- Home

- »

- Automotive & Transportation

- »

-

Europe Motorcycle Parts & Accessories Market Report, 2030GVR Report cover

![Europe Motorcycle Parts And Accessories Market Size, Share & Trends Report]()

Europe Motorcycle Parts And Accessories Market Size, Share & Trends Analysis Report By Parts (Handle Accessories, Electrical & Electronics, Batteries, Exhaust Systems, Sprockets), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-149-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

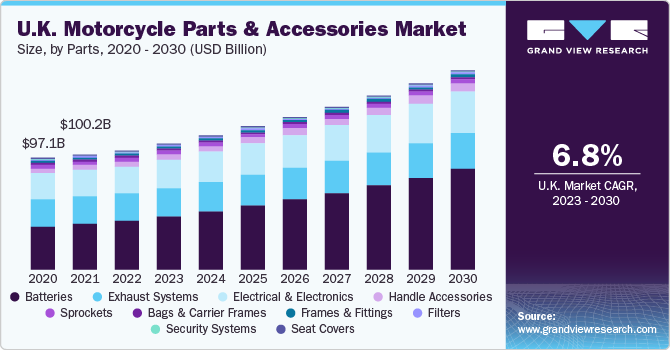

The Europe motorcycle parts and accessories market size was estimated at USD 879.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. The market growth is attributed to growing sales of motorcycles in major European countries, increasing traction of off-road motorcycles for adventure biking, touring, and leisure activities, and rising adoption of sports and touring bikes among Gen Z and millennials. The market is further experiencing growth owing to an ongoing trend of adding aesthetic features to the bike, such as designer lighting, handlebars, grips, and seat covers. Government safety mandates for wearing helmets and installing low-emission exhaust systems and safety systems are also driving the market growth.

The surge in expenditure on recreational pursuits, coupled with a growing requirement for environmentally friendly commuting options, has witnessed a significant rise in motorcycle spending, triggering a ripple effect across the motorcycle parts and accessories market in Europe. As consumer preferences gravitate towards products that prioritize efficiency and safety, manufacturers in the protective motorcycle riding gear sector are intensifying their research and development (R&D) investments to engineer products that amplify vehicle safety protocols. Hence, there is an expansion in demand for high-end motorcycles attributable to the proliferation of dual-income households, which has driven an upsurge in expenditure on premium electric motorcycles and their associated accessories across various regions. Thus, to cater to this demand industry participants are developing new and stylish products that provide effective safety while driving. Furthermore, product innovation, along with product line extension, leads to premiumization and is expected to drive demand for motorcycle parts and accessories in the industry.

Growing demand for improved sound, aesthetics, and products aids in enhancing the overall motorcycle performance, another element of the market expansion. Aftermarket exhaust systems are increasingly popular as a replacement for stock exhausts among sports motorcycle owners. The growing number of racing aficionados in the market is inducing the demand for components that can improve the performance of on-road bikes, resulting in a stronger demand for aftermarket exhaust systems.These aftermarket exhaust systems have various advantages over stock exhausts, including increased aesthetics, sound quality, and performance. Because of these advantages, aftermarket installation is a popular choice among sports motorbike owners. Due to economic considerations, aftermarket slip-on fitment is advised for individuals only concerned with cosmetic appeal and sound improvement. As a result, the vast majority of sports motorcycle owners choose aftermarket exhaust systems. The installation of aftermarket exhaust systems improves performance drastically.

Protective accessories such as smart helmets have been introduced into the European market, creating new growth opportunities for the market. Smart helmets contain enhanced features that assist motorcyclists in riding easily and efficiently while preventing road accidents. GPS connectivity, tracking systems, voice assistance, cameras, Wi-Fi connectivity, and Bluetooth are among the characteristics of the smart helmet. Smartphones can communicate with smart helmets and allow riders to make, receive, and reject phone calls. Smart helmets may also aid in the reduction of brain injuries in traffic accidents. As a result, the introduction of a multifunctional smart motorcycle helmet is likely to present the market with lucrative growth. The rising demand for luxury bikes, as well as the expanding popularity of motorcycle events and championships, are expected to fuel the growth of helmet makers.

The high customization cost of accessories such as helmets, lights, and carries is among the major market restraints hindering the market growth. The high cost of such customization deters students and Gen Z drivers from investing in accessories and parts. Moreover, the presence of counterfeit parts made from poor quality material is another factor restraining the market growth. Likewise, motorcycle noise emission regulations are another key barrier to market growth. Noise pollution from motorbike exhaust systems is a significant industrial concern. The growing traction of these aftermarket exhaust systems has drawn the attention of municipal and state authorities aimed at curbing excessive motorcycle noise. These standards cover equipment specifications, testing processes, and sound restrictions to ensure acceptable levels of sound emissions.

Parts Insights

Based on parts, the battery segment accounted for the largest market share of over 37% in 2022 and is projected to have the fastest growth over the forecast period. The growing popularity of electric motorcycles is increasing demand for batteries. Aftermarket companies specialize in developing motorcycle accessories that improve performance, style, and functionality. The rise in battery demand has prompted aftermarket companies to provide a broader choice of battery-powered accessories. Motorcycle batteries are used to heat grips, auxiliary lighting, GPS systems, and phone chargers to increase efficiency. These accessories improve motorcycle fans' riding pleasure and convenience.

The battery segment is expected to witness tremendous growth during the forecast period. The growth of the segment is attributed to increasing consumers' preference for electric motorcycles over the conventional two-wheelers. The rising integration of technologically advanced products in motorcycles to increase consumers' comfort and improve safety are receiving power from batteries which has created demand for highly efficient batteries in the market.

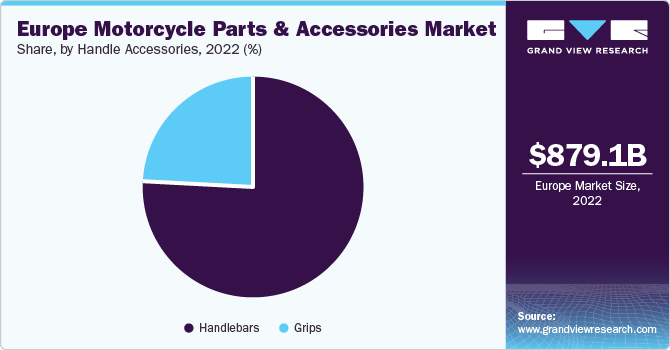

Handle Accessories Type Insights

Based on handle accessories, the handlebars segment accounted for the largest market share of over 75% in 2022. Manufacturers and major market players are focusing on corrosion-resistant and light-weight handlebars to improve the steering stability and performance of the two-wheeler vehicle. The manufacturers of two-wheeler vehicles are integrating handlebars into their vehicles, which deliver riding comfort to the rider. In addition, the rising traction of racing events has increased the demand for motorcycles and their parts and accessories, thus contributing to the high segmental share.

The grips segment is projected to have the fastest growth over the forecast period. The use of the motorcycle handle grip for motorcycles will be a critical factor that will have a significant impact on its growth. Motorcycles are designed for long-distance travel, which requires a high level of comfort as well as safety measures. Thus, motorcycle manufacturers in the region are majorly focusing on developing high-quality nonslip gel rubber handle grips and improving shock absorbers and storage bags which results in improving the customer experience.

Country Insights

Italy accounted for the largest market share of more than 28% in 2022. The country's growth is attributed to the growing traction of sports bikes in the country. Demography-wise, the growing traction of sports and cruiser bikes among millennials and Gen Z is a major factor driving the demand for motorcycle parts and accessories in the market. The congested traffic factor in major Italian cities is cited as a major factor for the popularity of motorcycles owing to their ease of commuting and compact parking.

Germany is projected to have the fastest growth over the forecast period. The growing traction over electric motorcycles owing to government subsidies and growing concerns over the environment is driving the market growth. Government regulation over helmet and exhaust safety standards is also driving the demand for high-quality and safe equipment while driving the motorcycle is another factor driving the market growth.

Key Companies & Market Share Insights

The market is competitive, with original equipment manufacturers coupled with aftermarket parts providers operating in the European market. Key players gained prominence by focusing on performance-enhancing components and premium aftermarket accessories, capitalizing on the growing demand from motorcycle enthusiasts for customized and high-performance solutions. Moreover, the emergence of e-commerce platforms and digital marketplaces has further intensified competition, allowing smaller players to reach a wider audience and challenge the dominance of established incumbents through competitive pricing and agile marketing strategies. To maintain their market share, key manufacturers are focusing on organic and inorganic growth strategies such as product launches, partnerships, joint ventures, mergers & acquisitions, and entering a new market. For instance, in September 2023, Akrapovič d.d., an exhaust systems manufacturer in Slovenia, launched a replacement exhaust system for the CB750 Hornet and XL750 Transalp. The OEMs operating in the Europe motorcycle accessories and parts market also sell their products through motorcycle parts wholesalers, online sites, and resellers.

Key Europe Motorcycle Parts And Accessories Companies:

- Akrapovic

- Caberg S.p.a.

- Dainese S.p.A

- GP Products

- GripWorks

- Hartmetall-Werkzeugfabrik Paul Horn GmbH

- HEDKASE LIMITED

- Odi Grips

- Schuberth GmbH

- Sinclair & Rush Ltd.

Europe Motorcycle Parts And Accessories Market Report Scope

Report Attribute

Details

Market Size Value in 2023

USD 937.35 billion

Revenue forecast in 2030

USD 1,501.62 billion

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Parts, country

Country scope

Italy; France; Spain; Germany; UK

Key companies profiled

Dainese S.p.A; Caberg S.p.a.; HEDKASE LIMITED; Schuberth GmbH; GripWorks; Sinclair & Rush Ltd; Odi Grips; Hartmetall-Werkzeugfabrik; GP Products; Akrapovič

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Motorcycle Parts And Accessories Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe motorcycle parts and accessories market report based on parts and country:

-

Parts Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handle Accessories

-

Handlebars

-

Grips

-

-

Electrical & Electronics

-

Lighting

-

Horns

-

-

Frames & Fittings

-

Crash Protection

-

Windshield

-

Foot Pegs

-

-

Bags & Carrier Frames

-

Exhaust Systems

-

Seat Covers

-

Security Systems

-

Filters

-

Sprockets

-

Batteries

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Italy

-

France

-

Spain

-

Germany

-

UK

-

Frequently Asked Questions About This Report

b. The Europe motorcycle parts and accessories market size was estimated at USD 879.08 billion in 2022 and is expected to reach USD 937.35 billion in 2023.

b. The Europe motorcycle parts and accessories market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 1,501.62 billion by 2030.

b. Italy dominated the Europe motorcycle parts and accessories market owing to growing traction of sports bikes in the country.

b. Some key players operating in the Europe motorcycle parts and accessories market include Akrapovic; Caberg S.p.a.; Dainese S.p.A; GP Products; GripWorks; Hartmetall-Werkzeugfabrik Paul Horn GmbH; HEDKASE LIMITED; Odi Grips; Schuberth GmbH; and Sinclair & Rush Ltd.

b. Key factors that are driving the Europe motorcycle parts and accessories market growth are attributed to the growing sales of motorcycles in major European countries, increasing traction of off-road motorcycles for adventure biking, and rising adoption of sports and touring bikes among Gen Z and millennials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."