exclusive bed fixed catalysts designed for the application of mobile of Hydrogenious LOHC Technologies’ proprietary liquid organic hydrogen carrier (LOHC) technology, which is founded on benzyl toluene.

Europe Homogeneous Precious Metal Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.37 billion

Revenue forecast in 2030

USD 3.90 billion

Growth rate

CAGR of 19.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Country scope

Germany; UK; France; Italy; Spain; Russia; Poland

Key companies profiled

Heraeus Holding; BASF SE; Evonik Industries AG; Johnson Matthey; Clariant AG; Haldor Topsoe; Umicore; American Elements; Chimet S.p.A.; Shaanxi Kai Da Chemical Engineering Co., Ltd.; Sabin Metal Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Homogeneous Precious Metal Catalyst Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe homogeneous precious metal catalyst market report based on product, end-use, and region.

-

Europe Homogeneous Precious Metal Catalyst Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Platinum

-

Palladium

-

Rhodium

-

Ruthenium

-

Iridium

-

Gold

-

Others

-

-

Europe Homogeneous Precious Metal Catalyst End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biomedical

-

Refineries

-

Agrochemicals

-

Fine Chemicals

-

Electrochemical

-

Power Generation

-

Other Industrial

-

-

Europe Homogeneous Precious Metal Catalyst Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Poland

-

-

Frequently Asked Questions About This Report

b. Europe homogeneous precious metal catalyst market size was estimated at USD 1.16 billion in 2023 and is expected to reach USD 1.37 billion in 2024.

b. Europe homogeneous precious metal catalyst market is expected to grow at a compound annual growth rate of 19.0% from 2024 to 2030 to reach USD 3.90 billion by 2030.

b. Germany dominated the European homogeneous precious metal catalyst market with a share of 23.60% in 2023. This is attributable to the strong presence of key end-use industries, such as pharmaceuticals, chemicals, and power generation.

b. Some key players operating in the European homogeneous precious metal catalyst market include Alfa Aesar; Heraeus Holding; BASF SE; Evonik Industries AG; Johnson Matthey; Clariant AG; Haldor Topsoe; Umicore; American Elements; Chimet S.p.A.; Shaanxi Kai Da Chemical Engineering Co., Ltd.; Sabin Metal Corp.

b. Key factors that are driving the market growth include increasing preference for homogeneous catalysts over heterogeneous ones owing to their specific features, especially associated with selectivity, augment the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."