- Home

- »

- Consumer F&B

- »

-

Europe Packaged Salad Market Size, Industry Report, 2030GVR Report cover

![Europe Packaged Salad Market Size, Share & Trends Report]()

Europe Packaged Salad Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vegetarian, Non-vegetarian), By Processing (Organic, Conventional), By Type, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-225-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Packaged Salad Market Trends

The Europe packaged salad market size was estimated at USD 4.11 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030.The growth of the market can be attributed tothe availability of packaged salads in a combination of various kinds of vegetables and fruits, dressed in various condiments and dressings, and accompanied by different meats and seafood has driven their popularity in the region. Furthermore, rising popularity of salads and the ease of consumption provided by packaged salad products is expected to boost market growth over the forecast period.

The European market accounted for a share of 32.3% of the global packaged salad market in 2023. The growing prevalence of social media has created mass momentum toward achieving a fit body. A majority of consumers consider healthy eating habits a major contributor to physical wellness. The demand for a fiber-rich diet with low-fat and protein-enriched content has made salads one of the most popular dishes to achieve their goal. Thus, the demand for packaged salad is expected to witness consistent growth over the coming years.

The fast-paced lifestyles of many Europeans have led to a surge in demand for convenient, ready-to-eat food options. Packaged salads are a convenient choice for individuals with busy schedules, as they offer a healthy meal solution that requires minimal preparation. This has led to several companies launching salad kits in the region. UK based provider of salads PDM offers wide varieties of prepared salads.

Rising concerns about health and wellness have compelled consumers in the region to switch from highly processed food products to fresh fruits and vegetables. Consumers are also looking to reduce their consumption of starch and cereals, leading to the increased incorporation of salads into their daily diets. This shift in consumer behavior is a key factor driving the packaged salad market in Europe.

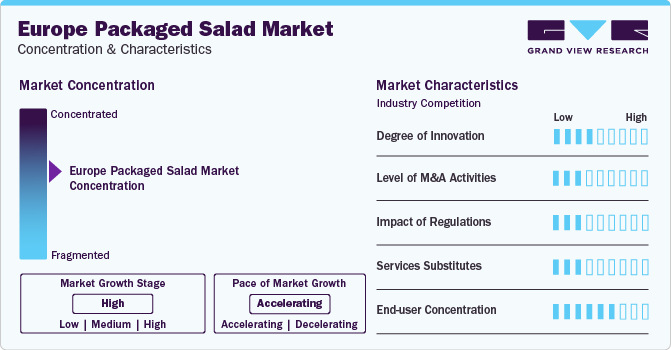

Market Concentration & Characteristics

The Europe packaged salad industry is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. The introduction of plastic-free salad packaging is another crucial factor boosting the consumption of packaged salads. In July 2020, Sirane, a UK-based absorbent food packaging specialist, developed a plastic-free salad packaging solution for Les Crudites salads and Carrefour-branded salads. These salad bags are made from the Earthfilm paper packaging range and are easily recyclable. This innovative packaging option is poised to result in a greater consumption of packaged salads.

Manufacturers are adopting various strategies to maintain a competitive edge, with a primary focus on introducing new salad varieties, flavors, and different serving size packaging formats to cater to evolving consumer preferences. Furthermore, manufacturers are also adopting sustainable practices, such as eco-friendly packaging and sourcing locally grown ingredients, to appeal to environmentally conscious consumers.

The demand for organically processed packaged salads is significant in European markets. The rising demand has compelled food companies to reformulate products to meet organic standards over the years. Increasing government support for organic agriculture and the rising popularity of organic foods among commercial buyers have driven the demand for organically processed packaged salads. This heightened demand is expected to create new trends in processing techniques and product labeling in the organic packaged food space.

Product Insights

The vegetarian packaged salads market in Europe accounted for a revenue share of 69.5% in 2023.The growth of this segment can be attributed to the increasing popularity of veganism in the region, fueled by rising concerns over animal welfare, sustainability, and personal health. Many consumers are also switching to a vegan diet to lower the risk of obesity and other heart-related diseases since vegan diets are rich in antioxidants, vitamins, and minerals, and have a lower fat content.Market players are focusing on offering vegetarian salad kits to cater to the evolving tastes and preferences of consumers in the country. Young consumers want to eat more vegetables without compromising on taste and creativity. This is encouraging companies to introduce new, unique, and exciting flavors inspired by cuisines around the world.

To further support this dietary shift, the V-Label, an officially registered and internationally recognized symbol, is used to label products as either vegan or vegetarian. According to a June 2022 survey conducted by V-Label among consumers in Denmark, Germany, Spain, Italy, France, England, and Poland, an average of 19% of consumers expressed their intent to modify their diets by incorporating a higher proportion of plant-based foods. Denmark led the way with the highest percentage at 24%, while Poland reported the lowest figure at 13%. This collective data indicates a growing preference for plant-based options in various European countries, aligning with the rising popularity of vegetarian and vegan packaged salads.

The non-vegetarian packaged salad market is projected to grow at a CAGR of 6.5% from 2024 to 2030. The shifting consumer focus towards protein-enriched diets to achieve their desired body figure or shape has been contributing to the worldwide demand for non-vegetarian packaged salads. Brands offering non-vegetarian packaged salads typically market their products as a wholesome choice for today's active lifestyle.

Processing Insights

The conventional packaged salads category accounted for a revenue share of 68.7% in 2023.Packaged salads processed through conventional farming methods differ from organic salads. From a retail perspective, the distribution of conventionally processed packaged salads is deemed more profitable. Retailers tend to favor conventional products over organic or organically processed packaged salads because they offer a higher profit margin per square inch of shelf space.For instance, Ireland-based Dole Food Co.’s Hawaiian Slawsome! kit is available at a budget-friendly retail price of USD 2.99, serving 3-4 people. The kit comprises a combination of shredded green and red cabbage and carrots, along with Dole's Grilled Pineapple Dressing and tropical seasoning. Other slaw kits offered by the company include Mango Sriracha Slawsome!, Sweet Apple Slawsome!, and Fiesta Lime Slawsome!

The organic packaged salad segment is projected to grow at a CAGR of 8.3% from 2024 to 2030. The demand for organic packaged salads is increasing due to the rising preference for pesticide-free food products. Moreover, consumers, especially millennials and Gen Z, are willing to pay a higher price for organic food, which is anticipated to further boost segment growth in the coming years. Several companies in the region are expanding their production capacity to offer consumers better, healthier, fresher, and organic packaged greens.

Type Insights

The packaged green salads segment accounted for a revenue share of 62.9% in 2023.Packaged greens have been gaining popularity owing to their raw taste without the addition of any type of seasonings, dressings, or condiments. Growing consumer preference for raw packaged salads has encouraged key players as well as new entrants to launch a number of products in the market.

The demand for packaged salad kits is projected to grow at a CAGR of 7.7% from 2024 to 2030. Traditional cooking methods are often too time-consuming and labor-intensive for individuals preparing meals for themselves, including fresh salads. The most time-consuming aspect of salad preparation involves washing, chopping, and mixing ingredients with the appropriate dressings or condiments to enhance flavor. Furthermore, consumers would need to go grocery shopping at least once or twice a week, in addition to spending an extra 20 to 25 minutes on meal preparation. This demanding process creates a new market opportunity for salad manufacturers in the global market.

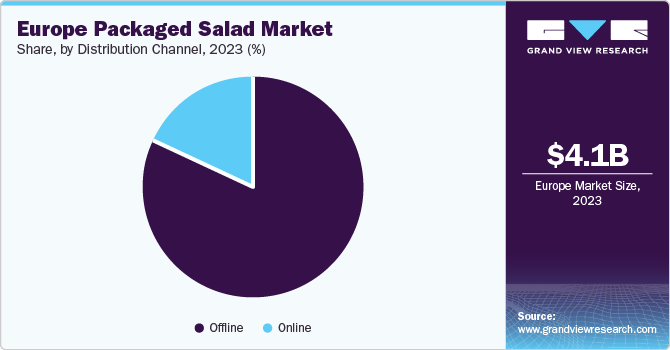

Distribution Channel Insights

The offline sales of packaged salads accounted for a revenue share of 82.4% in 2023.Consumers in European countries prefer to buy packaged salads after physical verification and, therefore, like to purchase the same from supermarkets and hypermarkets such as Sainsbury’s, Tesco, Carrefour, Aldi, Lidl, and Metro. Moreover, the customer services offered at retail stores encourage the younger generations to buy these products from such stores.

Online sales of packaged salads are projected to grow at a CAGR of 9.9% from 2024 to 2030.The increasing preference for online shopping owing to its convenience and home delivery has influenced many hypermarkets to deliver food products at home. For instance, in June 2020, Carrefour announced the launch of an online food marketplace in France, wherein consumers can visit the Carrefour.fr website to browse over 100,000 products from more than a hundred retailers. This is expected to drive the sales of packaged salads through the online channel. Furthermore, the online distribution channel is becoming popular among millennials and Gen Z due to the ease of shopping, safe payment getaways, doorstep delivery, and discounts offered.

Country Insights

The fast-paced lifestyles of many Europeans have led to a surge in demand for convenient, ready-to-eat food options. Packaged salads are a convenient choice for individuals with busy schedules, as they offer a healthy meal solution that requires minimal preparation. This has led to several companies launching salad kits in the region.

UK Packaged Salad Market Trends

The packaged salad market in the UK is expected to grow at a CAGR of 7.4% from 2024 to 2030, owing to the rising demand for healthy and convenient. The availability of various-sized salad kits helps consumers buy the required number of kits and prevent wastage, which is a common challenge when purchasing fresh raw salad ingredients. Moreover, the availability of a wide range of salad brands, such as Florette, Tesco, and Morrisons, in the UK has been influencing consumers to purchase these products. Advancements in technology are also anticipated to drive the market. For instance, in January 2021, Natures Way Foods invested in 16 GIC41000 vertical form fill and seal Salad Specification machines to process more orders at a time. The model comes with a Leaf Salad Assisted Drop functionality that speeds up the packing and reduces the risk of salad leaves being captured in seals.

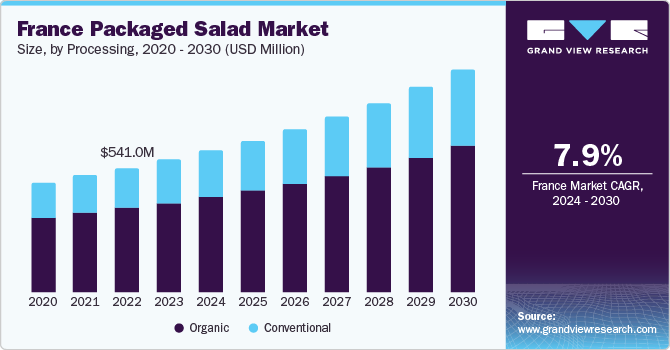

France Packaged Salad Market Trends

The packaged salad market in France is projected to grow at a CAGR of 7.9% from 2024 to 2030. Rising concerns about health and wellness have compelled consumers in the country to switch from highly processed food products to fresh fruits and vegetables. Consumers are also looking to reduce their consumption of starch and cereals, leading to the increased incorporation of salads into their daily diets. This shift in consumer behavior is a key factor driving the packaged salad market in France.

Key Europe Packaged Salad Company Insights

The packaged salads industry in Europe is highly competitive as a result of the presence of well-established companies and local players. Considering the increasing demand for packaged salads over the world, several companies are either augmenting their production facilities or collaborating with other players.Companies in the industry are also focused on expanding their product portfolios by launching new products.

Key Europe Packaged Salad Companies:

- Bonduelle

- Fresh Express, Incorporated

- Misionero

- Dole Food Company, Inc

- BrightFarms, Inc.

- Organicgirl, LLC

- Taylor Fresh Foods

- Gotham Greens

- Eat Smart

- Earthbound Farm

Recent Developments

-

In August 2023, Fresh Express introduced its new salad kit, French Blue Cheese, and expanded its lineup of popular chopped salad kits with three new additions; French Bistro, Smokehouse, and Twisted Caesar Enchilada. Amid the ongoing trend of international flavors and increasing consumer preference for kitchen convenience, these new fresh express options offer an easy and convenient means for consumers to savor globally inspired culinary flavors from the comfort of their homes.

Europe Packaged Salad Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.36 billion

Revenue forecast in 2030

USD 6.64 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, processing, type, distribution channel, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Bonduelle; Fresh Express, Incorporated; Misionero; Dole Food Company, Inc; BrightFarms, Inc.; Organicgirl, LLC; Taylor Fresh Foods; Gotham Greens; Eat Smart; Earthbound Farm

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Packaged Salad Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe packaged salad market report based on product, processing, type, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vegetarian

-

Non-vegetarian

-

-

Processing Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaged Greens

-

Packaged Kits

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe packaged salad market size was estimated at USD 4.11 billion in 2023 and is expected to reach USD 4.36 billion in 2024.

b. The Europe packaged salad market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 6.64 billion by 2030.

b. Vegetarian salads dominated the Europe packaged salad market with a share of 69.5% in 2023. The growth of this segment can be attributed to the increasing popularity of veganism in the region, fueled by rising concerns over animal welfare, sustainability, and personal health.

b. Some key players operating in the Europe packaged salad market include Bonduelle, Fresh Express, Incorporated, Misionero, Dole Food Company, Inc., BrightFarms, Inc., Organicgirl, LLC, Taylor Fresh Foods, Gotham Greens, Eat Smart, and Earthbound Farm.

b. Key factors that are driving the market growth include rising consumer awareness regarding healthy food lifestyles, coupled with the rising popularity of salads, and the ease of consumption provided by packaged salad products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.