- Home

- »

- Catalysts & Enzymes

- »

-

Europe PGM Catalyst Market Size & Share Report, 2030GVR Report cover

![Europe PGM Catalyst Market Size, Share & Trends Report]()

Europe PGM Catalyst Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Pt, Pd, Ru, Rh, Ir), By Product (Heterogeneous, Homogeneous), By End-Use (Pharmaceuticals, Agrochemicals), And Segment Forecasts

- Report ID: GVR-4-68040-132-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

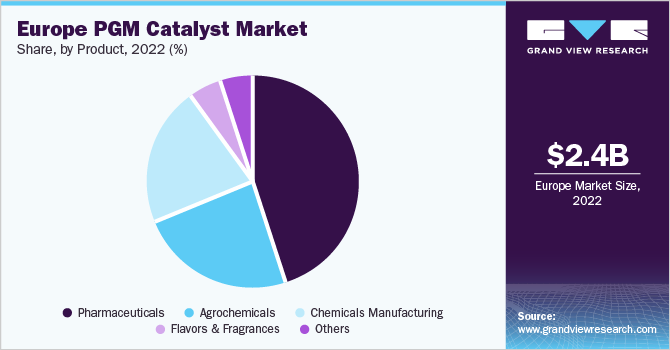

The Europe PGM catalyst market size was estimated at USD 2.40 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Platinum group metal (PGM) catalysts play a significant role in the pharmaceutical industry, particularly in synthesizing pharmaceutical compounds. PGM catalysts, such as palladium (Pd), platinum (Pt), and rhodium (Rh), are used in hydrogenation reactions. Hydrogenation involves the addition of hydrogen to unsaturated compounds, converting them into saturated forms. PGM catalysts facilitate this process by providing the necessary surface for response and promoting the desired chemical transformations.

According to Sabin Metal Corp., pharmaceutical processors extensively utilize PGM catalysts in producing drugs and other pharmaceutical products. These catalysts, such as heterogeneous palladium on carbon, platinum on carbon, and calcium carbonate, aid in hydrogenating different intermediates. PGM catalysts, including platinum, palladium, and rhodium, play a vital role in various synthesis processes within the pharmaceutical industry.

These catalysts are extensively used to facilitate reactions, such as hydrogenation, cross-coupling, and C-C bond activation, which are crucial for synthesizing pharmaceutical compounds and active pharmaceutical ingredients (APIs). The chemical industry in Germany, which encompasses the pharmaceutical sector, is prominent in Europe.With their unique properties, PGM catalysts are well-positioned to support the growth, innovation, and high-quality standards required in the dynamic pharmaceutical sector of Germany and other leading European countries.

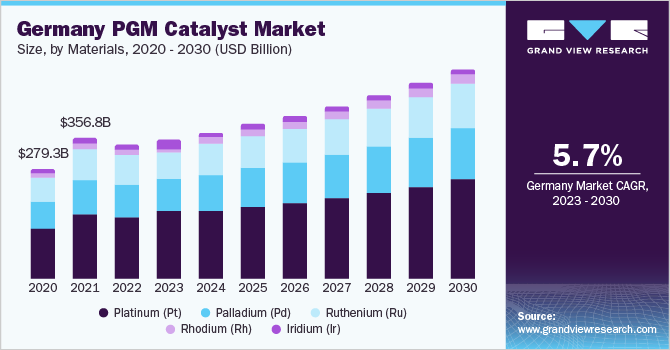

Materials Insights

The platinum (Pt) material segment dominated the market with a revenue share of 46.2% in 2022. This is attributed to its extensive use as a catalyst in various industrial and chemical processes. Catalysts are used to accelerate chemical reactions without undergoing any alteration in their composition and structure. The distinctive characteristics of platinum, including its high conductibility, ductility, and corrosion resistance, along with its stability, nontoxicity, and elevated melting point make it useful in high-temperature processes. Platinum catalysts have a considerable surface area, thereby offering additional prospects for chemical reactions. Palladium is an extensively used precious metal catalyst in various applications owing to its unique physical and chemical properties.

This makes palladium ideal for catalyzing a broad range of chemical reactions. It is a part of the platinum group of metals and shares similarities with platinum, including high corrosion resistance, excellent conductibility, and increased ductility. These distinctive features of palladium contribute to its usefulness as a catalyst. Ruthenium (Ru) catalysts are widely used in various applications due to their unique chemical and physical properties. As ruthenium belongs to the platinum group of metals, it has high corrosion resistance, excellent ductility, and high conductibility. These characteristics make this metal instrumental in catalyzing a broad range of chemical reactions in the chemical industry.

Product Insights

The heterogeneous PGM catalyst product segment dominated the market with a revenue share of 70.9% in 2022. This is attributed to its use in a diverse range of chemical reactions, including the production of specialty chemicals, pharmaceuticals, and petrochemicals. Heterogeneous precious metal catalysts offer several advantages, such as high catalytic activity for quicker reaction rates and higher product yields. Furthermore, these catalysts can be reused in several reactions, reducing the need for multiple catalysts. In addition, the solid support material of the catalyst simplifies its separation from the reaction mixture, facilitating catalyst recovery and reuse.

In homogeneous PGM, the precious metal is homogeneously dispersed in the reaction mixture. This means the precious metal is not supported on solid material and dissolves in the reaction medium. Common homogeneous catalysts based on precious metals include palladium, platinum, and gold salts or complexes. These catalysts are often used for reactions in which the presence of solid support would interfere with the response or lead to market deactivation.

End-use Insights

The pharmaceutical end-use segment dominated the market with a revenue share of 44.7% in 2022. This is attributed to the fact that PGM is widely used in the pharmaceutical industry, particularly for synthesizing complex organic molecules. These catalysts of platinum, palladium, rhodium, ruthenium, iridium, and ruthenium metals make them highly effective in various pharmaceutical processes. Agrochemicals offer moderate growth opportunities for platinum group metal in the Europe market as these metals are used to enable economic and efficient chemical reactions. Europe is the third-largest market in terms of crop protection, after Asia and Central & South America.

The demand for chemicals has increased significantly over the past few years as they are highly efficient and environmentally friendly. With the growing focus of manufacturers on the development of sustainable and environmentally friendly chemicals, the demand for chemicals is expected to rise further in the coming years. This is anticipated to drive the usage of homogenous precious metals for acceptable chemical consumption. The presence of major chemical manufacturers in Europe, including Solvay AG, BASF SE, and Lonza, is expected to result in a steady demand for the product over the forecast period, supporting market growth.

Country Insights

Switzerland dominated the market with a revenue share of 53.4% in 2022 due to the strong pharmaceutical manufacturing sector and numerous pharmaceutical companies, directly impacting the demand and utilization of PGM. The country's prominence in the pharmaceutical industry is reflected in its high healthcare spending and per capita healthcare expenditure. As PGM plays a vital role in pharmaceutical manufacturing processes, Switzerland's robust pharmaceutical sector is expected to impact the demand for these catalysts. The Netherlands Enterprise Agency reported that the chemical industry is responsible for over 40% of the total demand for PGM in the country.

PGM produces chemical products, such as fertilizers, plastics, and fine chemicals. Furthermore, major companies in the Netherlands, such as Johnson Matthey and BASF, specialize in the design and production of PGM. The chemical industry in Germany, which encompasses the pharmaceutical sector, is prominent in Europe. The European Chemical Industry Council reported that Germany's chemical industry, including pharmaceuticals, was the third-largest in Europe. Moreover, Germany's R&D investment in the chemical and pharmaceutical sectors emphasizes the country's commitment to advancing research and development activities in these industries.

Key Companies & Market Share Insights

The market is competitive owing to well-established players controlling the majority shares of the market. They have multiple channels for developing and distributing their finished products in Europe. A rise in demand for these products from various end-use industries has encouraged market players to enhance their footprint in Europe and offer products for them. Some key companies actively operating in the Europe PGM catalyst market are:

-

Axens

-

BASF SE

-

Chimet

-

Clariant

-

Evonik Industries AG

-

Topsoe A/S

-

Heraeus Holding

-

Honeywell International, Inc.

-

Johnson Matthey

-

Pressure Chemical Co.

-

Sabin Metal Corporation

-

Umicore

-

Zeolyst International

Europe PGM Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.47 billion

Revenue forecast in 2030

USD 3.46 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, country

Country scope

Austria; Belgium; Germany; UK; France; Switzerland; The Netherlands; Ireland

Key companies profiled

Axens; BASF SE; CHIMET; Clariant; Evonik Industries AG; Topsoe A/S; Heraeus Holding; Honeywell International, Inc.; Johnson Matthey; Pressure Chemical Co.; Sabin Metal Corp.; Umicore; Zeolyst International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe PGM Catalyst Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe PGM catalyst market report on the basis of material, product, end-use, and region:

-

Material Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Platinum (Pt)

-

Palladium (Pd)

-

Ruthenium (Ru)

-

Rhodium (Rh)

-

Iridium (Ir)

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Heterogeneous PGM catalyst

-

Homogeneous PGM catalyst

-

-

End-Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Agrochemicals

-

Chemicals Manufacturing

-

Flavors & Fragrances

-

Other End-Use

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Austria

-

Belgium

-

Germany

-

UK

-

France

-

Switzerland

-

The Netherlands

-

Ireland

-

-

Frequently Asked Questions About This Report

b. The global Europe PGM catalyst market size was estimated at USD 2.40 billion in 2022 and is expected to reach USD 2.47 billion in 2023.

b. The global Europe PGM catalyst market is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 3.46 billion in 2030.

b. Switzerland region dominated the market with a revenue share of 53.4% in 2022. This is attributable to the solid pharmaceutical manufacturing sector and numerous pharmaceutical companies, directly impacting the demand and utilization of PGM.

b. Some key players operating in the Europe PGM catalyst market include Axens, BASF SE, CHIMET, Clariant, Evonik Industries AG, Topsoe A/S, Heraeus Holding, Honeywell International, Inc., Johnson Matthey, Pressure Chemical Co., Sabin Metal Corporation, Umicore, Zeolyst International

b. Key factors that are driving the market growth include the increasing product penetration in the pharmaceutical industry. Platinum group metal (PGM) catalysts play a significant role in the pharmaceutical industry, particularly in synthesizing pharmaceutical compounds. PGM catalysts, such as palladium (Pd), platinum (Pt), and rhodium (Rh), are used in hydrogenation reactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.