- Home

- »

- Medical Devices

- »

-

Europe And MEA Condom Market Size, Report, 2030GVR Report cover

![Europe And MEA Condom Market Size, Share & Trends Report]()

Europe And MEA Condom Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Latex, Non-Latex), By Product, By Distribution Channel (Mass Merchandizers, Drug Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-849-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe And MEA Condom Market Trends

The Europe and Middle East & Africa condom market size was valued at USD 3.09 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% over the forecast period. Governments and healthcare institutions are aggressively promoting healthy contraceptive methods to prevent unwanted pregnancy and the spread of Sexually Transmitted Diseases (STDs) such as HIV/AIDS. The use of condoms is one of the important methods adopted in Europe and MEA. Bulk procurement of the product by government and international healthcare bodies for free and subsidized distribution is anticipated to drive the market growth. To encourage people, government bodies and healthcare departments distribute condoms for free or providing subsidies.

When used correctly, male condoms are 98% effective in preventing pregnancy and Sexually Transmitted Infections (STIs) including HIV. Hence, the use of male condoms during sexual intercourse is encouraged by most government and healthcare organizations on a global scale. International and government healthcare bodies such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) play a significant role in creating awareness regarding safe sex and the advantages of products.

Governments in various countries of these regions are focusing on younger population to raise awareness about sex education with an objective of controlling HIV and other STIs and to help avoid unintended pregnancies. The Joint United Nations Program on HIV/AIDS (UNAIDS), aimed to diagnose 95% of all HIV-positive individuals, provides antiretroviral therapy (ART) for 95% of those diagnosed and achieve viral suppression for 95% of those treated by 2030. The growing LGBTQ communities and adequate sex education are impacting the market.

Furthermore, the availability of condoms on online platforms has boosted sales and distribution in recent years. The popularity of smartphones and widespread internet even in the rural area has witnessed a sharp surge in the market. Manufacturing companies are strategically expanding their customer base through online e-commerce sites and apps.

Material Insights

Latex type dominated the condoms market by capturing 88.0% revenue share in 2023. The segment growth is driven by material properties such as stretch & strength. Also, as latex condoms are extremely effective in preventing pregnancy and STDs, the segment is witnessing rapid growth. It is made up of natural rubber instead of plastic which offers safer experience and do not incur any side effects. Consumers tend to opt for long-lasting and natural experience, further shaping the market growth.

The non latex condom segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. The increasing prevalence of allergies due to the use of latex condoms is the prime factor impacting the market. Non latex condoms are made of synthetic polyisoprene and polyurethane, which provide protection and a smoother experience.

Product Insights

Male condoms dominated the market in 2023 and held a market share of more than 98.0%. The ease in using and effectiveness are the most vital factors supporting the wide acceptance of male condoms. Also, couples prefer the male condoms more due to availability based on suitable material such as latex or non-latex condoms. Additionally, manufacturing companies are offering several flavors and varieties in products considering the dynamically changing consumer behavior.

The female condoms segment is expected to grow at a CAGR at 12.9% during the forecast period, 2024 to 2030. These condoms are suitable for consumers who have latex allergies, as these are made up of polyurethane or nitrile polymer. The natural sensation these products provide is expected to drive the segment’s growth over the forecast period.

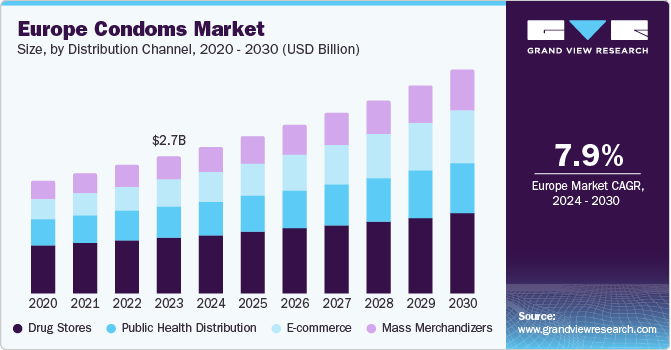

Europe Distribution Channel Insights

Distribution of condoms through drug stores held the largest market share of 40.8% in terms of revenue in 2023. Assurance of product quality, brand, and availability of wide variety in retail pharmacies, and drug stores have favored segment growth in recent years. Also, consumers are more open to purchasing condoms from stores than earlier, with the reduced social stigma around contraceptive methods.

The E-commerce distribution channel emerged to be the fastest growing segment with a CAGR of 10.3% over the forecast period. The increasing number of smartphone and internet users, particularly in the young population, is expected to propel the market. The convenient and discrete delivery services from several e-commerce companies are expected to foster growth in coming years.

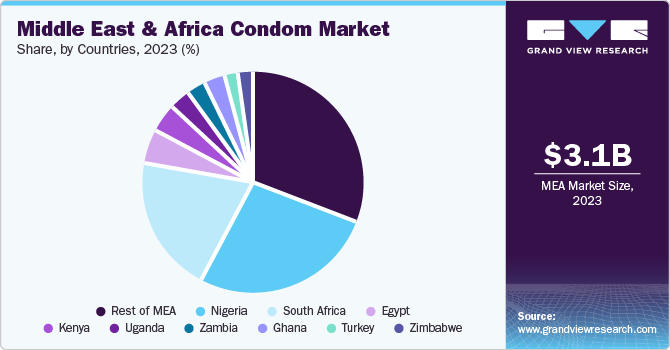

MEA Distribution Channel Insights

Depending upon the distribution channel, the MEA condom market is categorized in public sector, the social marketing sector, and the commercial sector. The public sector held the largest share of 36.7% in the Middle East and Africa condom market in 2023, owing to the strong presence of free condom brands, funded by the government and the United Nations Population Fund (UNFPA). These brands are made available through healthcare facilities and public health centers. Most of the population prefers these brands as they are free of cost and easily accessible.

The social marketing sector held a sizable market share of 36.6% in 2023. It is expected to continue dominance over the forecast period as well and record the fastest CAGR of 12.0%. Condom manufacturing companies are aiming to expand their customer base in the MEA region.

The availability of quality condoms in different variants at subsidized prices to meet customer needs is expected to increase the presence of the social marketing sector. Funding from NGOs, not-for-profit organizations, and social marketing of condom manufacturers are improving product access in this region.

Regional Insights

Germany condom market dominated the regional condom market by capturing 18.1% in 2023. In Europe, short-term methods of contraception, such as male condoms, are preferred over long-term contraceptives. Increasing occurrence of STDs, the growing presence of the LGBTQ community, increasing adoption of contraceptive measures to avoid unplanned pregnancies, and rising awareness among the young population about sexual health are the key factors that have increased the adoption of condoms in Europe. In several countries, Condom Distribution Schemes are being promoted by the government and healthcare bodies. In U.K., various distribution schemes target teenagers and young adults to encourage using condoms and healthy relations.

The Nigeria condom market held the largest market share of 26.7% in the MEA region in 2023. The use of condoms in this region largely depends on the age group and the type of relationship between the partners. The MEA condom market is largely impacted by the lack of awareness regarding HIV transmission through unprotected sex, inadequate promotion of condoms, and limited distribution in most of the countries.

Key Companies & Market Share Insights

The condom market in Europe and MEA is characterized by several international brands. However, local and regional manufacturers are aiming to expand their consumer base by introducing product variants that are suitable for local consumers. Brand loyalty among customers remains low due to the high competitiveness in the market. Some of the key players in this market are FUJILATEX CO., LTD, Reckitt Benckiser Group plc., Church & Dwight Co., Inc., Karex Berhad, LELO and others

- Reckitt is a global hygiene and healthcare, and nutrition brand operating in more than 60 countries. It is also a manufacturer of condoms through one of its brands named Durex. It aims to offer enhanced experience to the consumers through continuous innovation and product development considering the changing dynamics and preferences of consumers across the world.

Key Europe And MEA Condom Companies:

The following are the leading companies in the europe and mea condom market. These companies collectively hold the largest market share and dictate industry trends.

- FUJILATEX CO., LTD

- Reckitt Benckiser Group plc.

- Church & Dwight Co., Inc.

- Karex Berhad

- LELO.

- LifeStyles Healthcare Pte Ltd

- Ritex Gmbh

- Pasante Healthcare Ltd

- CPR GmbH

- Futura Medical

- RRT Medcon

- Cupid Limited

- Veru Inc.

- Okamoto Industries, Inc.

- Mankind Pharma

Recent Developments

-

In April 2023, the sexual wellness brand Roam, launched Skin Toned Condoms. They have been designed by leading experts and are available in medium brown, dark brown, light brown and in original latex.

Europe And MEA Condoms Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.3 billion

Revenue forecast in 2030

USD 5.2 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Product, Distribution Channel and Region

Regional scope

Europe and MEA

Country scope

UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, Netherlands, Switzerland,Portugal, South Africa, Nigeria, Saudi Arabia, UAE,Kenya, Zambia, Zimbabwe, Uganda, Egypt, Turkey Ghana, Kuwait

Key companies profiled

FUJILATEX CO., LTD, Reckitt Benckiser Group plc.,Church & Dwight Co., Inc., Karex Berhad, LELO.,LifeStyles Healthcare Pte Ltd, Ritex Gmbh, Pasante Healthcare Ltd, CPR GmbH, Futura Medical, RRT Medcon, Cupid Limited, Veru Inc., Okamoto Industries, Inc., Mankind Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe And MEA Condom Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the Europe and MEA condoms market report based on material, product, distribution channel and region:

-

Material Outlook (Revenue, USD Million, 2020 - 2030)

-

Latex

-

Non Latex

-

Polyurethane and Polyisoprene

-

Lambskin

-

Nitrile Butadiene Rubber (NBR)

-

-

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Europe Distribution Channel Outlook (Revenue, USD Million, 2020 - 2030)

-

Mass Merchandizers

-

Drug Stores

-

E-commerce

-

Public Health Distribution

-

-

MEA Distribution Channel Outlook (Revenue, USD Million, 2020 - 2030)

-

Public Sector

-

Social Marketing

-

Commercial Sector

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

Netherlands

-

Switzerland

-

Portugal

-

-

Middle East and Africa (MEA)

-

South Africa

-

Nigeria

-

Saudi Arabia

-

UAE

-

Kenya

-

Zambia

-

Zimbabwe

-

Uganda

-

Egypt

-

Turkey

-

Ghana

-

Kuwait

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Europe condom market size was estimated at USD 2 billion in 2019 and is expected to reach USD 2.2 billion in 2020. The MEA condom market size was estimated at USD 251 million in 2019 and is expected to reach USD 273.9 million in 2020.

b. The Europe condom market is expected to grow at a compound annual growth rate of 8.09% from 2020 to 2027 to reach USD 3.6 billion by 2027. The MEA condom market is expected to grow at a compound annual growth rate of 11.22% from 2020 to 2027 to reach USD 528.3 million by 2027.

b. Drug Stores dominated the Europe condom market with a share of 55.13% in 2019. This is attributable to easy access and availability of a wide variety of condoms. The public sector dominated the MEA condom market with a share of 42.55% in 2019. This is attributable to the strong presence of free condom brands, funded by the government and the United Nations Population Fund (UNFPA).

b. Some key players in the Europe and MEA market are FUJI LATEX CO., LTD.; Reckitt Benckiser Group plc.; Church & Dwight Co., Inc.; Karex Berhad; LELO; LifeStyles Healthcare Pte. Ltd.; Mayer Laboratories, Inc.; Ritex GmbH; Pasante Healthcare LTD.; CPR GmbH; Futura Medical; Restance, Inc., rrtMedcon; and Cupid Limited.

b. Key factors that are driving the market growth include an increase in government initiatives and awareness programs promoting the use of condoms is expected to aid the demand in Europe. Condoms are a vital element of the HIV/AIDS prevention strategy adopted in countries from the Middle East and Africa.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.