- Home

- »

- Medical Devices

- »

-

Europe Orthopedic Navigation Systems Market Report, 2030GVR Report cover

![Europe Orthopedic Navigation Systems Market Size, Share & Trends Report]()

Europe Orthopedic Navigation Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Knee, Hip, Spine), By End Use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-300-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

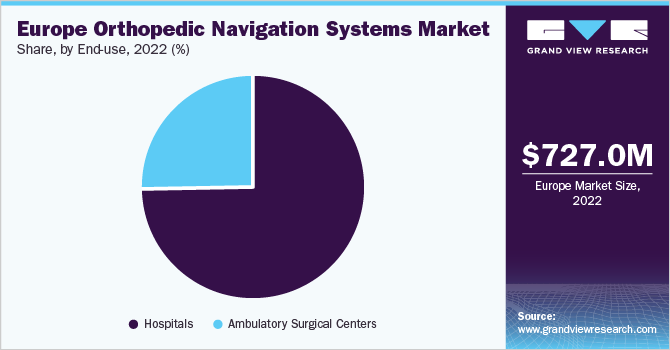

The Europe orthopedic navigation systems market size was valued at USD 727.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.8% from 2023 to 2030. Rising incidences of osteoarthritis and demand for minimally invasive surgeries for joint replacement surgery are expected to boost the demand for surgical navigation systems over the forecast period. Rising expenditure on healthcare, awareness about computer-assisted surgical navigation systems, and adoption of these techniques are some factors expected to contribute to market growth in the forthcoming years.

The market has been adversely impacted by the COVID-19 lockdown scenario. The COVID-19 outbreak negatively impacted the elective surgical procedure demand and thereby restricted the growth of the market in Europe. Disruption in the supply chain, inter-country travel restrictions, and slow economic growth resulted in a decline from previous years. As the restriction on elective surgeries lifted post lockdown, the demand for orthopedic navigation systems is set to rise. Orthopedic clinics started with a limited number of elective procedures as the COVID-19 cases began decreasing, which is expected to propel the market growth.

The European Commission estimates around 20% of the population to be aged above 60 years in 2025. Women are more prone to degenerative joint disorders as compared to men post the age of 50. The total age dependency ratio in Europe is expected to rise to 77.9% by 2080 and the age dependency ratio in 28 EU countries is projected to increase to around 51%. The growing geriatric and obese population prone to hip fractures and degenerative joint disorders is anticipated to create growth opportunities for orthopedic navigations systems in near future.

Application Insights

The knee navigation system dominated the Europe orthopedic navigation systems market in terms of revenue with a revenue share of 45.0% in 2022. The increasing usage of computer-assisted surgery for knee replacement procedures and wide applications of the surgical navigation system in knee replacement surgeries are the key factors contributing to the growth of this segment. The surgical knee navigation system is used in various procedures such as total knee replacement, kneecap replacement (patellofemoral arthroplasty), revision knee replacement, and uni-compartmental (partial) knee replacement for imaging & precision.

A study performed by the NCBI states that the estimated number of knee surgeries was valued at over 1.5 million. The fact that the number of procedures is on a constant rise will provide an attractive platform for the manufacturers to capitalize on. Additionally, favorable reimbursement policies and associated advantages related to knee navigation software are expected to boost market growth over the forecast period. Similarly, technological advancements in navigation systems such as information navigation systems will improve the demand over the forecast period.

On the other hand, hip surgery-based navigation systems are expected to witness rapid growth in usage rates due to the increasing volume of hip replacement procedures and incidences of hip fracture, osteoarthritis, and rheumatoid arthritis. Some key problems addressed by surgical navigation systems for hip surgery include leg-length discrepancy, impingement, and instability. Due to the increasing geriatric population and awareness about computer-assisted hip surgeries, the segment is anticipated to witness positive growth in the forthcoming years.

End-user Insights

The hospitals segment held the largest revenue share in 2023. Hospitals provide better treatment options relating to orthopedic procedures as compared to other treatment facilities. In addition, the availability of advanced medical devices and the growing number of patient footfall in hospitals further drive the segment growth.

The Ambulatory Surgical Centers (ASCs) segment is projected to show significant CAGR in the forthcoming years. The reduced waiting period, shorter stay duration, and personalized care are some of the key benefits offered by ASCs, which are expected to attract more patients in the forthcoming years. Innovative surgical methods in these settings allow procedures and tests to be performed without getting admitted. These associated benefits are further propelling the segment growth.

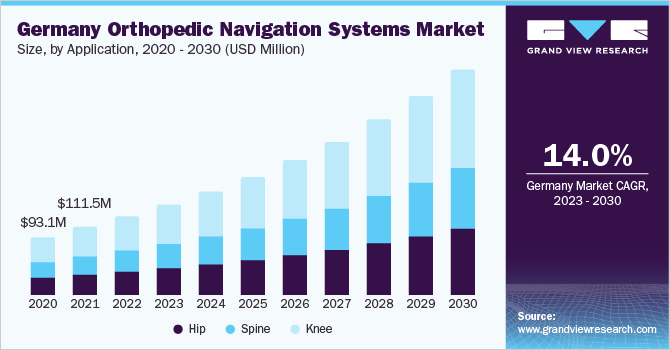

Country Insights

ROE dominated the overall industry in 2022 at over 20.0% owing to the rising adoption of automated orthopedic navigations system, coupled with increasing incidences of osteoarthritis due to the growing geriatric population. Furthermore, high patient awareness levels, rising demand for minimally invasive surgeries, and the presence of sophisticated healthcare infrastructure for joint replacement surgery are the other growth imparting drivers of this regional market.

The U.K. is one of the fastest growing segment over the forecast period, owing to high R&D investments aimed at joint reconstruction device development, and a rising level of awareness among the target population and orthopedic surgeons. According to data published by the National Joint Registry (NJR), around 160,000 knee and hip replacement surgeries are performed in the U.K. every year. This shows the potential opportunities in this region for orthopedic navigation systems.

Key Companies & Market Share Insights

The industry is competitive and manufacturers are engaged in rigorous R&D to develop cost-effective and efficient products for reconstructive joint replacement surgery. In addition, technological advancements and strategic alliances are expected to provide this market with a lucrative growth platform. For example, DePuy Synthes agreed with an advanced imaging solutions company Radlink Inc., thereby expanding its capabilities in the field of real-time imaging solutions for hip replacement procedures. Some of the prominent players in the Europe orthopedic navigation systems market include:

-

B. Braun Melsungen AG

-

Stryker

-

Medtronic

-

Brainlab AG

-

Johnson & Johnson Services, Inc. (DePuy Synthes)

-

Zimmer Biomet

-

MicroPort Medical

-

Orthokey Italia SRL.

-

Amplitude

Europe Orthopedic Navigation Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 832.1 million

Revenue forecast in 2030

USD 2,054.4 million

Growth rate

CAGR of 13.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, country

Country scope

U.K.; Germany; Switzerland; France; Spain; Italy; Belgium; Austria; Netherlands

Key companies profiled

Zimmer-Biomet Inc.; Stryker Corp.; Medtronic Plc; Brainlab AG; B. Braun Melsungen AG; MicroPort Medical; Orthokey Italia SRL; Amplitude; DePuy Synthes, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

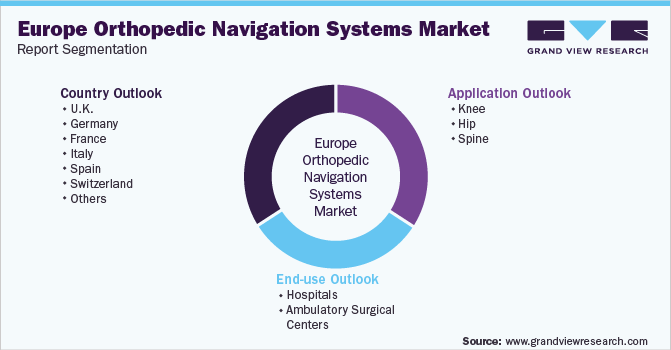

Europe Orthopedic Navigation Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe orthopedic navigation systems market report based on application, end-use, and country:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Knee

-

Hip

-

Spine

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Belgium

-

Austria

-

Netherlands

-

Frequently Asked Questions About This Report

b. The Europe orthopedic navigation systems market size was estimated at USD 727.0 million in 2022 and is expected to reach USD 832.1 million in 2023

b. The Europe orthopedic navigation systems market is expected to grow at a compound annual growth rate of 13.8% from 2023 to 2030 to reach USD 2,054.4 million by 2030.

b. Knee application dominated the Europe orthopedic navigation systems market with a share of over 45% in 2022. This is attributable to favorable reimbursement policies and associated advantages related to knee navigation software coupled with technological advancement in navigation systems.

b. Some key players operating in the Europe orthopedic navigation systems market include Zimmer-Biomet Inc., Stryker Corp., Medtronic Plc, Brainlab AG, B. Braun Melsungen AG, MicroPort Medical, Orthokey Italia SRL, Amplitude, and DePuy Synthes, Inc.

b. Key factors that are driving the Europe orthopedic navigation systems market growth include rising adoption of automated orthopedic navigations system coupled with incidences of osteoarthritis due to growing geriatric population, high patient awareness levels, rising demand for minimally invasive surgeries, and presence of sophisticated healthcare infrastructure for joint replacement surgery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.