- Home

- »

- Medical Devices

- »

-

Europe Mobility Aids Market Size And Share Report 2030GVR Report cover

![Europe Mobility Aids Market Size, Share & Trends Report]()

Europe Mobility Aids Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Rollators, Walkers), By Sector (Public, Private), By Distribution Channel (Online, Offline), By Type of Split, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-941-8

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The Europe mobility aids market size was estimated at USD 3.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. This growth can be attributed to the increasing geriatric population requiring Long-term Care (LTC), the growing prevalence of target diseases impairing mobility, the increasing availability of technologically advanced products, and the rising demand for home healthcare services & staff. The introduction of new mobility aids by market players is anticipated to increase the number of products available in the market and facilitate market growth. For instance, in March 2023, Drive DeVilbiss Healthcare launched UltraFold the auto folding scooter, the lightest (battery removed) scooter in the mobility market.

The demand for mobility aids devices is driven by the increasing geriatric population in Europe. According to the Eurostat, in 2022 over one-fifth (21.1%) of EU citizens were 65 years of age or older. In addition, the median age of the EU's population, which is rising, was 44.4 years old, making up half of the population. The rising prevalence of diseases, such as Parkinson’s, arthritis, and paralysis, is anticipated to increase the demand for mobility aids. The iWalkActive program initiated by Ambient Assisted Living (AAL) aims to integrate ICT technology with conventional walkers to provide a smart walker platform for the aging European population to assist in walking. Such initiatives are anticipated to drive market growth.Furthermore, the rising geriatric population is anticipated to increase the demand for mobility aids.

The various funding mechanisms implemented by several European countries for aiding patients in need of LTC are also likely to support market growth. For instance, several European countries provide universal long-term care coverage. The availability of a range of long-term care funding systems, such as social insurance, private insurance, universal health coverage, and others, across European countries will greatly improve the affordability of mobility devices. In addition, England’s tax-based system prioritizes the provision of rehabilitation and rehabilitative services to patients. These factors are expected to result in lucrative growth of the market over the forecast period.

The COVID-19 pandemic significantly affected the transport and mobility sector. It had disrupted the -supply channel of the wheelchair to a great extent. Wheelchair operations were put on hold across several countries owing to strict lockdowns being implemented. Hospitals witnessed consistent demand owing to a spike in the number of geriatric patients with COVID-19 infection.

Sector Insights

The private segment accounted for the largest revenue share of around 50.0% in 2022 and is expected to grow at the fastest CAGR of 3.3% over the forecast period. The private sector is characterized by the presence of a large number of privately held companies. These market players offer an array of innovative products and are actively involved in the launch of new products to outperform the market competition.

Every country in Europe has an established private sector that is involved in the funding of healthcare services to patients. For instance, in France, even though there is a compulsory social health insurance system that is financed through taxes and employee & employer payroll contributions, 90% of the population has opted for private health insurance (voluntary) that covers the remaining expenses.

The public sector segment held a revenue share of 49.5% in 2022 due to the presence of established players, such as Invacare Corporation, which has a strong local and international distribution network. In the UK, the public healthcare system−the National Health Service (NHS)−finances all the mobility aid devices and their services for free and is funded through taxation.

Distribution Channels Insights

The offline segment held the largest revenue share of 66.3% in 2022. This growth was attributed to a higher preference for the offline purchase of mobility aids. The offline channel enables the patients to assess the comfort, seating settings, and positioning feel, thereby aiding in the selection of appropriate assistive devices, especially for a first-time user. Choosing a wheelchair also depends majorly on the lifestyle of the patient upon which he can base his requirements, for instance, indoor or outdoor use, frequency of usage, etc. These factors have resulted in increased offline purchases of assistive devices.

The online segment is expected to grow at the fastest CAGR of 3.4% over the forecast period. The major e-commerce sites offering mobility aids are Wayfair and Amazon. Amazon offers a wide range of products in the mobility aids section, which consists of products from various companies. The availability of a wide range of products coupled with offers and discounts makes these platforms lucrative for users to buy the products online. The manufacturers of mobility assistive devices have their own e-commerce distribution channels or online sales sites for these products. Many companies like Invacare, Sunrise Medicals, Meyra, and Rehasense provide wide options for assistive medical aid devices online with products ranging from manual wheelchairs to power wheelchairs, mobility scooters, and LTS beds.

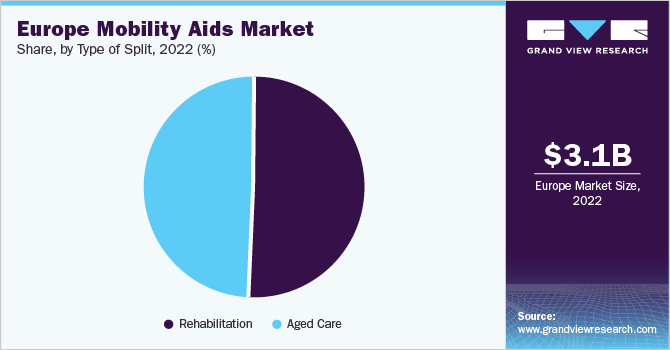

Type of Split Insights

The rehabilitation segment held the largest revenue share of 51.1% in 2022 owing to the increasing demand for rehabilitation activities. The increasing prevalence of chronic diseases, road accidents, and spinal cord injuries has led to a rise in the demand for long-term care eventually increasing the demand for rehabilitation equipment. In addition, in 2019, the EU accounted for nearly 15.4% of the global GDP and Germany accounted for nearly 3.7% of the global GDP. The high GDP is indicative of the high purchasing power in this region and is thus, anticipated to contribute to the affordability of rehabilitation devices. According to NOGO Inhibition in Spinal Cord Injury (NISCI), there are over 10,000 new cases of spinal cord injury per year, and more than 200,000 patients are living with a spinal cord injury in the EU.

The aged care segment is expected to grow at the fastest CAGR of 3.2% over the forecast period. The increasing geriatric population coupled with favorable government initiatives are the key factors driving the segment growth. The UK is one of the important economies in Europe and has projected that the elderly population in the UK will increase, accounting for 24% of the total population (17.4 million people) by 2043. The percentage of people 75 and older is anticipated to increase from 8% in 2018 to 13% in 2043, while the percentage of people 85 and older is anticipated to increase from 2% to 4%. Approximately 20,000 new cases of rheumatoid arthritis are diagnosed in the UK annually, eventually increasing the demand for rehabilitation equipment.

Product Insights

The wheelchair segment accounted for the largest revenue share of 32.8% in 2022. This can be attributed to the high preference for wheelchairs as mobility assistive devices among the geriatric and disabled population. The wheelchairs segment is further bifurcated into manual and powered wheelchairs. The manual wheelchair segment is sub-segmented into active, bariatric, rehabilitation, and others. Among them, active wheelchairs dominated the market in 2022 due to their enhanced capabilities for users. In February 2022, Invacare Corporation launched The Alber e-fix eco Power Assist, which uses a joystick, a battery, and in-wheel motors to convert a manual wheelchair into a transportable power chair.

The rollators segment is expected to grow at the fastest CAGR of 4.1% during the forecast period. This is due to various technological advancements, which have led to the availability of rollators with adjustable handle heights that enable the most comfortable and correct walking postures for patients, thereby increasing their adoption. In October 2020, HUMAN CARE, launched the neXus 3, which has the world’s first-ever cross-folding frame, to enhance the mobility of the user. Other prominent players in the rollators market are TOPRO and Eurovema AB.

Regional Insights

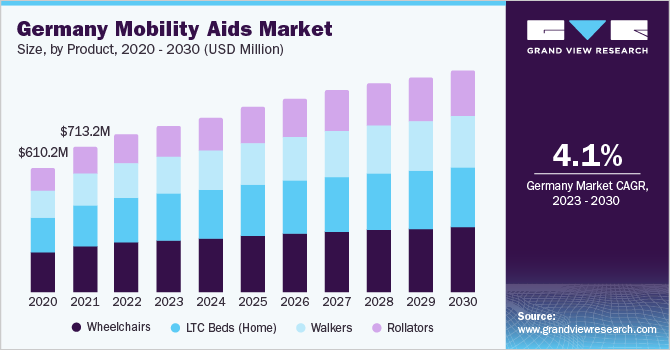

The Europe regional market has been segmented into Germany, the UK, Italy, France, Spain, Switzerland, and Poland. According to the Economist Intelligence Unit, in 2019 osteoarthritis (OA) affected about 57 million persons in Western Europe, resulting in the loss of almost 2 million years of healthy life. Germany dominated the market with the largest revenue share of 25.2% in 2022 and is expected to grow at the fastest CAGR of 4.1% during the forecast period. This can be attributed to the presence of advanced technologies, easy product availability, favorable reimbursement structure, and a strong healthcare system. Germany is one of the largest medical equipment markets, which is anticipated to contribute to the country’s overall share.

As per the OECD data, approximately 33% of the population in Germany will be above 65 years of age, and nearly 15% of the population is expected to be above 80 years of age by 2050. German residents are required to have health insurance, and around 73.2 million people are covered by statutory health insurance (Gesetzliche Krankenversicherung) (GV). Around 8.7 million Germans have private health insurance, while the rest are supported by government subsidies.

The government initiatives in the UK are contributing to the growth of the market in Northwestern Europe. The UK accounted for the second largest revenue share of 17.6% in 2022 and is expected to grow at a CAGR of 3 % during the forecast period. In March 2022, the UK government announced a package of USD 26.9 million to upgrade and make their public transport system more accessible for disabled people.

Key Companies & Market Share Insights

The market is highly competitive marked by the presence of a large number of local as well as international players. Companies are engaging in new product launches, mergers, and acquisitions to strengthen their product portfolios and provide competitive differentiation. For instance, in May 2022, OCR Canada Ltd. announced the acquisition of Day’s Mobility Ltd., which will widen its product offerings. In February 2020, Sunrise Medical acquired Oracing, a Spain-based designer and manufacturer of innovative sports, made-to-measure wheelchairs, and E-Mobility power products.

A number of industry players are offering their products through various e-commerce platforms, which have improved product accessibility for patients and increased market competition. Some prominent players in the Europe mobility aids market include:

-

Human Care HC AB

-

Drive DeVilbiss Healthcare

-

Roma Medical

-

Day’s Mobility Ltd.

-

Van Os Medical

-

Invacare Corp.

-

Z-Tec Mobility

-

Sunrise Medical

-

Karma Mobility

-

TOPRO Ltd.

Europe Mobility Aids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.2 billion

Revenue forecast in 2030

USD 3.9 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sector, type of split, distribution channel, region

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain; Switzerland; Poland

Key companies profiled

Human Care HC AB; Drive DeVilbiss Healthcare; Roma Medical; Day’s Mobility Ltd.; Van Os Medical; Invacare Corp.; Z-Tec Mobility; Sunrise Medical; Karma Mobility; TOPRO Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Mobility Aids Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe mobility aids market report based on product, sector, type of split, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rollators

-

Walkers

-

Wheelchairs

-

Manual

-

Active

-

Bariatric

-

Rehabilitation

-

Others

-

-

Powered

-

-

LTC Beds (Home)

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Type of Split Outlook (Revenue, USD Million, 2018 - 2030)

-

Rehabilitation

-

Aged Care

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Poland

-

-

Frequently Asked Questions About This Report

b. The Europe mobility aids market size was estimated at USD 3.1 billion in 2022 and is expected to reach USD 3.2 billion in 2023.

b. The Europe mobility aids market is expected to grow at a compound annual growth rate of 3.1% from 2023 to 2030 to reach USD 3.9 billion by 2030.

b. Some key players operating in the Europe mobility aids market include MEYRA GmbH, Sunrise Medical, Invacare Corporation, Medline Industries, Inc, and Hill-Rom Services Inc.

b. Germany dominated the Europe mobility aids market with a share of 25.2% in 2022. This is attributable to the presence of advanced technologies, high product availability, favorable reimbursement structure, and a strong healthcare system.

b. Key factors that are driving the Europe mobility aids market growth include the increasing geriatric population requiring long-term care and the growing availability of technologically advanced products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.