- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Mailer Packaging Market Size, Industry Report, 2033GVR Report cover

![Europe Mailer Packaging Market Size, Share & Trends Report]()

Europe Mailer Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Non-cushioned Mailers, Cushioned Mailers), By Insulation (Non-insulated, Insulated), By Material Type, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-996-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Mailer Packaging Market Summary

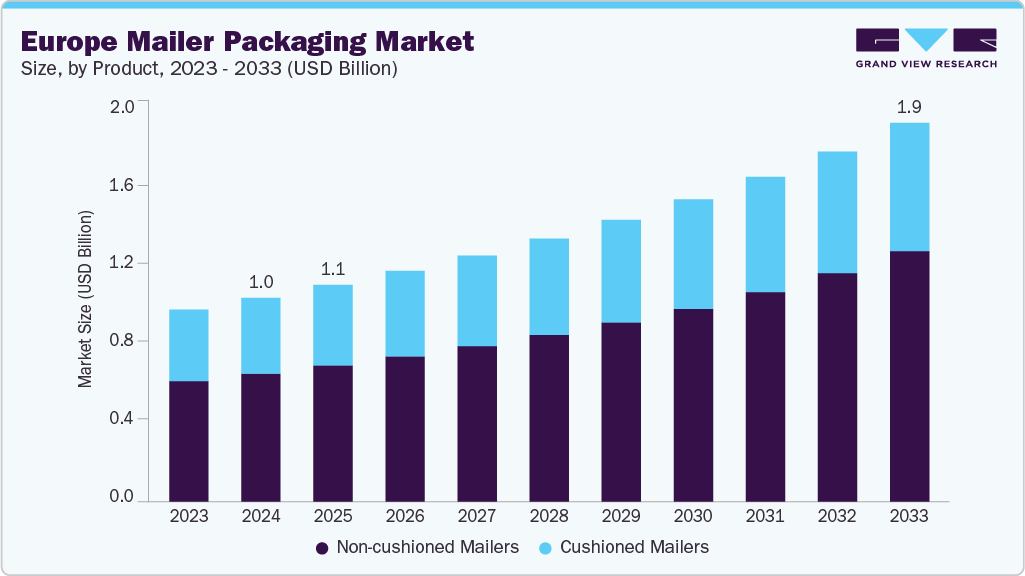

The Europe mailer packaging market size was estimated at USD 1.05 billion in 2024 and is projected to reach USD 1.95 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The market growth is driven by the booming e-commerce sector and increasing demand for sustainable, lightweight packaging solutions.

Key Market Trends & Insights

- By product, the cushioned mailers segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By insulation, the insulated segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By material type, the paper segment is expected to grow at a considerable CAGR of 9.1% from 2025 to 2033 in terms of revenue.

- By end use, the e-commerce segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 1.95 Billion

- CAGR (2025-2033): 7.2%

Additionally, stringent EU regulations promoting recyclable and eco-friendly materials are accelerating market growth. The rapid expansion of the e-commerce industry across Europe has emerged as a driver for the mailer packaging market. With increasing consumer preference for online shopping due to convenience, variety, and competitive pricing, e-commerce sales have surged across key European economies such as Germany, the UK, France, and the Netherlands.According to the European E-commerce Report 2024, online retail sales in Europe reached USD 975.7 billion in 2023, marking a 3% increase compared to USD 950.4 billion in 2022. This growth highlights the resilience of the European digital commerce sector despite ongoing economic challenges such as inflation and geopolitical uncertainties. Western Europe, the largest market, witnessed a slight decline of 1% to USD 697.3 billion, while Southern and Eastern Europe experienced strong growth of 14% and 15%, respectively, in 2023. Moreover, cross-border e-commerce is expanding rapidly, reaching USD 358.6 billion in 2024, driven by consumers’ increasing willingness to shop internationally within Europe.

Mailer packaging, including bubble mailers, padded envelopes, and lightweight poly mailers, has become essential in protecting items during transit while minimizing material usage and shipping costs. As more small and medium-sized enterprises (SMEs) adopt direct-to-consumer models and digital storefronts through platforms such as Amazon, Zalando, and Shopify, the volume of small parcel shipments has significantly increased. This shift in retail dynamics has intensified the need for versatile mailer solutions that offer tamper-evidence, moisture resistance, and adequate cushioning, key features that enhance customer satisfaction and reduce returns.

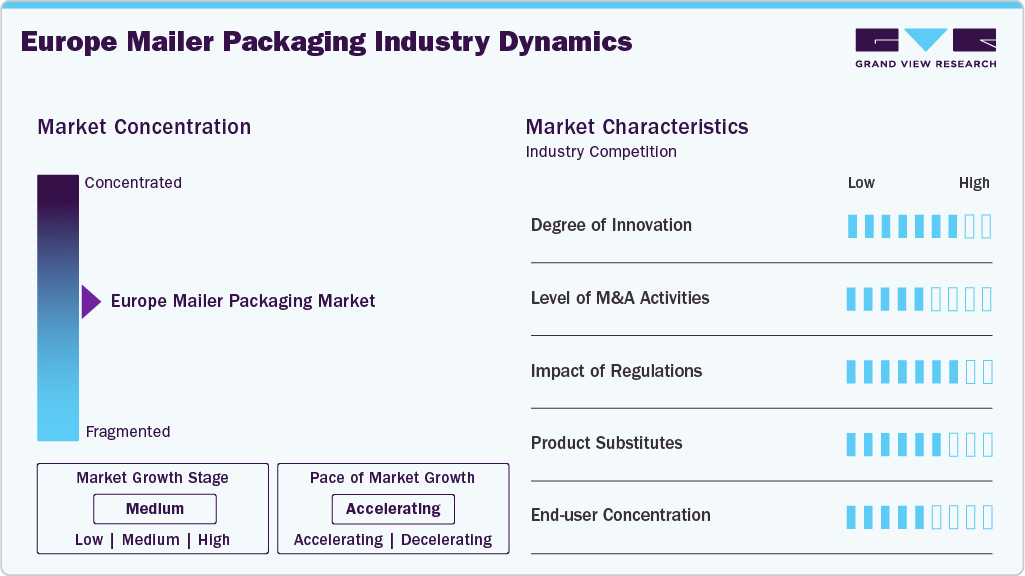

Market Concentration & Characteristics

The Europe mailer packaging industry is characterized by a dynamic blend of sustainability focus, high customization demand, and rapid responsiveness to e-commerce trends. With a significant push toward circular economy principles, the industry is undergoing a shift from conventional plastic-based mailers to recyclable and compostable materials such as kraft paper and bio-based films. The industry is also marked by increasing collaboration between packaging suppliers, e-commerce retailers, and logistics providers to co-develop solutions that reduce material waste while maintaining product protection and aesthetic appeal.

Additionally, the market is highly competitive but moderately consolidated, with a mix of multinational players such as Mondi, DS Smith, and Stora Enso, along with smaller, niche manufacturers specializing in sustainable or customizable solutions. Innovation plays a central role in differentiating products in a relatively standardized segment. As such, manufacturers are investing in automation, digital printing, and smart packaging technologies to cater to the growing demand for branding and traceability, especially from small and medium-sized e-commerce businesses.

The industry is logistics- and regulation-sensitive, where packaging formats must conform to evolving postal standards, shipping cost structures, and environmental directives. Packaging that reduces dimensional weight and fits through standard letterboxes is especially valued in last-mile delivery optimization. Overall, the industry reflects a balance of environmental responsibility, functional design, and scalability, with trends deeply influenced by consumer behavior, retail logistics, and regulatory developments across Europe.

Product Insights

The non-cushioned mailers segment recorded the largest revenue share of over 62.0% in 2024. Non-cushioned mailers are lightweight, flat envelopes made from materials such as paper, plastic, or composite films without any internal padding. These mailers are predominantly used for shipping documents, clothing, brochures, and other flat, non-fragile items. Due to their slim profile, they offer cost savings on postage. They are space-efficient for storage and shipping, making them ideal for industries like apparel, publishing, and direct mail marketing.

The cushioned mailers segment is expected to grow at the fastest CAGR of 7.2% during the forecast period. Cushioned mailers are envelopes with built-in protective padding, commonly using bubble wrap or foam linings to safeguard fragile or sensitive items during shipping. These mailers are popular for electronics, cosmetics, books, and small consumer goods that require added protection from impact, vibration, or rough handling. They offer a compact yet protective alternative to box packaging and reduce the need for secondary protective materials like air pillows or void fill. The main driver behind cushioned mailers is the increased shipment of delicate consumer electronics, small gadgets, and beauty products through e-commerce platforms.

Insulation Insights

The non-insulated mailers segment recorded the largest revenue share of over 81.0% in 2024. Non-insulated mailers are the most commonly used type of mailer packaging in Europe, primarily made from materials such as kraft paper, polyethylene, or bubble linings. Their minimal material usage contributes to lower shipping costs and improved environmental sustainability when recyclable or biodegradable materials are used. The primary driver for non-insulated mailers is the booming e-commerce and direct-to-consumer retail industry in Europe. The rise in small parcel shipping for apparel, electronics, accessories, and subscription boxes continues to create demand for lightweight and cost-effective packaging solutions.

The insulated segment is expected to grow at the fastest CAGR of 7.3% during the forecast period. Cushioned mailers are envelopes with built-in protective padding, commonly using bubble wrap or foam linings to safeguard fragile or sensitive items during shipping. These mailers are popular for electronics, cosmetics, books, and small consumer goods that require added protection from impact, vibration, or rough handling. They offer a compact yet protective alternative to box packaging and reduce the need for secondary protective materials like air pillows or void fill. The main driver behind cushioned mailers is the increased shipment of delicate consumer electronics, small gadgets, and beauty products through e-commerce platforms.

Material Type Insights

The paper segment led the Europe mailer packaging industry with the largest revenue share of over 57.0% in 2024 and is expected to grow at the fastest CAGR of 9.1% during the forecast period. Paper mailers have gained strong traction in Europe due to their sustainability and recyclability. These mailers are primarily made from kraft paper or corrugated paperboard. The push for circular economy policies, consumer demand for plastic alternatives, and extended producer responsibility (EPR) regulations are driving the adoption of paper mailers. The EU’s ban on certain single-use plastics and growing preference for biodegradable and compostable packaging among environmentally conscious brands like H&M and Zalando are accelerating growth in this segment. Additionally, paper’s ease of disposal and compatibility with curbside recycling programs boost its appeal.

Plastic mailers, often made from polyethylene (PE), remain a dominant material in the Europe mailer packaging market due to their durability, water resistance, lightweight properties, and lower cost. They are widely used for shipping clothing, electronics, and other items requiring tamper resistance and protection from the elements. Plastic mailers continue to thrive due to cost-effectiveness, superior barrier properties, and compatibility with automated packaging lines. Many brands favor plastic due to its lightweight nature, which reduces shipping costs, and its ability to offer strong product protection. Furthermore, innovations in recycled plastics and biodegradable plastic films are helping companies meet sustainability goals without compromising functionality.

End-use Insights

The e-commerce segment recorded the largest market share of over 49.0% in 2024 and is projected to grow at the fastest CAGR of 7.4% during the forecast period. The e-commerce sector is the dominant end-user of mailer packaging in Europe, driven by the exponential growth of online retail platforms such as Amazon, Zalando, ASOS, and others. The primary driver for mailer packaging in e-commerce is the surge in online shopping, particularly post-pandemic, along with growing cross-border transactions within the EU single market. Increasing mobile commerce, rising demand for personalized packaging, and a shift toward eco-friendly packaging in response to EU regulations (like the European Green Deal and SUP Directive) are reinforcing demand. Moreover, returnable and reusable mailers are gaining traction due to the high volume of returns in the fashion and electronics sectors.

The shipping & logistics sector in Europe utilizes mailer packaging for parcel transportation, B2B transactions, courier services, and third-party logistics (3PL). The packaging solutions here emphasize durability, tracking compatibility (QR/barcodes/RFID), and cost-efficiency in bulk handling. These packages are designed to withstand long-distance transport through various distribution channels across borders. Key factors driving mailer packaging in shipping and logistics include increasing demand for cross-border delivery services, growth in third-party logistics, and the rise in just-in-time (JIT) supply chain models across Europe.

Country Insights

UK Mailer Packaging Market Trends

The UK mailer packaging market recorded the largest revenue share of over 21.0% in 2024. This outlook is due to a mature online retail sector, high penetration of subscription boxes, and strong domestic courier networks. The rising demand for premium packaging also plays a crucial role. A highly digital consumer base and a post-Brexit shift toward domestic fulfillment centers are driving packaging innovation. The Plastic Packaging Tax introduced in 2022 is further encouraging the adoption of paper-based and recycled content mailers.

Germany Mailer Packaging Market Trends

The mailer packaging market in Germany is one of the major contributors in Europe due to the country’s robust e-commerce infrastructure, advanced logistics, and high volume of cross-border online shopping. German consumers have a strong preference for sustainable packaging solutions, which is accelerating the demand for eco-friendly mailer packaging options. Germany's commitment to environmental sustainability, supported by strict packaging waste regulations like the German Packaging Act, is pushing the market toward recyclable and biodegradable mailers. Additionally, the growth of Amazon’s regional operations and local e-retailers like Zalando boosts demand for efficient and protective packaging.

Netherland Mailer Packaging Market Trends

The Netherlands mailer packaging market is expected to grow during the forecast period. The Netherlands is a logistics hub and acts as a gateway for e-commerce distribution across Europe. Its advanced supply chain infrastructure supports high-speed and efficient delivery services. High digital literacy, government-backed sustainability initiatives, and a well-connected urban delivery system are supporting the shift to paper and bio-based mailer materials. Growth in cross-border online shopping further supports volume expansion.

Sweden Mailer Packaging Market Trends

The mailer packaging market in Sweden is anticipated to grow over the forecast period. Sweden has a digitally advanced population and high e-commerce penetration across electronics, fashion, and cosmetics. The market is focused on minimalistic, recyclable, and functional mailers. Sweden’s strict sustainability regulations and widespread environmental consciousness are driving innovation in mailer packaging. The expansion of online furniture and lifestyle brands further increases demand for durable and branded mailers.

Poland Mailer Packaging Market Trends

The Polandmailer packaging market is an emerging market in Europe’s mailer packaging landscape, with rapid e-commerce growth and increasing participation from local retailers and marketplaces. Strong growth in mobile commerce, investments in warehousing, and EU-backed sustainability reforms are encouraging the adoption of lightweight and recyclable mailers. Local courier and parcel services are also expanding operations.

Key Europe Mailer Packaging Company Insights

The competitive environment of the mailer packaging market in Europe is moderately consolidated, characterized by the presence of both established global players and specialized regional manufacturers. Key players such as Mondi, DS Smith, and Stora Enso dominate the market through extensive product portfolios, strong distribution networks, and investments in sustainable packaging innovations. However, the market also includes a significant number of mid-sized and small enterprises offering customized and eco-friendly solutions, driving intense competition in terms of pricing, product differentiation, and environmental compliance. The push toward circular economy practices and stringent EU packaging waste regulations has further intensified competition, as companies strive to develop recyclable and biodegradable mailer solutions to meet evolving consumer and legislative demands.

-

In May 2025, Mondi expanded the production capacity of its recyclable MailerBAG by adding a new production line at its Krapkowice plant in Poland. This expansion is in response to the growing demand for sustainable eCommerce packaging solutions. It aligns with Mondi’s MAP2030 sustainability commitments and its focus on circular packaging solutions, reinforcing the company’s leadership in delivering innovative, sustainable alternatives to plastic mailers in the rapidly growing online retail market.

-

In March 2024, Pregis LLC, a global provider of protective packaging, launched the EverTec Automated Mailer in North America. Made from specialty kraft paper, the mailer is designed to integrate seamlessly with Pregis’ Sharp MaxPro automated bagging machines, increasing throughput and efficiency while reducing freight costs for e-commerce businesses with medium- to high-volume packing requirements. The curbside-recyclable EverTec Automated Mailer is available in three stock sizes and offers one-color custom printing. This new solution addresses the growing demand for sustainable, paper-based packaging.

Key Europe Mailer Packaging Companies:

- Mondi

- Intertape Polymer Group

- Henkel Corporation

- Manufacturas Polisac SA

- Storopack Hans Reichenecker GmbH

- Abriso Jiffy

- 3M

- Pregis LLC

- Dinkhauser Kartonagen GmbH

- Stora Enso

- Sealed Air

- DS Smith

Europe Mailer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2033

USD 1.95 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, insulation, material type, end-use, country

Country scope

Germany; UK; Italy; Spain; France; Netherlands; Switzerland; Sweden; Poland; Belgium; Austria; Norway; Denmark; Ireland; Finland

Key companies profiled

Mondi; Intertape Polymer Group; Henkel Corporation; Manufacturas Polisac SA; Storopack Hans Reichenecker GmbH; Abriso Jiffy; 3M; Pregis LLC; Dinkhauser Kartonagen GmbH; Stora Enso; Sealed Air; DS Smith

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Mailer Packaging Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe mailer packaging market report based on product, insulation, material type, end-use, and country:

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Non-cushioned Mailers

-

Cushioned Mailers

-

-

Insulation Outlook (Revenue, USD Million 2021 - 2033)

-

Non-Insulated

-

Insulated

-

-

Material Type Outlook (Revenue, USD Million 2021 - 2033)

-

Paper

-

Plastic

-

Foil

-

-

End-use Outlook (Revenue, USD Million 2021 - 2033)

-

E-commerce

-

Shipping & Logistics

-

Manufacturing & Warehousing

-

-

Country Outlook (Revenue, USD Million 2021 - 2033)

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Netherlands

-

Switzerland

-

Sweden

-

Poland

-

Belgium

-

Austria

-

Norway

-

Denmark

-

Ireland

-

Finland

-

Frequently Asked Questions About This Report

b. The Europe mailer packaging Market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The Europe mailer packaging market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 1.95 billion by 2030.

b. Paper dominated the market with a share of over 57.0% in 2024 due to its eco-friendly nature.

b. Some of the key players operating in the Europe mailer packaging Market include Mondi; Intertape Polymer Group; Henkel Corporation; Manufacturas Polisac SA; Storopack Hans Reichenecker GmbH; Abriso Jiffy; 3M; Pregis LLC; Dinkhauser Kartonagen GmbH; Stora Enso; Sealed Air; and DS Smith.

b. The key factors that are driving the Europe mailer packaging market include an increasing number of e-shoppers, increased demand for sustainable packaging solutions, and increasing expansion of e-commerce giants in the regional market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.