- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Polypropylene In 3D Printing Market Report 2030GVR Report cover

![Europe Polypropylene In 3D Printing Market Size, Share & Trends Report]()

Europe Polypropylene In 3D Printing Market Size, Share & Trends Analysis Report By Form (Filament, Powder), By End Use (Automotive, Medical, Aerospace & Defense, Consumer Goods), By Country, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-919-9

- Number of Report Pages: 67

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

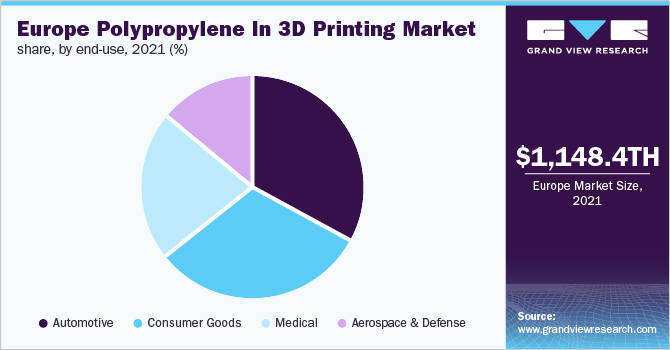

The Europe Polypropylene in 3D Printing market size was valued at USD 1,148.40 thousand in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 15.2% from 2022 to 2030. The growth of the polypropylene in 3D printing market in the region depends on its use in automotive, medical, aerospace & defense, and consumer goods industries. The use of polypropylene in these end-use industries is attributed to its properties, including chemical resistance, impact resistance, lightweight, and good flexibility. Polypropylene manufacturers for 3D printing are entering into distribution partnerships with renowned distributors to expand their reach and gain competitive advantage. For instance, in August 2021, Braskem entered into a partnership with distributors Nexeo Plastics, LLC to distribute Braskem’s polypropylene (PP) filament to North America and Europe

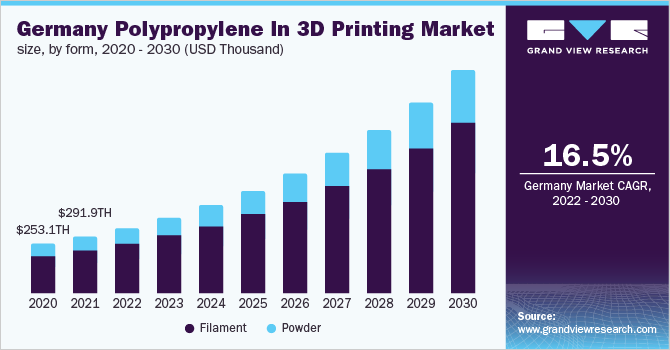

The market size for polypropylene in 3D printing in Germany was valued at USD 291.98 thousand in 2021. The high market share of the country is attributed to the presence of well-established automotive, medical, aerospace & defense, and consumer goods industries. According to the International Trade Administration data of 2020, Germany has the third-largest aerospace & defense market in Europe. The Federal Ministry of Economic Affairs and Energy (BMWi) lists aerospace as a significant industry with a solid industrial core and high growth rate in Germany.

Aerospace applications use advanced engineering materials to reduce weight while improving performance. 3D printing enables the fabrication of lightweight and highly complex structures, contributing to its usage in the aerospace sector. The growing adoption of lightweight plastic components by many manufacturers to achieve fuel efficiency and weight reduction in passenger and sports cars is driving the automotive industry in Germany.

The rising adoption of PP in the automotive sector due to easy processability, effective sealing, and stiffness features will increase safety subsystems, doors, and seat components. This is expected to fuel the polypropylene in 3D printing market in Germany. For instance, on June 28, 2021, Volkswagen, a leading German car manufacturer, planned to adopt binder jet 3D printing technology to create components at its Wolfsburg, Germany factory. The company is the first one to use 3D printing technology in the car manufacturing process.

Germany’s consumer market is one of the largest consumer goods industries in Europe. Due to the properties of flexibility and chemical resistance, use of polypropylene in 3D printing across Germany has witnessed growth in the consumer goods industry, including consumer electronics manufacturing. This trend is expected to follow throughout the forecast period and boost the demand for polypropylene in the 3D printing market in Germany.

Form Insights

The filament segment dominated the Europe polypropylene in 3D printing market based on form, and accounted for more than 74% of the overall revenue share in 2021. Polypropylene exhibits good fatigue resistance, heat resistance, and lightweight characteristics, which are suitable for 3D printing applications. Fused deposition modeling (FDM) is the most widely used 3D printing technology. It is suited for low-cost and quick prototyping of simple parts, which has driven the market for the filament form.

Powder 3D printing technology is used to print various materials, including fewer common ones like silica and metal. FDM 3D printing technology is limited to thermoplastics, whereas the powder 3D printing technology can include materials other than thermoplastics, making them suitable to handle more complex prints. Powder form has basic flowability, good stability, high packing density, compressibility, and permeability, making it ideal for the aerospace & defense industry. Properties like compressibility and permeability make them relevant to manufacturing interior and exterior finishing materials for automotive.

End-Use Insights

Automotive dominated the end-use segment for the polypropylene in 3D printing market in Europe, and accounted for the largest revenue share of more than 32.0% in 2021. The automotive sector has witnessed a growing popularity post the COVID-19 pandemic amid the rising trend of electric vehicles. The increasing demand for electric vehicles is expected to create growth opportunities for players operating in the polypropylene in the 3D printing market during the forecast period.

Medical technology demands biocompatible, chemical resistant, and sterilizable materials along with other properties, including flexibility and break resistance. Polypropylene grades are considered skin-friendly and classified as not harmful to health, and fulfill the requirement of orthopedic aids such as lightweight, crack resistance, biocompatibility, and semi-flexibility. The rising demand for medical devices such as shoe covers, shoe insoles for medical application, and orthopedic and dental aids can fuel the polypropylene in the 3D printing market growth in Europe.

Country Insights

Germany dominated the European market and accounted for an overall revenue share of more than 25% in 2021. Germany's demand for polypropylene in 3D printing is driven by the high demand from key industries, including aerospace, automotive, medical, and consumer goods. As per the International Organization of Motor Vehicle Manufacturers (OICA), in 2020, Germany produced more than 3.5 million vehicles. This is expected to be driven by the growing population in the area. Polypropylene in 3D printing in the automotive sector is used to develop prototypes, vehicle interior & exterior components, and spare parts.

The growing automotive industry in Germany can fuel the market for polypropylene in 3D printing in Europe. The e-commerce industry has seen an upward trend in the region, resulting in increased sales of commercial vehicles to cater to the rising automotive industry. Moreover, the growing utilization of high-performance and lightweight plastic components by many manufacturers to achieve fuel efficiency and weight reduction in passenger and sports cars has augmented the demand for polypropylene (PP) compounds in the region.

Polypropylene in 3D printing is used to protect the operating devices from extreme temperatures, chemical components, and shocks. The growing automotive sector in Germany is expected to drive the growth of the Europe polypropylene in the 3D printing market. The medical industry's demand for 3D printing plastics in the UK is higher than in other European countries due to its cost-effectiveness, ease of customization, and rising rates of vascular and arthritic illnesses.

Key Companies & Market Share Insights

Established players in the industry, such as BASF SE and SABIC, are investing in startups related to the use of polypropylene in 3D printing, which is expected to further strengthen its position in the market. In December 2021, Braskem started an Amazon E-Commerce store to make polypropylene filaments for 3D printing accessible to the public. Braskem and Xenon Arc collaborated to develop the first consumer-facing e-commerce platform of the company on Amazon. Some of the prominent players operating in the Europe polypropylene in 3D printing market include:

-

BASF SE

-

LyondellBasell Industries Holding B.V.

-

SABIC

-

Exxon Mobil Corporation

-

Covestro AG

-

RECREUS INDUSTRIES S.L.

-

Braskem

-

Sculpteo

Europe Polypropylene In 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,313.27 thousand

Revenue forecast in 2030

USD 4,084.44 thousand

Growth Rate

CAGR of 15.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Tons, Revenue in USD Thousand, and CAGR (%) from 2022 to 2030

Report coverage

Revenue forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Form, end-use, and region

Region scope

Europe

Key companies profiled

LyondellBasell Industries Holdings B.V.; SABIC; Braskem; BASF SE; Covestro AG; RECREUS INDUSTRIES SL; Sculpteo

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume and revenue growth at the regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Europe Polypropylene in 3D Printing market report based on form, end-use, and region:

-

Form Outlook (Volume, Tons; Revenue, USD Thousand, 2019 - 2030)

-

Filament

-

Powder

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2019 - 2030)

-

Automotive

-

Medical

-

Aerospace & Defense

-

Consumer Goods

-

-

Country Outlook (Volume, Tons; Revenue, USD Thousand, 2019 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Czech Republic

-

Poland

-

Hungary

-

Romania

-

-

Frequently Asked Questions About This Report

b. The Europe polypropylene in 3D printing market size was estimated at USD 1,148.40 thousand in 2021 and is expected to reach USD 4,084.44 thousand in 2030.

b. The Europe polypropylene in 3D printing market is expected to grow at a compound annual growth rate of 15.2% from 2022 to 2030 to reach USD 4,084.44 million by 2030

b. The automotive and end-use segment dominated the Europe polypropylene in 3D printing market and accounted for the highest revenue share of over 33.07% in 2021.

b. Some key players operating in the Europe polypropylene in 3D printing market include BASF SE, LyondellBasell Industries Holdings B.V., SABIC, Exxon Mobil Corporation, and Covestro AG.

b. Germany dominated the largest Europe polypropylene in 3D printing market with a share of 25.43% in 2021. This is attributable to rising demand from various end-use industries such as the automotive, medical, aerospace & defense, and consumer goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."