- Home

- »

- Next Generation Technologies

- »

-

Europe Indoor Farming Market Size & Share, Report, 2030GVR Report cover

![Europe Indoor Farming Market Size, Share & Trends Report]()

Europe Indoor Farming Market Size, Share & Trends Analysis Report By Facility (Greenhouses, Vertical Farms), By Component, By Growing Mechanism, By Crop Category, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-338-6

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Europe Indoor Farming Market Size & Trends

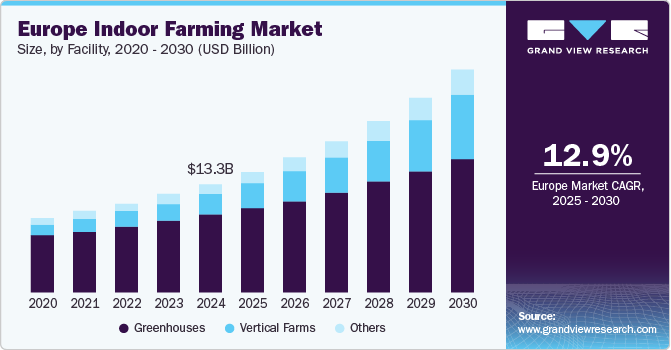

The Europe indoor farming market size was valued at USD 13.28 billion in 2024 and is projected to grow at a CAGR of 12.9% from 2025 to 2030. Growing concerns regarding soil pollution, increasing urbanization coupled with rising demand for fresh produce such as fruits, vegetables, and herbs, a growing inclination towards utilizing indoor space for plants, positive regulatory scenarios, and government support are some of the key growth driving factors for this market.

Continuous decrease in farmlands or agricultural lands in Europe driven by unceasing urbanization is one of the key growth drivers for this market. The impacts of human-caused climate change, such as heavy precipitation and warm weather, contribute to challenges posed in front of traditional farming. Increasing inclination in the urban population towards health & fitness accompanied by the shift to more organic and healthy dietary regimes is also generating an upsurge in demand for indoor farming. In addition, water scarcity, the reduction in effective rainfalls, and other climatic changes are likely to drive growth for this market in the coming years.

Environmental concerns, growing consumer demands, technological advancements in indoor farming, initiatives regarding food security, focus of multiple organizations and countries on sustainability, and innovation are adding to the growth opportunities for this market. Increasing demand for natural and organic products is also contributing to the growth potential of this market.

Facility Insights

Based on facility, the greenhouses segment has dominated the European vertical farming market with a revenue share of 71.6% in 2024. Greenhouses are extensively utilized for indoor farming owing to factors such as controlled environment availability, enhanced protection offered by the facility, energy efficiency, alignment with sustainability goals, and more. Ongoing research & development activities, a growing focus on improving productivity, and increasing demand for enabling food security are expected to enhance the growth of this segment during the forecast period.

The vertical farms segment is expected to experience the fastest CAGR of 20.3 % from 2025 to 2030. New investments in vertical farming, a growing focus on R&D and innovation, the emergence of technological advancements and their integration with modern farms, rising demand for organic foods in the region, urbanization, and an approach to optimally utilizing space in urban residents are some of the major growth driving factors.

Component Insights

The hardware segment dominated the market in 2024 with the largest revenue share. Growing adoption of vertical farming in the region, the emergence of concepts such as smart farming, government support for indoor agriculture, the requirement of a controlled environment for indoor farming, and the role of efficient hardware components are growth drivers for this segment. Availability of advanced components, technology innovations, and advancements are expected to drive demand for this segment in the next few years. Indoor farming depends on the availability and accessibility of hardware components such as climate control systems, lighting systems, sensors, and irrigation systems.

The software segment is projected to experience the fastest CAGR during the forecast period. The growing use of web-based and cloud-based solutions offered by major IT and agriculture technology companies to enhance the management of vertical farms and greenhouses is also driven by the availability of solutions backed by modern technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and others. Businesses rely on intelligent software solutions for various purposes, including tracking data, real-time analysis, operation management, decision-making, remote monitoring, and more.

Growing Mechanism Insights

Hydroponics segment held largest revenue share of the European market in 2024. Using mineral nutrient solutions offered by sand, gravel, or liquid is key in the hydroponics process of indoor farming. Growing demand for fresh produce in the region, rising urbanization, water scarcity, innovation, and technological advancements are contributing to the growth of this segment. The ability of plants to grow by hydroponic farming techniques with the help of water, nutrients, and sunlight in a soil-free environment adds to the segment's enhanced commercial value.

Aquaponics segment is expected to experience significant CAGR from 2025 to 2030 owing to several benefits, including its environmental advantages, economic efficiency, growing demand for organic produce, reduced water wastages, minimized use of chemicals, urban agriculture, vertical farming, and more. Scalability is also attained through this mechanism of aquaponics.

Crop Category Insights

Based on crop category, fruits, vegetables, and herbs dominated the European indoor farming market in 2024. Fruits such as strawberries and apples, vegetables such as spinach, lettuce, tomatoes, kale, cabbage, cucumbers, turnips, parsnips, and others, herbs, and mushrooms are commonly grown through indoor farming in Europe. Increasing demand for organically grown, chemical-free products is this segment's primary growth driving factor. Innovation and ongoing research and development activities in institutes and organizations are adding to the growth opportunities for this segment.

Flowers & ornamentals segment is anticipated to experience significant CAGR during the forecast period owing to the impact of seasonality and limited demands in other times of year except for spring and summer, increasing demand for indoor flower plants from residential and commercial markets, demand from flower trade businesses, urban architecture integration and more.

Country Insights

The UK indoor farming market dominated the European industry with a revenue share of 25.0% in 2024. Benefits such as assistance in growing crops for an entire year, reduced carbon footprints, minimized costs and utilization of lesser resources, the presence of large-size vertical farms in the country, the availability and accessibility of advanced technology assistance required for vertical farming, and government encouragement to increase adoption of sustainable farming practices through innovation and research are driving the growth of this market.

Germany indoor farming market is projected to grow at the fastest CAGR of 14.7% from 2025 to 2030. Germany’s emphasis on agriculture innovation and scientific advancements in farming technology, higher consumer demand for locally grown sustainable fresh produce in the country, rapid growth of vertical farming technique, urban food demands, facilitations by institutes and non-profit organizations, and presence of multiple companies operating in vertical farming are contributing to the growth.

Key Europe Indoor Farming Company Insights

Some of the key companies operating in the European indoor farming market include V-Farm, LettUs Grow, Bridge Greenhouses Ltd., Priva, and others. The growing demand and competition in the market have encouraged key players to adopt strategies such as innovation, the inclusion of modern technologies in operations for enhanced outcomes, expansion, collaborations, research, and more.

-

V-Farm, one of the prominent companies in the UK's advanced horticulture market, uses controlled environments and stacked layers accompanied by soilless farming techniques such as aquaponics and hydroponics. It offers fully customizable systems for advanced vertical farming and consumables such as seeds, growth optimization additives, plant feeds, growing media, trays, pots, food packaging, spare parts, health, and maintenance.

-

LettUs Grow is a major market participant in aeroponic technology for soilless growing mechanisms and control software for vertical and indoor farming while engaging in research associated with agriculture technology. This includes offers Aeroponic Rolling Benches and projects with different organizations.

Key Europe Indoor Farming Companies:

- Bridge Greenhouses Ltd.

- LettUs Grow

- V-Farm

- GrowUp Farms Limited

- Netafim

- Priva

- Richel Group

- Signify Holding

- Everlight Electronics Co., Ltd

View a comprehensive list of companies in the Europe Indoor Farming Market

Recent Developments

- In September 2024, Elevate Farms Inc., one of the key players in vertical farming technology industry, joined forces with Cultivatd Inc., major market participant in Farming as a Service, to accelerate its plan to expand its operations in Europe. Solothurn, Switzerland focused plan of Elevate Farms is facilitated by its expertise in photobiology automation technology and expected to commence its facility operations by 2025.

Europe Indoor Farming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.74 billion

Revenue forecast in 2030

USD 27.04 billion

Growth Rate

CAGR of 12.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Facility, component, growing mechanism, crop category, country

Country scope

UK, Germany, France, Spain

Key companies profiled

Bridge Greenhouses Ltd.; LettUs Grow; V-Farm; GrowUp Farms Limited; Netafim; Priva; Richel Group; Signify Holding; Everlight Electronics Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Indoor Farming Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Europe indoor farming market report based on facility, component, growing mechanism, crop category and country.

-

Facility Outlook (Revenue, USD Billion, 2018 - 2030)

-

Greenhouses

-

Vertical Farms

-

Shipping Container

-

Building-based

-

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Climate Control Systems

-

Lighting Systems

-

Sensors

-

Irrigation Systems

-

-

Software

-

Web-Based

-

Cloud-Based

-

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Growing Mechanism Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aeroponics

-

Hydroponics

-

Aquaponics

-

-

Crop Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fruits Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens (excluding lettuce)

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others (Cannabis, Microgreens)

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

France

-

Spain

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."